Inflation has become a growing concern in recent years, drawing comparisons to the inflationary period of the 1970s. This article delves into the parallels between the two eras, highlighting the potential impact of rising inflation on the economy, with a particular focus on oil prices. By examining historical trends, current market indicators, and the interconnection of oil and inflation, we aim to provide insights into the possible future economic landscape.

The Erosion of Value: Risk of High Inflation

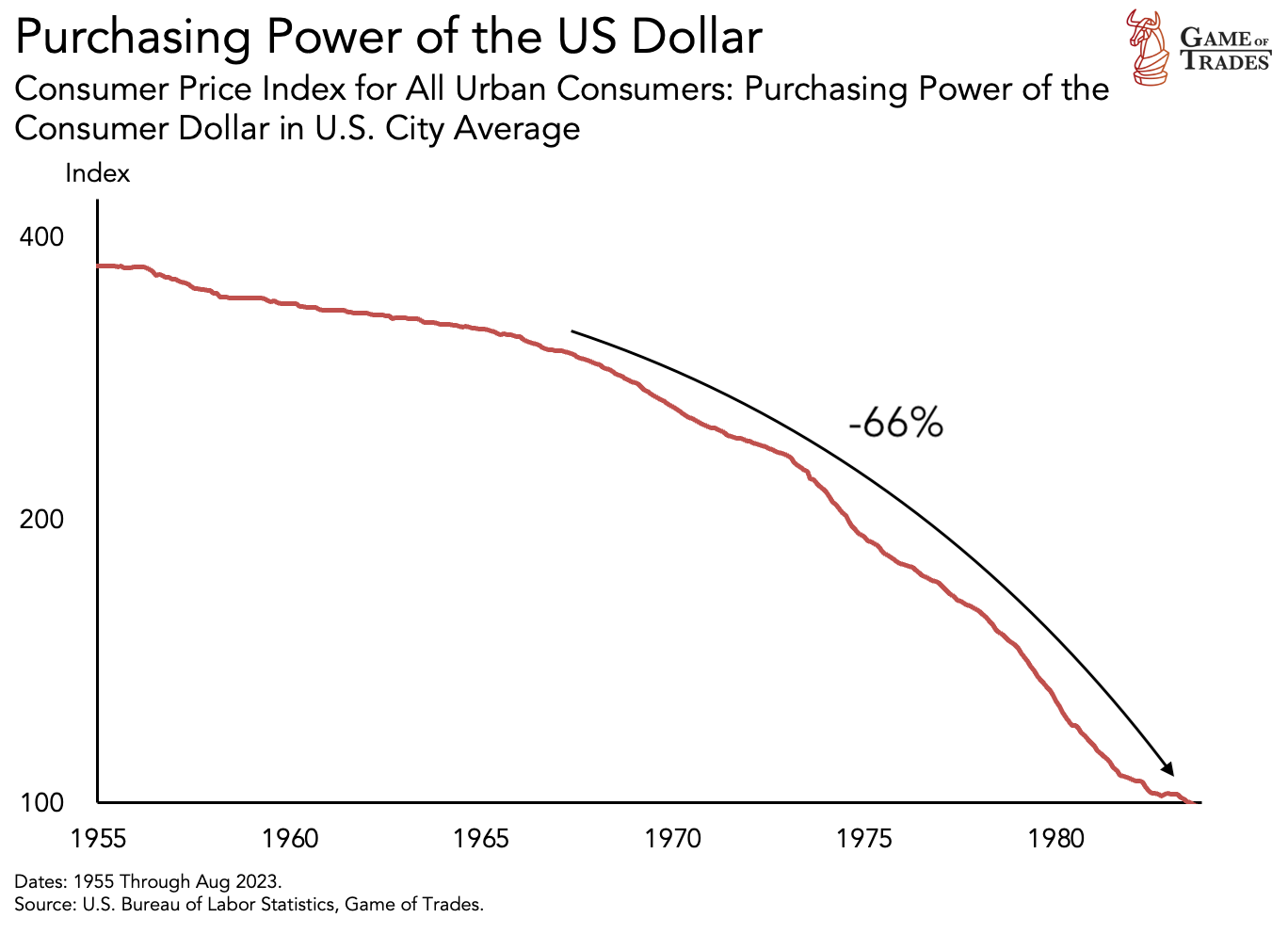

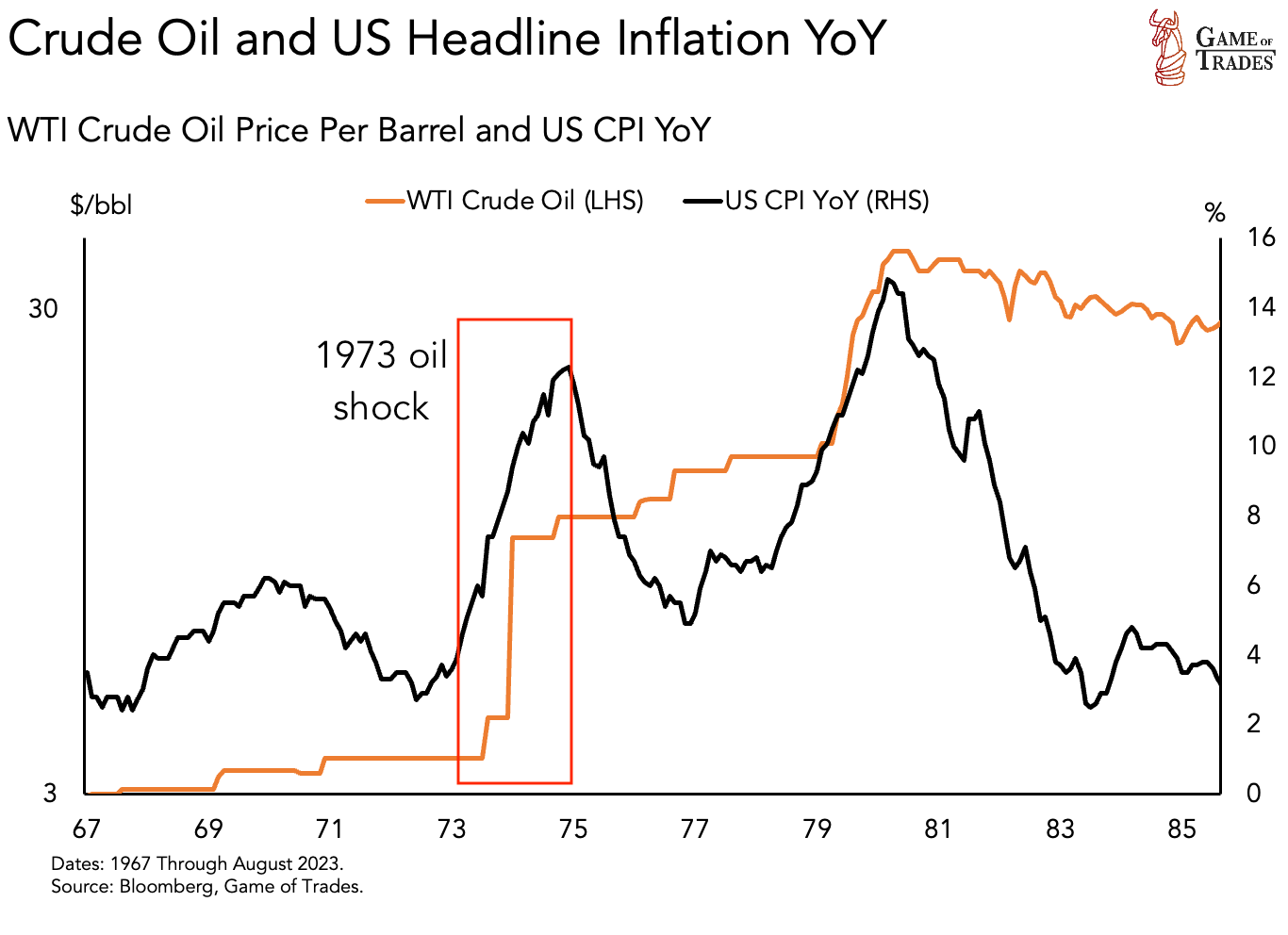

Between 1967 and 1982, the value of $10,000 in a bank account dropped by 66%. This period also witnessed a significant increase in oil prices, soaring from $3 to $30 per barrel. Moreover, US home prices tripled, rising from $22,000 to $66,000. These facts shed light on the tangible effects of inflation during that time.

