As the US economy faces challenges and signs of economic downturn emerge, the Fed finds itself in a difficult position. With weakening housing market conditions and contracting leading economic indicators, investors might expect the Fed to cut interest rates to stimulate the economy. However, contrary to expectations, the Fed has plans to raise rates. This article explores the reasons behind the Fed’s decision and the complexities involved in maintaining price stability while navigating potential economic pain.

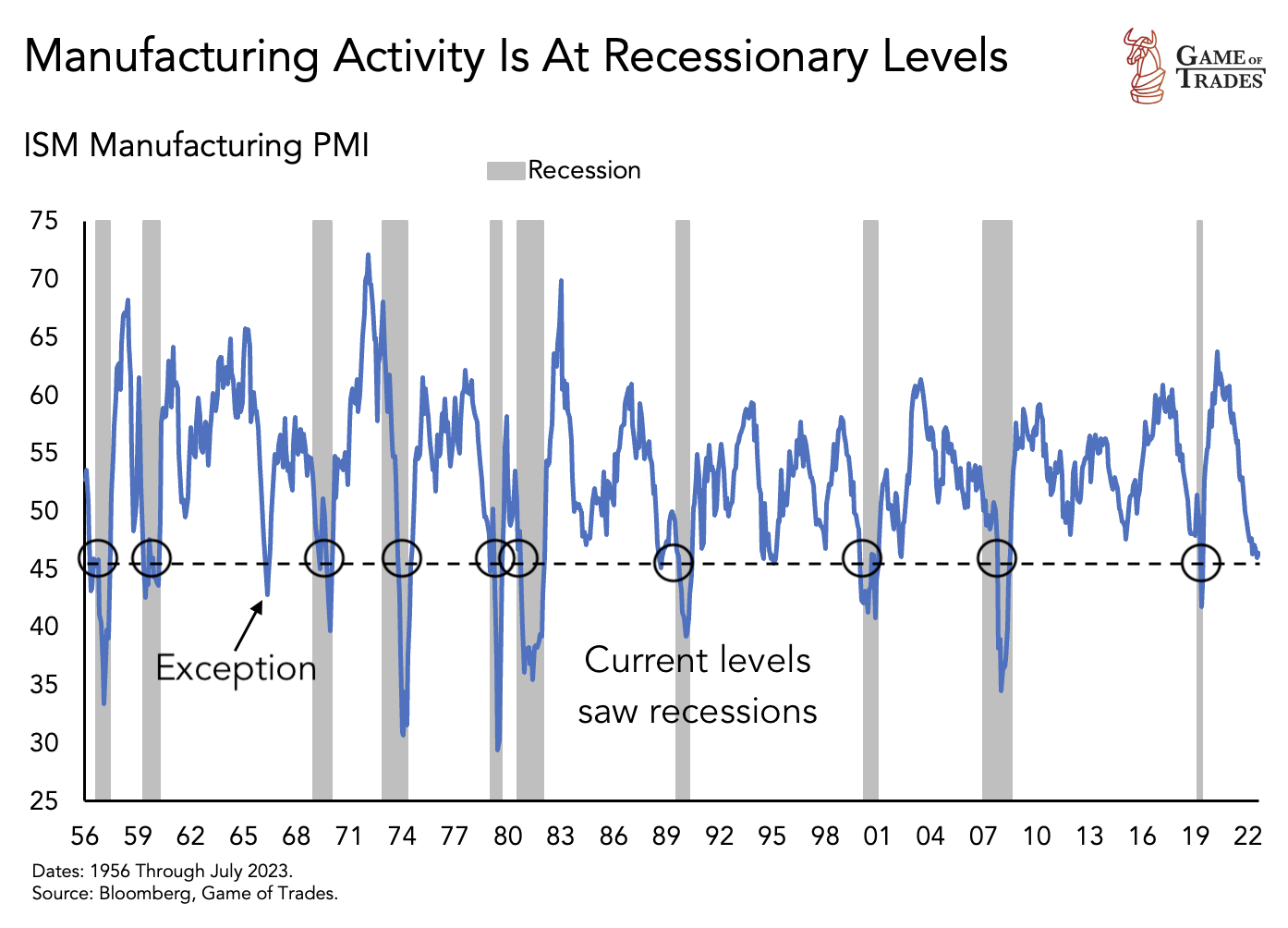

Manufacturing Activity and Economic Downturn Signals

The US economy is showing cracks as manufacturing activity hits a level of 46, a figure commonly associated with economic downturns. This raises concerns about the overall health of the economy and prompts a closer examination of the Fed’s response.

