Government spending and debt levels have reached unprecedented levels in recent years, raising concerns about their implications for the economy and financial markets. In this article, we delve into the current state of government finances, the challenges they pose, and the potential impact on investors. By understanding these dynamics, individual investors can make informed decisions and navigate the complexities of the market.

Government Spending and Debt: Reaching Unprecedented Levels

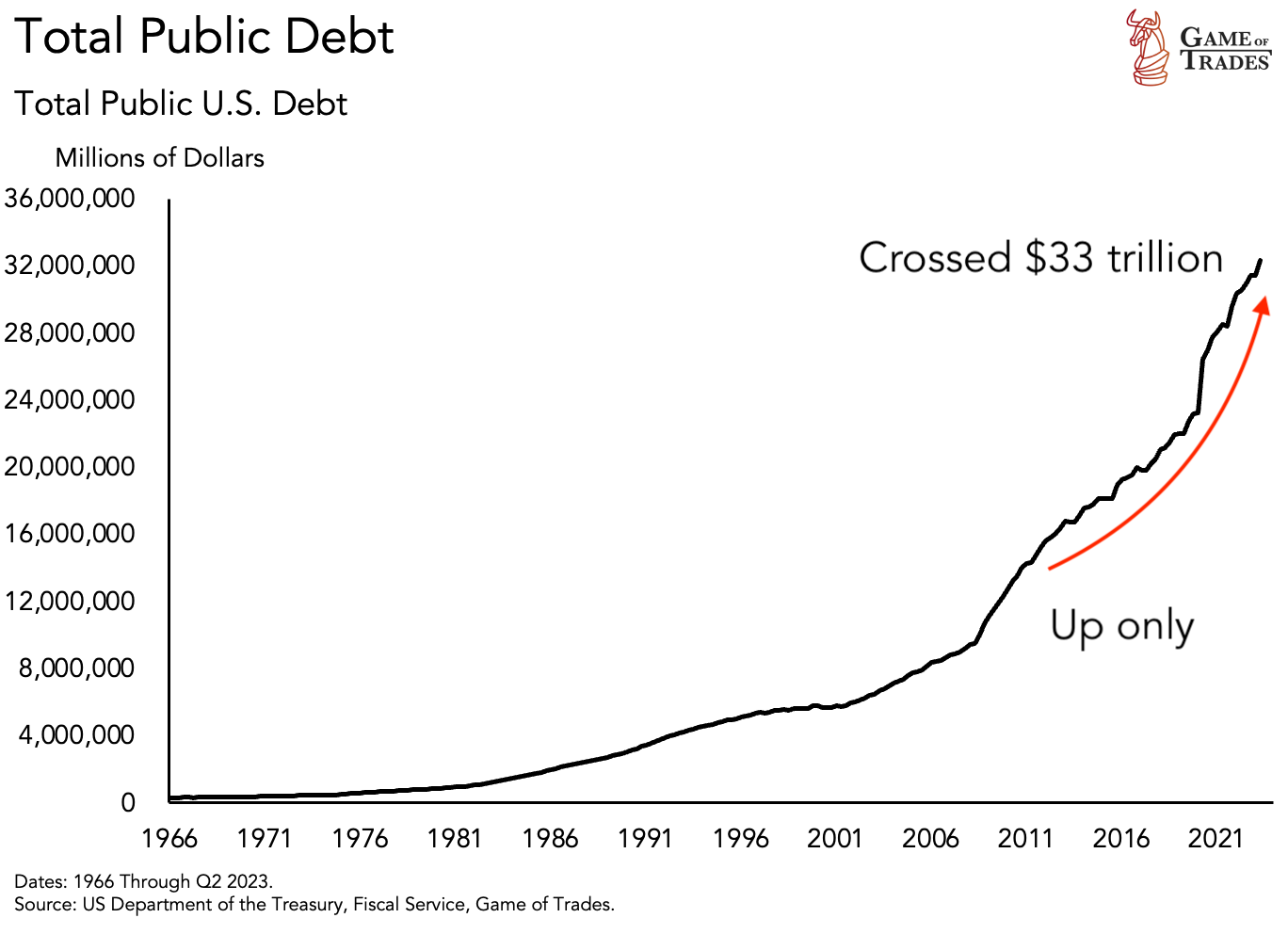

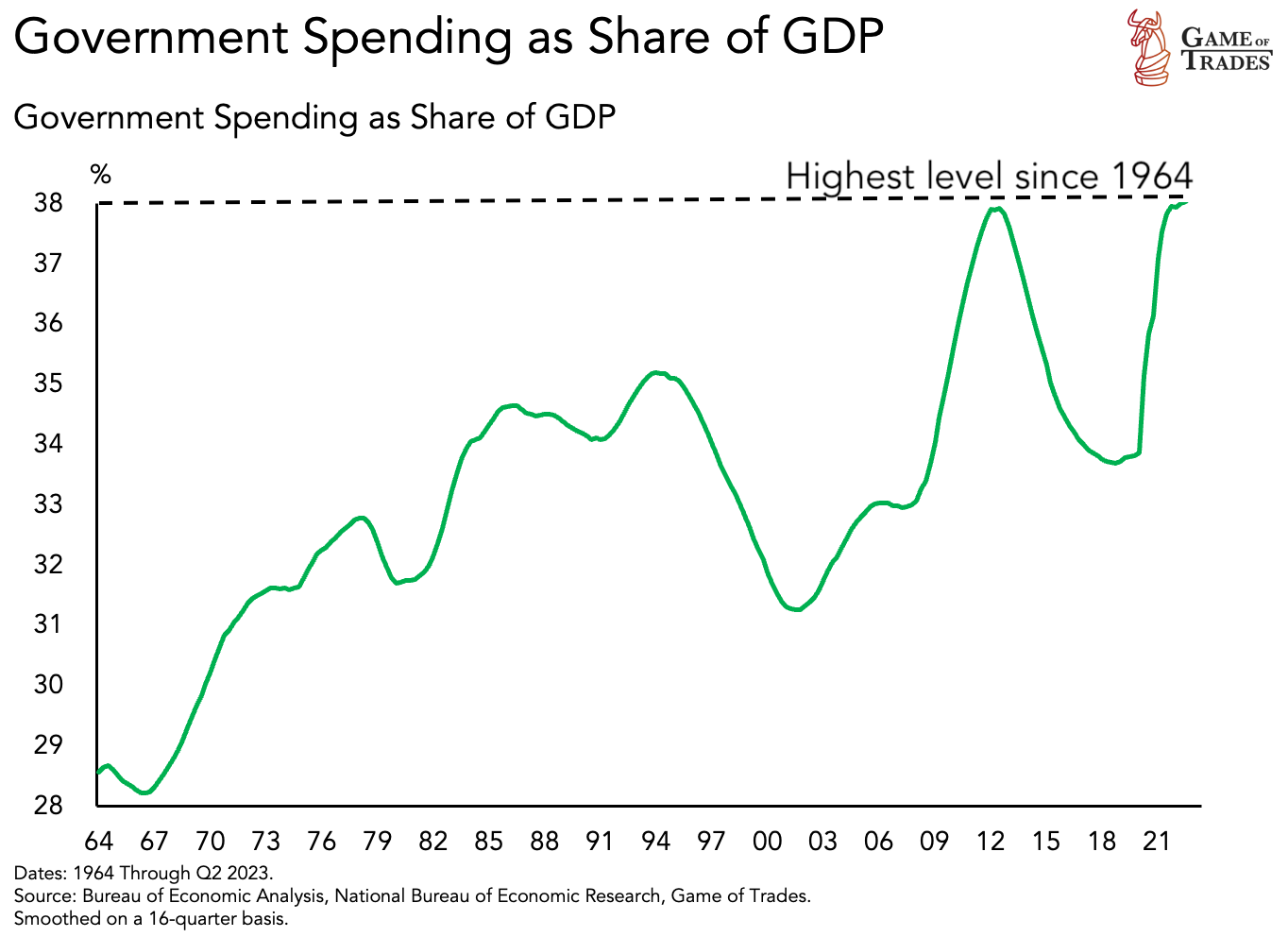

Over the last two decades, government spending as a percentage of GDP has soared to record highs, surpassing levels not seen since 1964. In parallel, government debt has exceeded 100% of the US GDP, a level only observed after World War II in 1945. This metric highlights the magnitude of the debt relative to the economy’s capacity to repay it.

