Inflation is Causing Concerns

In the dynamic world of finance, staying on top of the latest economic developments and market movements is crucial for investors looking to make informed and profitable decisions. This article offers a deep dive into recent shifts in inflation, the performance of the S&P 500, trends in bond yields, geopolitical tensions, and how these factors correlate with market movements. By dissecting these components, we aim to provide a clearer understanding of current financial trends and what they may indicate for future market behavior.

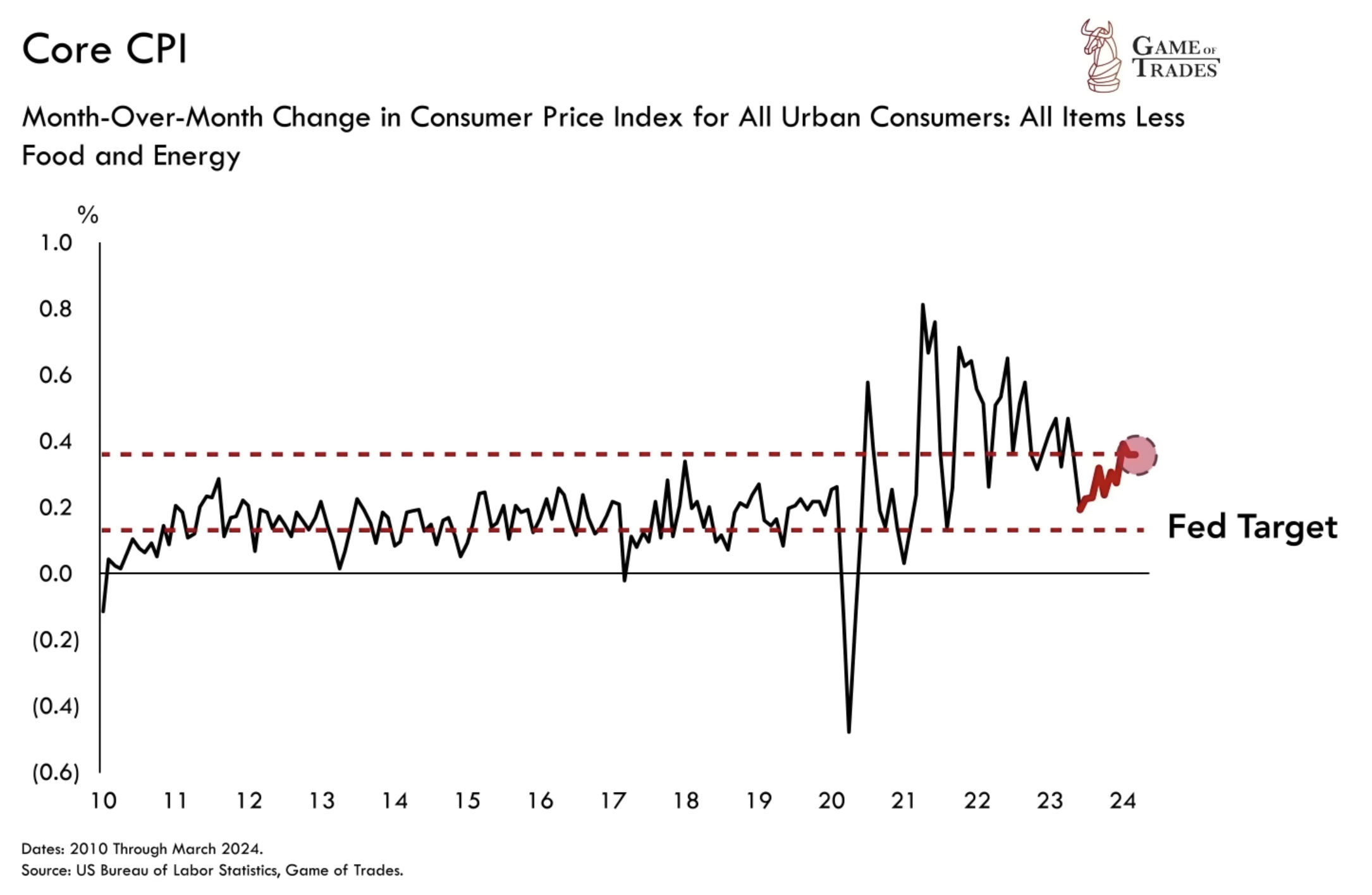

Analysis of Recent Economic Data

The core inflation rate for March was reported at 0.4%, indicating a potential resurgence and stabilization at levels above the targets set by the U.S. Central Bank. This increase may suggest that inflationary pressures are more entrenched than previously believed, prompting a reassessment of investment strategies in anticipation of sustained higher inflation.

Stock Market Volatility: The S&P 500’s Recent Decline

The S&P 500 witnessed a significant downturn of over 3%, marking its first major pullback since October 2023. While this decline might alarm some investors as a potential precursor to a broader market downturn, a detailed analysis suggests that this is likely not a major turning point. Instead, it reflects normal market corrections after periods of significant gains and likely continuation of the ongoing bull market.

