-

Decreasing VIX 20 Strike 10/18/2023 Long Call to 1%

Taking Profits on Our VIX Call (VIX 20 Strike 10/18/2023)

With VIX almost hitting an intraday level of 30 today, we’re trimming our VIX long call option to 1% of the portfolio at a price of $7.30 relative to our entry price of $5.50. We’re booking profits of 33%.

We opened a long VIX call option trade back in early-February given the favorable technicals as the VIX was hovering near key support.

The concerns around the U.S. banking system triggered by the collapse of Silicon Valley Bank on Friday have led a surge in the VIX.

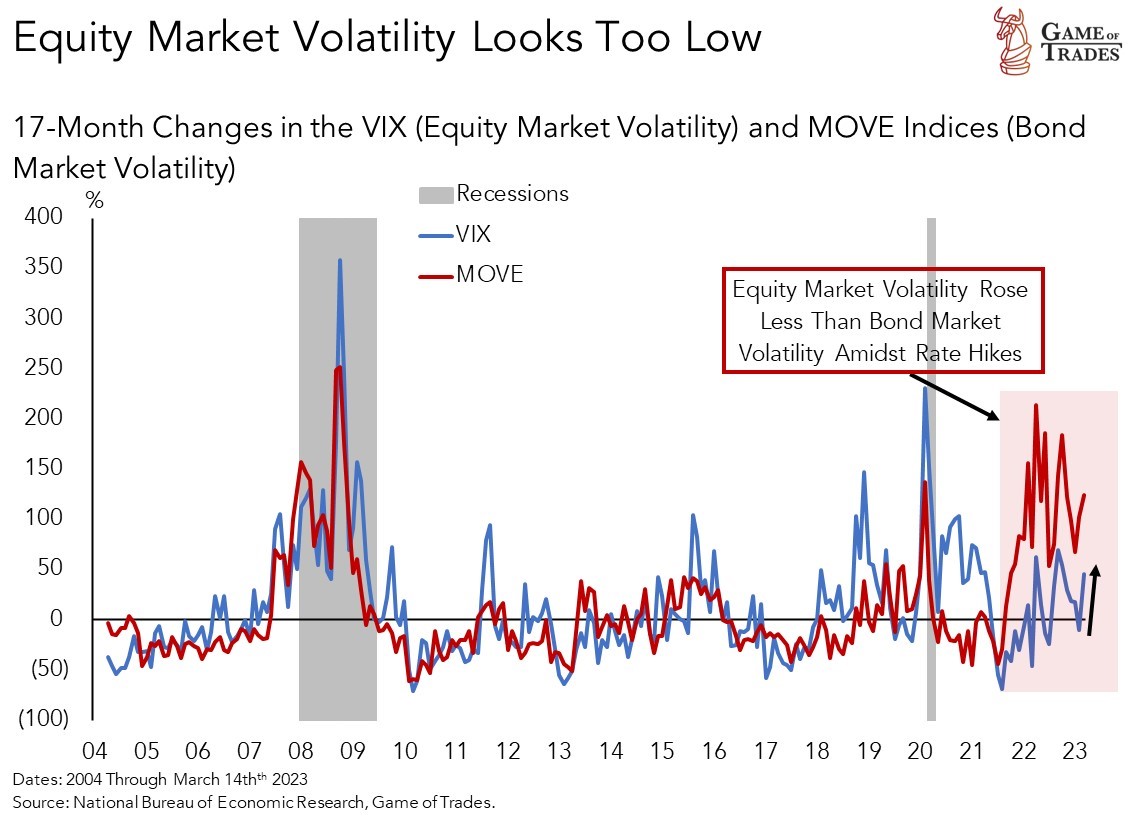

We’d previously highlighted the VIX looked too low relative to the MOVE index (i.e., interest rate volatility). Equity market volatility is catching up.

We’re moving proceeds from the sale to cash. We’ll keep 1% of the position open as we expect volatility to rise in coming months as the S&P 500 approaches our target level of 3,500.

sheeesh boi we eating good tonight

Is it possible that VIX could be included in the tactical watchlist as well? It would be well appreciated! Also, despite the removal of the S&P 500 and XLK from the model portfolio, I’d personally prefer them remaining on the watchlist, given how commonly they are being referred to in the news.

@Samonita Kayden Thank you for the feedback. We’ll discuss with the research team.

Do some brokerages not offer VIX to trade? TD Ameritrade seems to not offer it.

The VIX isn’t tradable it is just a volatility index. You can however trade options on the vix which is what GOT is doing. Its essentially a derivative of a derivative.

On TD, you need to use thinkorswim and use ticker VIX to trade the options. You need option clearance.

Peter @GOT,

Leading indicators are pointing down… Without unemployment rise, there cannot be a recession… That’s my 2 cents…

Unemployment is the most lagging indicator. Historically it has almost always been the last shoe to drop. By the time unemployment rises it would already be too late to position yourself for a drop in the stock market

Farah,

Yes, but this is what the FED is looking for as confirmation. Covid exasperated the labor shortage issue and the labor/population availability is declining…. the govt can’t payback the huge loans without inflation. Where does one put your money?

You have any data on Freight movement? how does that look?

@Veejay Mali Thank you for the suggestion! Unfortunately we’ve not taken a look at freight indicators.

Nailed it.

I sold half of my VIX options today (a day late) – not as profitable as if I sold the day of the alert, but happy to have some gains. When I did check email to find the alert, market is closed.