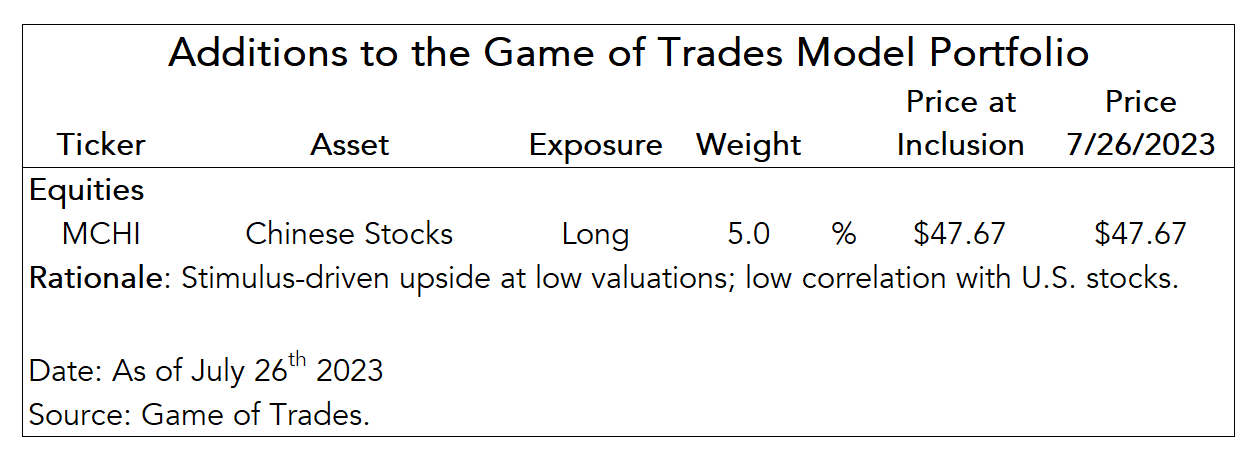

• Initiating 5% Long Position on Chinese stocks (MCHI)

Adding Chinese Stocks to Our Model Portfolio

We’re initiating a 5% long position on Chinese equities through the MCHI ETF.

In a note posted about a month ago we laid out our investment thesis for Chinese stocks. We believe they offer significant upside if the authorities act decisively on stimulating the economy.