In times of current Purchasing Managers’ Index (PMI) levels, the Fed typically lowers interest rates to stimulate manufacturing activity and support the broader economy. This historical trend raises questions about the Fed’s current stance, given the weakening economic indicators.

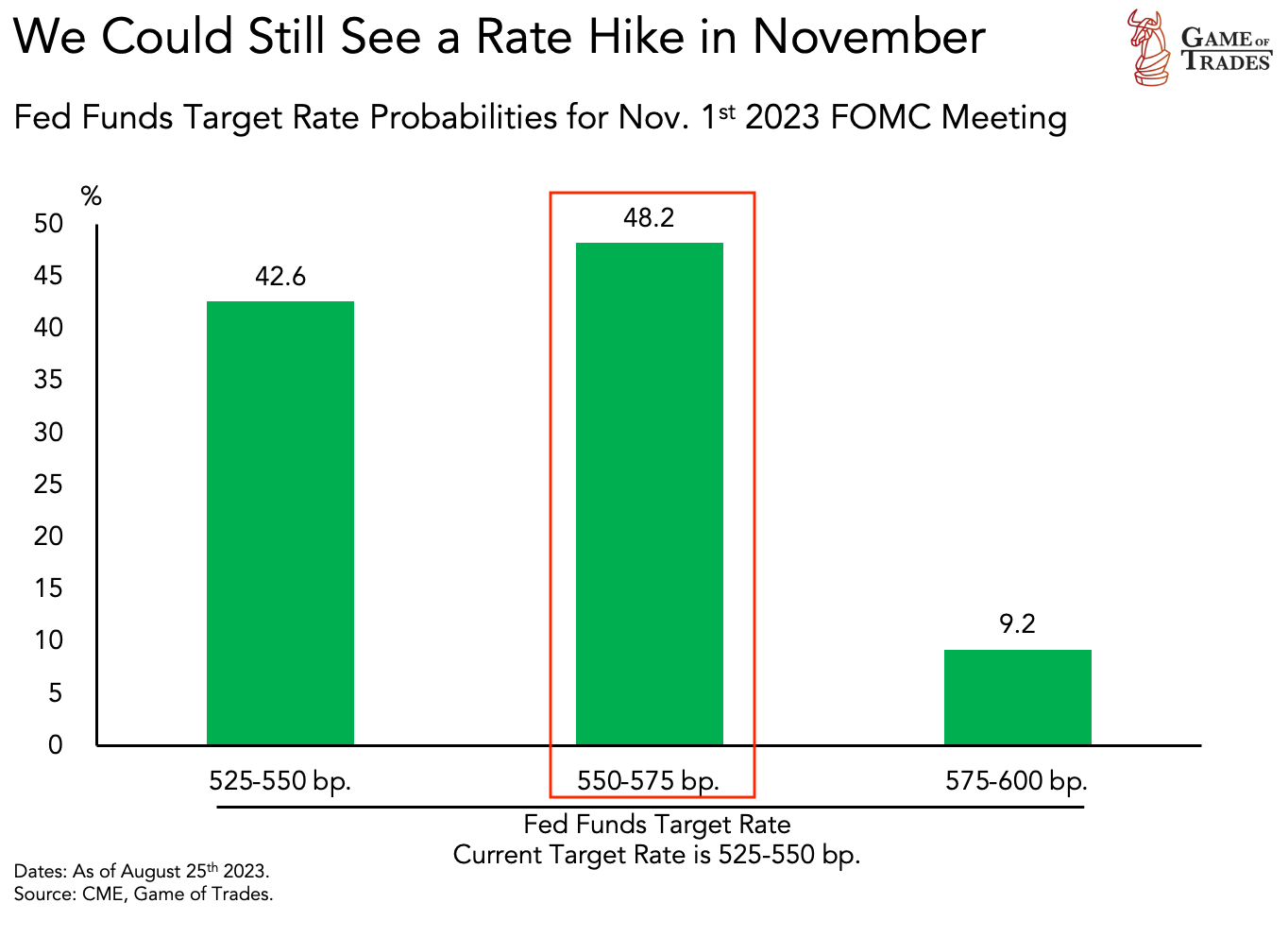

Unexpected Plans for Rate Hike

The Fed plans to raise rates in November 2023, despite the challenging economic climate. This decision seems counterintuitive, considering the weakening housing market and contracting leading indicators. The target rate probability for November 2023 currently stands at 5.5 to 5.75%, indicating another 25 basis points hike. This probability assessment provides insight into the Fed’s intention to further tighten monetary policy and could have further weaken the economy.