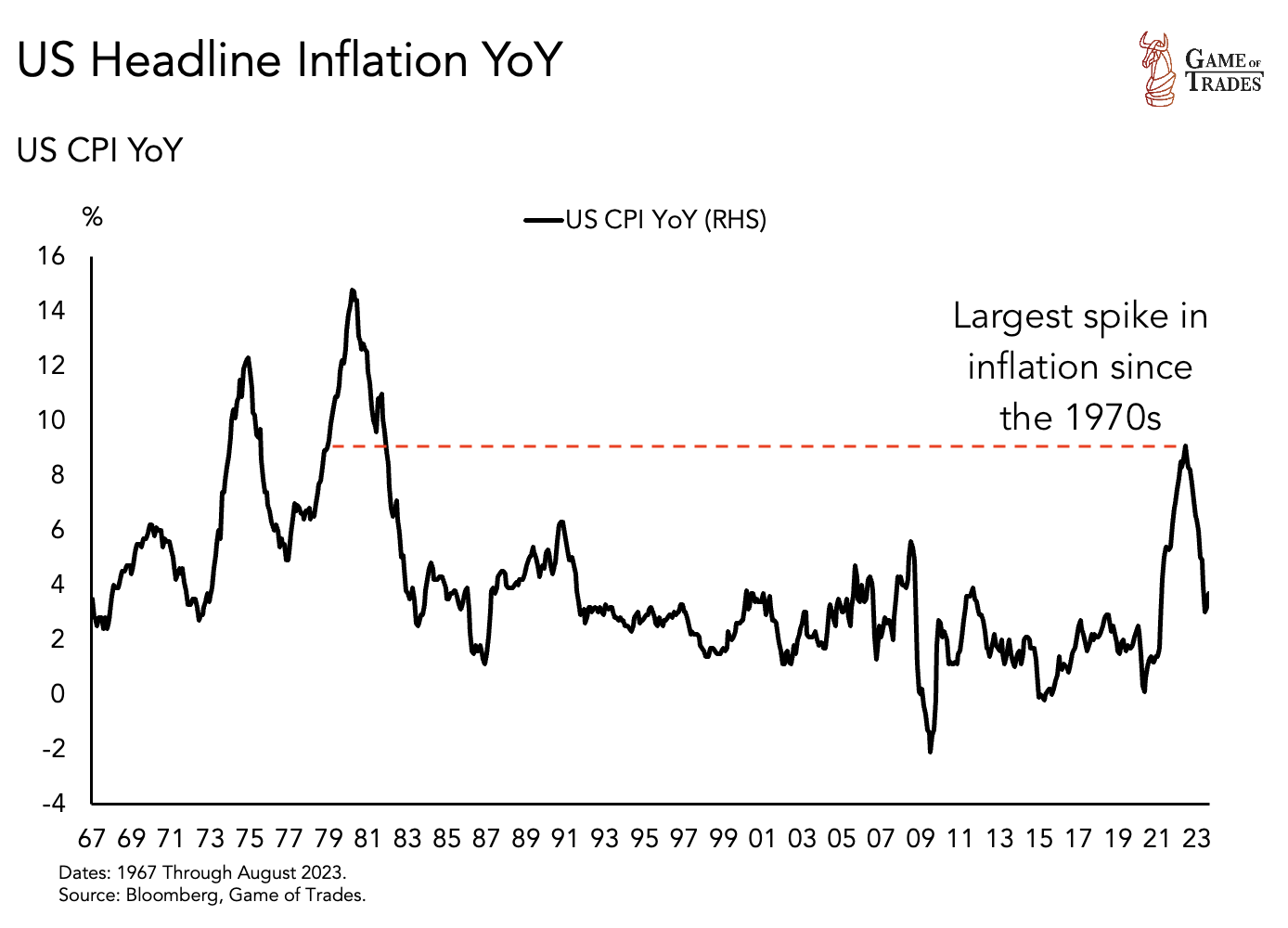

Presently, home prices have already surged from $320,000 to $420,000 since 2020. Additionally, the US dollar has experienced a nearly 20% decline in purchasing power over the past three years, coinciding with the largest spike in inflation since the 1970s.

Parallels to the 1970s: Waves of Inflation

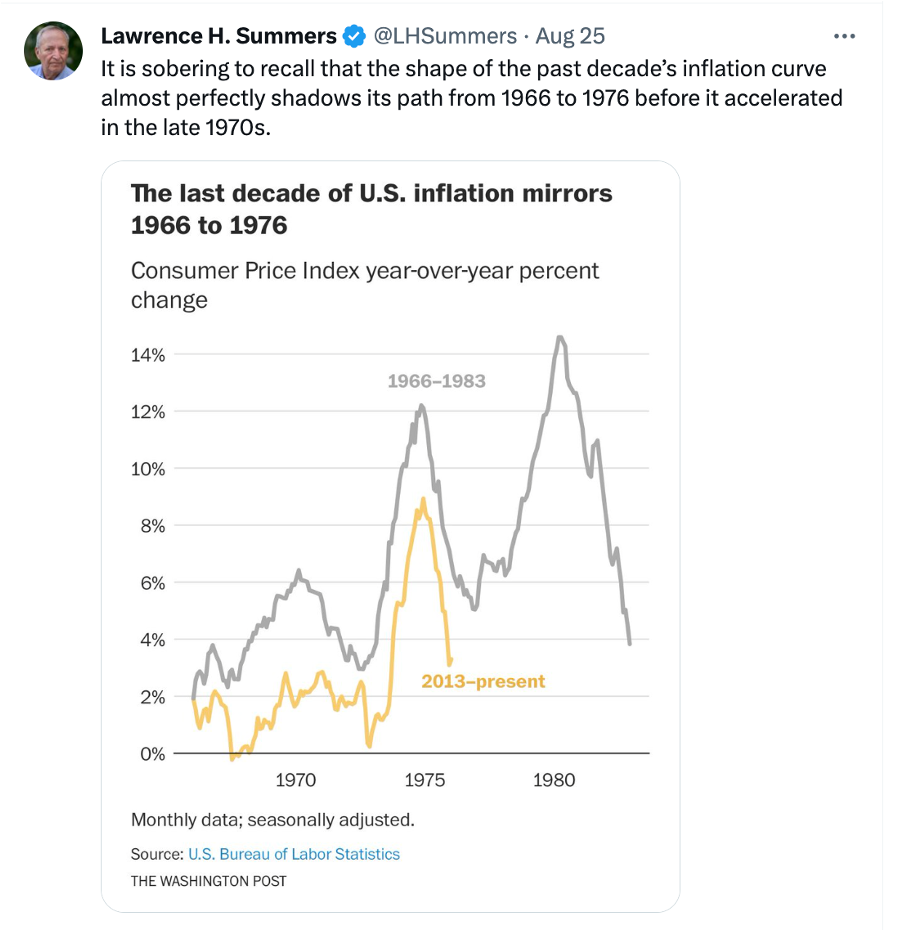

Drawing from historical patterns, economists suggest that inflation may be following a similar trajectory to that of the 1970s. During that era, there were three successive waves of inflation, each larger than the previous one. Extrapolating this trend to today, some argue that another wave of inflation may be due.

