The U.S. equity market, with its diverse landscape, is an ever-evolving stage where the weight of stocks shifts over time. This article aims to provide a comprehensive understanding of this phenomenon, comparing today’s market leadership with past market cycles, and assessing the current state of the bull run. A key focus will be on the patterns of market concentration, leadership rotation, and the effects of recessions on these dynamics.

Market Concentration and Leadership Rotation

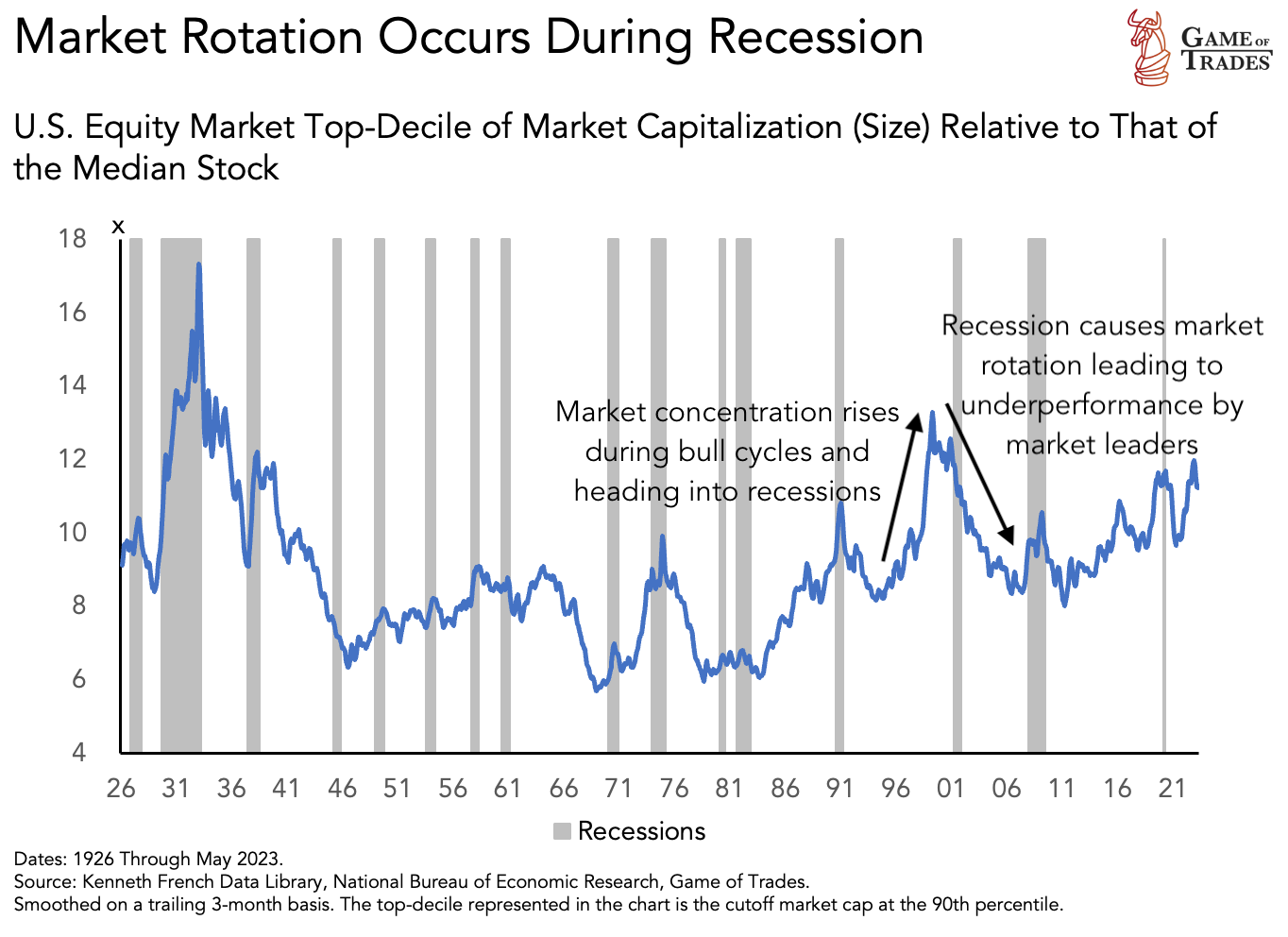

In bull market phases, certain stocks excel in performance and inevitably grow to constitute a larger portion of the market. This leads to increased market concentration as these stocks attract investor confidence and gain higher valuations. However, this concentration tends to increase steadily until a recession strikes, triggering a substantial rotation in leadership. The high valuations deflate, and the former market leaders often underperform in the next cycle, paving the way for new market leadership.