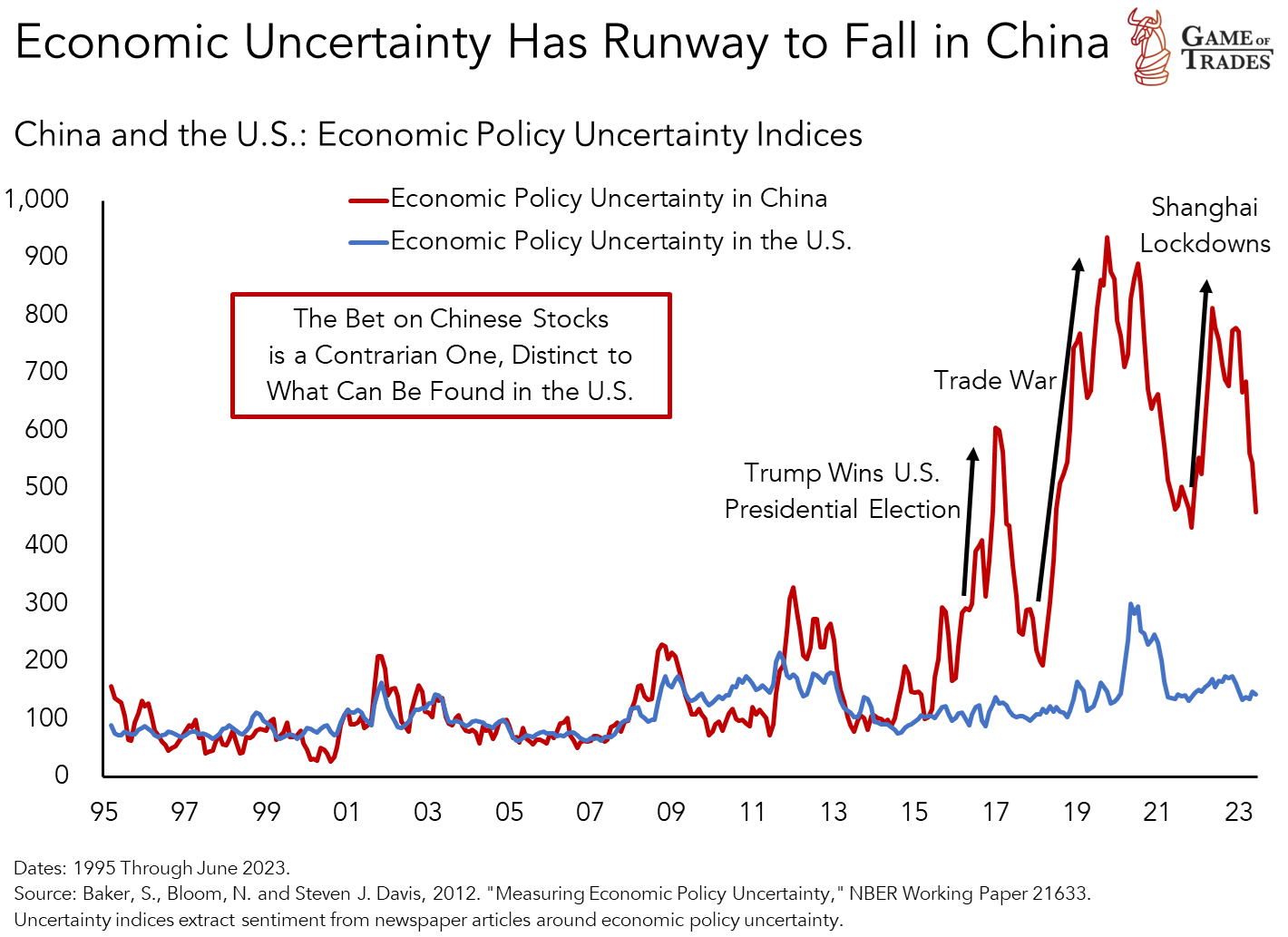

The upside looks big because the economic uncertainty remains at historically-high levels in China. By comparison there’s not much uncertainty in the U.S. to bet against.

We had not initiated a long on Chinese equities yet because we were waiting to optimize the timing of the entry. That largely depended on whether credible stimulus was coming.