Commodities as an Inflation Indicator

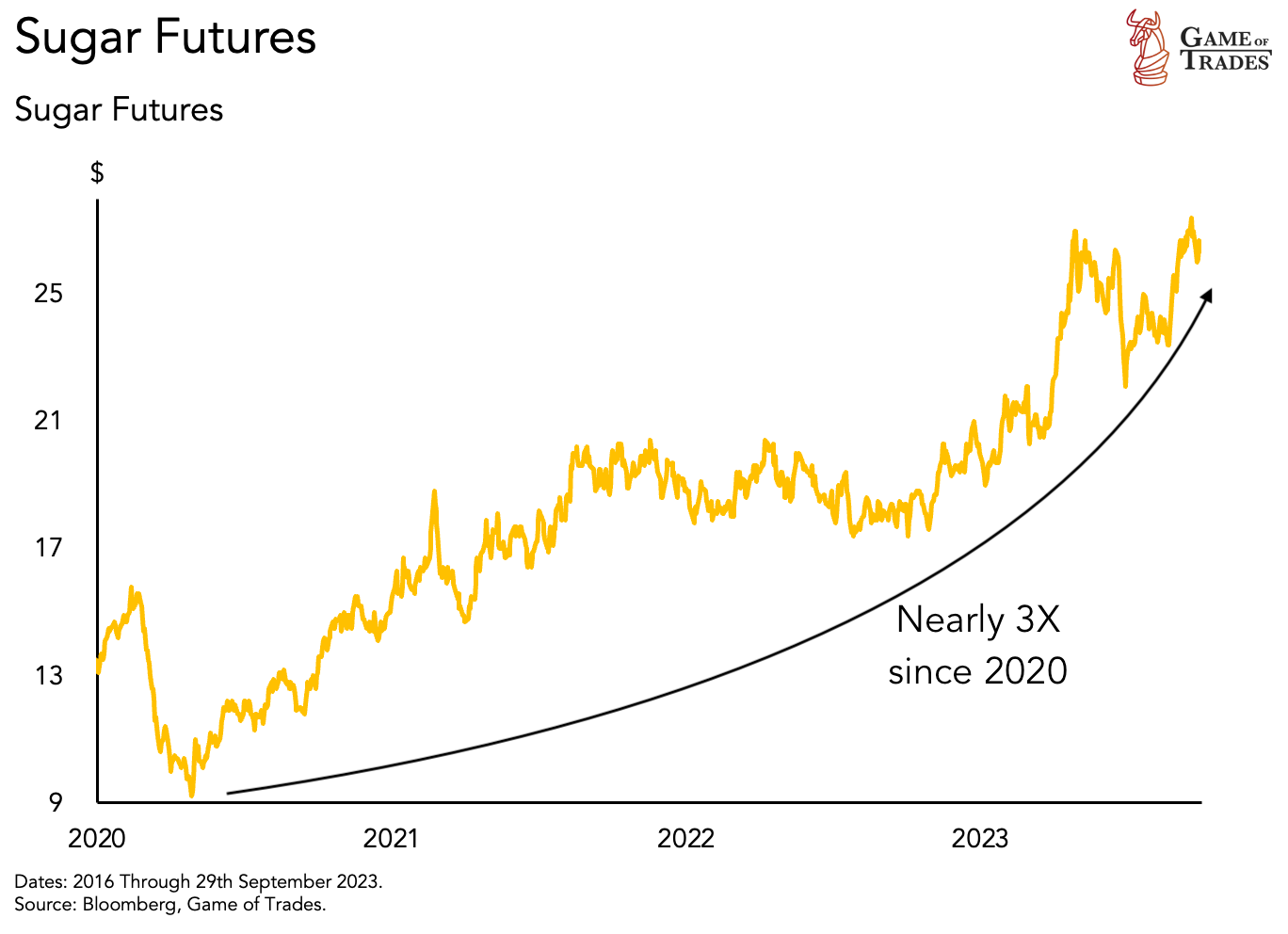

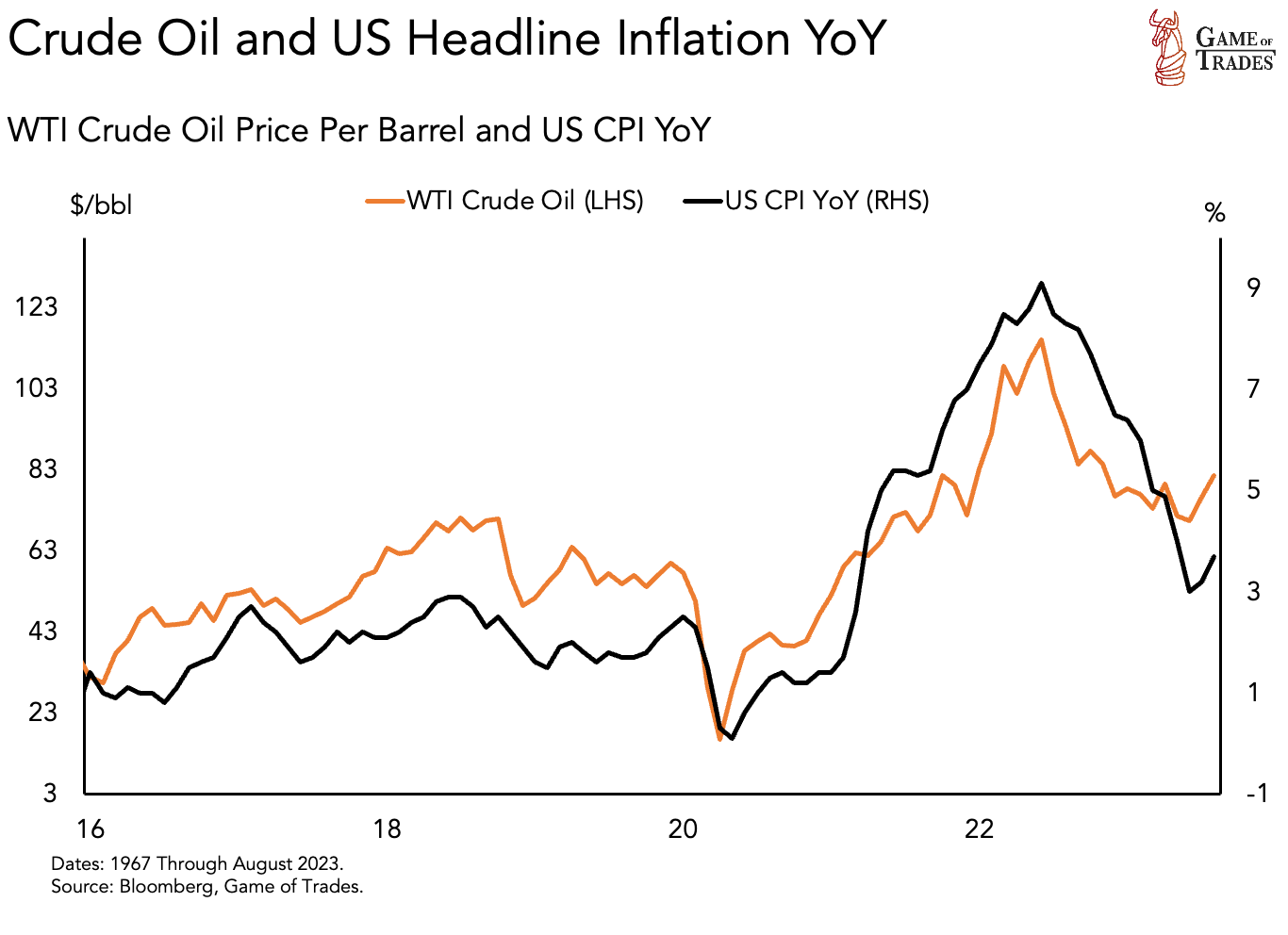

Commodities often serve as leading indicators of inflationary pressures. Notably, oil prices have increased by nearly 40% since June 2023, while sugar prices have almost tripled since 2020, and live cattle prices have more than doubled. These upward trends in commodity prices signal a potential return of inflation.

