Summary

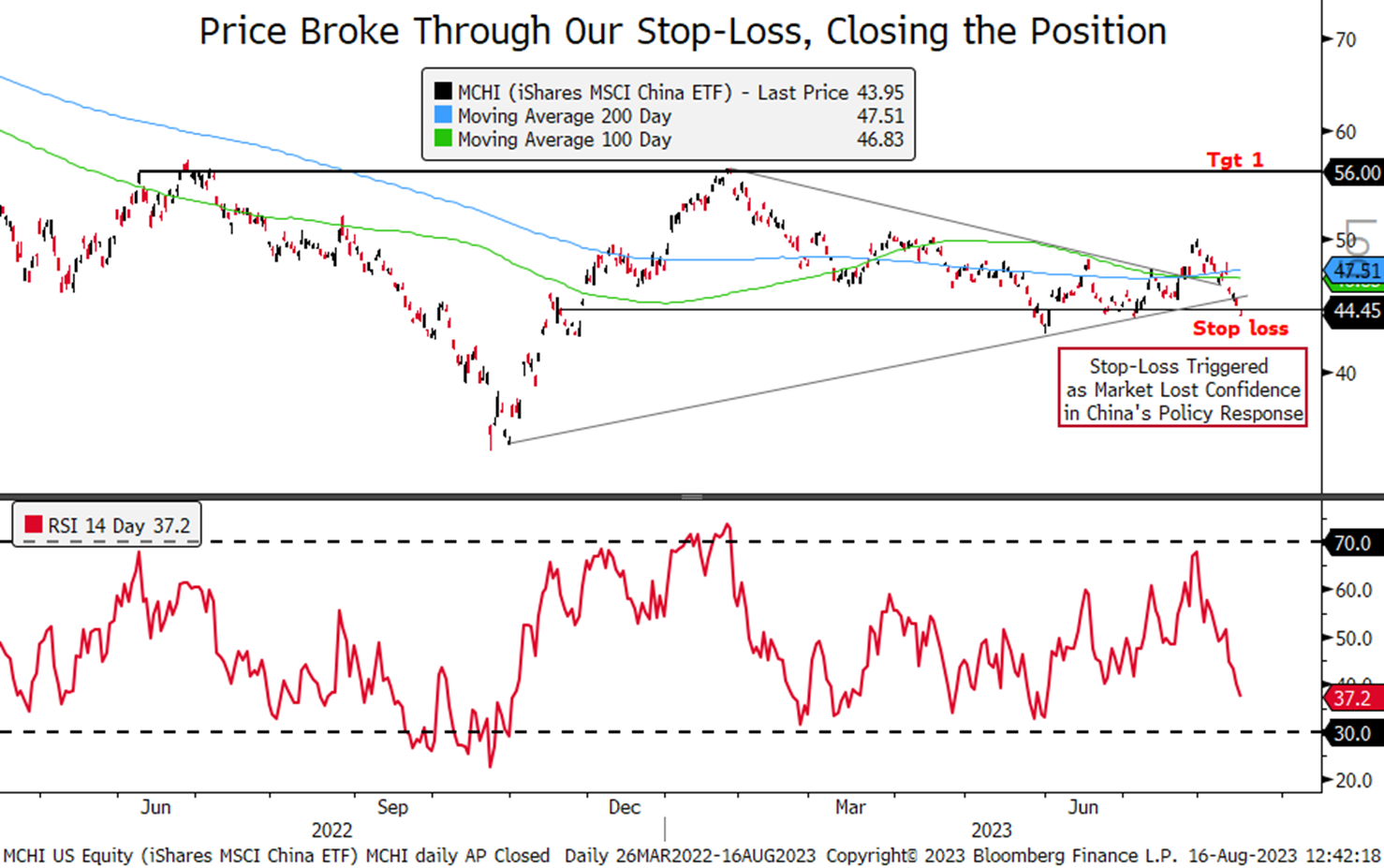

- Closing long position on Chinese stocks (MCHI)

- Stop-Loss was triggered at a close below $44.50

- We’ll reconsider re-opening the trade if a more decisive policy response is brought forward

China’s Policy Response Proves Insufficient

We’re closing our long position on Chinese stocks (MCHI) as the price closed below our stop-loss level of $44.50 on Wednesday. It also broke through uptrend and horizontal support.