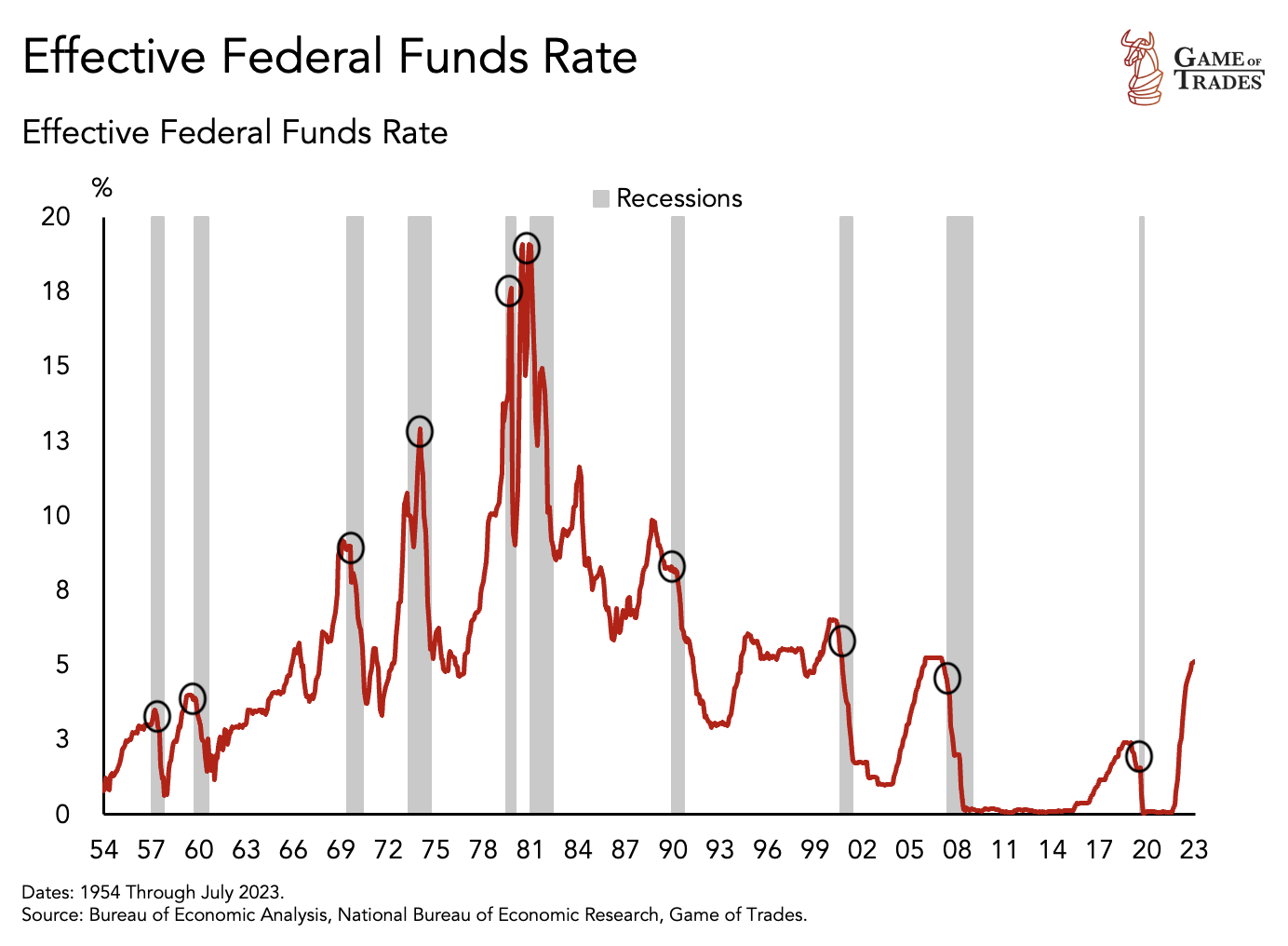

Impact of Rate Hikes on Borrowing and Inflation

When the Fed raises rates, borrowing becomes more expensive, which slows down economic growth and helps cool inflation. Conversely, lowering rates has the opposite effect, stimulating borrowing and potentially fueling inflation. Understanding these dynamics is crucial to comprehending the Fed’s actions.

