Taking Profits in Growthy Sectors

Back in mid-December we mentioned that the down beaten growth sectors would stage a comeback in 2023.

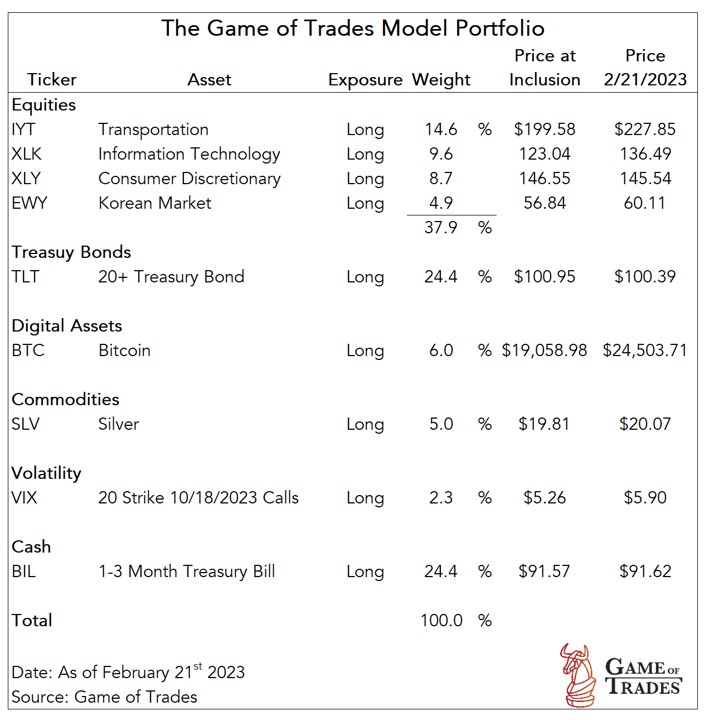

Tech (XLK) and consumer discretionary (XLY) are big growth exposures in our portfolio, giving our portfolio a growth-tilt.

