Here’s January’s Monthly Portfolio Review video:

Launching the Monthly Portfolio Review Series

We’re launching the Monthly Portfolio Review series to review our model portfolio launched in September on a monthly basis.

The Monthly Portfolio Review series will cover the following topics:

- Performance

- Changes to the Portfolio

- Portfolio Positioning and Outlook

In future publications we’ll strive to publish the Monthly Portfolio Review closer to the end of the month.

Performance

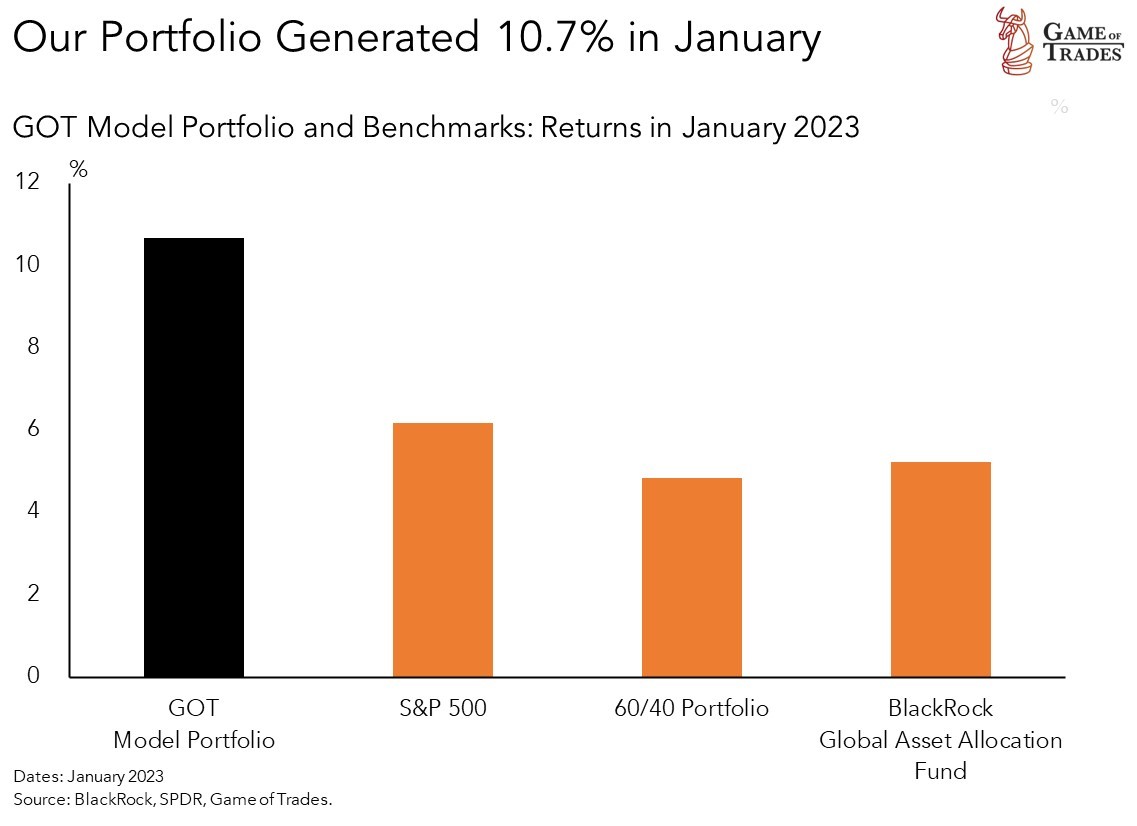

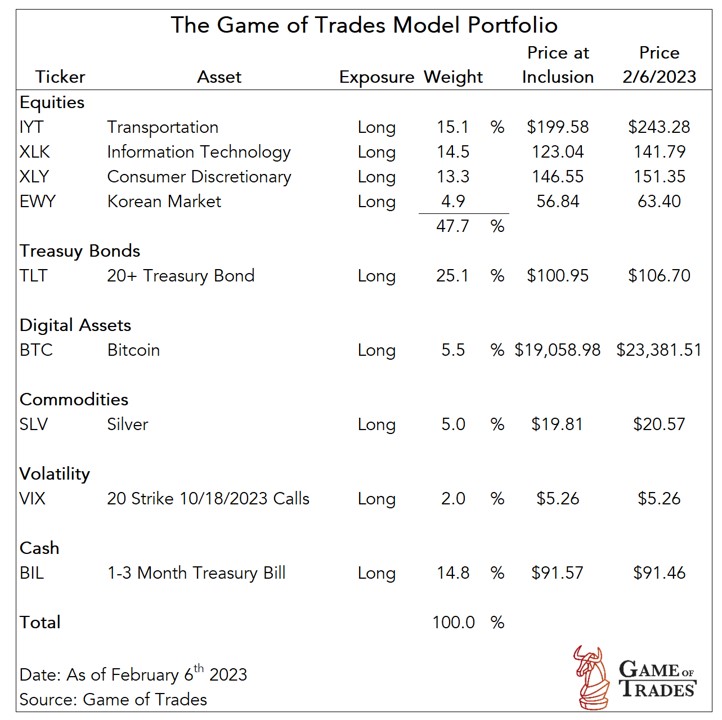

Our model portfolio generated a return of 10.7% in January, outperforming the benchmarks comprising the S&P 500, a 60/40 portfolio and a global asset allocation fund.