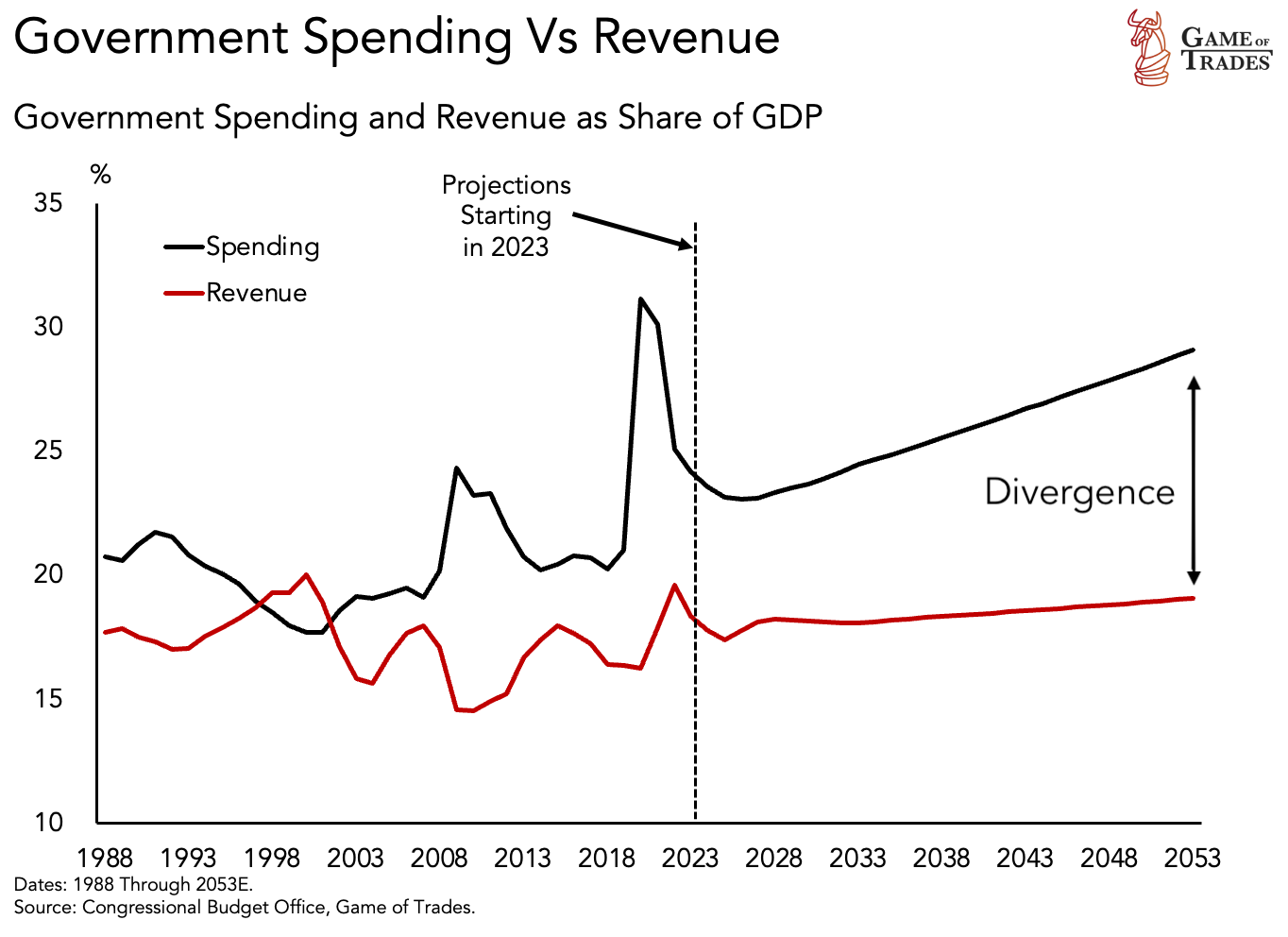

The average debt-to-GDP ratio for a developed economy typically ranges from 50% to 60%. However, projections indicate that government spending will continue to increase significantly, while revenue is expected to remain relatively flat. This trajectory could lead to substantial deficits in the next three decades, posing challenges for the economy and financial stability.

Balancing the Budget: Challenges and Social Unrest

Following the Global Financial Crisis, governments attempted to cut spending to rebalance their budgets. However, this approach often resulted in major social unrest movements, such as the Occupy Wall Street movement in New York, anti-austerity protests in Europe, and the Yellow Vests protest in France. Governments face the challenge of addressing wealth inequality while ensuring fiscal sustainability.

