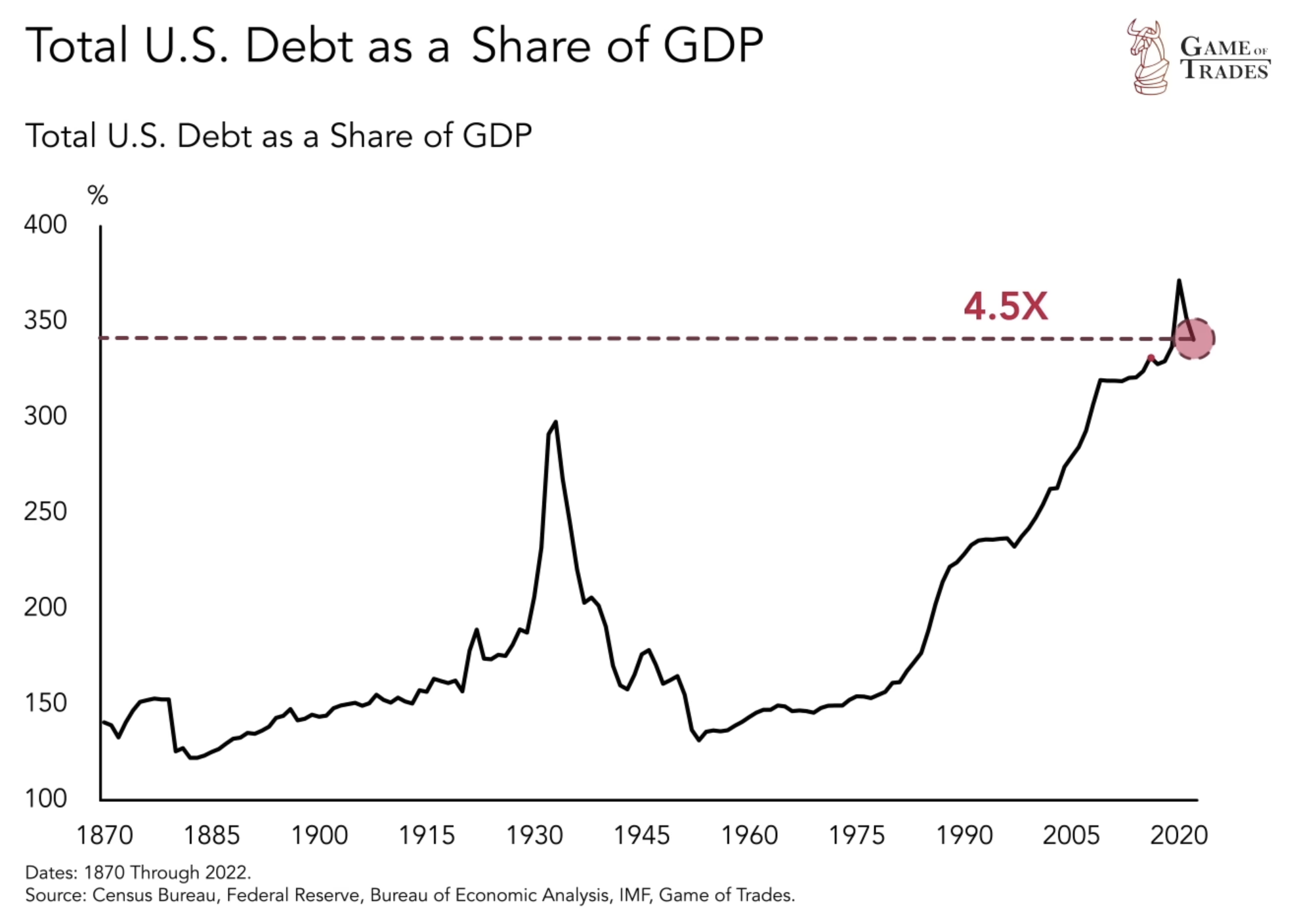

The United States is currently grappling with a monumental economic challenge – its total debt has reached an unprecedented 350% of its GDP, dwarfing the size of the economy by 4.5 times. This surge, predominantly witnessed since 1980, has raised concerns about the potential consequences for the financial landscape.

