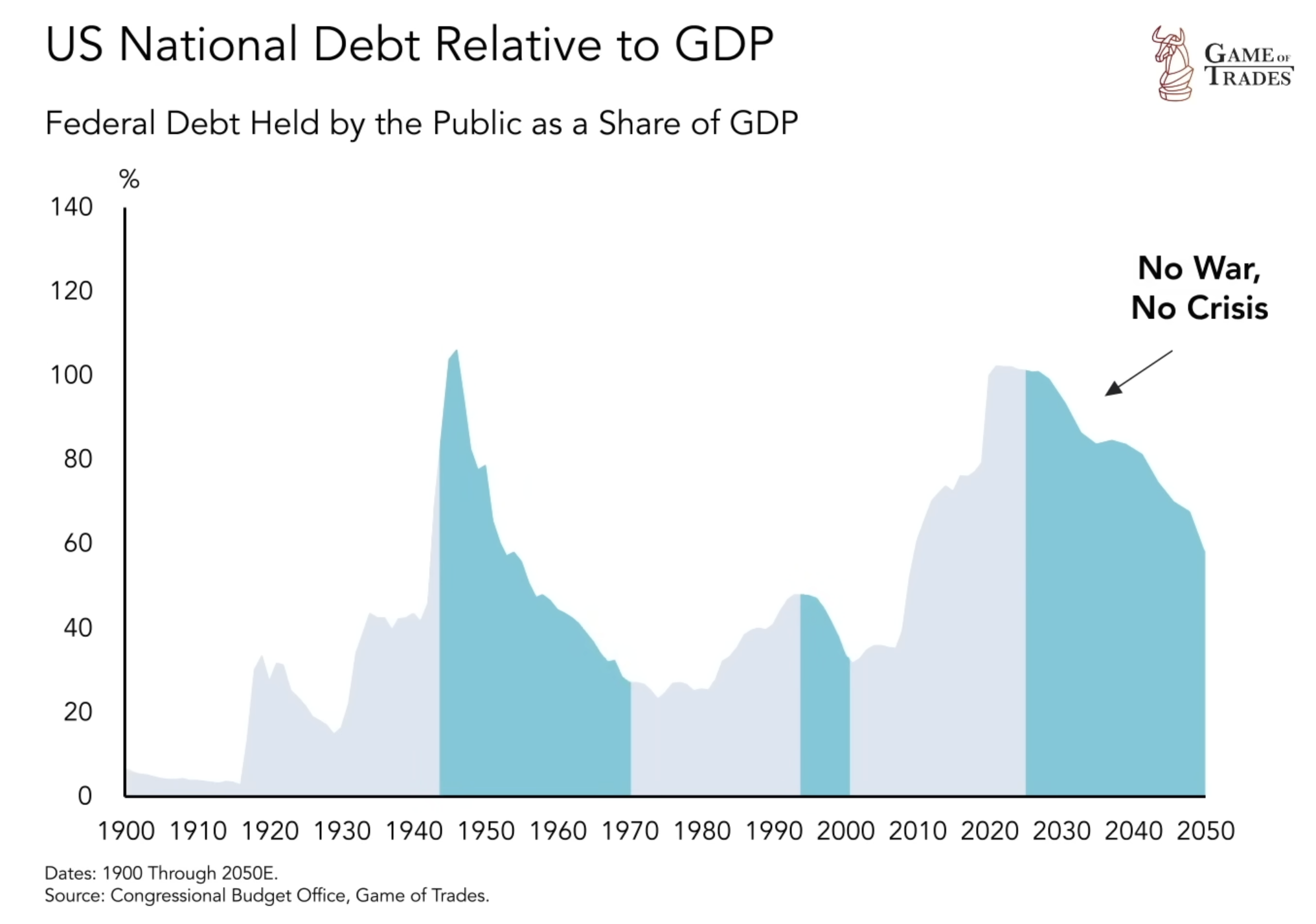

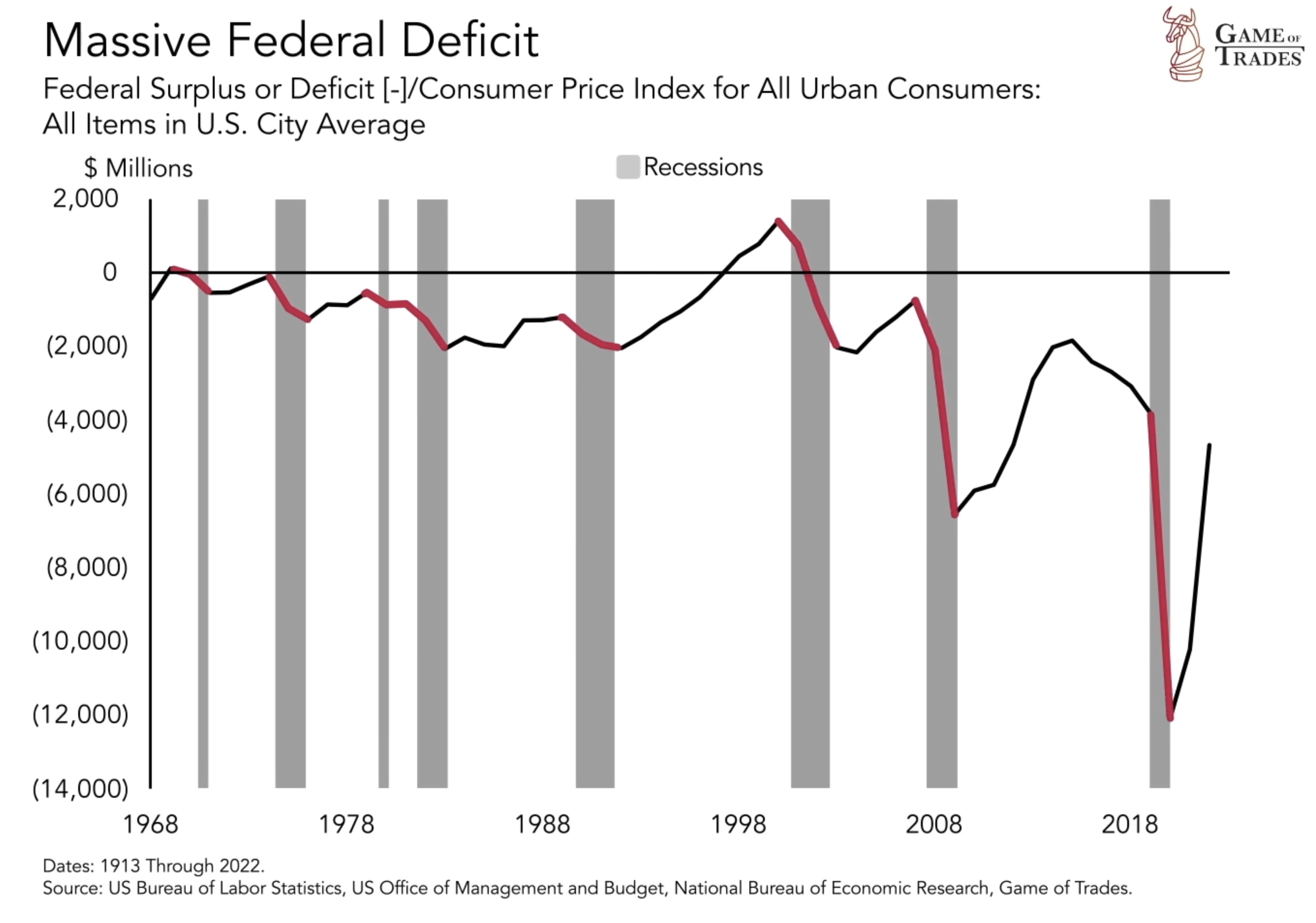

The US government’s spending has reached unprecedented levels in recent years. Projections by the Congressional Budget Office (CBO) indicate a concerning trend of worsening deficit spending, with deficits expected to consistently exceed $1 trillion until 2030. If these projections hold true, the national debt could grow to an alarming 200% of the US economy by 2050. This article delves into the implications of rising government spending, particularly in Social Security and Medicare, and explores potential strategies to address the growing deficit.