Assessing the Debt Crisis Threshold

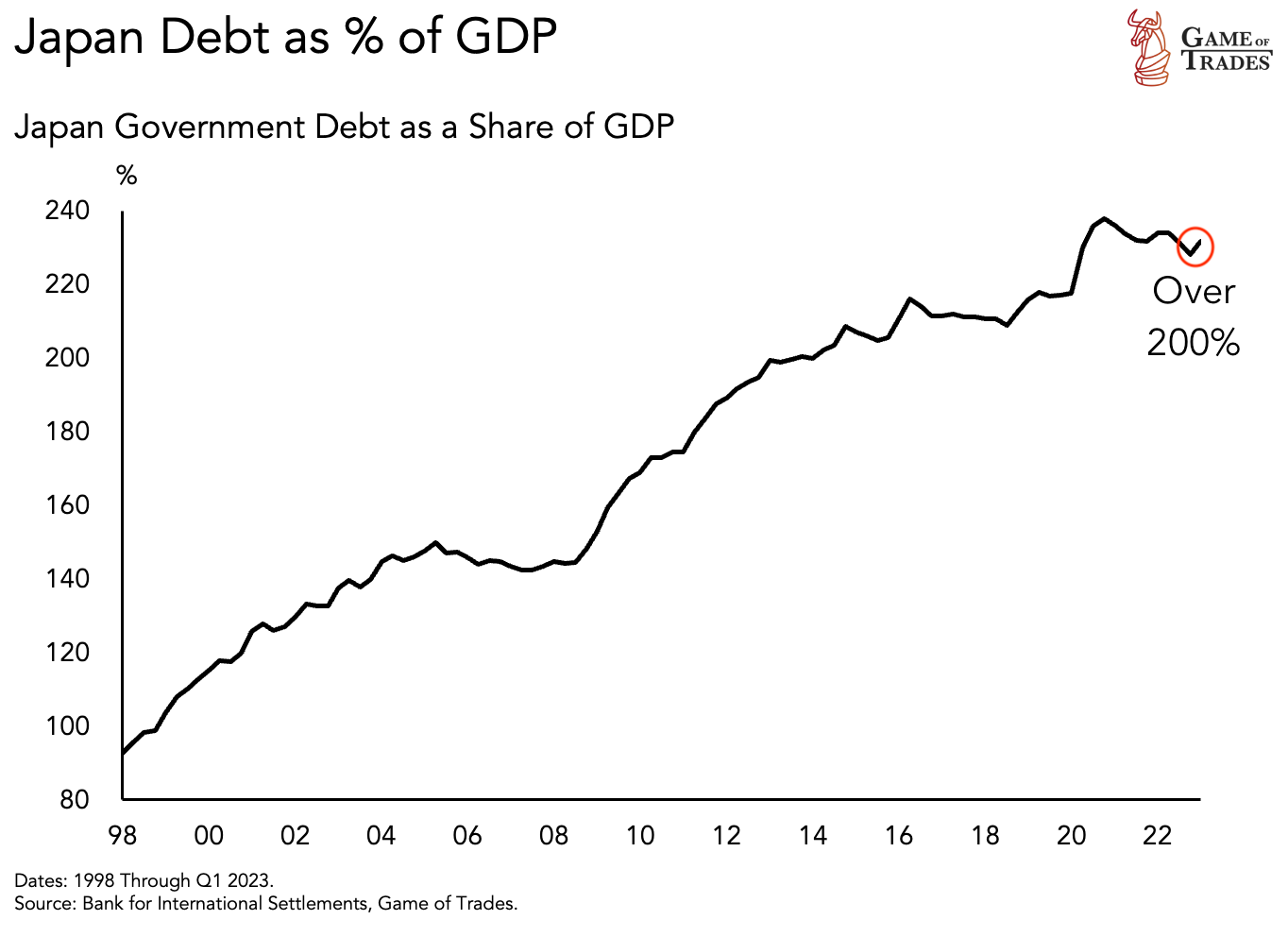

Determining the point at which the US government experiences a debt crisis is a topic of ongoing debate. With US debt at $33 trillion, some question whether it is already too high. Japan, for instance, has a debt-to-GDP ratio of 200%, yet it has not faced a full-blown debt crisis. Factors like economic growth and market dynamics play crucial roles in managing debt.

