In the dynamic and often unpredictable world of financial markets, understanding shifts in key economic indicators and asset performances can offer profitable insights for investors and financial strategists. Recent years have seen significant movements in U.S. Treasury bonds (TLT), rise in gold prices (GLD price), and changing inflation expectations. These factors are critical in shaping investments and market outlooks. This article provides a detailed analysis of these trends, helping investors to navigate the complexities and prepare for future shifts.

The Decline of Treasury Bonds

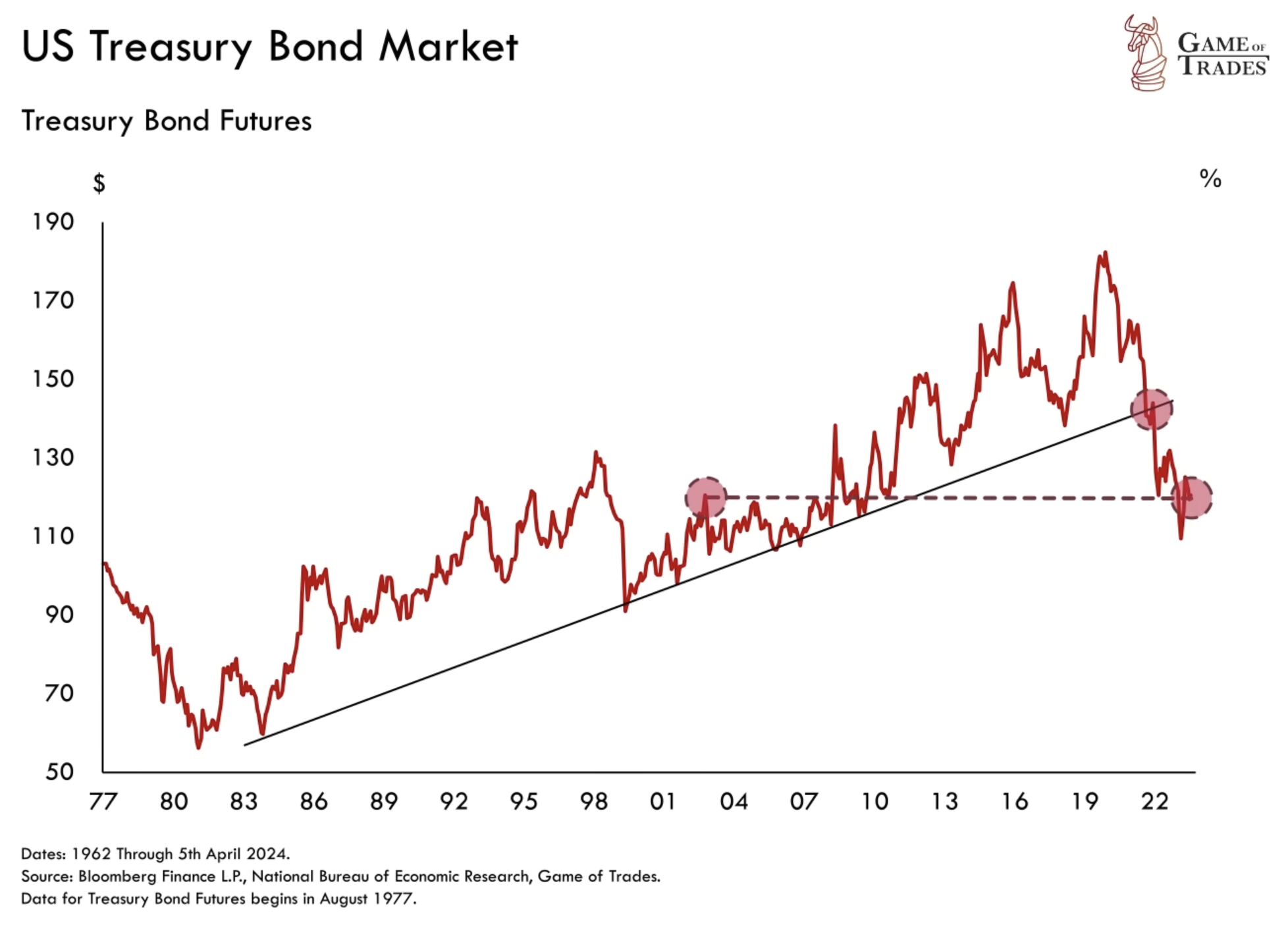

U.S. Treasury bonds (TLT) have experienced one of their most challenging periods since the 1980s, marked by a significant break below a 40-year uptrend. Currently, bond prices (TLT) have plummeted to levels comparable to those in 2013, encapsulating a stark bear market within just a few years. This dramatic shift is largely due to increased government spending and higher inflation expectations, which typically lead to higher interest rates, decreasing the attractiveness of existing bonds with lower yields.