Rising Government Spending and the National Debt

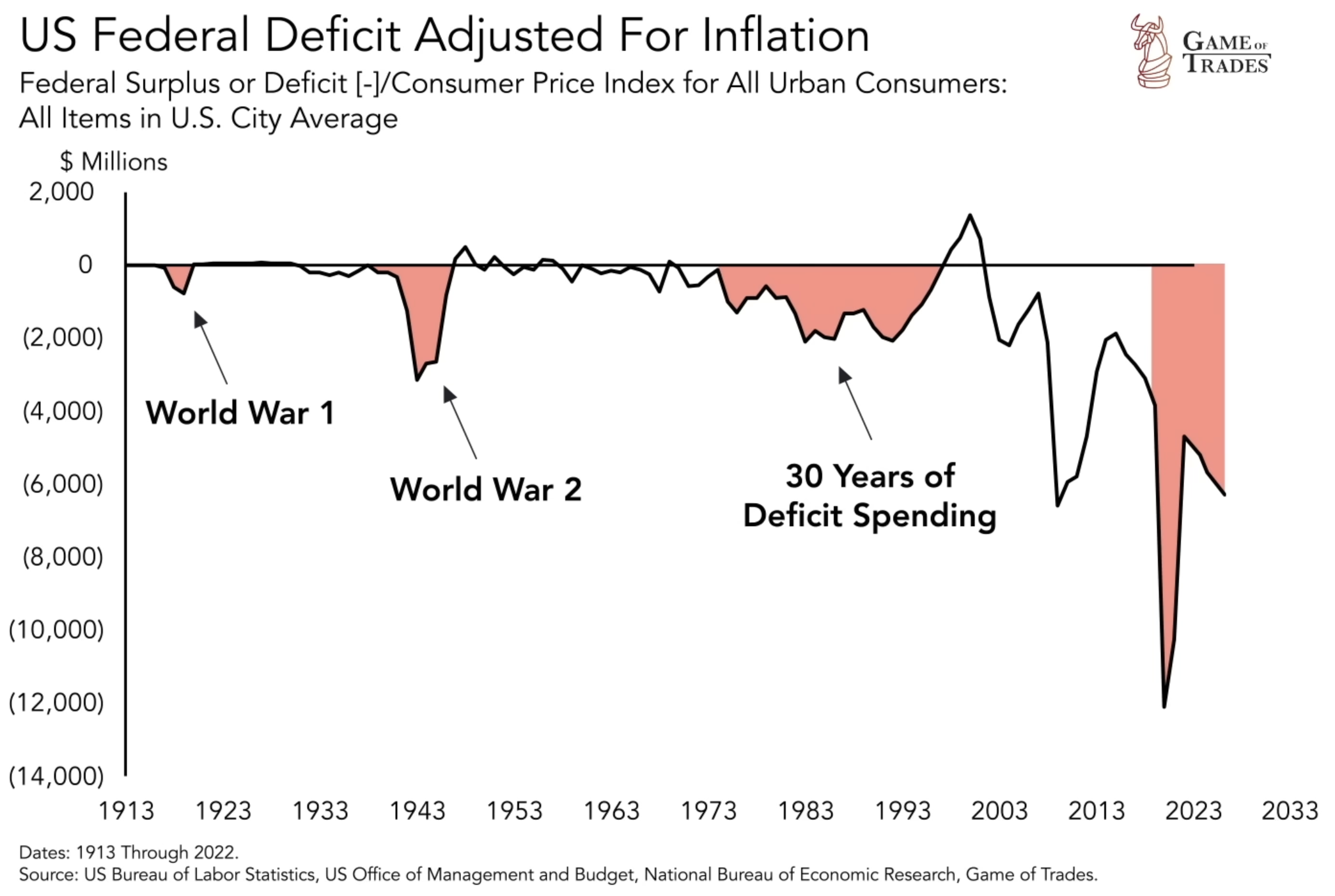

Over the past 3 years, the US government’s inflation-adjusted spending has exceeded the combined spending of both World Wars and the 1970s, ’80s, and ’90s. This trend raises concerns about the sustainability of fiscal policies and the impact on the national debt. The CBO’s projections suggest that the debt could triple the size of the GDP by 2050, creating significant economic challenges.

