Geopolitical tensions in the Middle East have been a concern for global oil markets. Recent warnings from the World Bank about potential oil price increases due to geopolitical tensions have raised questions about the direction of oil prices. In this article, we delve into the relationship between geopolitical tensions and oil prices, evaluate the current market dynamics, and explore trading opportunities in the oil market.

Geopolitical Tensions and Oil Price Dynamics:

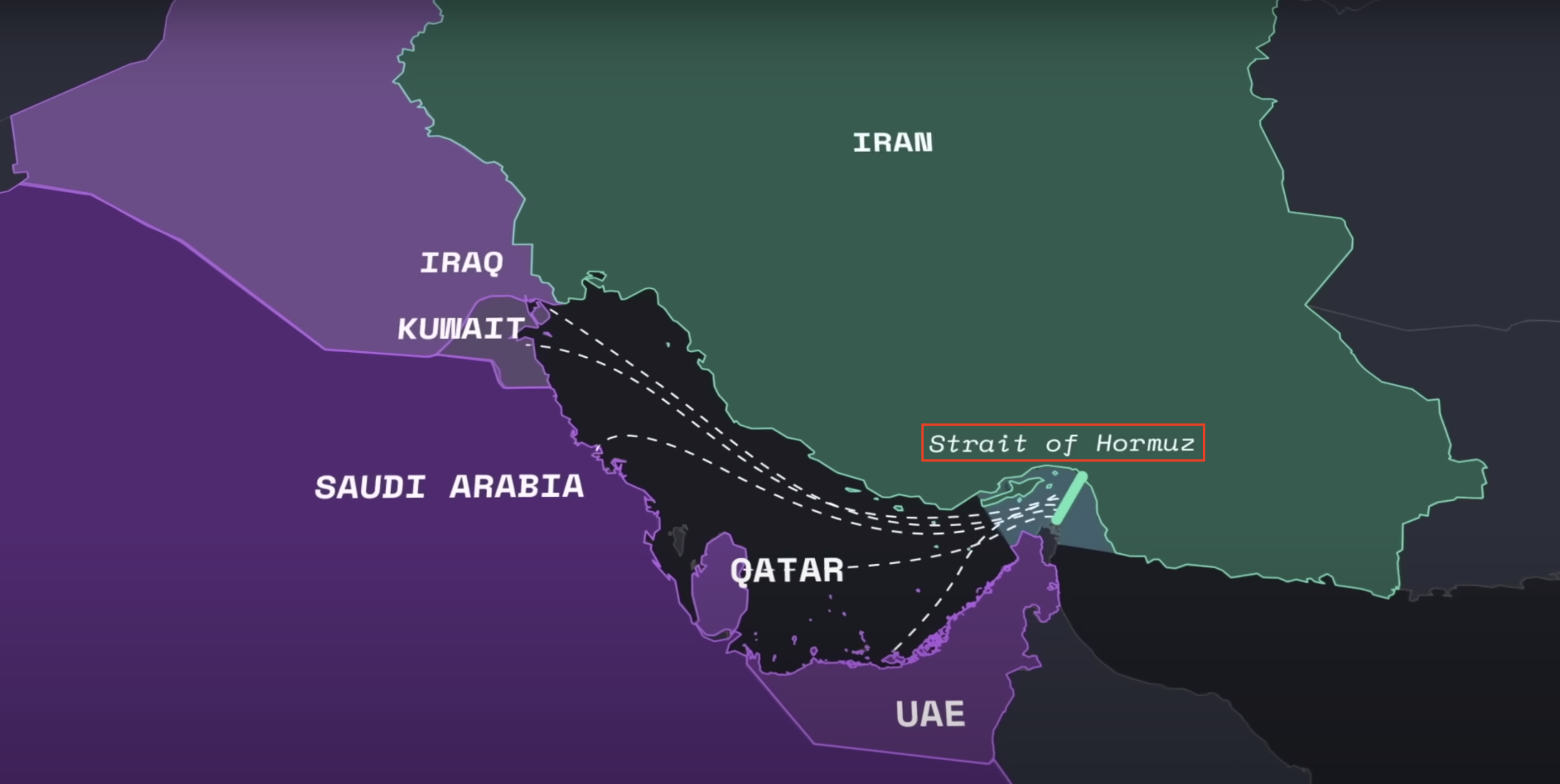

Geopolitical conflicts in the Middle East have historically caused oil prices to rise as the market reacts to potential disruptions in oil supply. While Israel and Palestine are not major oil players, Iran’s ability to disrupt oil supply by closing the Strait of Hormuz, a crucial shipping route, is a concern. Such a disruption could cut global oil supply by 7.5% and potentially lead to a 75% surge in oil prices, reaching a historical high of $145 per barrel.

