As the American economy continues to evolve, it is crucial to assess the state of personal finances and their potential impact on the broader financial landscape. This article delves into the concerning trends in savings, debt levels, and economic vulnerability that are prevalent among Americans today. From the dwindling savings rates to the staggering increase in consumer debt, we examine the factors contributing to these challenges and their potential consequences for individuals, the economy, and financial markets

Declining Savings and Financial Strain

A recent study revealed that only 39% of Americans have enough savings to cover a $1,000 emergency expense, highlighting the precarious financial situation faced by many individuals. Surprisingly, even among those earning $150,000 or more annually, one-third are living paycheck to paycheck and rely on credit cards to make ends meet. This underscores the widespread financial strain experienced across income brackets.

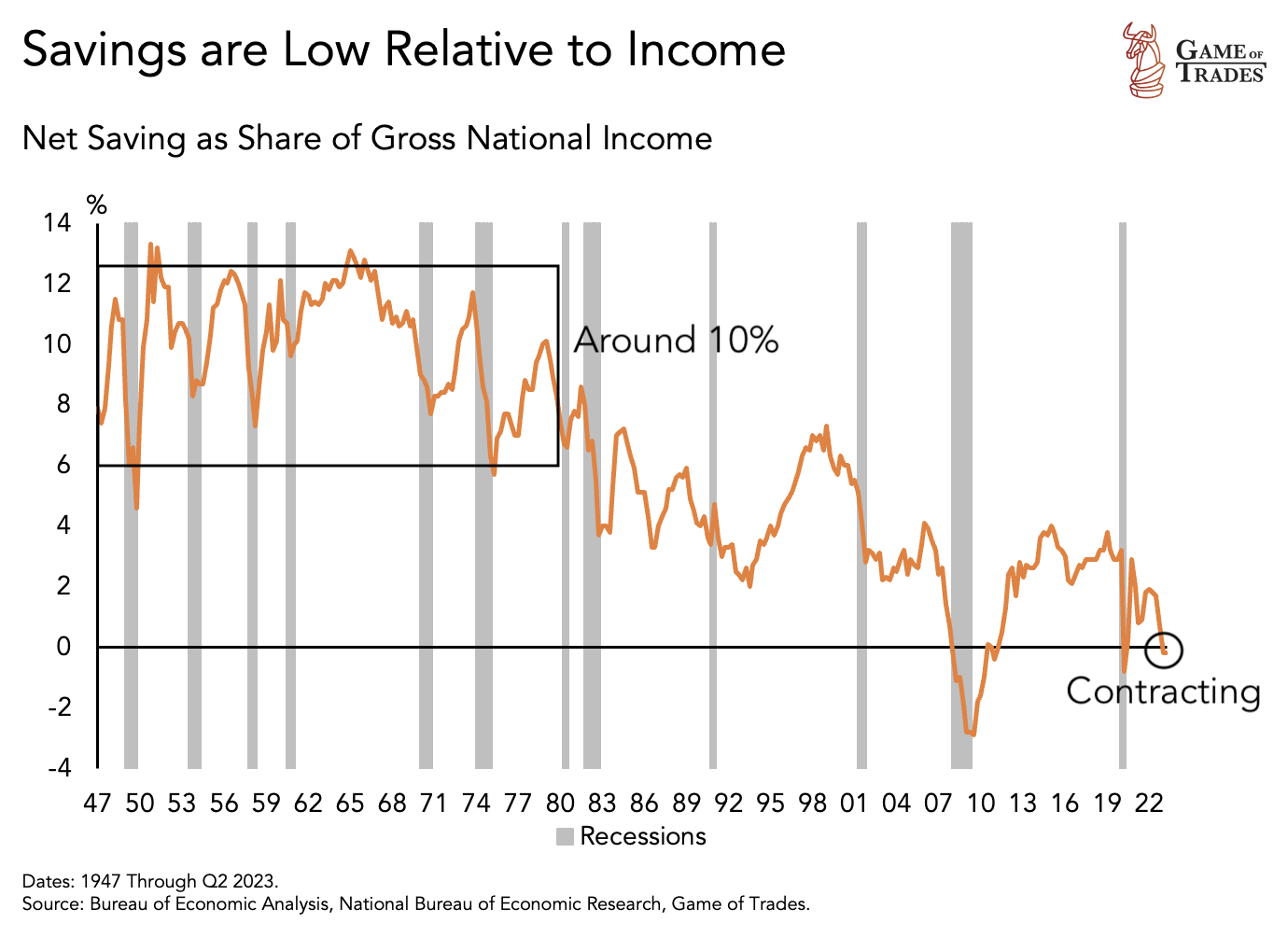

Historically, Americans saved around 10% of their income annually from the 1940s to the 1970s. However, in recent years, this savings metric has been contracting, indicating a concerning trend of spending more than earning. The decline in savings relative to income signifies a growing challenge in building financial security and preparing for the future.

