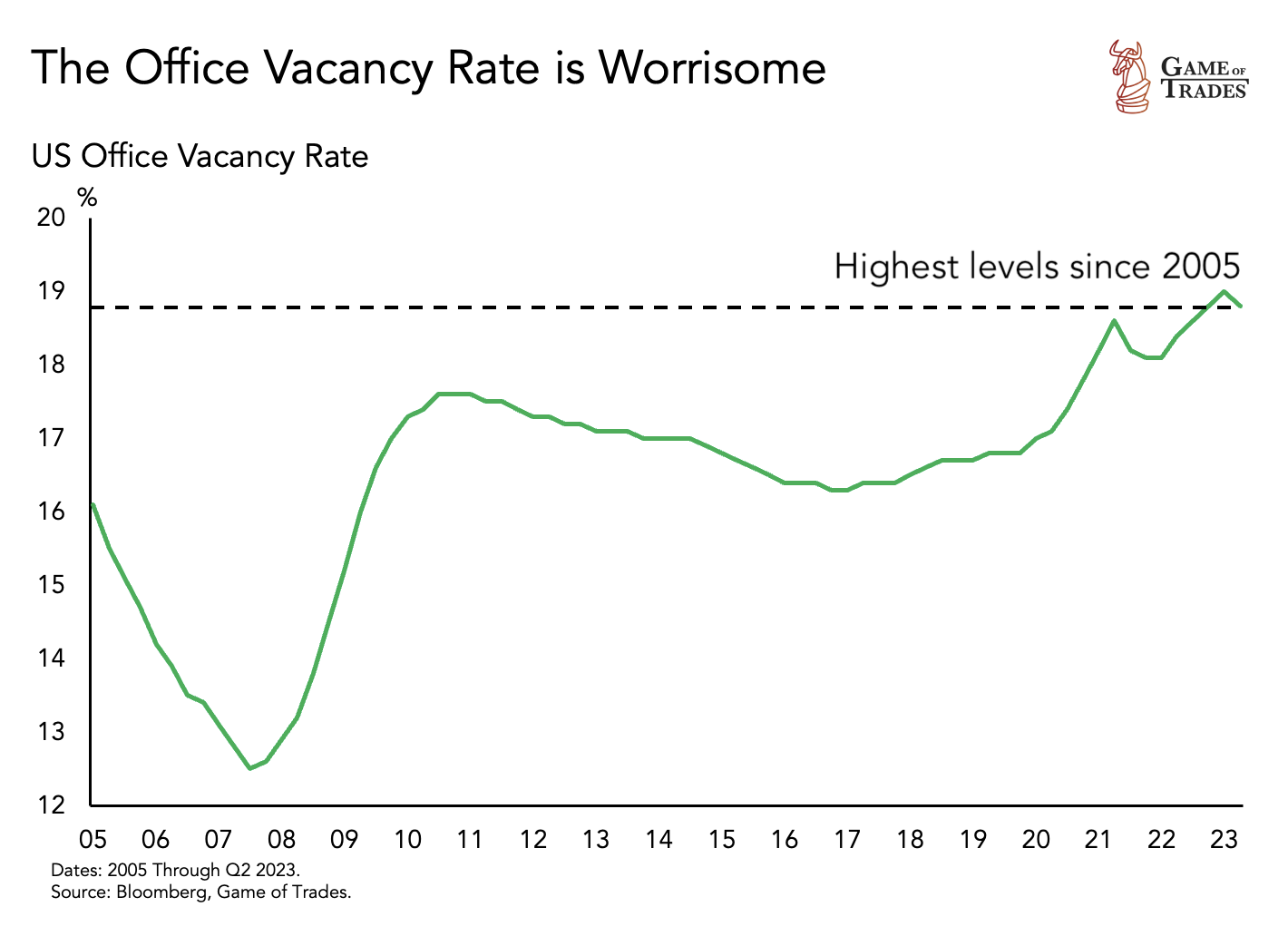

In 2023, office vacancy rates in the U.S. have climbed to unprecedented levels, even exceeding the zenith reached during the 2008 Financial Crisis. This has major implications for the regional banking sector. But first, what’s the catalyst for this new trend?