Energy’s Role in Inflation

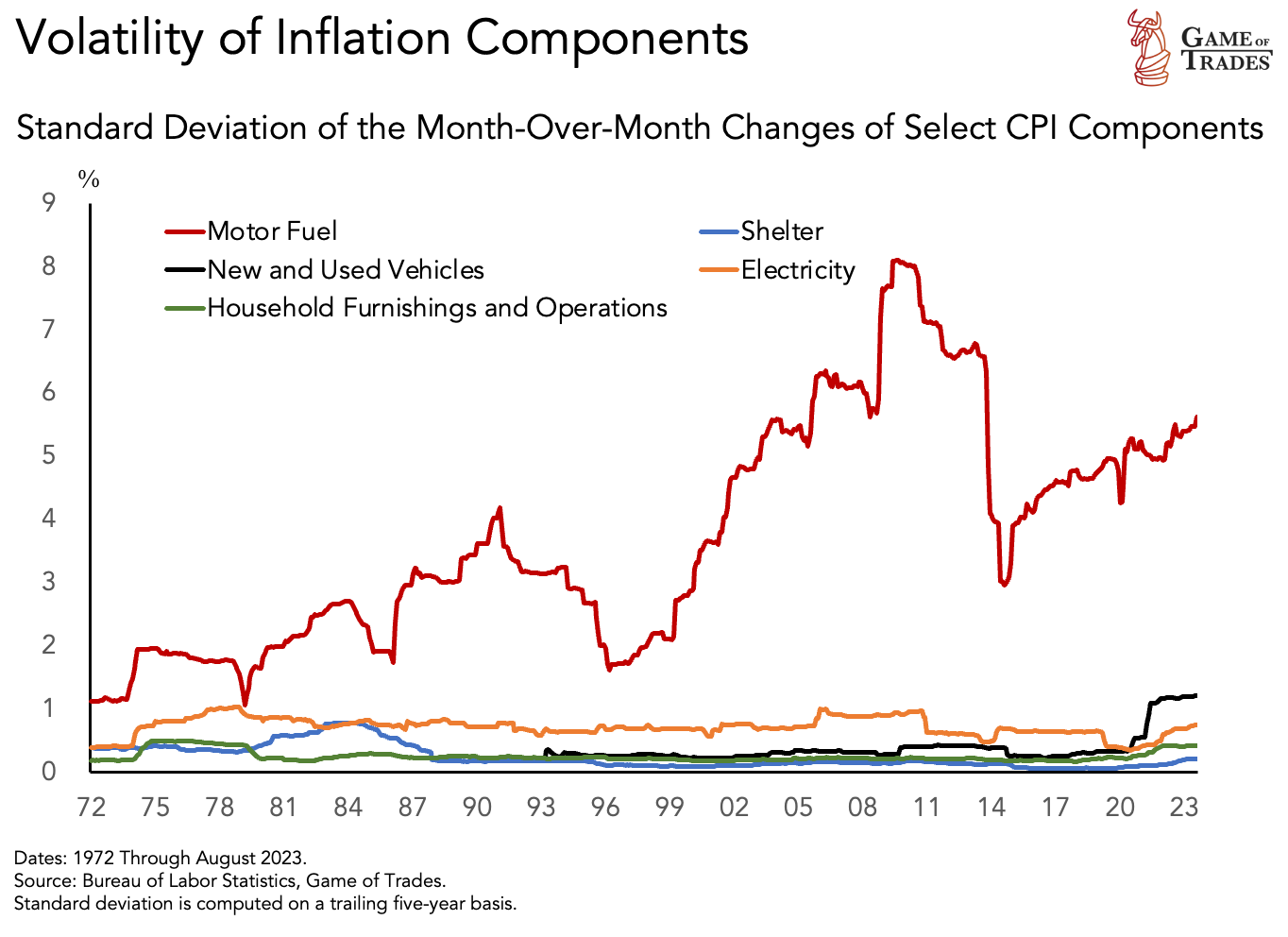

Although energy may not be the largest component of the Consumer Price Index (CPI), its volatility can significantly impact overall inflation. The sheer unpredictability of energy prices underscores its importance in driving inflationary pressures.