Soaring Consumer Debt Levels

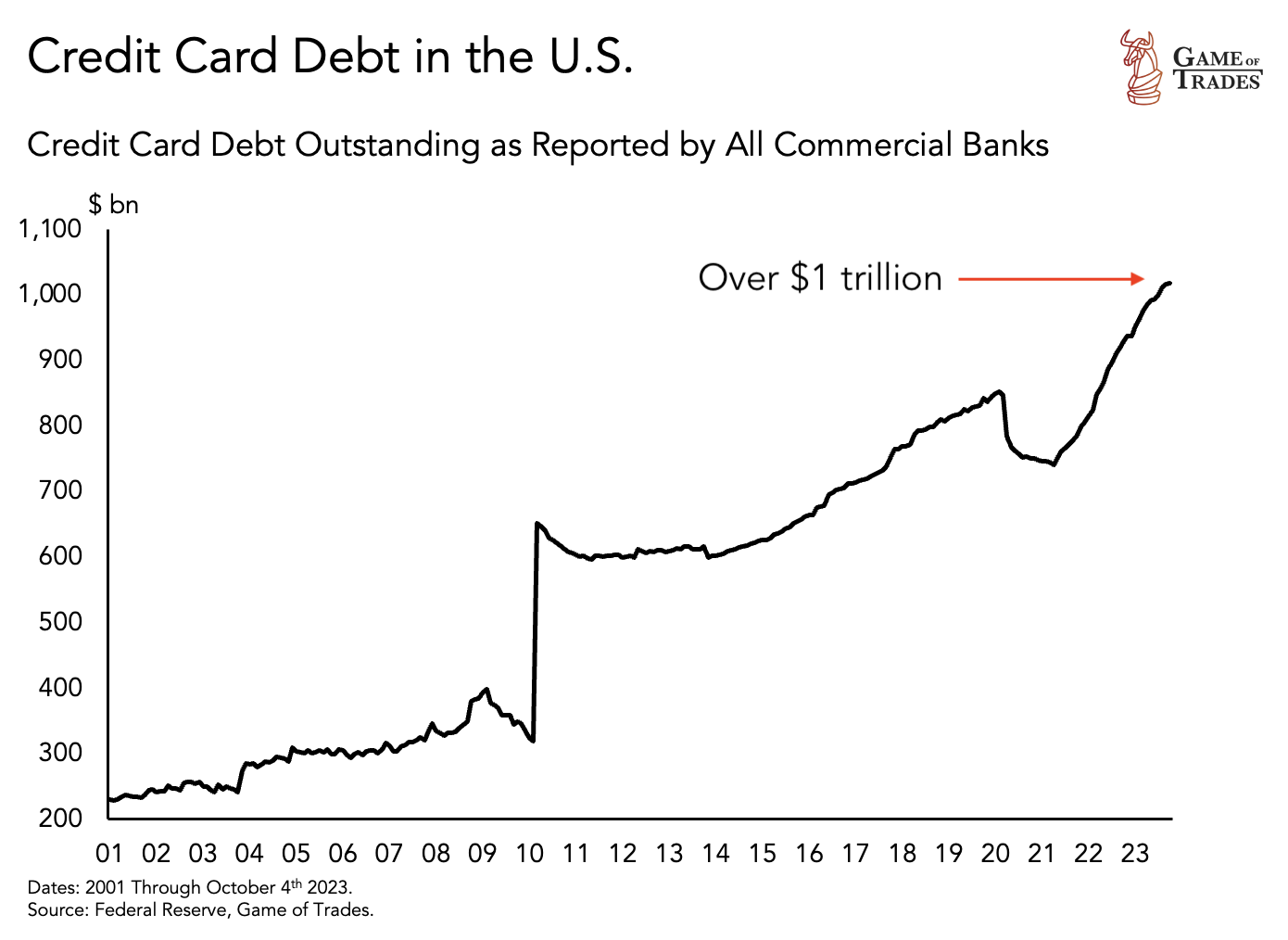

The accumulation of credit card debt has reached alarming levels in the United States. Americans now owe over $1 trillion in credit card debt, doubling the amount from a decade ago. However, it is crucial to note that credit card debt represents only a fraction of the total consumer debt burden.

