Summary

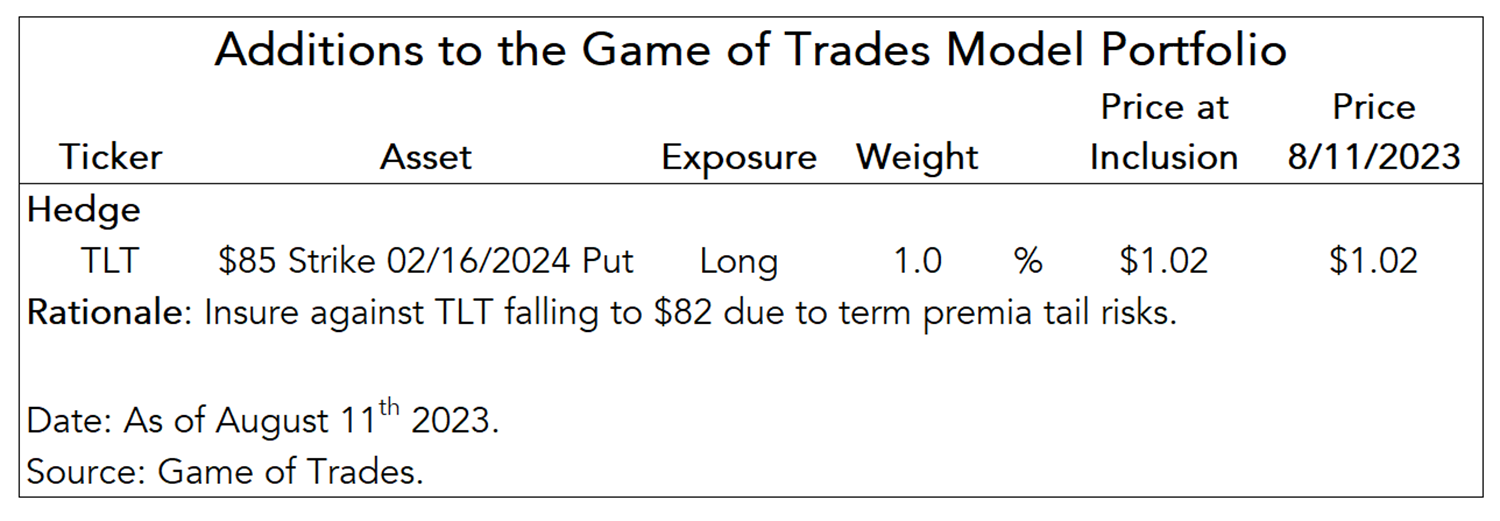

- Initiating 1% long out-of-the-money (OTM) put position on TLT

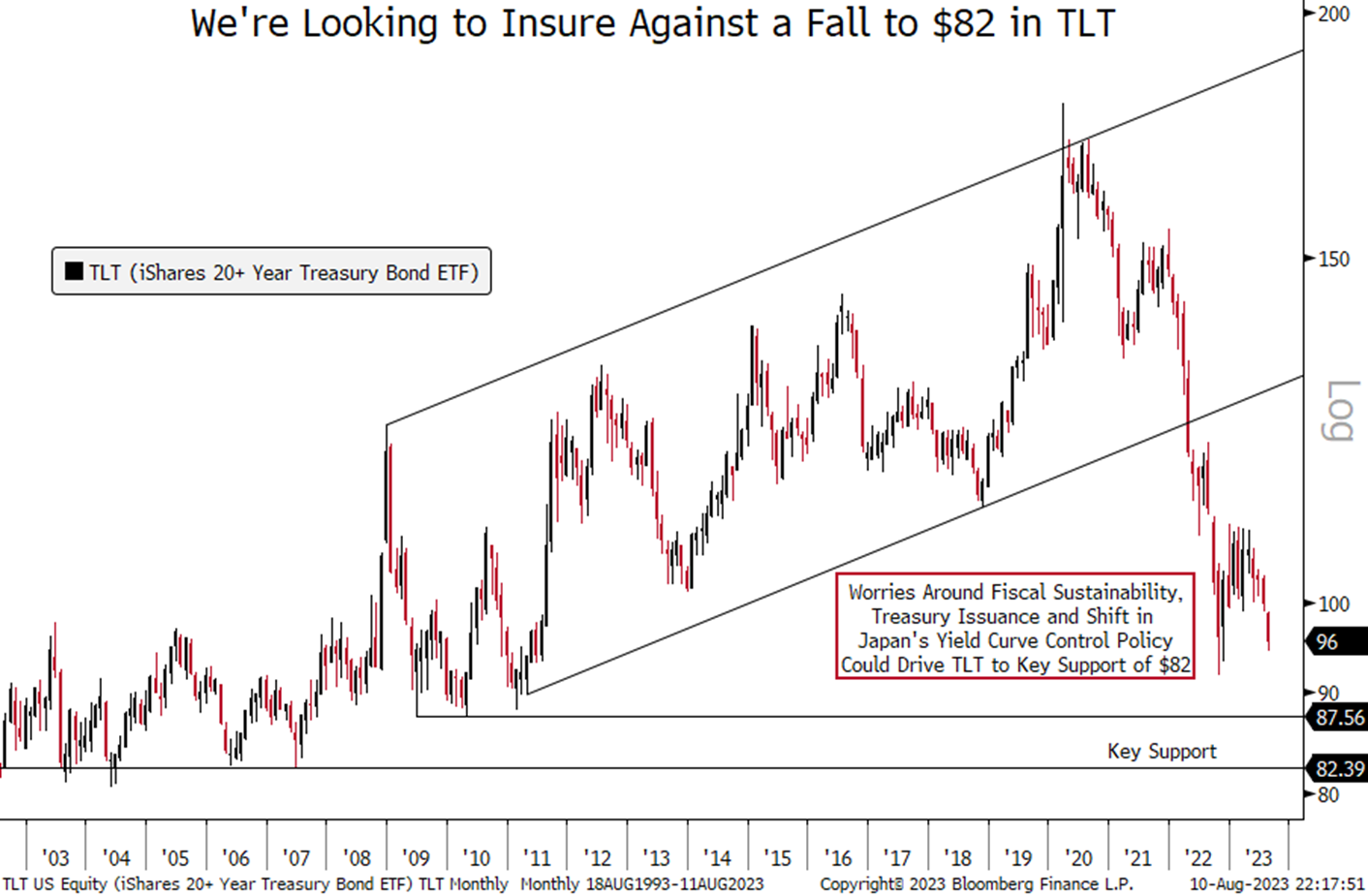

- Insuring against TLT falling to pre-financial crisis support of $82

- $85 Strike with February 2024 Expiration

Term Premium Emerges as New Tail Risk for Bonds

We’re initiating a 1% long put position on TLT to hedge against significant new tail risks emerging for U.S. Treasury bonds that have driven the breakdown in TLT this month.