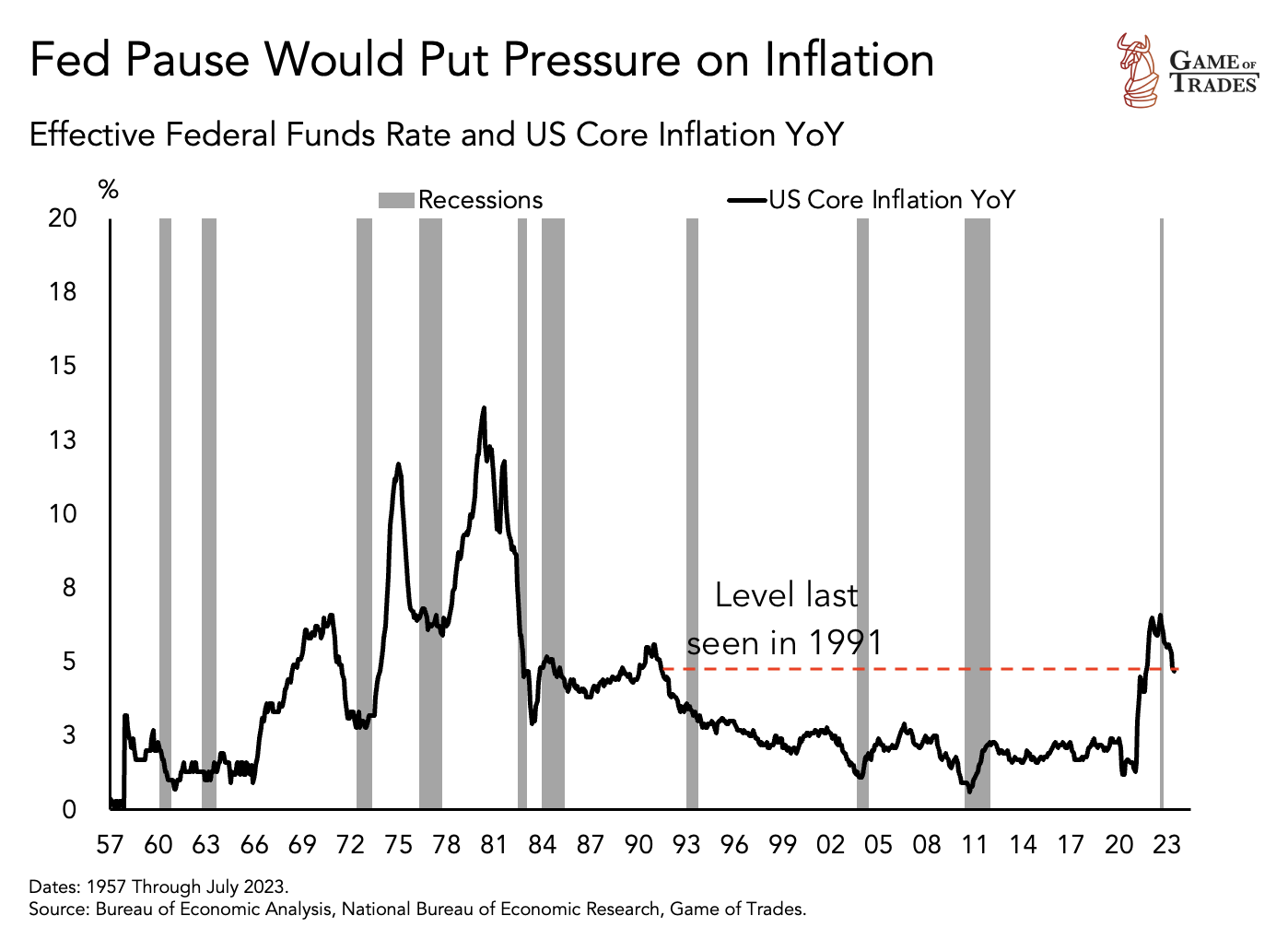

Inflation Control as the Primary Motive

The primary reason the Fed is raising rates is to curb inflation, as core inflation levels is at levels that were last seen in 1991. Core inflation focuses on price changes excluding food and energy, which are known to be volatile and can distort the overall inflation picture. The Fed’s ultimate goal is to maintain inflation at 2% to foster a steady economic environment.

