In the ever-evolving landscape of global finance, the ability to forecast economic downturns with precision remains one of the most sought-after skills among economists and investors alike. Using a blend of historical data, current economic indicators, and sophisticated modeling techniques, professionals in the field aim to predict future economic conditions and prepare accordingly. This article explores the parallels between current market conditions and those that have historically preceded recessions, shedding light on potential triggers for future economic downturns and evaluating the overall health of the economy.

Economic Forecasting

Economic forecasting involves the analysis of a vast array of economic data to predict future conditions. Key metrics such as GDP growth rates, unemployment figures, stock market performance, and inflation rates are integral to these analyses. More nuanced indicators like Federal Reserve (Fed) policy decisions, the behavior of yield curves, and sector-specific performances also provide deep insights into the economic outlook. By comparing current conditions to historical patterns, economists aim to predict not just recessions but also recoveries and booms.

Historical Context of Rate Hikes and US Recession Precursors

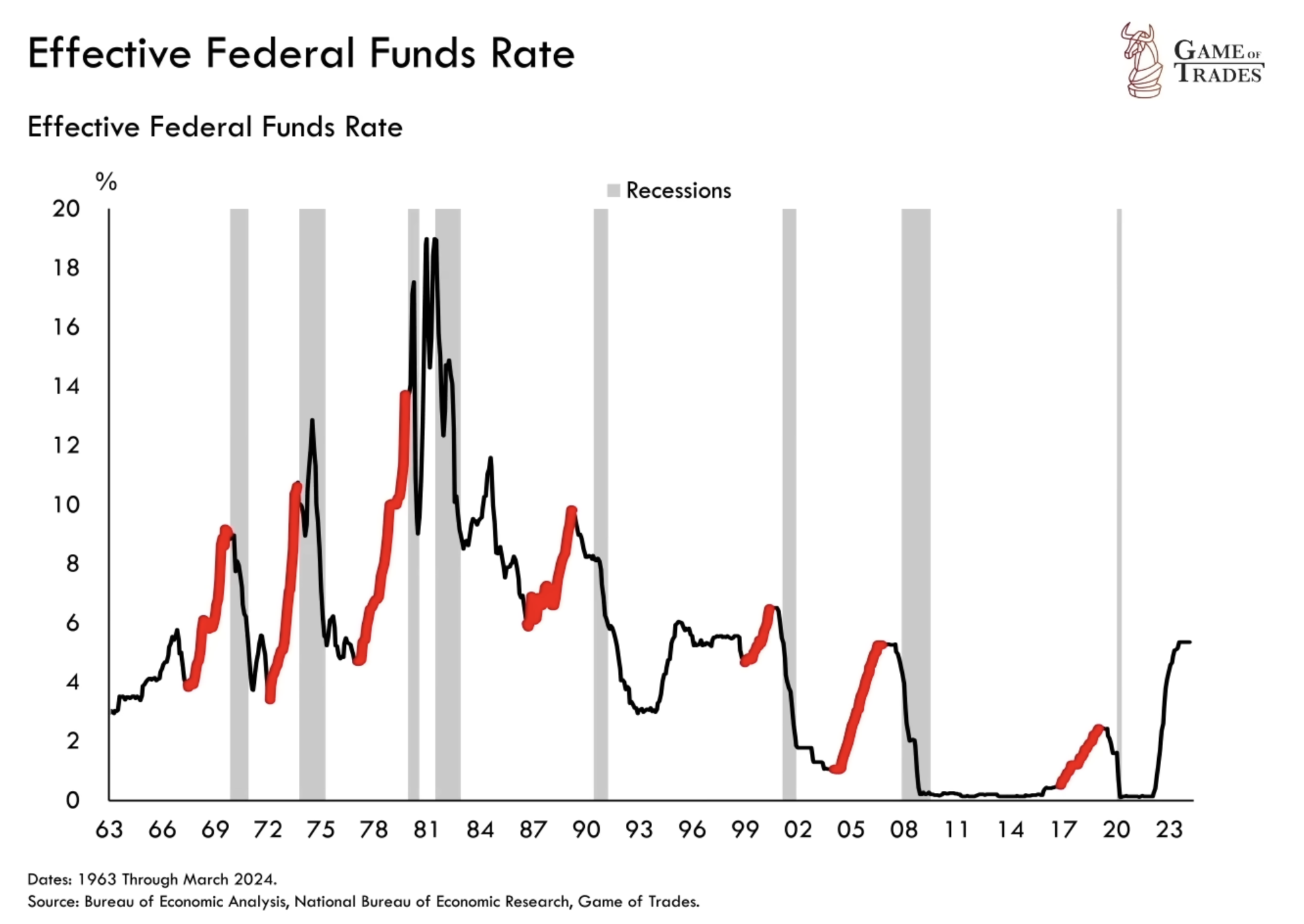

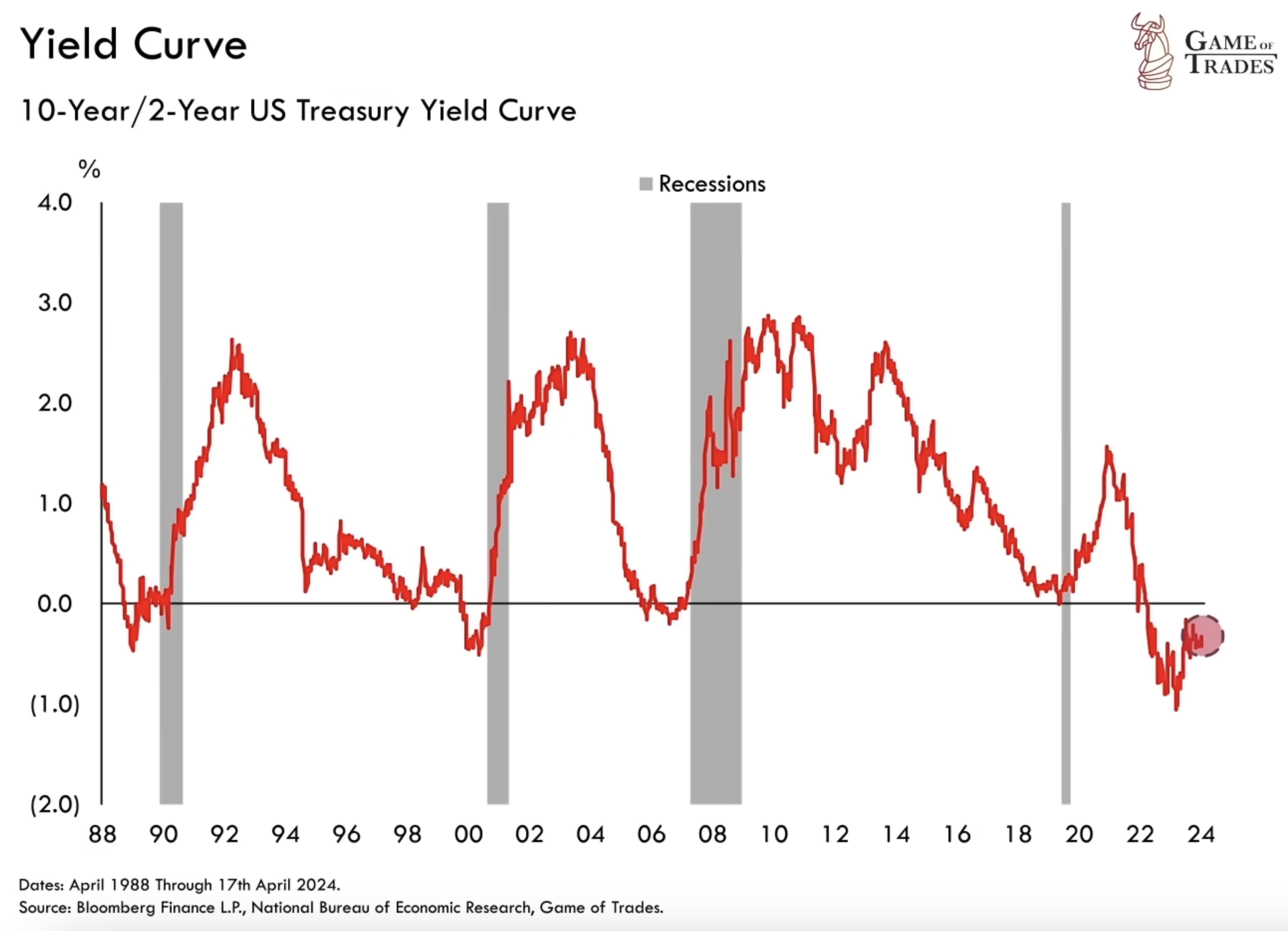

In February 2007, the Federal Reserve concluded a significant cycle of interest rate hikes, the most aggressive since the 1970s. Such monetary tightening has often been a precursor to economic recessions. Alongside this, an inverted yield curve—where long-term interest rates fall below short-term rates—signaled potential trouble. This phenomenon has historically been one of the most reliable predictors of a forthcoming recession. Furthermore, during this period, businesses reported increasing difficulties in securing loans, a condition that tightened liquidity and constrained economic growth.

