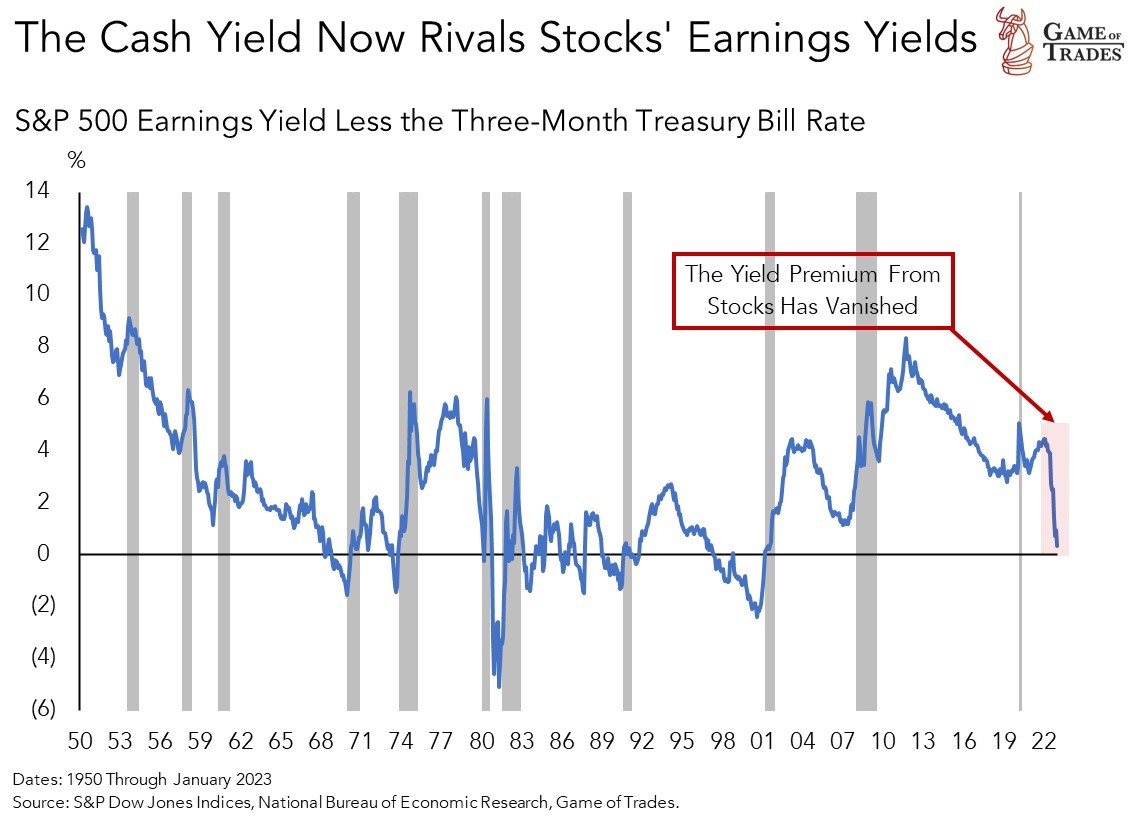

Cash is Now an Attractive Asset Class

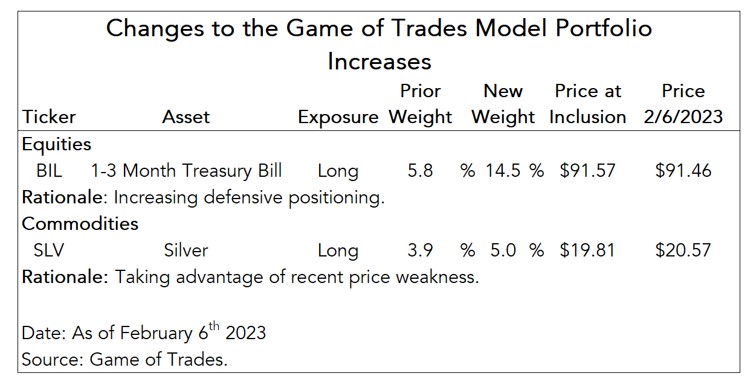

Following up on our last Macro Note, where we downgraded our S&P 500 year-end target to 3,500, our first change to the model portfolio consists of raising our cash allocation (BIL) by 10 pp.