The Growing Burden of Social Security and Medicare

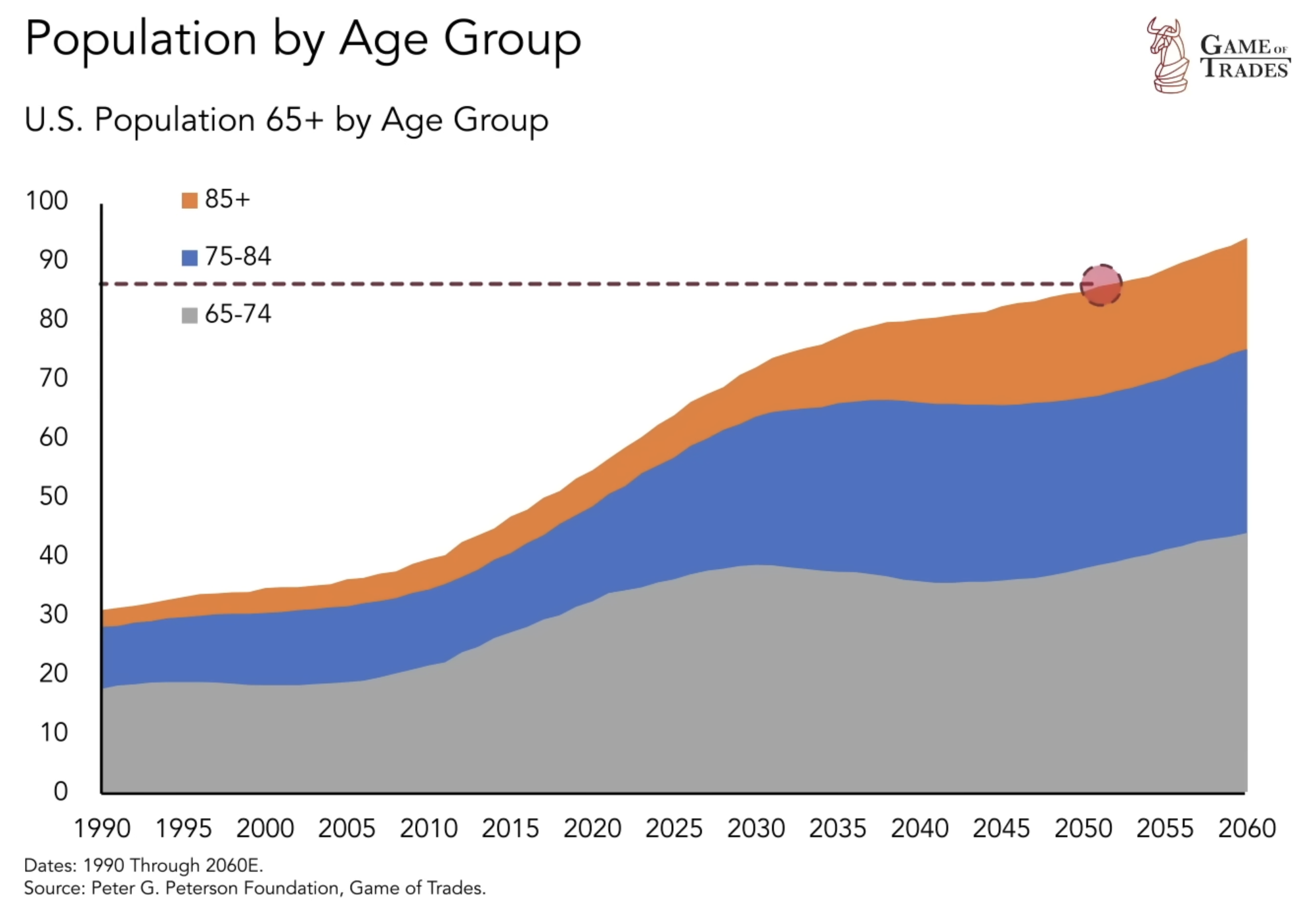

Social Security and Medicare are projected to surpass all other forms of government spending, reaching a staggering 10% of GDP. This contrasts with the period between 2008 and 2023 when other spending categories were relatively higher. The anticipated growth in Social Security and Medicare spending is driven by the aging population. The number of Americans aged 65 and above is projected to increase from 60 million to 85 million by 2050, leading to increased reliance on government benefits.

