Summary

- Our TLT position contributed significantly to our Model Portfolio’s underperformance in July, offsetting gains in our precious metals’ exposures.

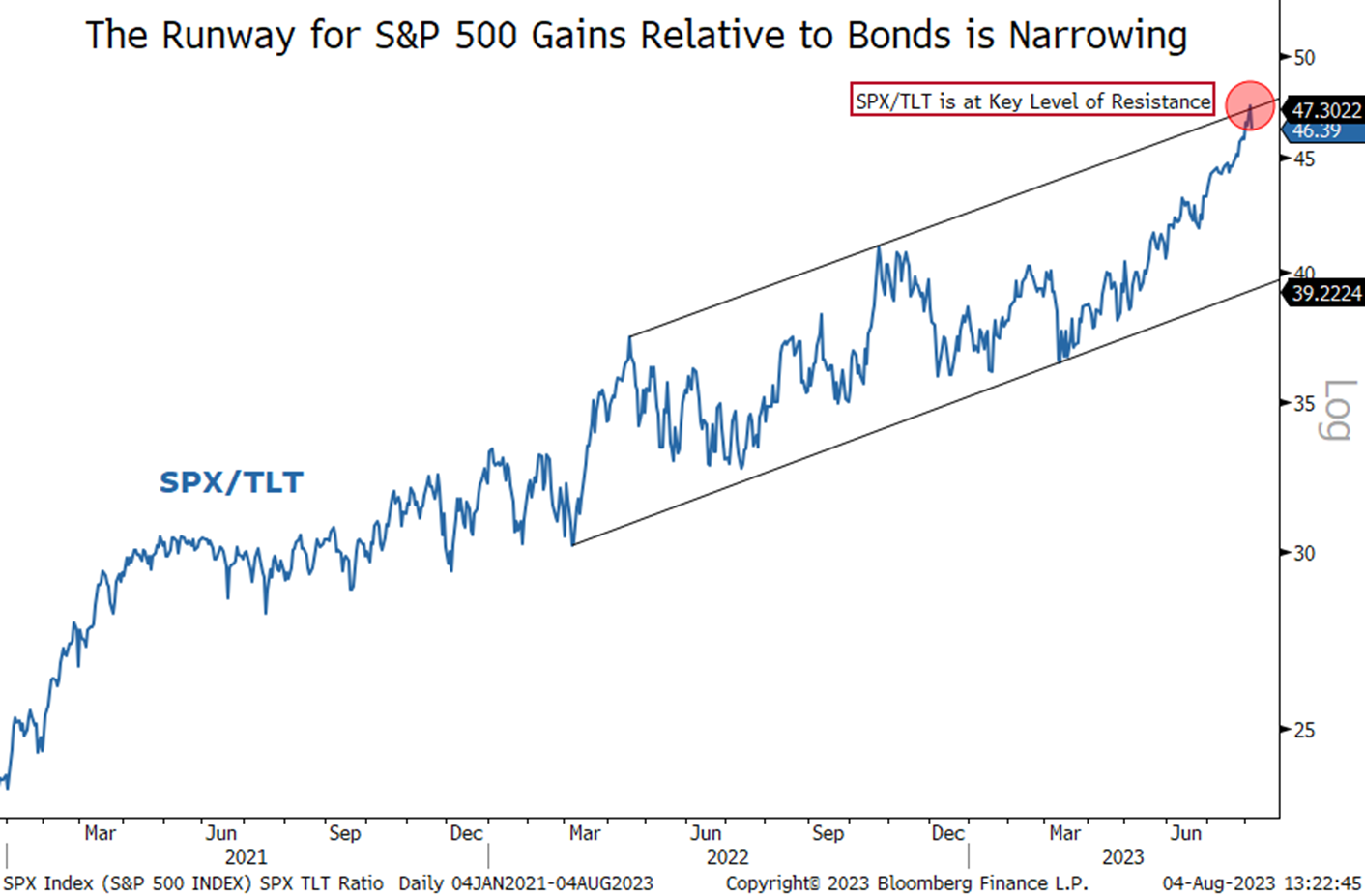

- We’ll be reviewing our TLT position in an Investment Radar article this week, as the S&P 500/TLT ratio is testing a key resistance level.

