The American dream of homeownership has long been an aspiration for individuals seeking stability and financial security. However, in recent months, aspiring homeowners have faced significant challenges in their pursuit of buying a home. This article delves into the factors contributing to the housing affordability crisis in the United States and provides insights into the current state of the housing market. From rising home prices to limited housing supply and increasing institutional ownership, we examine the systemic challenges that hinder the average person’s ability to become a homeowner.

The Escalating Cost of Homeownership:

In 1970, the median home price was a mere $17,000, and it took an average person approximately three years to save for a 10% down payment. Fast forward to 2023, and the median home price has soared to $430,000, requiring an average person a staggering 21 years to save for a down payment. This exponential increase in home prices has created a significant barrier to entry for prospective homeowners.

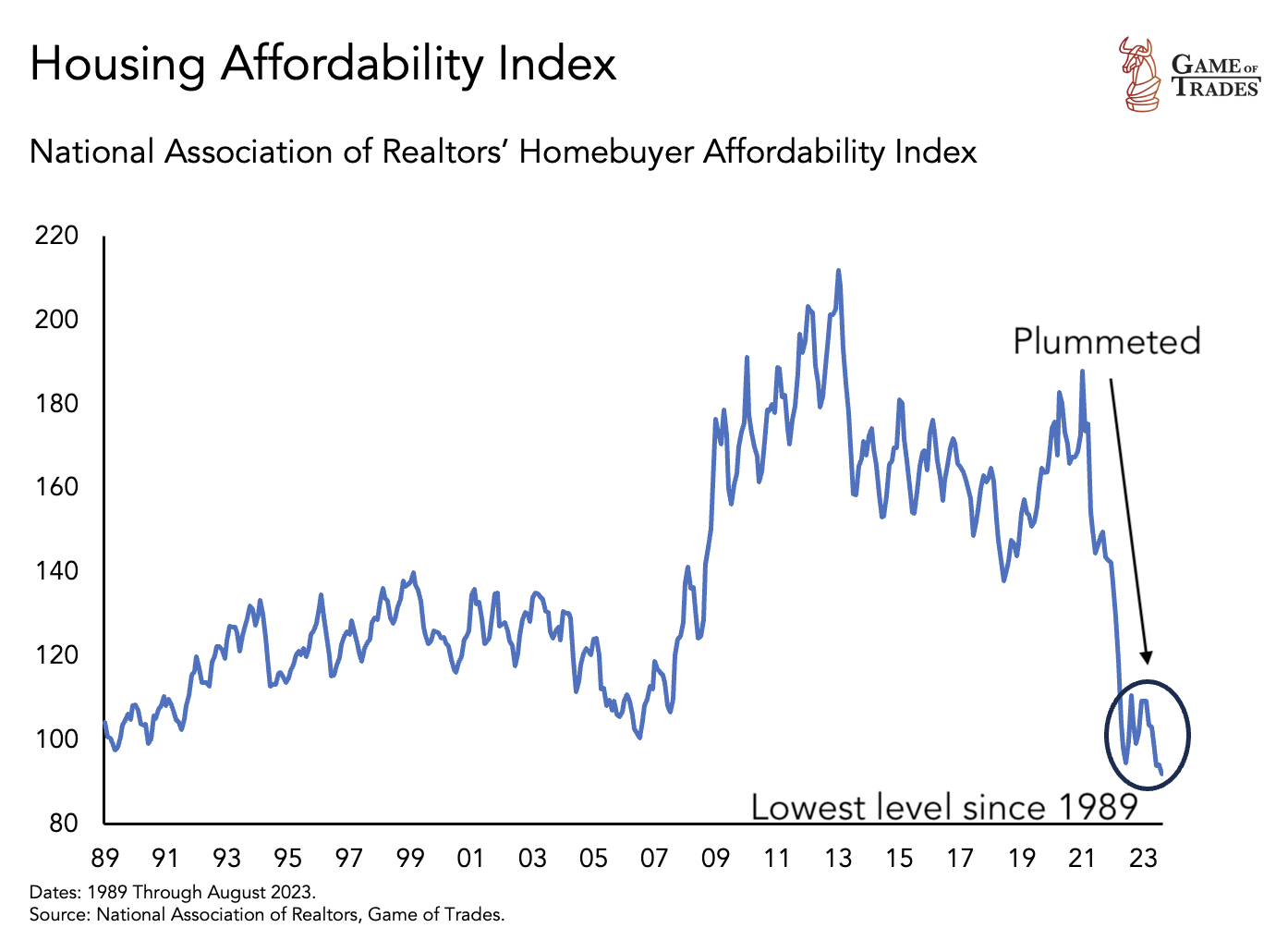

The housing affordability index, a metric that gauges the average family’s ability to afford a down payment on a home, is currently at its lowest levels since 1989. This index reflects the growing disparity between income and housing costs, making it increasingly challenging for individuals to achieve homeownership.