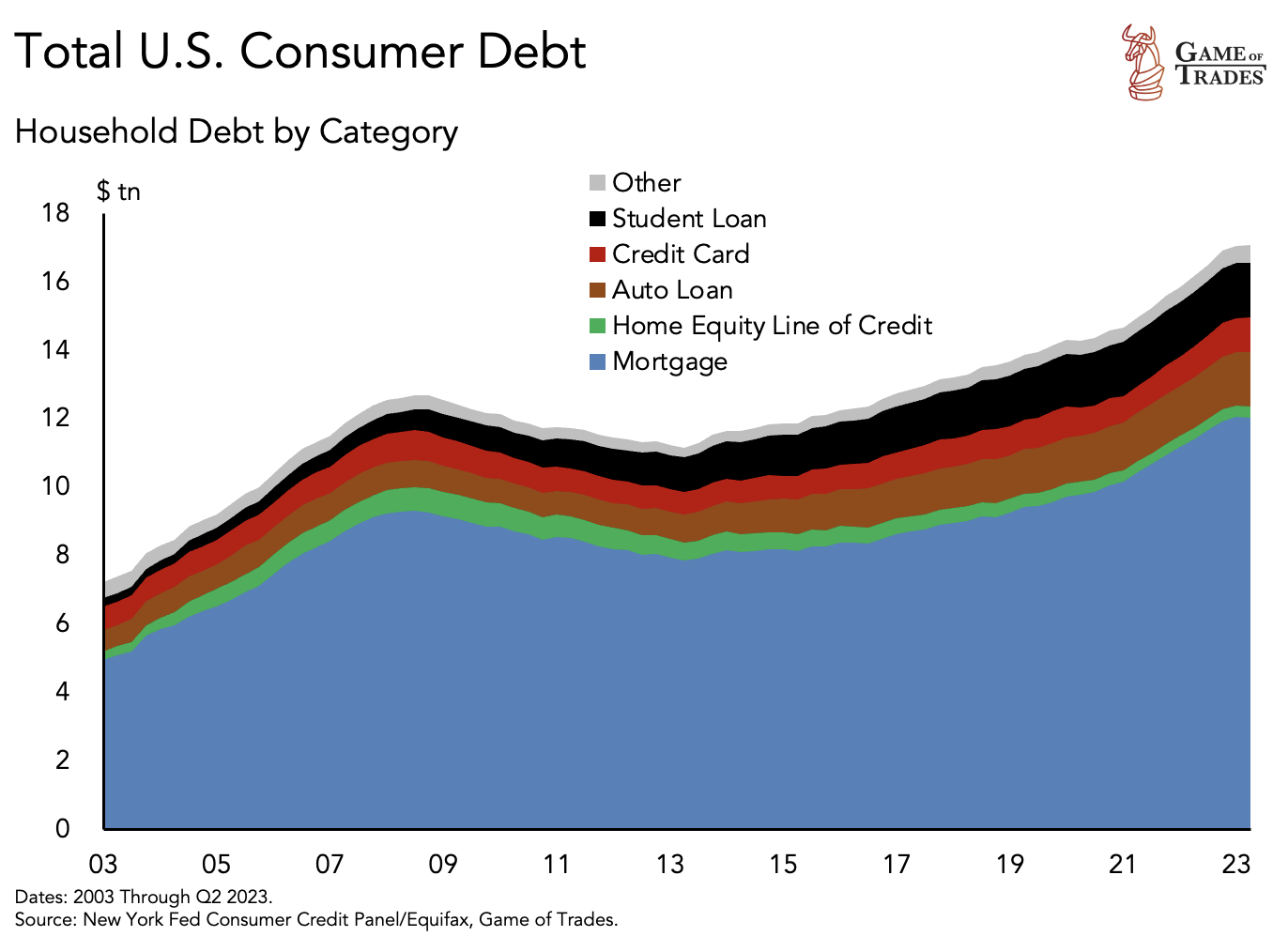

In 2023, total consumer debt reached a staggering $17 trillion, with mortgages constituting a significant portion. The increase in mortgage debt was a key factor behind the 2008 Financial Crisis. While mortgage debt has come down substantially relative to total household debt since then, rising home prices and high mortgage rates have contributed to housing unaffordability.