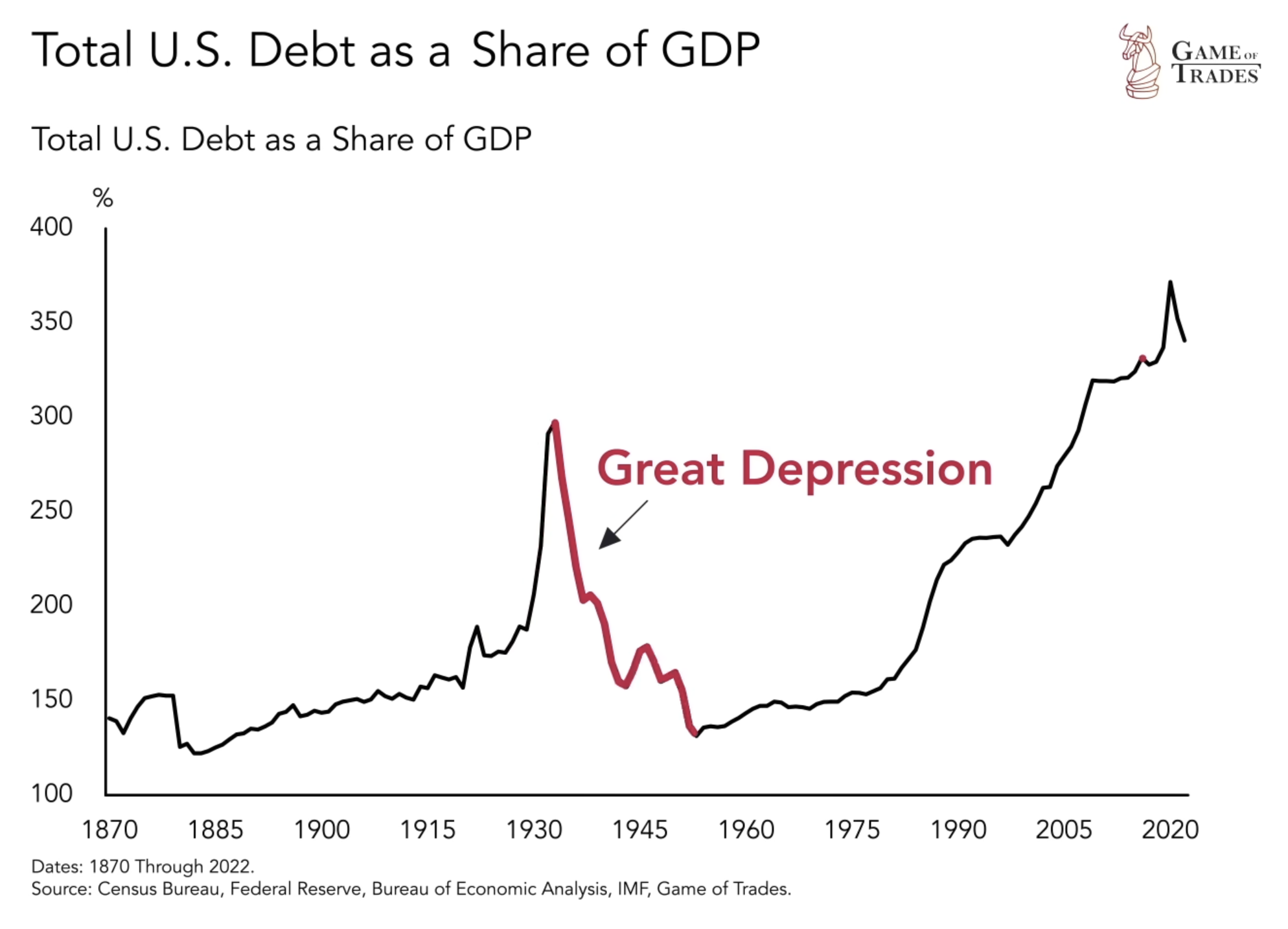

Historical Echoes: Comparisons to 1929 and the Great Depression

This surge in debt draws historical parallels to the period leading up to the Great Depression in 1929. The subsequent unwinding of such debt occurred during the traumatic economic downturn, but a similar deleverage hasn’t materialized since. Understanding this historical context is crucial for comprehending the potential risks associated with the current debt scenario.