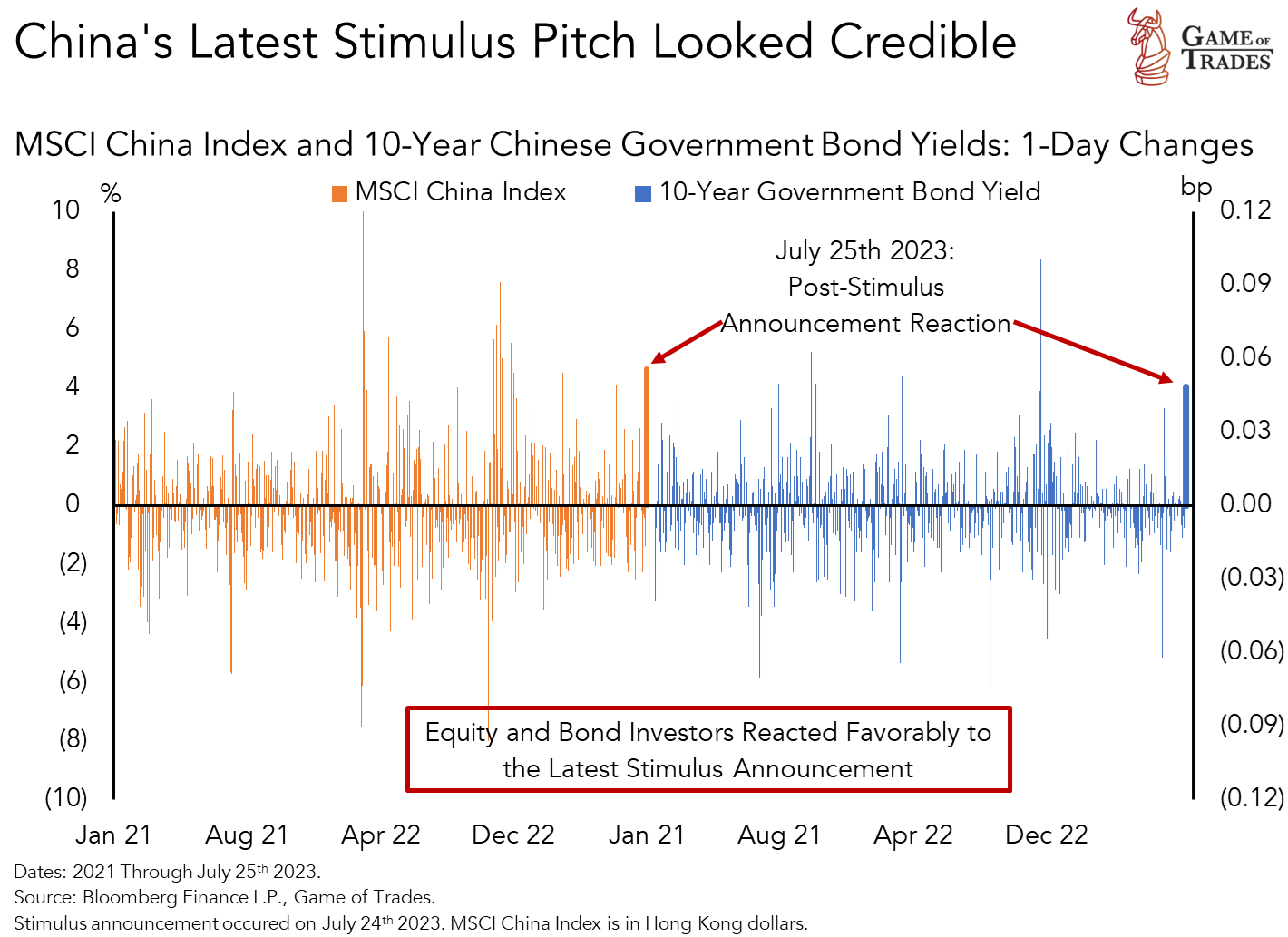

The stop-loss level was set slightly below that before the stimulus announcement of July 25th. Price falling below that level indicates loss of credibility in the policy response, negating the thesis.

The market has lost confidence on the authorities’ response on the back of continued weakening in the economy since the new measures were revealed around 3 weeks ago.

We opened the position on Chinese stocks (MCHI) in late-July based on a favorable risk-reward following the market’s positive response to the authorities’ policy announcement mentioned above.

We also mentioned that a more credible stimulus policy didn’t guarantee upside for Chinese equities.

In a note posted in June we detailed our investment thesis for Chinese equities. We believe the stocks offered significant upside if the authorities acted decisively on stimulating the economy.

The upside looked big to us because the economic uncertainty in China remains at historically-high levels, offering runway for a significant change in sentiment to take hold.