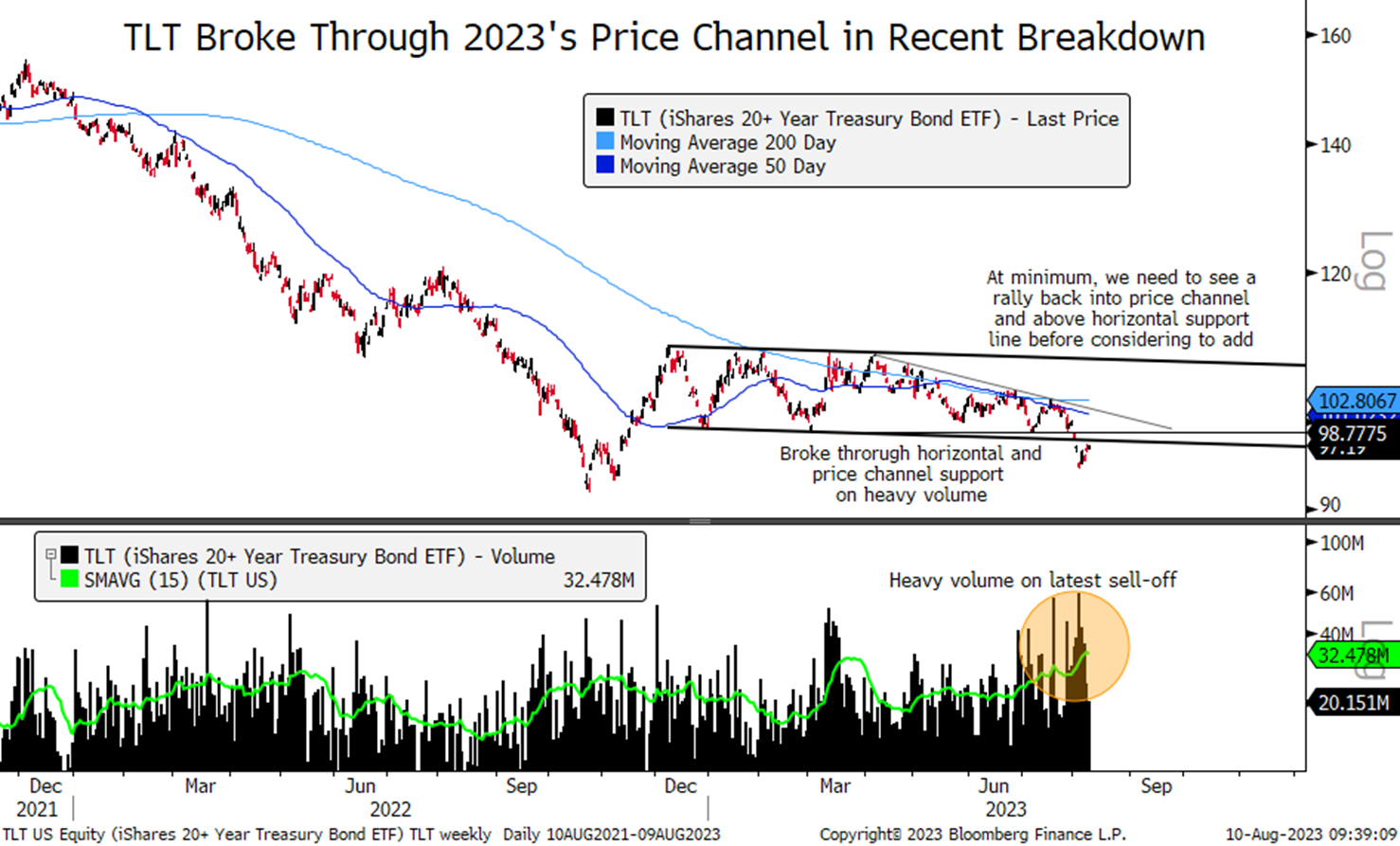

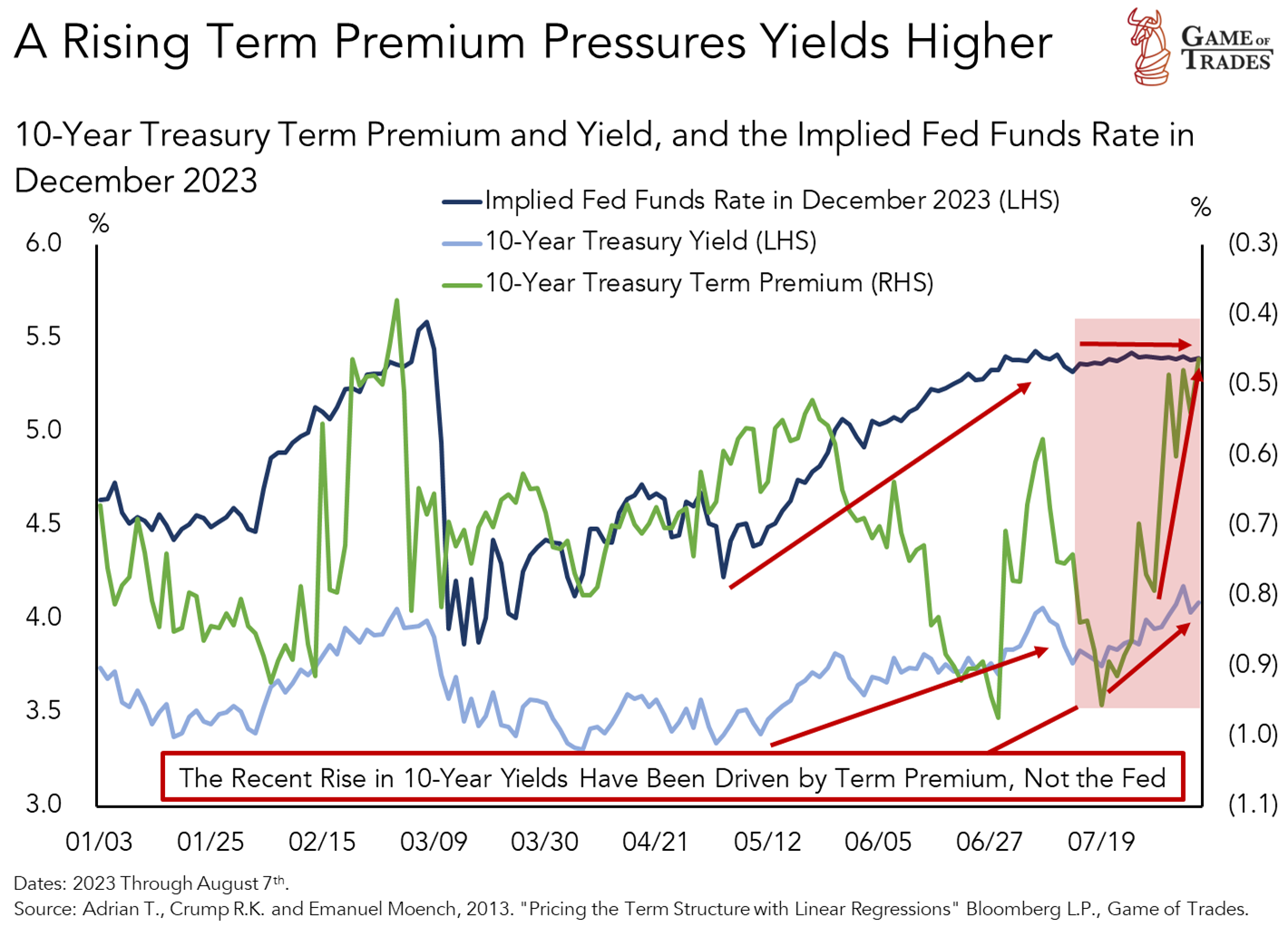

TLT’s breakdown in August has been driven by a rising term premium, not the Fed. It reflects risks around fiscal sustainability, Treasury issuance and a shift in Japan’s yield curve control policy.

The interlinkages between the three is a concern: big fiscal spending funded with large Treasury issuance at high yields to attract waning demand, as Japanese institutions step back as buyers.