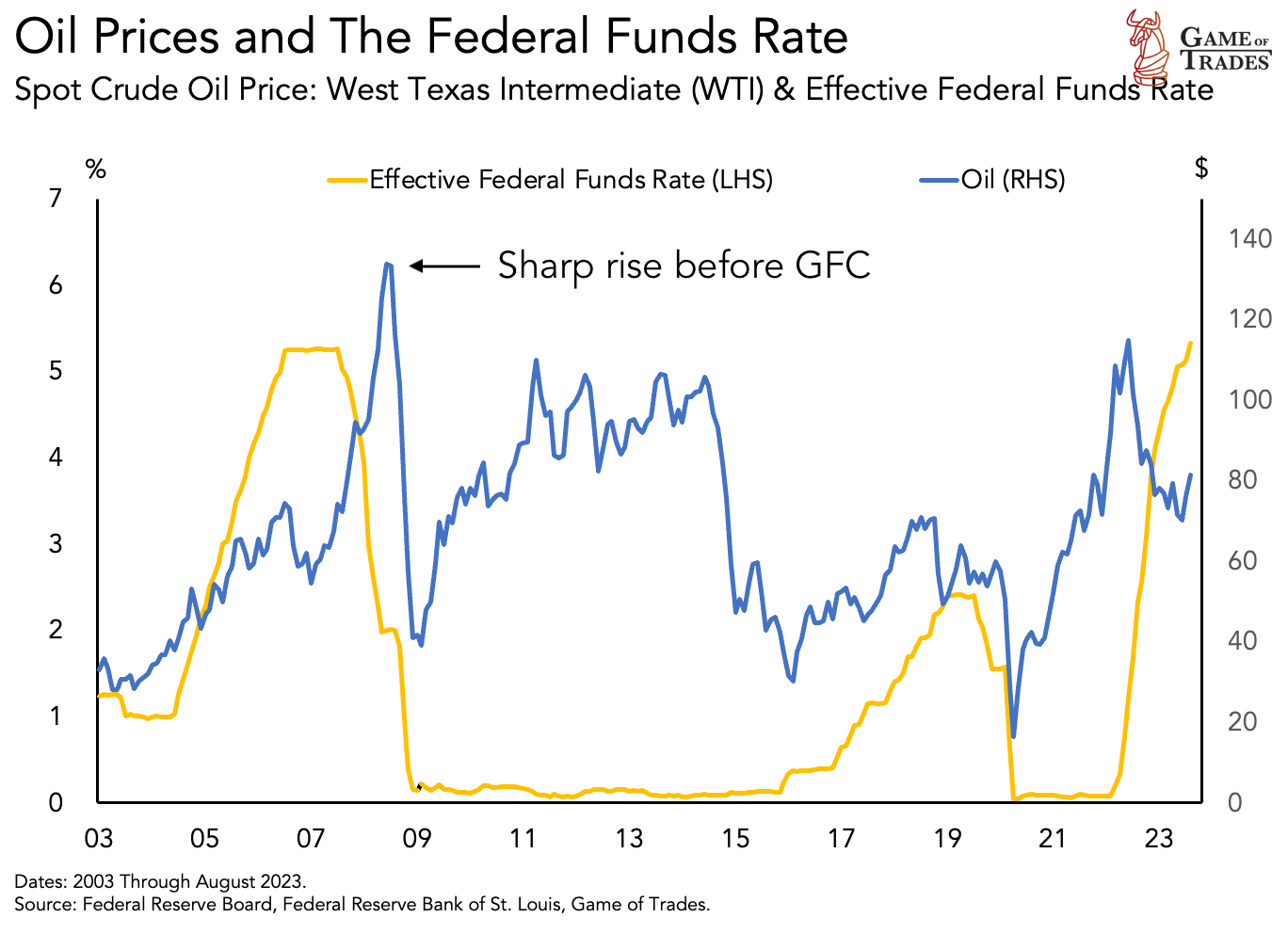

Oil prices have historically demonstrated a strong correlation with inflation. Given its volatility and its influence on the broader economy, analyzing the relationship between oil prices and inflation is crucial. For a resurgence of inflation, oil prices need to continue rising aggressively.

Similar to the 1970s, oil shocks have the potential to trigger substantial inflationary pressures. For instance, in 1973, Arab oil-producing countries ceased oil shipments to the US, resulting in a massive wave of inflation. Recent announcements of oil cuts by Saudi Arabia and Russia until the end of 2023 raise the possibility of an oil shock.