Shifting Dynamics: Homeownership vs. Foreclosures:

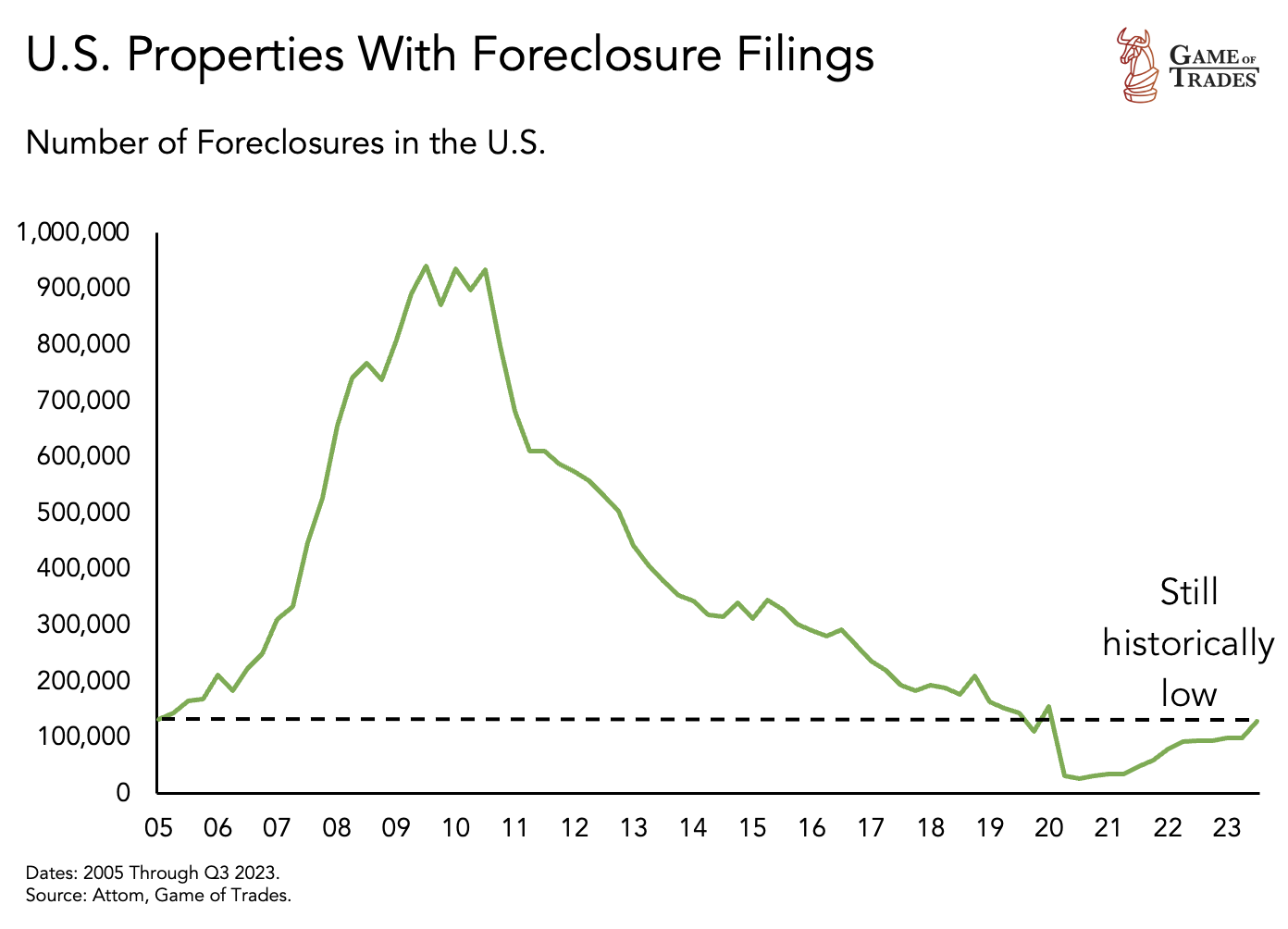

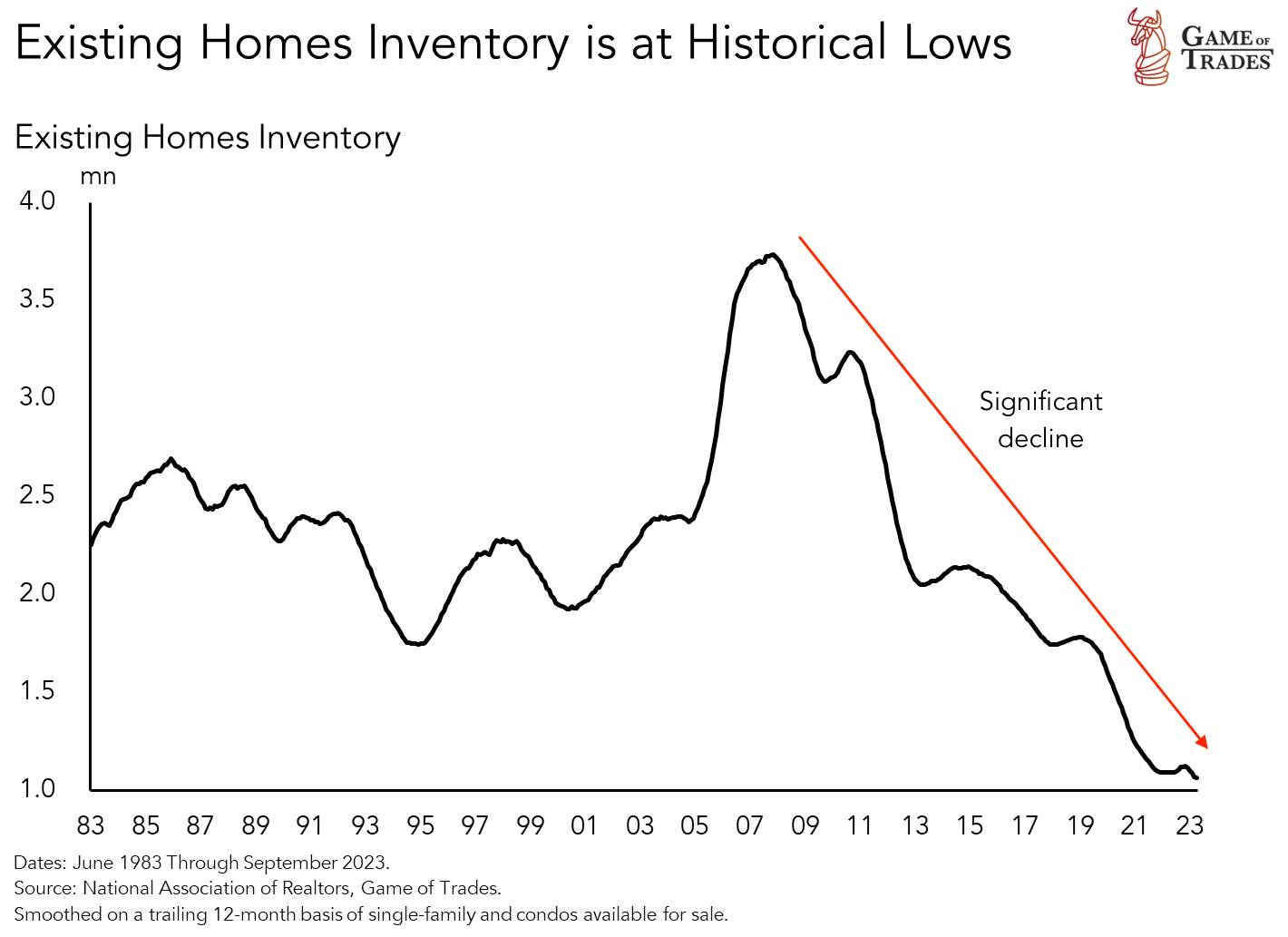

Unlike the 2008 housing collapse, the primary issue in 2023 lies in the inability of the average person to become a homeowner in the first place. The number of foreclosures today remains at historically low levels, signifying a different challenge for the housing market. Instead, the focus has shifted to the struggles faced by individuals in entering the housing market.

Significant Hurdles in the Housing Market:

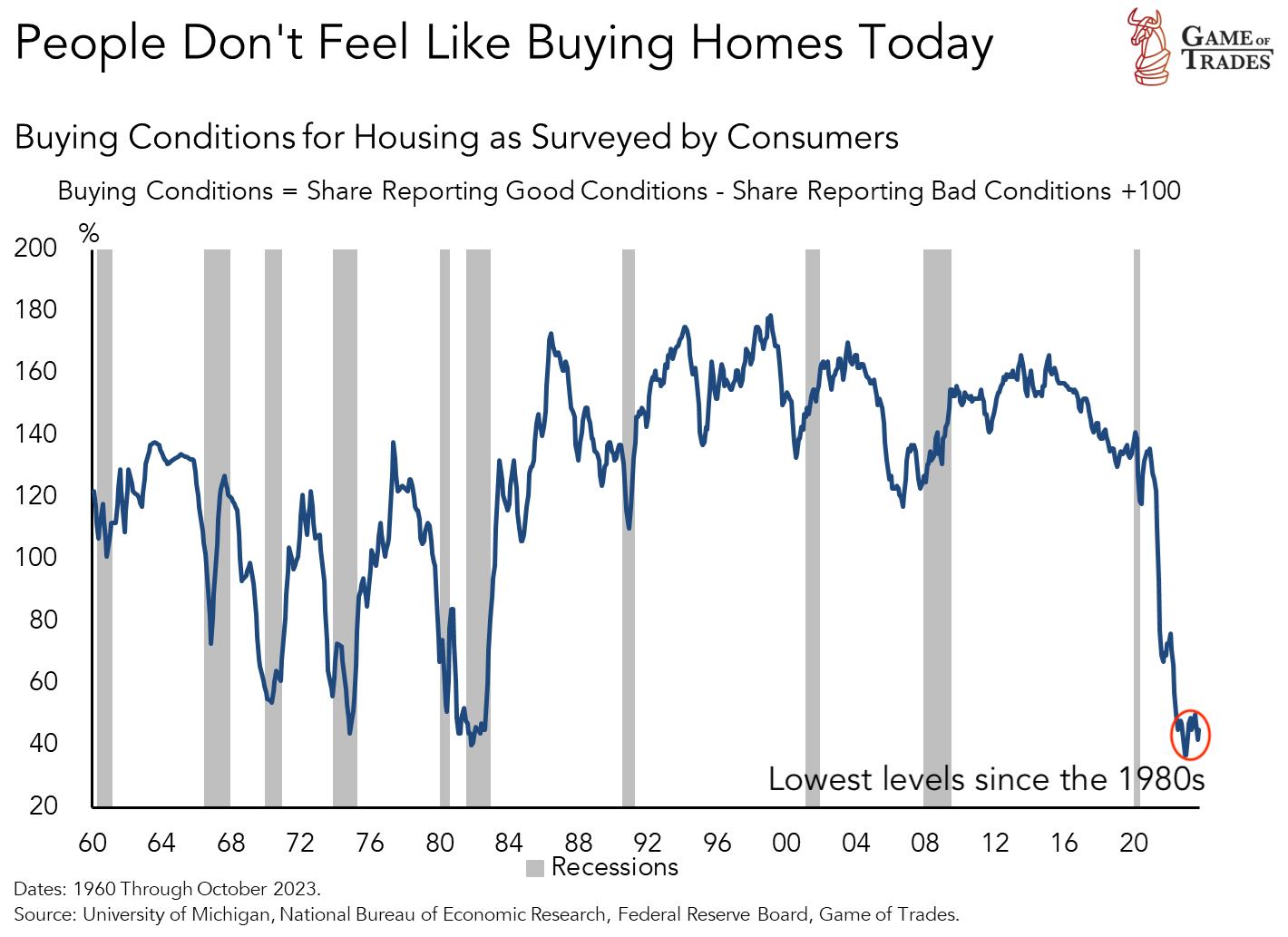

The housing market has presented substantial hurdles for aspiring homeowners. Many people believe that the current conditions are unfavorable for purchasing a home, with buying conditions falling to levels unseen since the 1980s. These challenges exacerbate the affordability crisis, making it increasingly difficult for individuals to realize their dreams of homeownership.