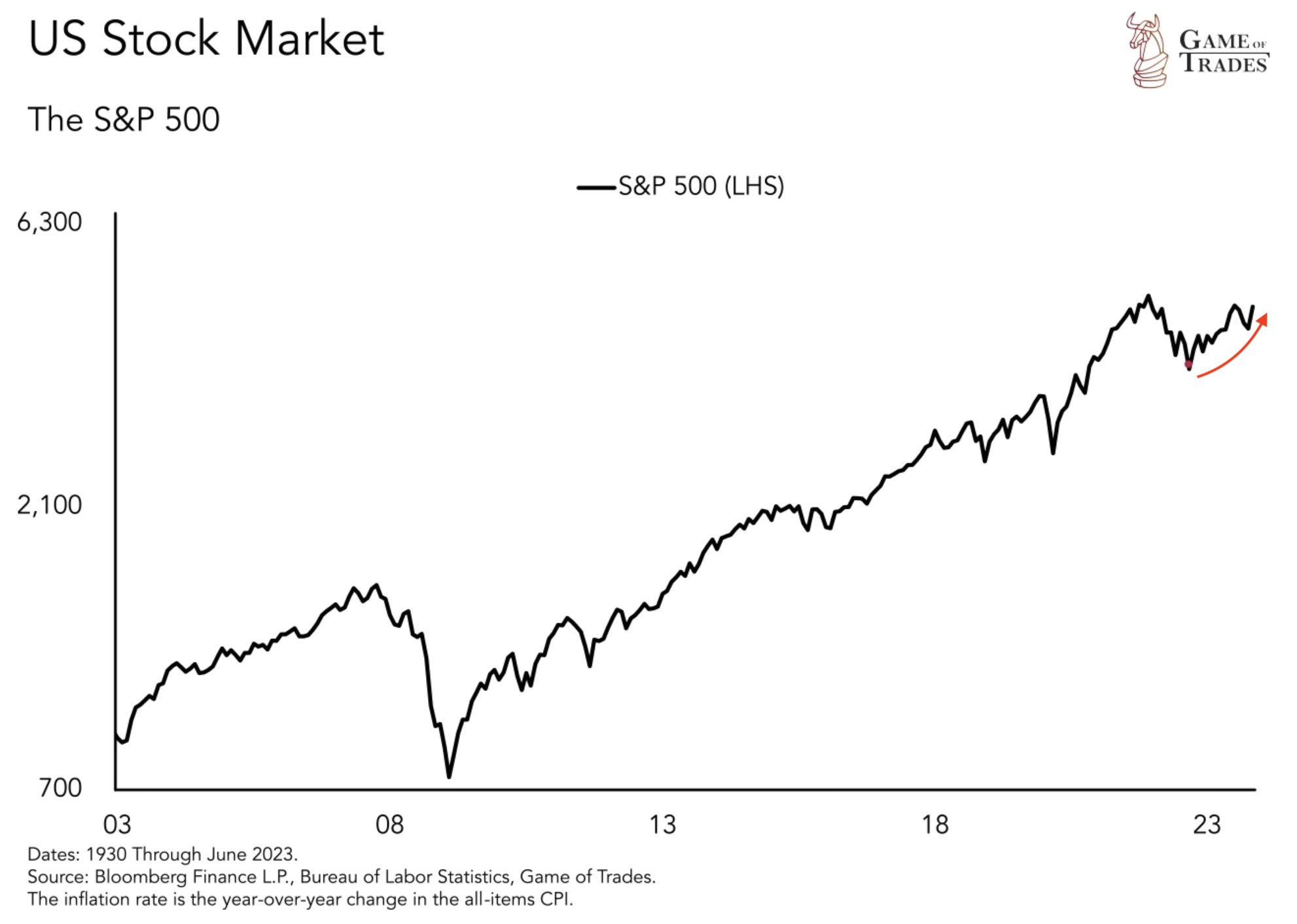

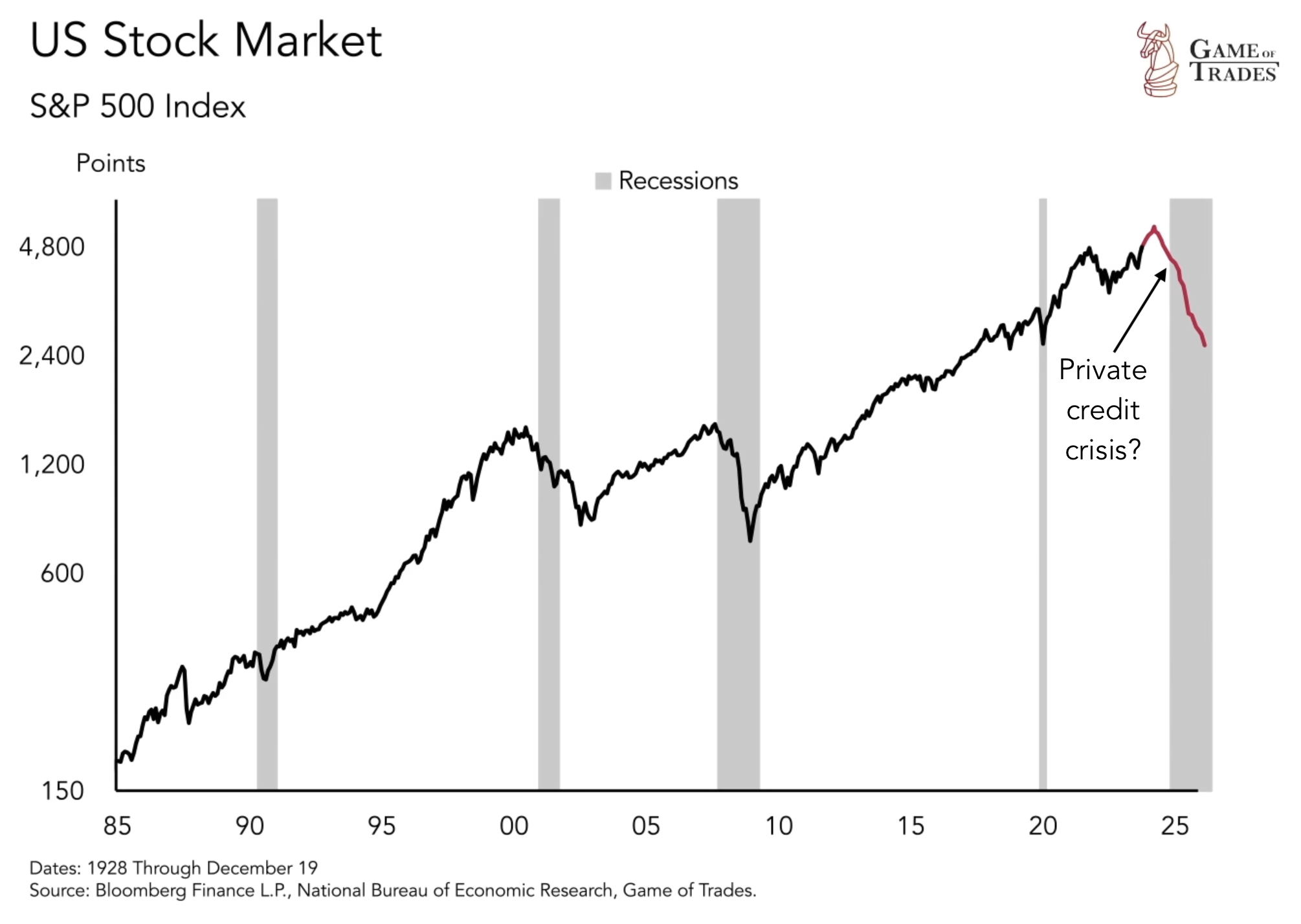

Surprisingly, despite the soaring US debt, the stock market seems unperturbed, approaching all-time highs reminiscent of the period before the 2007 financial crisis. However, the implications of a similar event occurring now could have far-reaching repercussions.

