The Fed’s ability to raise interest rates without triggering a recession has been a topic of discussion among economists and investors. Some argue that history shows a strong correlation between rate hikes and economic downturns. However, there have been instances when interest rate increases did not lead to a recession, resulting in what is known as a “soft landing.” In this article, we look at the historical data to calculate the likelihood of a recession following interest rate hikes by the Fed. By examining these patterns, we can gain valuable insights into the current economic landscape.

Examining the Historical Data

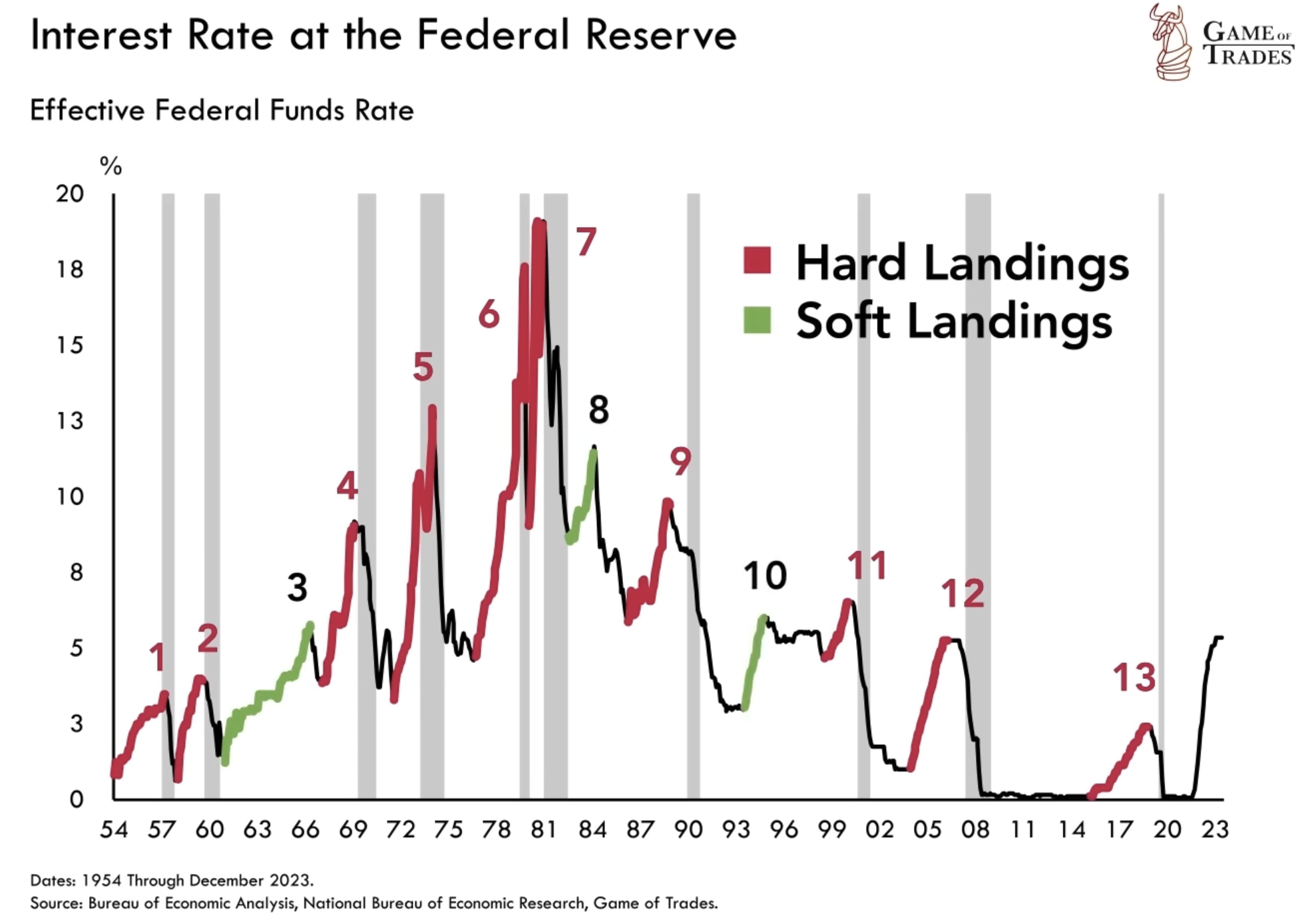

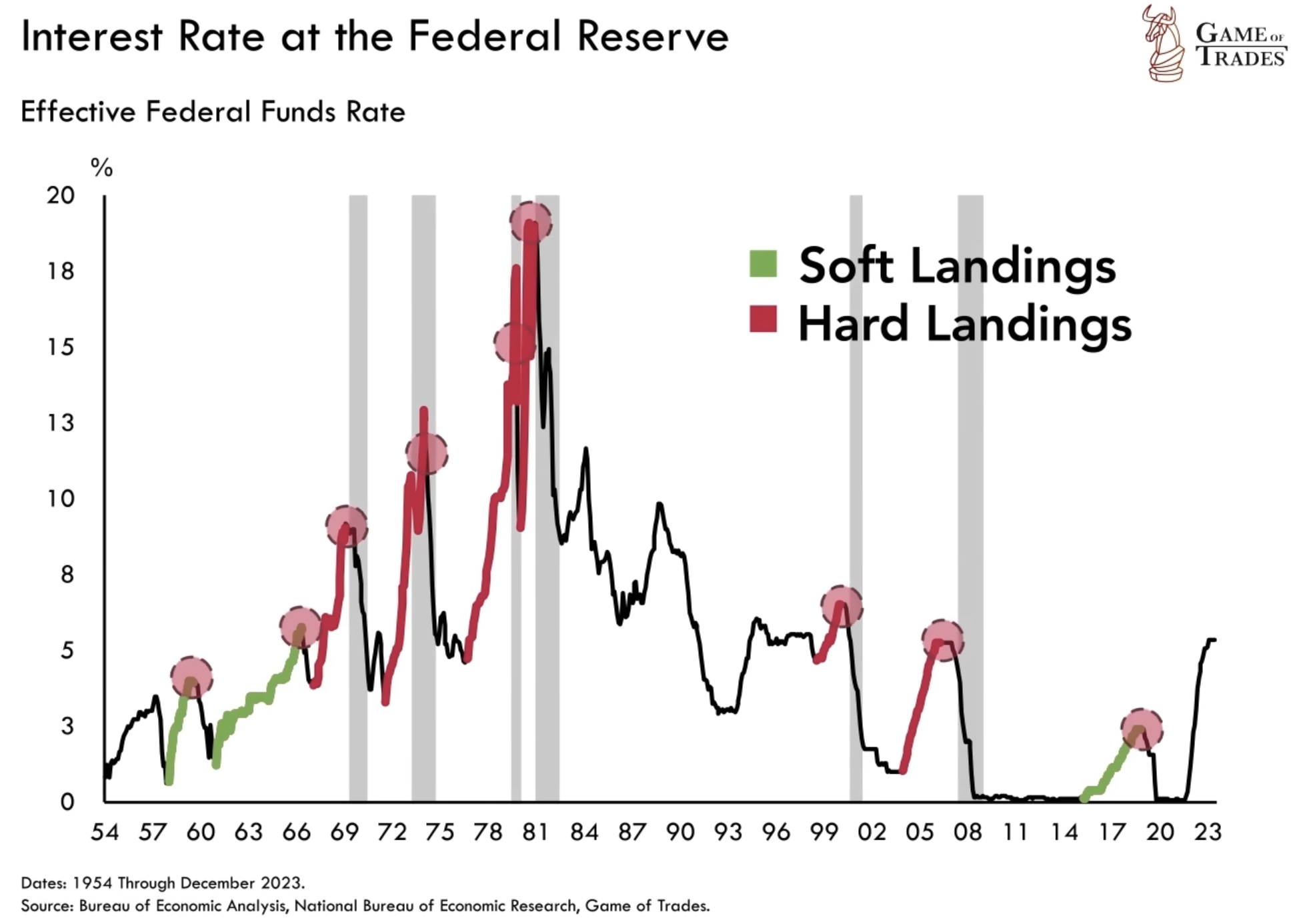

To thoroughly examine the relationship between increases in interest rates and economic recessions, we will delve into a comprehensive analysis of the tightening cycles that have been set in motion by the Fed since as early as 1955. Throughout the course of these 13 distinct cycles, an overwhelming majority of 10 of them were subsequently followed by recessions, signifying the impact that interest rate hikes have had on the economy. However, it is worth noting that in a few exceptional cases, specifically 3 cycles, a soft landing was achieved instead. By taking into account this historical data, we can deduce that there exists a considerable 77% probability of experiencing a hard landing in the wake of interest rate hikes.

The Impact of External Factors

It is crucial to consider external factors that might have influenced recessions during past tightening cycles. For instance, the COVID-19 pandemic in 2020 led to a sudden economic downturn, making it unfair to attribute the recession solely to the Fed’s rate increases. Similarly, in the 1989 tightening cycle, the Fed stopped raising rates in March 1989, but the recession began in August 1990. The recession was likely triggered by the Kuwait oil shock, which caused a significant increase in oil prices, negatively impacting the overall economy. Therefore, in order to be fair, these 2 episodes can be considered as having a potential for a soft landing if it weren’t for the other external factors at play.