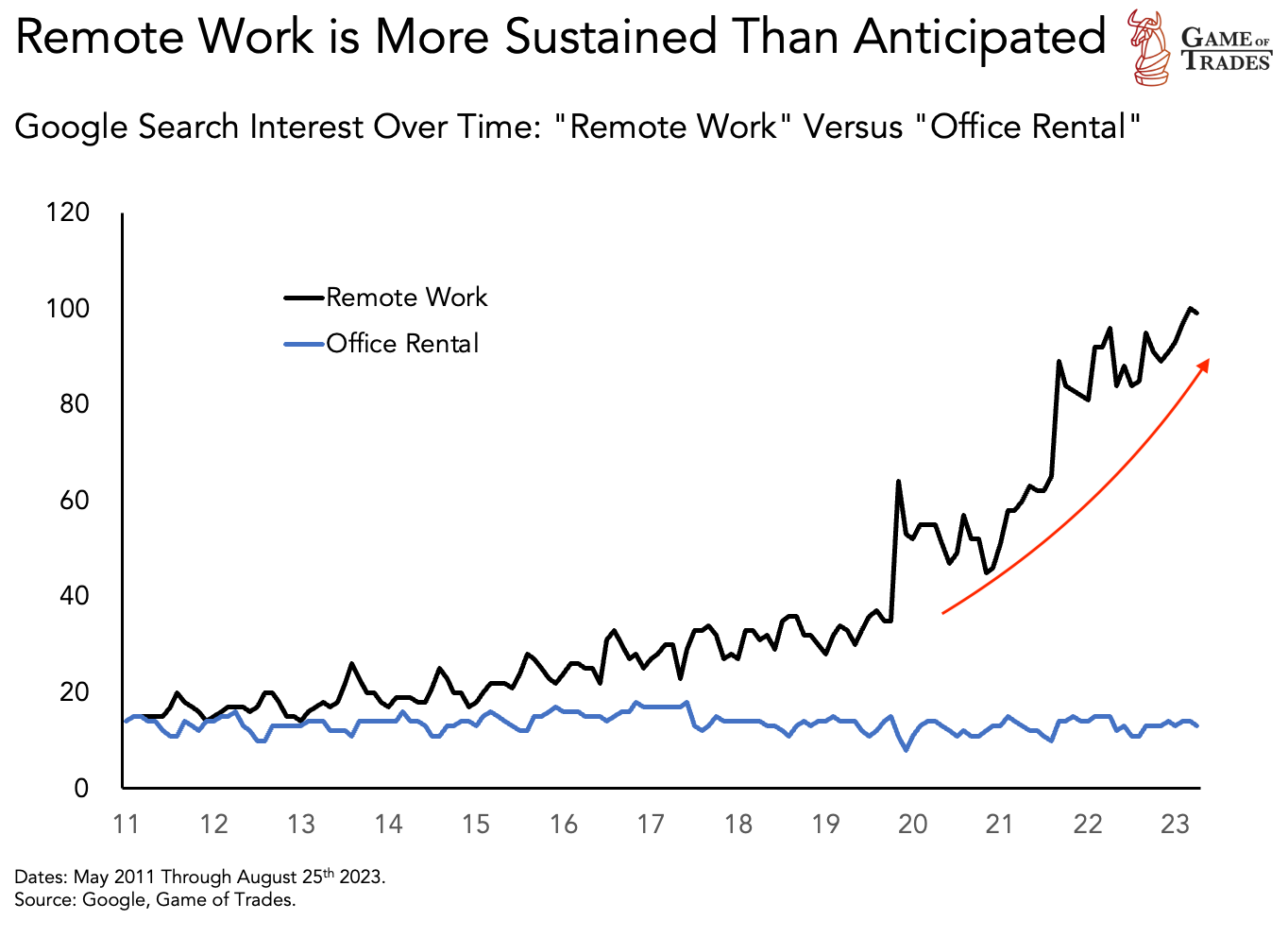

The Catalyst: A Rising Remote Work Trend

The primary catalyst behind an increase in office vacancy is the remote work trend instigated by the 2020 pandemic lockdowns. This trend has continued to gain momentum, with no signs of abating even 2 years after the initial lockdowns. This shift in work culture has led to an increased number of unoccupied office spaces, triggering a spike in vacancy rates.