Historically, Treasury bonds make up a substantial portion of an investor’s portfolio, around 40%, because of their perceived safety and steady returns. However, the recent downturn has led to substantial losses, shaking confidence in their role as a portfolio cornerstone.

US Debt Crisis and Gold’s Ascendancy in Uncertain Times

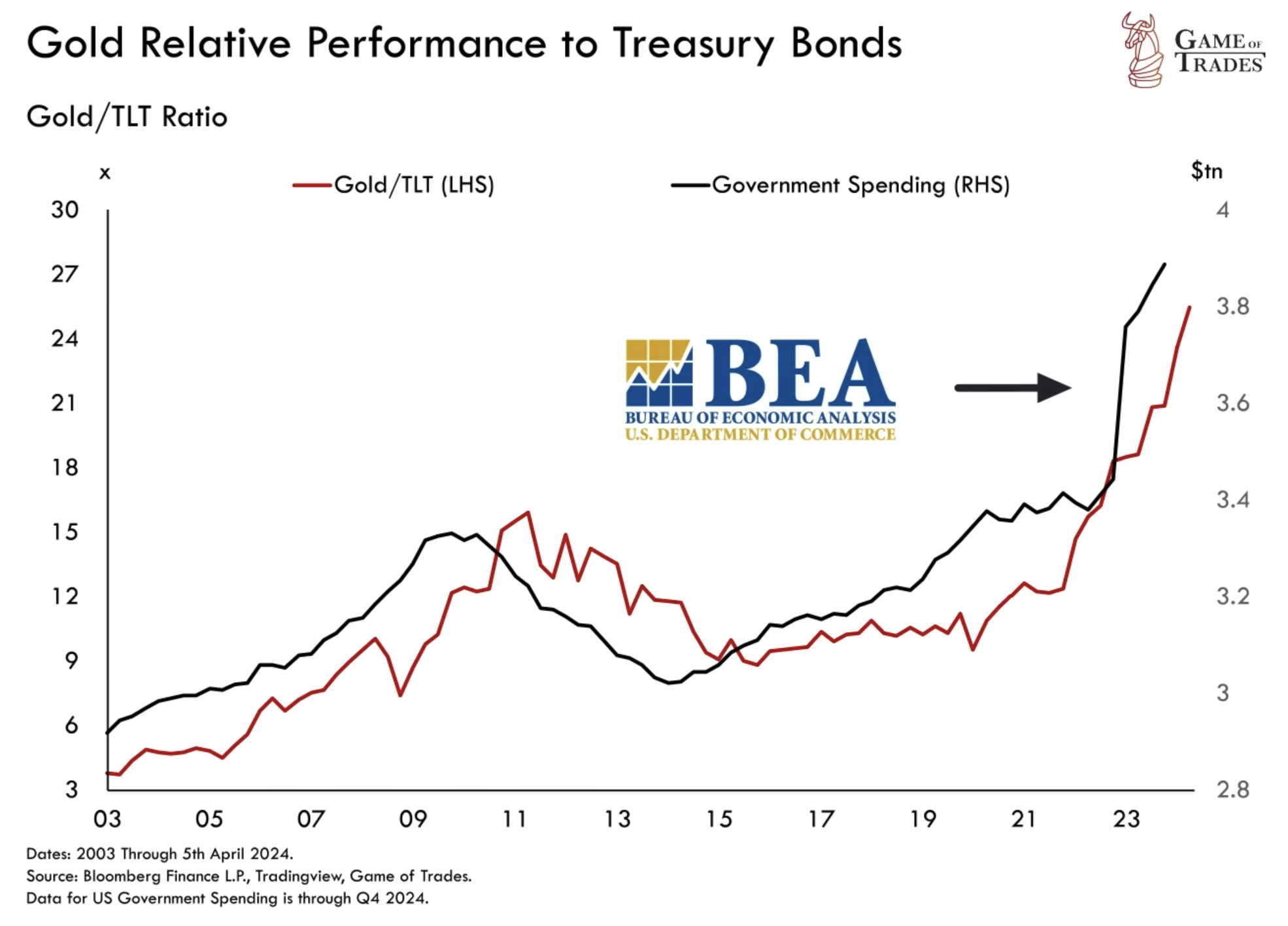