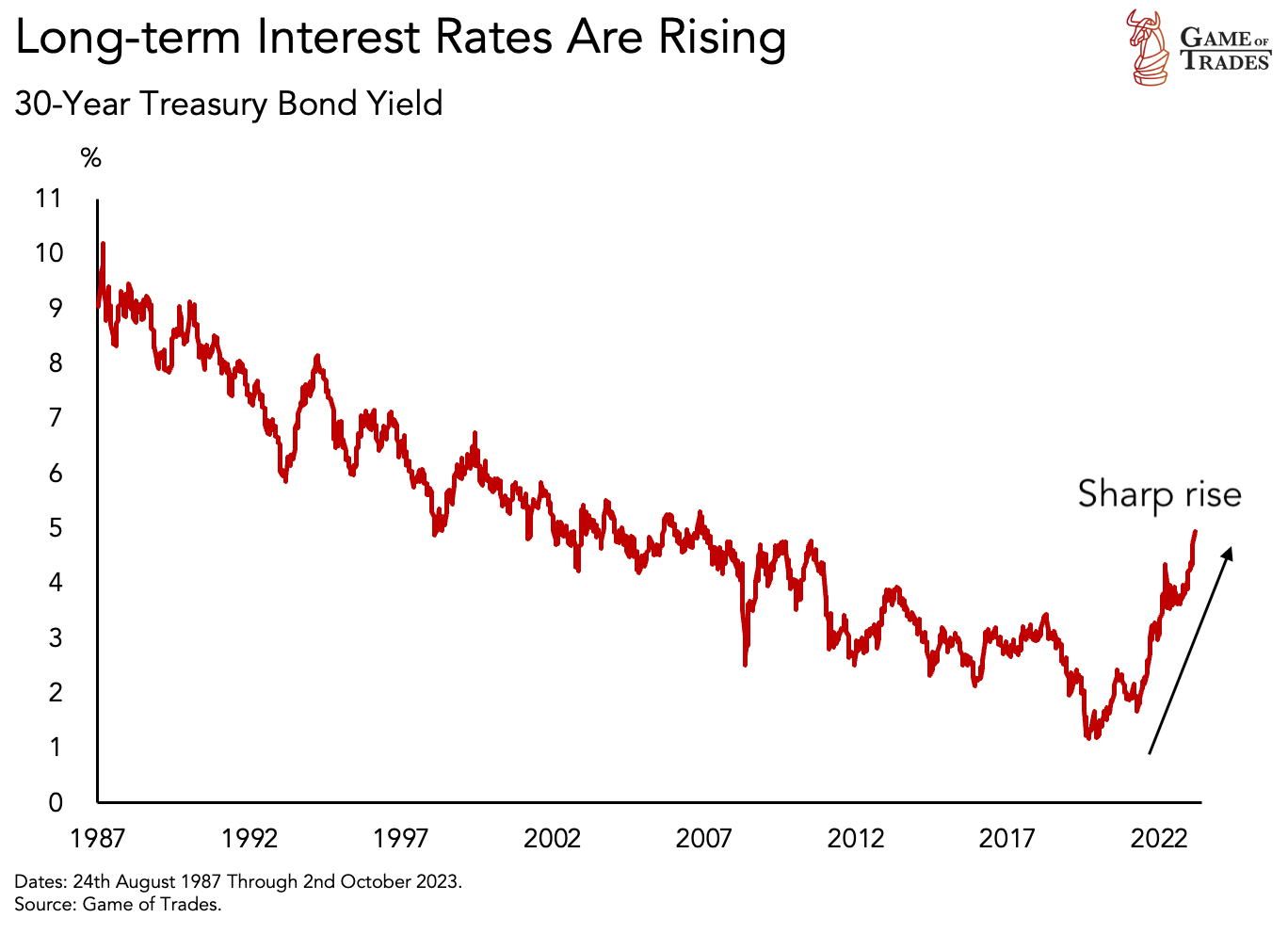

The rate of economic growth is pivotal in managing debt. If growth surpasses the interest rate on government debt, the economy has the potential to grow out of its debt burden. Recent years have seen a significant increase in US interest rates, leading to increased risk perception among investors holding US government debt. This has triggered selling, causing yields to spike.