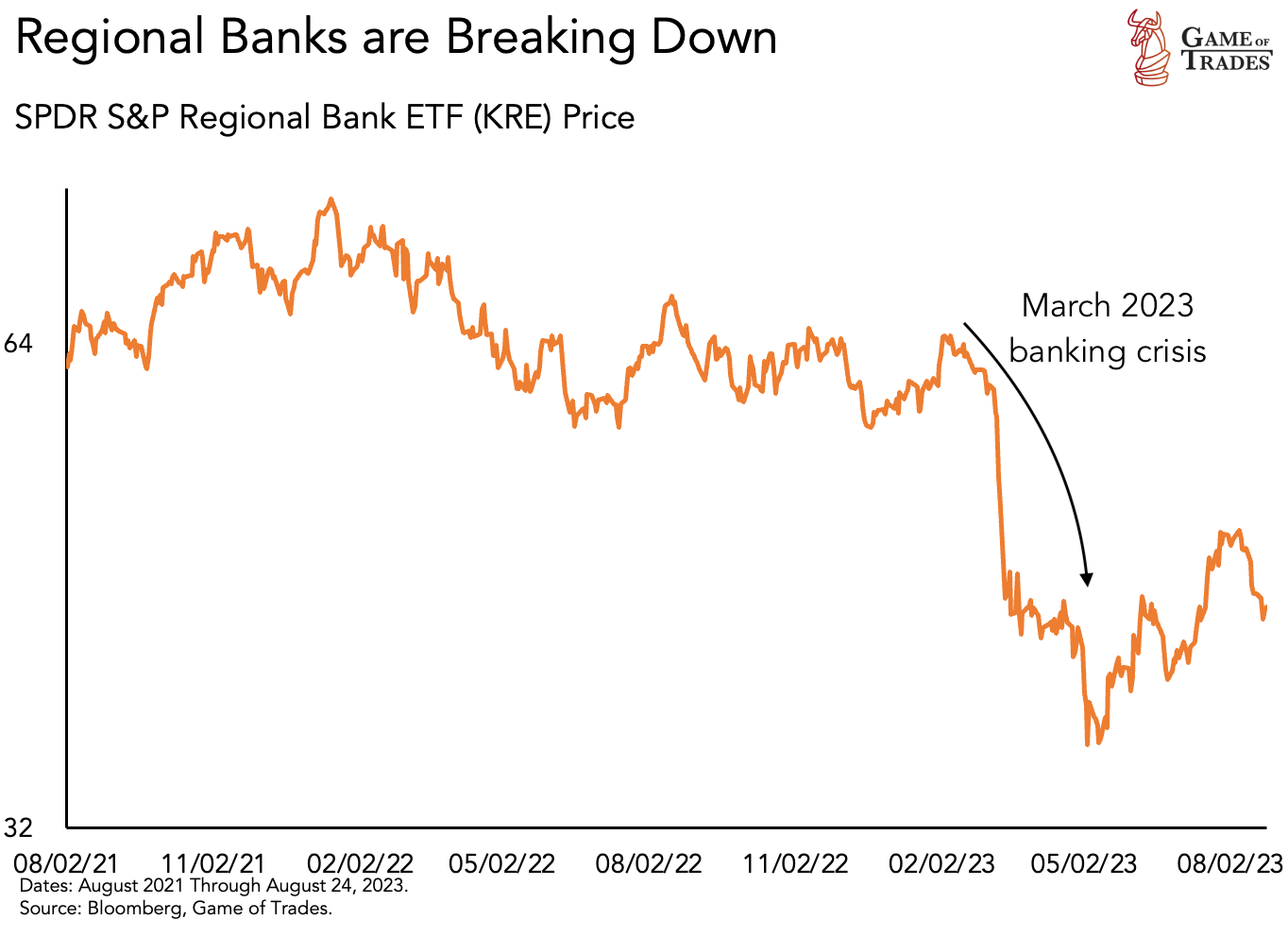

This seismic shift in work culture could send shockwaves through the regional banking system, which is already under strain. A glimpse at the regional banking ETF ($KRE) paints a concerning picture. In March 2023, the banking system teetered on the brink of a complete collapse, but not without reasons.