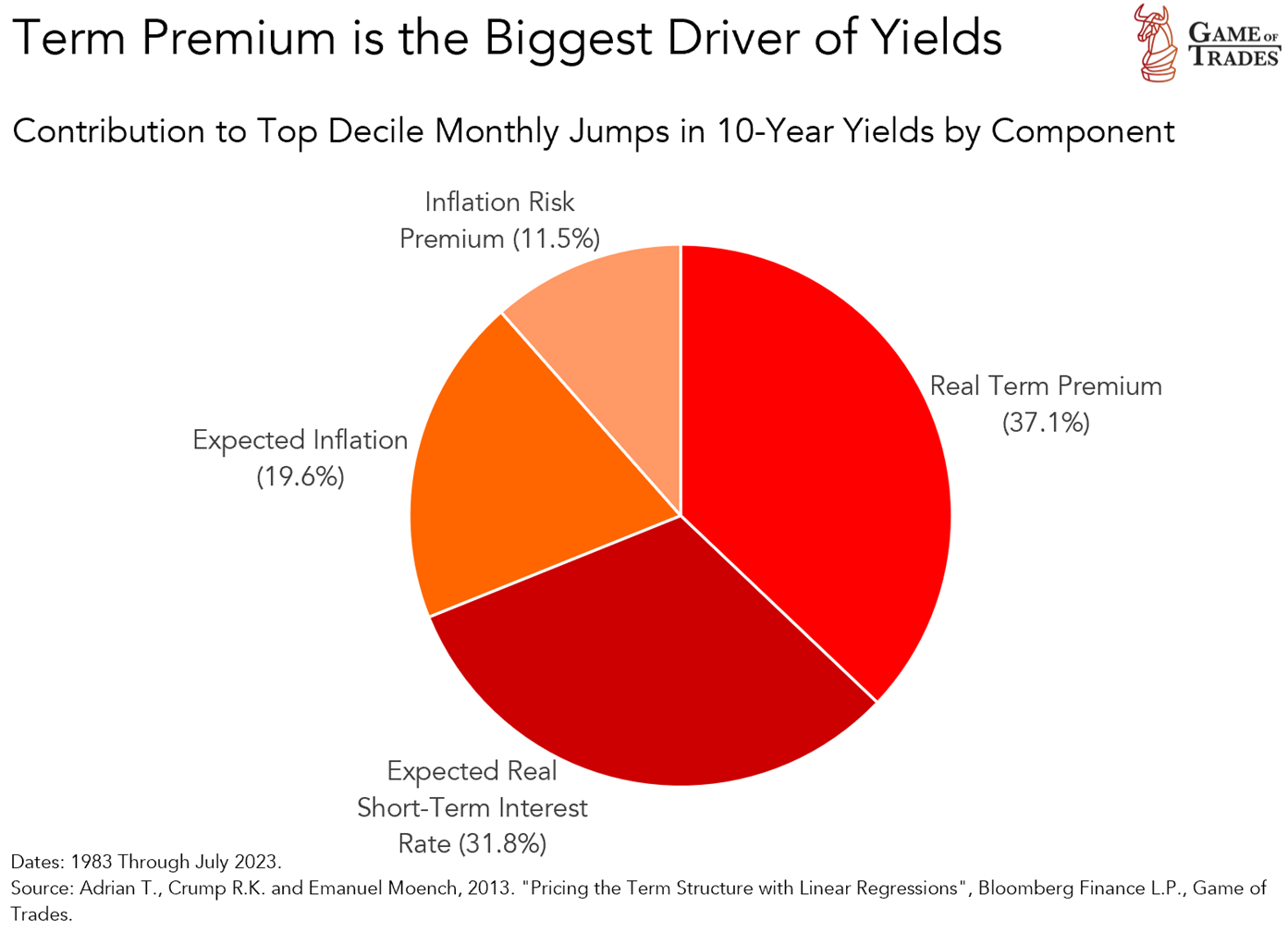

With the term premia at historically low levels, the runway for upside in yields is a concern for our TLT allocation. Term premia, historically, has been the biggest driver spikes in 10-year yields.

Hedging With an Out-of-the-Money (OTM) Put

We’re looking to insure against the risk of TLT falling to $82 in the next 6 months, a level that’s proven key support post-financial crisis.

TLT’s fall to $82 implies a 14% drop from today’s level, a move within the worst 5% of TLT’s return distribution. Our target price for TLT is $113, about 18% higher than today’s levels.

To protect against tail risks on TLT, we’re hedging via an out-of-the-money (OTM) put with a strike price of $85 and expiring in February 2024.

A fall to $82 on TLT would prove large enough to generate a large profit in the option position, offsetting losses accrued from the TLT position falling to the $85 strike price.

The low premium paid on the put provides upside if TLT rises towards our $113 target and the option then expires worthless, minimizing the 1 pp. drag to performance.

The insurance cost of 1 pp. would also prove less of a drag to the portfolio if TLT merely consolidates in months to come and the option expires worthless.