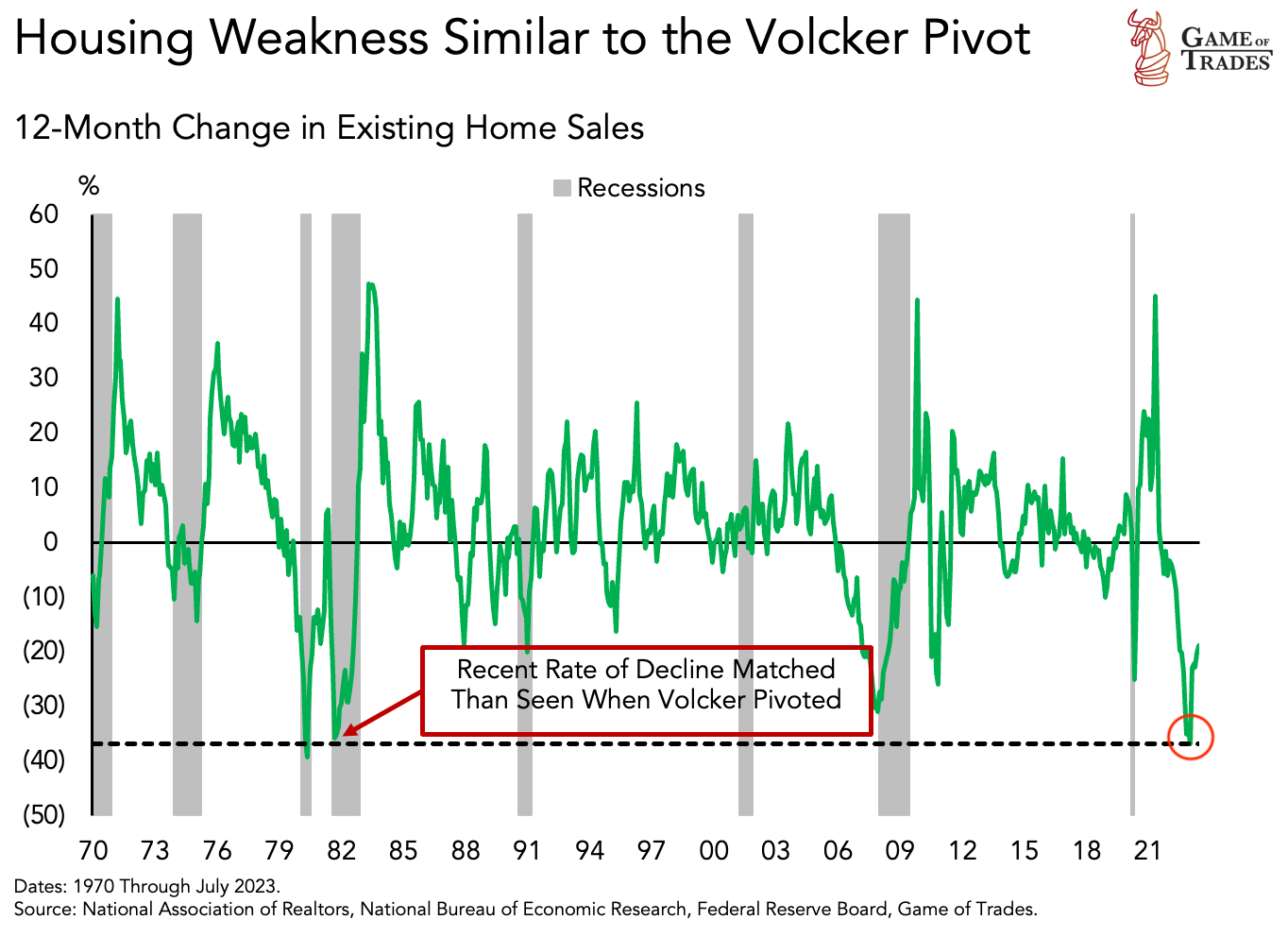

Tight monetary policy has been a major headwind for the US economy. It has negatively impacted the housing market, with existing home sales reaching contraction levels last seen during the Volcker-era.