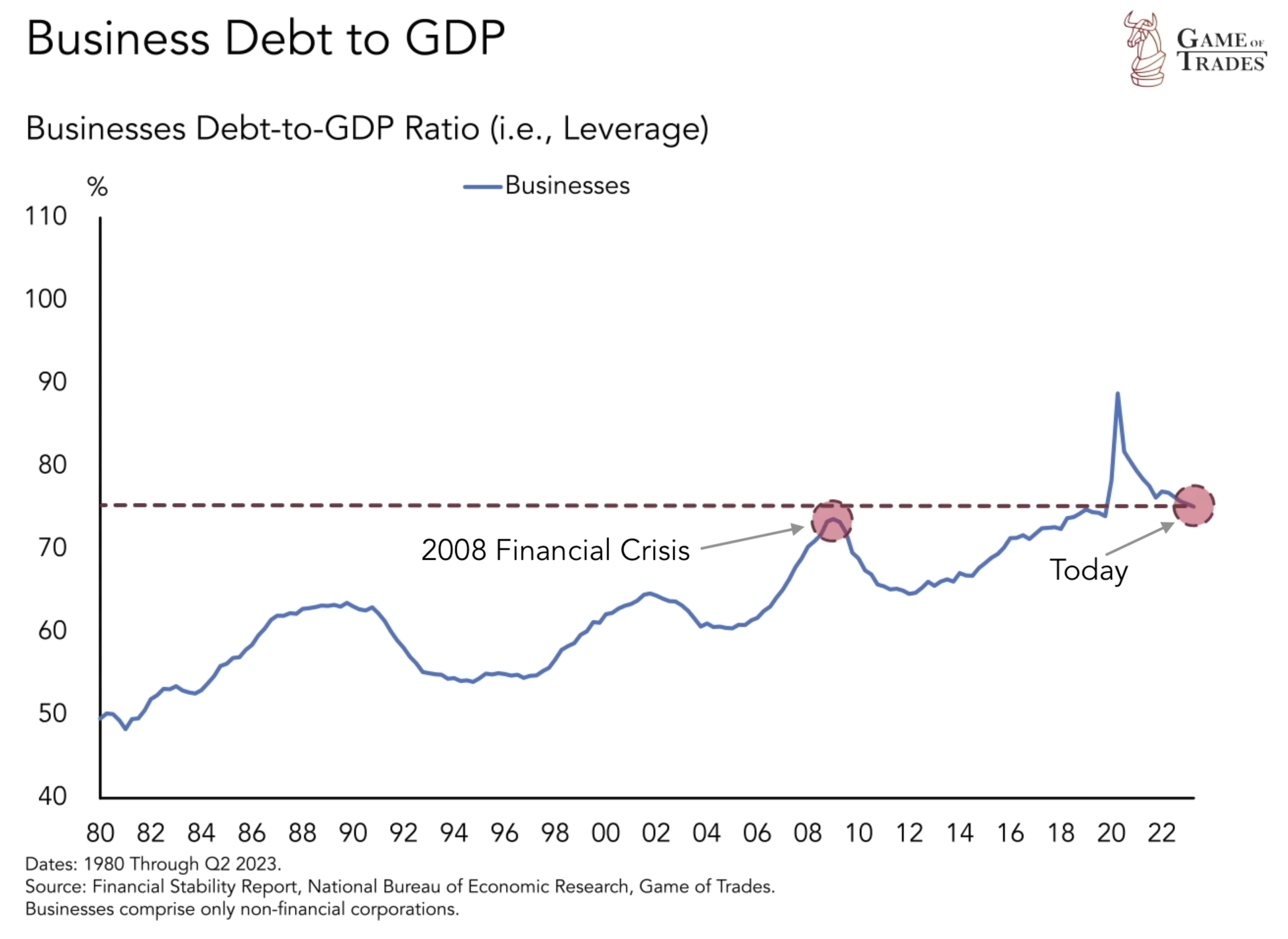

Business Debt Dynamics: Facilitating Growth, Heightening Risks

While household debt has reduced significantly since the 2008 Financial Crisis, business debt has surged to about 75% of GDP, up from 50% in the 1980s. This rise in business debt is a double-edged sword – facilitating growth but increasing repayment obligations and vulnerability to default.