BIL is a 1-3 Month T-Bill ETF we use for allocating to cash. Given our newfound pessimism on stocks, we’re increasing our allocation to T-Bills to close to 15% from about 6%.

The Fed’s aggressive rate hikes have boosted the 3-month T-bill rate to 4.5%. That’s only 40 bp less than the earnings yield of the S&P 500. Cash is now a formidable competitor to stocks.

The 40 bp advantage of stocks today pales in comparison to the premium seen before the Fed turned aggressive. At the end of 2021, the earnings yield was 430 bp higher than the T-bill rate.

We may continue to increase our allocation to cash in the weeks ahead to boost our nimbleness in the face of very mixed economic data until we see confirmation of the weakening anticipate.

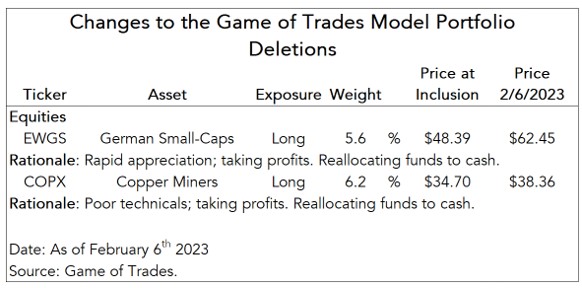

We’re adding to BIL with proceeds from closing our recently-profitable positions in German small-caps (EWGS) and in copper miners (COPX).

Locking Profits on German Small Caps (EWGS) and Copper Miners (COPX)

We added EWGS in late-October as a bet on a weakening dollar and a reversal of the pessimism related to Europe’s energy crisis. Since inclusion, EWGS has outperformed the S&P 500 by 23 pp.

While the bet on EWGS has worked out, the velocity of its gains has exceeded our expectations and leaves it vulnerable to a correction. We’re looking to lock in profits.

We believe the dollar faces more downside this year, giving non-U.S. stocks like EWGS an edge. However, we’d be looking to re-enter at a more opportunistic level.

EWGS by gameoftrades_yt on TradingView.com

We added COPX in November as a bet on a falling dollar and a reopening in China. Since inclusion, COPX has outperformed the S&P 500 by 10 pp.

China’s aggressive reopening has benefited COPX and its rise has been violent. We’re taking COPX off our portfolio to lock in profits as the easy money on the China reopening has been made.

Similarly to EWGS, we believe COPX stands to benefit from a weaker dollar ahead. However, we’re waiting for more clarity on whether China’s reopening will continue unabated.

COPX by gameoftrades_yt on TradingView.com

Adding to Silver (SLV) Given the Recent Weakness

The hot payrolls print on Friday triggered a surge in the dollar and selloff in the silver ETF (SLV). That’s not a surprise given that silver is a high-beta bet a bet on a falling dollar.

We added SLV to our portfolio in November alongside COPX. SLV is our levered bet that the dollar will weaken as the year progresses.

The big decline in SLV recently has substantially reduced our gains since adding the ETF to our portfolio. Since inclusion it’s led the S&P 500 by about 1.3 pp.

We’re taking advantage of the recent weakness in SLV to add to our position, given our conviction that the dollar will weaken. We’re upping our allocation to SLV to 5% of the portfolio.

SLV by gameoftrades_yt on TradingView.com

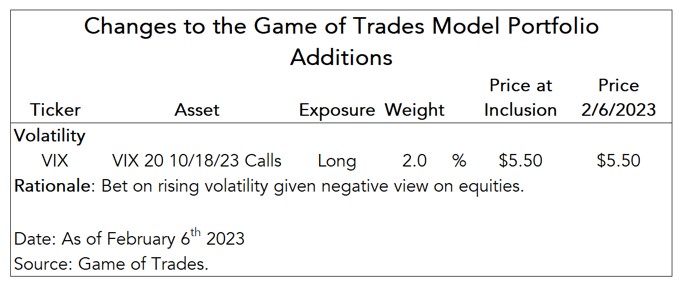

Adding VIX Calls as a Bet on Volatility

As we highlighted in our recent tactical premium video, the log-based VIX is testing important support that has previously led to bottoms in volatility as shown in the chart below.

We believe the timing to buy VIX calls is opportunistic. We believe that volatility will rise as equities move lower later this year.

Our view of a 15% decline in the S&P 500 by year-end implies a rise in the VIX of close to 70%, to a level around 32.[1]

The options market is pricing only a 17% probability that the VIX will exceed 32 by mid-October. We believe that probability looks low.

