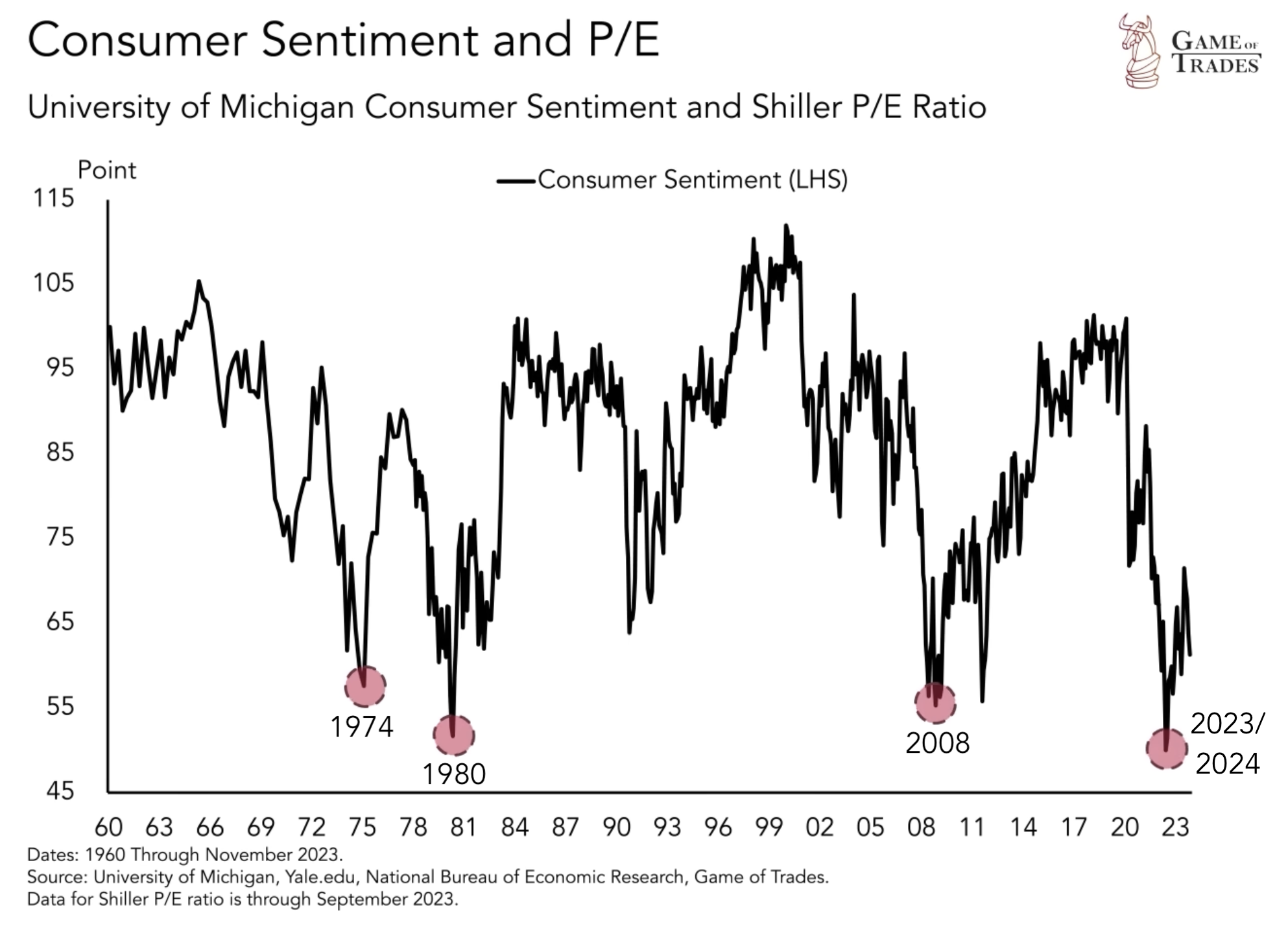

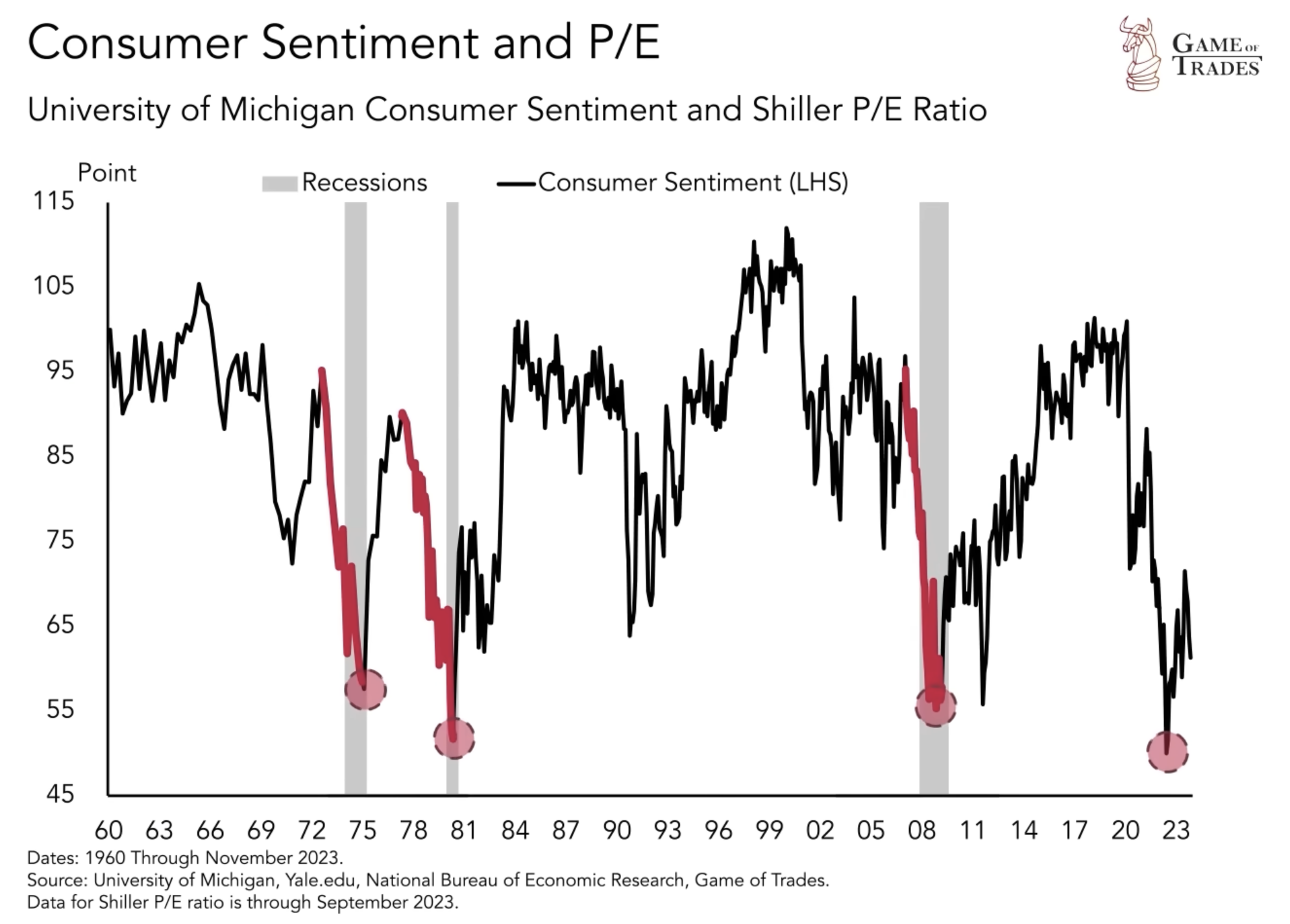

The year 1974, 1980, 2008, and 2023 / 2024 share a common thread of widespread pessimism about the future of the economy. These periods were characterized by economic recessions and significant macro challenges.

Interestingly, today’s economic landscape presents a contrasting picture. Unemployment rates are at historic lows, inflation is relatively low, and the stock market continues to reach new all-time highs. However, there is a clear divergence between Wall Street’s optimistic outlook and the average person’s concerns.

In this article, we will delve into history to determine who is right about the future and whether current market valuations accurately reflect the underlying economy.