The Great Recession and Stock Market Responses

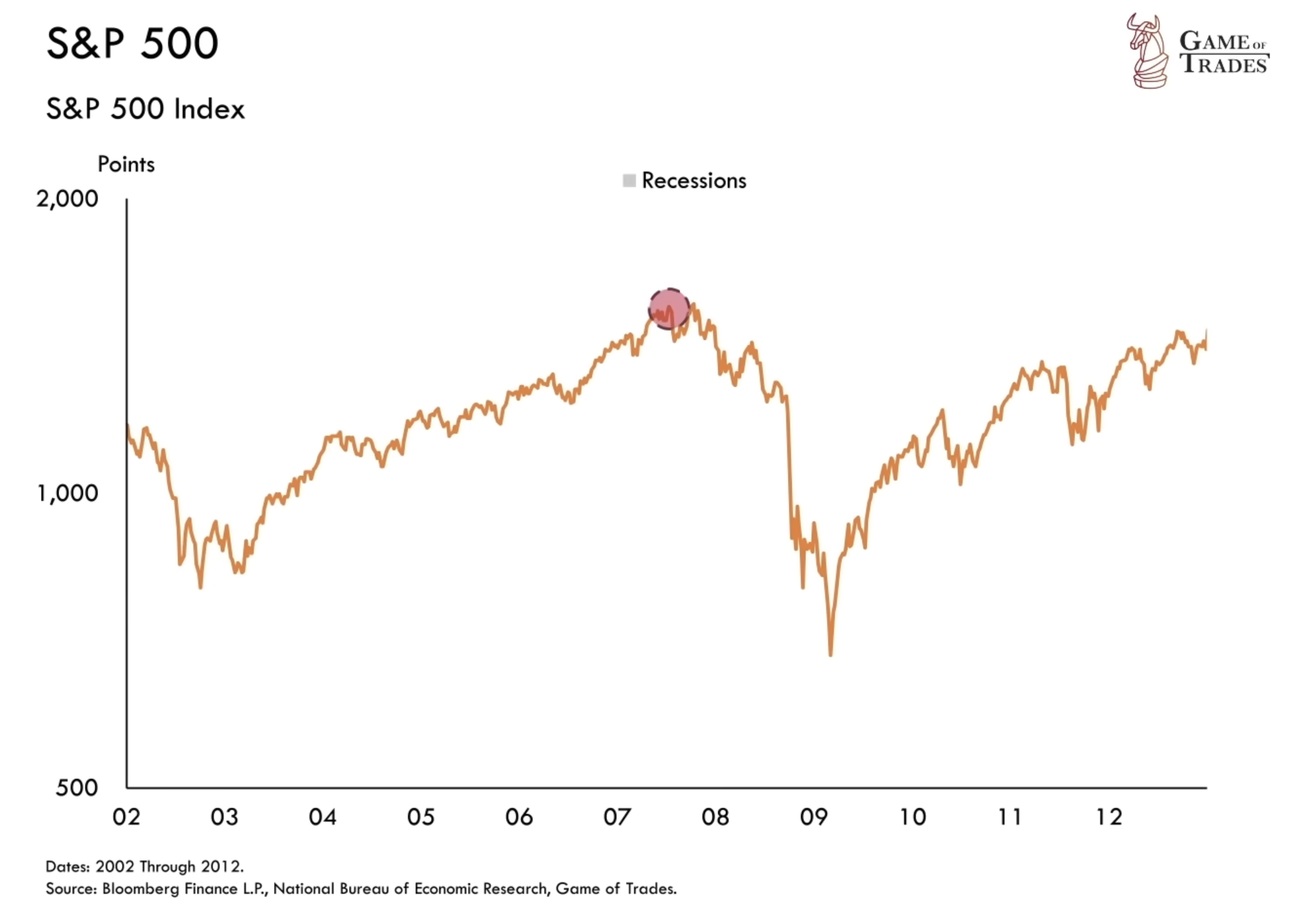

The late 2007 peak of the stock market was followed by a steep decline into a severe bear market. Unemployment soared, reflecting deep economic distress. Known as the Financial Crisis, this period was precipitated by a collapse in the housing market compounded by inadequate regulatory oversight and excessive risk-taking in financial markets. These factors contributed to a crisis that rippled across the global economy, highlighting the interconnectedness of modern financial systems.

Current Economic Conditions and Historical Parallels

In the present day, we are witnessing a recurrence of economic indicators akin to those observed in the year 2007. The Federal Reserve, the central banking system of the United States, has once again embarked on a path of sharply increasing interest rates, reminiscent of the monetary policy actions taken just over a decade ago.

Moreover, we are seeing another instance of an inverted yield curve, a phenomenon often considered a reliable harbinger of an impending economic downturn. Businesses are grappling with stringent borrowing conditions, much like the challenging environment they faced in the lead-up to the 2007 financial crisis. These striking parallels to the period preceding the 2007 recession have sparked significant concern and drawn attention to the possibility of another imminent recession. However, despite these warning signs flashing on the economic dashboard, a recession has not yet come to pass.