Financial Struggles and Vulnerability

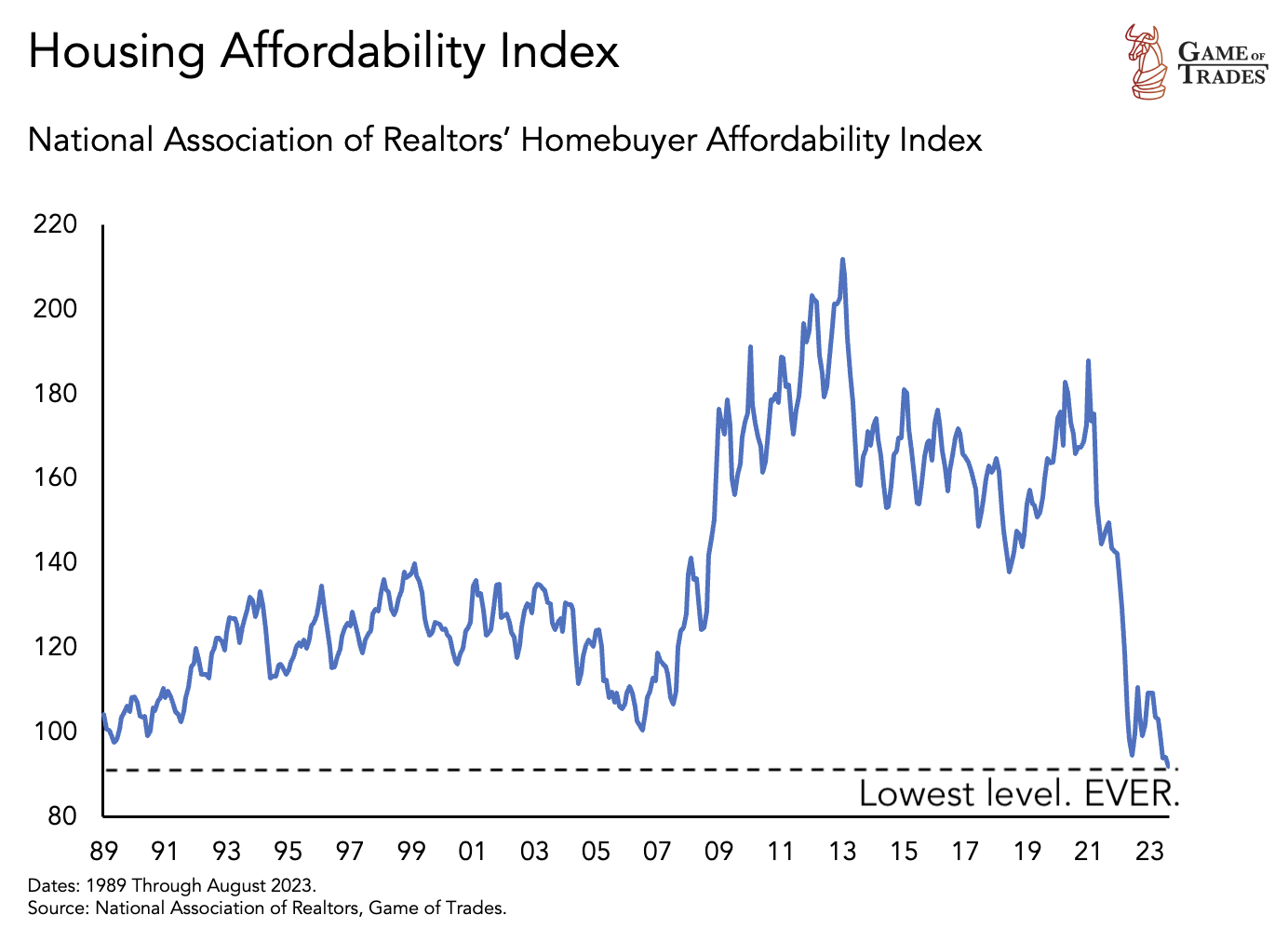

The housing affordability index is currently at its lowest levels since the 1980s, indicating a significant challenge for prospective homebuyers. Rising home prices, nearly doubling since 2012, coupled with mortgage rates at 20+ year highs, have made home purchases extremely expensive. This adds to the financial strain experienced by many Americans.