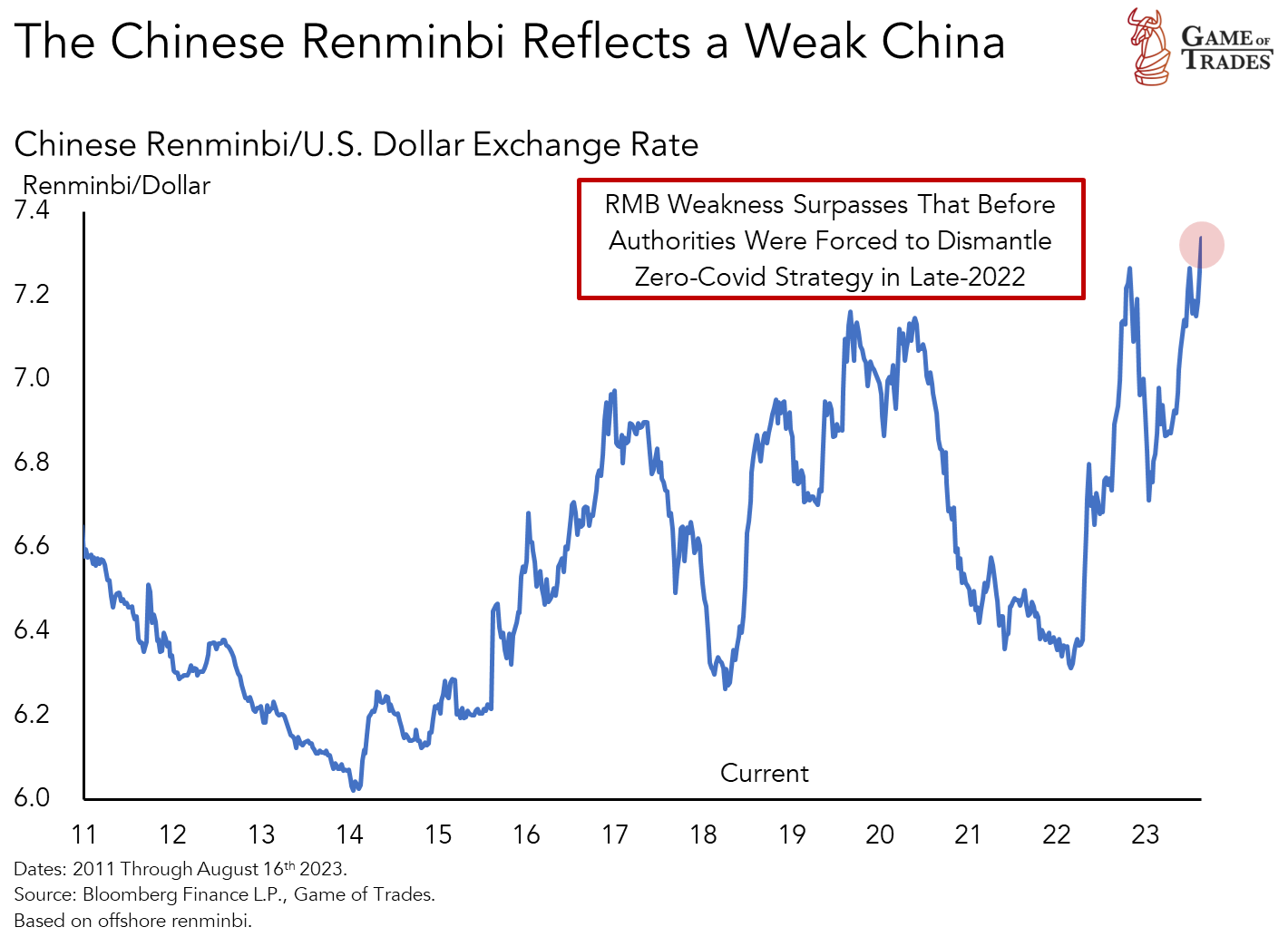

Since the policy announcement of July 25th, the worst returns within China were seen in Real Estate, pointing to continued worries around the housing market.

The Chinese yuan is now trading at historically-weak levels, pointing to the direness of the situation.

A more decisive policy response from the Chinese authorities to address the weakening macroeconomic backdrop would prompt us to reconsider re-opening this trade.

We’d be keen on a household-focused fiscal stimulus package that addresses the depressed state of consumer spending. That type of response could be what the market is waiting for.