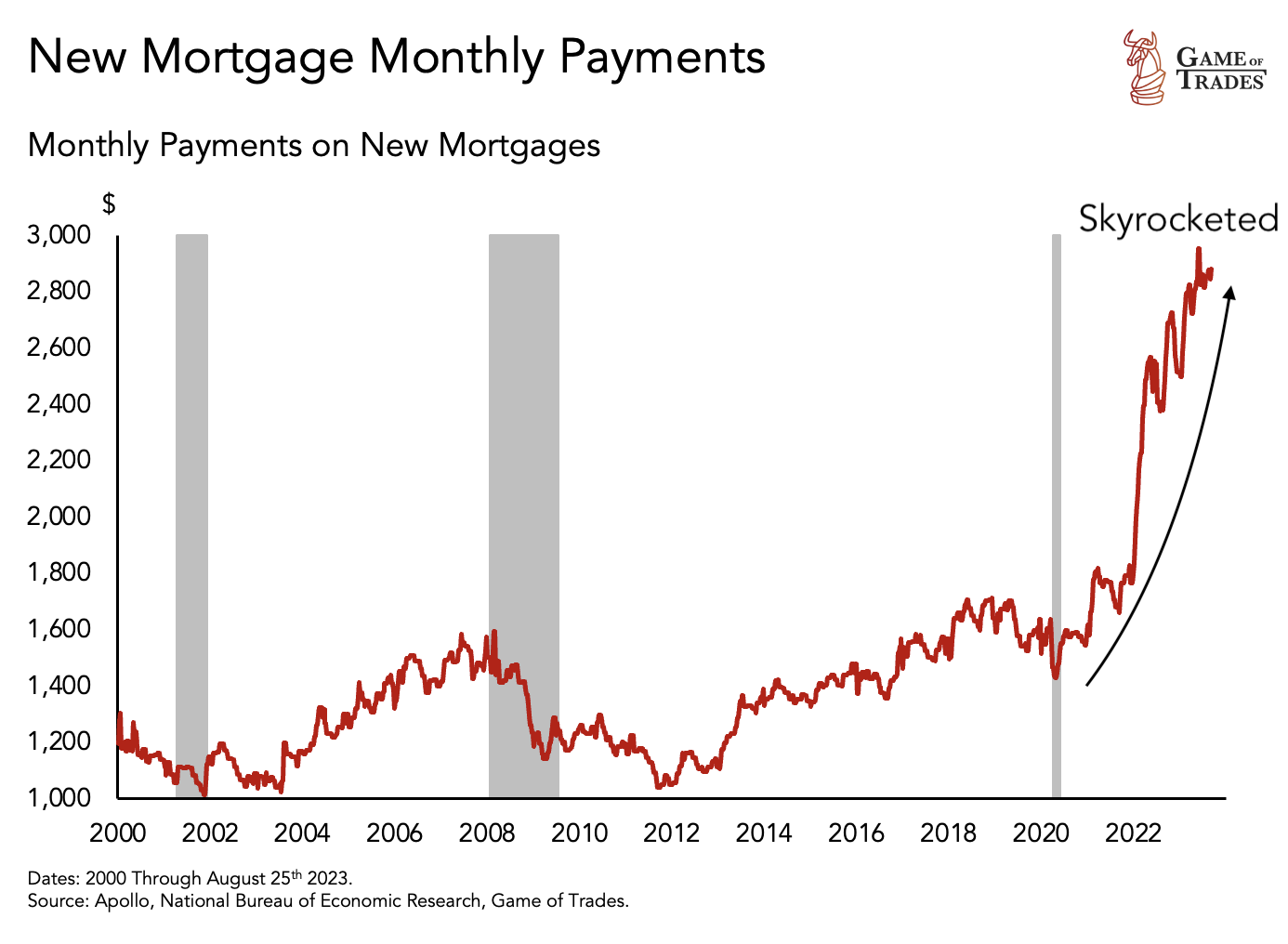

One prominent factor contributing to poor buying conditions is the rapid rise in the cost of new mortgages. In 2023, the average monthly payment on a new mortgage has reached $3,000, three times the amount from 2012. This escalation in mortgage costs is a direct consequence of 30-year fixed mortgage rates shifting from around 2.5% in 2020 to 7.7% in 2023, significantly impacting the affordability of homes.

One prominent factor contributing to poor buying conditions is the rapid rise in the cost of new mortgages. In 2023, the average monthly payment on a new mortgage has reached $3,000, three times the amount from 2012. This escalation in mortgage costs is a direct consequence of 30-year fixed mortgage rates shifting from around 2.5% in 2020 to 7.7% in 2023, significantly impacting the affordability of homes.