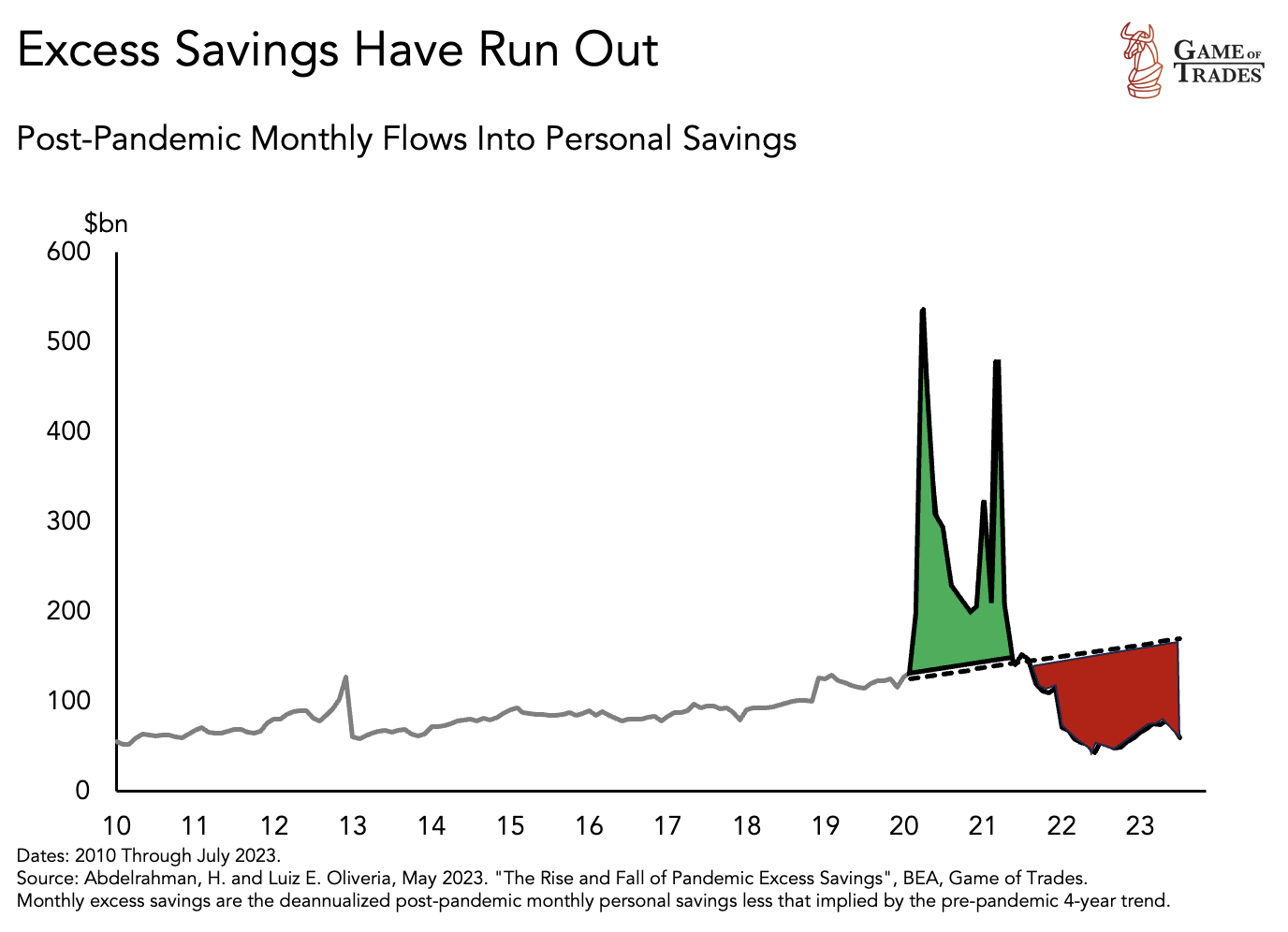

The economic impact of the COVID-19 pandemic has left many individuals struggling to make ends meet. As a result, numerous people have depleted their post-pandemic savings, exacerbating their financial vulnerability.