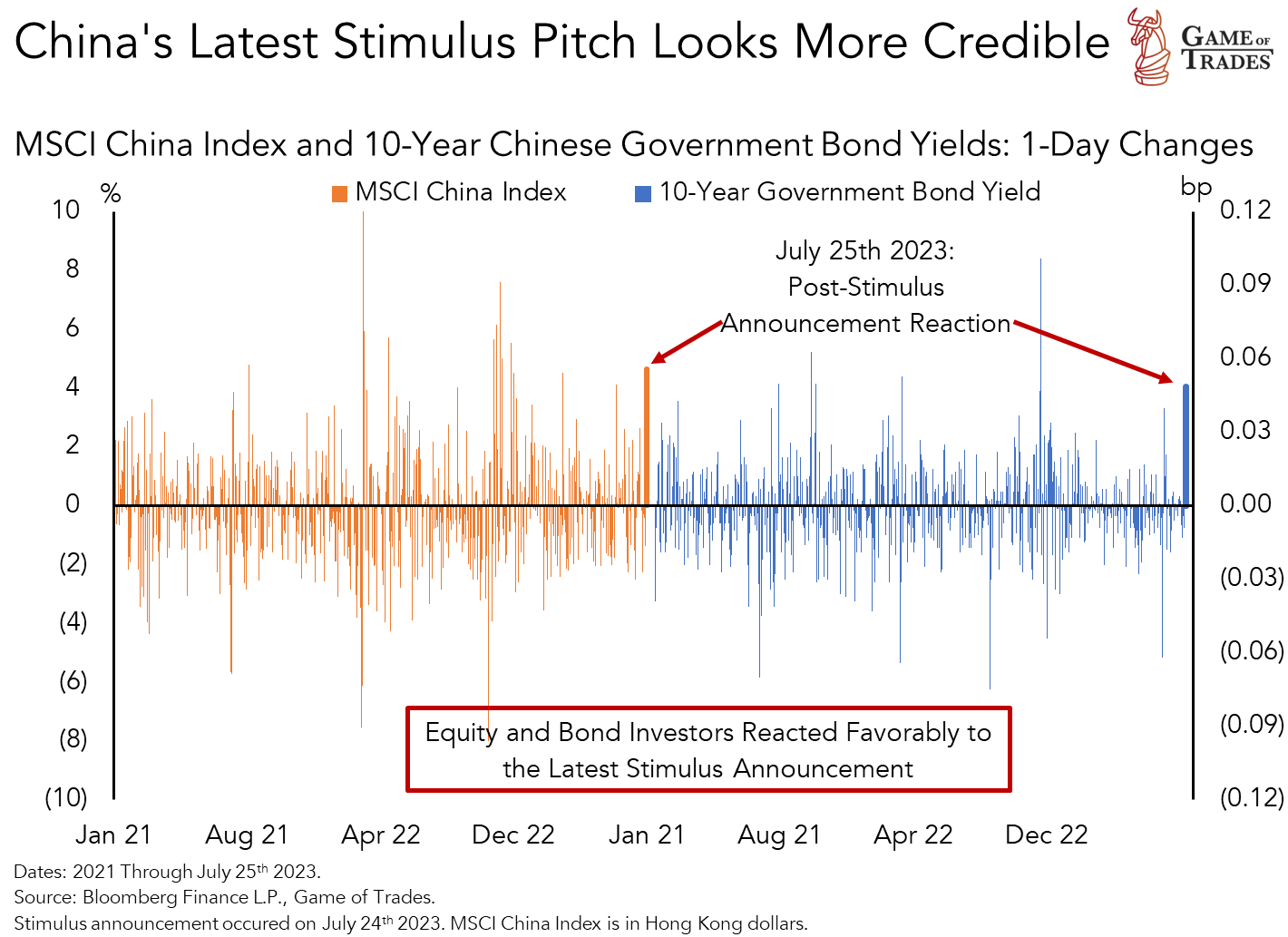

On Monday, Chinese policymakers announced a new set of stimulus measures that engendered a significantly-positive reaction in both equity and bond markets in China.

The MSCI China Index rose 4.7% post-announcement, while 10-year govt. yields spiked 5 bp. Both moves were the biggest this year, rivaling the reactions in November the re-opening was priced. [1]

The favorable market response signals that investors see the new policy move as more credible than prior stimulus pitches proposed this year. This latest one includes key distinctions:

- The authorities appear willing to promote domestic demand over industrial policy, seeking to address the root cause: a consumer unwilling to spend.

- The government looks poised to resolve local government debt through debt swaps and loan restructuring, freeing up local govt. spending power in support of GDP.

- Policymakers removed the “housing is not for speculation” commentary that had been common in prior stimulus communications, signaling significant support for the real estate sector.

Of course, more credible stimulus doesn’t guarantee upside for Chinese equities. However, we see the risk-reward as favorable here. Waiting for clear blue skies may see us miss a potential rally.