We’re allocating 2% of the portfolio to long VIX calls with a strike of 20 expiring in October 18th 2023. The premium is $5.26.

VIX by gameoftrades_yt on TradingView.com

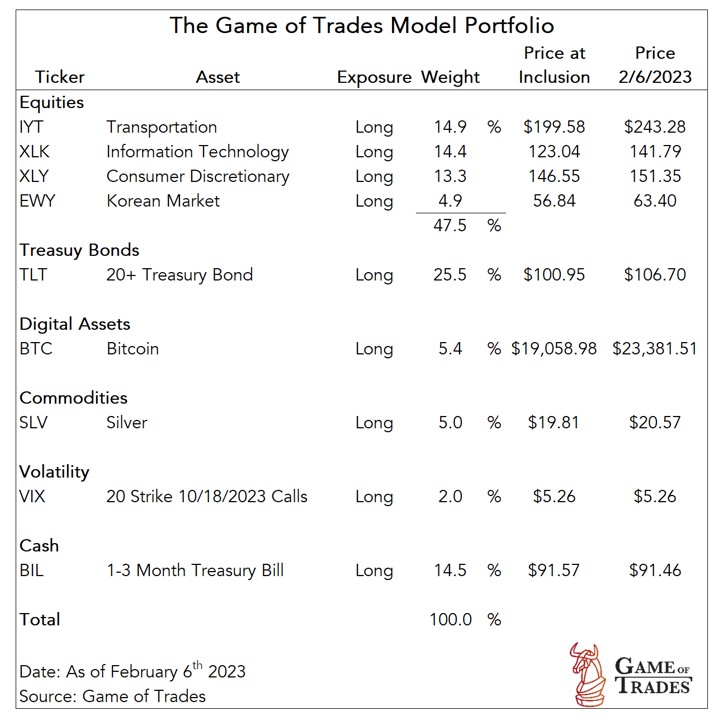

Putting everything together, below we document the changes we’re making to our portfolio. The updated portfolio is shown following the updates.