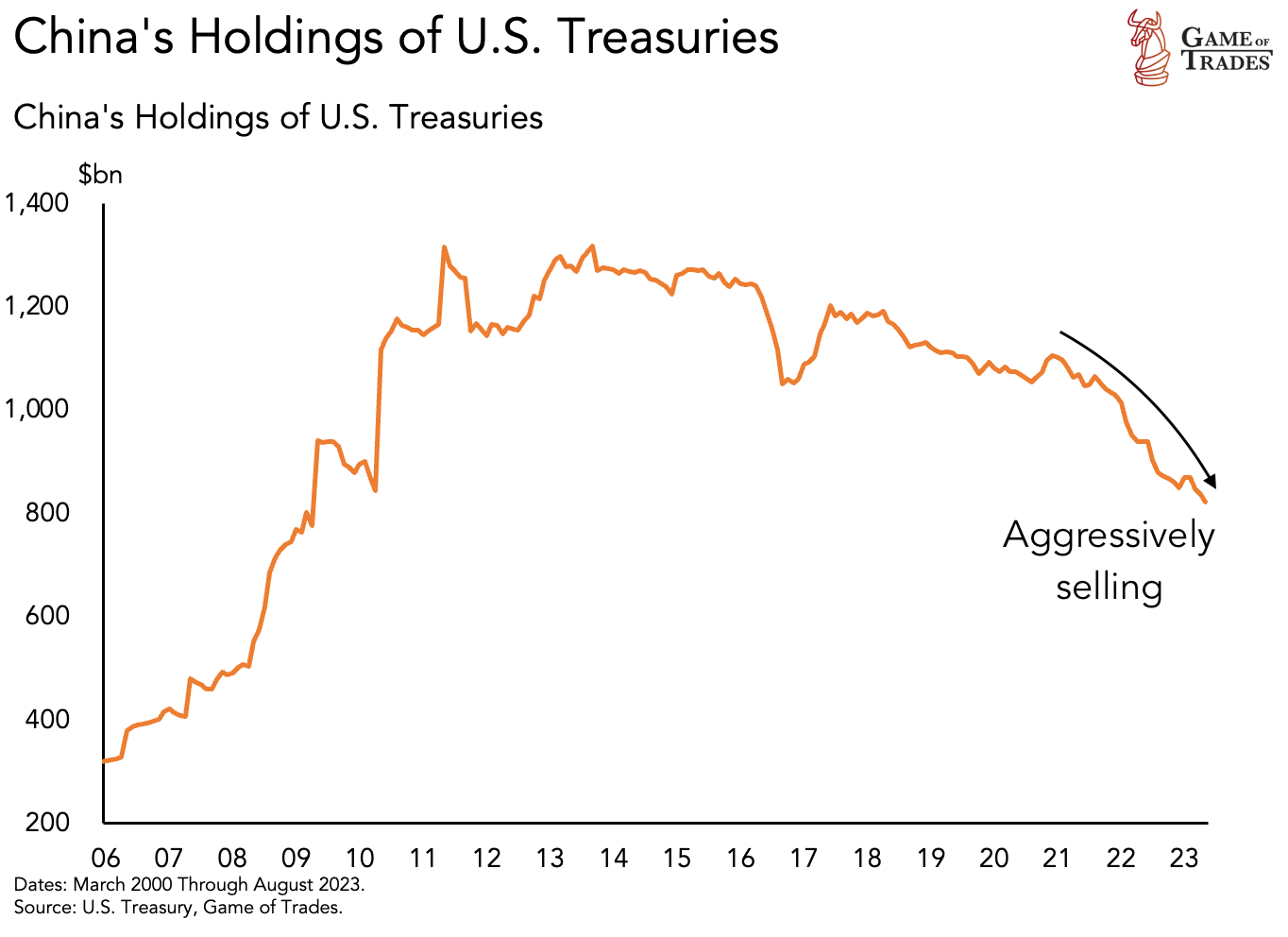

China and Japan are the largest holders of US government debt. China has been aggressively reducing its holdings since 2021, contributing to the recent rise in interest rates. However, China still holds approximately $800 billion worth of bonds that could potentially be sold. Japan has also been selling its holdings, albeit at a slower pace, and still owns around a trillion dollars’ worth of US government bonds.