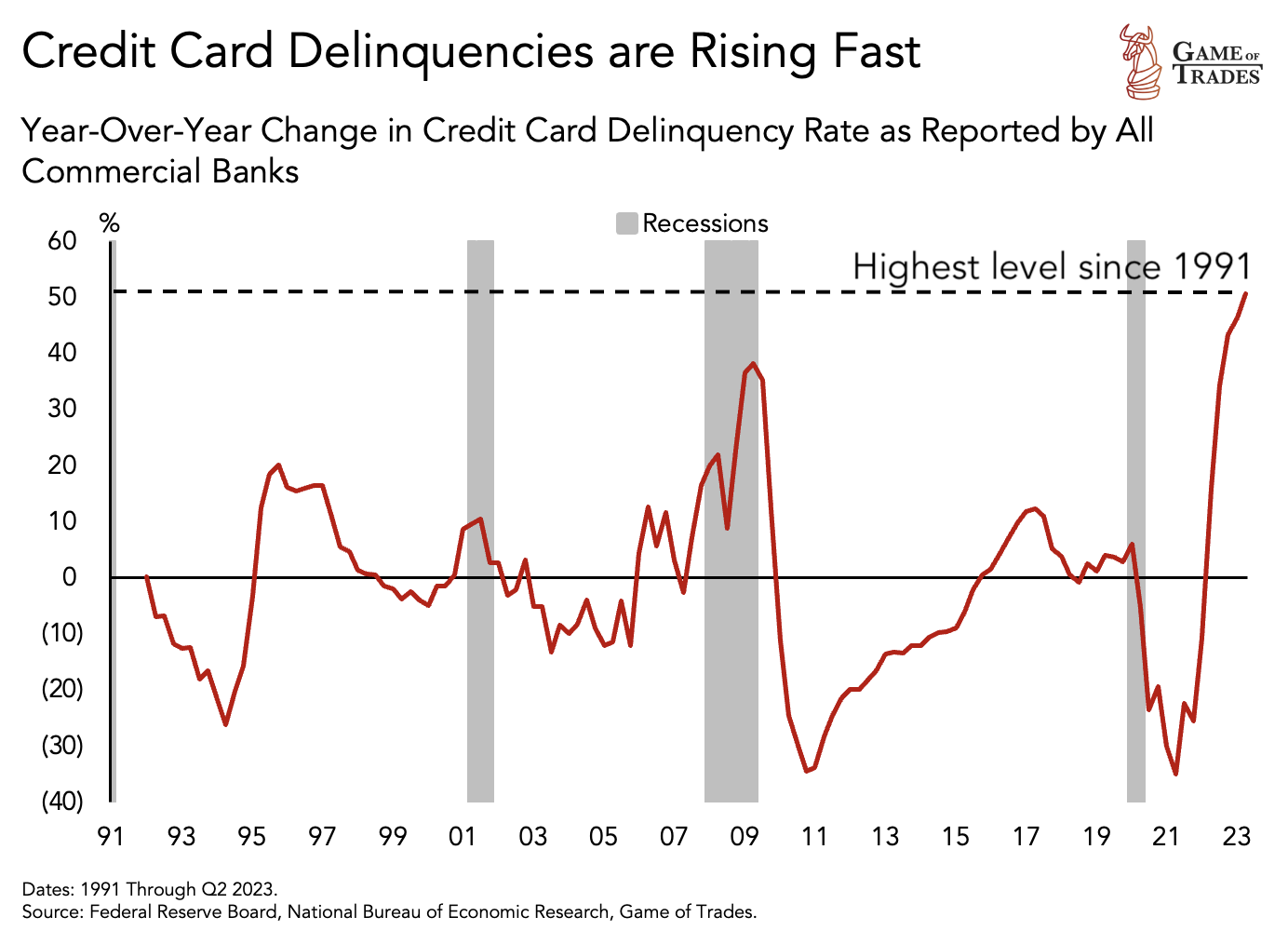

Escalating Credit Card Debt and Defaults

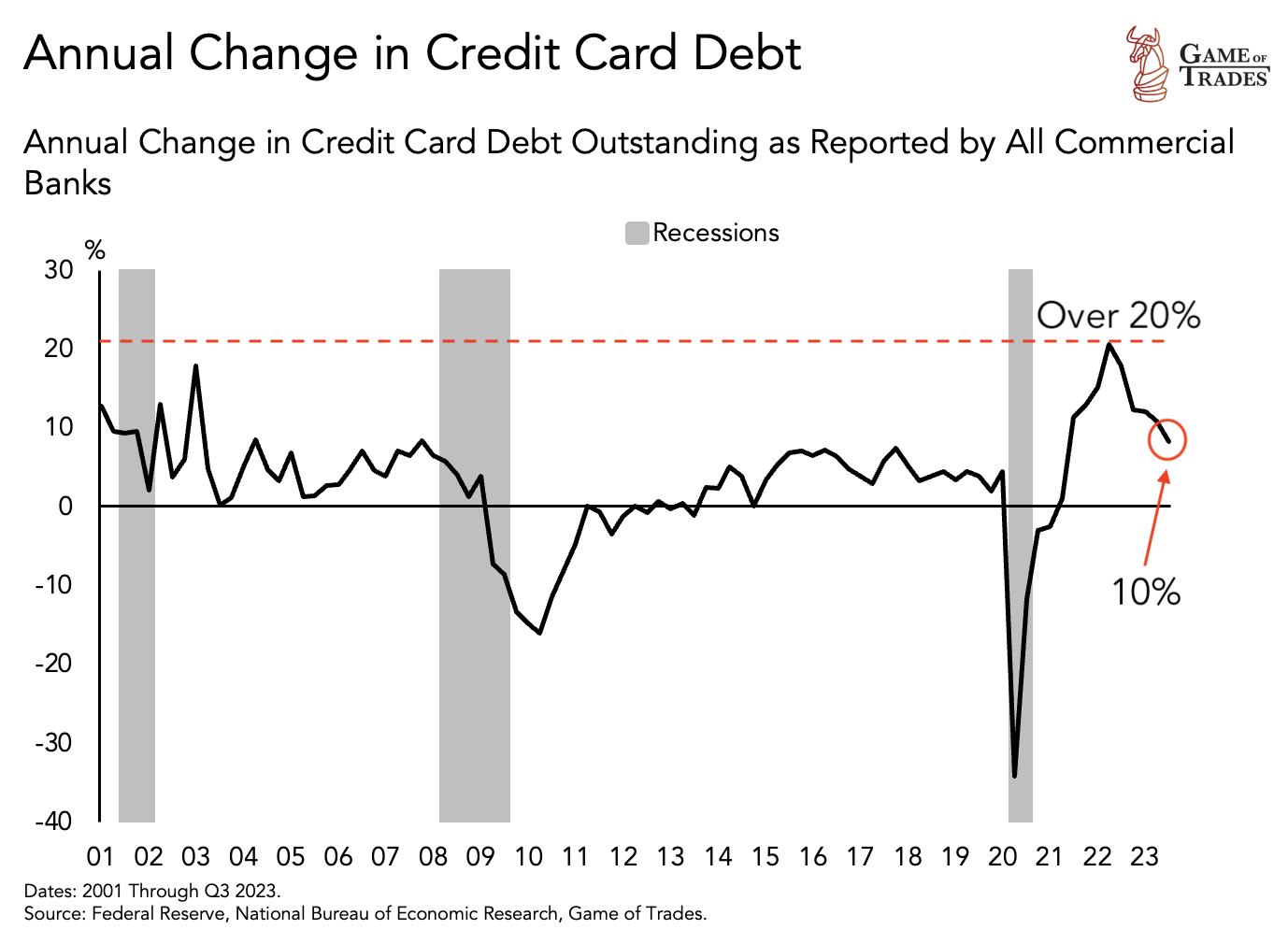

Over the past two decades, there has been a significant increase in credit card debt accumulation. In the last year alone, the yearly change in credit card debt rose by over 20%, marking the largest increase since 2000. This trend is currently continuing with a growth rate of 10%.