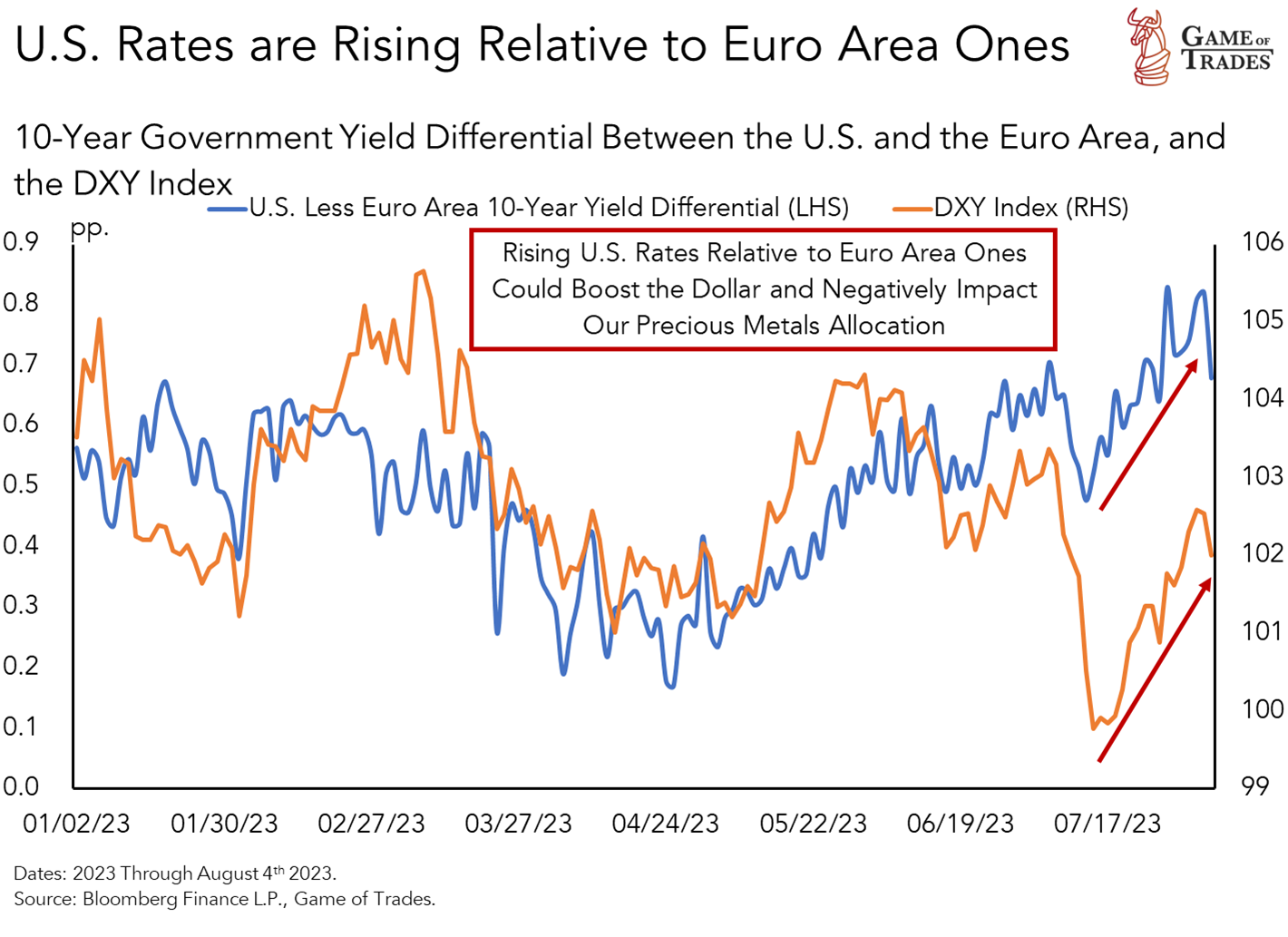

- Potential dollar strengthening due to a decelerating European economy could pose a headwind for our precious metals position, driven by falling interest rates in Europe relative to the U.S.

- We’ll continue broadening our investment ideas outside of our U.S. exposures through our newly-launched Investment Radar product. Emerging markets are central focus today.