Recent Market Trends:

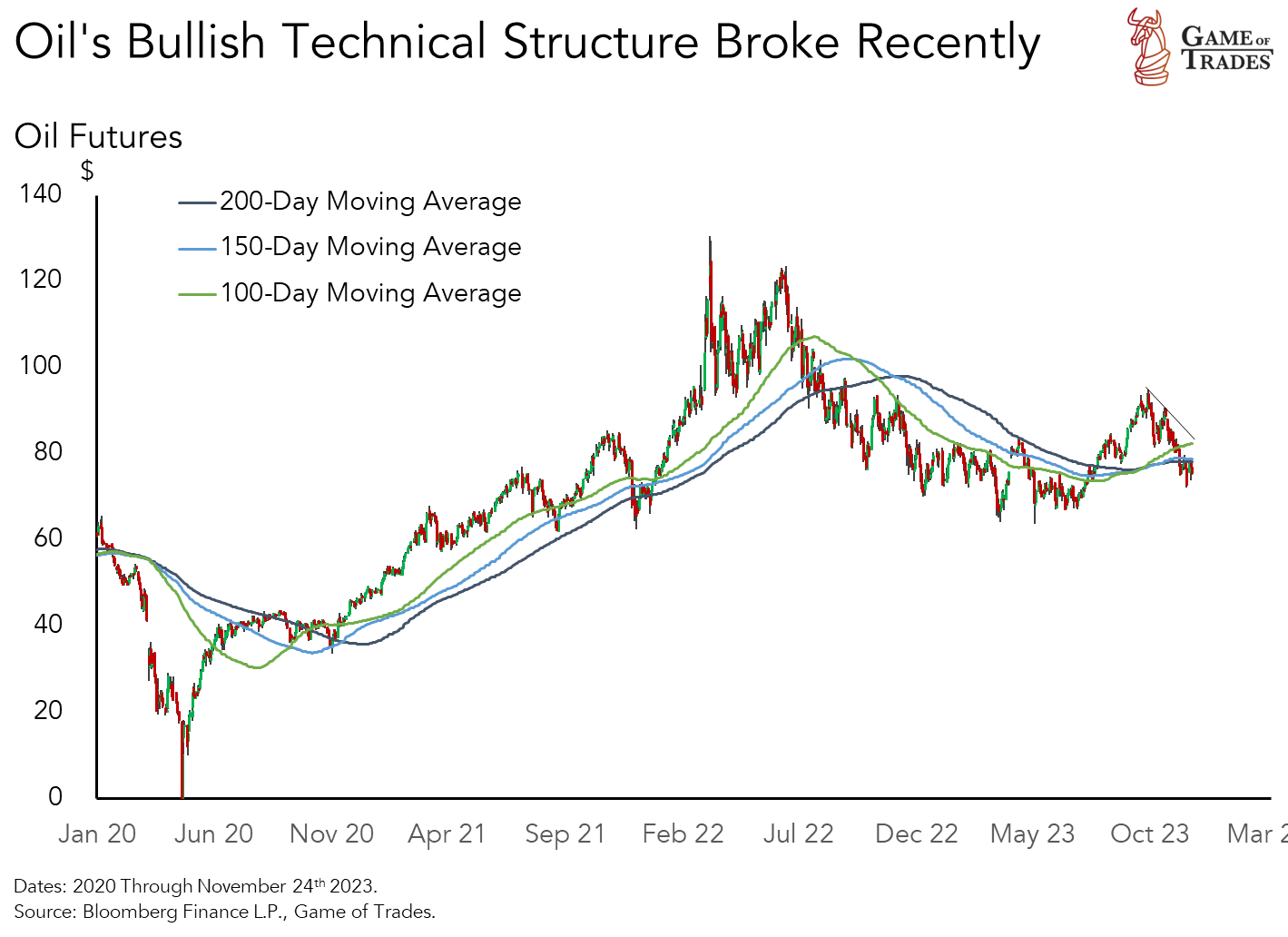

Despite the heightened tensions and warnings from the World Bank, oil prices have been dropping in the past month. This trend can be attributed to several factors, including recent OPEC+ production cuts and shifting market dynamics. Notably, oil has broken down from key moving averages, indicating that investors are more concerned about falling demand rather than supply disruptions.

Impact of Demand on Oil Prices:

Demand plays a crucial role in determining oil prices. Recent data on US inventories confirms a decrease in demand, indicating weaker consumption from the largest oil consumer and producer globally. Historically, demand fluctuations have had a more significant impact on oil prices than supply disruptions. Therefore, monitoring demand trends is essential for understanding the direction of oil prices.