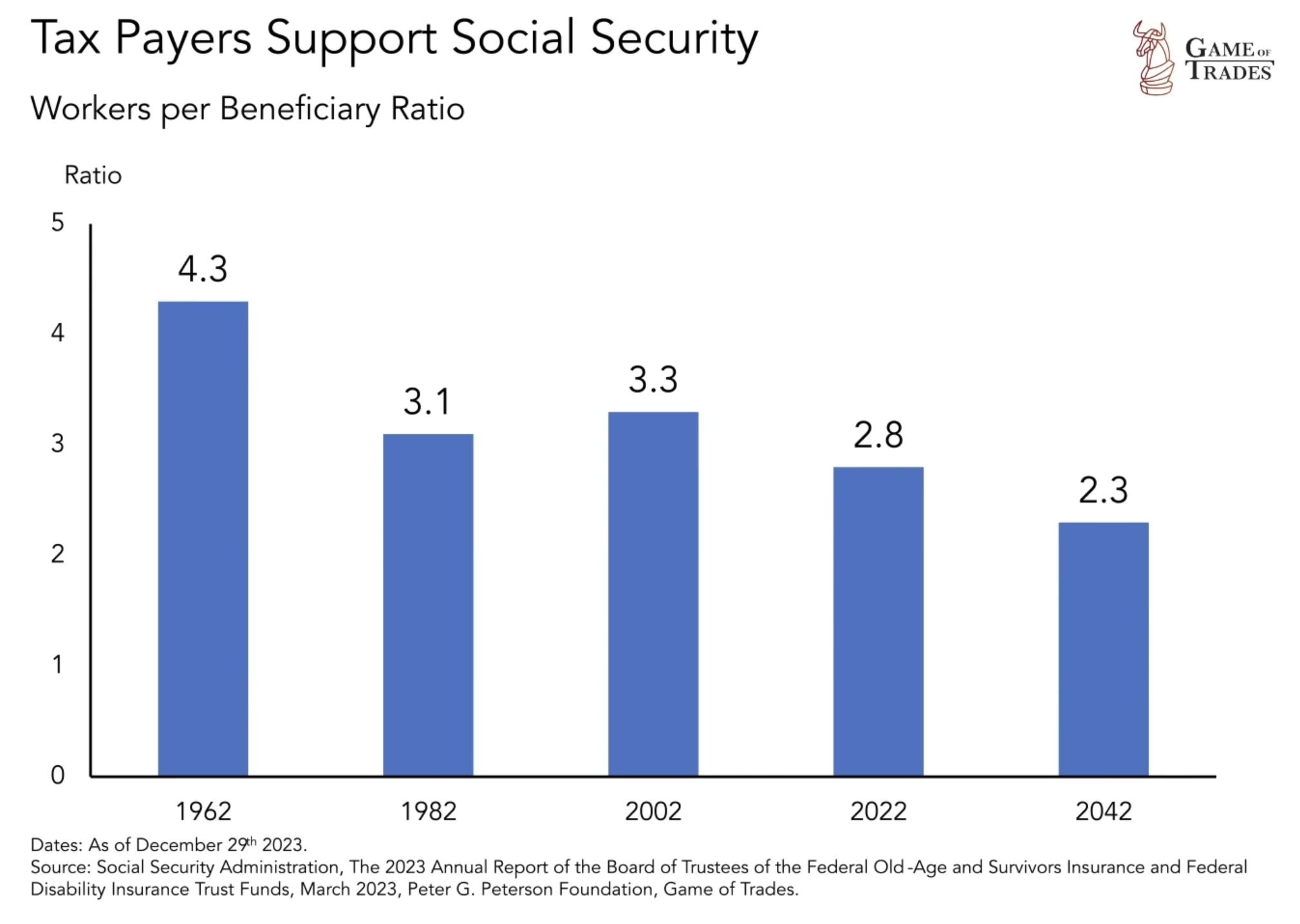

The diminishing workforce relative to benefit recipients poses a significant challenge. Currently, there are 2.8 workers per Social Security beneficiary, and this ratio is projected to decrease further. The strain on the workforce highlights the need for sustainable solutions to balance the burden of benefit programs and ensure long-term fiscal stability.