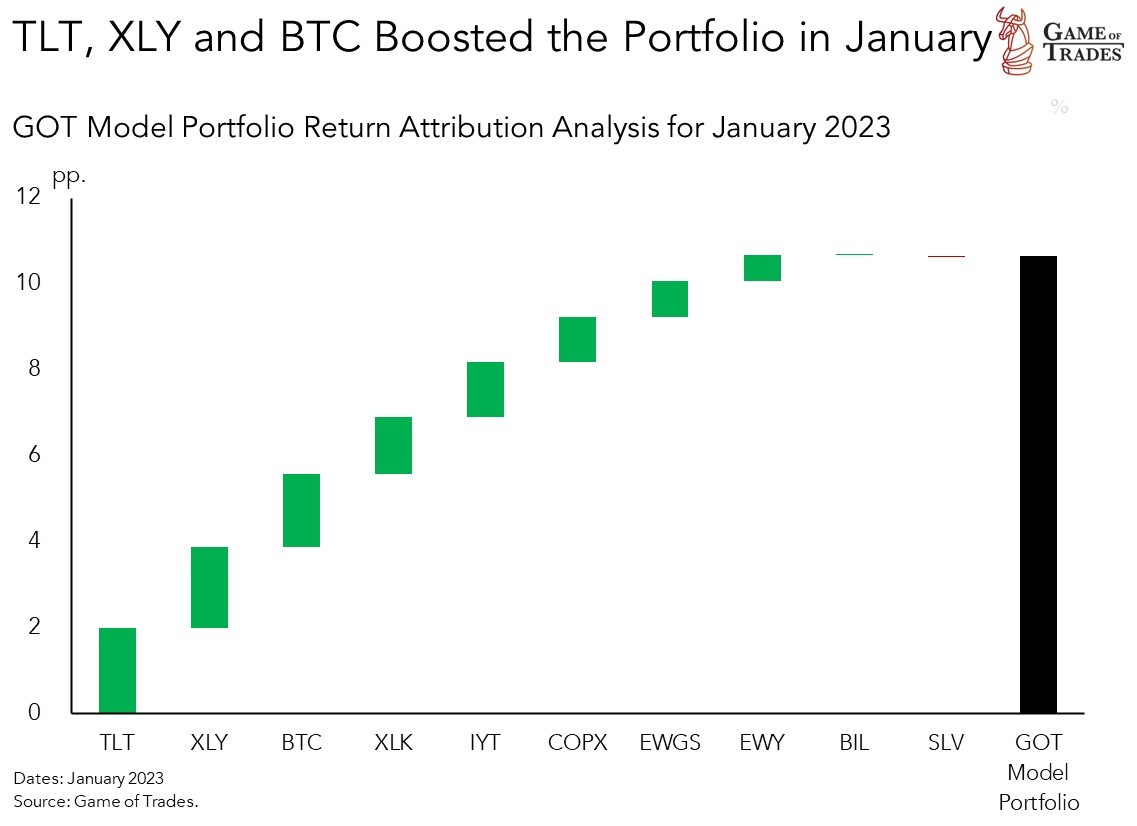

The top-5 drivers of the model portfolio’s performance in January were TLT (20+ Treasury Bond), XLY (Consumer Discretionary), BTC (Bitcoin), XLK (Technology) and IYT (Transportation).

The outperformance of growth sectors like XLY and XLK in January is consistent