Case Studies: The Nifty 50 and Dot-Com Bubbles

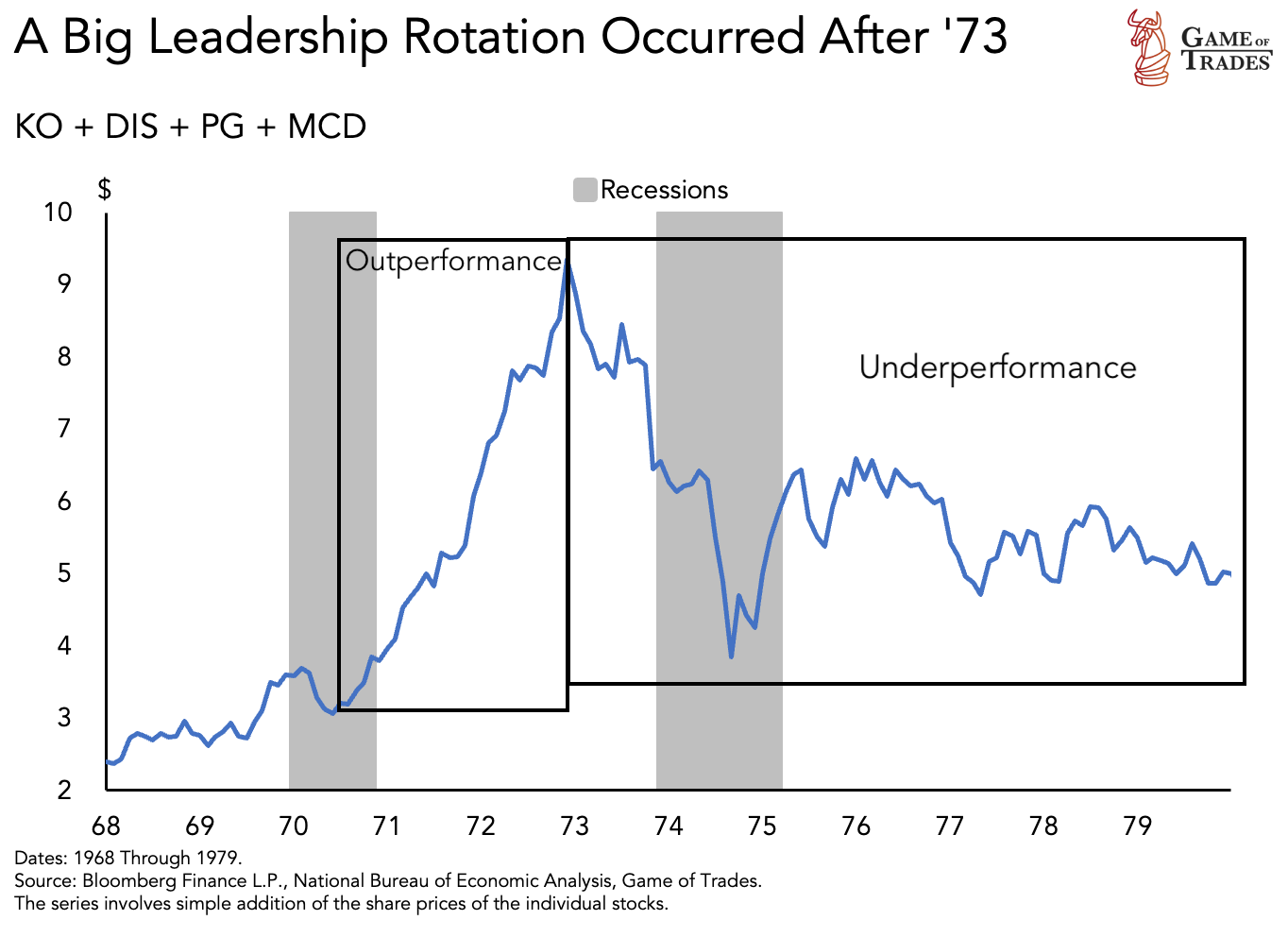

Rewinding to the 1970s, companies like Coca-Cola, Disney, Procter & Gamble, and McDonald’s were impressively outperforming until December 1972. This surge began after the 1970 recession, with these stocks bouncing back swiftly and surpassing their previous highs. However, the bubble burst in December 1972, just before the 1973 oil shock recession. The stocks that made up the Nifty 50 bubble declined by 80%, largely due to the deflation of high valuations.