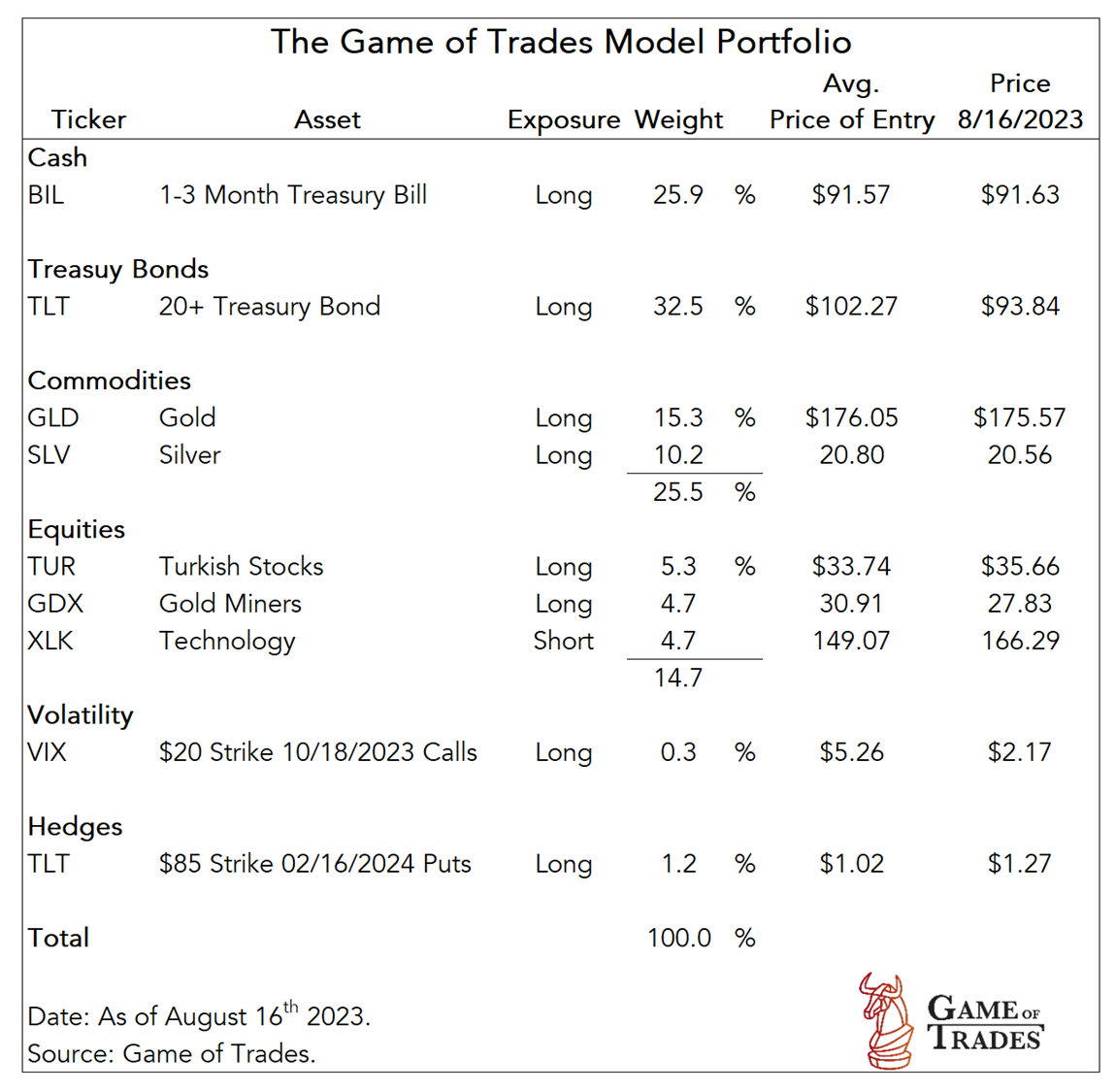

We’re closing the MCHI position at Wednesday’s market-closing price and allocating the proceeds to cash (BIL). The loss on the position based on the initiation price is 7.8%.

The drag on the portfolio’s performance from the loss was small given the 5% size of the allocation.

Below is the updated Model Portfolio.

Good call!

how about going short now?

Hi, GOT have significant position in gold. Would you consider hedging it as well given the rising yield / DXY would also be a headwind for gold.

@Toliver Ma Thank you for the question. We’ll have a Tactical Update on precious metals out this week. Stay tuned for that.

I allocated 15%. A mistake. However, happy to be out of the position to be honest.

It was good to try this trade and I appreciate that you had a stop loss in place. I like that you go through the revised thesis for the trade and stop yourselves out with an elaborate explanation why. Good trade management! Now begs the question: isn’t it time to build a position to go short China or at least the Chinese sectors that will be impacted by the pending housing bust in China?

I had sold pretty much all of my Chinese stocks about 2 years ago. The demographics of China are horrible, and the Communist Chinese can’t help themselves. They continue to hide data, punish innovation, pump foreign companies for information and otherwise dissuade foreign investment. I never lost on this one, but I have lost on some other trades recently. It is never a good feeling.

Good.