Near-Collapse and the Advent of Deposit Flight

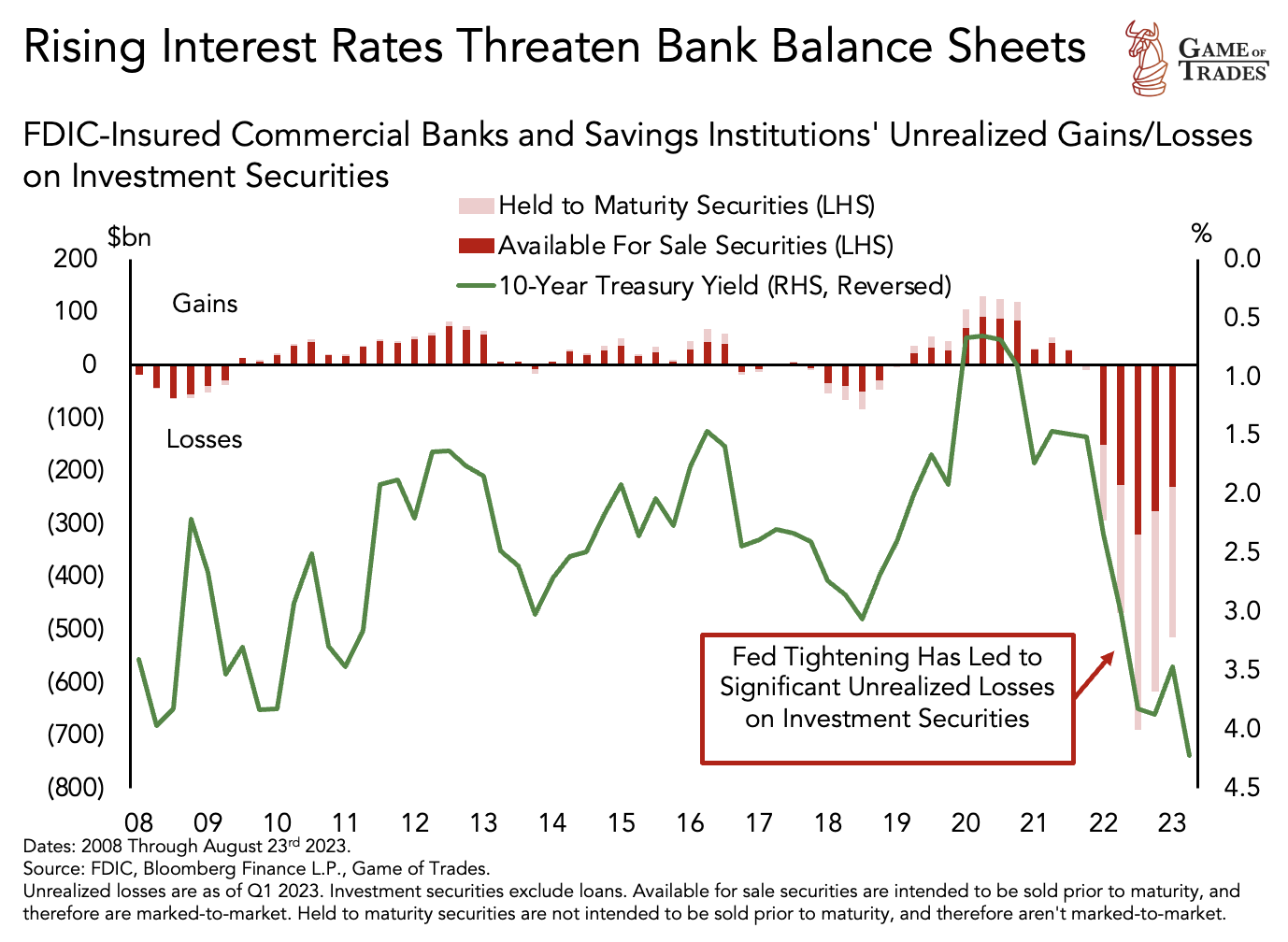

Regional banks, defined as banks with assets under $100 billion, hold a significant proportion of U.S. government Treasury bonds. Over the past couple of years, these bonds have experienced a significant depreciation due to rising inflation and interest rates. This has resulted in regional banks carrying $700 billion in unrealized losses, an issue that continues as bonds persist in their downward trajectory.