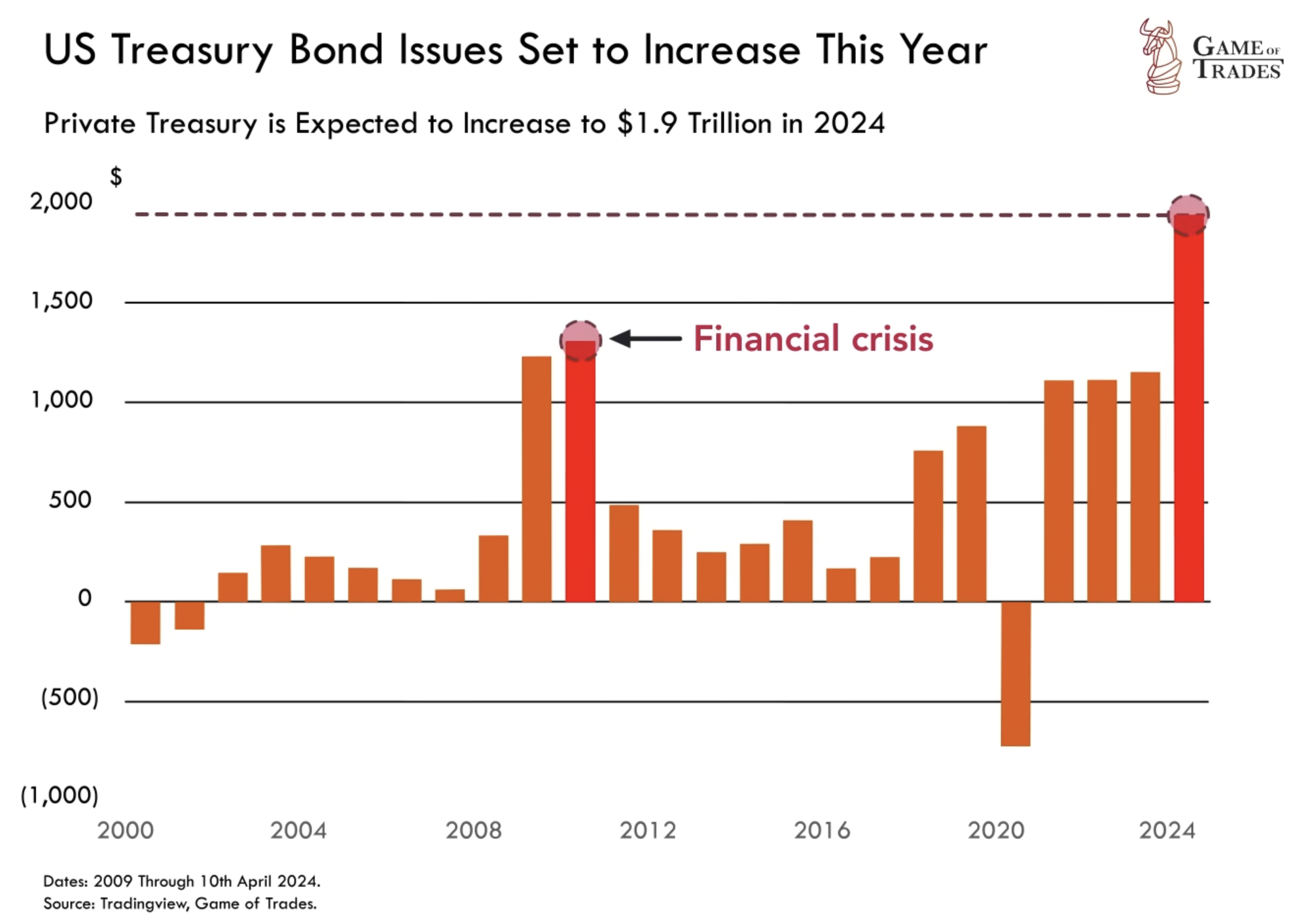

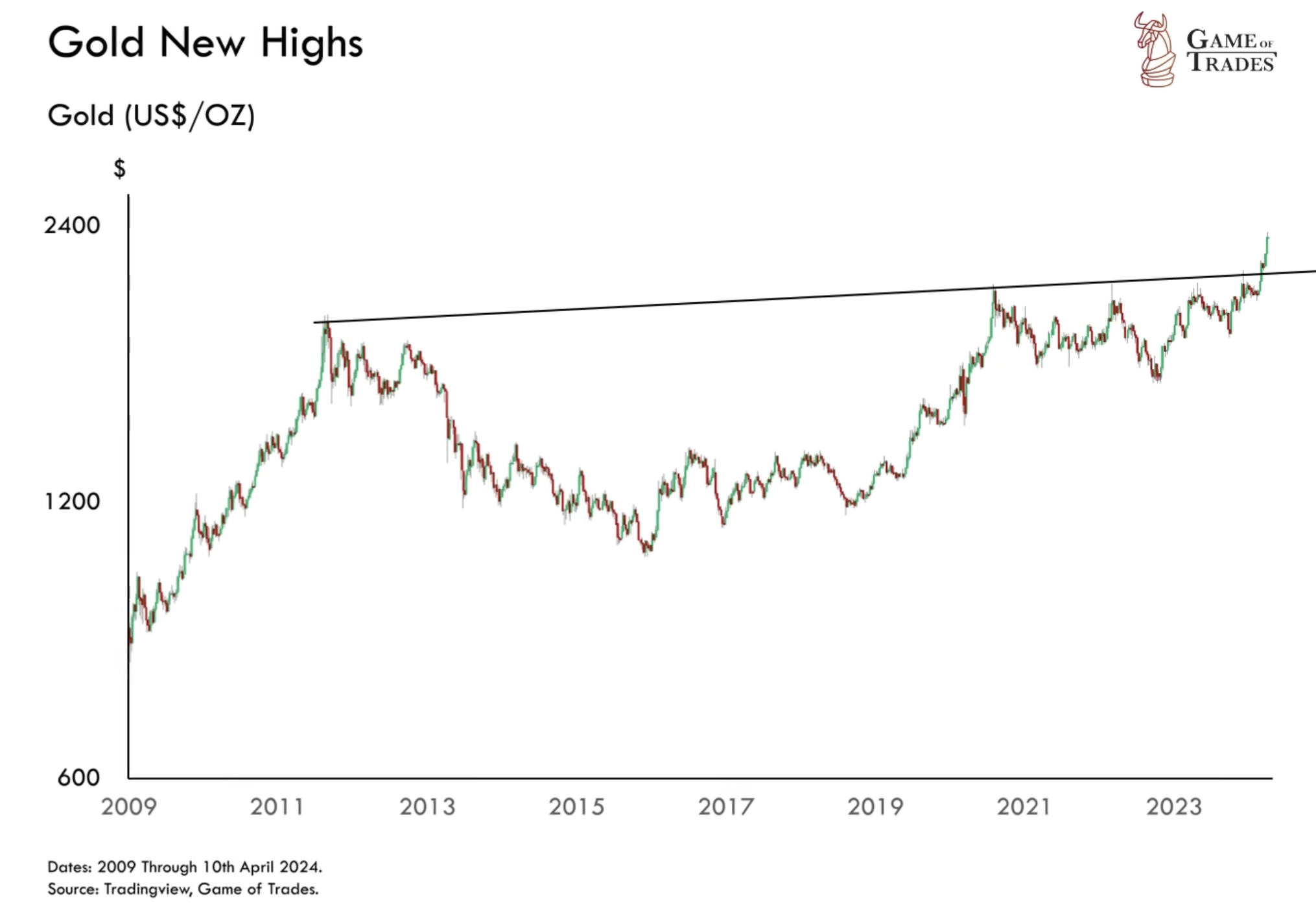

Contrasting sharply with the bleak performance of Treasury bonds, gold (GLD) has surged, outperforming Treasury bonds (TLT) by a staggering 170% since March 2020. This remarkable outperformance is directly linked to the dramatic increase in government spending over the last few years, which surged from $3.4 trillion to nearly $4 trillion. Such spending increases, often financed by the issuance of more Treasury bonds, dilute bond values but simultaneously boost gold’s appeal as an inflation hedge and alternative investment. This makes gold trading and gold-related investments a very profitable investment.