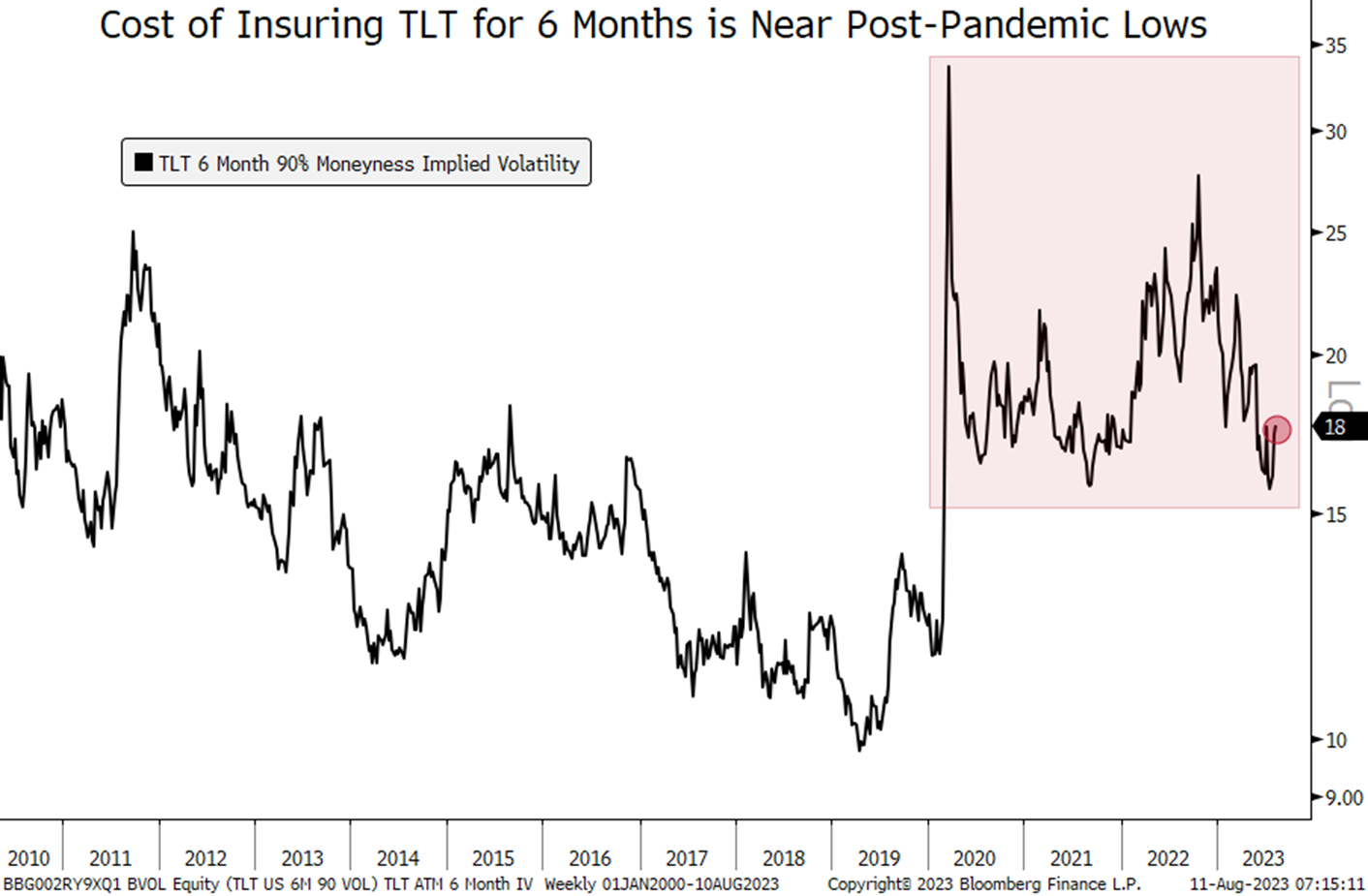

The hedge is priced attractively relative to levels seen post-pandemic based on implied volatilities. Investors expecting no return to the era of low rates may find the insurance a bargain. [1]

We’re funding the 1% hedge via our cash allocation (BIL) paying a premium of $1.02 for the OTM put at Friday’s closing price.