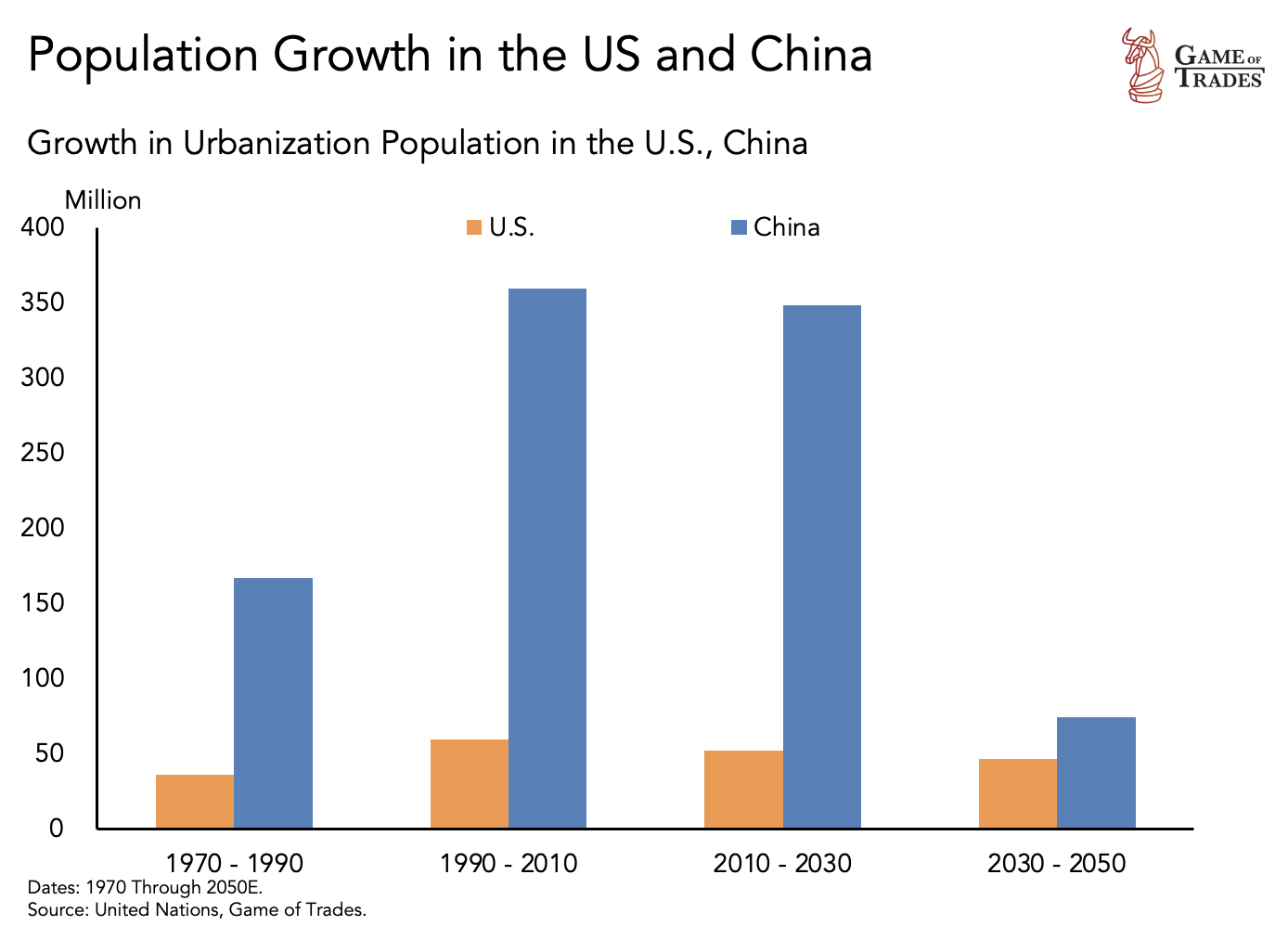

Population Growth and Global Context:

Fortunately, population growth in the United States is expected to level off in the coming decades. This stabilization could potentially relieve some pressure on the housing market. In comparison, China’s substantially higher population growth explains why Chinese real estate has been yielding astronomical returns. Understanding the global context helps shed light on the unique challenges of the US housing market

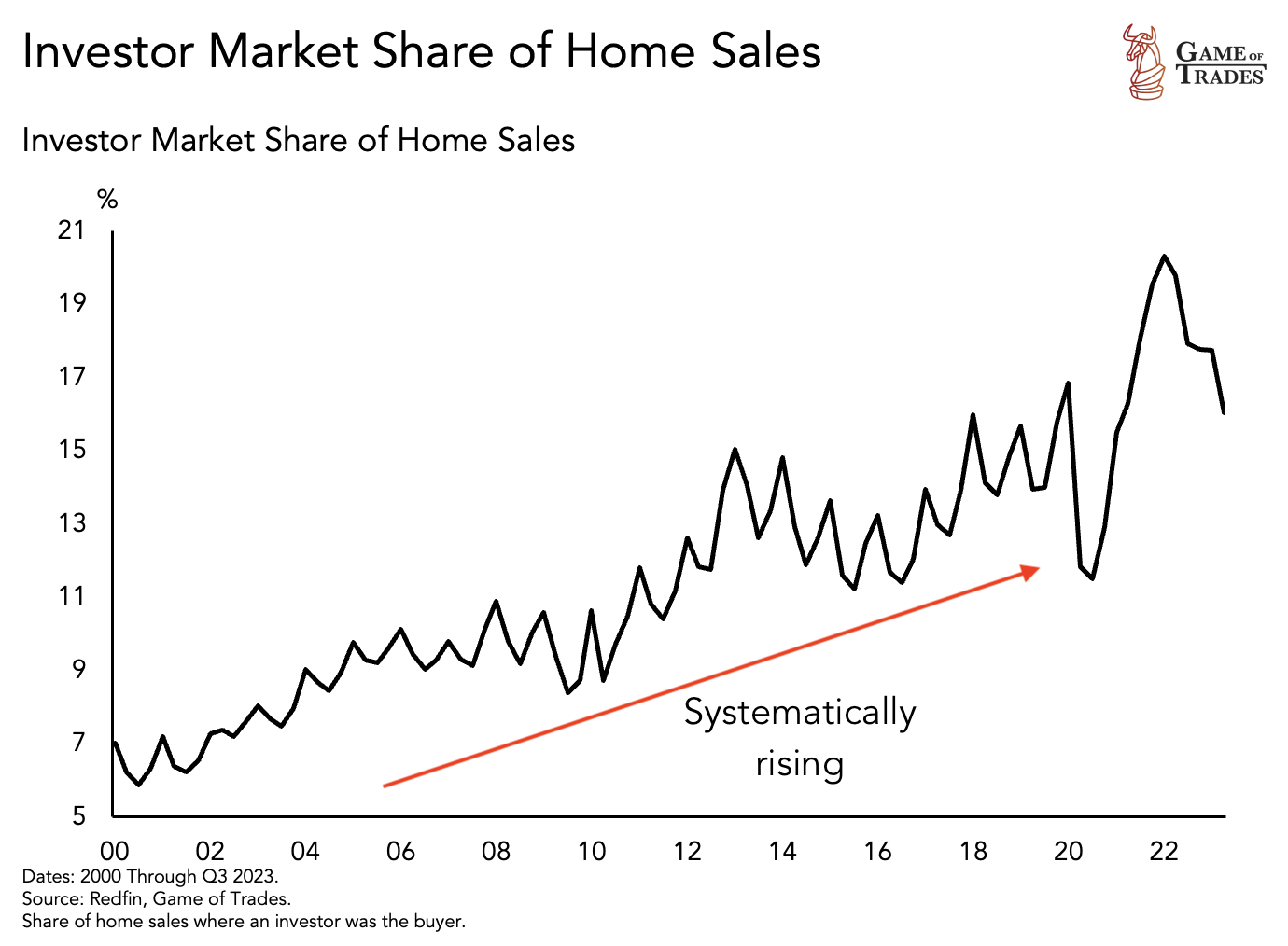

Increasing Institutional Ownership:

A fundamental issue contributing to the housing affordability crisis is the escalating institutional ownership of homes. In 2023, a record 18% of the total housing market is owned by investors, marking a significant jump from the 6% ownership recorded in 2001. This trend is projected to reach 40% by 2030, further impacting affordability for individual buyers.

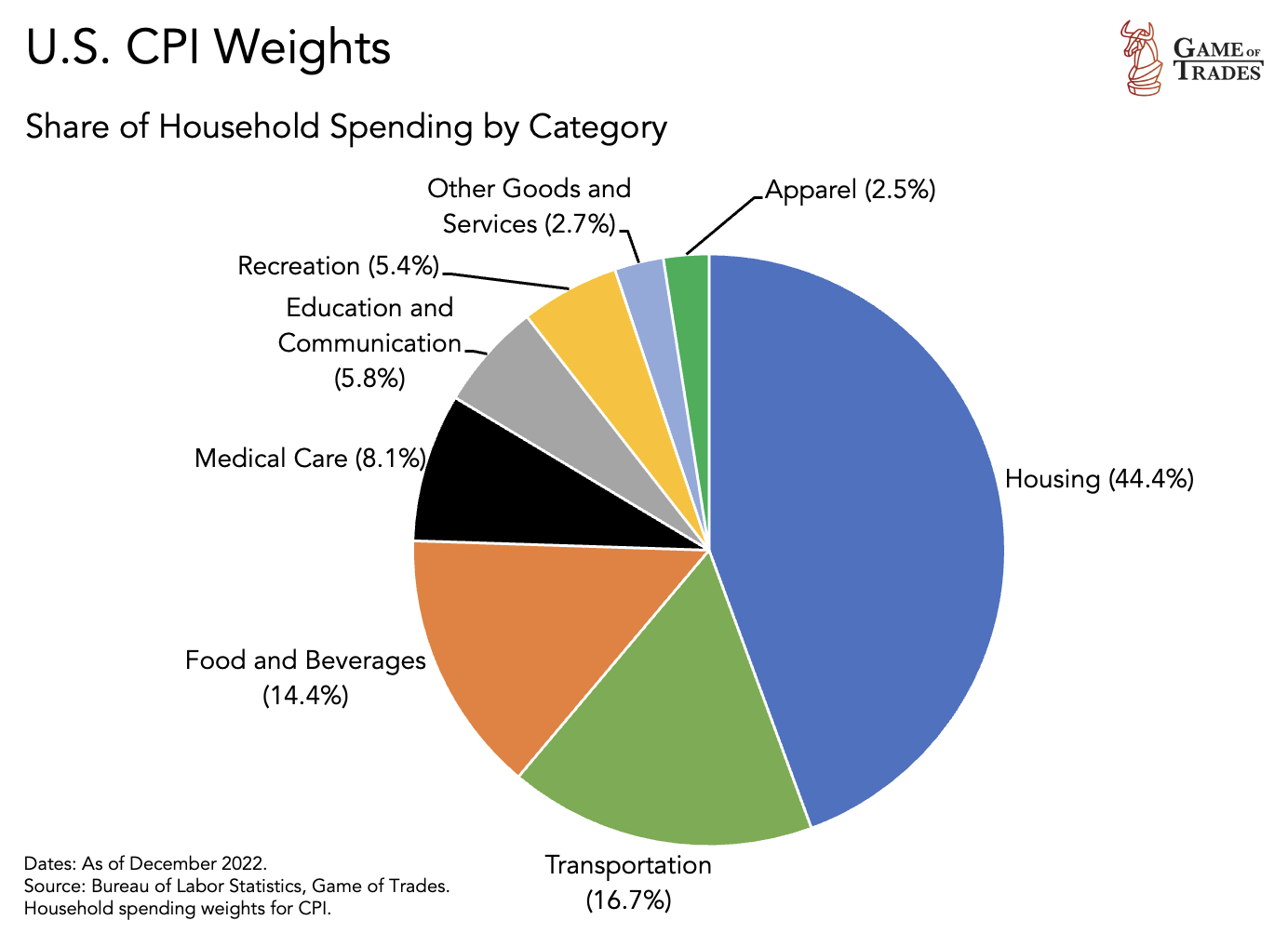

Institutions have the advantage of surplus funds, enabling them to invest heavily in real estate. In contrast, average Americans must balance their housing budgets against rising costs in other essential areas such as food and transportation, which have increased by 20% and 35%, respectively, since 2020. These factors, coupled with diminishing savings relative to income, are contributing to a growing wealth inequality gap.