Analyzing Current Economic Strengths

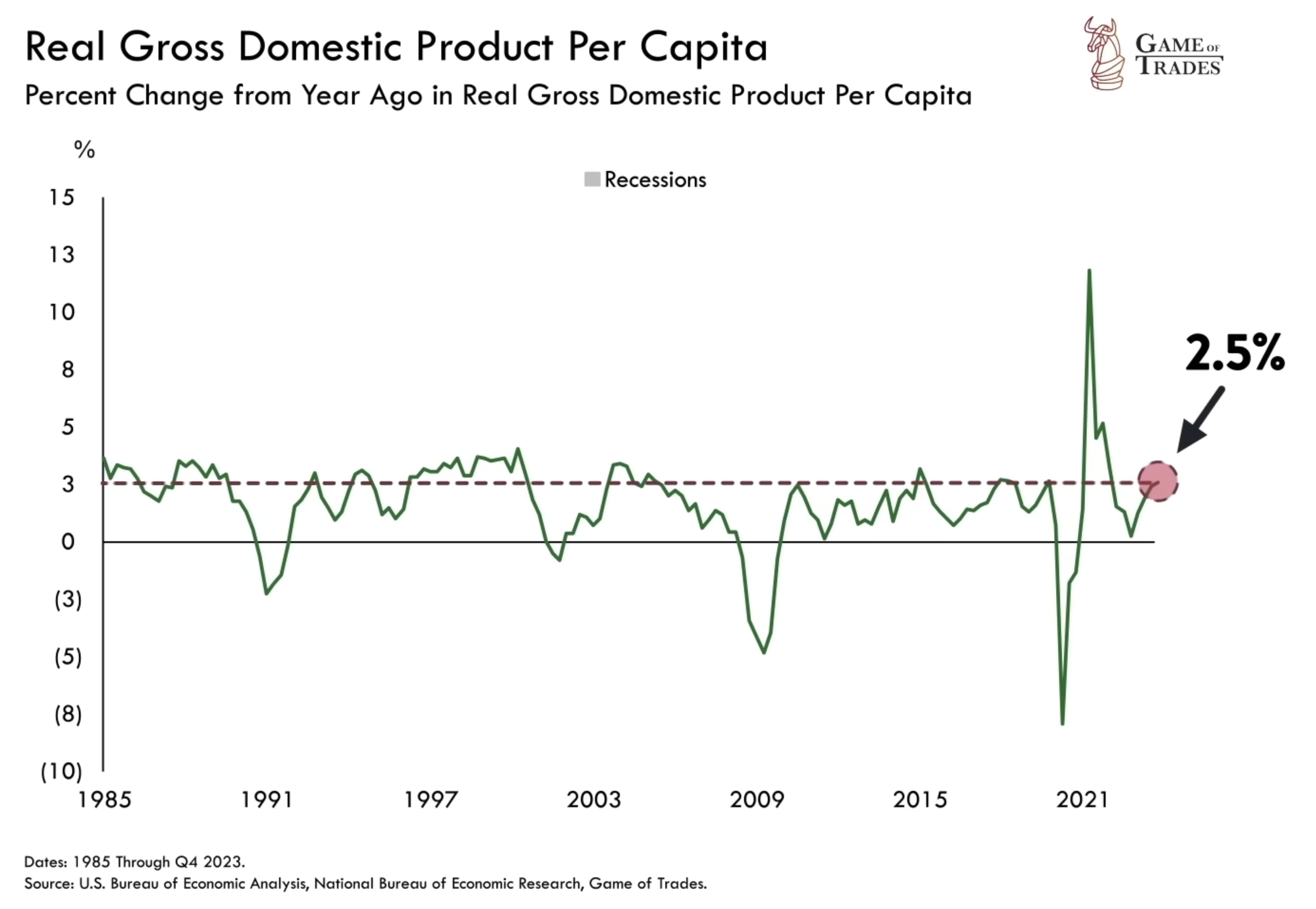

Contrary to the standard pre-recession landscape that many of us are accustomed to observing, the current U.S. economy is exhibiting several key strengths that cannot be overlooked. One of the most notable of these is that the Real GDP is experiencing growth at an impressive rate of 2.5%. This figure refers to the GDP when it has been adjusted for inflation and is considered robust by any standard that has been applied over the past four decades.

In addition to this, the unemployment rate remains near historical lows, demonstrating the strength and resilience of the job market in the face of potential economic shifts. This is a significant indicator of economic health, as a low unemployment rate signifies a high level of employment and, consequently, a strong consumer base.

The stock market, despite some degree of volatility which is to be expected given the ever-changing nature of financial markets, has generally been performing well. This is another positive sign, as a strong stock market often reflects confidence in the economy as a whole.

