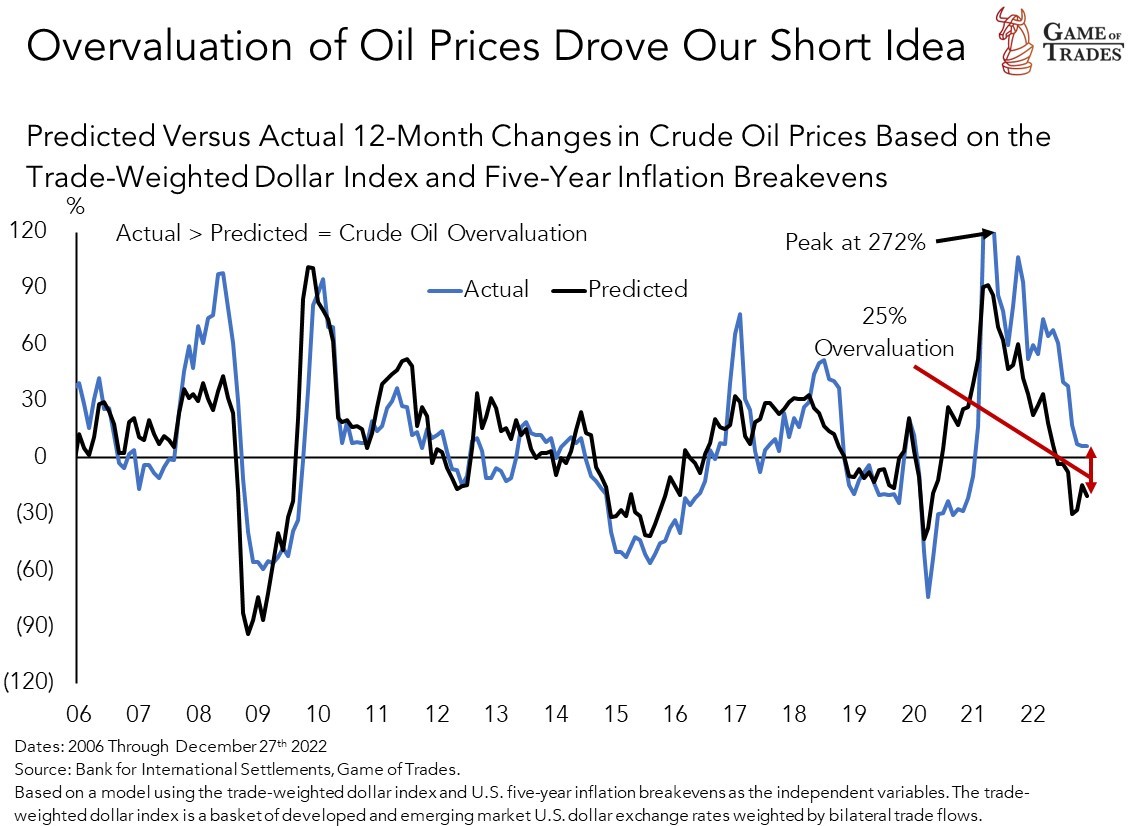

Back in June we laid out our thesis on why oil prices would fall and drive disinflation. In our last Macro Note we detailed how falling gasoline prices have driven the weakening CPI this year.

In an article in August, we reiterated our view that oil was overvalued, as found by our model. We assigned a target of $67 for the commodity. In early-December, oil prices fell to $70.

Our model for crude oil still points to oil being about 25% overvalued today.

However, the overvaluation doesn’t take into account our expectations for dollar depreciation in the next 12 months. We believe that China’s economic reopening will help drive dollar weakness.

Global commodities like oil appreciate in value when the dollar weakens. A weakening dollar is indicative of rising global demand and falling uncertainty, positive factors for commodities.

As a result, the risk-reward of being short oil is much less today than it was back in June, when China was deeply entrenched in its Covid-Zero policy.

From a technical standpoint, we note bullish divergence on the weekly time frame as oil made a new low while the momentum indicator (RSI) made a higher low.

This signal indicates that the underlying downtrend may be reversing and that oil’s price may start to rise in a counter-trend rally.