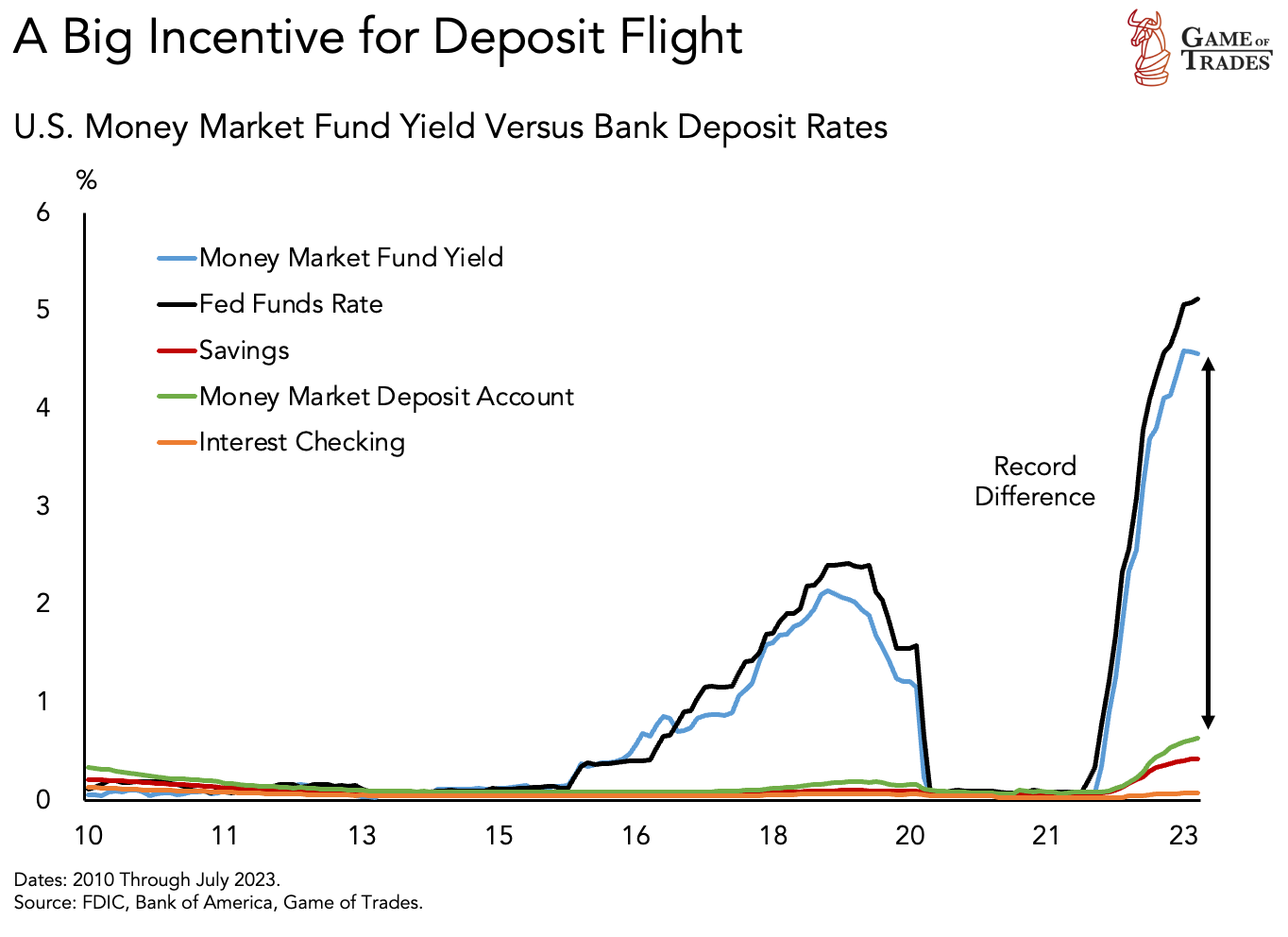

Another impending threat was a nationwide bank run due to deposit flight. The Federal Reserve’s decision to hike rates in 2022 to control inflation triggered an increase in money market fund (MMF) yields, while bank savings account yields remained low. This widened the spread and instigated a deposit flight.

