The stock market is a complex and dynamic entity that reflects the state of the economy and various underlying factors. Recent trends in the global financial landscape have raised concerns about the potential for a reverse US stock market crash, similar to Argentina’s experience. Additionally, the strength of the US dollar, inflationary pressures, and the relationship between the stock market and the money supply warrant careful examination. This article aims to provide insights into these issues, highlighting the implications for investors and the potential risks involved.

The Argentina Stock Market Surge Amidst Currency Collapse

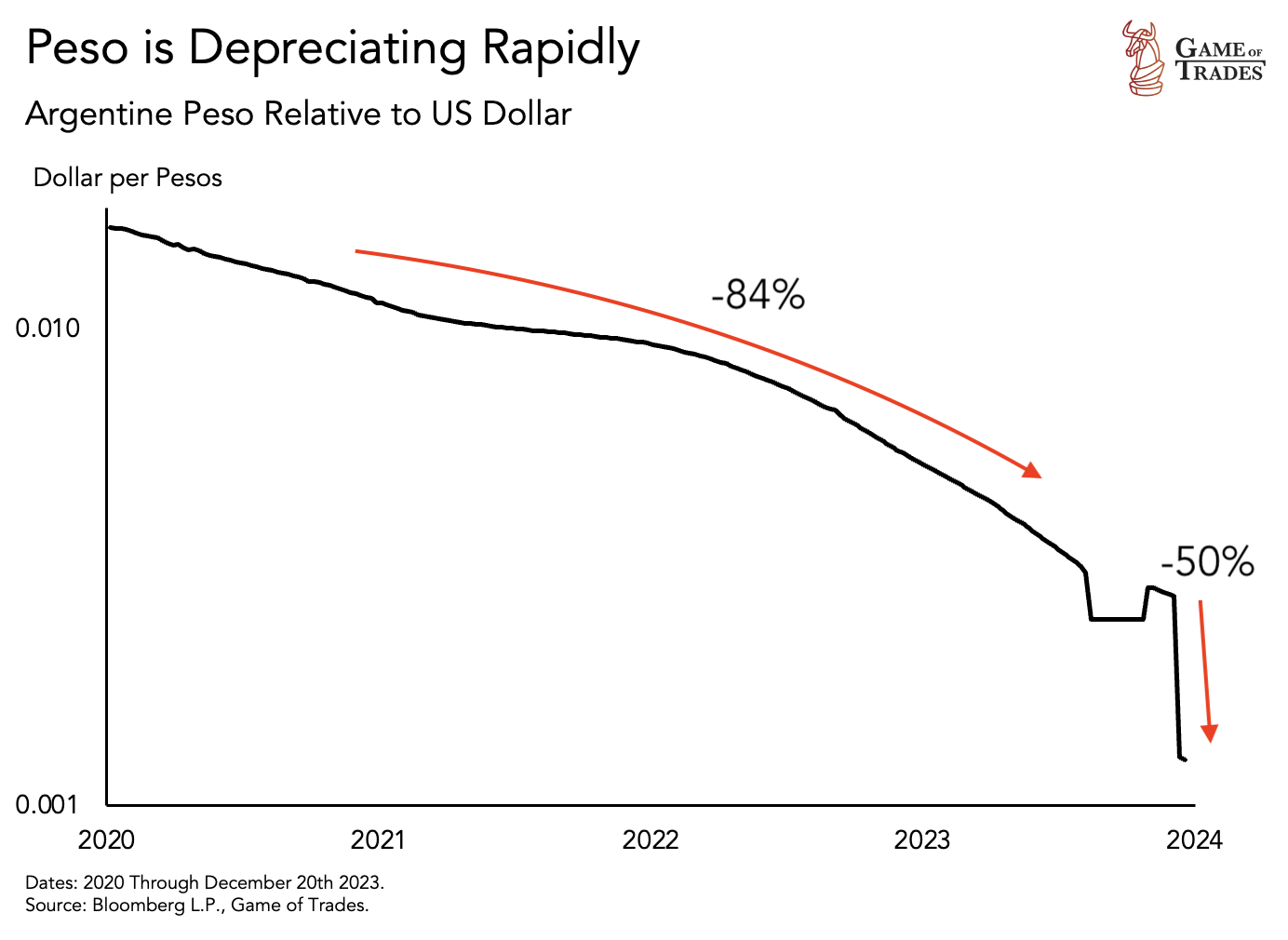

The Argentinian stock market experienced an astonishing surge of 3500% since March 2020. However, this growth is not indicative of a booming economy but rather the result of the collapse of the Argentine Peso. The currency lost 84% of its value against the US dollar, with an additional 50% devaluation recently. This situation underscores the importance of understanding the role of currency devaluation in stock market performance.