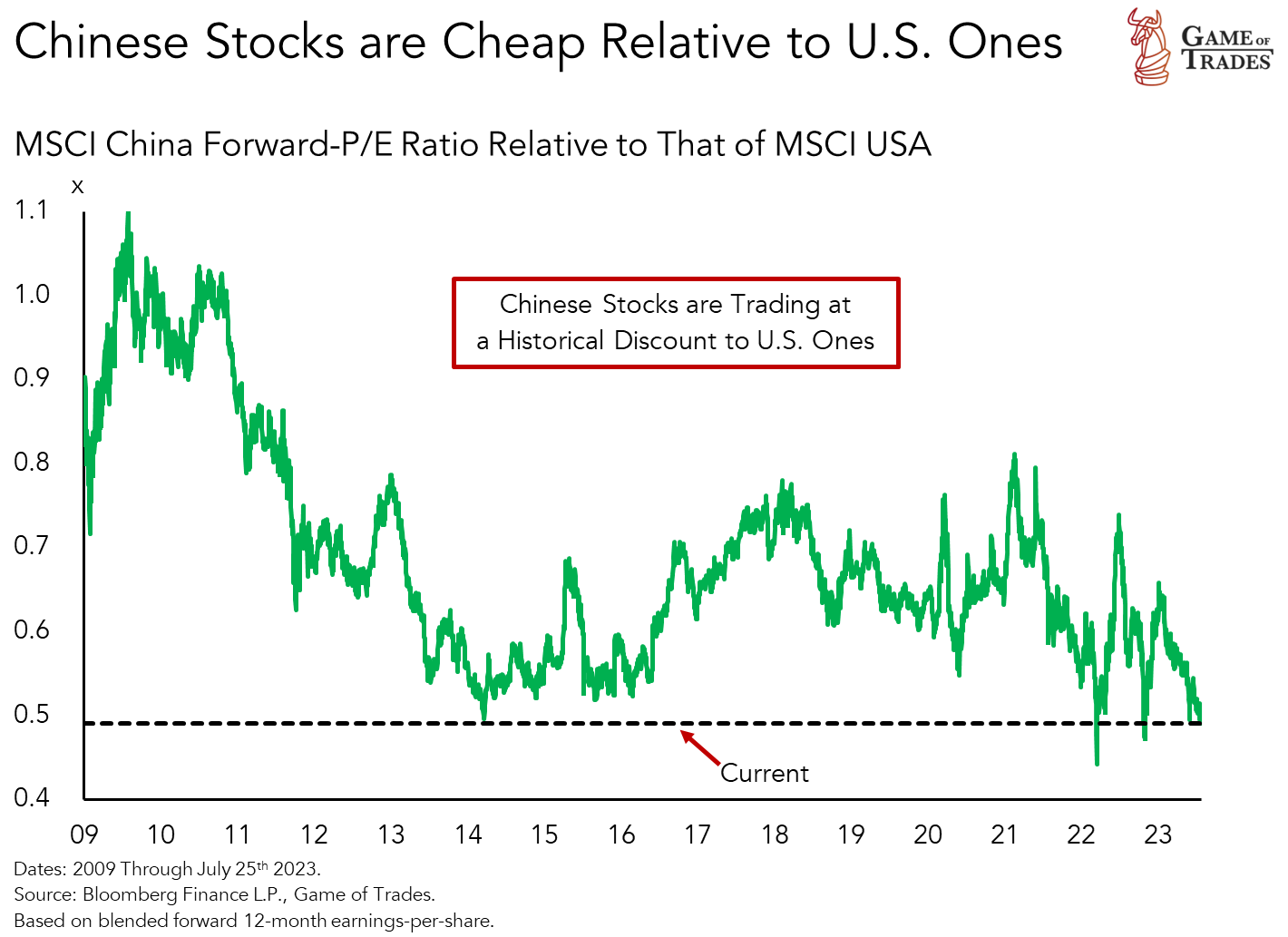

With a lot of bad news already priced in, we find the stocks more opportunistic than their U.S. counterparts. Chinese equities are priced at a nearly 50% forward-P/E discount to U.S. ones.