Tactically-Riding the Equity Market Rally

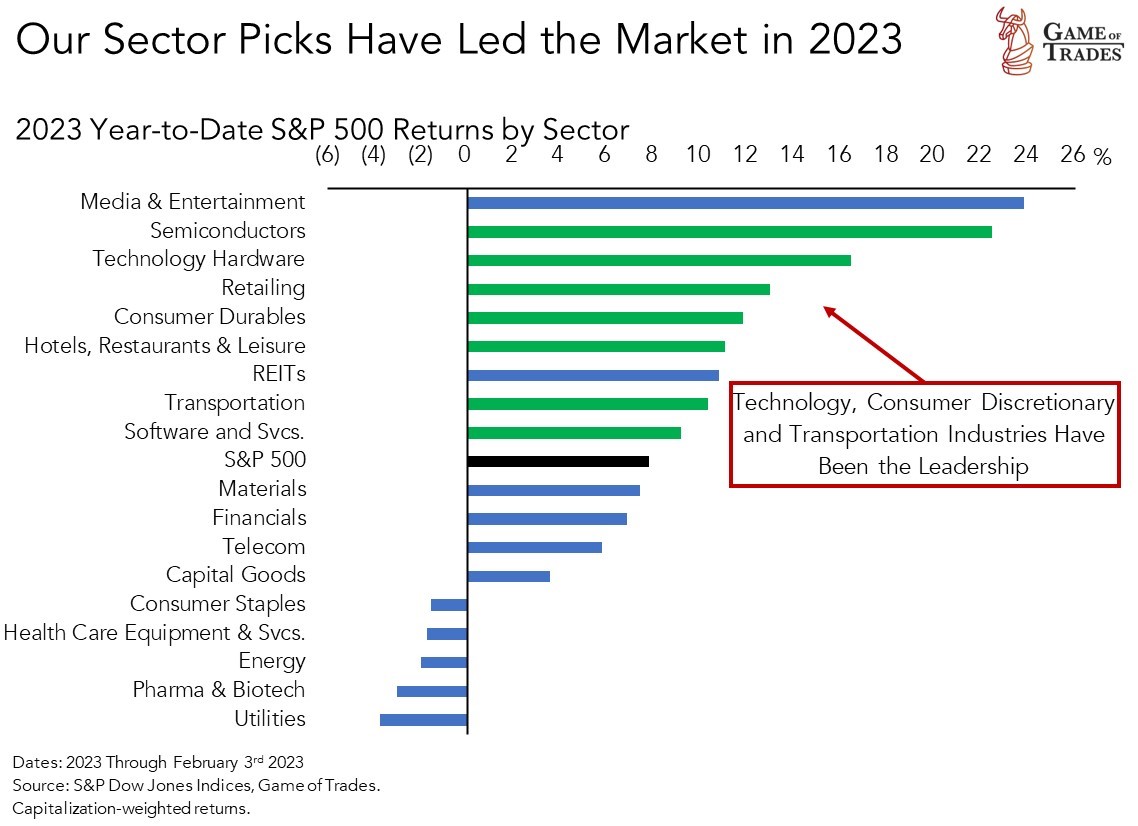

We’ve been tactically positioned to benefit from this year’s rally in stocks, with our key sector picks of tech (XLK), consumer discretionary (XLY) and transportation (IYT) outperforming the S&P 500.

While our view is that the S&P 500 is headed to 3,500 by year-end, we don’t want to be on the wrong side of a growth-stock-driven rally. They can be very punishing to performance.

Changes to our model portfolio to a more defensive stand will come when the S&P 500 breaks the key level of 3,900 that we’ve identified in our technical strategy.

My account is not set up for futures.

Are there calls for the vix index?

Any alternatives? I was thinking VXZ.

Thanks.

@Maxrothira Thank your for the question. The VIX calls we’ve added to our portfolio are not based on futures contracts, but rather on the spot VIX. The alternative you mentioned, VXZ, tracks VIX futures contracts with an average of 5 month maturities. Please let us know if that answers your question.

Yes, thank you.

I figured out how to get the call options on thinkorswim from TD Ameritrade.

Sorry, but could you propose an alternative to calls on VIX? Also not getting how BIL works.

Thank you for this. I cannot use futures, what do you think of UVXY as an alternative to VIX calls?

If you have options clearance, you don’t need to mess with futures. I figured it out with thinkorswim from TD Ameritrade that you an use ticker VIX to find the calls. I could not buy them where I normally buy options on the website.

I personally don’t like UVXY as it is a 2x fund and has horrible decay.

VXZ uses futures (not calls) as GOT stated, and the mid term (5 mo.) is closer to the October calls than VXX or UVXY, which are short term (1 mo.). It is also an ETN and has counterparty risk. The ETF version VIXM issues K-1s. Yuck.

The more I think about it, the more a call 8 months out is different than holding futures of a constant maturity of 5 months. In the call, you get 8 months for spot VIX to go up to sell at a profit. For VXZ, you are dependent on the 5 month futures rising.

Still, I think VXZ is the best product if calls are not an option (pun intended). Beware that the term structure of the futures can have a big impact, and not just VIX spot price. This product’s previous incarnations decayed more rapidly due contango present in the 4-7 month VIX futures at that time.

VXX decays to rapidly for me.

The mystery of the Vix low volatility is interesting. It could be a combination of the number of short dated options that day traders are placing trying to find money to pay the rent. We could also be entering a complacency stage before a big fall. If this is the case the entry point could be closer to 15 Vix but you are far enough out that it should pay off with any adverse effect and pay handsomely if we get into a huge drop as earning continue to disappoint and inflation ticks back up. I like your pick here GOT.

Can you please explain how the BIL ETF works ?

Does it pay dividends ?

I see the price drops at the end of each month, what happens when it drops ?

BIL holds 1-3 month treasury bills. The dividend from the ETF is the payments from the T-bills. The price inches up as you get closer to the dividend date. When the dividend goes out, the price drops by about the dividend amount.

Thank you @Maxrothira. That’s correct. We show the BIL price in the portfolio but returns to BIL should account for the income yield as it’s invested in 1-3 month T-bills (i.e., the total return).

I like to use morningstar because you can choose “price with dividends” or “growth with dividends” for total return.