Taken together, these indicators suggest that while the economy may indeed be nearing the end of an expansion phase, it is not necessarily time for a recession yet. It is important to note, however, that a recession could still be triggered by a significant catalyst or significant economic event. Therefore, while the current economic situation is strong, it is crucial to remain aware of potential changes in the economic landscape.

Historical Catalysts for Economic Downturns

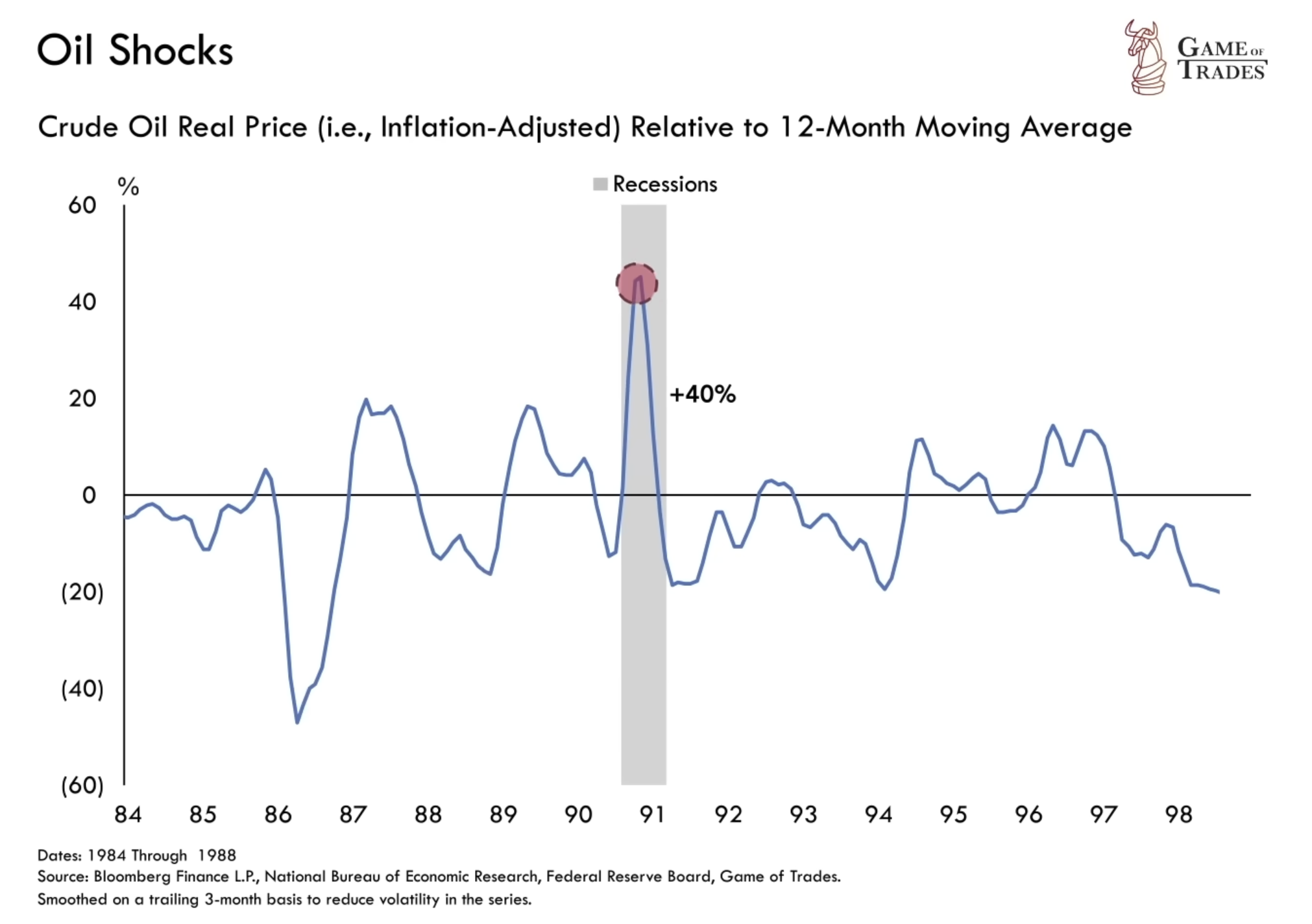

Throughout history, it has been observed that specific triggers or events have precipitated economic downturns or recessions. For instance, let’s take a look at the recession that occurred in the year 1990. This economic downturn was primarily sparked by an oil (USOIL) shock that occurred in the aftermath of Iraq’s invasion of Kuwait. The invasion led to a significant disturbance in the oil market, causing the prices of oil to skyrocket dramatically. This sudden increase in oil prices destabilized the global economy, eventually leading to a recession.