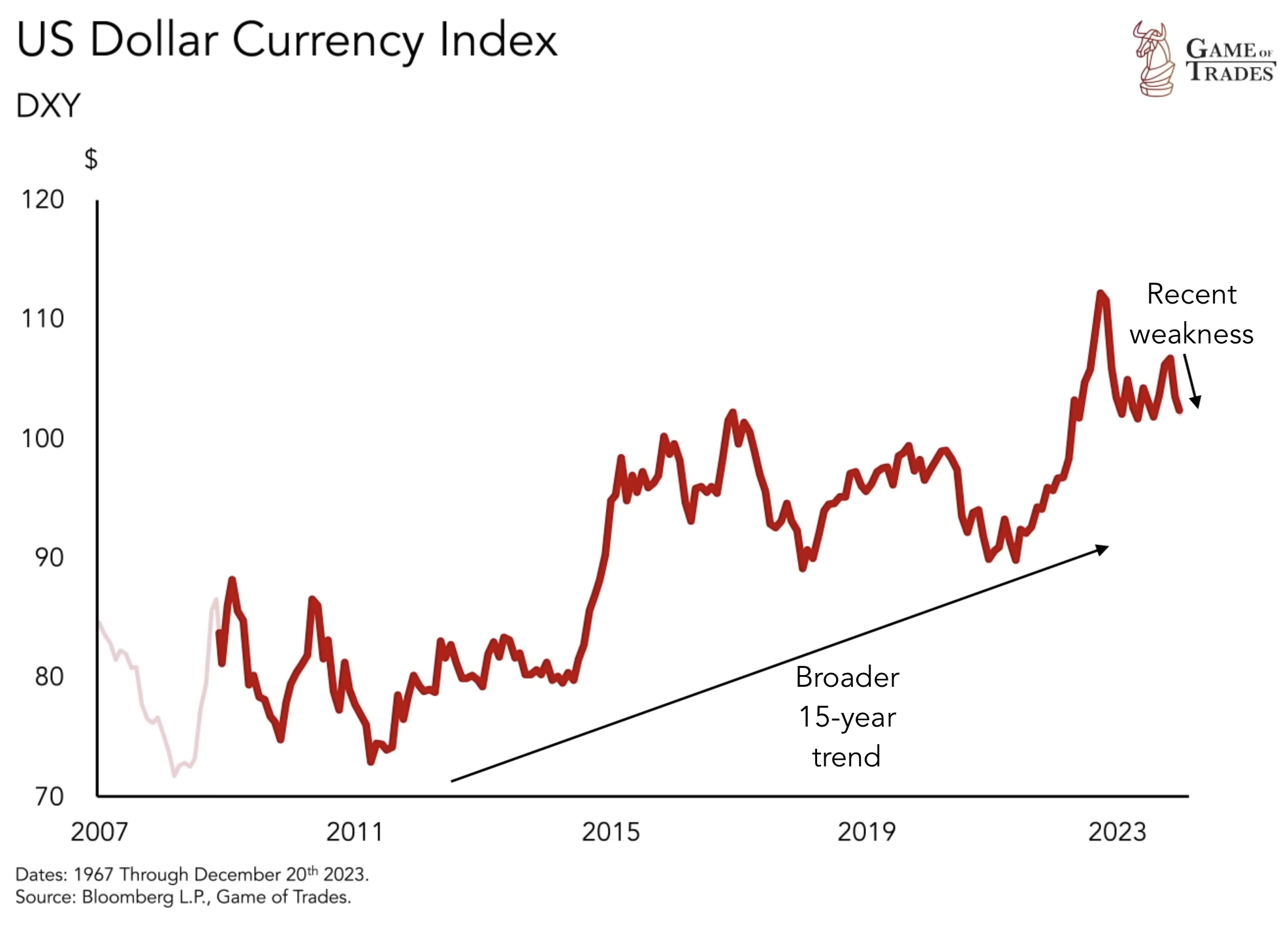

There is growing concern about the possibility of a reverse stock market crash in the United States, similar to what occurred in Argentina. While the US dollar remains strong overall, recent weakness can be attributed to the Federal Reserve’s plans for interest rate cuts. It is important to note that the long-term trend of the US dollar has been upward over the past 15 years.