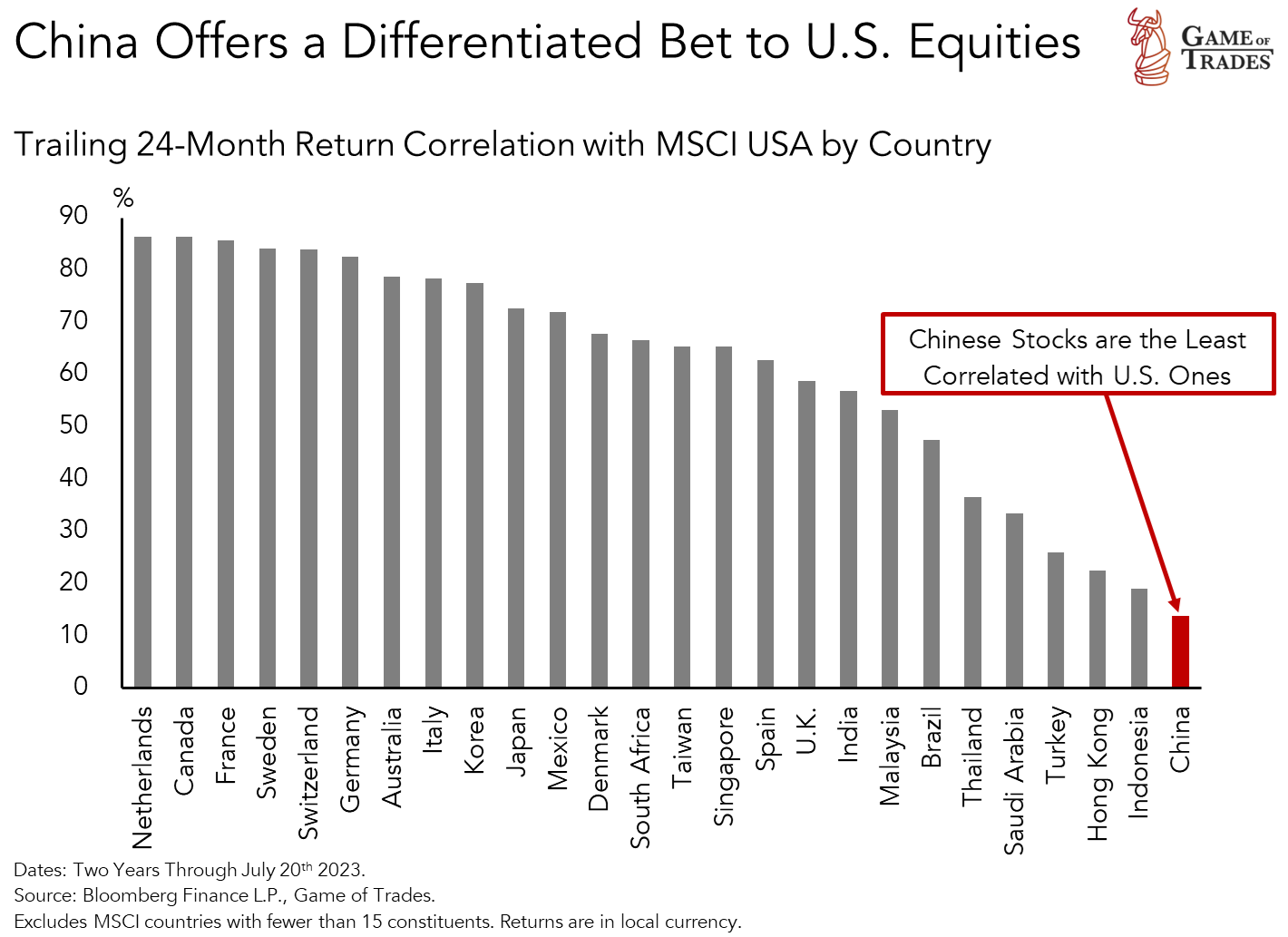

Aside from their more attractive valuations, Chinese stocks are also the least correlated to U.S. equities. Diversification is an attractive feature when adding positions to our Model Portfolio.