The patterns observed during this recession were not unique but rather echoed similar conditions observed during other economic downturns. For example, during the oil crises that shook the world in the 1970s, rapid and unexpected spikes in oil prices played crucial roles in triggering economic recessions. The financial crisis of 2007-2008, another significant economic event in recent history, followed a similar pattern. Here too, sudden increases in oil prices played a significant role in bringing about the economic downturn.

Hence, it can be seen that sudden fluctuations in oil (USOIL) prices have often been key triggers in causing economic recessions. These events showcase the impact that changes in the oil market can have on the global economy.

Other catalysts for a recession have been a pandemic, as seen in 2020, or a market crash, as seen during the Dot Com bubble bust in 2000 and the Black Tuesday crash in 1929. These 3 factors together, namely, oil shock, pandemic, and market crash, are the 3 primary catalysts for a recession from a historical standpoint.

The Role of Oil Shocks in the Current Economy

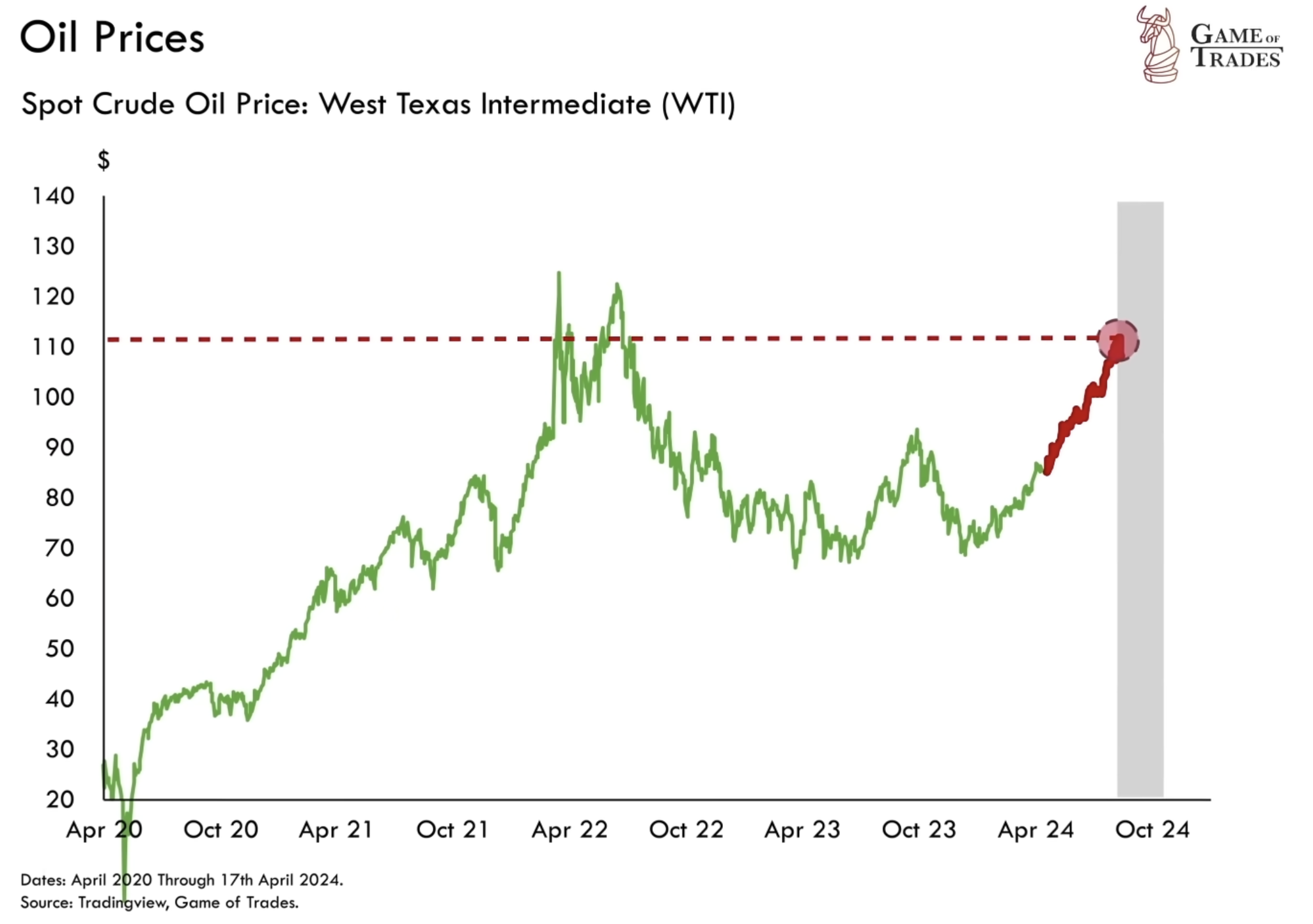

In the current economic scenario, oil (USOIL) prices have again risen significantly. Geopolitical tensions in the Middle East suggest the potential for a major oil shock, akin to those that have triggered previous recessions. For an oil shock to trigger a recession, oil would need to hit at least $111, based on past occurrences