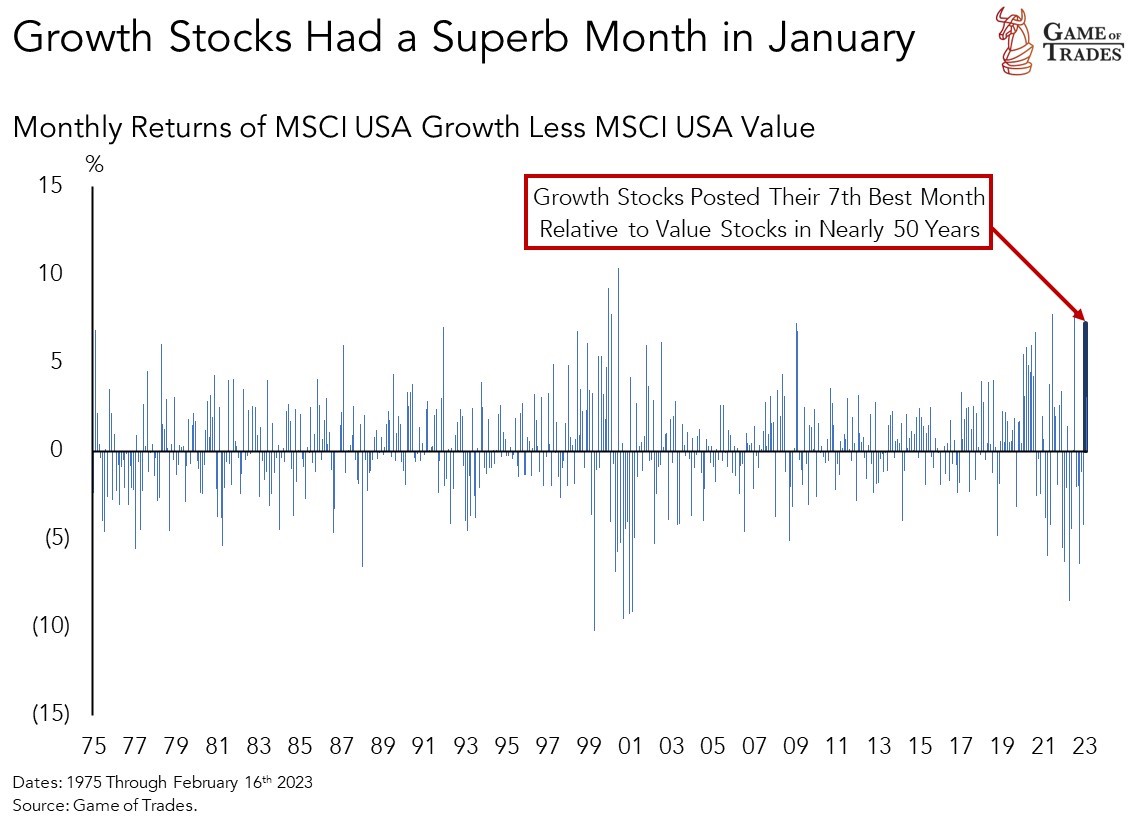

Growth stocks featured stellar returns in January, outperforming value stocks by more than 7 percentage points. That’s the 7th biggest outperformance since 1975.

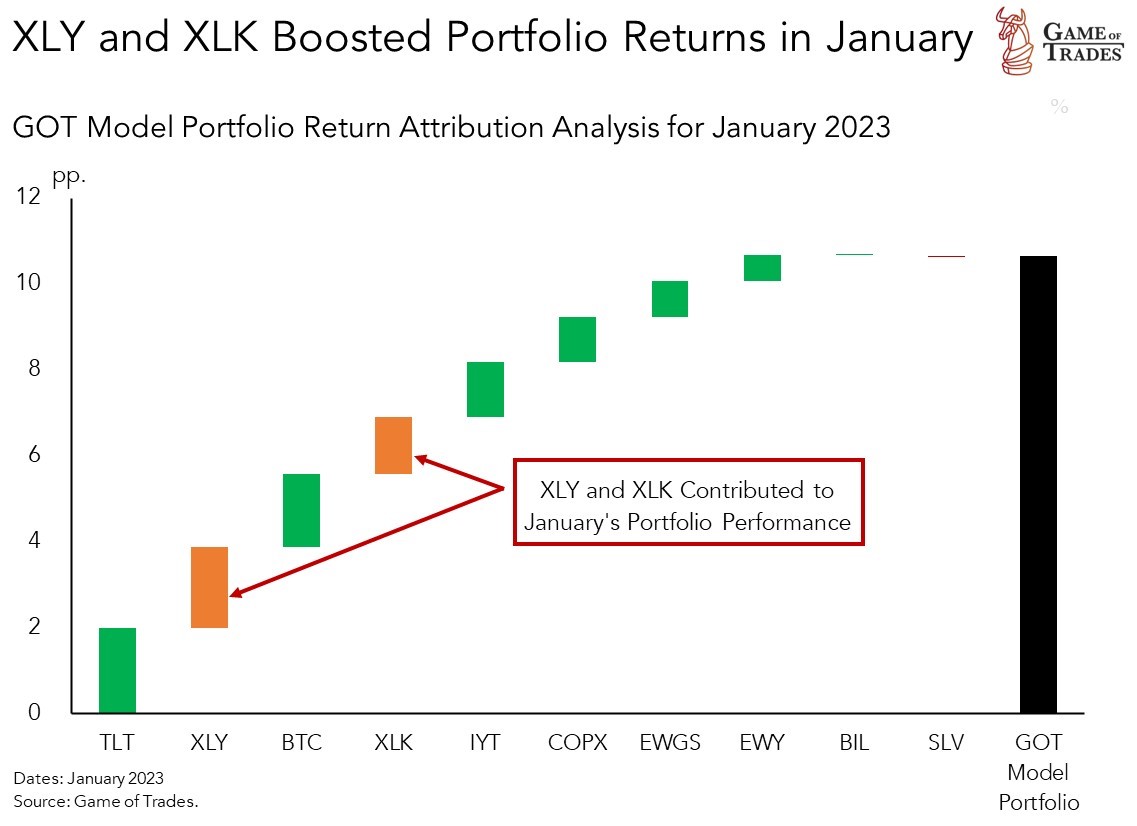

Both XLY and XLK contributed significantly in January to our model portfolio’s outperformance relative to the S&P 500, as we documented in our Monthly Portfolio Review for January.