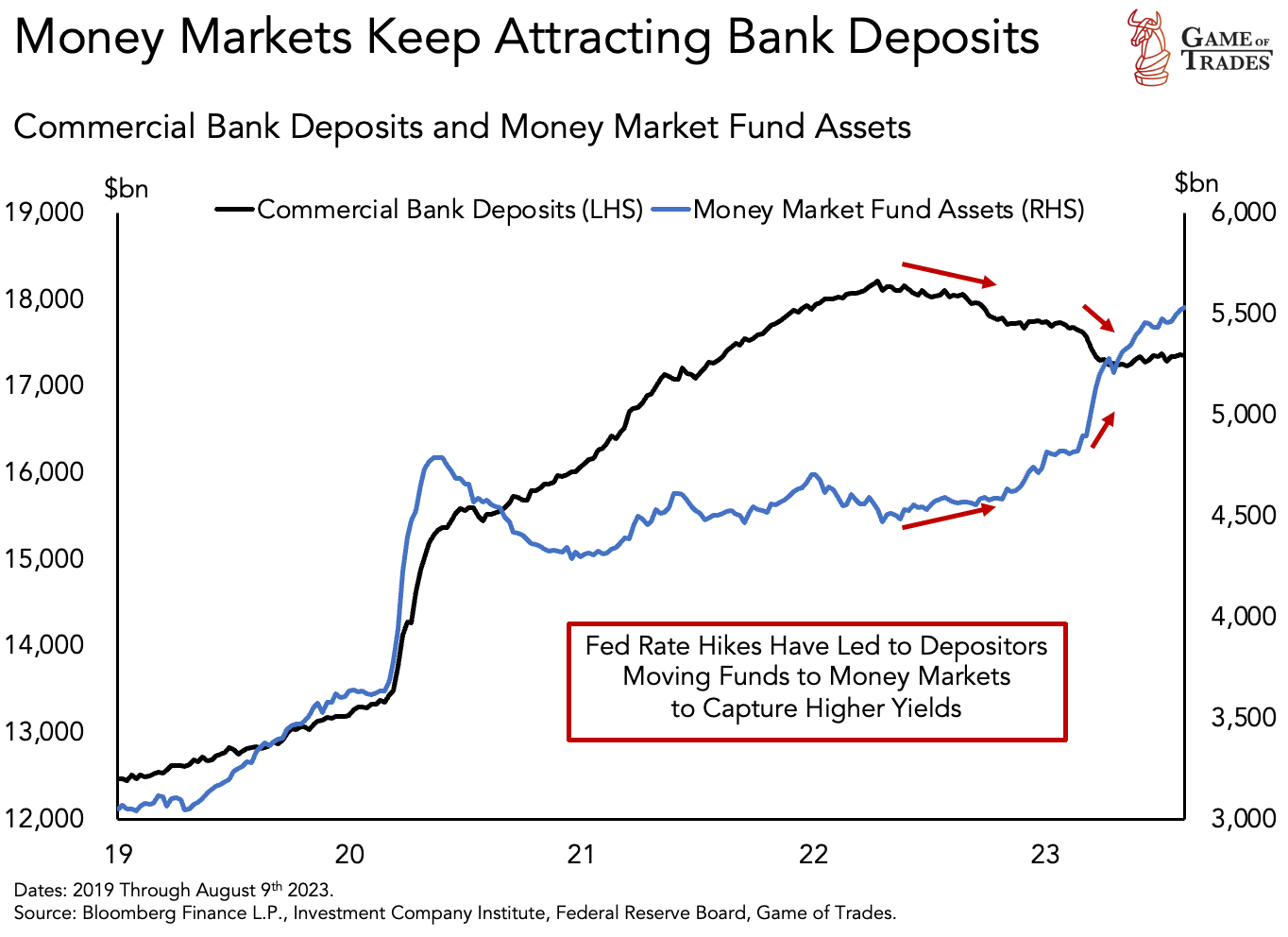

Signs of this phenomenon are evident in the decline in commercial bank deposits and the rise in MMF assets throughout 2022 and 2023. In response to this crisis, the Federal Reserve intervened by injecting around $100 billion liquidity into struggling banks through the Bank Term Funding Program (BTFP) in 2023.