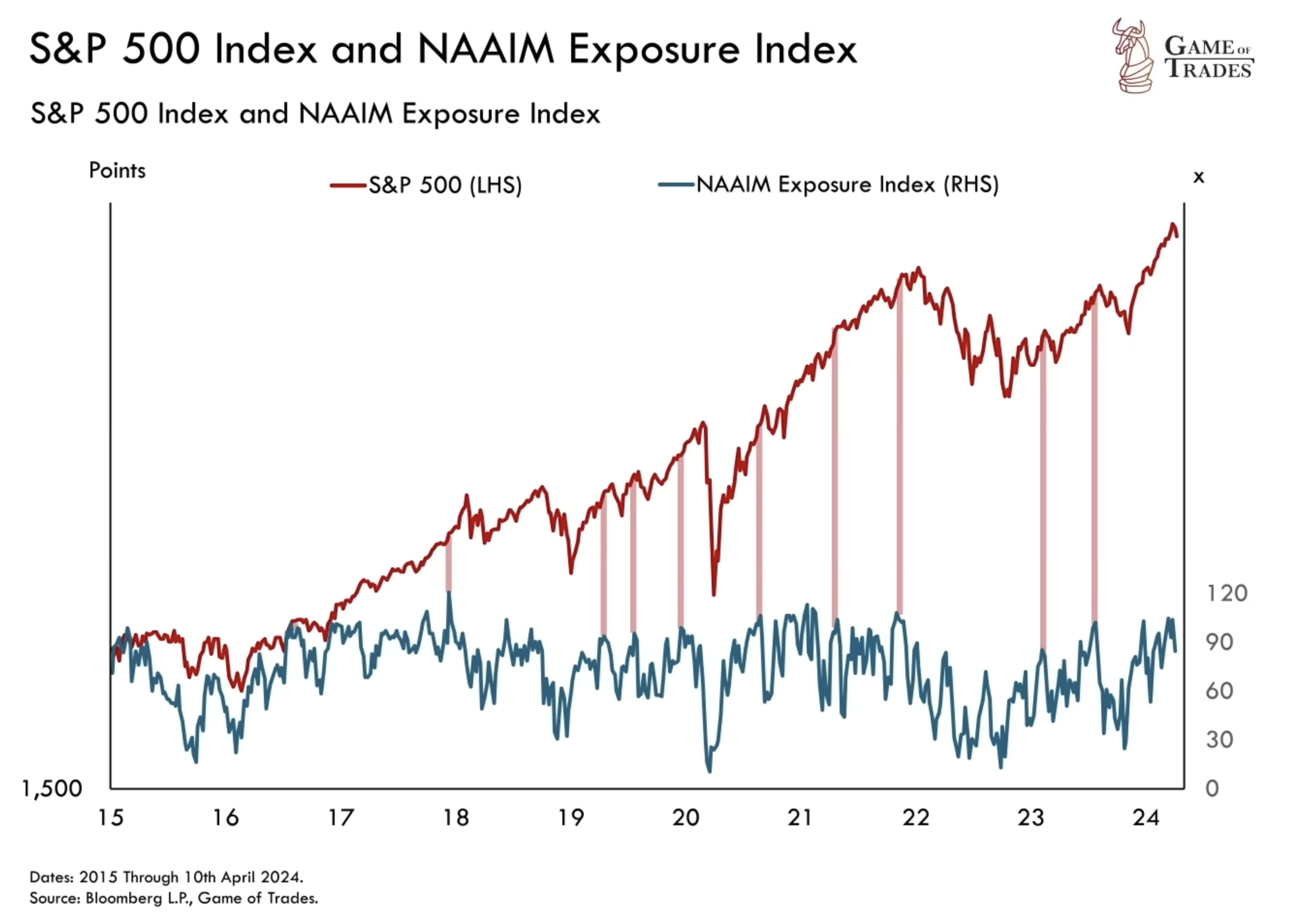

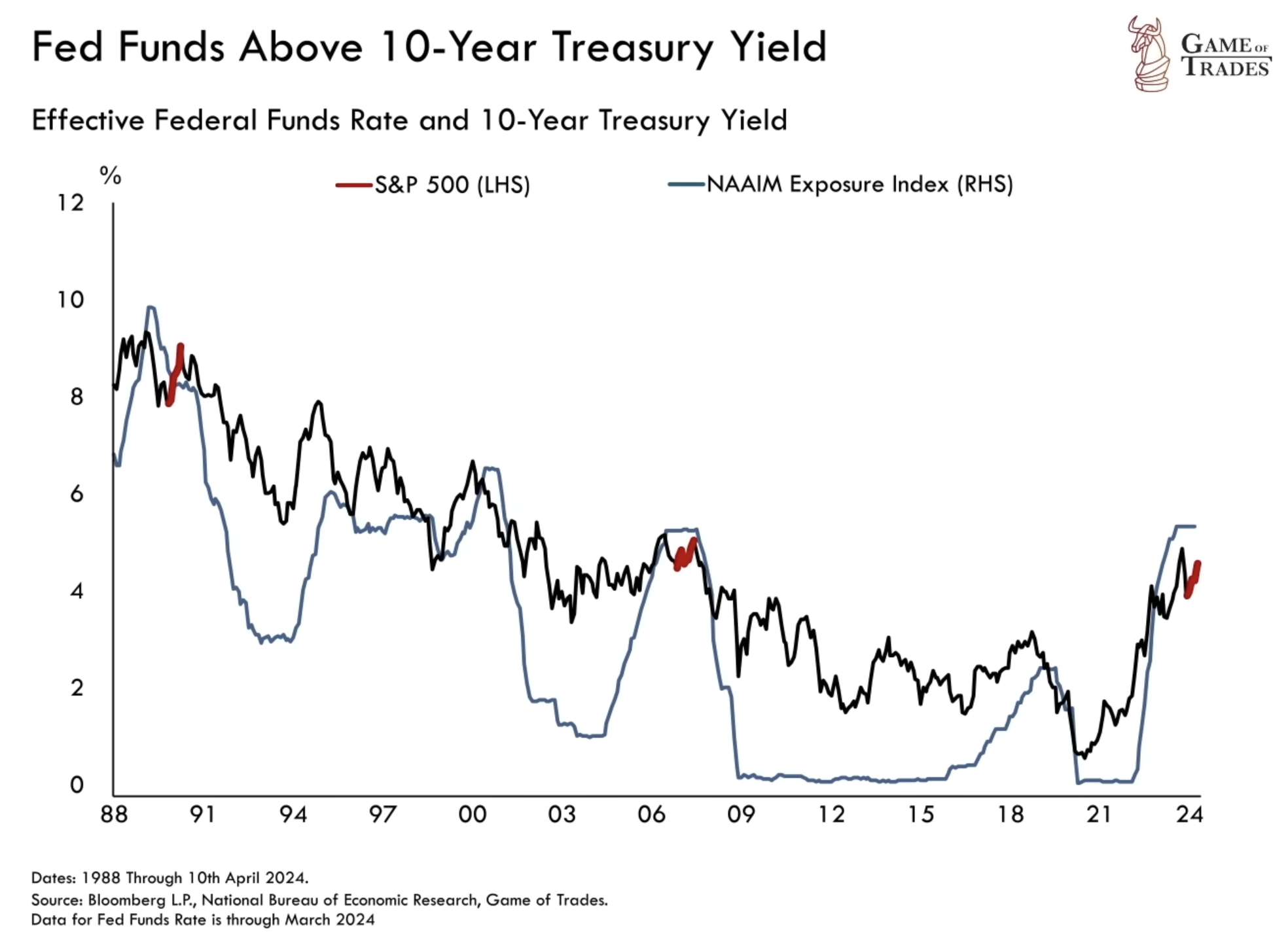

Overexposure in Investment Management

Recent data shows that active investment managers had exposure levels exceeding 100% prior to the pullback, indicating they were leveraged beyond their capital. This level of market exposure, the highest since November 2021 just before a notable market downturn of about 20%, signaled an overextended market. Such high exposure levels are often precursors to short-term volatility, as currently observed in the market.