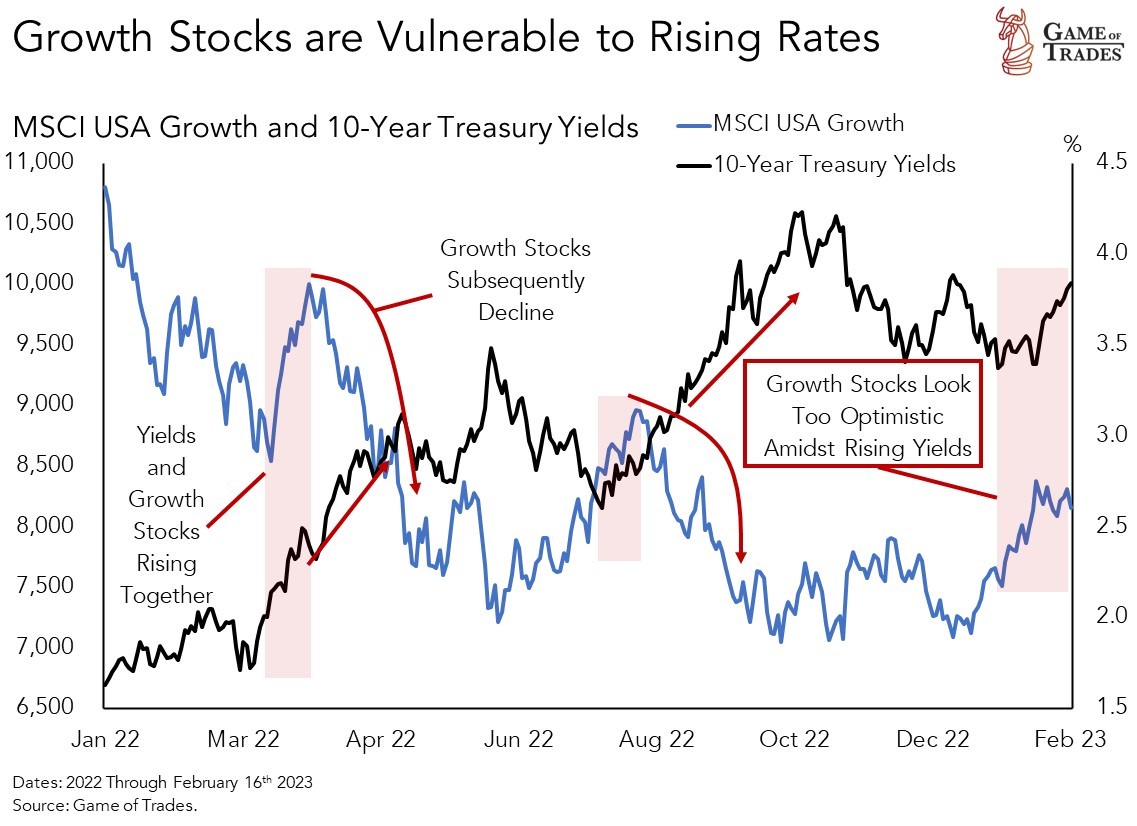

The outperformance of growth stocks has happened so fast and it’s been so big that they now look vulnerable to give up those gains.

The rise in interest rate of late on the back of stronger-than-expected economic data makes growth stocks vulnerable to give up all of its gains accrued this year.

As a reminder we launched a new Watchlist feature on the website that tracks in real time our current technical setups for the assets in our model portfolio.

XLK is featuring an island cluster reversal pattern, while the MACD shows a bearish crossover.

XLK by gameoftrades_yt on TradingView.com

XLY is featuring an island top reversal pattern, with the MACD also showing a bearish crossover.

XLY by gameoftrades_yt on TradingView.com

The recent bearish technical developments for XLK and XLY point to these growth-oriented sectors’ vulnerabilities to rising interest rates.