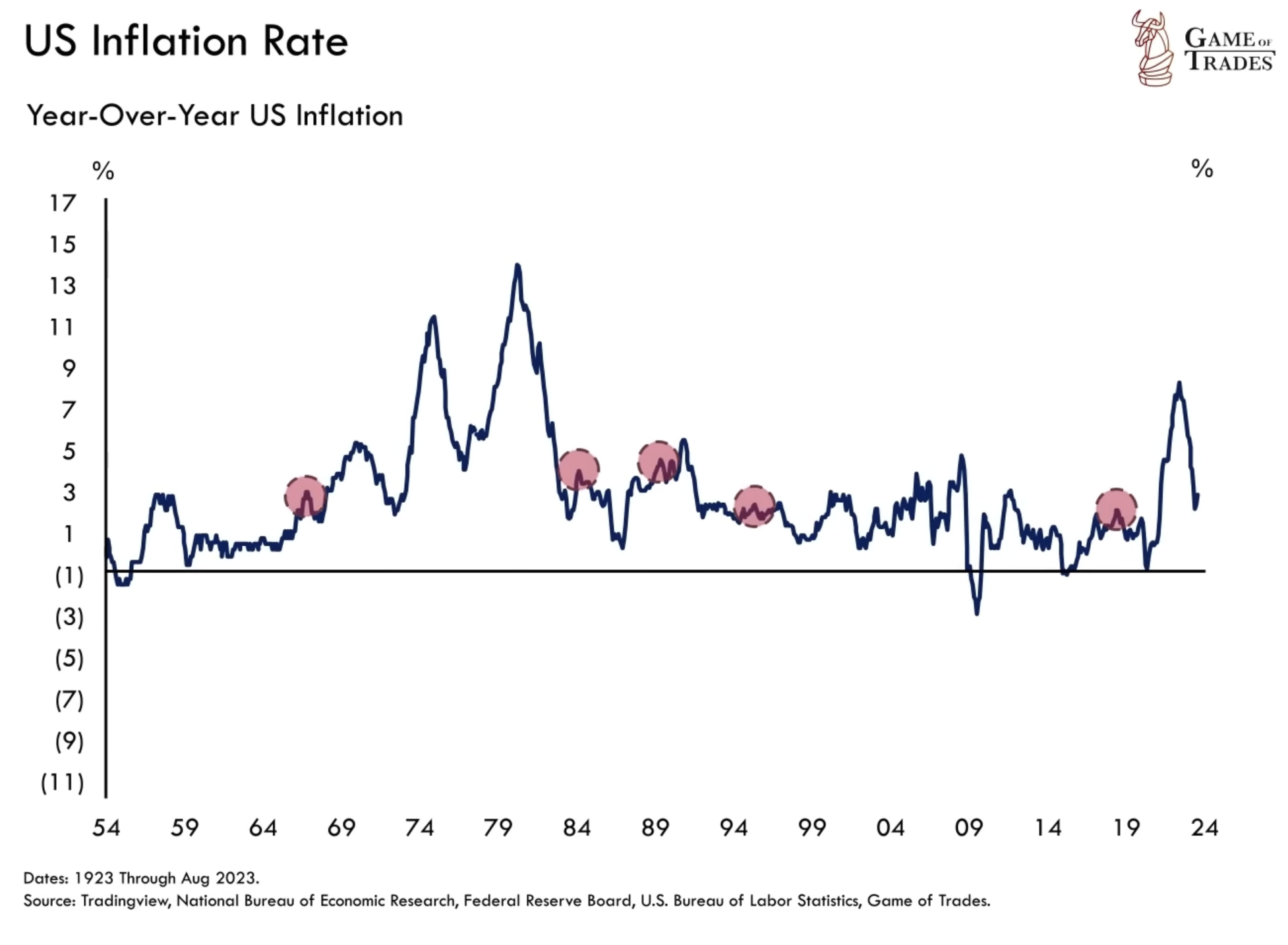

Low Inflation and Stable Economic Conditions

An interesting observation is that all the episodes resulting in soft landings or with a soft landing potential occurred when inflation was low and stable. This suggests that when inflation is well-contained and kept at a low level, it allows the Fed to have more flexibility in its monetary policy. With low inflation, the Fed can focus on achieving maximum employment without resorting to aggressive interest rate hikes. By maintaining stable economic conditions, the Fed increases the chances of successfully implementing rate increases without causing disruptions to the economy. These instances provide valuable insights into the importance of stable economic conditions in determining the outcome of rate increases.