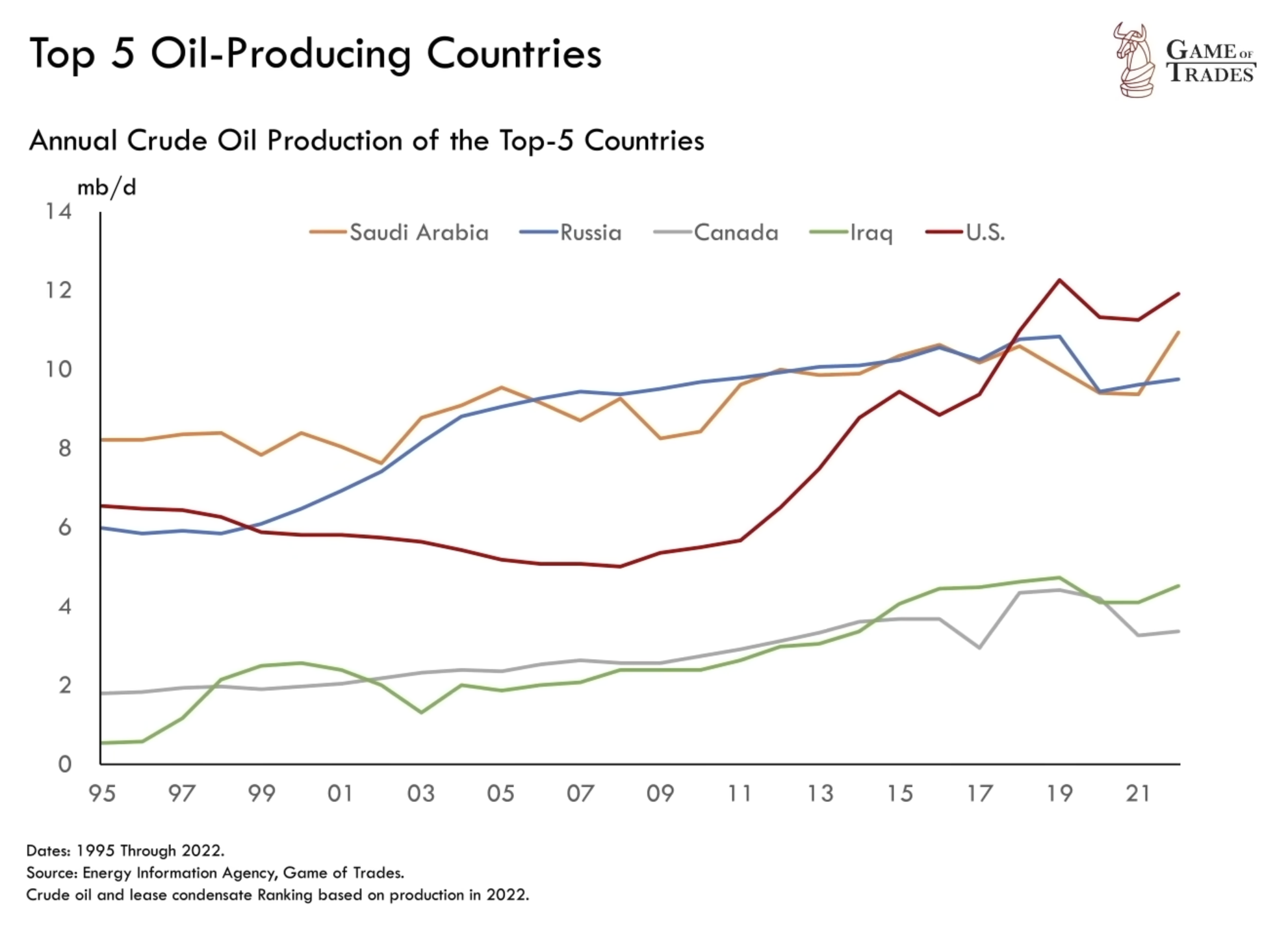

However, the United States is now a much larger producer of oil, which could help buffer some of the negative impacts of rising oil prices on the domestic economy. For a major oil shock to trigger a recession similar to those in the past, an event like a large-scale war disrupting global oil supplies would likely be necessary.