The correlations between U.S. and Chinese stocks broke down in the aftermath of Covid, as the two countries embarked on different approaches in containing the virus and in fiscal/monetary policy.

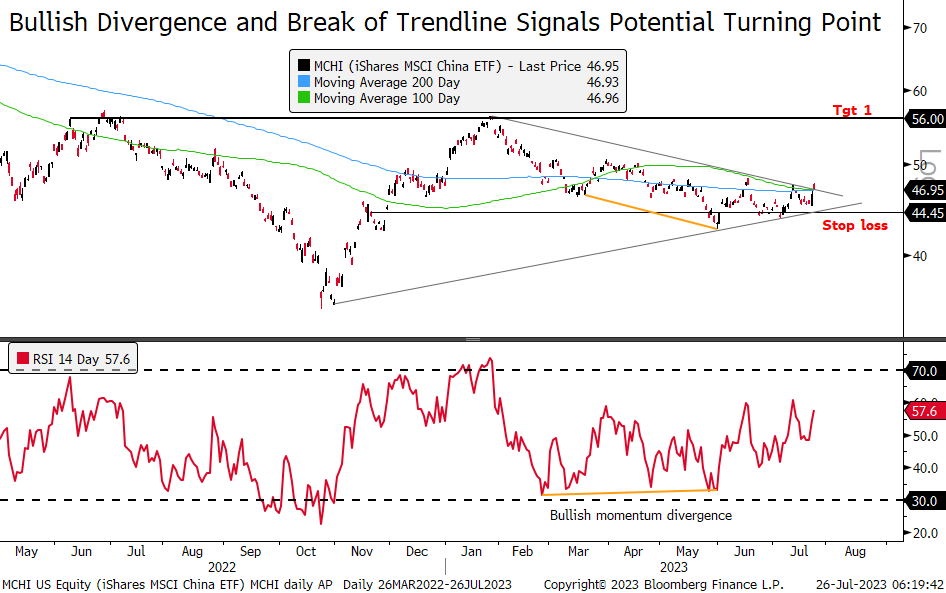

The bullish RSI divergence in MCHI (iShares MSCI China ETF) seen from March through May signaled waning downside momentum as price made lower lows.

The bearish divergence hints at a reversal higher in MCHI in coming months. We’re targeting a level of $56.

A stop loss is set a $44.50, slightly below the level seen before the stimulus was announced. Price hitting that level would negate the thesis, pointing to loss of credibility in the stimulus.

The $44.50 stop loss level would also allow for a retest of the support trendline that’s extended since early-November 2022.

Price has recently broken above converging 200/100-day moving averages at the resistance trendline, boosting our bullish conviction.

We initiated the MCHI long at market close at today’s closing price, funding the 5% position with our cash allocation (BIL).