Addressing Healthcare Costs and Potential Savings

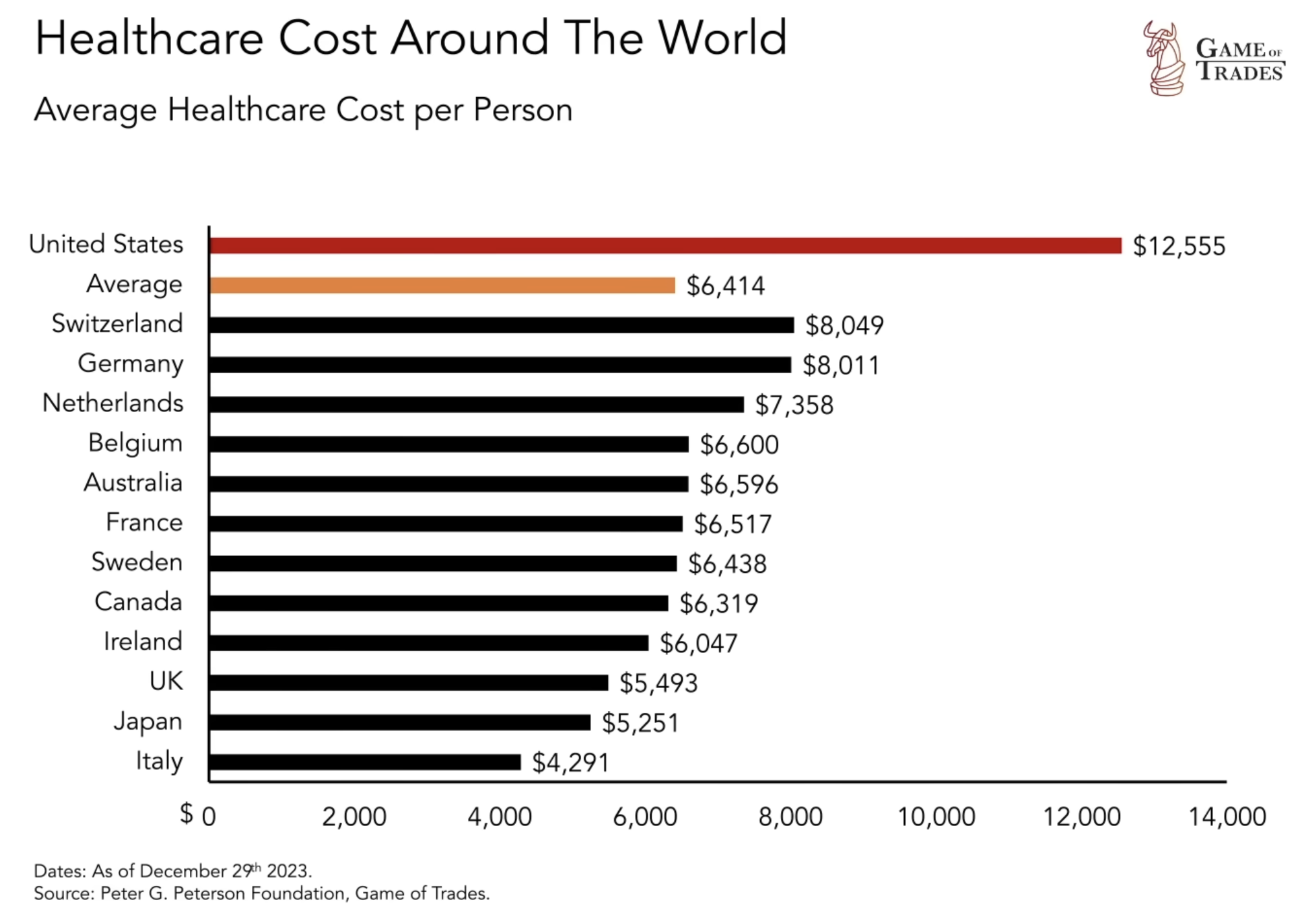

The US spends around $112,500 per person on healthcare, nearly double the average of developed economies. Aligning healthcare spending with other nations could potentially result in significant savings, altering the pessimistic debt projections. By implementing effective cost-containment measures and improving healthcare efficiency, the US can alleviate the strain on the budget.