Federal Reserve Intervention and its Aftermath

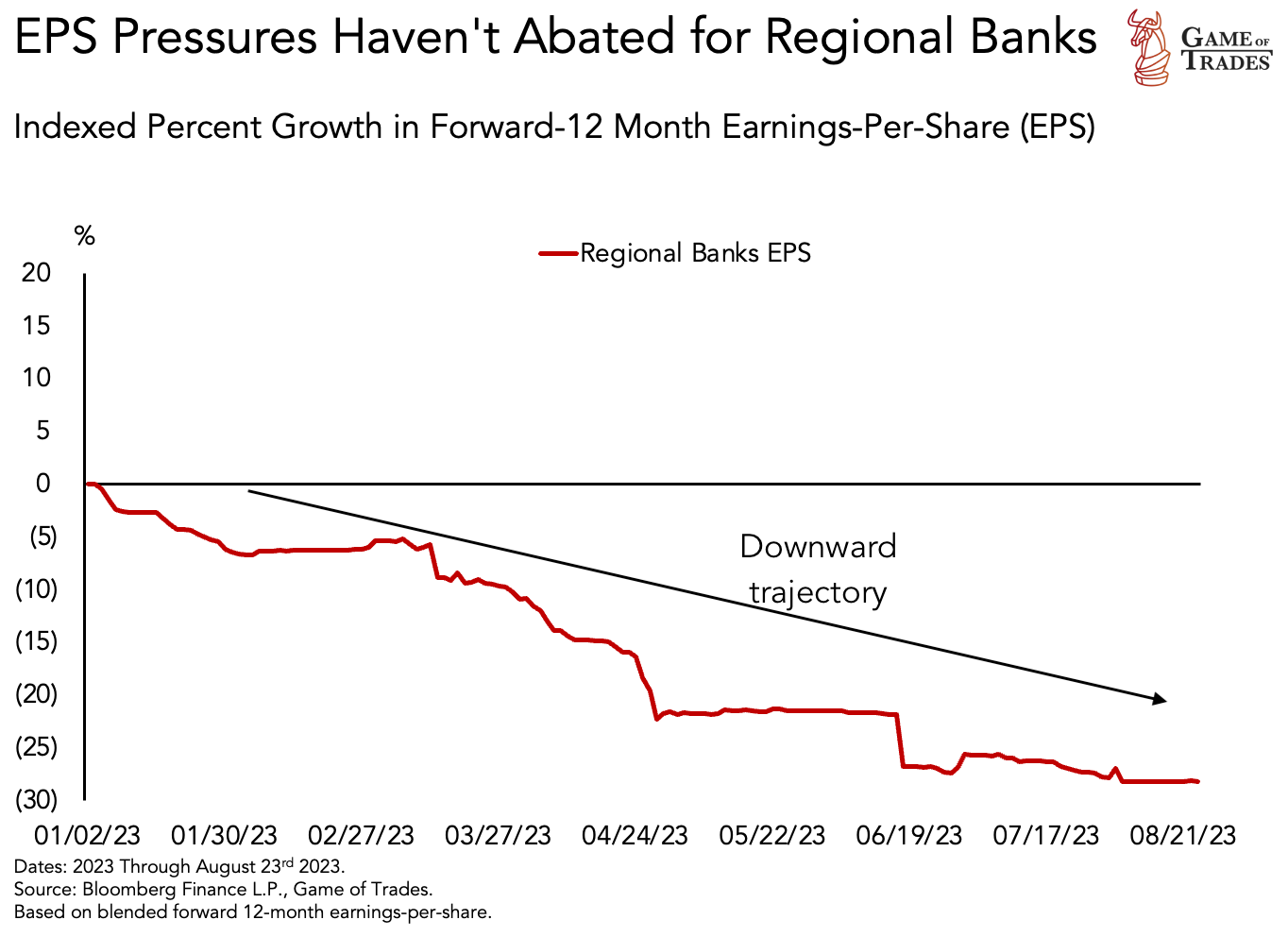

The intervention soothed depositor concerns, slowed deposit flight, and initiated a $KRE rally. Yet, despite these efforts, regional banks find themselves under pressure again today. Regional bank earnings have been on a downward trajectory since the beginning of 2023, and the Fed’s efforts to quell bank run concerns did little to alleviate the burden of high interest rates.

The Threat of Commercial Real Estate (CRE) Loans

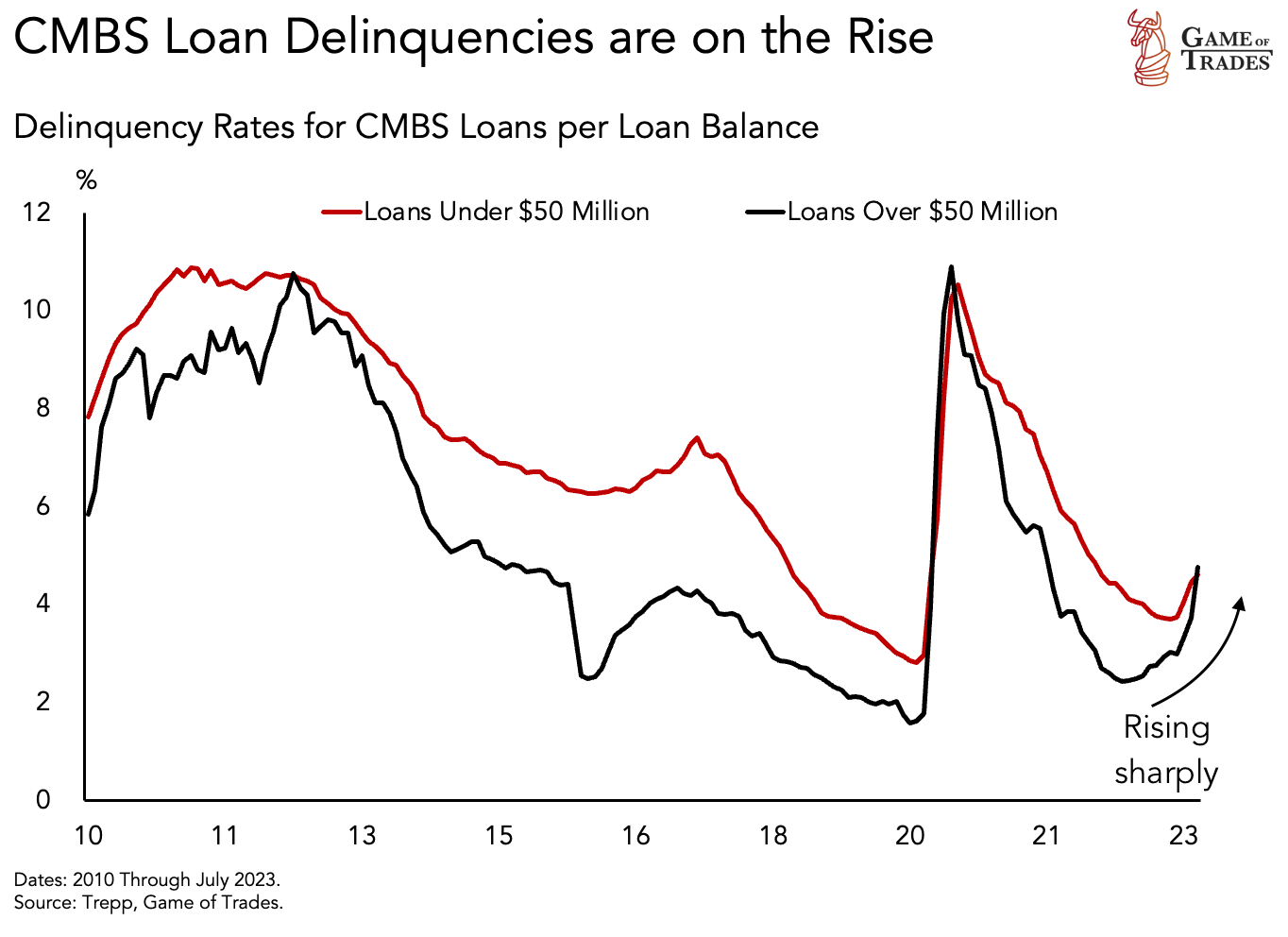

A major looming threat for these banks is their high exposure to Commercial Real Estate (CRE) loans. Smaller banks hold the highest concentration of these loans, and with default rates on CRE loans increasing sharply since 2022, it indicates businesses purchasing CRE, such as office spaces, are struggling to generate sufficient income to repay their loans.