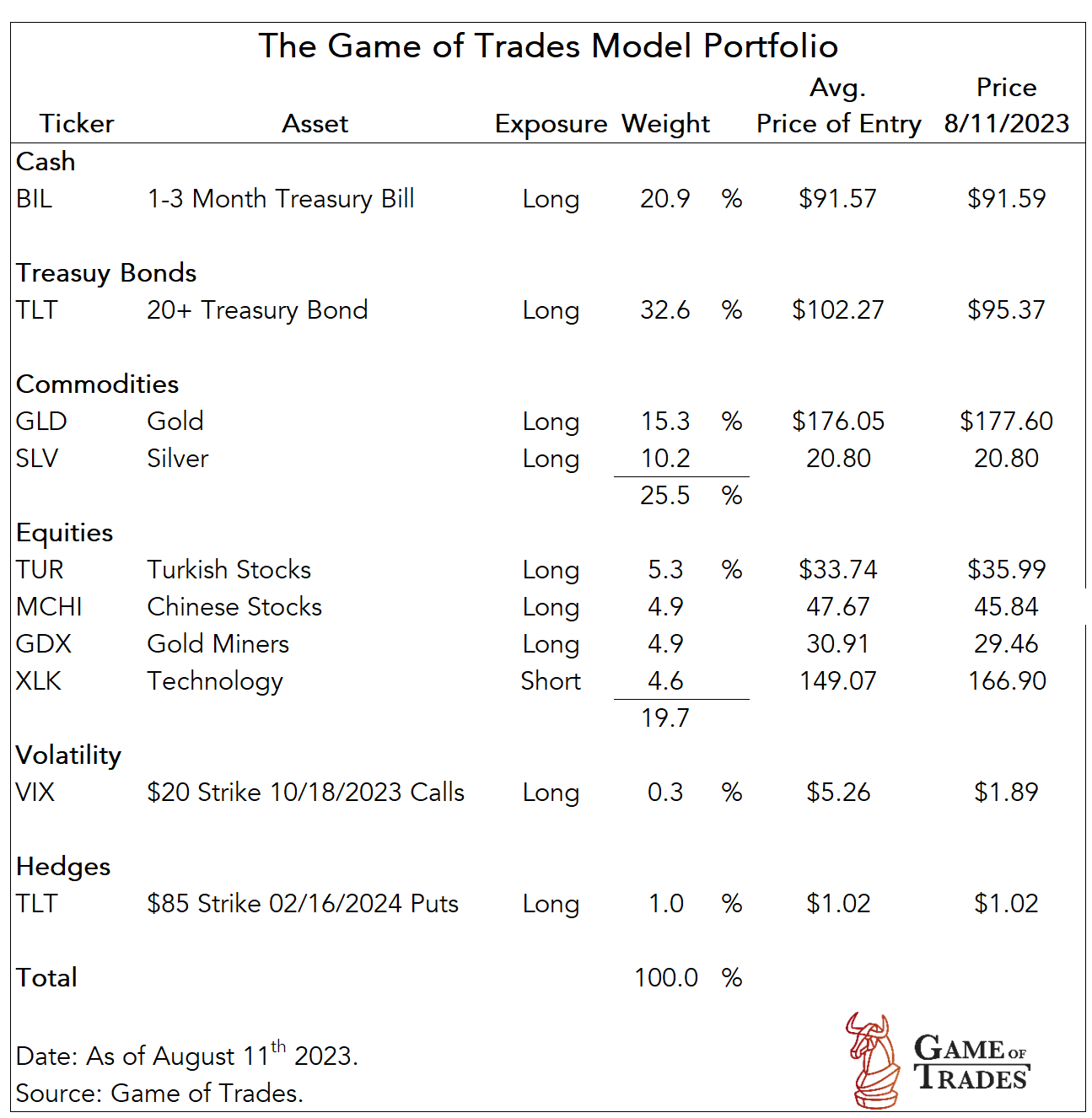

Here’s the updated Model Portfolio.

Footnotes

[1] Given the strike is $85, while the underlying is around $95, the option is at 90% moneyness (i.e., distance of strike to the current price).

In short, as the largest owner of treasuries, Japan is in control of the long term US yield and hence controls the US economy… a crazy situation, I don’t think this will be a long term situation.

China is the 2nd biggest US bond holder, given their current economy and such, do you think they will increase/decrease on US bond purchases? I think that would be interesting to look into as well.

@HL Indeed, global portfolio flows in Treasuries could impact the term premium. In the case of China, given how low interest rates are there due to the ongoing economic malaise, perhaps it’s less likely that we’ll see them sell U.S. bonds that are yielding more than Chinese ones. 10-year Treasuries are yielding 4.2% today, versus the equivalent in China of 2.6%.

Hi wonder how do I know the position size I should enter for the option. As for me I have a smaller TLT position in the portfolio as compared to GOT.

@Toliver Ma Thank you for the question. The position size should be a function of how big the notional amount of what you’re looking to hedge. A put option provides you the right (but not obligation) to sell 100 shares of the underlying position. Therefore, if you have fewer than 100 shares of TLT in your portfolio, 1 put option would be more than enough to hedge the entire position with an ATM put option.

I cannot trade options on USD 20+ Treasury with my broker … :/ frustrating pur

Your portfolio has 32.6% long TLT, but your hedge is 1%. How is that relation providing sufficient hedging? Are you holding one $85 put contract for every 100 shares of TLT you own in the model portfolio, or did you decide on a different ratio than basically a 1:1 hedge? Thanks!

I’d like to know too. Thanks