Performance

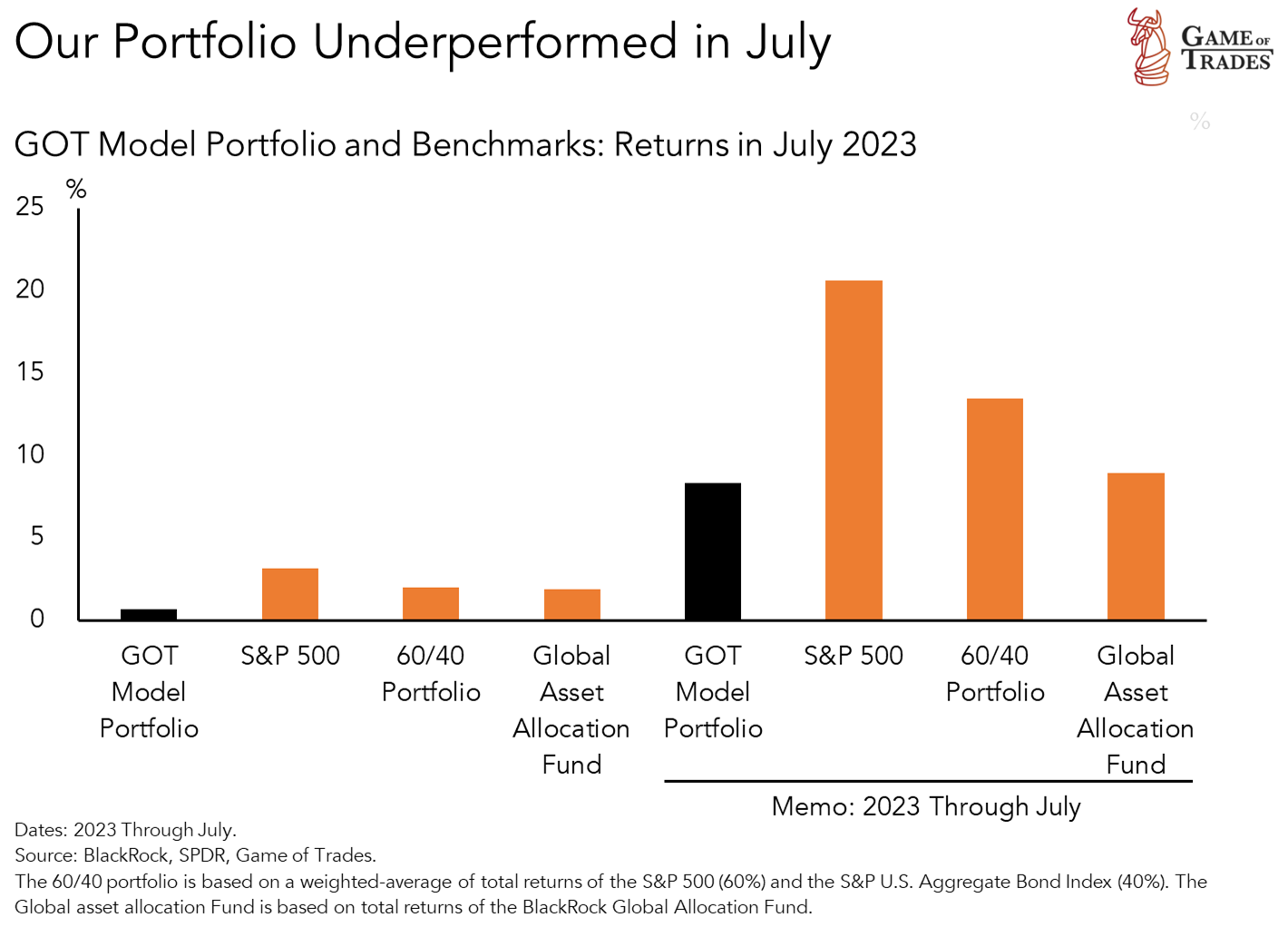

Our Model Portfolio was up 0.7% in July, underperforming the S&P 500 by 2.5 pp., a 60/40 portfolio by 1.4 pp. and a global asset allocation fund 1.2 pp. [1]

For the year through July, our portfolio is up 8.3% compared to 20.7%, 13.5% and 9.0% for the S&P 500, a 60/40 portfolio and global asset allocation fund, respectively. [2]