Impact of Government Spending on US Debt Crisis

The linkage between increased government spending and financial market dynamics is very important. High levels of government expenditure, particularly when financed through increased debt issuance, can flood the market with bonds, reducing their price and increasing yields. Conversely, the finite nature of gold’s supply, contrasted with the almost limitless potential for fiat currency issuance, helps maintain its value. As a result, in periods of aggressive fiscal expansion, gold becomes an increasingly attractive asset for those seeking to preserve wealth.

Future Projections for Treasury Bonds

Looking ahead, while we anticipate a potential rebound in Treasury bond prices (TLT) in the short-term. We believe bonds (TLT) is nearing a local bottom is near and getting ready for a profitable bounce. We’re open to the possibility of a double bottom in bonds (TLT), however, before a significant bounce occurs, which could provide a potential 30% gain.

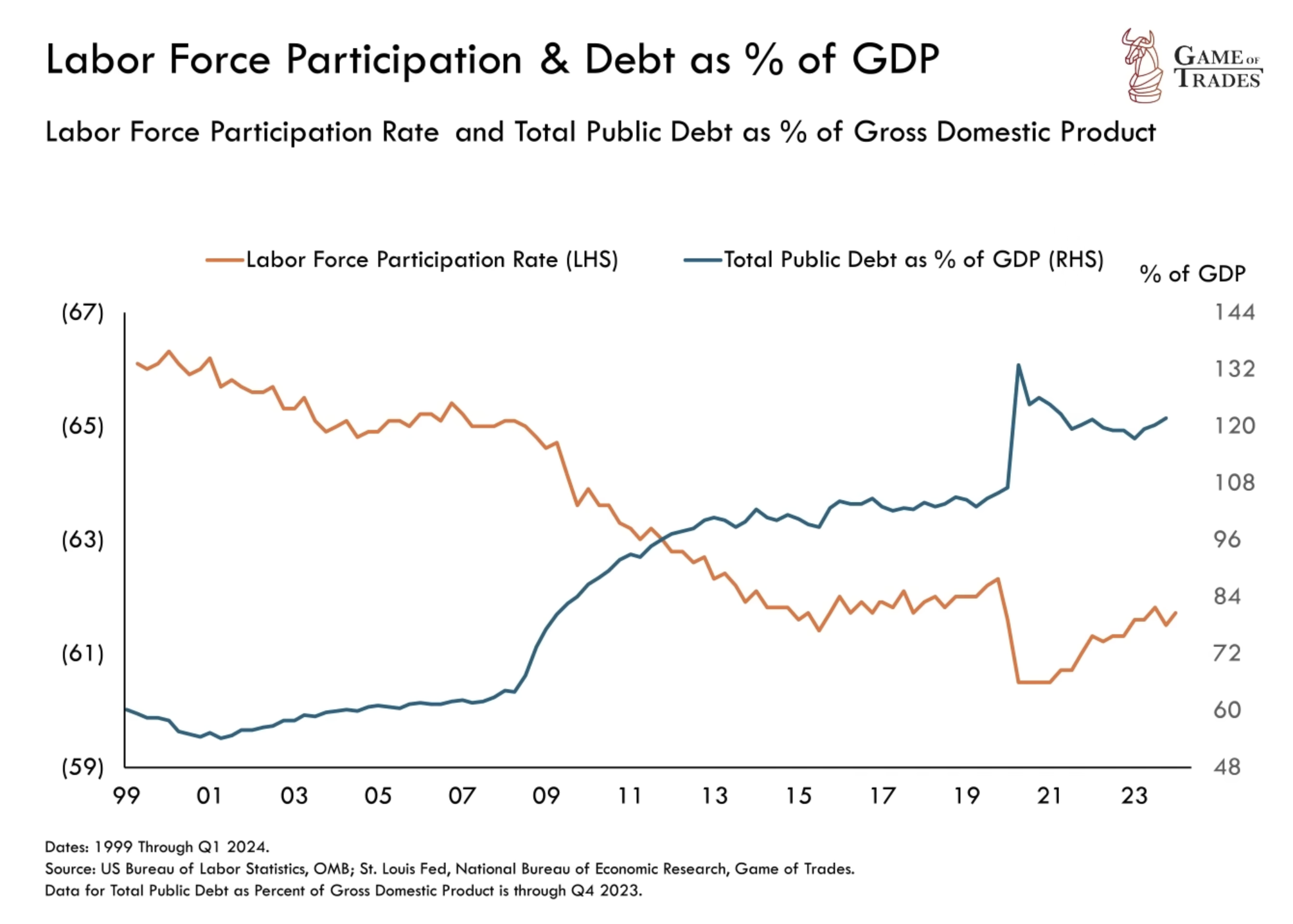

Our long-term outlook remains less optimistic though. A deeper bear market could be on the horizon, reflecting not just immediate market reactions but also underlying economic shifts such as the declining labor force participation rate. Since 1999, this rate has steadily decreased, signifying fewer people are available to work, leading to lower tax revenues, thus exerting additional pressure on government finances.