Game of Trades’ Oil Rating and Trading Opportunities:

Considering the market dynamics, Game of Trades recently downgraded its Oil rating from neutral to sell. Several factors, including price breakdowns, reduced geopolitical concerns, and signs of economic weakness, have influenced this decision. However, despite the downward outlook, oil presents unique trading opportunities due to its inherent volatility and sensitivity to business cycles.

Trading Oil: A Volatile Asset:

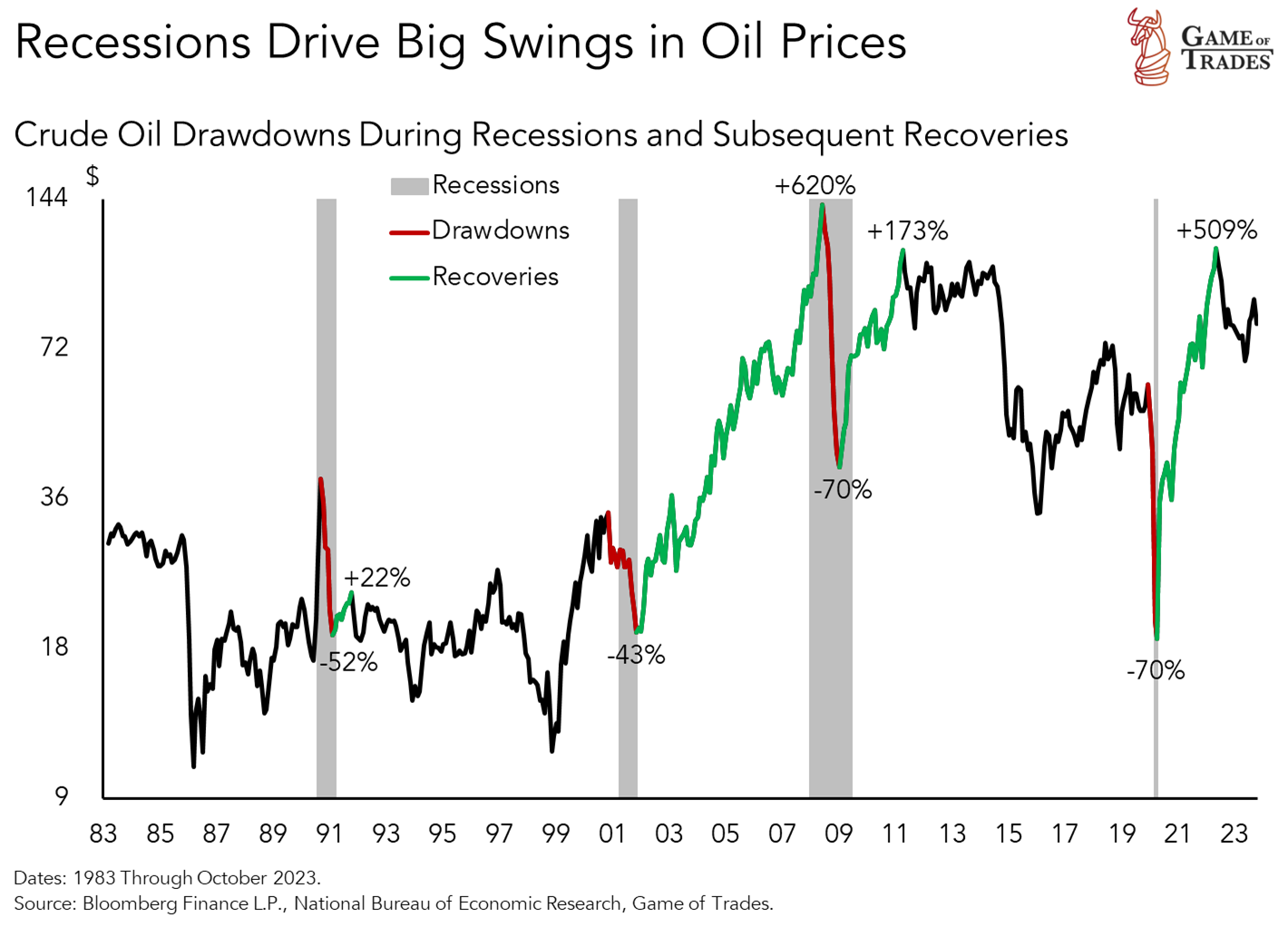

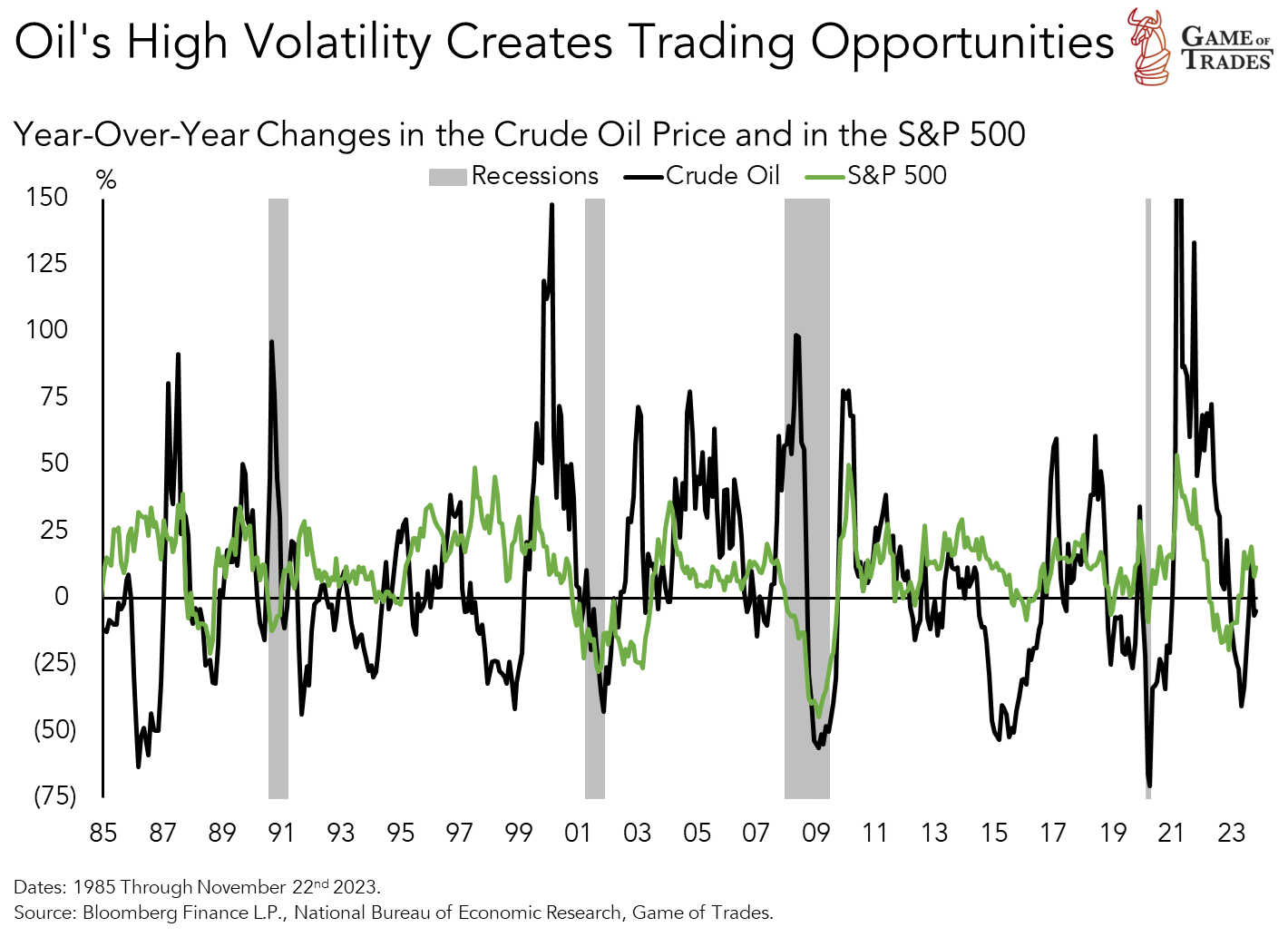

Oil exhibits significant price swings during recessions, often surpassing the volatility of stocks. It follows a typical pattern across economic downturns, experiencing substantial drawdowns leading into recessions, sometimes preceded by a melt-up. However, as the economy improves, oil prices tend to recover strongly. This volatility opens up trading opportunities both on the short and long sides of the market.

Conclusion:

Geopolitical tensions in the Middle East have the potential to impact global oil markets, but recent market trends suggest that falling demand is currently a more significant concern than supply disruptions. Monitoring demand indicators, geopolitical developments, and market dynamics is crucial for investors looking to navigate the oil market successfully. Despite the downward rating, oil’s volatility presents unique trading opportunities during business cycles. By staying informed and understanding the interplay between geopolitical risks, demand, and market trends, investors can make informed decisions in the ever-changing oil market. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: The State of American Finances: Rising Debt, Falling Savings, and Economic Vulnerability