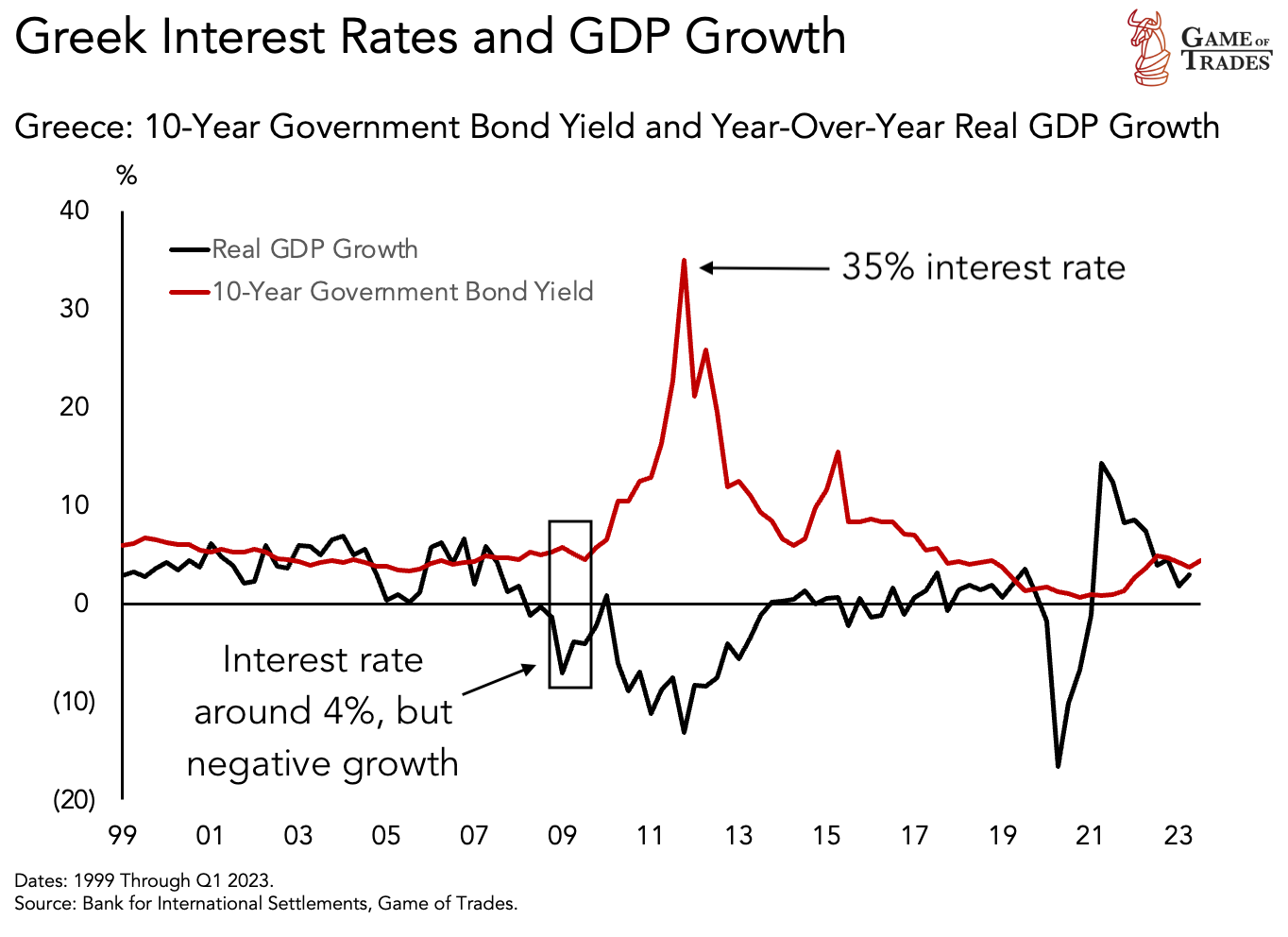

Lessons from Greece’s Sovereign Debt Crisis

The example of Greece serves as a reminder of the risks associated with a sovereign debt crisis. In 2009, Greece experienced negative economic growth while facing interest rates on its debt at around 4%. Investor confidence in Greece’s ability to repay its debt evaporated, resulting in skyrocketing interest rates of up to 35%.