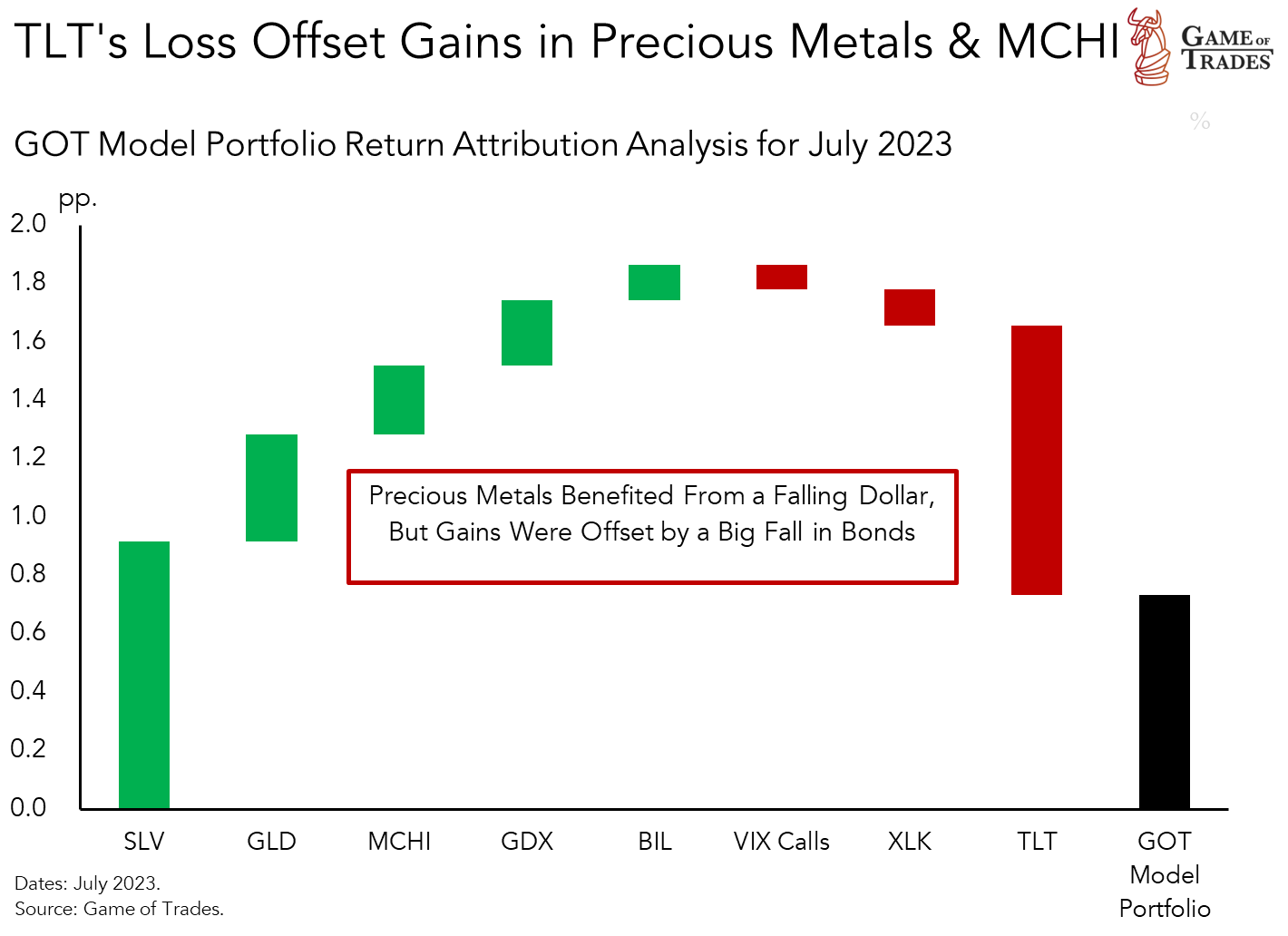

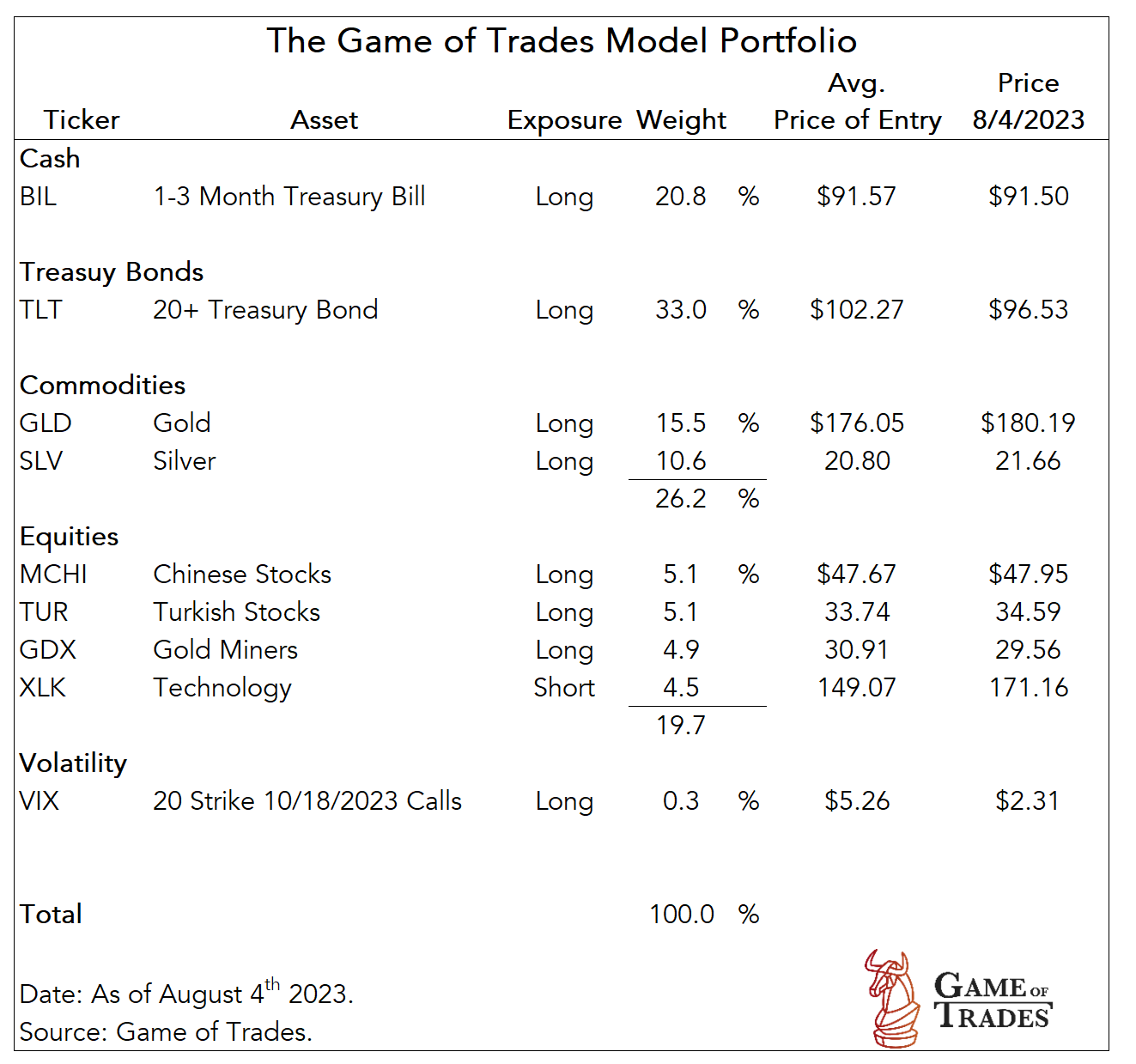

The top drivers of the Model Portfolio’s performance in July were SLV (Silver), GLD (Gold), MCHI (Chinese Stocks), GDX (Gold Miners) and TLT (20+ Treasury Bond).

Precious metals added to our performance, driven by a weakening dollar. SLV was the most additive contributor. MCHI, a new addition to our portfolio, also added to performance.

Our TLT position dragged performance significantly, offsetting one-for-one the gains from SLV. The 6%+ fall in TLT in July was the worst seen since September of last year.

TLT has been a mainstay of our Model Portfolio since inception, expressing our recession thesis. We’ll be reviewing the TLT position in an Investment Radar article this week.