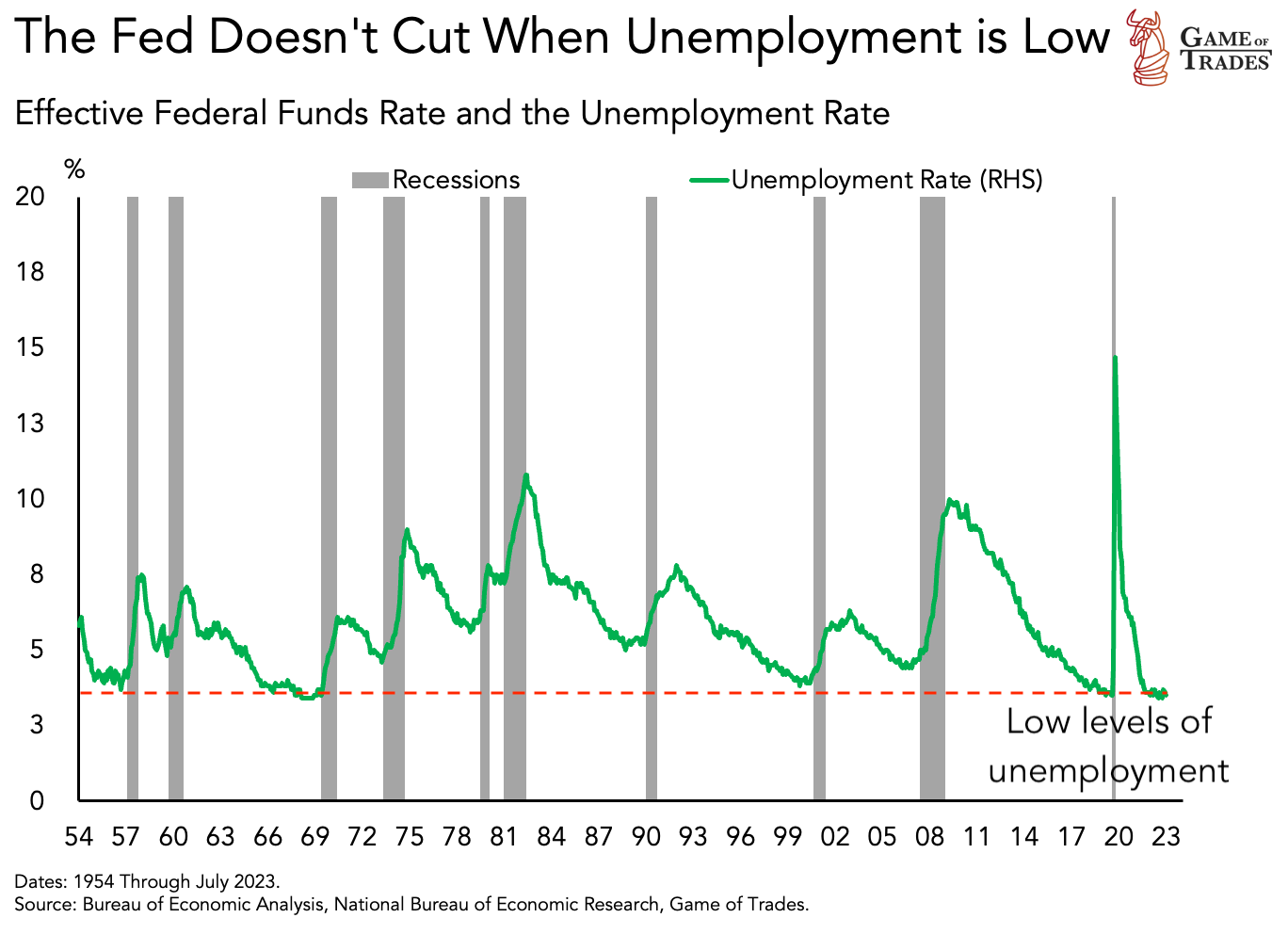

While economic activity deteriorates, the Fed’s decision to raise rates is largely driven by the historically low unemployment rate. Understanding the two core mandates of the Fed – maximum employment and price stability – sheds light on their current priorities and challenges.