Understanding Currency Devaluation and Purchasing Power

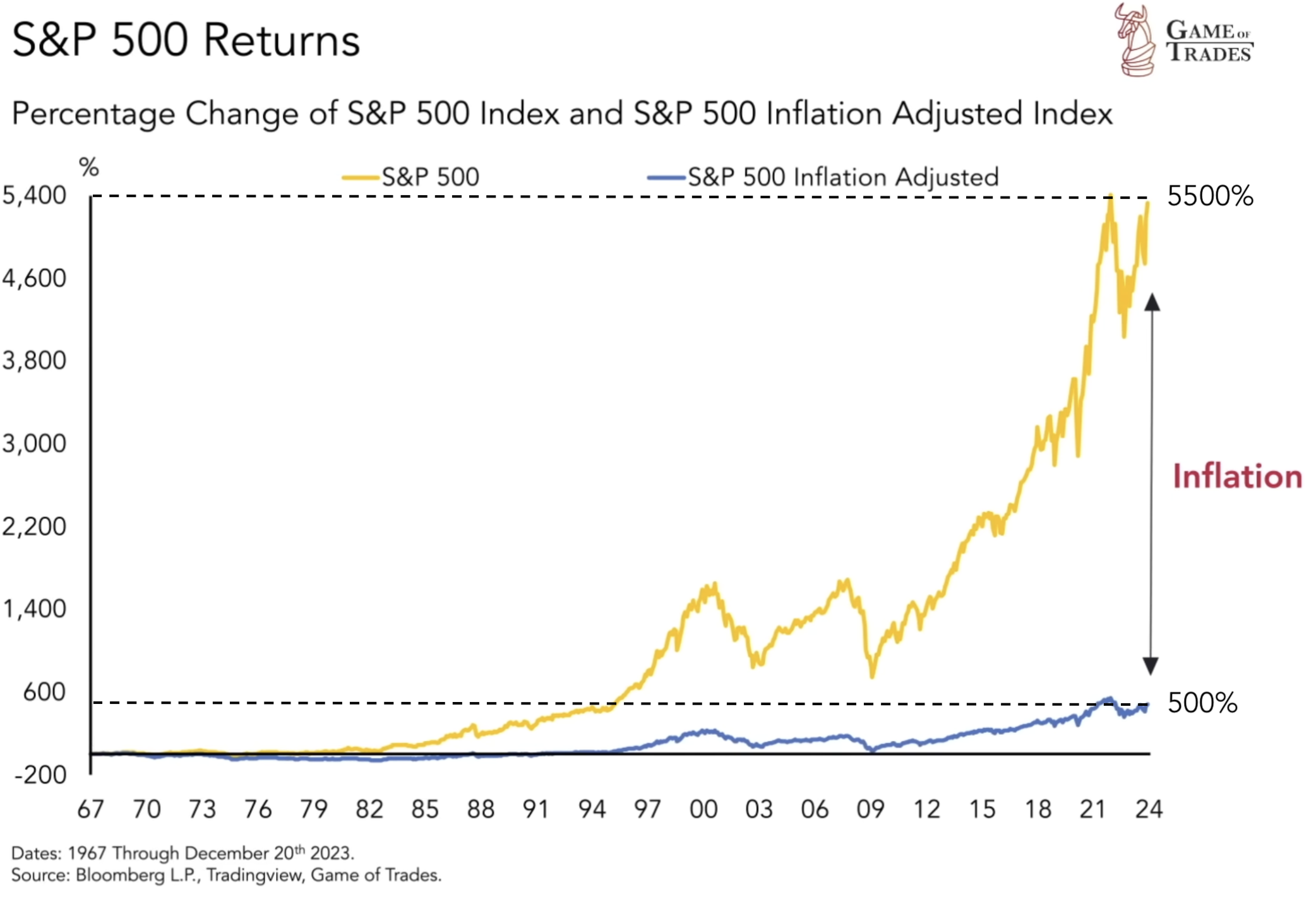

The US dollar index, which measures the currency’s exchange rate against other currencies, does not provide a comprehensive picture of whether all currencies are losing purchasing power. The US dollar can remain strong against other currencies while all currencies collectively decline. Adjusting the stock market’s impressive 5000% growth since 1970 for inflation reveals a more modest real growth of only 500%, underscoring the significance of currency debasement.