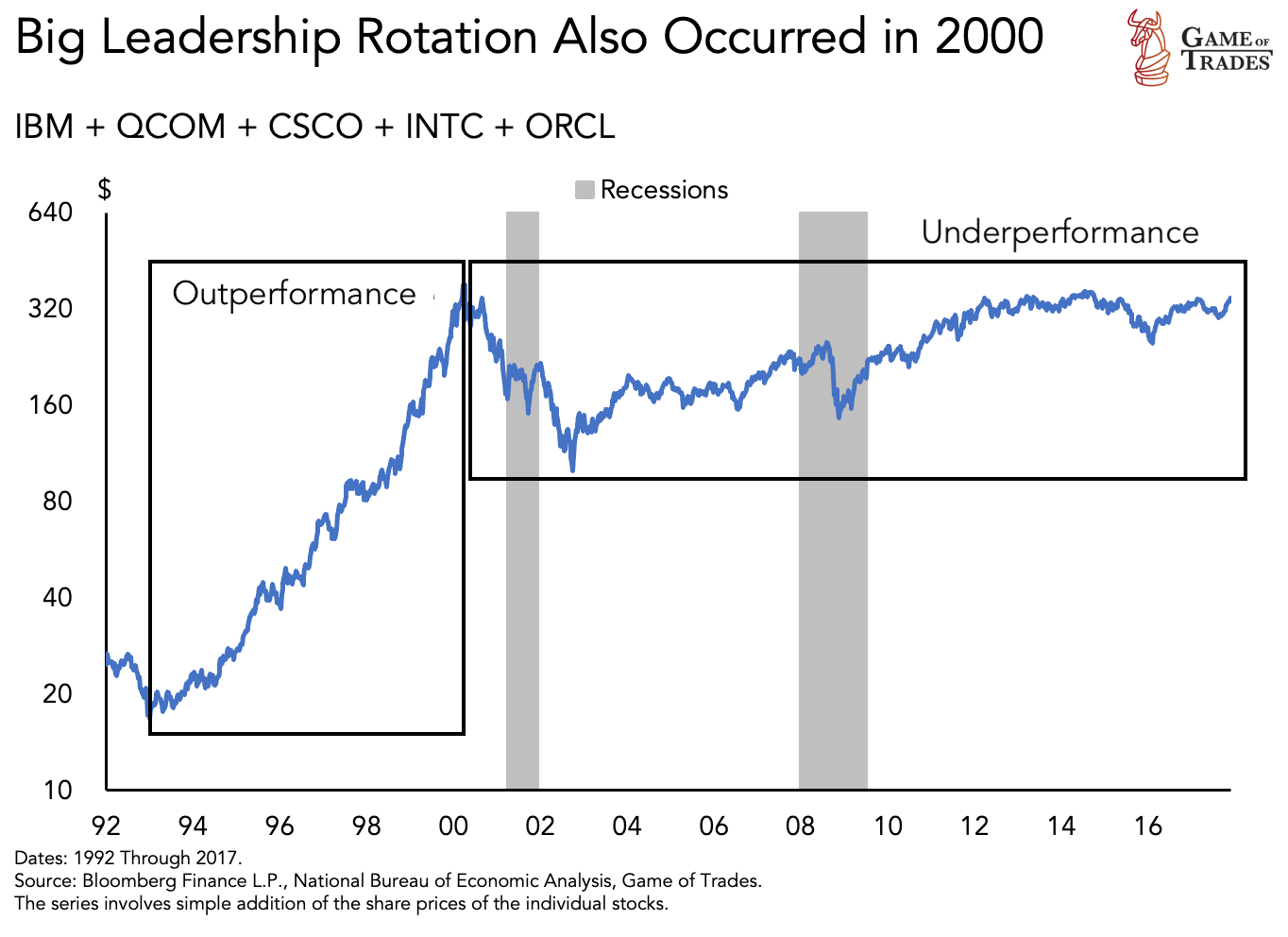

Fast-forward to the 1990s, the internet stocks like IBM, Qualcomm, Cisco, Intel, Oracle formed a new leadership after the 1990 recession. These stocks outperformed until the Dot-Com bubble burst in March 2000, then deflated over 80% as the recession unfolded.

Current Market Leadership: Mega-Cap Stocks

Today, we observe a similar pattern. Mega-cap stocks like Microsoft, Apple, Nvidia, Google, Netflix, Amazon underwent a sharp correction during the Financial Crisis. They recovered to begin a massive bull run and continue to outperform as we’ve had no recession since then. Interestingly, the Mega-cap leadership briefly peaked in December 2021, right before the Fed initiated one of history’s most aggressive tightening cycles. However, these stocks have been moving back up in 2023, leading the entire market higher.

Why Mega-Cap Tech Leadership Didn’t Underperform?