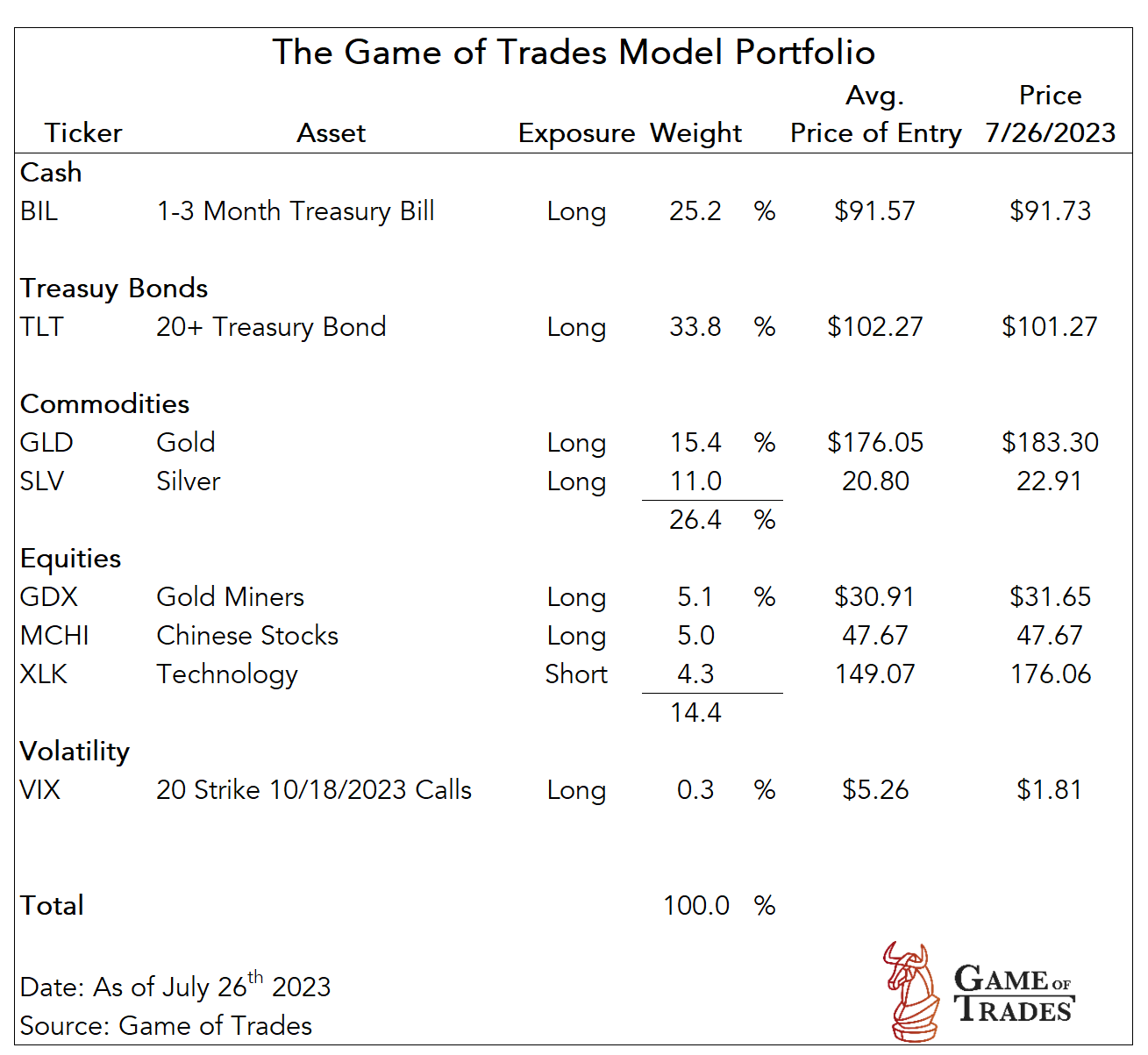

Below is the updated Model Portfolio.

Footnotes

[1] Local currency-based returns for the MSCI China Index.

@GOT There are a bunch of different China index ETFs, is there a particular reason you choose MCHI instead of others?

@s Thank you for the question. We prefer MCHI as opposed to other large China ETFs for a various reasons.

First, MCHI has larger assets under management (~$8bn), compared to the next runner up FXI (~$5.4bn). Therefore, MCHI offers a bit more liquidity. Second, MCHI is a bit more diversified than FXI, as the former includes companies across the large- and mid-cap space within China, as opposed to FXI that includes only large-cap names (i.e., the biggest companies). Third, MCHI includes companies listed in both Hong Kong and Mainland China, while FXI only includes companies listed in Hong Kong.

We hope that answers your question.

Because how much I know about China’s politics, I won’t invest in the MCHI. The situation right now is China facing a Japan like property bubble burst and heading into more of a deflationary situation like Japan did in the 1990s. The financial stimulus is not going to be much help just like 0% interest rate in Japan did not boost their economy in the 1990s. The pandemic times, China did not bailout their citizens and allow civilian small businesses to collapse. With continious trade war with the west and the preparation of the invasion of Taiwan, I don’t see much upside in their stocks especially the China copy of the “Magnificent Seven” – Alibaba, Tencent, Baidu, BYD…etc

@Anson Yeung We appreciate your opinion. China is certainly facing medium- and long-term headwinds as you point out. The leverage of the economy is a headwind for long-term growth and it’s uncertain what China will look like 5 years from now.