Stocks have historically served as a hedge against inflation, protecting against the erosion of purchasing power. When inflation occurs, businesses can raise prices, maintaining profit margins even as raw material costs increase. Consequently, stock prices tend to rise as revenues naturally grow with inflation, safeguarding investors’ purchasing power.

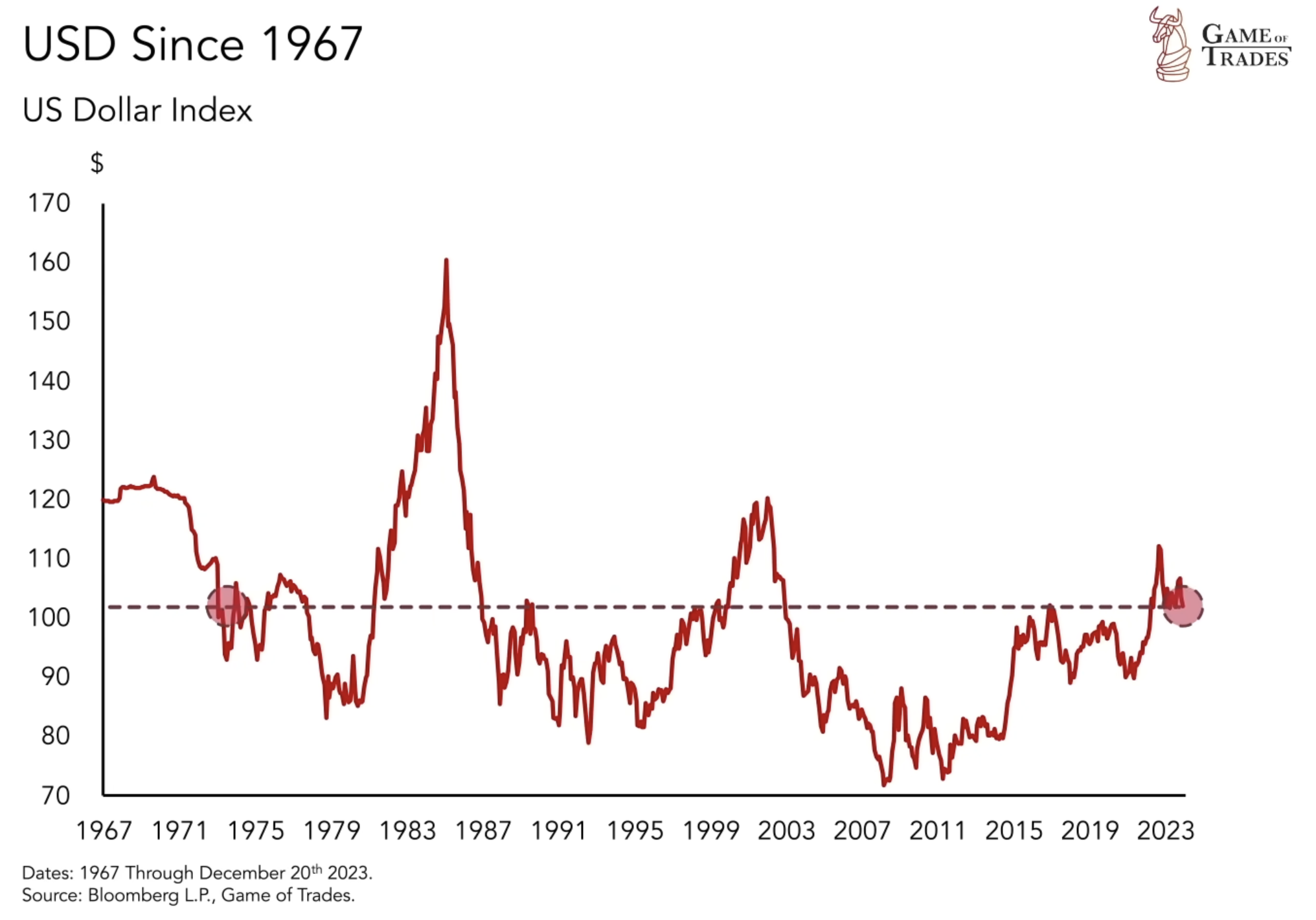

While the US dollar’s exchange rate may appear stable over the past 50 years, it masks the currency’s declining value relative to goods and assets. Prices of essential items such as food, housing, oil, and gold have substantially risen during this period, raising questions about the future of this trend.