Access to Affordable Housing:

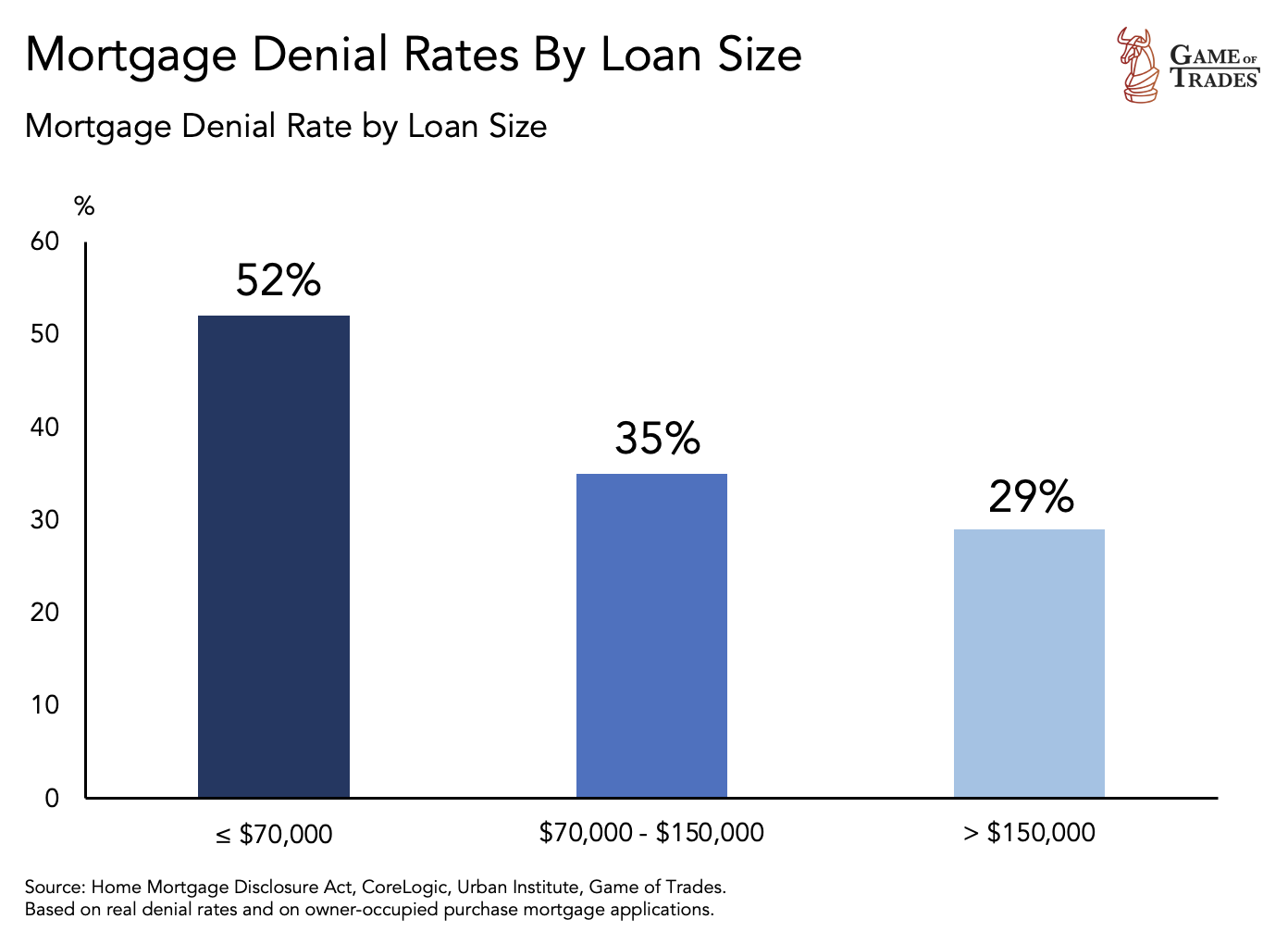

Despite the availability of homes sold for under $100,000, loan denials for individuals requiring these affordable homes remain a significant challenge. Loan applications below $70,000 face a denial rate of around 50%, nearly twice the rejection rate for loans above $150,000. Access to affordable financing continues to be an obstacle for aspiring homeowners.

Conclusion:

The American dream of homeownership is facing significant challenges in 2023. Rising home prices, limited housing supply, increasing institutional ownership, and a lack of affordable financing options have made it increasingly difficult for the average person to become a homeowner. Understanding these systemic challenges is crucial for addressing the disparities in the housing market. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Oil Market Outlook: Geopolitical Risks, Demand Concerns, and Trading Potential