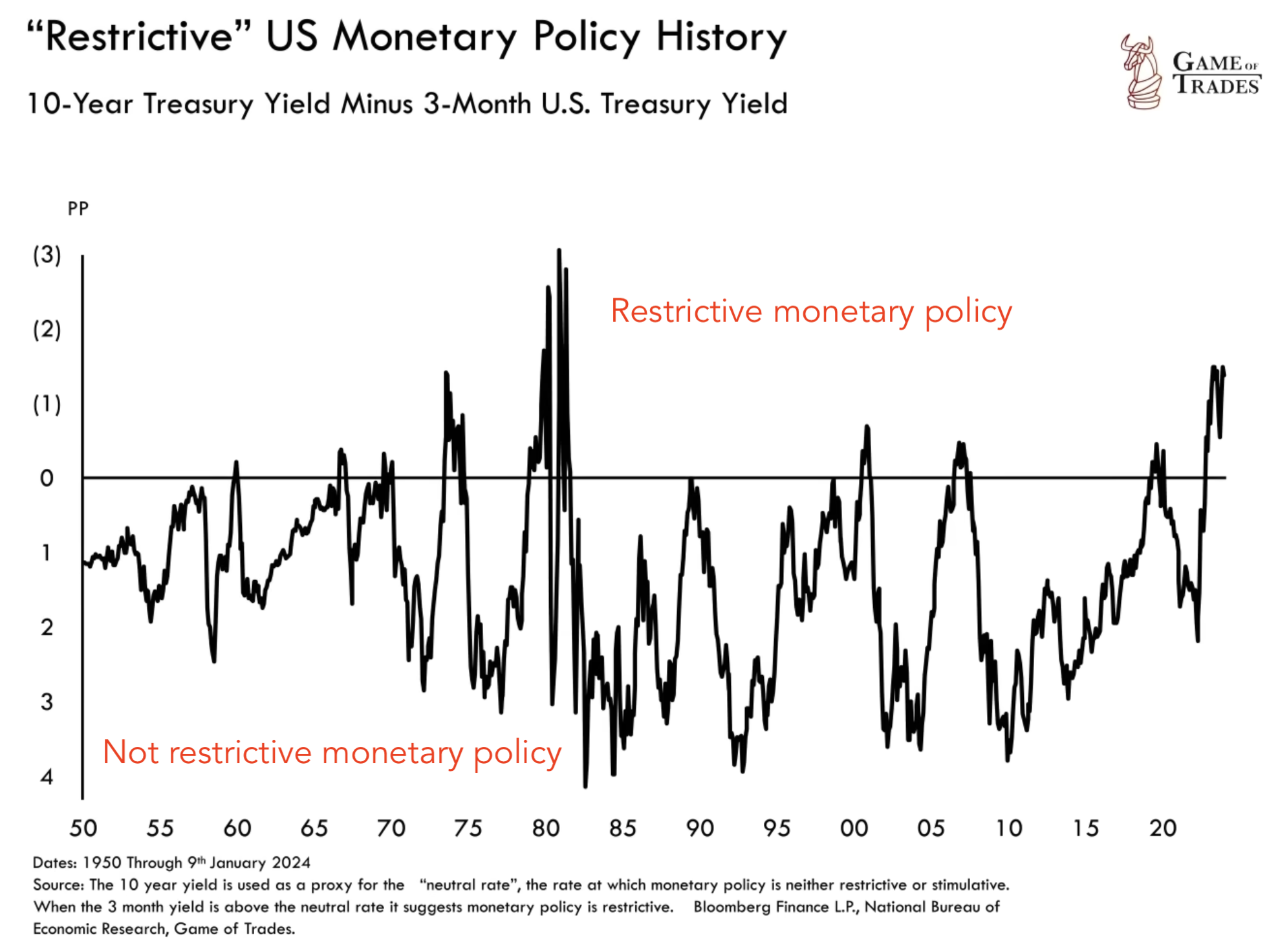

Restrictive Monetary Policy and Economic Consequences

A restrictive monetary policy occurs when the Fed decides to increase interest rates above long-term interest rates. This tightening of monetary policy is aimed at addressing specific issues in the economy, such as speculative bubbles or high inflation. The chart below provides a visual representation of the moments when monetary policy becomes restrictive, indicating the periods when the Fed has implemented such policies. Implementing a restrictive monetary policy is a strategic decision made by the central bank to maintain economic stability and prevent the economy from overheating.