The Role of Money Supply in Stock Market Performance

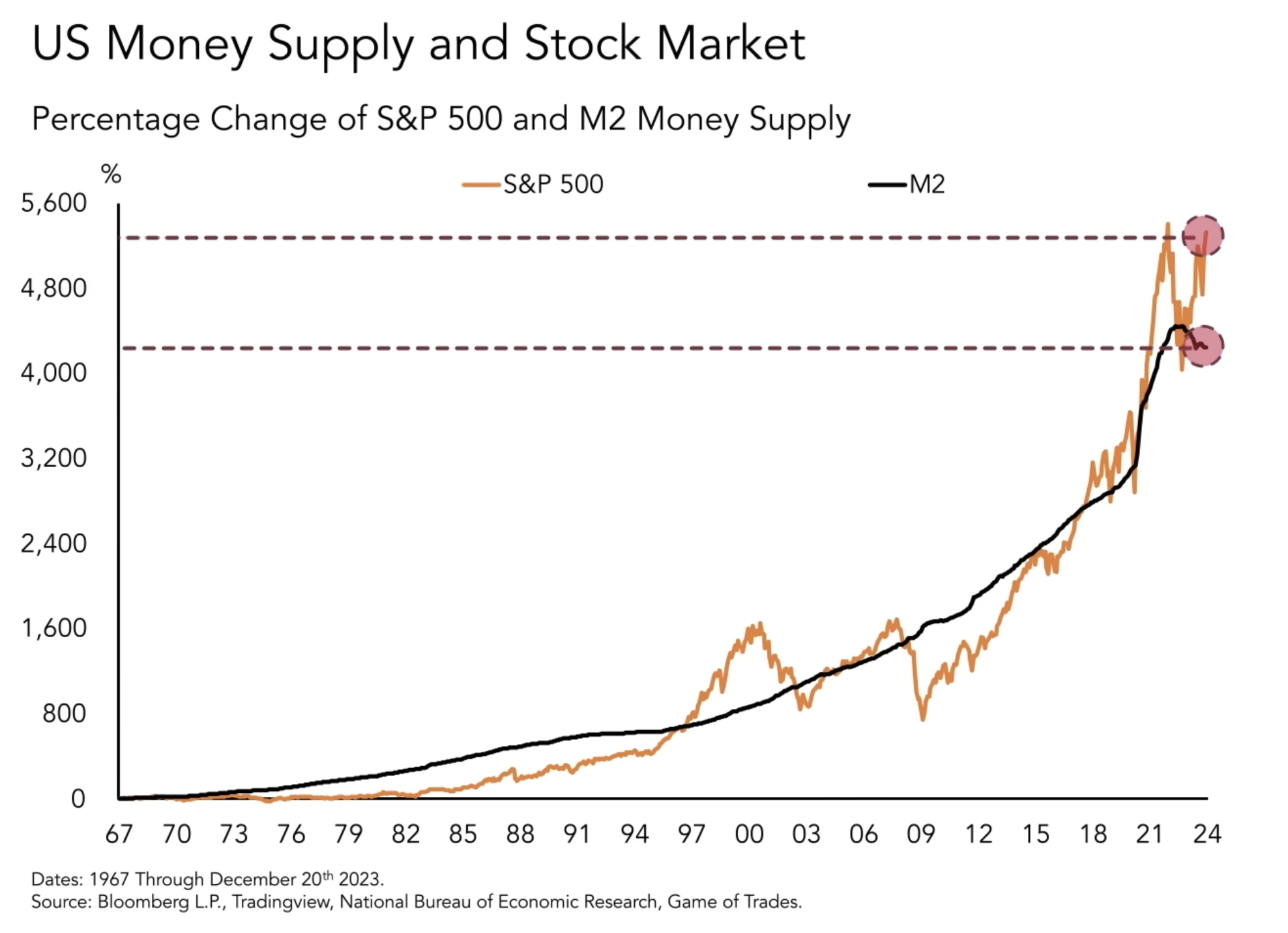

To predict future trends in the stock market, it is crucial to examine the money supply, which refers to the total amount of US dollars in the financial system. The increase in the money supply tends to drive prices higher and has historically correlated with stock market growth. Both the stock market and the money supply have expanded by over 4,500% since 1970. While the money supply generally influences the stock market, there are periods of divergence, like the 50% declines in 2001 and 2008.