with our expectations for a reversal that we highlighted in mid-December.

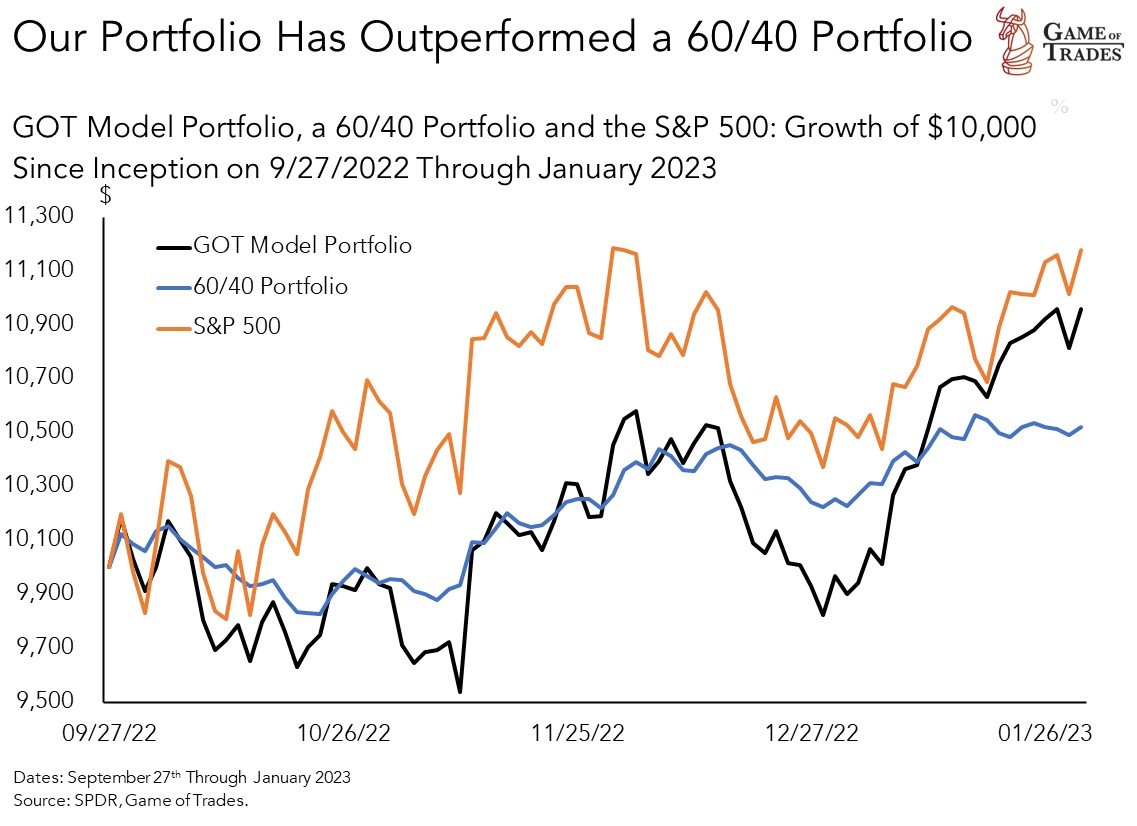

Since inception, our portfolio has generated a return of 9.6%, beating a traditional 60/40 portfolio by 44 bp but lagging the S&P 500 and a global asset allocation fund by over 2 pp.