The Burden of Interest Payments

In 2023, the US government is projected to pay a staggering $663 billion in interest payments alone. This amounts to 2% of US GDP, equivalent to the annual expenditure on Medicare. While the US government is unlikely to face bankruptcy like Greece, the significant interest burden highlights the importance of managing debt and implementing sustainable fiscal policies.

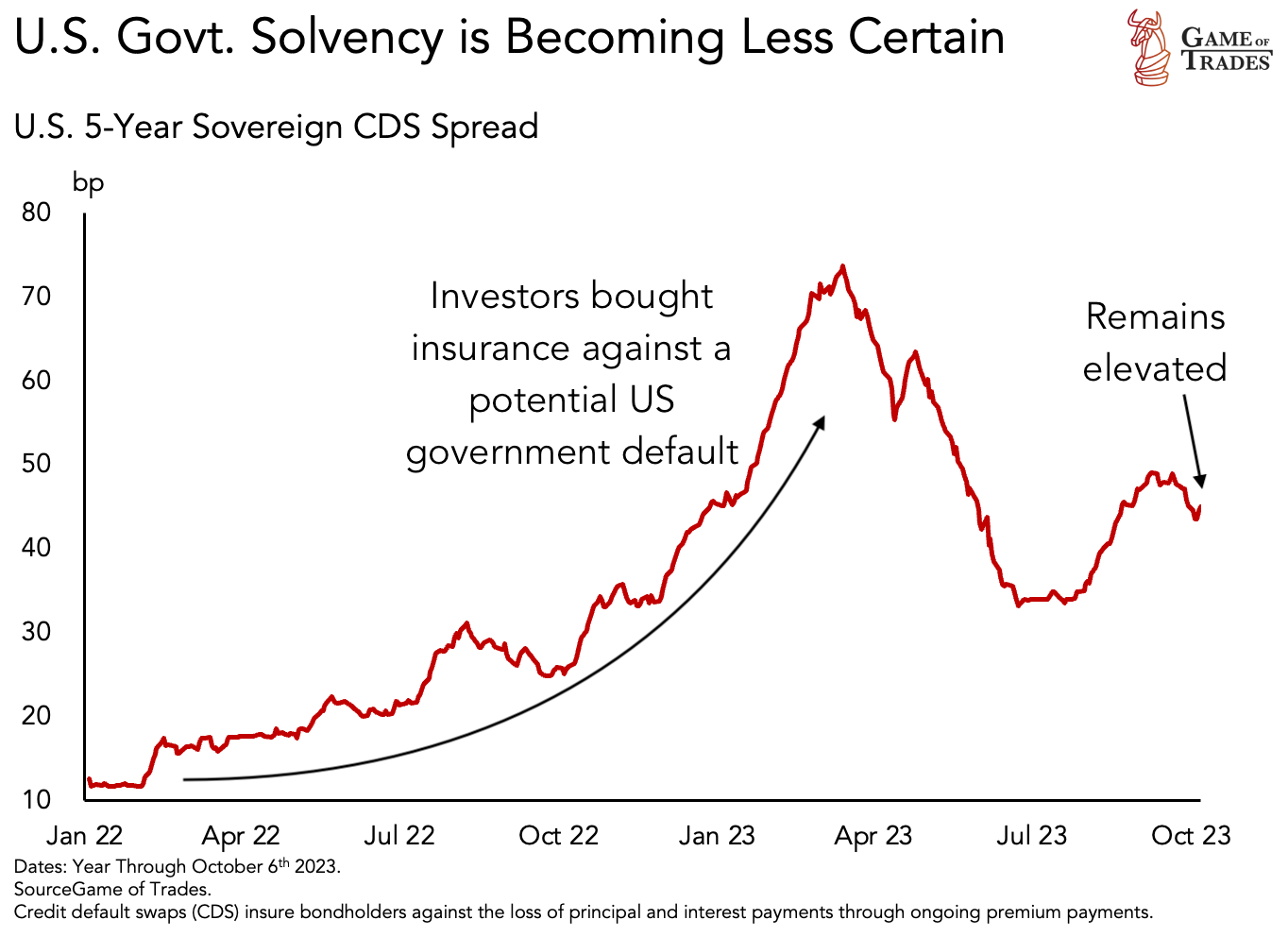

Since 2022, some investors have started to bet on the possibility of a US government default. The purchase of insurance against this scenario has increased significantly, particularly during the debt ceiling crisis in February 2022, and remains elevated.