The Changing Dynamics of Oil Prices

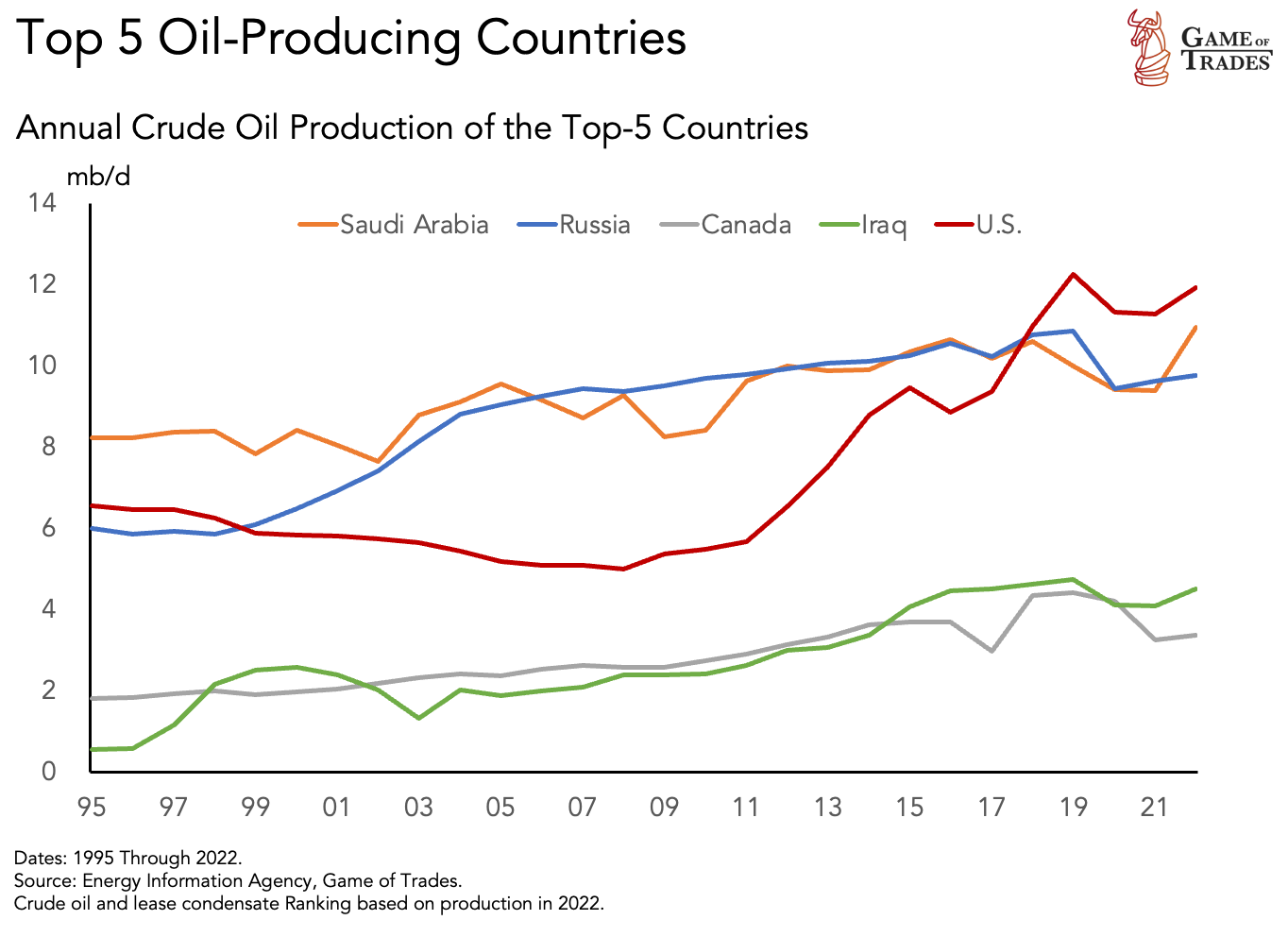

The US has become the largest oil producer globally, which positions it to mitigate potential supply shocks. Increased domestic production allows the US to compensate for any oil shortages, as demonstrated in 2022. Understanding the dynamics of oil supply and demand is crucial in predicting future oil price movements.

The Impact of Recession on Oil Demand

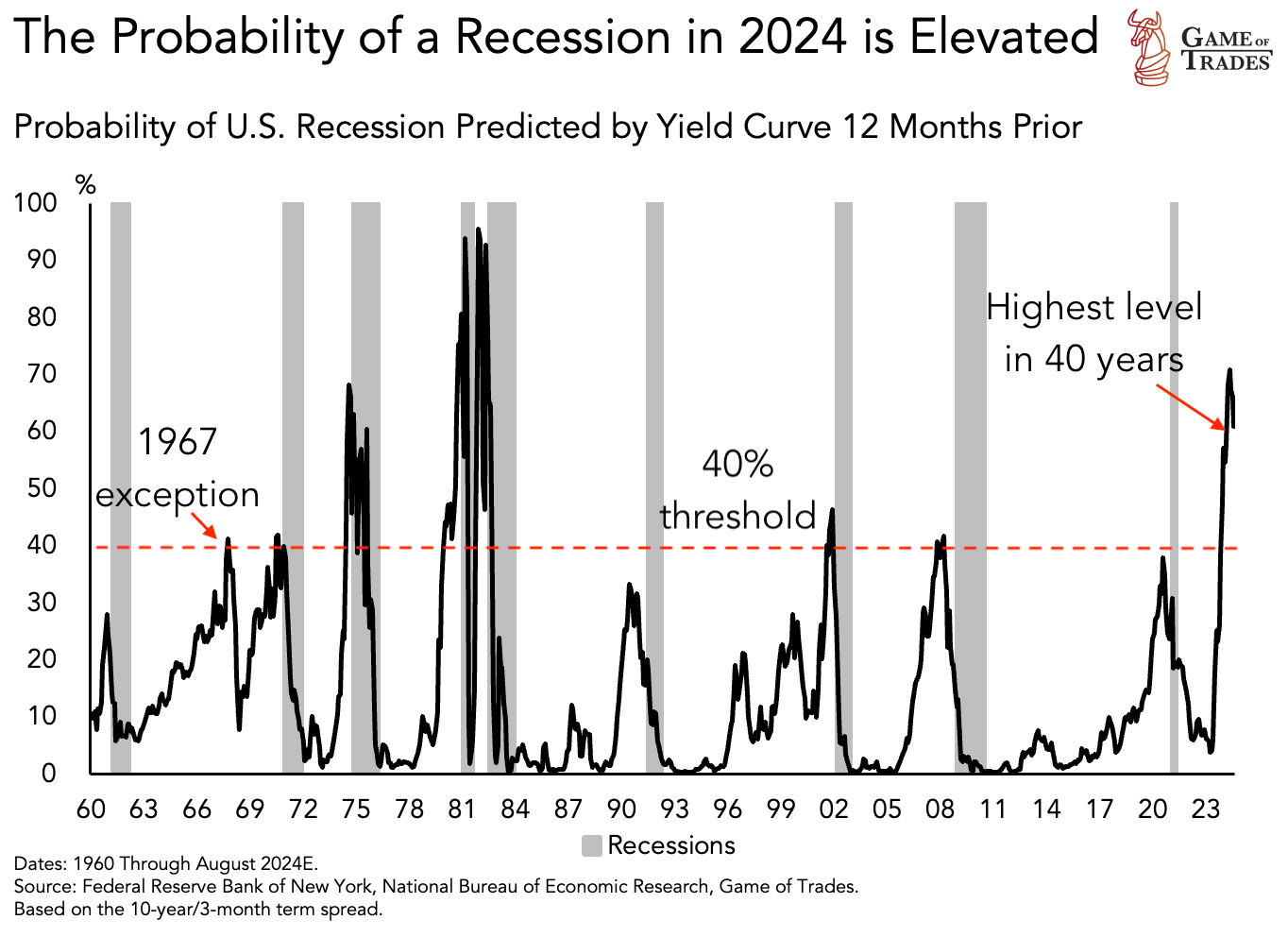

The probability of a recession, as predicted by the yield curve, currently stands at the highest level in 40 years. Historically, when the probability has surpassed 40%, a recession has followed, except in 1967. A recession could pose challenges for oil demand, potentially affecting its price trajectory.