The biggest detractors since inception have been our XLY and TLT positions. The weakness in TSLA and AMZN last year took a toll on XLY, as both stocks comprise close to 40% of the ETF.

Changes to the Portfolio

We recently downgraded our target for the S&P 500 to 3,500 given our expectation of an earnings recession materializing later this year.

As detailed in our recent Portfolio Update, we’ve increased our allocation to BIL (3-month T-bills) to 15% to increase the nimbleness of the portfolio in the face of mixed economic data.

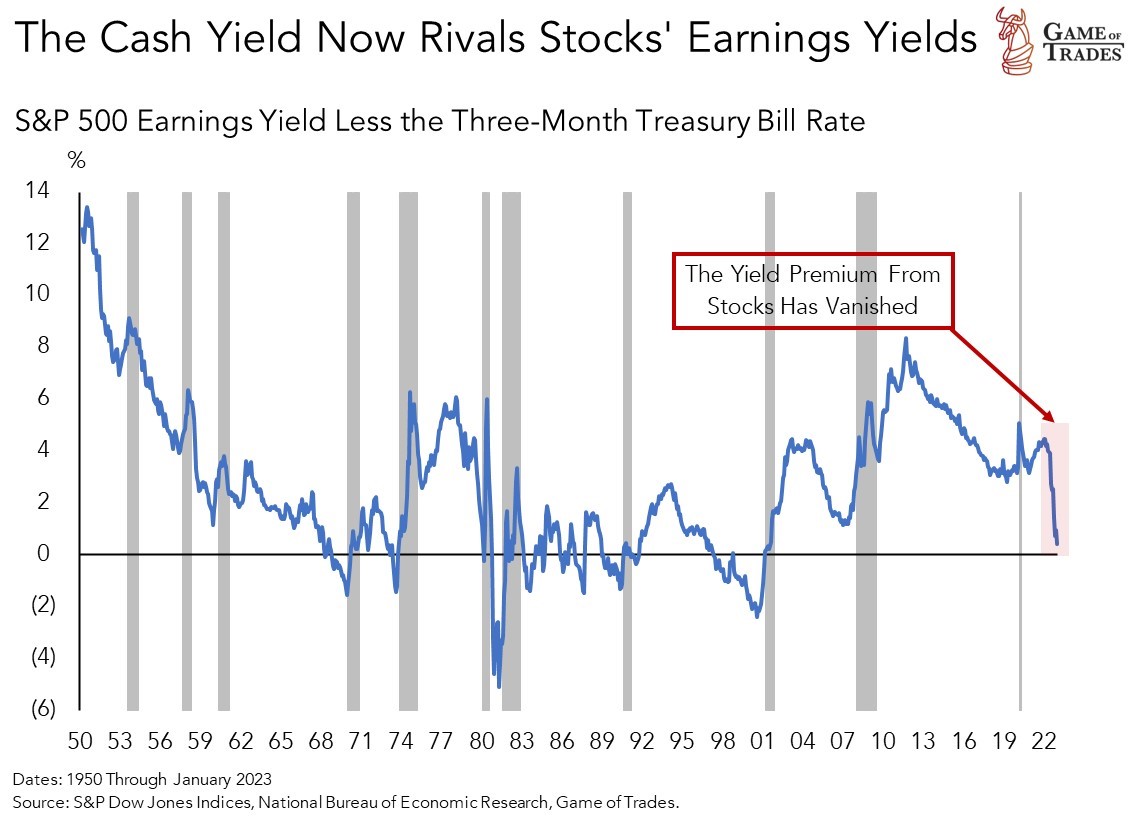

With a 4.5% yield, cash is now a formidable competitor to stocks. We may continue to increase our cash allocation over time given our pessimistic outlook.

We’re boosting cash by closing our positions on EWGS (German Small-Caps) and COPX (Copper Miners) after profitable runs.

EWGS and COPX proved additive to returns after being added several weeks ago, outperforming the S&P 500 by 23 and 10 pp., respectively. We’re reducing portfolio risk by locking profits.

