Interest rates and their impact on the economy have been subjects of great importance throughout history. By examining historical events and drawing parallels to the present, we can gain valuable insights into the significance of interest rates, inflation, and government intervention. This article explores the historical context of interest rates, the consequences of past economic downturns, and the potential implications for today’s markets

Interest Rates and Economic Downturns

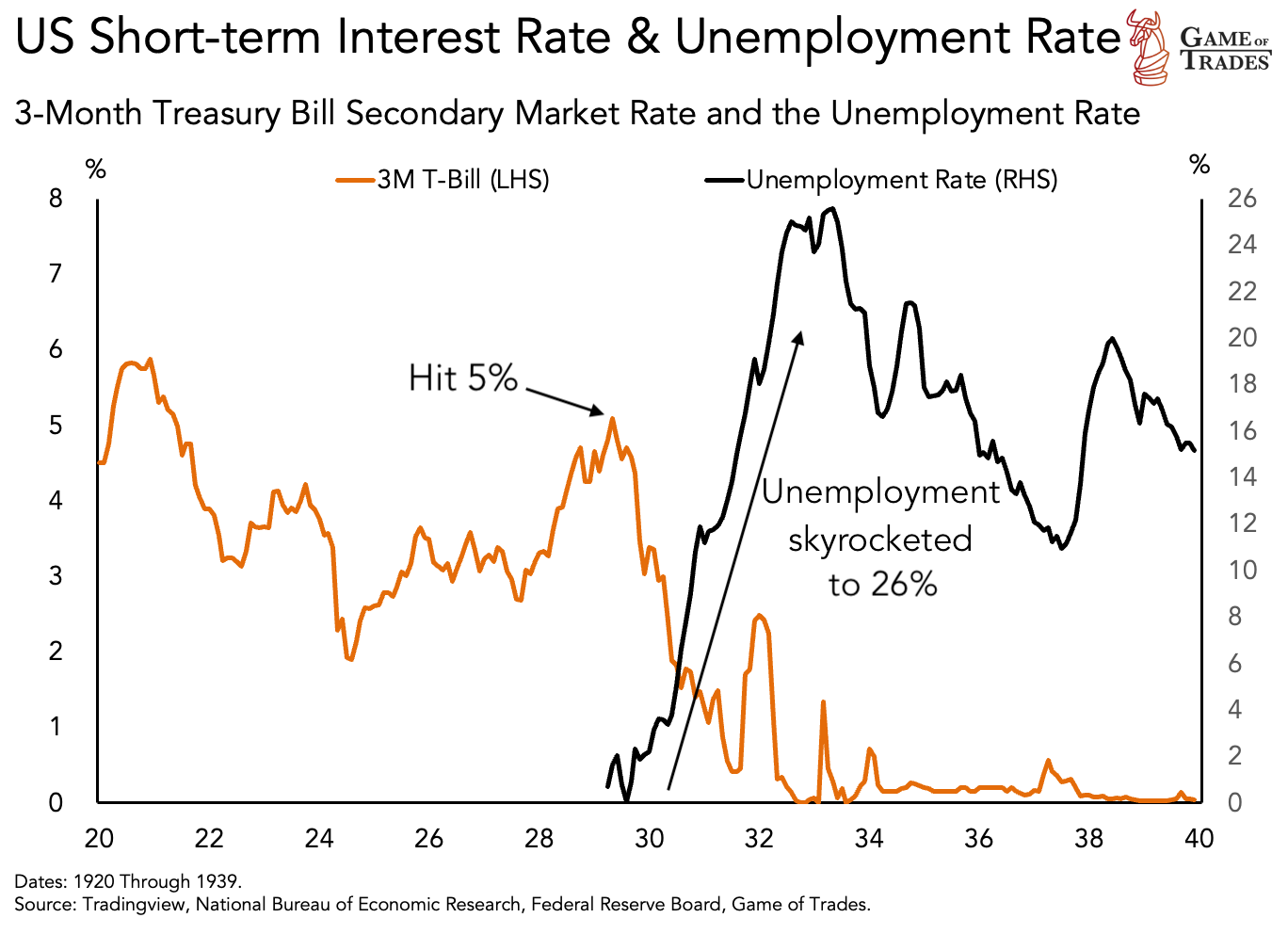

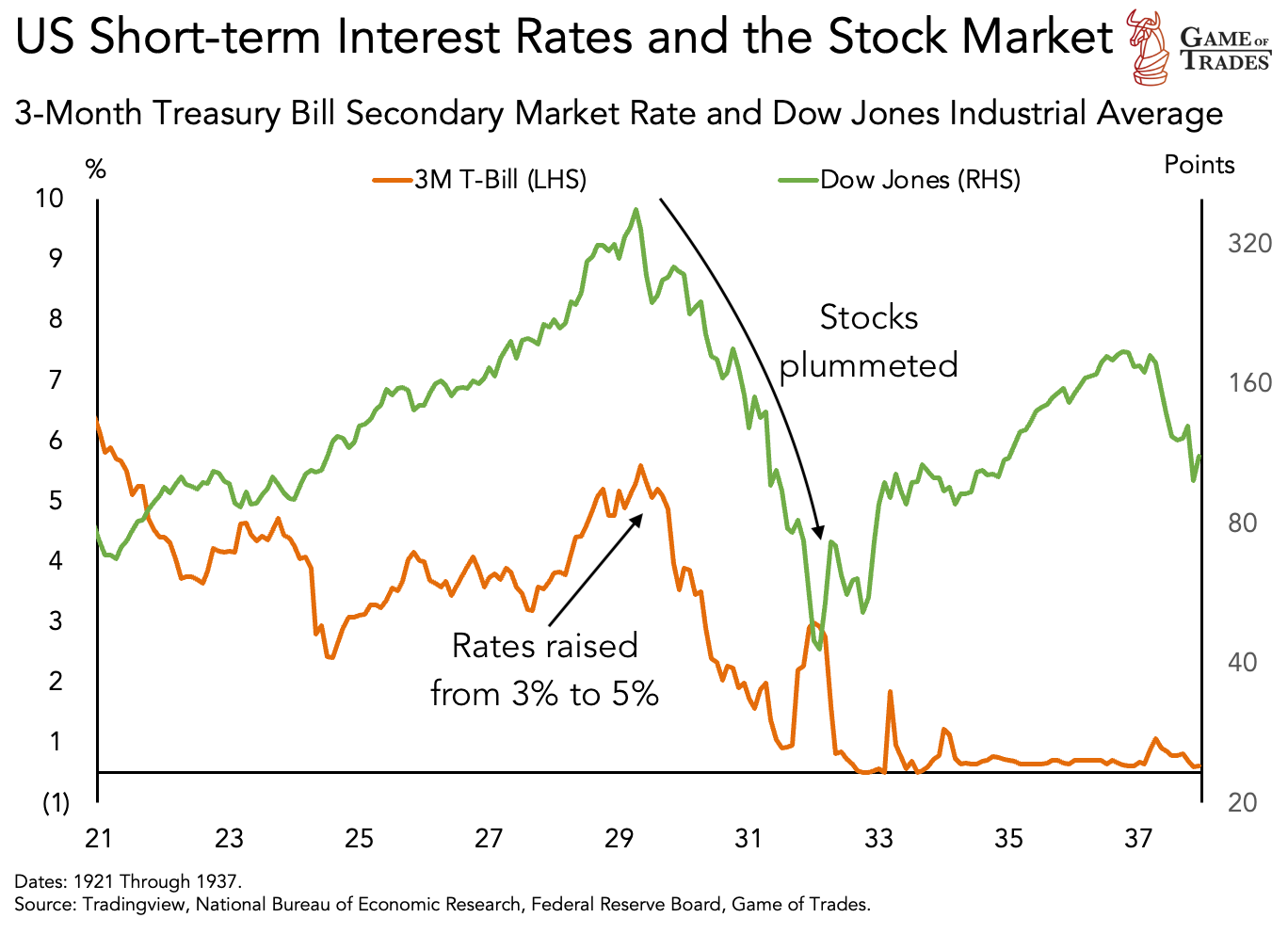

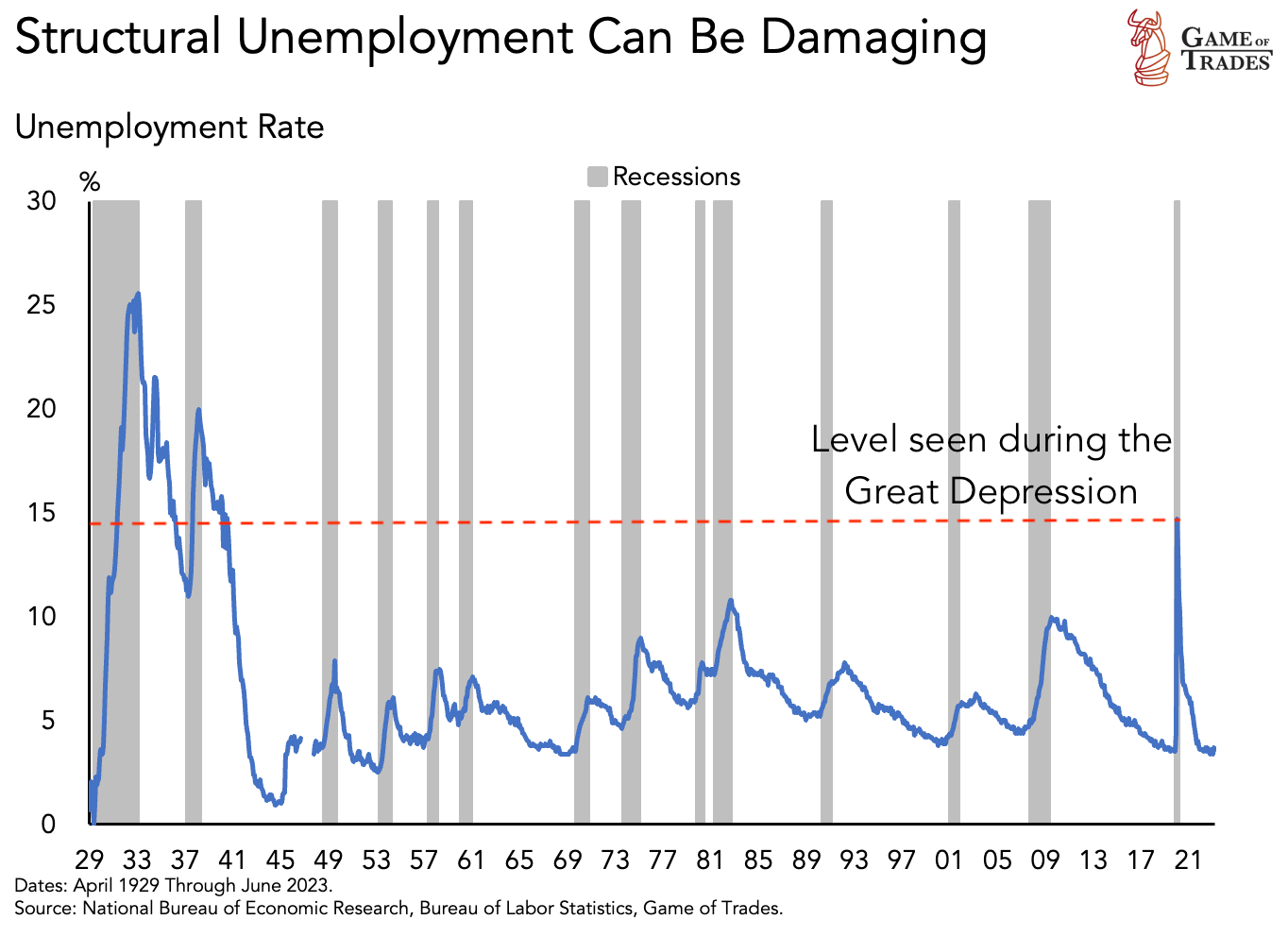

In May 1929, US interest rates reached 5%, marking the beginning of the most severe economic downturn in history—the Great Depression. Unemployment skyrocketed to 26%, while interest rates eventually plummeted to 0%. Fast forward to May 2023, and US interest rates have once again surpassed the 5% mark, a level last seen in 2007 before the Financial Crisis. The recent rise in rates aims to combat elevated inflation.

The Fed’s decision to raise rates from 3% to 5% in 1929 was an attempt to curb stock market speculation. However, it was followed by the largest stock market crash in US history. This raises the question of whether today’s economy can withstand rates higher than those during the Financial Crisis and the Great Depression.

