Summary

- Closing remaining long (OTM) call position on VIX initiated in February of 2023

- Half of the original position at a big profit in March, when banking panic ensued

- VIX call position has strike of 20 and expires on 10/18/2023

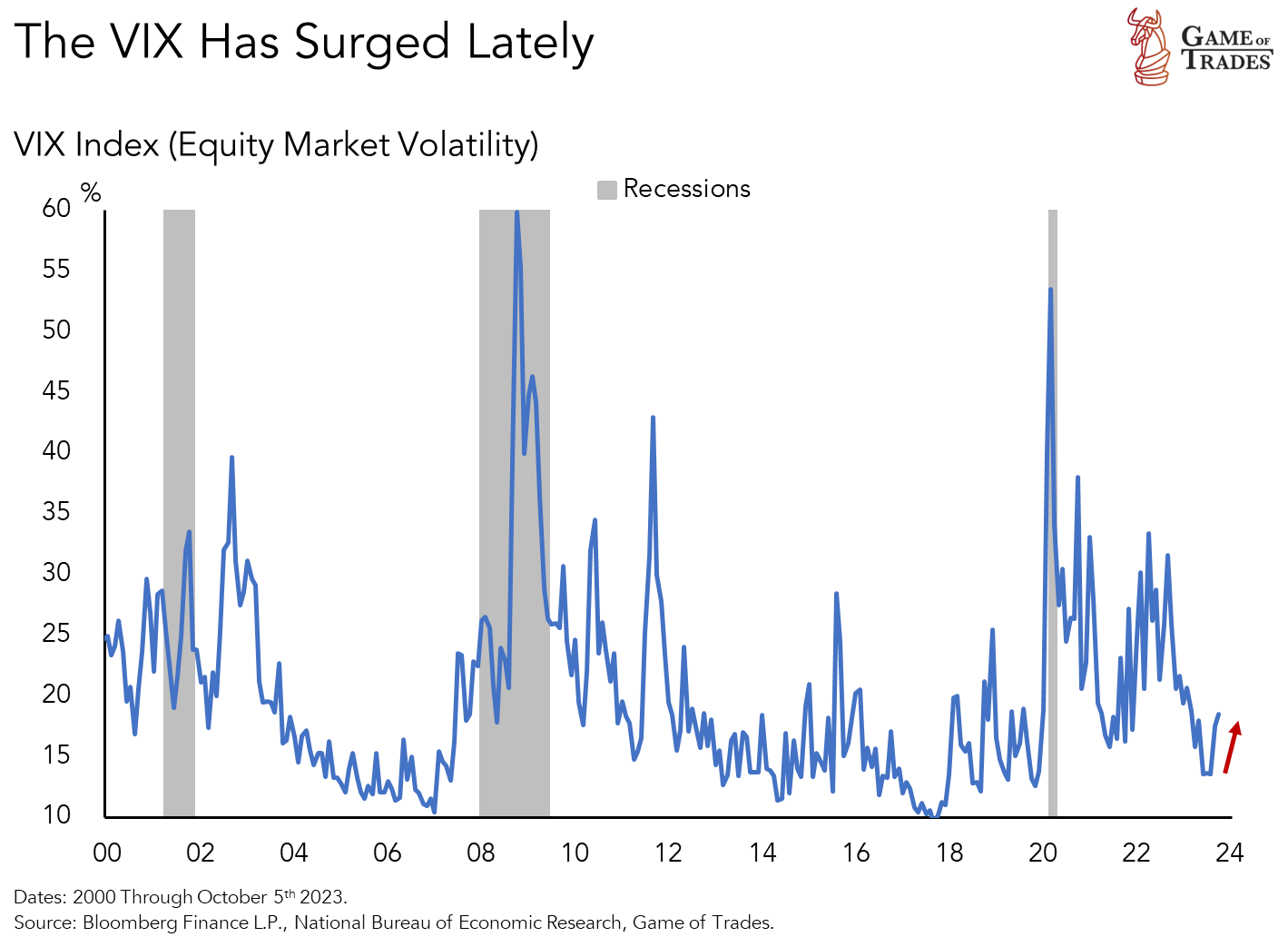

Taking Advantage of Recent Surge in Volatility to Close Our VIX Call Position

We’re taking advantage of the recent spike in volatility to close the remaining of our small long call VIX position. The position was a bet that VIX would surge to 32 into a recession this year.