Strategies for Debt Reduction

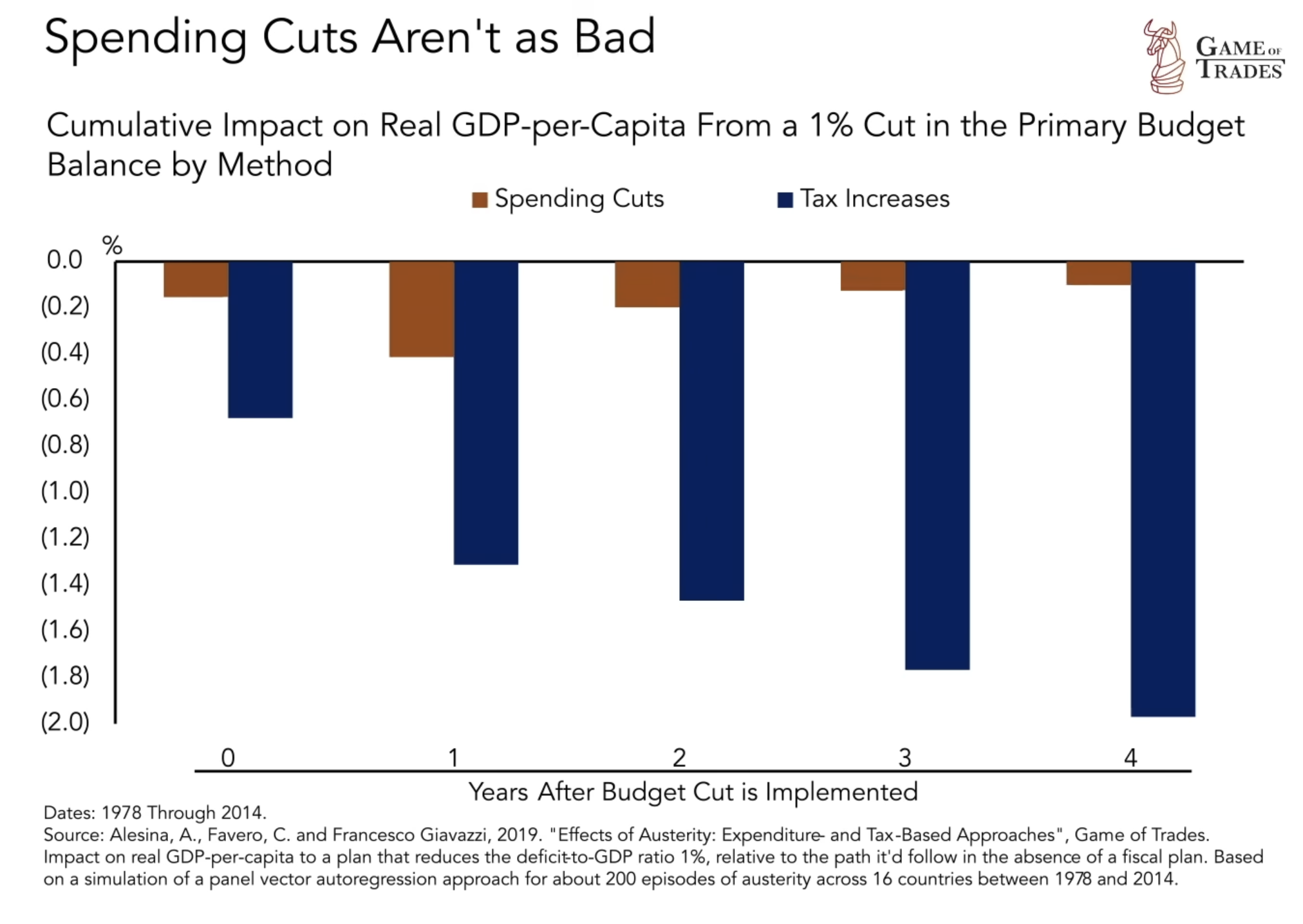

Independent institutions have proposed spending programs that could reduce the debt-to-GDP ratio to 50% by 2050, presenting an alternative to current policies that contribute to elevated debt levels. While increasing taxes may seem like a viable solution, research suggests it could harm economic growth. Alternatively, reducing government spending has a limited and shorter negative impact on the economy, making it a potentially more successful approach to balance the budget effectively.

Effect of Wars and Recessions

Political shifts may guide a debt reduction trajectory, but this hinges on avoiding war, pandemics, or economic crises. Major wars historically caused significant debt increases. However, CBO projections assume no substantial increase in defense spending due to large-scale wars.

Recessions, which occur more frequently, also lead to increased deficit spending as job losses rise and demand for benefits like Social Security increases. As a result, the government borrows money to bridge the gap. However, The CBO projections assumes a steady unemployment rate for 20 years. History suggests this is unlikely because the longest recession-free period was 11 years. When a recession occurs, the projections may prove to be overly optimistic, necessitating increased government spending.

Conclusion

Managing rising government spending and addressing the growing deficit require careful consideration and strategic planning. As the US faces the challenges posed by increasing Social Security and Medicare spending, as well as the potential impact of wars and recessions, policymakers must strike a balance between fiscal responsibility and meeting the needs of an aging population. By implementing prudent fiscal policies, the US can navigate these challenges and work towards a more sustainable economic future. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!