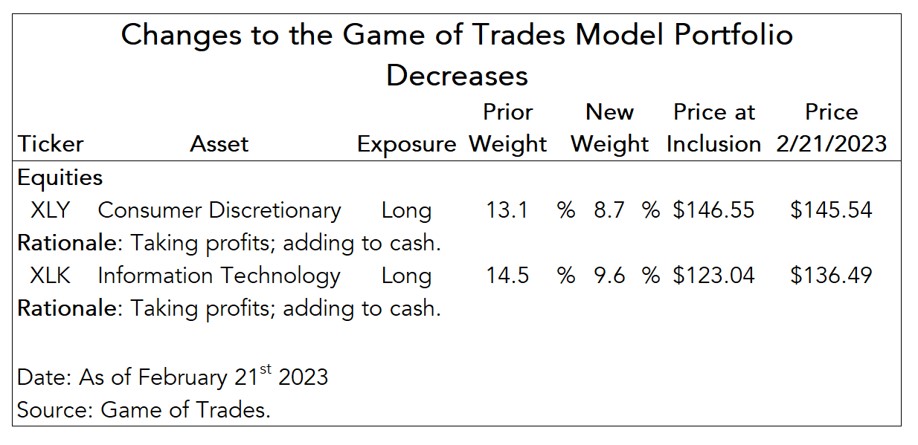

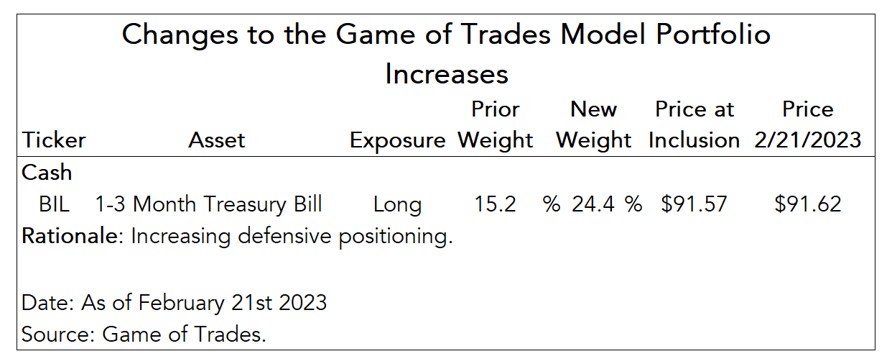

We’re Reducing Consumer Discretionary (XLY) and Tech (XLK) and Moving Proceeds to Cash (BIL)

We’re reducing the weight of XLY and XLK by 1/3. We’re taking profits and moving the proceeds to our cash allocation in BIL, an ETF invested in 1-3 month T-bills.

We’ve been tactically riding the market rally of late, but if the technicals continue to deteriorate we’ll trim our exposures to XLK and XLY even further. Our year-end target for the S&P 500 is 3,500.

In our last Portfolio Update we started increasing our cash allocation by taking profits in EWGS and COPX.

The idea of adding to cash is to improve the agility of the portfolio amidst mixed economic data. A sizeable cash allocation will allow us to deploy assets when the opportunity reveals itself.

With 3-month T-bills yielding 4.8%, we’re getting paid while we wait for the right time to rotate to a more defensive portfolio. Short equities, long bonds and precious metals are viable candidates.

Below is the updated model portfolio.

what is the short term and 6 month outlook on the S&P? Are the highs already in???

The last short-term update on the SP500 was provided in the following video:

https://www.gameoftrades.net/news-feed/sp500-is-not-pricing-in-contracting-earnings-and-higher-yields-opportunities-in-precious-metals/

We highlighted the divergence with between the SP500 and bond yields along with the low probability that earnings would lift the market higher.

A new short-term update on the SP500 and various positions in the model portfolio will be coming out later today.

I’m interested in getting into TLT through call options but don’t know how to choose the strike price and expiry date. Has anyone put on this position? What strike price and date did you choose?

Disclaimer – I completely take responsibility for my trading decisions and your response is for my education. My loss is my loss. My win is my win. Sharing info, we all win.

Thanks!

XLY is actually a loss, not a gain (buy at 146.55, sell at 145.54). Not sure why you’re saying “Taking profits” with XLY, no profits from this one. But XLK is still up…

I added FTXG on Friday. I was looking at technicals for consumer staples and many of them were oversold. I used this website (https://www.etf.com/etfanalytics/etf-stock-finder) to find an ETF with large exposure to GIS.

Figured I would give back some. I am new and have not bought into the long side of your model since they have mostly run. It’s like doing double dutch with the girls downtown, you have to wait and time that entry or you will get tripped up 😉

Thank you so much for BIL. I did add to that and the VIX trade. I also have PSQ, RWM, SEF & SARK do y’all use those and what are your thoughts?

[…] decision to cut Bitcoin’s weight is consistent with our recent decreases in tech (XLK) and consumer discretionary (XLY) to reduce the beta of the portfolio. […]

[…] Reduced XLY (Consumer Discretionary) and XLK (Technology) to take profits from January’s big outperformance of growth stocks. Moved proceeds to BIL to increase portfolio agility. […]