Shadow Banking and the Rise of Concentration Risk

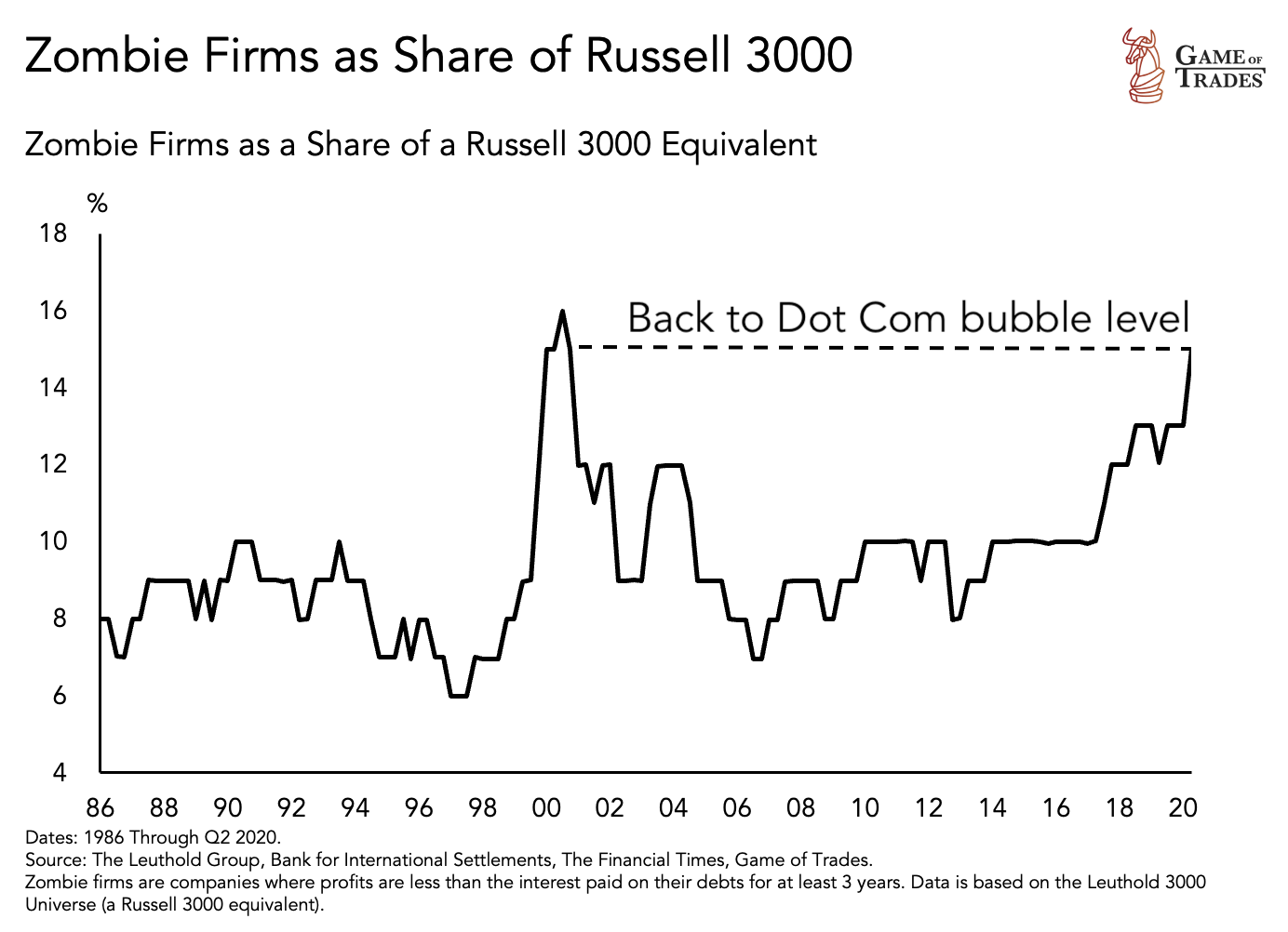

The rise of zombie companies, unprofitable entities with high debt, raises questions about the potential risks that persist in the financial system.