Inflation, Deflation, and Economic Crisis

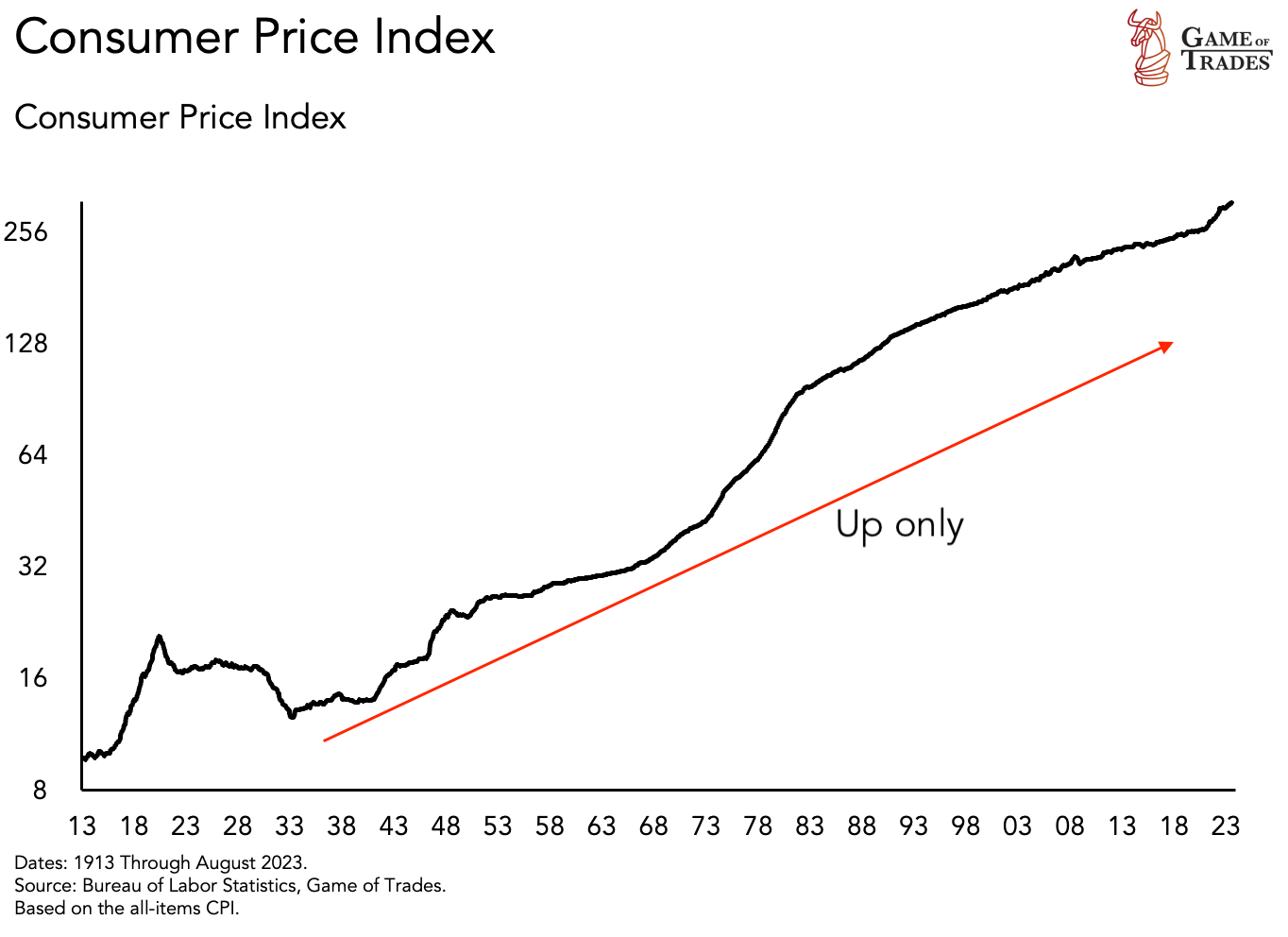

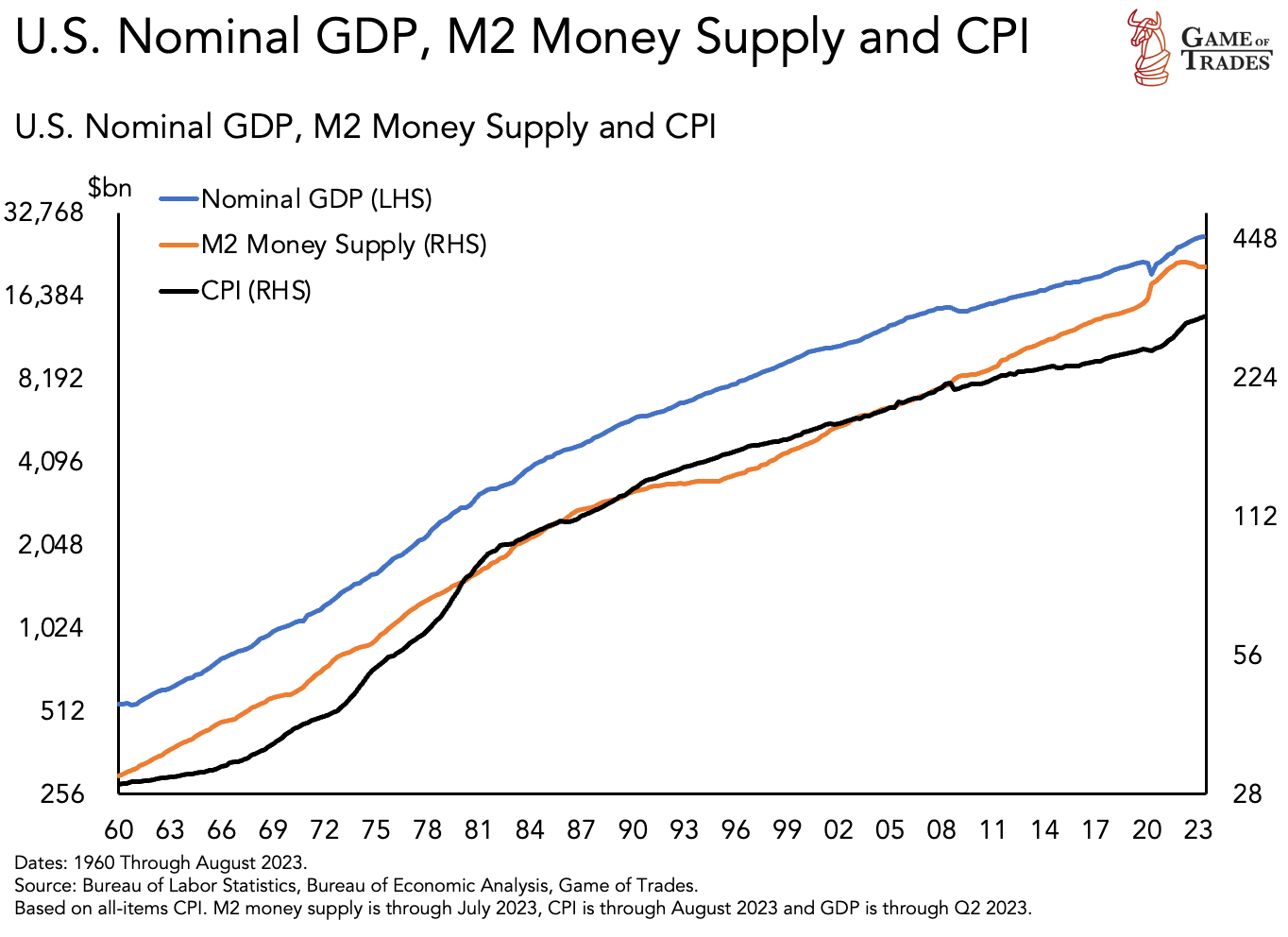

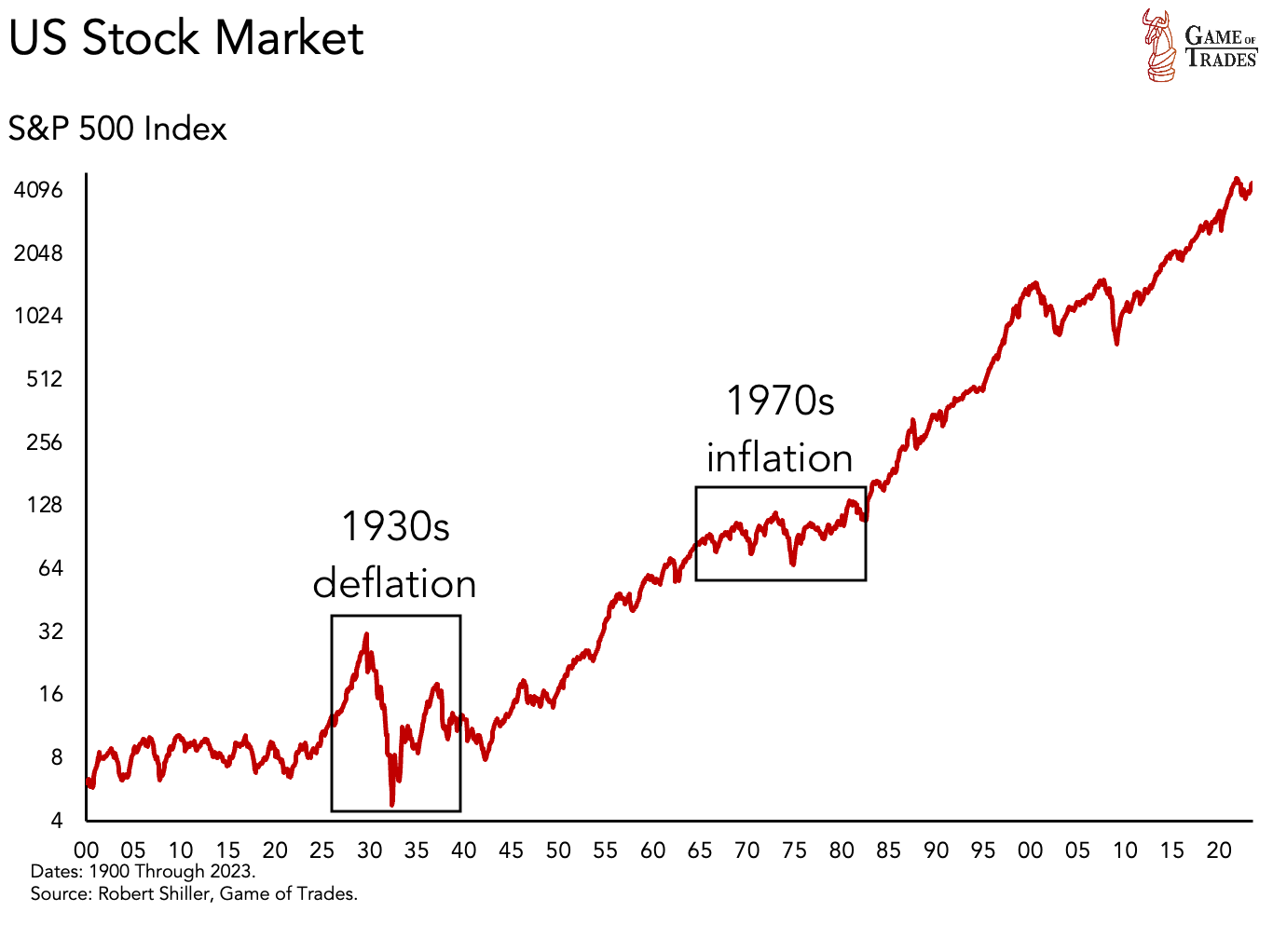

In both 2009 and the early 1930s, inflation transitioned into deflation due to the depth of the economic crisis. Today, the Fed believes that inflation will return to a stable 2% level and remain there. However, the central bank’s track record in achieving this outcome is poor. Analyzing the Consumer Price Index (CPI) helps us understand the risk of a deflationary episode today. The CPI tracks the price of everyday items, revealing the rate of change over time.

As GDP expands, the amount of money in circulation tends to increase, leading to higher prices. This phenomenon, initially not fully understood by investors, became apparent over time. The period between 1913 and World War I witnessed severe and prolonged periods of declining consumer prices, known as deflation. The reason behind this occurrence lies in human psychology. After the inflationary period following World War I, people expected prices to return to their original levels. In the early 1900s, the prevailing belief wasn’t that prices only rise.

The Impact of Expectations

Expecting price declines, consumers reduce spending, which initiates a vicious deflationary cycle: reduced spending leads to lower prices, tightened profit margins, increased layoffs, higher unemployment, and further reduced spending. However, a key distinction between today and the Great Depression is that contemporary understanding acknowledges that prices increase over time without returning to their original levels. Currently, we face the opposite problem, with people expecting rapid price increases. This anticipation prompts consumers to advance their purchases, creating an inflationary spiral. This concept is known as the de-anchoring of inflation expectations