Inflation Expectations and Their Implications

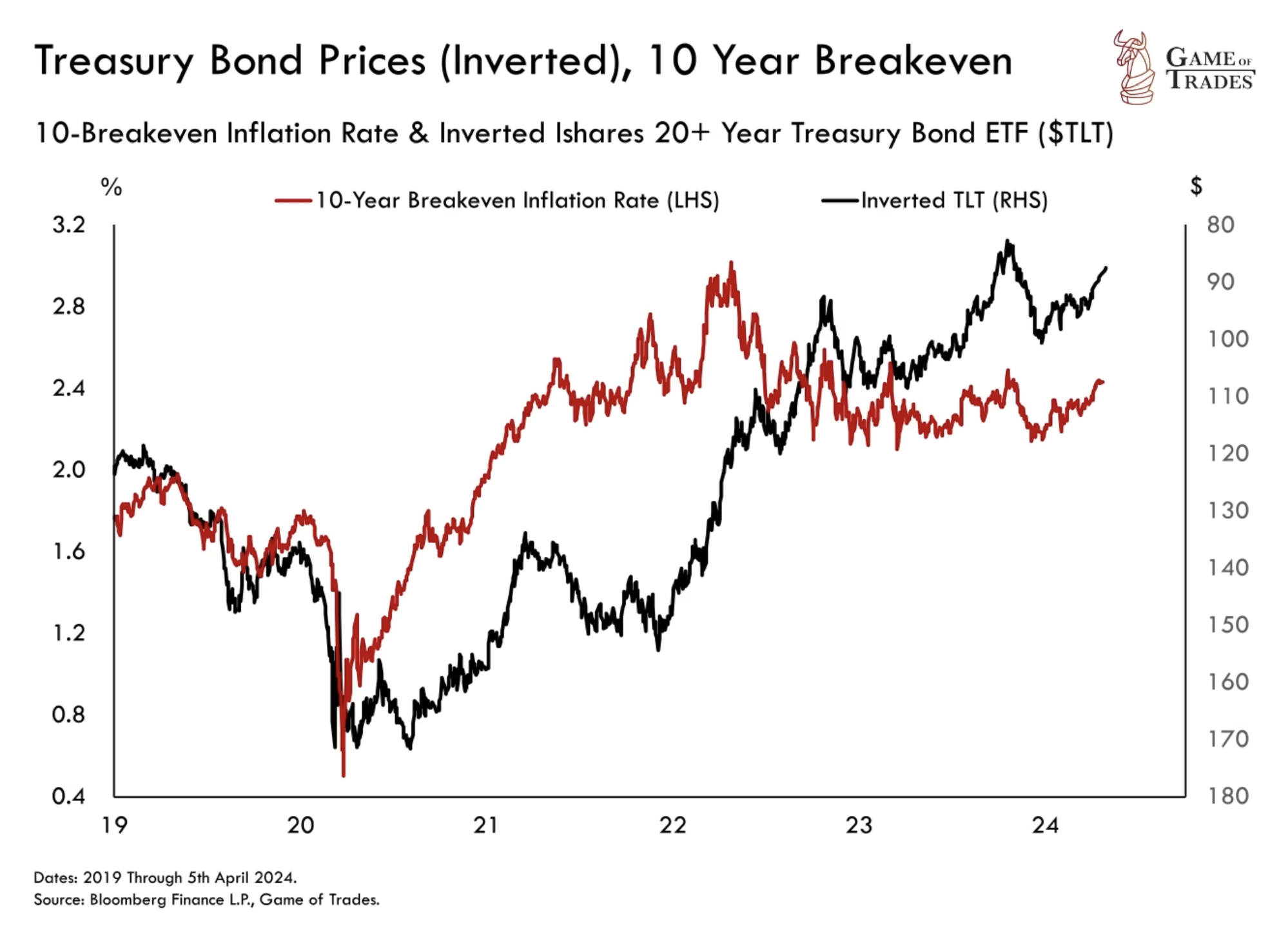

Inflation expectations are of paramount importance when it comes to the valuation of Treasury bonds. The reasoning behind this is fairly straightforward: if investors anticipate that inflation will rise in the future, they naturally require higher yields on their investments to compensate for the diminished purchasing power of future interest payments. This is an intuitive response to the potential threat of inflation, as the real value of money decreases when prices rise.