We’ve moved our recession timeline to the 1st-half of 2024. Hence, our VIX call isn’t in full alignment with that timeline any longer, given its expiration date of 10/18/2023.

With the option expiring soon, time decay is a concern. We’re instead looking to cut our losses and salvage the position.

We’ve sold the remaining of our VIX call position today at an intraday price of $1.20. The entry price was $5.50. Funds will be added to our cash position (BIL).

Half of the original VIX call position was sold in March at a profit. The volatility surge that month was driven by worries around bank runs. We sold the position then at $7.30 at an intraday VIX of 30.

Salvage???

Sorry, but I’m losing faith in GOT. I know portfolio management is not easy and I expect losses along the way, but the goal of GOT beating the S&P500 isn’t working out so far.

First you made extreme prediction of S&P500 to 5200, then pivoted way low to 3500. Predicted recession in 2023, then 1st half of 2024, now to 2nd half 2024. Going long on TLT way too early and then going short on TLT to hedge with a net loss so far. SPY call is down 75%. Metals are hammered with DXY surging. TUR is the only winner at the moment.

I can only hope the results improve moving forward.

Same feeling here.

I was looking forward to learning from GOT for portfolio management but I am not so sure anymore.

The SPY call ends up dragging the portfolio even further down which is ironic because it was put in place after missing the SPY upside so it’s a loss on both sides.

The TUR winner is far from balancing out the rest.

Thank you for the comments, Paul. The prediction for recession is 1st-half of 2024, not 2nd-half of 2024. Apologies for the typo. That’s been corrected.

Our hedge on TLT has not generated a net loss. The hedge has produced a net profit for the portfolio taking into account the TLT loss since the hedge was put in place. The SPY call was a hedge against not having equity exposure in the portfolio.

The decline in the value of the SPY call isn’t a “double loss”. The SPY call was put in place to hedge against the risk of equities melting up considering we have little long S&P 500 exposure. If the market is falling, we’d expect the insurance to decline in value. But we’re not being “doubly penalized” as we’re not holding equities in our portfolio.

We’re optimistic that our portfolio will significantly outperform the S&P 500 in a recession.

I echo the sentiment. GOT was too adamant about the looming recession that it positioned itself for it but it did not materialize which ended up hurting the portfolio with losses and losing out on the upside in the equities. Predictions are hard I agree. And I enjoy the content you put out, yes. However, the risk management portion can be improved significantly by putting more weight to the price action which may contradict your theses.

Yes it’s not technically a “double loss” but you get what I mean: we lost both ways, we didn’t gain from rising equity first and instead piled up losses with the other bets and then “real” loss when we tried to take exposure in equity with this insurance bet but it was too late.

$8.50/2=$4.25

Loss 25%

GOT. Admit the mistakes. Making excuses is unacceptable.

GoT, why not add a time-frame element (short/med/long) to the portfolio and include some (all) of the Trader setups in the portfolio? It may make all commenting here happier… read on…

BTW – Everyone has been waiting for TLT to turn bullish. The large volume spikes the last two weeks could be signaling a turn for the better is near. That will make the portfolio look much better.

I get the frustration in these comments.. the portfolio is the teaser that got me to subscribe, and frankly I haven’t used it (stopped out). I have used other GoT recommendations though which have straight-up paid off. The stuff they put out is not BS, well put together, and useful. The way I look at it.. a buck or two a day is not going to get me anything more than suggestions.. I need to take it from there.

My gripe is, considering how much (or rather, little) I’ve gotten out of the portfolio, it was off-putting to introduce the “Trader” subscription as an additional charge.

I agree that the trader portion was off putting as well. Especially since, when that service launched, the content for the regular service became weaker and less frequent. Too much kitchen, not enough cooks perhaps.