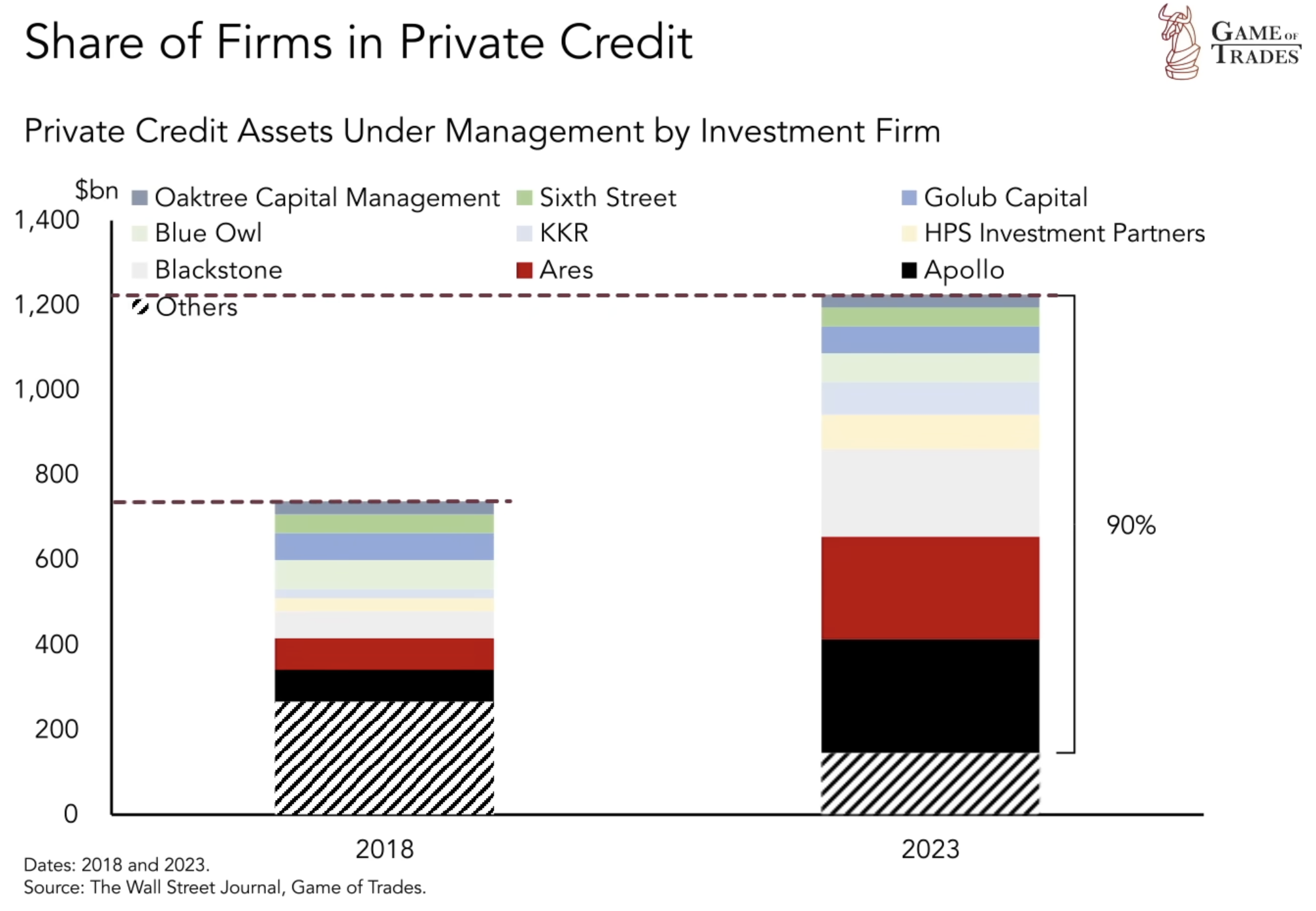

The attention turns to the alternative lending sector – private credit also known as shadow banking. Representing 50% of business lending, this unregulated industry, led by firms like Blackstone, Apollo, and Ares, has seen exponential growth, managing $1.2 trillion, up from $700 billion in 2018. However, concentration risk looms, with the potential for over $1 trillion in wealth destruction if risky ventures default.