I think that you are getting too bearish in a situation that is not clear, maybe the after inversion-recession is already happening and after this we’r going up, and maybe the earnings discount in the markets are already in at most a lit bit more of chip-chop. Be careful starting to cherrypicking. I remember you that in June of 2020 you were extremely bearing and in November of 2021 you were extremely bullish, and look what happened. We are not in 2001, 2007 or in the 70′. In 2007 I remember well how that unfolded it started with a the housing market exploring and many mortgages not been payed back after years of reckless lending for many institutions around the world, but the credit were running for many people until September of 2008 after Lehman Brothers that sent in to peaces the financial markets with a really slowly central banks reaction around the world and been too hawkish, what happened after that is that credit went to zero, and every thing started to crumble. Are we seen the same now?, of course not.

I love your analysis and and I be here for years, but do not get attached too much in one thesis and be open to keep two or three running. In deed I would love to see how you keep those thesis always running at leat one bullish one bearish and one neutral, give us the information and we will decide where to invest. I don’t like that Model Portafolio, this is not UBS, this could be a lot better.

Thank you

What do you think about gold miners?

Thanks

Hi @Joanna. In our work we’ve found silver to be a better expression for a dollar short than gold or gold miners. That’s why we added SLV to the portfolio to express a pessimistic view on the dollar, rather than gold or gold miners. The article below goes into more detail explaining our reasoning. You’ll find evidence that gold miners outperform gold mainly when the equity market is rising. Given our negative view of stocks in the next 6-12 months, we’re not looking to add long equity commodity exposure like GDX at the moment, given the regime we envision for the rest of the year (stocks down, yields down and dollar down).

https://www.gameoftrades.net/news-feed/adding-silver-and-copper-miners-to-our-model-portfolio/

GOT,

With increased allocation to SLV, do you have any recommendations on silver miners? Are they a sell if already bought? They really have not moved with the increased price of silver as metal during this recent rise at all. Very interesting to see this type of nil price movement in stocks associated with silver production even going back a year or so. Nothing. As a matter of fact these miners topped out in fall 2021 and have been going down since. Something was up back then and I watch these miners as it tells me smart money never has bet on any recovery since then. IMO.

Call options on VIX are great recommendation. Just bought some at $5.30. we are getting in close to very bottom. Please let us know if and when these should be rolled should that happen as you would know more than anyone if any options are showing discounts to do this.

Would you suggest a larger percentage for those who like more risk as I feel it is a great opportunity as I just liquidated big profits in some high tech bought when completely discarded by most. They were still moving up but I have been down that road before on this. Bullish when most are bearish and bearish when most are bullish. Not 100% but risk is much lower.

Your data has helped greatly. Keep it up.

@ggb58 Great question. We covered that topic in our recent article detailing why we added SLV to the portfolio (see the link below).

Silver miners like SIL have an equity component to their return behavior, as opposed to physical silver ETF like SLV. Given that our bet on SLV is purely an expression of a dollar short trade, we’re more comfortable with that type of risk (i.e., currency), as opposed to equity risk given our pessimistic view on stocks over a 6-12 month horizon. If the equity market moves down (alongside a falling dollar) in the next several months, it’ll likely drag silver-base equities like SLV down, while SLV should outperform both the market and SIL. We hope that helps you think through this very pertinent question.

https://www.gameoftrades.net/news-feed/adding-silver-and-copper-miners-to-our-model-portfolio/

On Streetsmart use $VIX

On Tradestation $VIX.X

Peter, what is the reason behind your bearish views on USD towards the end of the year? Shouldn’t capital flow into safe haven of USD when inflation slows down and the recession fears start to materialise? Shouldn’t dollar grow as S&P goes down to your stated target of 3500?

Hi David. Thank you for the question. Our bearish view on the dollar is due to its aggressive pricing of rate hikes last year (i.e., interest rate differential with the rest of the world). That leaves the dollar vulnerable to an easing Fed, as the economic data worsens and the recession ensues later this year.

We welcome you to take a look at our more recent in-depth look at the dollar in case you haven’t yet, that details our thesis for a weaker dollar.

https://www.gameoftrades.net/news-feed/the-dollar-has-more-downside-from-here/

Game of Trades, the displayed VIX call option date in the model portfolio section says Oct 18 2021, very confusing. Pls update to 2023 as noted in this article.

[…] Closed EWGS (German Small-Caps) and COPX (Copper Miners) after profitable runs and moved proceeds to BIL (1-3 month T-bills) to boost portfolio agility. […]

[…] We opened a long VIX call option trade back in early-February given the favorable technicals as the VIX was hovering near key support. […]

[…] recent spike in volatility to close the remaining of our small long call VIX position. The position was a bet that VIX would surge to 32 into a recession this […]