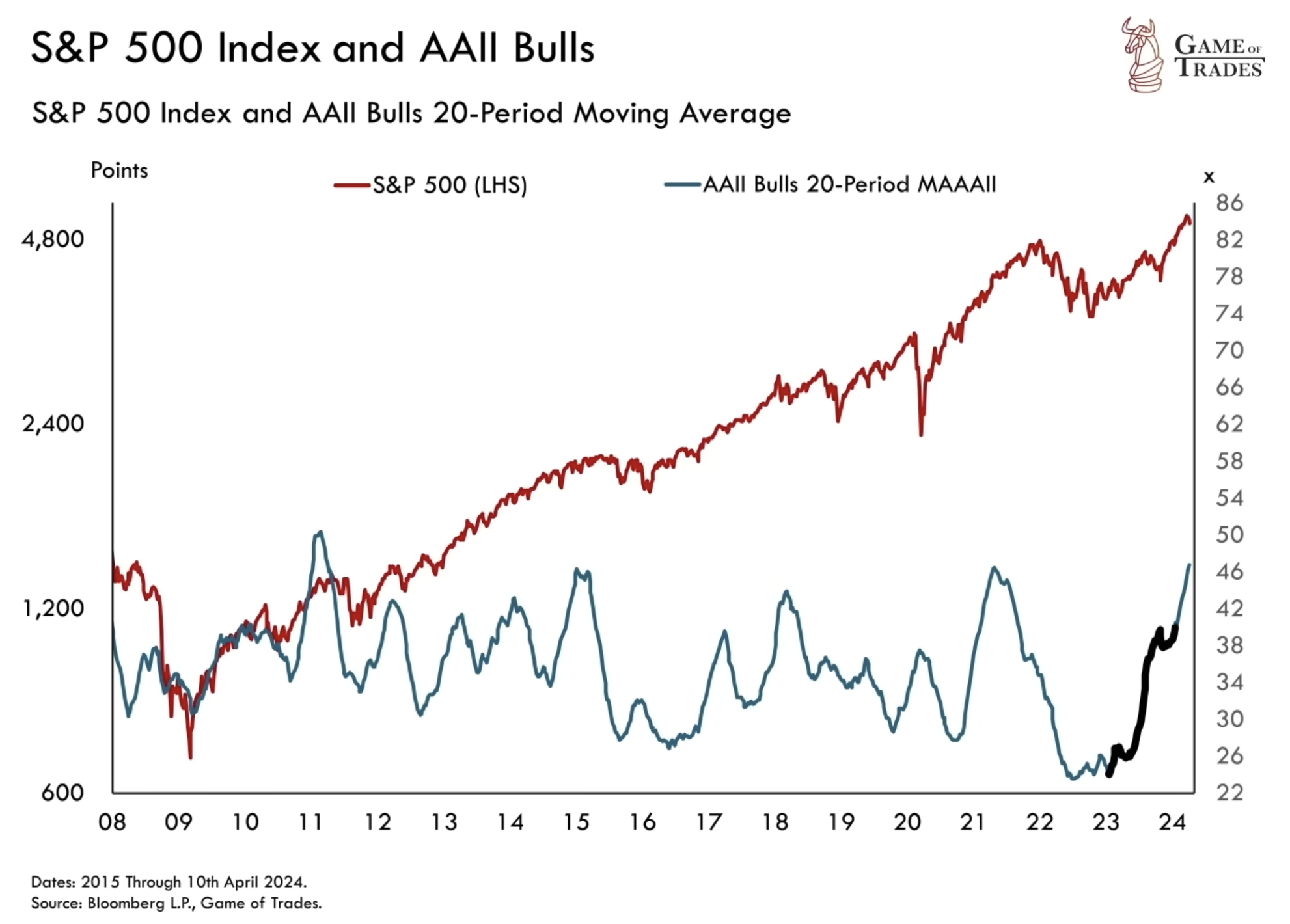

Retail Investors and Market Sentiment

There has been a noticeable shift in investor sentiment among both fund managers and retail investors, who had turned extremely bullish, driven by expectations of multiple Federal Reserve interest rate cuts in 2024. However, the recent uptick in inflation has recalibrated these expectations, highlighting the volatility and unpredictability of investor sentiment and market expectations.