Leverage, Funding Sources and Regulatory Oversight

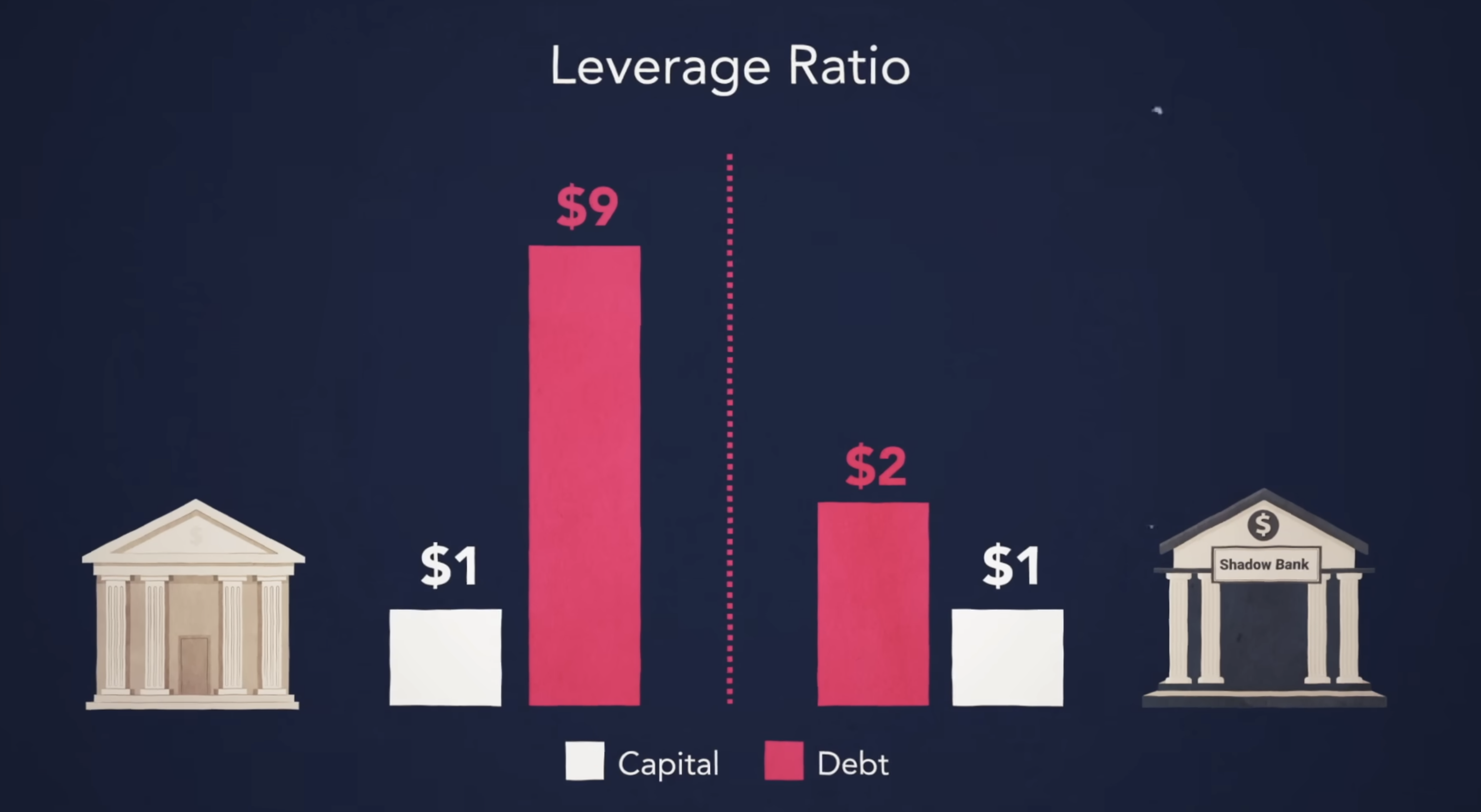

Shadow banks have lower leverage than regular banks. Private credit firms use a $1 to $2 capital-to-debt ratio, while banks leverage at $1 to $9. Some argue that this makes them more resilient.

Differences in funding sources and regulatory oversight further distinguish shadow banks from traditional banks. Investors in shadow banks, often state pension plans, have locked-in funds, reducing the risk of a bank run. However, the absence of regulatory support, unlike traditional banks, poses a significant risk to the economy in the event of a private credit crisis.

Conclusion

As the financial landscape evolves, the vulnerability of shadow banks remains a critical unknown. Only in the next economic downturn will the overleveraged parts of the financial system, including shadow banks, undergo stress testing. As we navigate these uncertainties, understanding the intricate web of debt, resilience, and risks is paramount for informed decision-making in the financial realm. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Is the US Economy at Risk of Deflation?