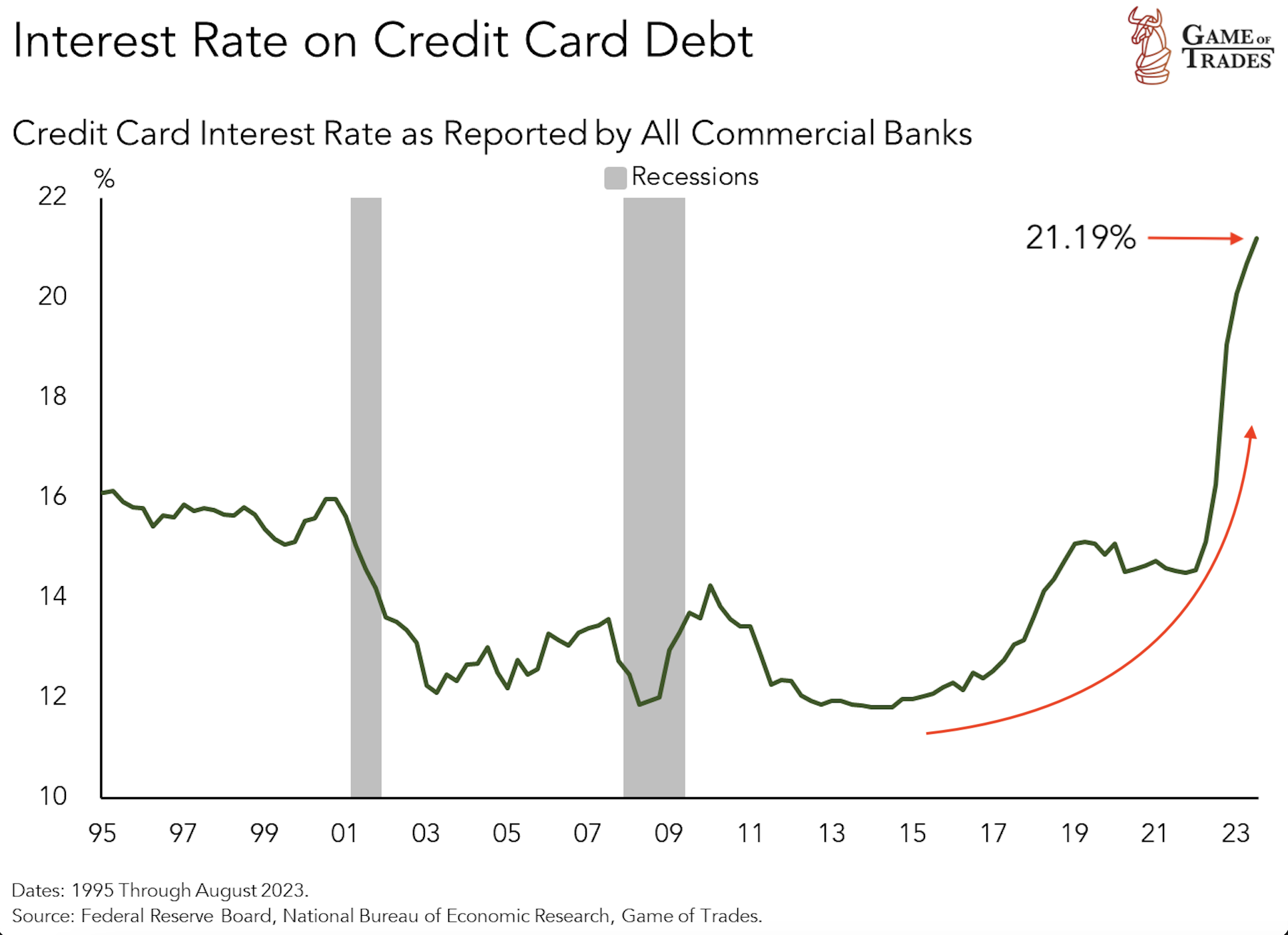

Credit card interest rates have reached their highest level ever, surpassing 21%. Compared to 2014 when rates were at 12%, it is now almost twice as expensive to carry credit card debt. These elevated rates contribute to the financial burden faced by individuals, making it even more challenging to escape the cycle of debt.

Credit card interest rates have reached their highest level ever, surpassing 21%. Compared to 2014 when rates were at 12%, it is now almost twice as expensive to carry credit card debt. These elevated rates contribute to the financial burden faced by individuals, making it even more challenging to escape the cycle of debt.

Economic Vulnerability and Future Outlook

Consumer behavior has undergone a radical shift, as evidenced by the rapid growth of the Buy Now Pay Later market. Within just three years, this market has expanded from $1 billion to $6 billion, indicating a growing reliance on credit for immediate purchases.