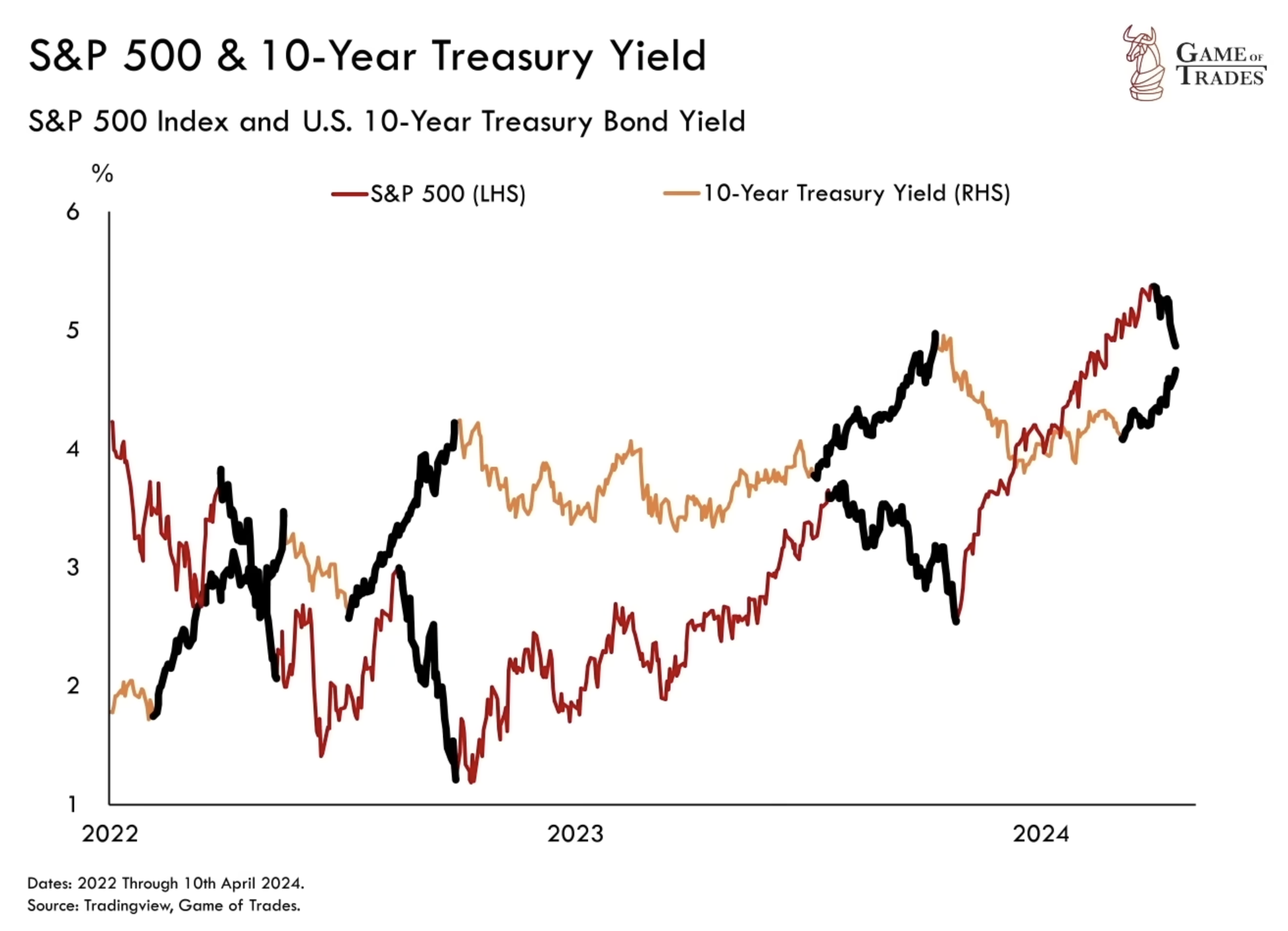

The Bond Market and Interest Rates

The recent significant increase in long-term bond yields, especially noticeable in the 10-year U.S. Treasury bonds, is frequently seen as one of the factors contributing to corrections in the stock market. This upward trend in bond yields has been causing ripples of concern among investors, as it can potentially impact the valuation of equities. However, it’s important to note that this increase is primarily a normalization of expectations rather than a signal indicating the imminent end of the ongoing bull market.

Federal Reserve’s Stance on Interest Rates

The current Federal Reserve interest rate stands at 5.3%. The Fed has expressed its intent to maintain elevated rates until it is confident that inflation is under control. The gap between long-term yields and the federal funds rate suggests that yields could catch up to the Fed Funds rate if inflation remains stubborn, which would be an ominous sign for TLT.