The Historical Context

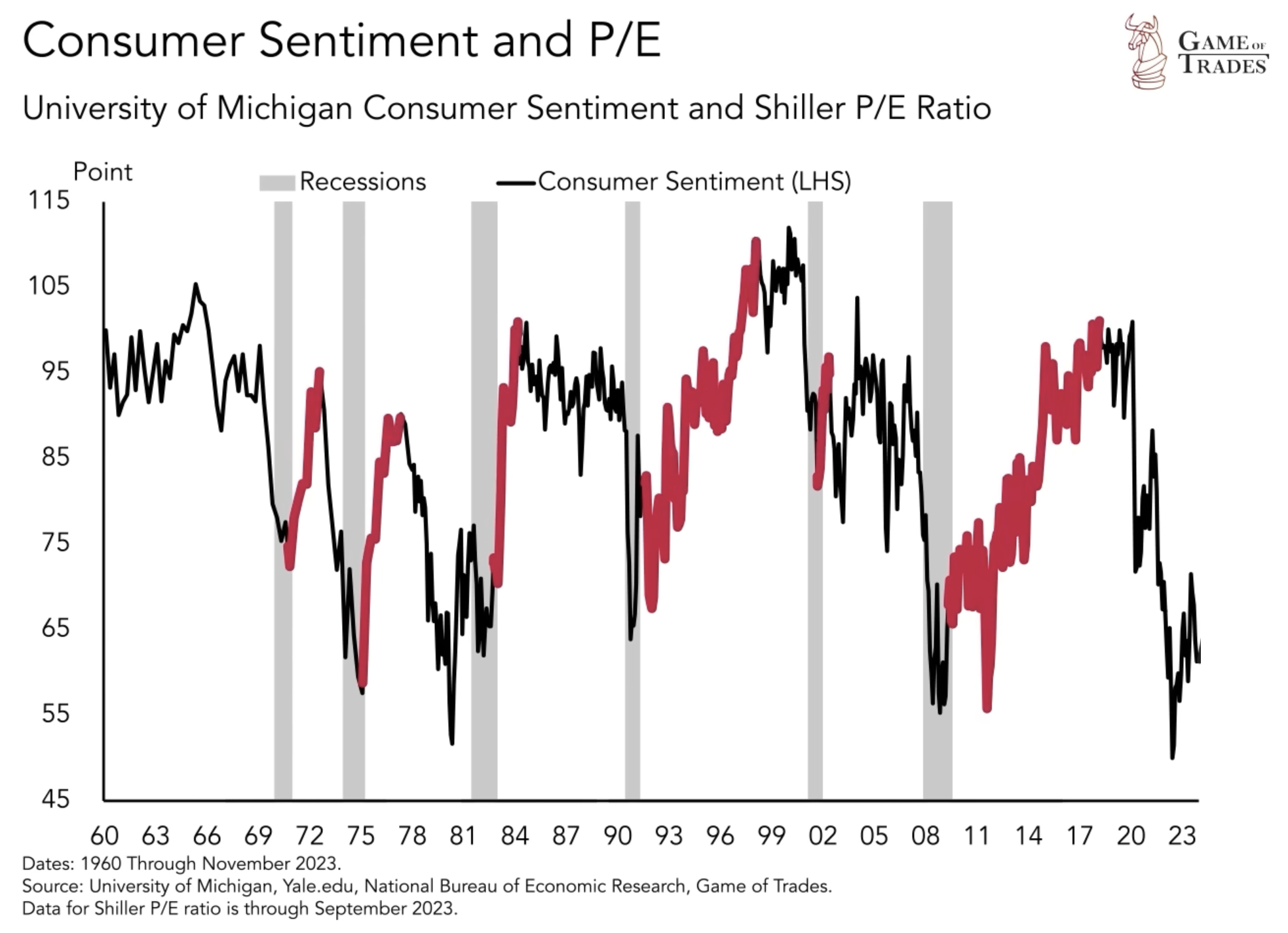

Examining historical episodes, such as 1974, 1980, and 2008, provides valuable insights into the relationship between consumer sentiment and market performance. These periods were marked by economic downturns accompanied by rising unemployment rates.