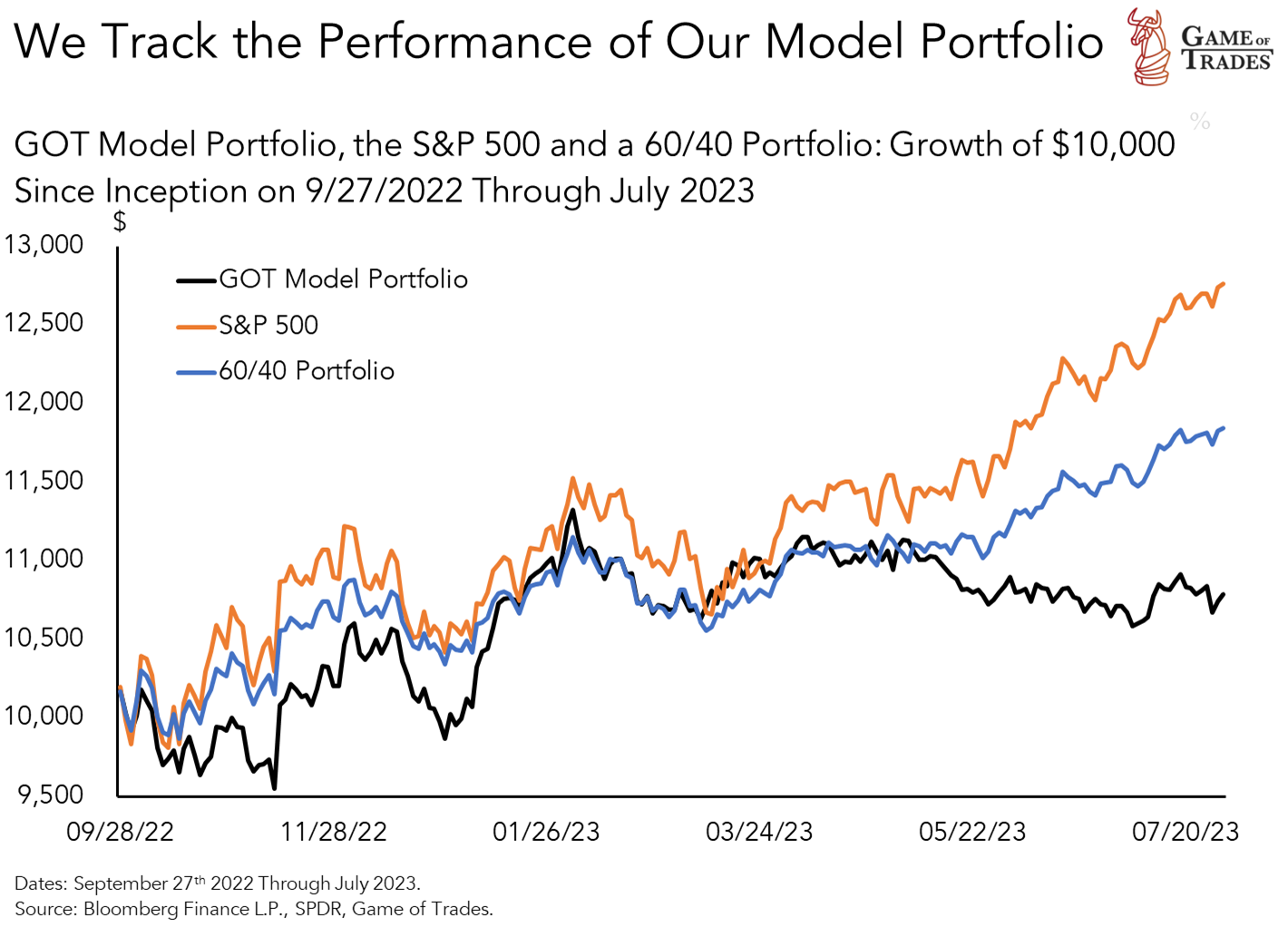

Since inception on 9/27/2022, our portfolio is up 7.9%. It’s underperformed the S&P 500 by 19.7 pp., a 60/40 portfolio by 10.5 pp. and global asset allocation fund by 8.0 pp.

Changes to the Portfolio

We made one change to the Model Portfolio in July, as shown below:

- Initiated 5% MCHI (Chinese Stocks) long position. We expect significant upside potential as policymakers seem poised to deploy credible stimulus to arrest economic uncertainty.

Portfolio Positioning and Outlook

Year-to-date, our Model Portfolio has underperformed the S&P 500 by around 12 pp. The result has been a function of our concentrated positioning around a U.S. recession expected in the 2nd-half.

The drag in our portfolio was driven by closing our stock longs between February and March, given our negative view on earnings. The AI rally left us unexposed to the surge in equities.

Our TLT long has also hindered our portfolio’s performance this year. While its allocation is modestly lower than in a 60/40 portfolio, it’s faced worst-decile returns relative to stocks YTD.