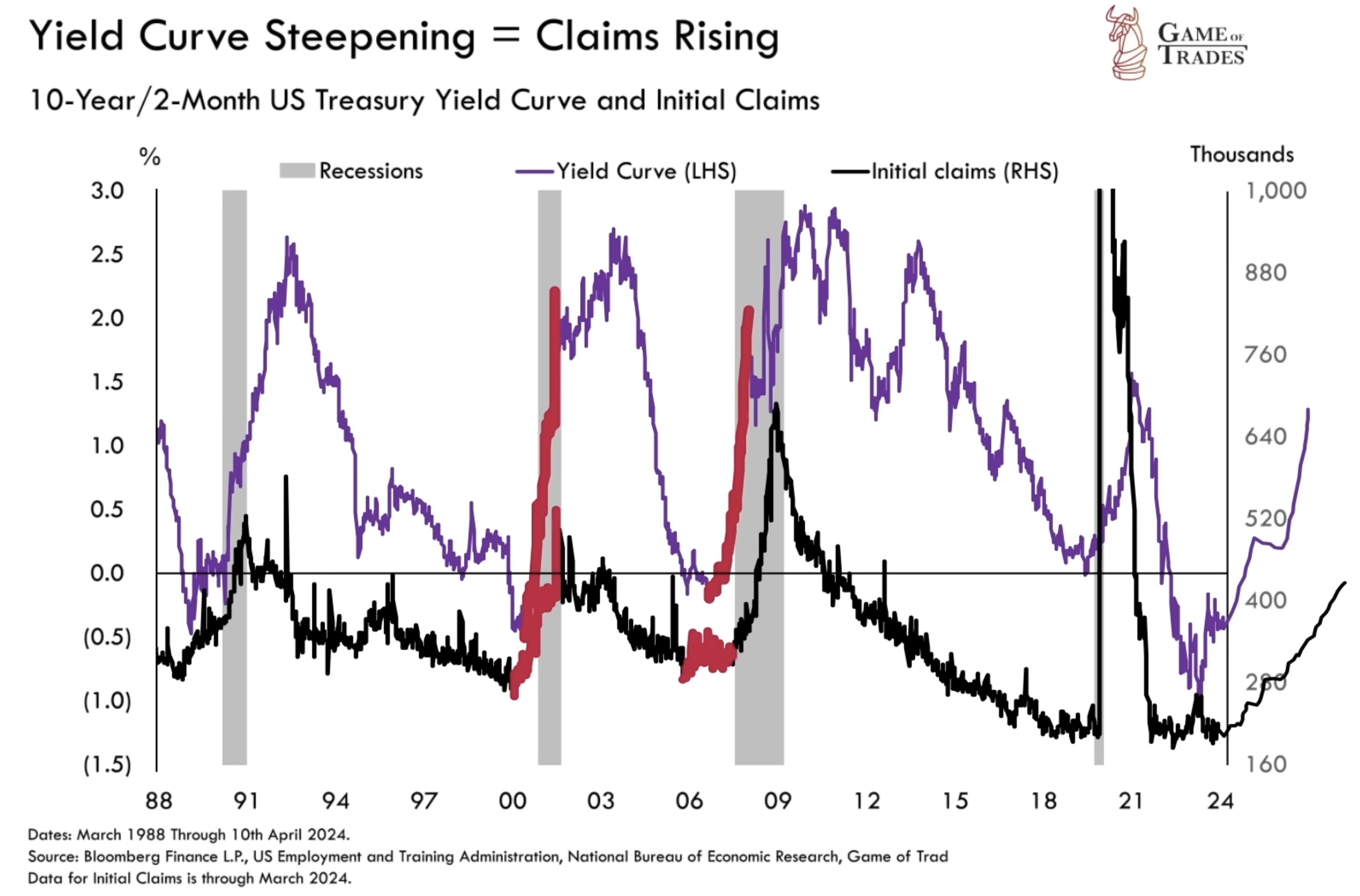

Recession Indicators and Market Turning Point

Given the blend of investor optimism and potential spikes in bond yields, a market pullback was anticipated. Nevertheless, we expect such a pullback to be shallow, as there are no strong indications that inflation will reignite to more severe levels.

A significant downturn in the stock market is often caused by a recession, signaled by a rising unemployment rate and an un-inversion in the yield curve. Currently, these developments have not manifested in a manner that suggests an immediate recession, indicating that while the market is on the cusp of change, significant shifts may still take some time.

Bullish Market Structure

Even though we’ve recently experienced some pullbacks, it’s important to note that the overall structure of the market continues to be bullish. This is exemplified by the performance of the S&P 500, a key market index. The S&P 500 has recently broken out from an upward price channel – a significant development in the world of technicals. This breakout suggests the potential of further upward movement in the market. While we are currently in the midst of a retracement, this is often a normal part of market cycles. Once this retracement phase stabilizes, we can expect the market to resume its upward trajectory. This is based on the strength of the current market structure.