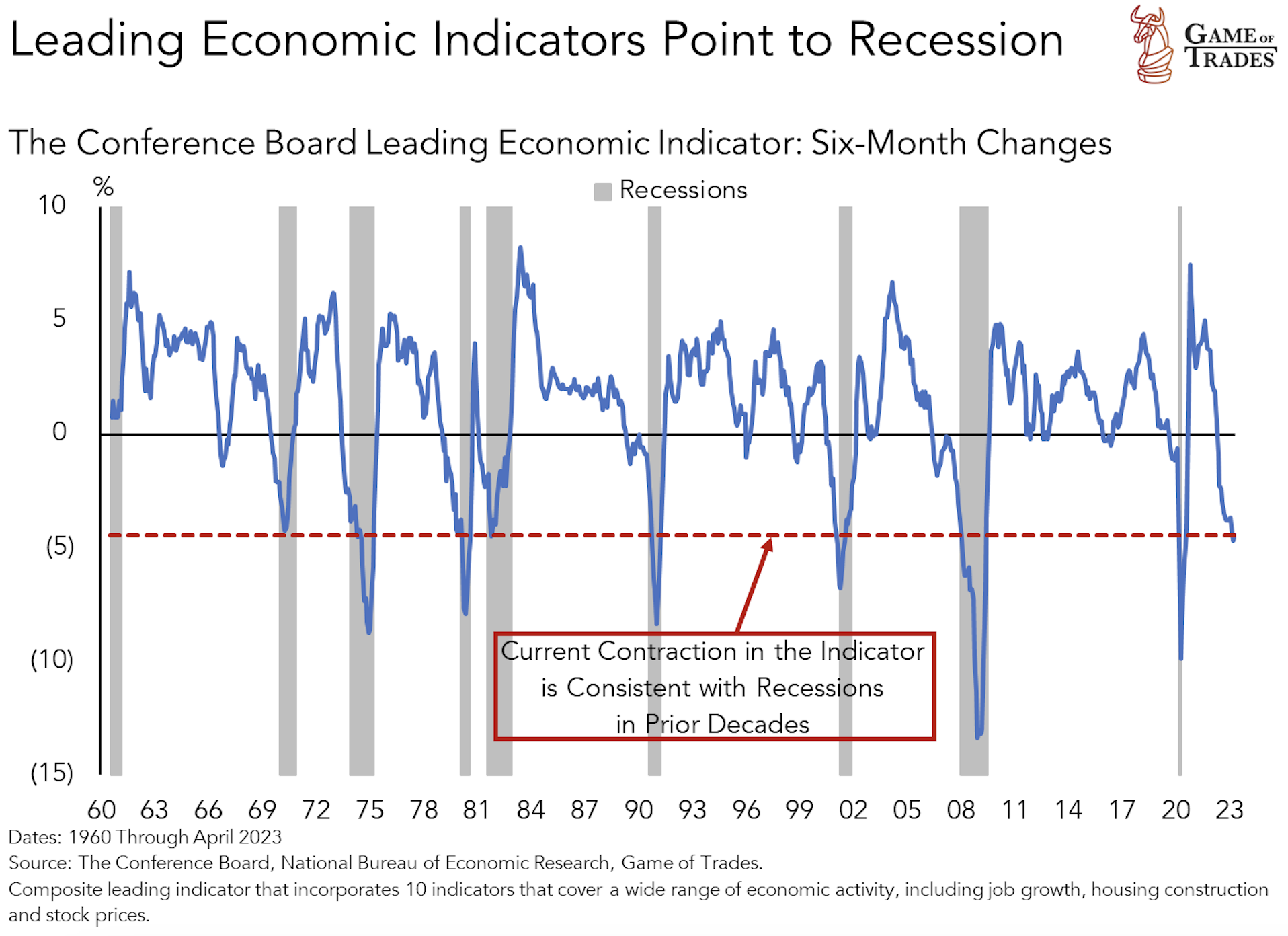

Leading Economic Indicators Foreshadows a Recession

Most economists consider the unemployment rate as a lagging economic indicator, while leading indicators arguably provide more timely warning signals. Currently, leading economic indicators are contracting at levels that have always anticipated recessions since 1960. The Fed may be underestimating the downside potential of the economy. However, aggressive rate cuts could trigger an economic boom and resurgence in inflation, complicating the decision-making process further for the Fed.

Conclusion

Understanding the Fed’s rate decisions and the factors driving them is crucial for investors. The current macro landscape presents challenges, with the Fed aiming to maintain price stability despite warning signs of a sharp economic downturn. Balancing inflation control and price stability requires careful consideration and a nuanced approach from the central bank. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Unraveling the Implications of Soaring Office Vacancy Rates on US Regional Banks