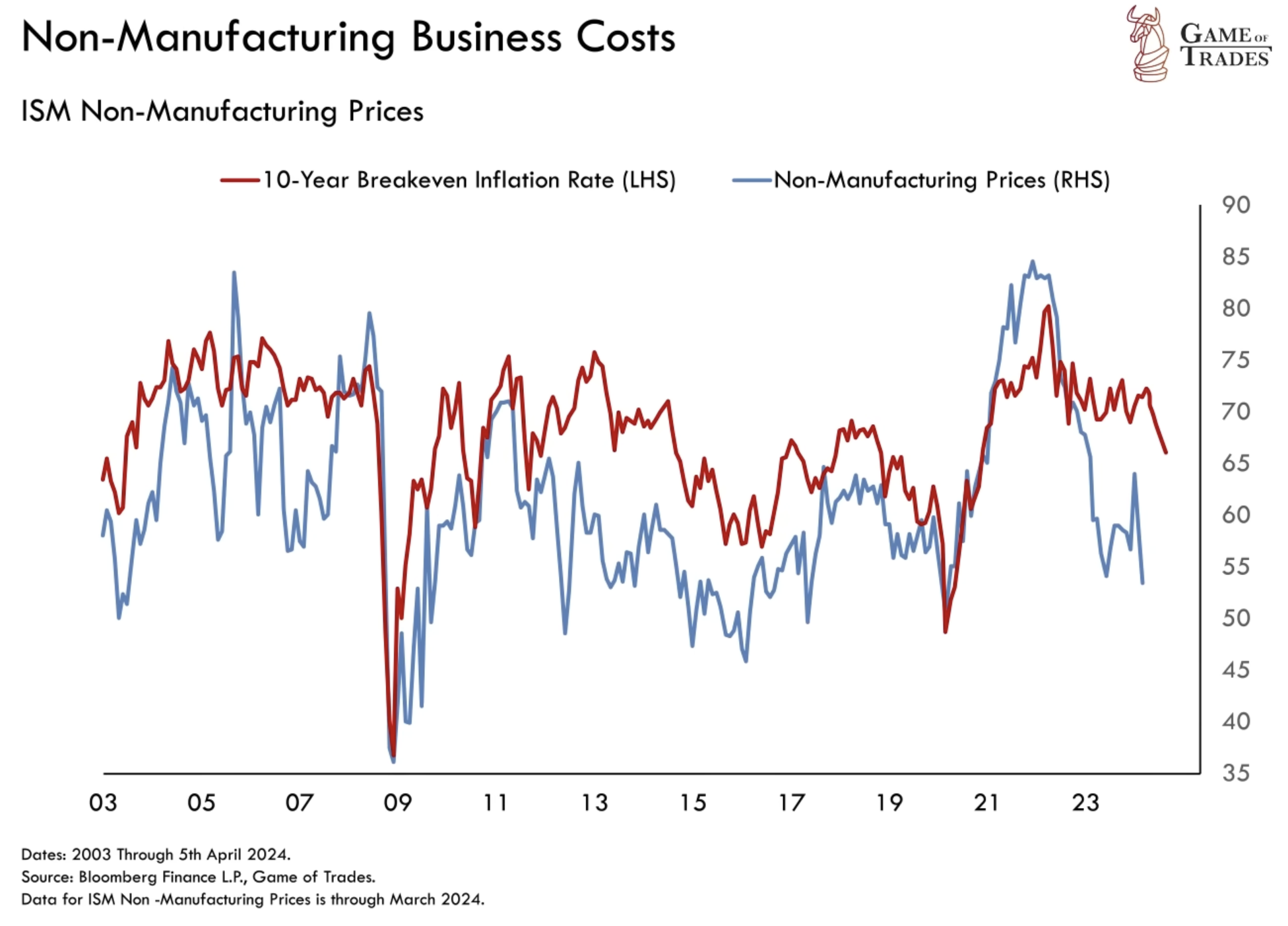

Recent data, however, paints a slightly different picture. It suggests that inflation expectations have reached a point of relative stability, which in turn provides a glimmer of hope for stability in the bond market. The stabilization of inflation expectations may serve to comfort investors, who can now anticipate a steadier and potentially more predictable return on their investments in Treasury bonds in the near-term at least.

The recent stabilization, which is also indicated through the slowing of inflation pressures in the non-manufacturing sector, indicates a possible reduction of immediate inflation risks. This trend can be seen as a positive sign for the economy, as it means that the pressures that drive bond prices up are potentially easing. As such, the 10-year breakeven inflation rate, which is a critical measure of long-term inflation expectations, is likely to decline, given the close positive correlation. This decline could be a reflection of the market’s growing confidence in the central bank’s ability to control inflation and maintain the stability of the economy for now.

Gold’s Role Amidst US Debt Crisis