The Relationship Between the Stock Market and the Money Supply

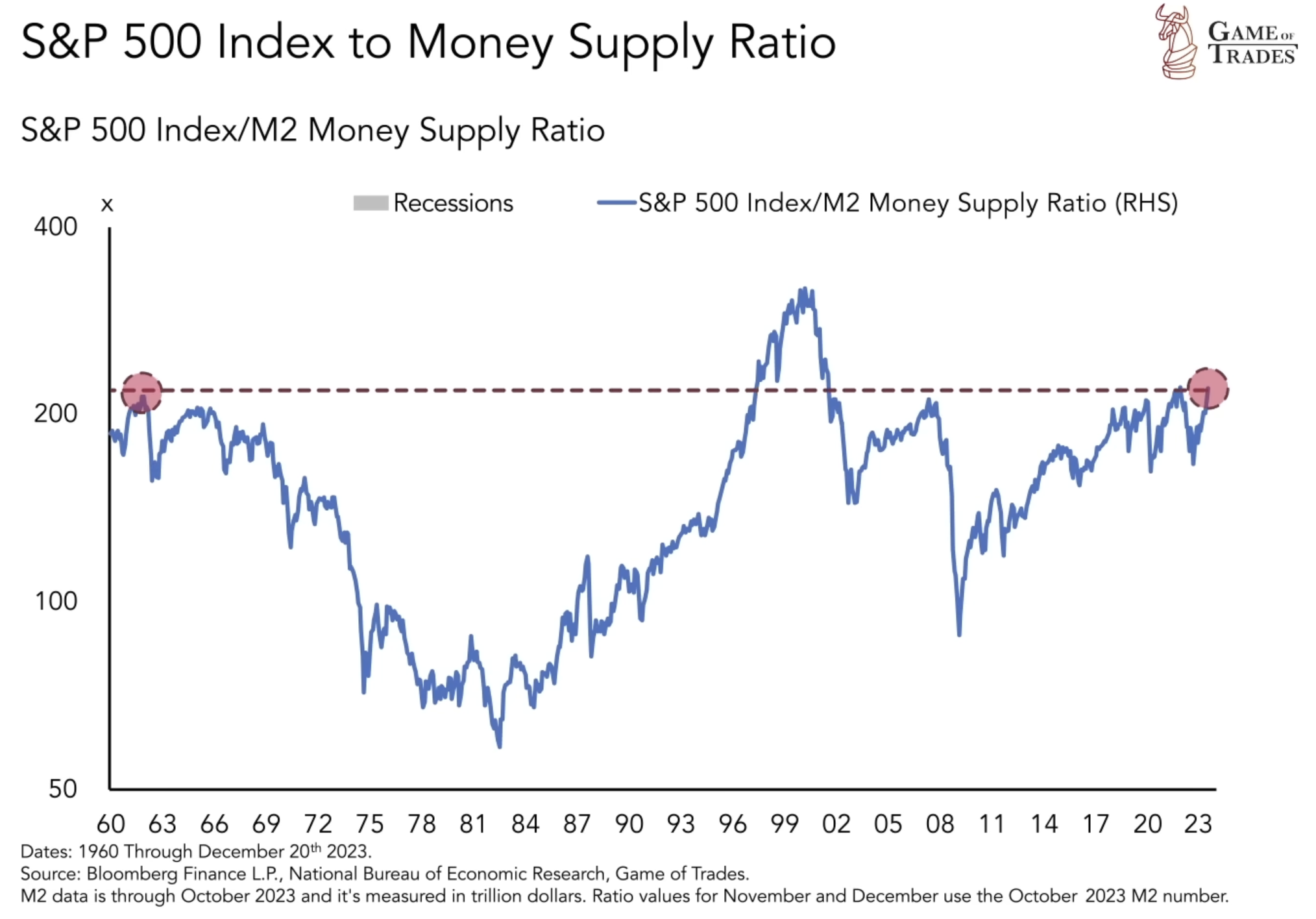

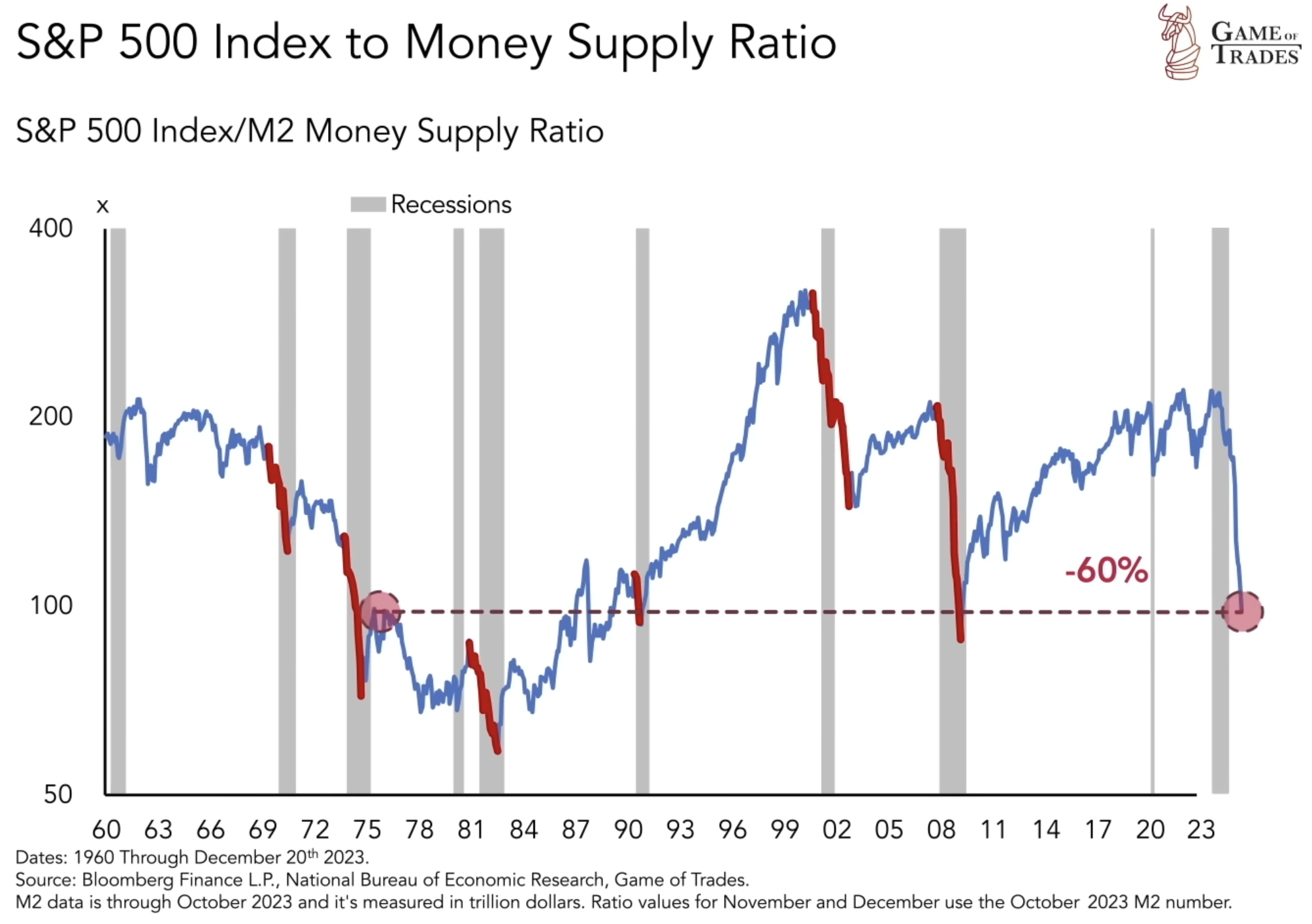

Analyzing the S&P 500-to-money supply ratio reveals that since 1968, the S&P 500 hasn’t outpaced the money supply consistently. Swings in the S&P 500 are tied to the strength of the American economy. In the late 1990s, the S&P 500 surged due to a booming economy, whereas, during the 2008 recession, the S&P 500 declined relative to the money supply.

Currently, the S&P 500 is rising relative to the money supply, similar to the 1990s. History repeating could mean a 40% surge beyond the money supply, like the Dot Com bubble. However, during recessions, the stock market tends to decline compared to the total money supply. A return to 1970s/80s levels could lead to a 60% fall in the S&P 500 relative to the money supply.

Conclusion

Understanding the interplay between currency devaluation, the money supply, and stock market performance is essential for investors seeking to navigate the dynamic and often unpredictable financial landscape. While recent trends worry investors about a potential for a reverse stock market crash in the US, historical analysis highlights the importance of economic conditions and the money supply’s impact on the stock market. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!