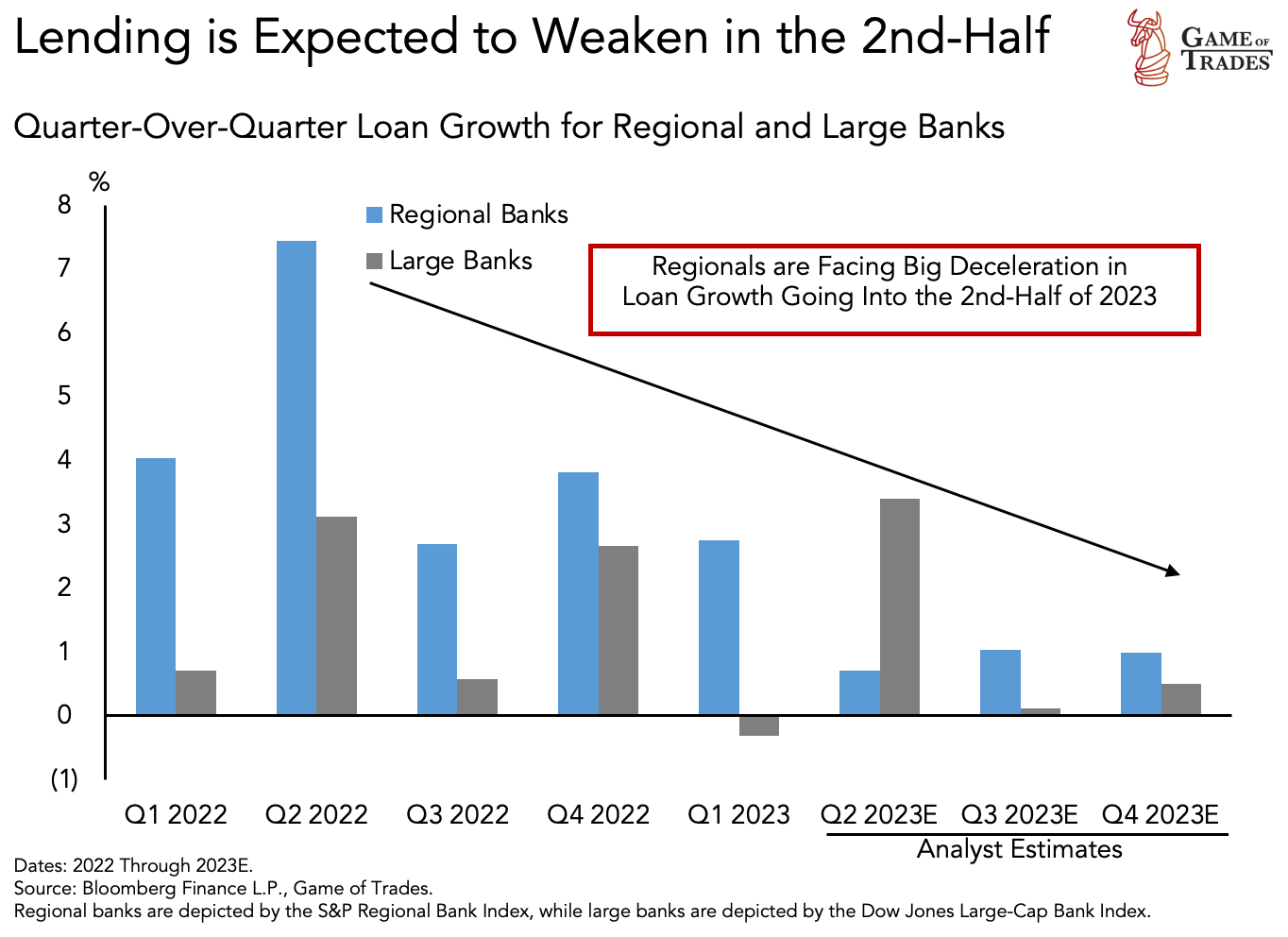

The majority of these CRE loans are due in 2024 and 2025, suggesting a further rise in the default rate. While this situation is unlikely to incite a full-blown banking crisis like in 2008, it will force banks to tighten lending standards and reduce loan disbursements. The quarterly loan growth of regional banks is projected to decrease significantly heading into the end of the year, relative to 2022.

Conclusion

In a credit-based economy, lower levels of lending translate into lower economic growth. These challenging times highlight the importance for investors to have a properly diversified and actively managed portfolio to mitigate steep market drawdowns. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Decoding the S&P 500 Earnings Yield: What History Tells Us