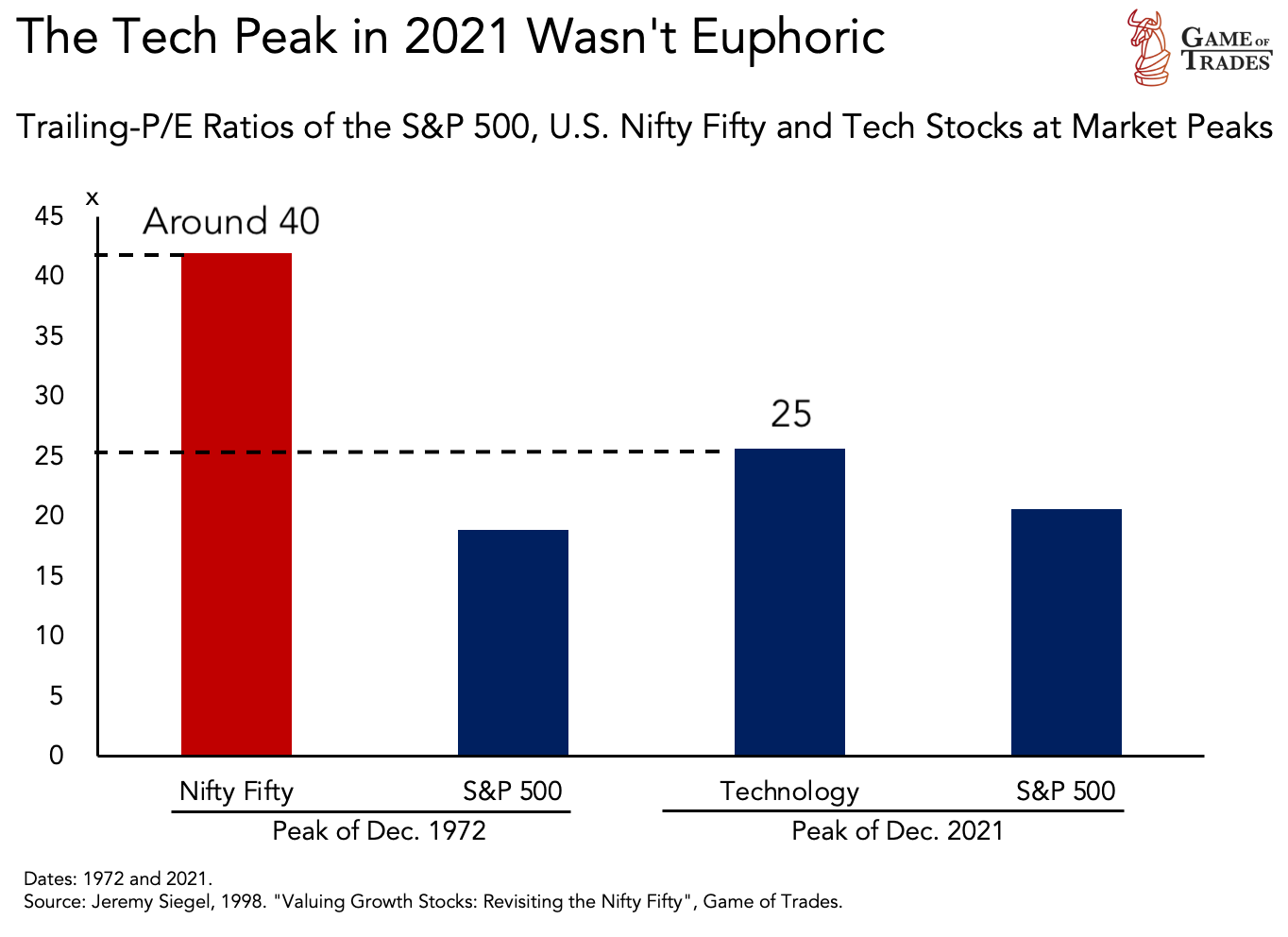

One key question is why did the mega-cap tech leadership not continue to underperform like it did in 1975 and 2002? The reason equities didn’t plummet like in the 1970s or 2000 is because Tech stocks in December 2021 were still relatively cheap. The Nifty 50 had a trailing P/E ratio of around 40, compared to 25 in December 2021. This indicates we didn’t have the same levels of euphoria that we did in 1974, suggesting it wasn’t a full fledged bubble.