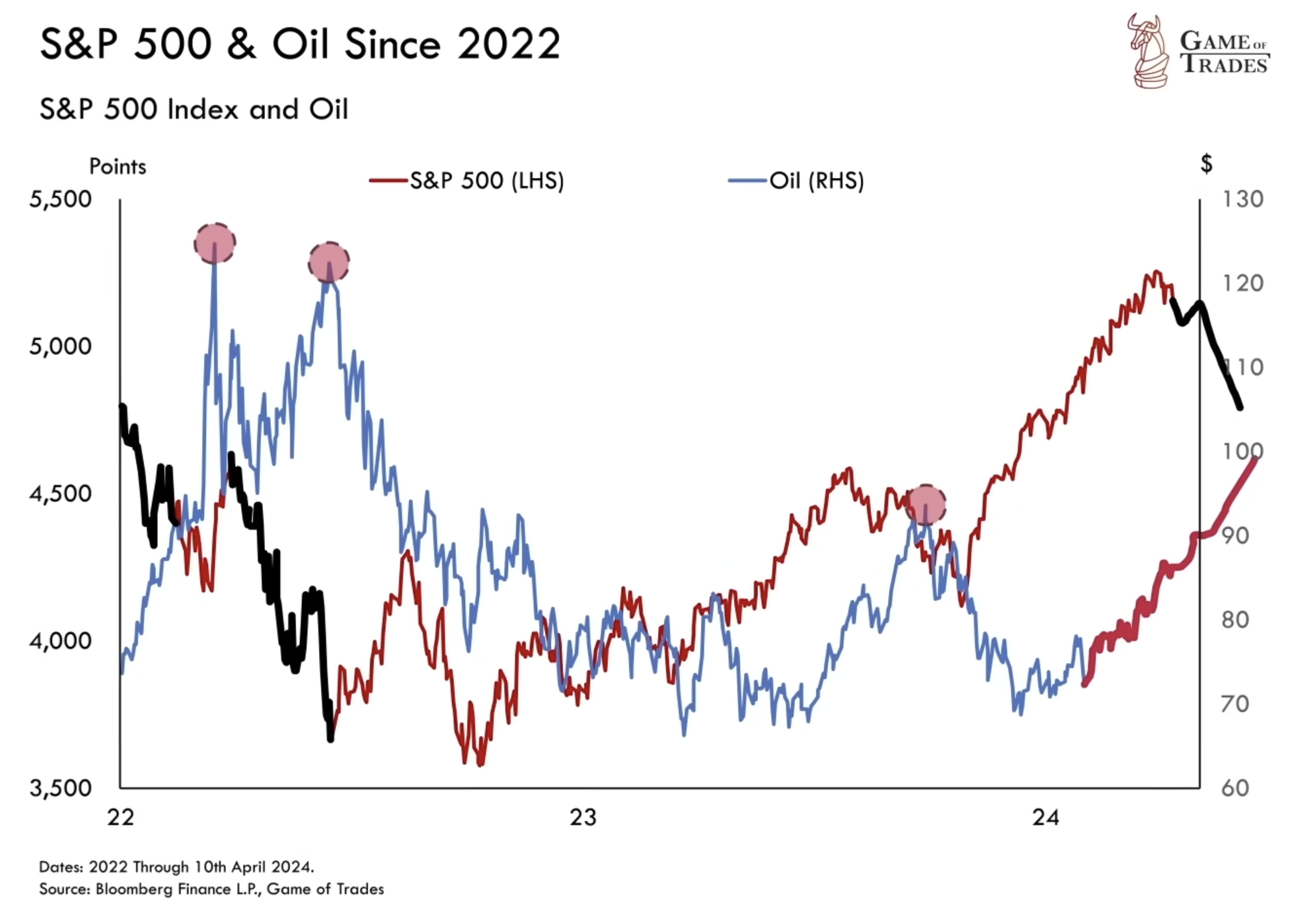

Geopolitical Tensions and Oil Prices

Rising oil prices (USOIL), fueled by geopolitical tensions in the Middle East, could lead to a larger market correction. This relationship between oil price spikes and market corrections has been consistently observed and remains a vital factor for market analysts. If Middle East tensions escalate, we might see the S&P 500 revisit the 200-day MA. This is a common event in bull markets, but is currently not our base case.

Conclusion

The interplay of rising core inflation, S&P 500 fluctuations, heightened bond yields, and shifting investor sentiment paints a complex picture of the current financial landscape. While these developments suggest potential market adjustments, the underlying bullish sentiment, supported by structural market trends, indicates that a severe downturn or recession is not immediately on the horizon, but is still very much on the table. Click here to get a 7-day free trial! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: U.S. Government Spending, Debt, and its Implications for the Economy