As of late 2023, gold’s value (GLD price) has increased significantly, with a 30% rise since October alone, outperforming traditional equity benchmarks like the S&P 500. This surge reflects investors’ growing concerns about fiscal stability and their inclination towards assets that can safeguard value in times of economic uncertainty. The robust performance of gold is a testament to its enduring role as a protective asset in investment portfolios, particularly when confidence in governmental fiscal policies wanes.

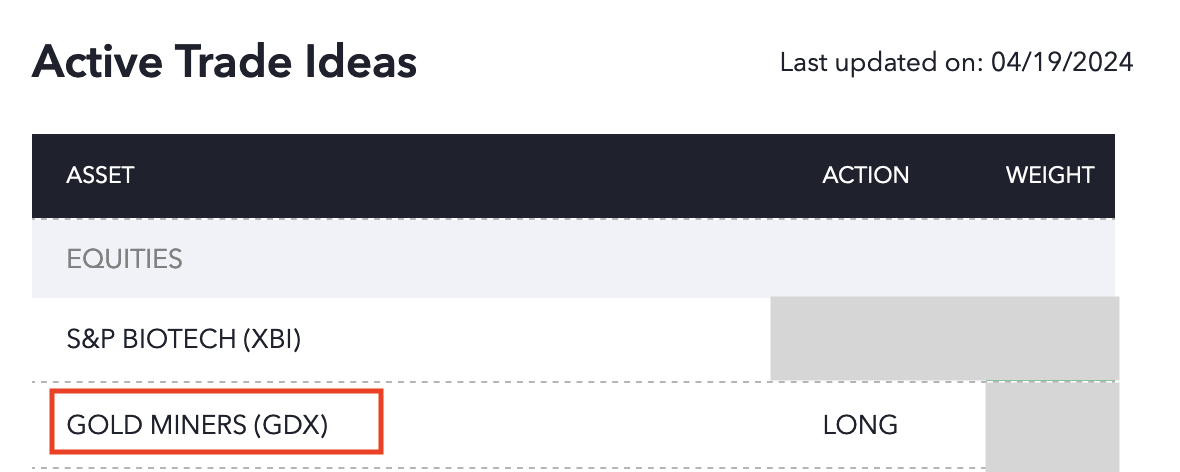

Since October 2023, our big bet on gold miners has paid off handsomely for our members, matching gold’s +30% increase. To view our ongoing trading ideas, consider becoming a member at Game of Trades.

Conclusion

The contrasting fortunes of U.S. Treasury bonds and gold highlight a broader narrative of economic transition and uncertainty. Investors face a landscape marked by potential fiscal instability, demographic challenges, and shifting monetary policies. While a bounce is very likely for bonds (TLT), the longer-term outlook still remains uncertain and bearish, especially given the US government’s high debt backdrop. Click here to get a 7-day free trial! Subscribe to our YouTube channel and Follow us on Twitter for more updates!