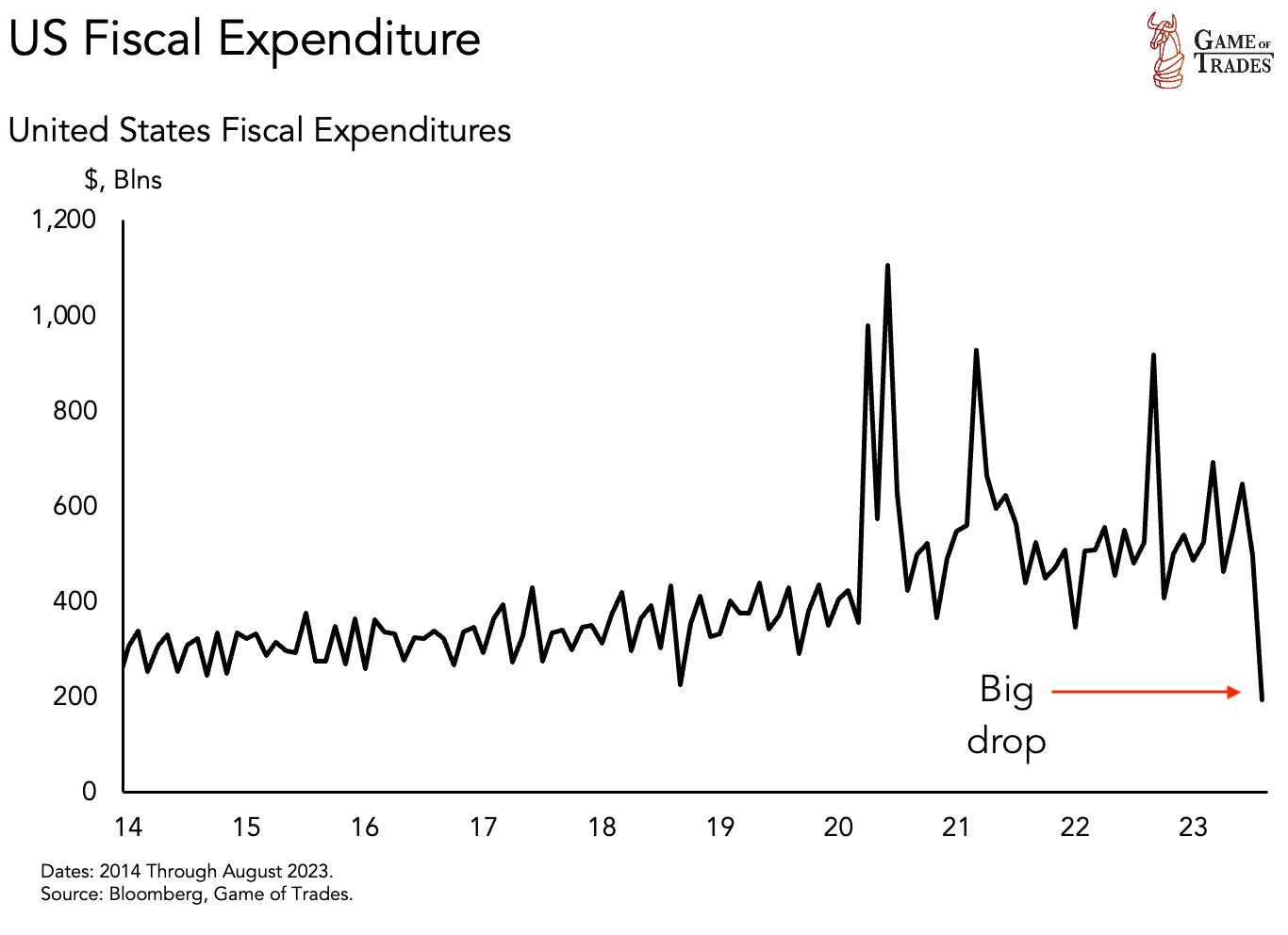

The decline in fiscal expenditure, coupled with the depletion of excess savings, indicates a return to pre-pandemic economic levels. Income and wealth inequality have increased over the past four decades, leaving the economy in a more vulnerable position compared to 50 years ago when inequality was lower.

The Fragility of the US Consumer and Oil Prices

In 2007, oil prices surged before the onset of the worst downturn since the Great Depression. This example highlights the possibility of oil prices spiking without genuine fundamentals, leading into a downturn. Such a scenario today could have a severe impact on the struggling US consumer and potentially trigger a recession.

To avoid a recession, a combination of fiscal stimulus and rate cuts by the Federal Reserve may be necessary. This approach can lead to robust economic growth, but it also carries the risk of higher inflation as demand for oil rises. The Federal Reserve, however, has expressed its caution in risking a repeat of the inflationary era of the 1970s.

Conclusion

The similarities between the current economic landscape and the inflationary period of the 1970s raise concerns about the potential resurgence of inflation. The volatility of oil prices and its historical correlation with inflation highlight the significance of monitoring energy markets. Factors such as potential oil shocks, changing dynamics of oil supply and demand, and the possibility of a recession can all impact oil prices and, consequently, inflation. Balancing economic growth and inflation remains a challenge for policymakers, as they strive to avoid a repeat of the inflationary era while stimulating the economy. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Inflationary Spirals and Deflationary Cycles: A Tale of Two Eras