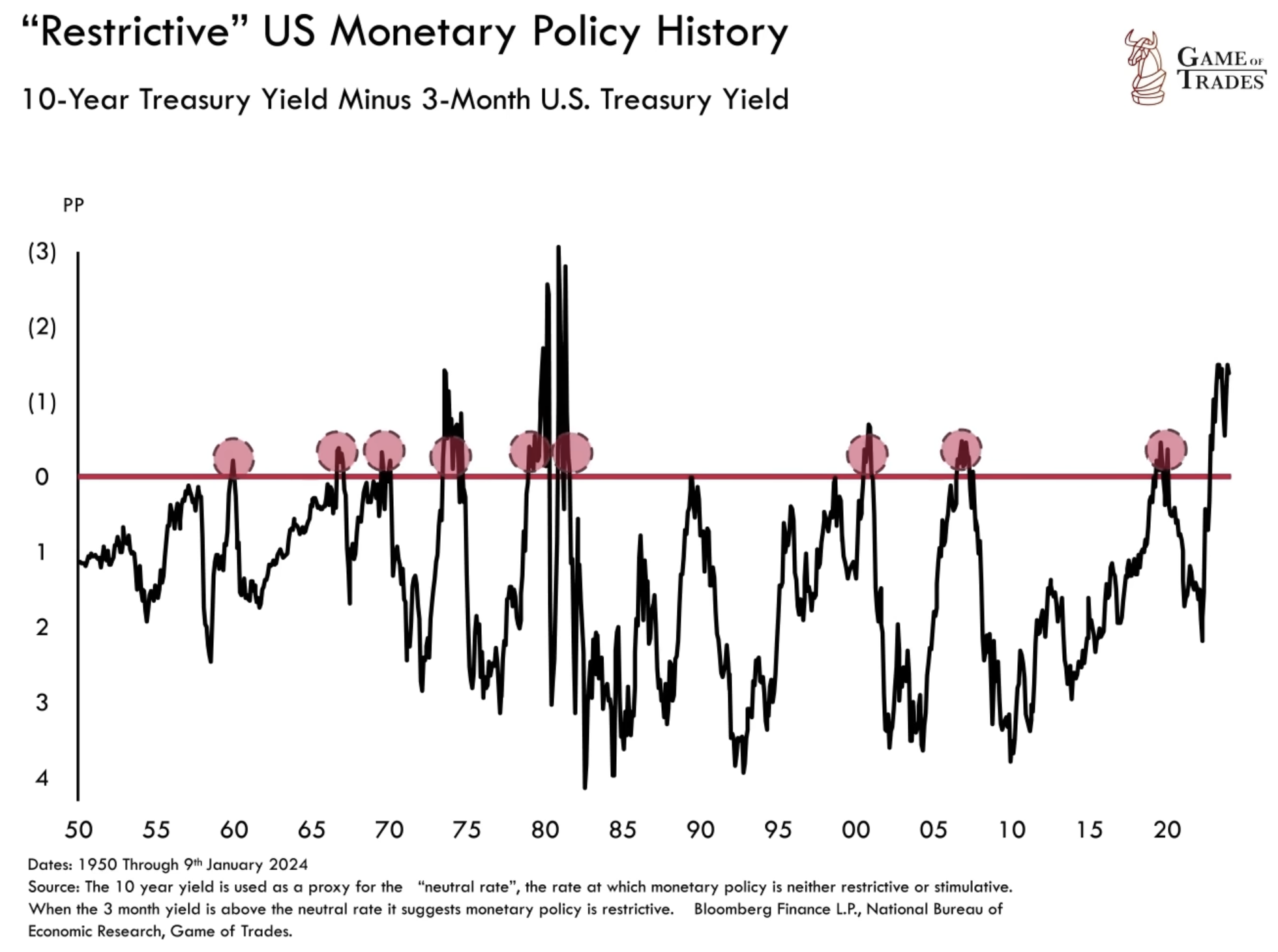

By examining past episodes, we find that there have only been nine instances since the 1950s where monetary policy reached a restrictive stance.

An additional four episodes of rising rates never actually reached a restrictive stance, so they are removed from the study in order to be fair. This leaves us with 9 episodes in total, which contains 3 soft landings and 6 hard landings. Thus, the probability of a hard landing is at 66%.

Considering the Context of Economic Downturns

To accurately assess the likelihood of a recession, it is necessary to examine the context surrounding each episode. For example, while 2001 is considered a hard landing, the recession was relatively mild, and real GDP never dipped into negative territory. The bursting of the technology bubble played a significant role in job losses during that period. Similarly, the housing bubble in 2008 had a substantial impact on the severity of the financial crisis.

Conclusion

Predicting economic crises with certainty is an impossible task due to the multitude of factors at play. Although historical data suggests a 66% chance of a hard landing following interest rate increases, it is crucial to consider the specific context of each episode. Soft landings have occurred when inflation was low and stable, highlighting the importance of economic conditions. Ultimately, successful macro investing involves identifying risk-reward opportunities rather than attempting to predict the future with absolute certainty. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!