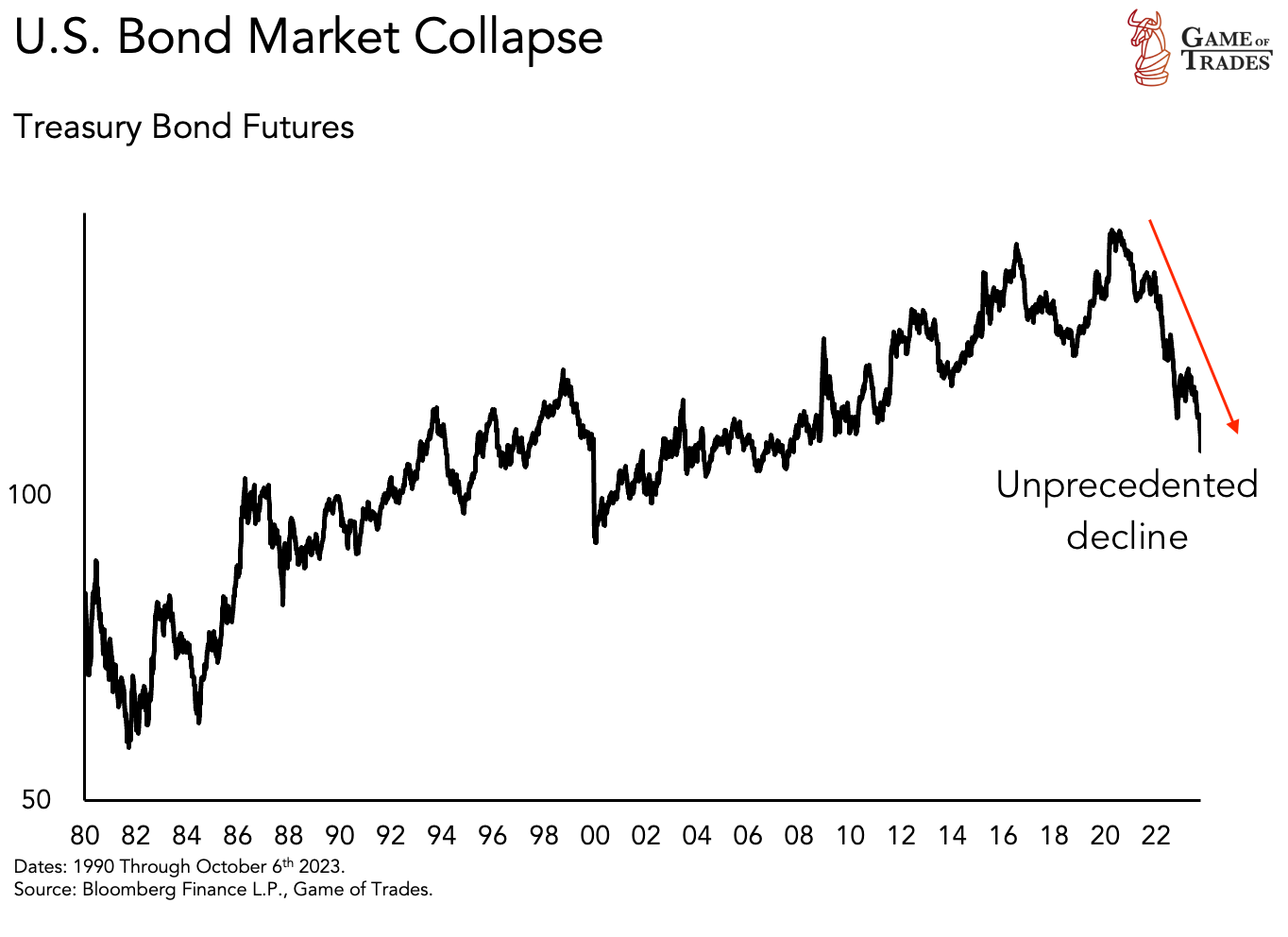

Interestingly, this rise in insurance purchases coincides with an unprecedented selloff in US Treasury bonds. US Treasury yields have broken out of their long-term downtrend, signaling a shift in the economy and financial markets.

Interestingly, this rise in insurance purchases coincides with an unprecedented selloff in US Treasury bonds. US Treasury yields have broken out of their long-term downtrend, signaling a shift in the economy and financial markets.

Conclusion:

Government spending and debt levels have reached historic highs, presenting challenges for the economy and financial markets. Balancing the budget, managing debt, and addressing wealth inequality are crucial tasks for policymakers. Individual investors should stay informed, adapt their strategies, and closely monitor economic growth, interest rates, and market dynamics to navigate these complexities successfully. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Navigating Uncertainty: Inflation, Oil Prices, and the Fragile Economy