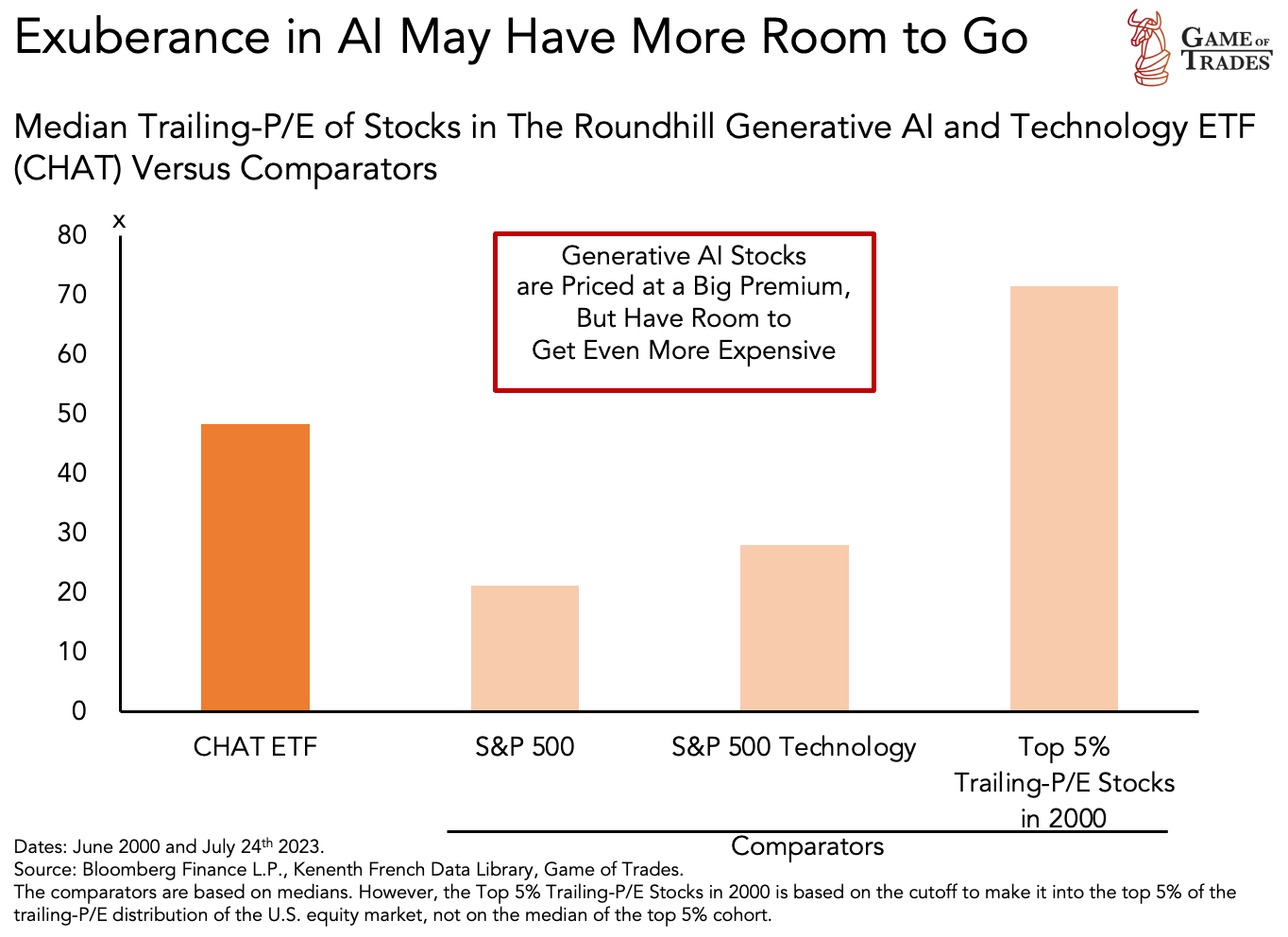

Current Valuations and the Risk of Overvaluation

In 2000, the expensive stocks had a P/E ratio of around 70, compared to around 25 today. However, today’s AI stocks have a P/E ratio of 50, indicating much more bubble-like behavior similar to the Dot-Com bubble. It’s crucial to remember that elevated valuations don’t directly indicate the timing of price changes. They merely suggest that there’s less scope for upside than downside. An expensive stock can stay expensive indefinitely, but a catalyst is needed to deflate the valuations, shifting investor sentiment from optimism to pessimism. Historically, this catalyst is often a recession.