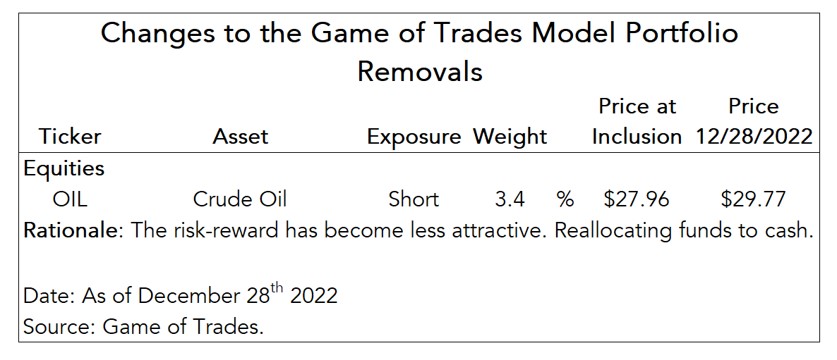

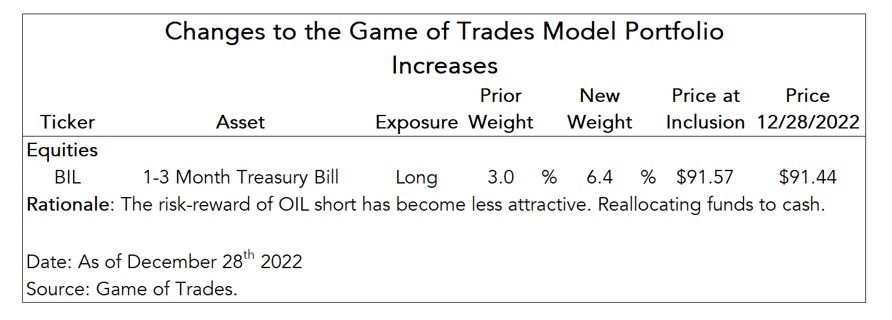

We’re closing the short crude oil position (OIL) and moving the funds to cash (BIL) until better opportunities arise.

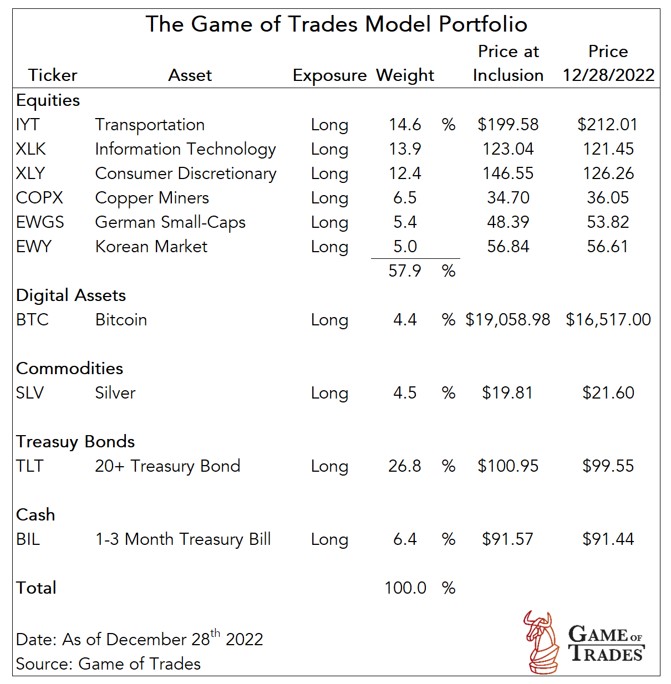

Below is our updated model portfolio following the change.

Love the update! Thanks Peter and GoT team! I’m curious, for future reference and to help my ignorance turn into knowledge, what instrument did you use to short oil? I used ticker DRIP which is 2x Bear oil&gas – it was a fantastic trade for me, worked well – closed out a few weeks ago. I just don’t like holding leveraged ETFs for long – but it was all my ignorant self knew about haha.

Sometimes I just need to type ticker OIL to figure these things out – answered my own question….LUL To be fair to myself, I was in DRIP before joining this service…. I feel foolish LMAO. Plz add delete function hahah JK 😀

To be fair to myself, I was in DRIP before joining this service…. I feel foolish LMAO. Plz add delete function hahah JK 😀

Thanks for the update on the Model Portfolio.

What would be more useful is if you had a profit and loss per investment.

One way to do this is to pretend you started with a $100k investment fund.

Then as you buy and sell you can allocate the amount of the investment by percentage allocated to each investment, and show how many shares and at what cost for each recommended investment.

This can be updated as investments gain and lose, or as you sell and buy new investments.

Then you can total the new value of the $100k initial investment based on the overall results to see the gains or losses of the model portfolio.

The gains and losses of a theoretical $100k Model Portfolio.

I feel seeing the actual gains and losses per each recommended investment would be useful.

And a cumulative running total. Index start date to 100 or whatever and keep a cumulative track record, as well as a history of each trade with dates, prices, and percent gain/loss.

Right, an imaginary I started with $100k,

I bought these investments on this date and price, sold these at this date and price , and here is where we are at on our 100k.

.