We still hold a negative view on the dollar and may re-enter these positions or add non-U.S. bets in the future at a more opportunistic entry point.

Non-U.S. stocks have seen a big rise amidst China’s reopening. However, a big part of their outperformance has fizzled this year given the aggressive rise in U.S. equities.

This week we added to our position in SLV (Silver), taking advantage of recent weakness resulting from dollar strength following strong economic data. Silver is a high beta short dollar expression.

As we documented in the aforementioned Portfolio Update, we’re allocating 2% of the portfolio to long VIX calls with a strike of 20 expiring in October 18th 2023 as a bet on rising volatility this year.

As highlighted in a recent tactical premium video, the log-based VIX is testing important support that has previously led to bottoms in volatility.

Portfolio Positioning and Outlook

We’re leaving our U.S.-based growth-tilted equity allocation in the portfolio for the time being as we continue riding this year’s swift market rally through a short-term tactical strategy.

XLK appears to be breaking out of a bearish price channel. If the breakout proves sustainable it’d indicate that the market is less worried about rate hikes impacting rate-sensitive sectors like tech.

However, if price were to come back within the channel, we wouldn’t yet consider this to be a legitimate breakout, leaving tech vulnerable to Fed aggressiveness much like the case last year.

Given our negative view on stocks for the latter part of the year, we’ll be gradually transitioning our portfolio to a more defensive stance once the S&P 500 breaks through the key level of 3,900.

As mentioned earlier, this week we’ve begun boosting our cash allocation by locking profits in assets that saw big price runups in recent weeks, as well as betting on a rise in volatility.

We hope you found this first edition of the Monthly Portfolio Review useful in keeping abreast of our model portfolio’s performance and positioning.

Please let us know your comments below whether you find this a useful addition to the service. We look forward to your feedback in improving the value of our service.

Well done Peter

Greattttt!

It’s always good to review strategy and tactics. The greater the amount of information, the higher the degree of confidence in our decision making.

Very useful for a new member! Thank you!

Great

Peter,

can you propose an alternative for the BIL Etf for European investors?

Thanks.

Nice thank you. I hope u keep it up.

Thank you for the model portfolio performance update!

I’m not cleared for options trading, is there another way to get exposure to the VIX position?

@Marcus Waugh The short answer is that there’s no great avenue to replicate our long call VIX exposure.

You can get exposure to VIX futures if you’re cleared for futures trading. Also, there are a couple of ETFs (VXZ, VIXM) that provide exposure to a portfolio of VIX futures. Keep in mind that futures trading carry significant risk of loss and the return behavior may look very different from our exposure to the VIX call through call options.

Woah! Massive changes in the price targets of the Model Portfolio (Bitcoin target went down by like 2/3)! Is that a mistake or did the targets really change that abruptly?

@Aaron Linskey Great question Aaron! We’ve recently downgraded our S&P 500 target to 3,500, which was a big decline from our prior target of 5,200. As a result, the price targets of the watchlist have changed, particularly for those that use the S&P 500 as a input in their pricing. Our work has shown Bitcoin to be heavily influenced by the stock market, and as a result the price target has been downgraded substantially. We don’t expect to see big changes to our price targets often, this was really the result of us meaningfully downgrading our S&P 500 target.

Downgrading targets makes sense, but how, when the target it now lower than the current price are the positions still Long? Wouldn’t you want to at least close the position?

Great work BTW.

What ETF would you recommend as a replacement for BTC? Is BITO the closest match?

I have owned BITO, GBTC, and MSTR. BITO tracks the price most closely. GBTC is trading at a huge discount because it cannot be redeemed. MSTR seems to have more wild swings.

MSTR also has a counter-party risk as Micheal Saylor took out a smallish loan with his bitcoin as collateral.

@GOT What ETF would you recommend as a replacement for BTC? Is BITO the closest match?

[…] Both XLY and XLK contributed significantly in January to our model portfolio’s outperformance relative to the S&P 500, as we documented in our Monthly Portfolio Review for January. […]