Population Growth and Job Automation

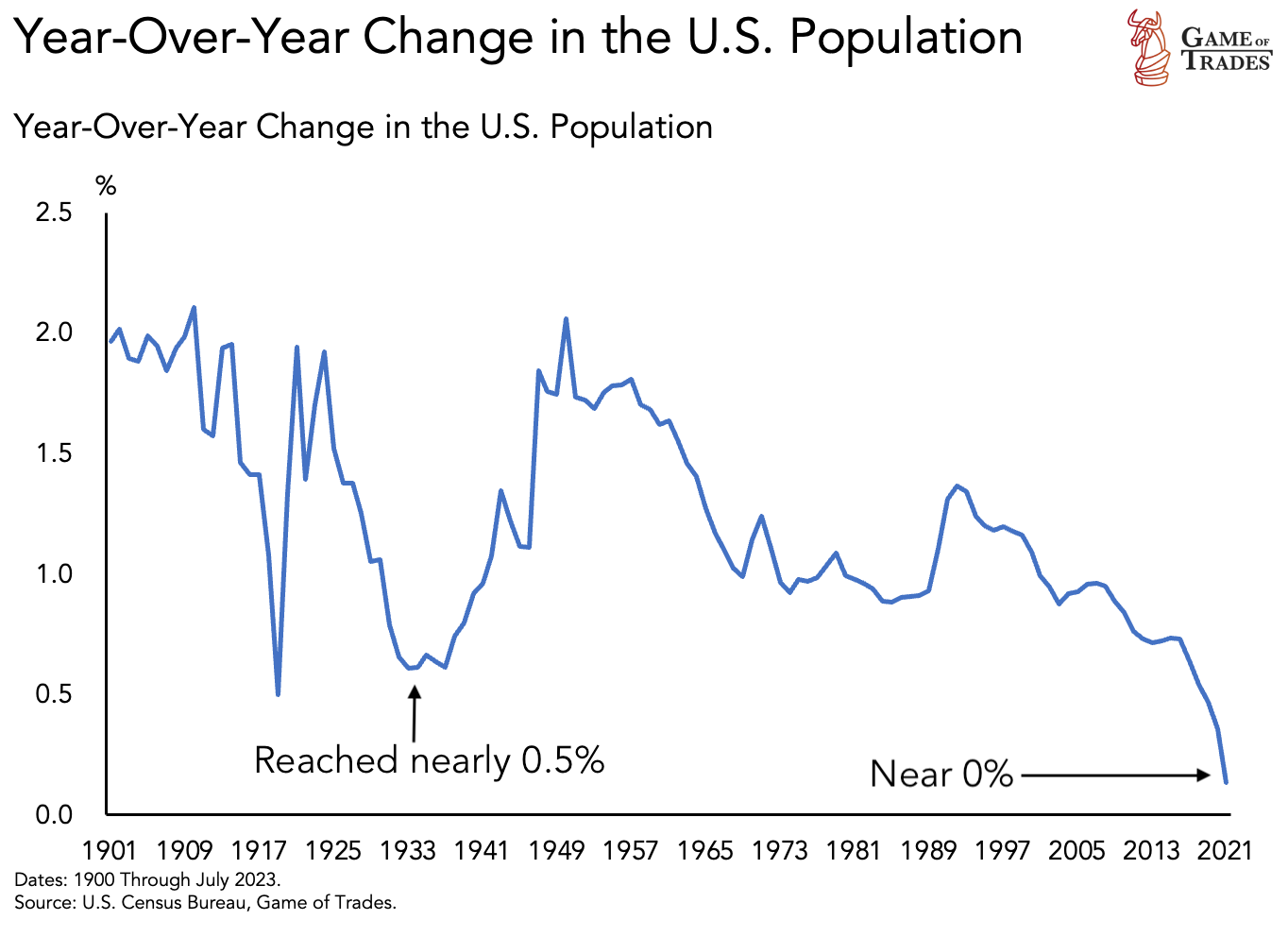

Another factor to consider is population growth. In 2021, US population growth declined to nearly 0%, echoing a similar reading from the 1930s. This development raises concerns for the economy. Additionally, there is a surge in discussions surrounding job automation, reminiscent of the concerns during the Great Depression era. The impact of automation on employment has evolved over the course of a century, with technological unemployment becoming a significant theme.

Government Intervention and Market Volatility

Government intervention has played a crucial role in preventing a Great Depression-like scenario until now. Even amidst the challenges of 2020, government stimulus prevented a deflationary spiral and its accompanying consequences. While a massive deflationary period like the 1930s is unlikely, there are similar themes occurring, such as uncontrollable government spending, which can lead to inflationary pressures akin to the 1970s. As a result, market volatility and investment opportunities may arise in the coming years.

Conclusion

Understanding historical parallels between interest rates, inflation, deflation, and government intervention provides valuable context for navigating today’s markets. By examining lessons from the Great Depression, we can identify potential risks and opportunities. Factors such as inflation expectations, population growth, and job automation contribute to the evolving economic landscape. While the likelihood of a massive deflationary period like the 1930s is low, market volatility and potential inflationary pressures remain relevant considerations. As investors, it is crucial to stay informed, adapt to changing conditions, and seek opportunities amid uncertainty. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Europe’s Stagflation Challenge: Understanding the ECB’s Balancing Act