It would be easier to follow these if the model portfolio would use dollar amounts/shares.

For example, the model portfolio could start the year with $10k and then use that. This way, a trade is X shares of Y @ price based on that original $10k portfolio and what happened so far this year.

It would also add transparency and clarity to how the portfolio is doing over time.

If the portfolio value is for example $8k today, then we know it lost $2k since the beginning of the year, etc, and opening a new trade uses what’s available at a given time.

In our Portfolio Review, for example, you can see that we assume a $10,000 portfolio when we track the performance over time.

https://www.gameoftrades.net/news-feed/portfolio-review-july-2023/

That does not cover it all.

It’s impossible to know at the moment where the model portfolio stands until you create one of these reports.

Also, it does not address the position size originally mentioned.

Good question. Personally, I’d wait for a “pop” in the price and sell calls rather than buy puts. That’s a better hedge imo especially if you think TLT will continue it’s downward spiral like I do.

@Wolfram Luchner Thank you for the question. The number of puts needed depends on the notional size you’re looking to hedge. For a $10,000 portfolio, the TLT position would be $3,260. The put is $85 strike, while the underlying is currently trading at $95. An $85 put would allow to sell 100 shares at $85, so $8,500 worth of TLT. If the TLT notional is $3,260 and the underlying is at $95, that means there are roughly 34 shares of TLT in the portfolio. As a result, the hedge is roughly $2,916 (34 x $85). That leaves $344 unhedged (i.e., the move from current price of $95 to $85), and the full position hedged at any price below $85. The cost of the put option is $102 ($1.02 unit price). $102/$10,000 is roughly 1% of $10,000 portfolio.

What Wolfram and Michael said.

.

Sorry same question already asked.

I am baffled and obviously don’t understand how to make this trade.