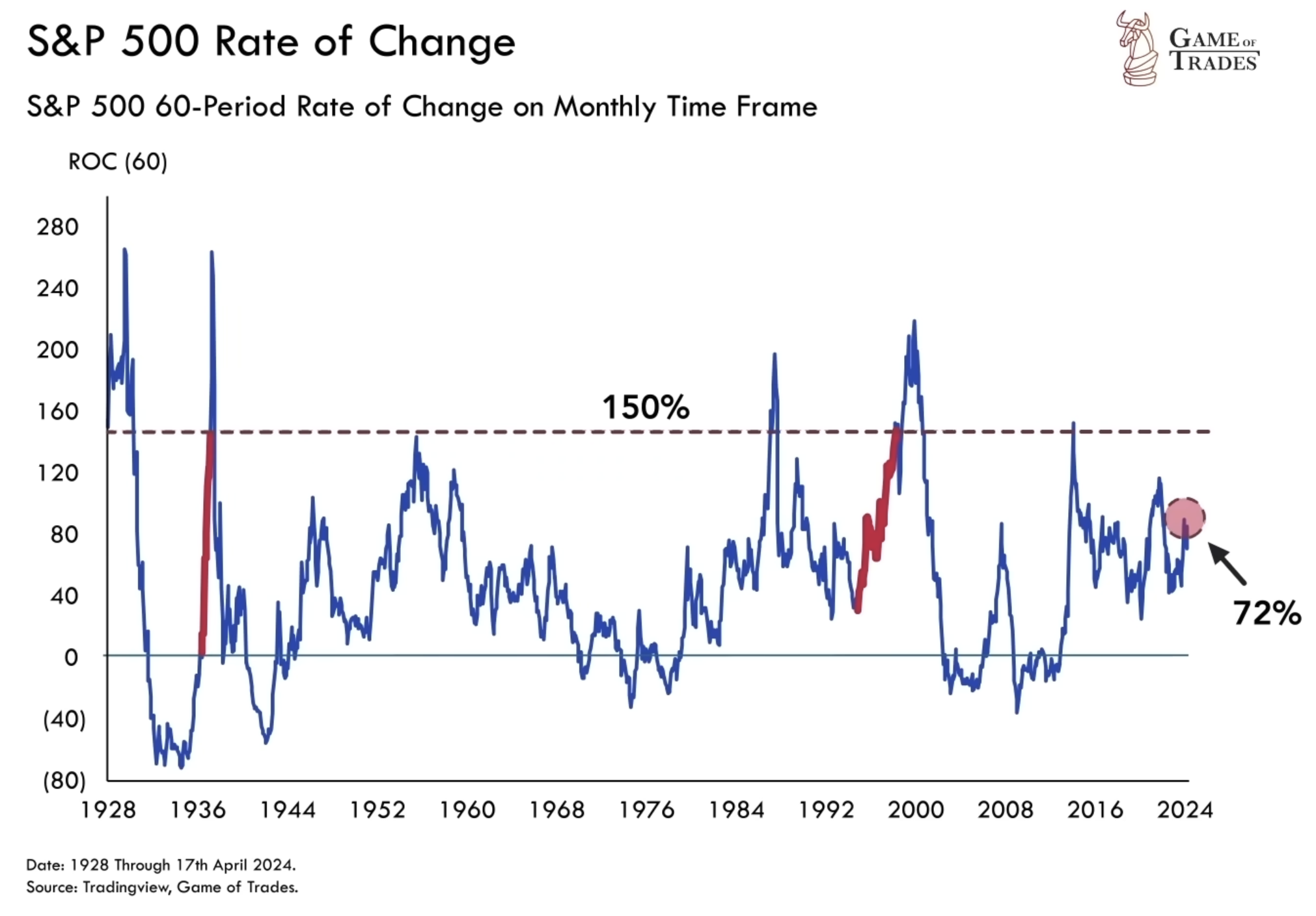

Stock Market Valuations and Potential Risks

Today’s stock market valuations are notably high, reminiscent of the periods just before significant market corrections in 2000 and 1929. However, the current market lacks the extreme euphoria characterized by the dot-com bubble or the pre-Great Depression era, as shown by more modest five-year returns. This suggests that while the market may be due for a correction, a collapse akin to those historic downturns would likely require a significant external shock, like a war breaking out.

Despite the pullback, the bull market remains structurally intact. The technicals still show more upside. We’re seeing this as a chance to load up on stocks at a discount for the next run-up. Get access to our Shopping List and Trading Ideas with a 7-day free trial at Game of Trades.

Conclusion

The conditions for a recession appear to be aligning today, similar to previous economic downturns, but a clear catalyst for a recession has yet to emerge. As long as the economy lacks a significant catalyst, current dips in the stock market should represent buying opportunities rather than signs of a looming recession. Investors and economists alike should continue to monitor key indicators and potential catalysts closely, particularly geopolitical developments and oil (USOIL) price movements, to better predict and prepare for any significant shifts in the economic landscape. Click here to get a 7-day free trial! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: US Debt Crisis Will Have Major Implications for the Economy