How come you are not adding to BTC? Seems like a good time to even out back to 5% or whatever it started at…

The Model Portfolio has had some changes over the past 3 months since 9/27. A back of the hand calculation shows the original MP if held through yesterday would be down about $2500 based on an initial $100k total investment. That $2500 loss however is too high, as positions have changed, the MP seems to have sold some big losers like Consumer discretionary and added some smaller winners like Copper and German Small caps. If you consider selling some loser like XLY, and buying some winners like Copper or the German small cap, the loss of the MP is certainly lower than the 2.5% loss on my back of the envelope calculation for the original portfolio, but likely still negative. An investment in the S&P 500 which is the normal comparison benchmark for portfolios would be up about $3200 or about 3.2% over the same time frame. A more traditional 60/40 stock bonds portfolio would be up less as the short term bonds have only minor gains, the TLT is about break even, and there would be $40k less out of $100k invested in the S&P 500 which almost cuts the gains in half. But even still a slight 3 month gain of around 2% for a traditional 60/40 where the stock part was the S&P and the bond part was a mix of BIL and TLT. In fairness to GOT, there time frame for their MP is 6-12 months, and if things do turn around next year the relatively poor results of the first 3 months (the MP is underperforming both a traditional 60/40 portfolio and a 100% S&P 500) can be made up over the next 9 months. The two biggest bets in the MP are Consumer Discretionary XLY which has gotten killed relative to most other asset major asset classes over the past 90 days, and TLT which is about break even or slightly up. Transportation also a good size bet is doing well, while Information Tech is down a little. Bitcoin bet is a big loser but a small position, oil a decent gain and German small caps have done quite well. But the big takeaway is 3 months in, the MP is overall underperforming typical investment strategies including 100% S&P 500 and a 60/40 stock/bond portfolio.

All of the changes we\’ve made to the model portfolio have been documented through various articles over the past 3 months. For example, in the article titled \”Adding Silver and Copper Miners to Our Model Portfolio\” (see link below) we documented how we added COPX and SLV to the portfolio by trimming positions in BIL, XLY, OIL and TLT, with specific detail as to how the weights for each position had changed and the investment rationale for making those changes. We show the changes using the same type of tables as we do in this Portfolio Update note. That said, going forward we\’ll be documenting the changes to the portfolio through standalone Portfolio Update notes, while still linking back to the investment thesis research. https://www.gameoftrades.net/news-feed/adding-silver-and-copper-miners-to-our-model-portfolio/

I believe the desire here is to have a paper trading account implemented within the website with a theoretical 100k investment reflecting in real time the P&L, Position Size, Cost Basis and current Market Value of assets held within the MP – same as it is when I log in to my broker account. This would be visually informative and highly efficient for users. The question is, I think, how to implement a paper trading account & view of the model portfolio and whether GoT service would consider implementing this feature. With love & understanding, I can see Peter and GoT team going “oh crap, more time and energy to figure out how to implement this feature.” Haha, it would be a fantastic feature – I’m fine with or without, but there is a clear desire from some members here to have this feature added. Imo it would only be a PLUS. Individually we could do this, as The Oracle has shared above, but I guess cut right thru to the meat here – is such a feature a hard no, or maybe something the GoT team would at least consider moving forward?

Peter.

Thanks. That’s the problem with having a model portfolio based only on percentages, without tethering it to a an initial dollar investment total such as 100k. It makes it complicated for followers to make adjustments to their portfolio and see the ups and downs. Most of the model portfolios I follow start with a $ amount in theory and then adjust up and down.

And I don’t pay too much attention to the MP anyway as I’m not using it to base my investments 100%, just looking for good ideas.

I really think if you go back and adjust the portfolio to a 100k start, nice round number, and then buy and sell accordingly, it will be useful to all of us. Instead of using percentage changes.

Exactly, well put Oracle – to be clear the paper trading account representing the MP would only be for displaying the MP in a more comprehensive way – tethering the MP to a starting dollar amount (100k sounds perfect), displaying in real time the Cost basis, market value, % weighting for each asset (which would rise and fall as the market value rises and falls) and actualized profit & loss as positions are adjusted. Not at all desiring a feature for us to play with nor to create our own paper trading accounts, but a MP paper trading account to accomplish the visualization of the MP without us individuals having to do the calculations. It really would take the MP to the next level!

Question for GOT,

If your MP started with $100k, and you made all the trades you made during the last 3 months, what would be the ending balance today? I’m guessing around $97-98k?? A very small cumulative loss over the past 3 months? I don’t have the time to do the calculations or read back over the trades, as I’m not using the MP 100% just looking for ideas, but certainly it’s something your staff should have an interest in doing.