However, as we pointed out in the article, the valuations of China reflect a lot of bad news already. Moreover, we’re not making a long-term call (i.e., 1-3 years) on China. Our horizon in our Model Portfolio is 6-12 months. The bet here is that policymakers understand the direness of the situation and are calibrating a credible policy response. We established a tight stop-loss that will get us out of the trade in the event the stimulus loses credibility.

I do not have a crystal ball, but from my understanding, while there are similarities between China and Japan, there are also distinct fundamental differences from the two.

To name just two, first, not every country has sovereignty over both currency and government debt issuance. Given Japan’s historical links with the US, it had and still has no choice but to accept US political influence over its monetary policy (in particular, the one in the 1986 Plaza Accord). China, no matter you like it or not, has held tightly to both of these powers, and has a lot more flexibility over monetary and fiscal policy conducive to its economic benefit.

Second, size matters. The way Roosevelt averted the economic crisis in the Great Depression through infrastructure programs and stimulating domestic demand is NOT applicable to all countries. The size of China’s population and land thus make a big difference to Japan. Evidently, after the 2008 GFC, Japan did not implement domestic stimulation policies like in China. Instead, Japan focused on overseas investments, i.e. the core of Abenomics. This speaks to the fundamental difference in mechanics both economies work.

While it is uncertain whether the fiscal stimulus this time will prove strong enough to turn the tide, I think we cannot draw correlations between Japan and China, simply by the fact China is in the midst of a housing crisis and also has high debt levels. Their political and economic natures are different.

I’m down on my TLT investment – it appears your macro call so far this year is wrong as gdp was 2.4%. Not sure what to do with TLT as it is going nowhere. Thank God I didn’t take the XLK short – as you know it made a new all time high! Which is not bearish.

I think if you are wrong in your trades you need to come clean and say it. No one is perfect as Mike Wilson came clean and said he was wrong this January. Also a stop loss is needed for these trades as the XLK loss is too large-

thanks greg

They aren’t the only ones who’re making this call. The market seems irrational this year. Historically bet is right, but sticking to rationale is hard during exuberant times. Once sobering will kick in everything will move very quickly, you won’t hop on it.

Traders plan theoretically should address pain of waiting for a big moves, but it’s to early to conclude if it will. Btw I feel that it’s bad time for such a plan launch.

Off topic- what is the narrative with the market tanking on strong GDP #s? Higher for longer with the fed?

I like the setup with using a stop loss, though my probability of success is a little less. There are some fantastic, thoughtful comments in this thread. I want to add a couple more points.

In addition to fiscal stimulus, China faces the need to devalue the yuan to boost exports. But doing so weakens its desired role as a global currency. The former is aneconomic consideration, the latter is political. Political considerations may cause delay and or weakening of fiscal support and weakening of the yuan. This is murky.

Second, we are looking at a possible global recession with even more of a demand shock. China and the US would likely be more correlated in the event of a recession.

The reward is certainly great here, but probability of success is hard to assess. You are right, a tight stop loss is necessary but this is a much more attractive setup than being bullish on US equities.

For the record, I am passing, and own a lot of ATM LEAPS puts on US indexes/ETFs right now. The risk to reward is much better imo.

EU retail: anyone was lucky to find a tradable substitute with KID?

Unfortunately my broker (NL based) doesn’t support MCHI.

@GOT The stop loss threshold of $44.50 was reached today. Can you provide the current GOT guidance?

[…] opened the position on Chinese stocks (MCHI) in late-July based on a favorable risk-reward following the market’s positive response to the authorities’ […]