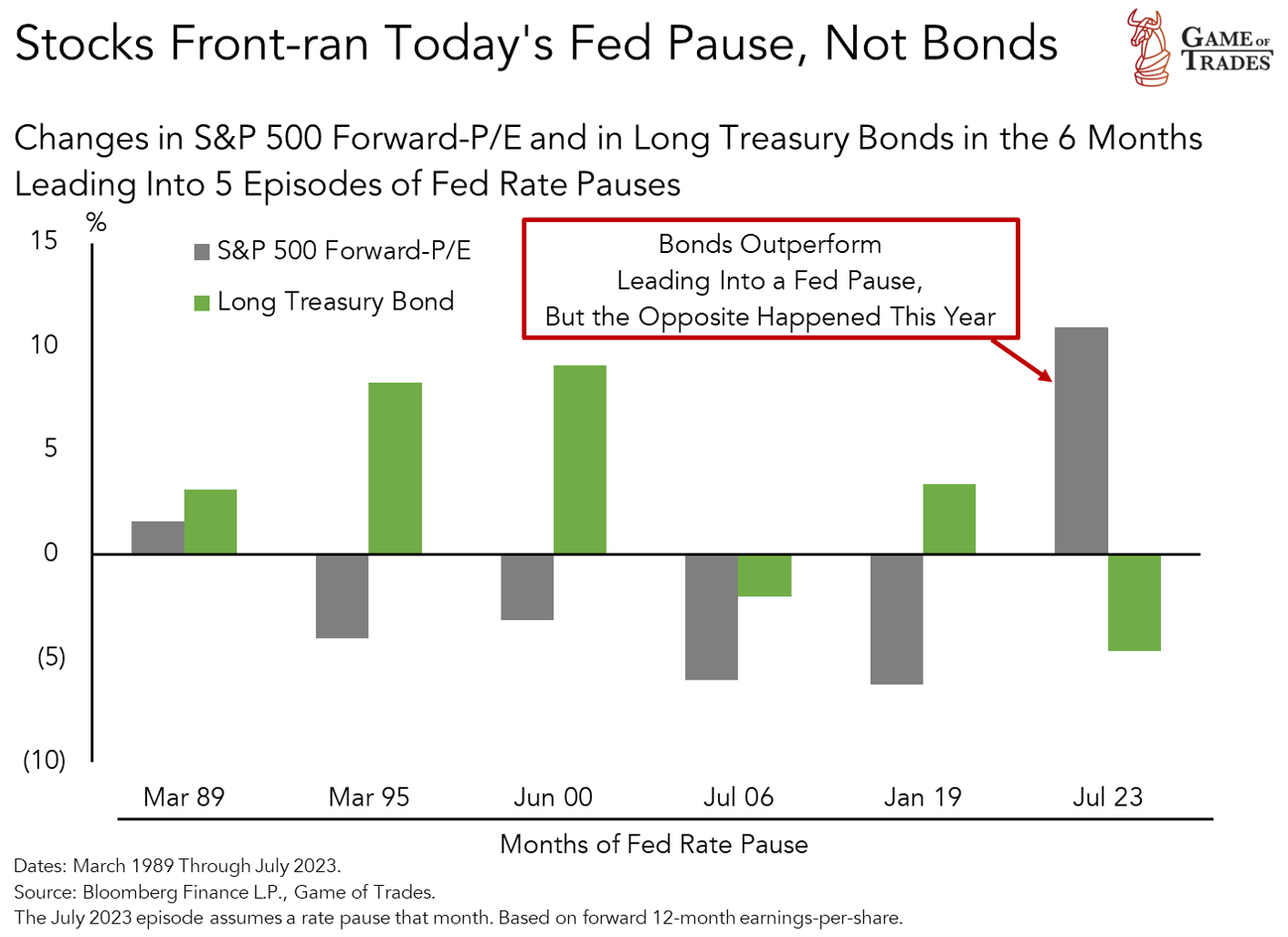

Our decision to stay the course with TLT relates to our view that stocks have front-ran a Fed pivot, capping further upside. The opposite has been true for bonds, giving them runway.

We expect a reversal in bonds, where they outperform stocks significantly in a recession that materializes later this year. We expect that scenario will put our portfolio ahead of the S&P 500.

We’ll be reviewing the TLT trade in an Investment Radar piece this week. While stocks have had an impressive run this year, the SPX/TLT ratio is now at an important level of resistance.

SLV, GLD and GDX, contributed positively to our portfolio’s performance as the dollar weakened. The dollar is an important driver of precious metals.

Our precious metals exposure is a bet on a U.S. recession that would see a falling dollar and real yields as the Fed eases. Precious metals would outperform then, adding upside to our portfolio.

One risk we’re monitoring is potential dollar strength in coming months if the economy in Europe deteriorates further, forcing the ECB to shift to a more dovish stance.

A relenting ECB could see European interest rates fall, putting pressure on the euro as investors rotate into a haven like the dollar. That would have negative implications for precious metals.