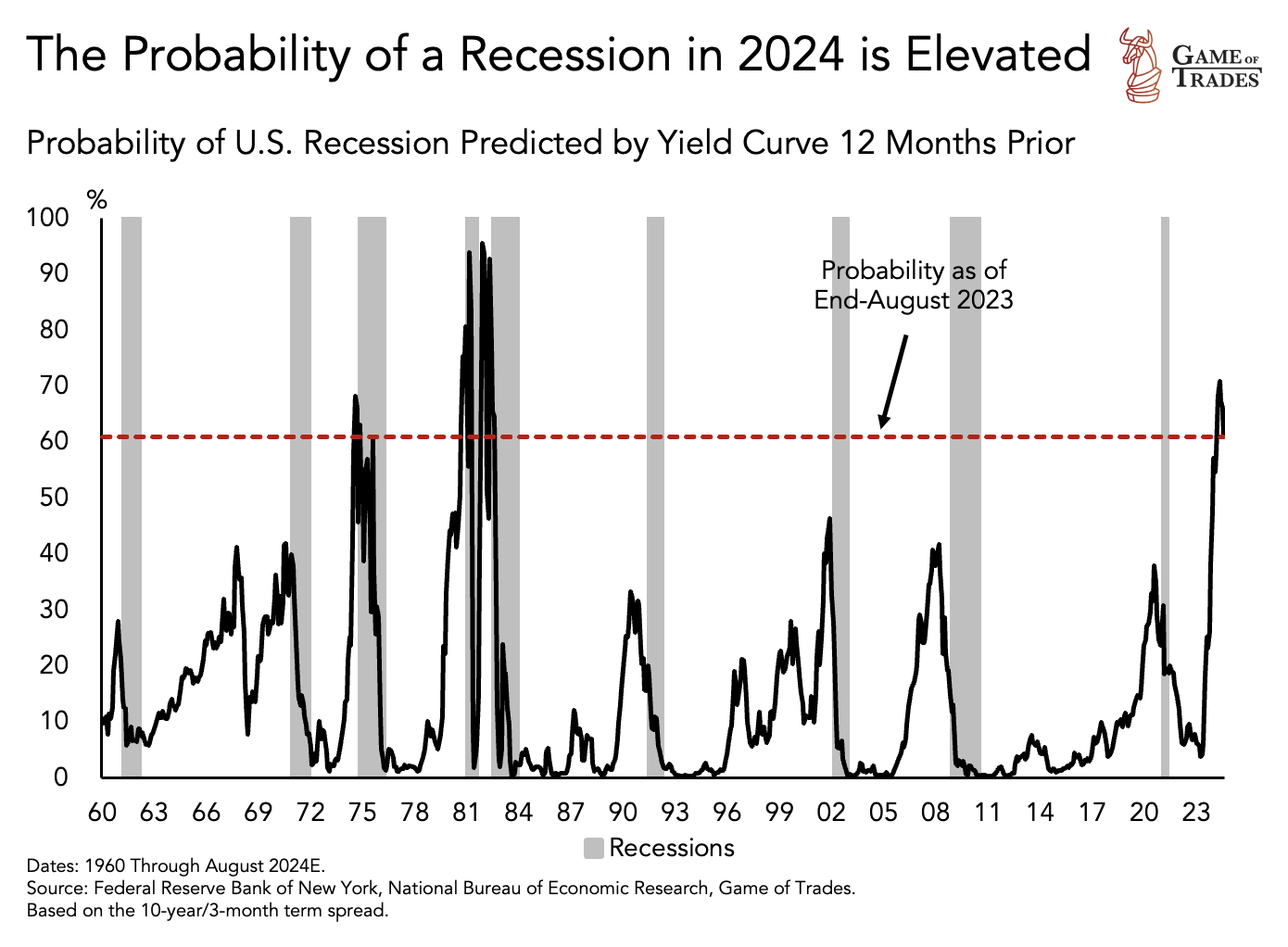

Considering the rising debt levels, diminishing savings, and economic vulnerability, the ability of Americans to withstand a future recession is doubtful. The probability of a recession, predicted by the yield curve, stands at around 60%. Historically, such levels have often resulted in sharp economic downturns. In the event of a recession, the government may need to print more money to mitigate economic volatility, further exacerbating the existing spending problem and triggering long-lasting negative effects in the economy and financial markets.

Conclusion

The state of American finances presents a worrisome landscape characterized by declining savings rates, escalating consumer debt levels, and increasing economic vulnerability. With only a fraction of Americans prepared for emergencies and a significant portion relying on credit cards to make ends meet, the financial strain is evident. As debt accumulates and savings dwindle, the potential for economic repercussions looms, emphasizing the need for individuals and policymakers to address these challenges and promote financial resilience. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: U.S. Government Spending, Debt, and its Implications for the Economy