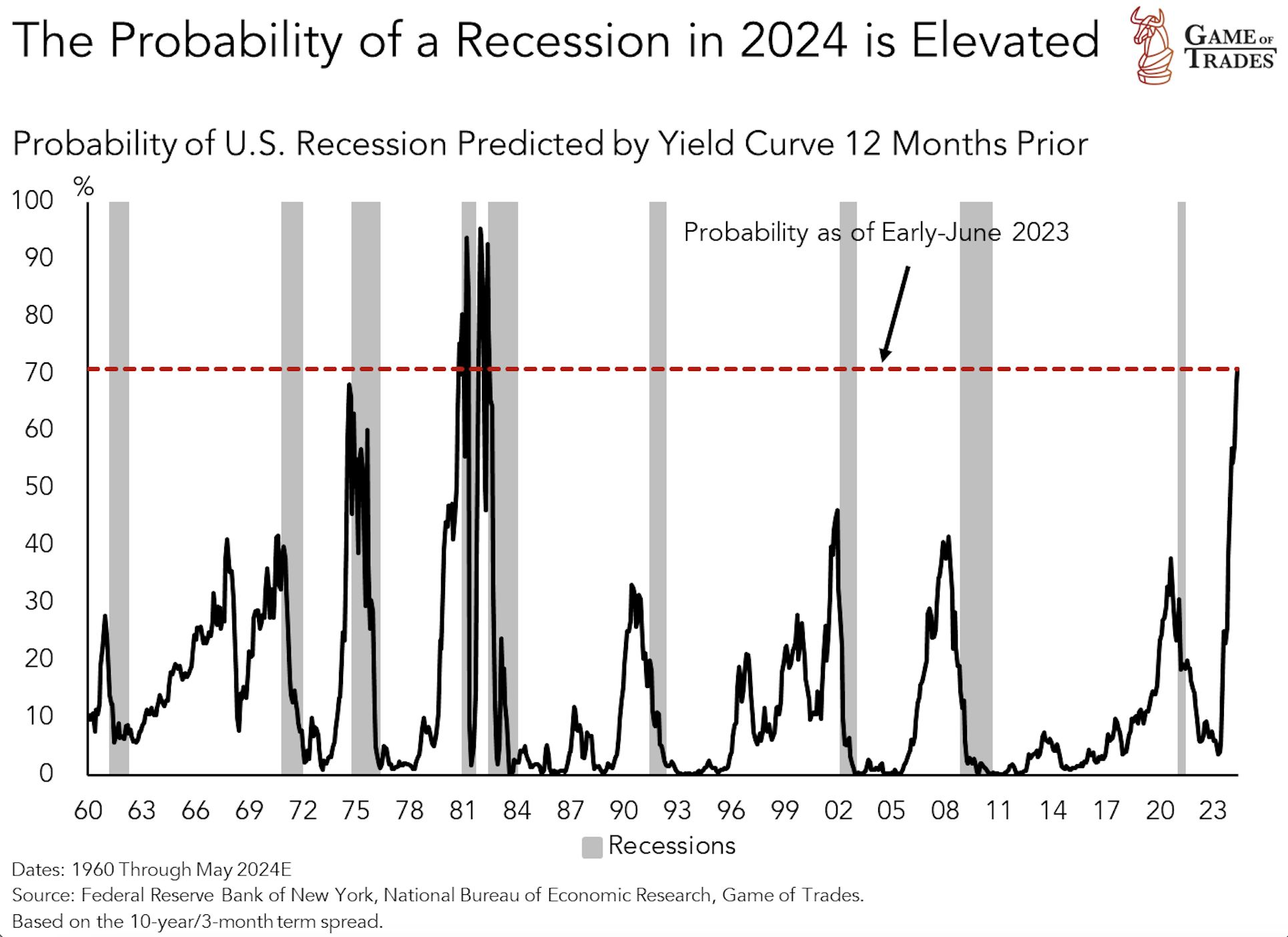

Recession Predictions and the Impact on Mega-Cap Stocks

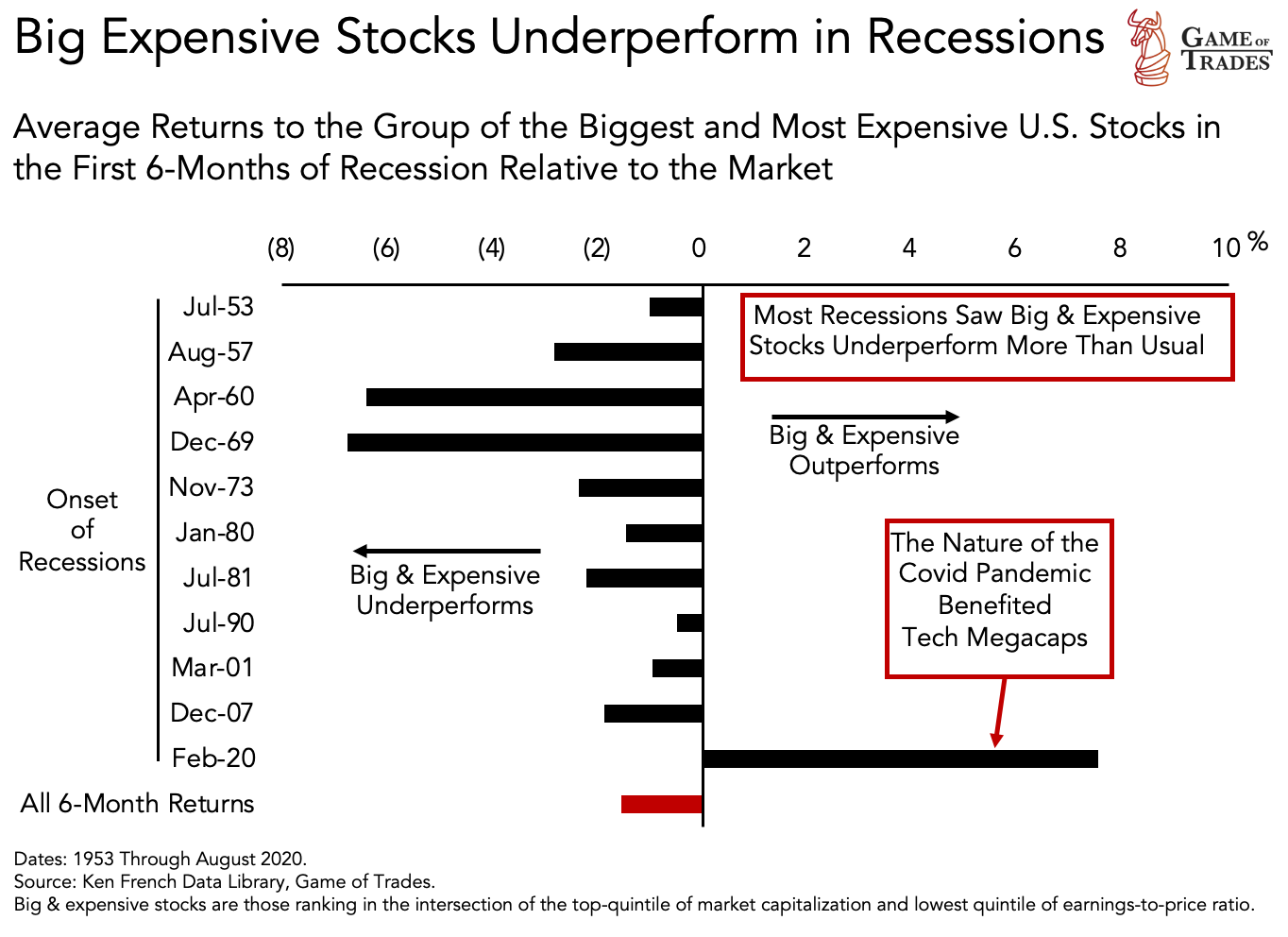

Most economists in 2022 predicted a recession in H1 2023, but the economy has managed to avert it to date. This is a key reason why Mega-cap stocks have outperformed in 2023. Since 1953, big and expensive stocks have underperformed during recessions. The only time we didn’t witness an underperformance of big and expensive stocks was after the 2020 Pandemic, which wasn’t a typical natural recession.

Our analysis suggests elevated odds of a recession in the next 6 – 12 months. Unemployment is expected to rise significantly towards the end of 2023 as a result of tight monetary policy. Big and expensive stocks appear vulnerable to the downside, even if they’re not as expensive as during the Nifty 50 or Dot Com. History shows us that the primary determinant of when market leadership turns isn’t valuations, but the onset of a recession. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Predicting US Unemployment Trends: Rise Expected by September 2023