If the portfolio allocation if 100,000 and we have 32.6% of it in TLT at average price of 102.27 then the portfolio would own 318.76 shares of TLT.

I’ll display my ignorance here.

1% of portfolio = $1000, divided by the average cost of a share 102.27 = 9.77 shares.

If a contract represents 100 shares how do I make that trade?

If it is 1% of the shares owned then it is 3.18 shares.

I understand the skill level here may be wide and I maybe near the bottom when we are talking about options, however the terms used and the assumptions involved in the brevity made regarding the specificity of the trade components more or less ensures I won’t make the right trade.

For example if I purchase 3 put contracts for an 85 strike and I paid 102.27 per share and the price goes to $82 and I exercise my option to sell my shares for $85 dollars then buy shares at $82, well that looks like a huge loss versus hold the TLT shares until the rise above the 102.27 price while I collect dividend payments along the way.

PLEASE. Please, please, help me understand what you are asking us to do and I apologize for my naivety.

The put hedge here is not for you to sell you shares at $85 but to capitalize on the near term bearish price action and sell your put contracts for a profit to offset the “drawdown/losses” on your long position. If you’re long term bullish on TLT for 2nd half of 2024 as I am then there’s no reason to sell your position at a significant loss now. It simply helps you put some profit in your pocket now. Personally, I wouldn’t (and haven’t) bought the put even though I could have bought one @.92 cents today. I’m waiting for a TLT “bounce” and then I’ll sell ITM calls. For example, if your entry price is $95 and you own 100 shares, I’d sell near term (say Dec, Jan or Feb) $100 calls collect the premium and if TLT closes below $100 at expiry you keep the entire premium PLUS keep your shares. If it closes @$100 or higher you may get exercised but you still made $500 profit PLUS whatever you collected buying selling the call (the premium). I’m not long any TLT now. I liquidated my position for a loss and will re-enter if TLT gets near $91. Other than that, it’s a wait and see game imho

Hope that helps.

Exceedingly helpful with a trove of information I hadn’t arrived at. I am constantly trying to enhance my understanding and I comprehend, from an informational point of view the strategy you have defined.

I understand that if I purchased the long put I could always buy the stock if it went ITM at the market price and then exercise the option to sell the shares at the strike price. However, the gains from that exercise seem limited due to the probability of TLT heading south of $82.

This is a testament of how the more experienced GOT community members can support some of us with less experience by illuminating alternate opportunities or even just clarifying what Peter shares (which is always wonderful and intended for the more savvy clientele none the less, I will endeavor to persevere).

100 Karma points to Mr. Stabile.

Maybe folks that do the same can accrue points that can offset GOT purchases. Maybe call you folks “Guardians of the Trades”.

Bests Regards;

Jim

@GOT can you please elaborate the criteria that would trigger you to sell or exercise this Put Option. Thanks

I own TMF, and wanted to hedge using same strategy, but something about allocation doesn’t add up for me using proposed allocation.

To make calculations easier, assuming model portfolio of 100k, TLT is 32% -> 32k -> 336 shares @ 95.32 as of today.

Given that allocation we need to spend 1K on TLT Puts, 16th Feb 2024 $85 Put costs $1.25, and gives us 8 contracts.

If I put these numbers into https://www.optionsprofitcalculator.com/calculator/long-put.html, it gives me following: https://www.dropbox.com/scl/fi/glnty5zyly1y7qbsuhkea/TLT_puts.PNG?rlkey=2ddcr1jt7f7xlkkl8jhku1kni&dl=0

According to this 1% TLT Puts allocation is barely making any difference in hedging against TLT going to $82. To make a difference you’d need to buy closer to 80 contracts, that is 10k or 10% of the portfolio: https://www.dropbox.com/scl/fi/51y9y0ng4jbn5rvtv0gwk/TLT_puts2.PNG?rlkey=7rp076ipq265dyfsk5z61dyne&dl=0

What am I missing here?

To hedge I’m considering selling some part of TMF holding at a significant loss, and then buying call options once TLT@82 or 10 year yield is at ~5.25%.

What do you think?

Given TLT’s breakdown below key long term support levels (under $86 at time of this comment) and it’s gap down approach to the PUT $85 strike price, please provide an update on your exit strategy.

To the GOT community: I’m new to PUT options and and seeking some guidance. Since the TLT $85 PUT has been ITM, what have you exercised and why? Have you done nothing (yet), have you sold your PUT contract, or have you sold your put contract shares at the $85 strike price? What is your strategy regarding TLT?