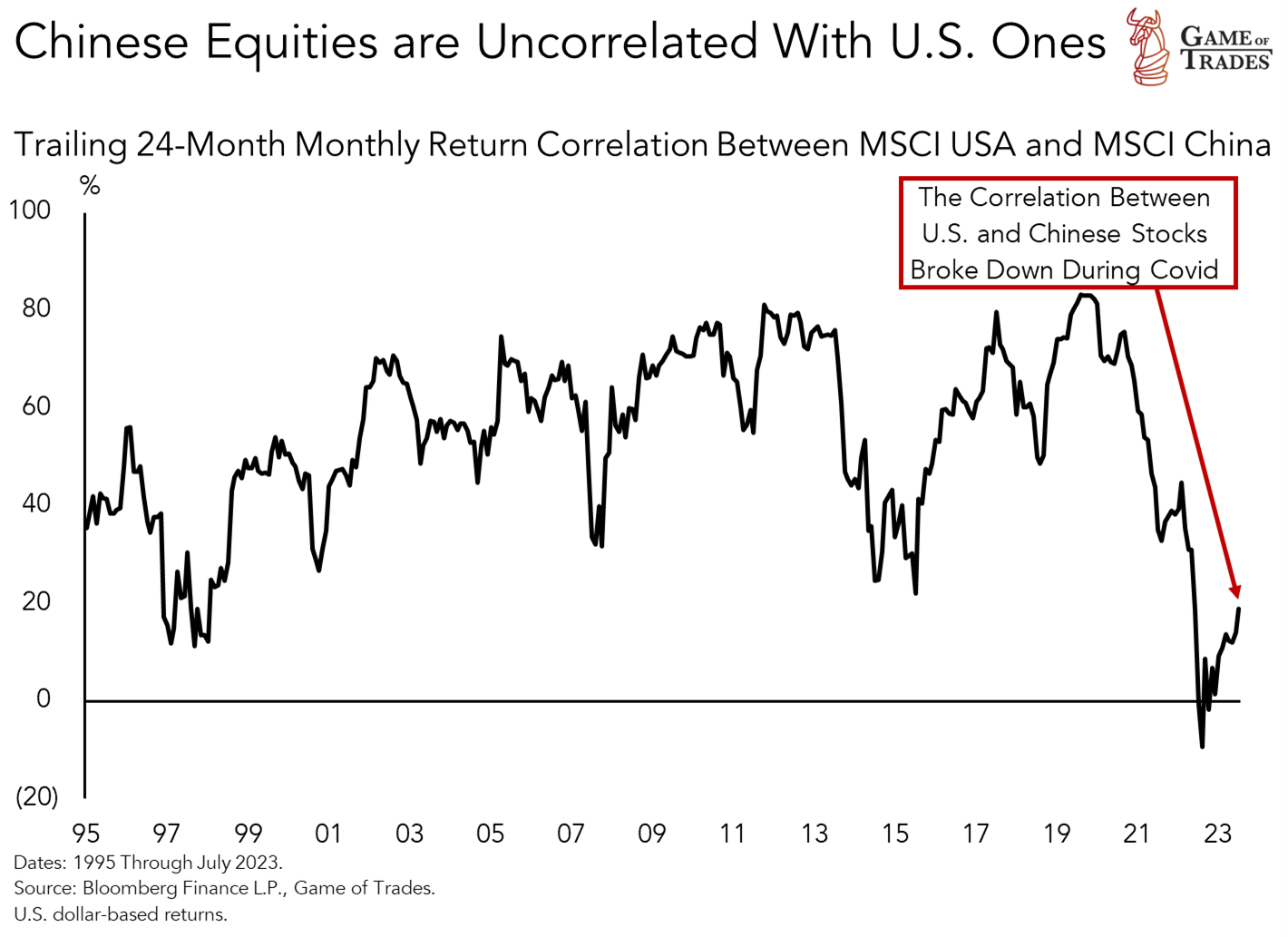

Lastly, the poor risk reward evident in the U.S. market today has shifted our focus to look for opportunities offering uncorrelated exposures to U.S. equities.

We’ve recently added MCHI (Chinese Stocks) to our Model Portfolio, as those stocks’ correlations with the U.S. broke down post-Covid. The stocks also look undervalued.

MCHI, as well TUR (Turkish Stocks) that we added in August, have room for double-digit gains, compared to an S&P 500 that’s extremely overextended and vulnerable to disappointing investors.

We’ll continue to look for high reward-to-risk opportunities that can further diversify our exposure to our recession thesis and help boost the performance of our portfolio.

The GOT Model Portfolio is shown below.

Footnotes:

[1] Returns are computed on a total return basis (i.e., including dividends and distributions).

[2] The 60/40 portfolio is based on a weighted-average of total returns of the S&P 500 (60%) and the S&P U.S. Aggregate Bond Index (40%). The global asset allocation fund is based on the total return of the BlackRock Global Allocation Fund.

i got rekt from TLT. can you analyze a stock with symbol SE?

@0xtendies Thank you for the question. We don’t produce research on individual equities.

What is GOT’s plan if SPX/TLT breaks through channel resistance? Would it mean stop loss in the short term?

We have to be patient with TLT, this is a 1 – 3 year play, but fundamentally a good position. Not for a quick win however.

@Samonita Kayden We appreciate the question. We’ll provide more information in an Investment Radar piece focused on TLT this week.

That’s why I like your channel and suscribe for membership. Although recently the forecast is not up to expectation, but it’s OK since you will review the judgement if not it is not as expected. Hope your channel will have precise forecast as I first discover this channel in 2020. Would you make an episode to show us how to buy VIX options? I have monitored the VIX index for a period and I found that once it drop to around 13 it will go up significantly to around 16 (at least) but I found none of the VIX ETF follows the VIX index, so I try to look for call option, but I don’t know which I should buy as there are so many. Thanks!

Looks like we’ll get more info on TLT when we see Thursday’s inflation data and how yields react to it.

your recession call was way too early – that is why you bought tlt vs spy – no recession until the yield curve reverts –

No comments!