In 1974 a massive oil shock was triggered, 1980 saw interest rates reach 15% and the unemployment rate spike to 10%, and 2008 witnessed a housing the subprime crisis led to a housing crash. Consumer sentiment during these times was typically low, understandably reflecting the challenging economic conditions.

Wall Street’s Optimism and Market Valuations

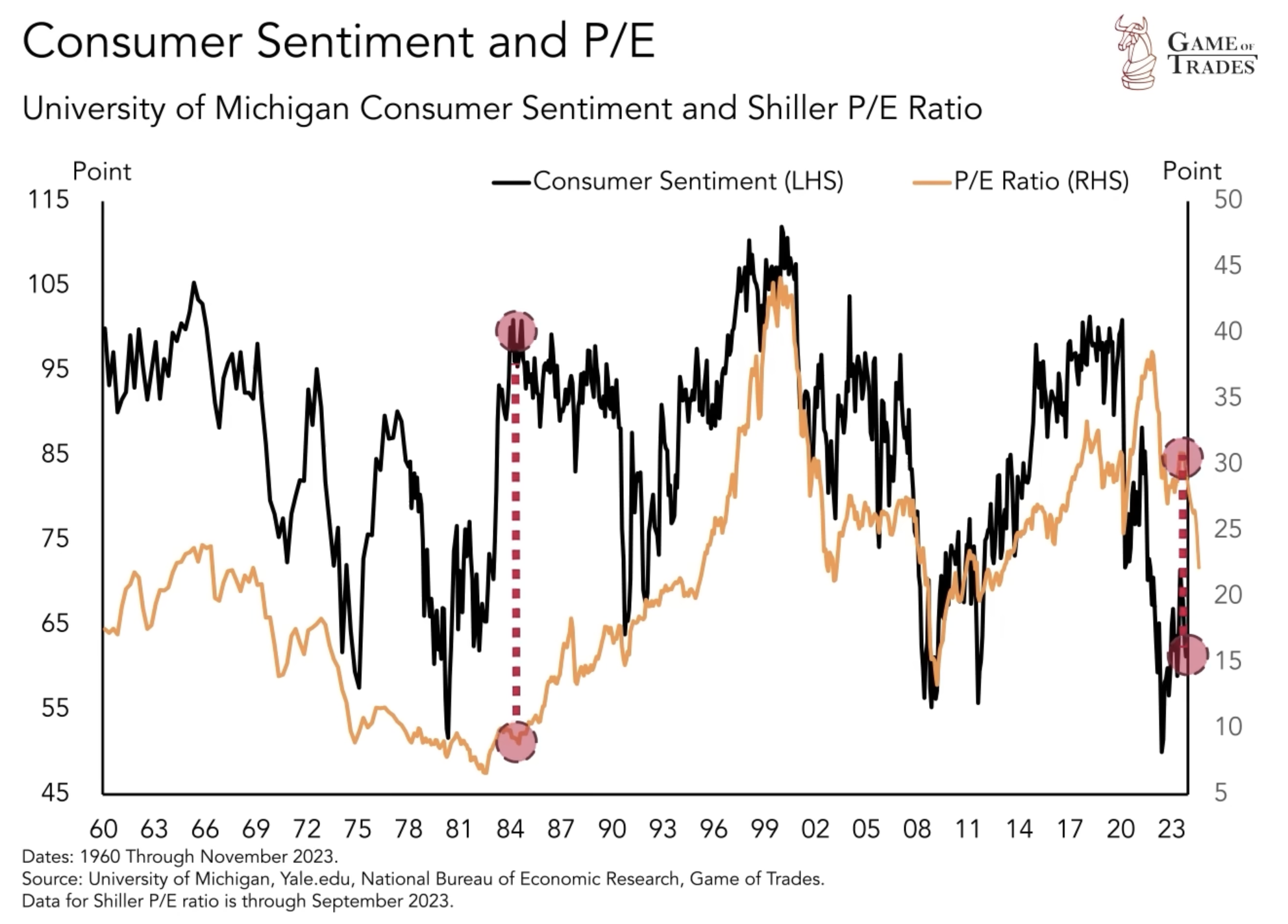

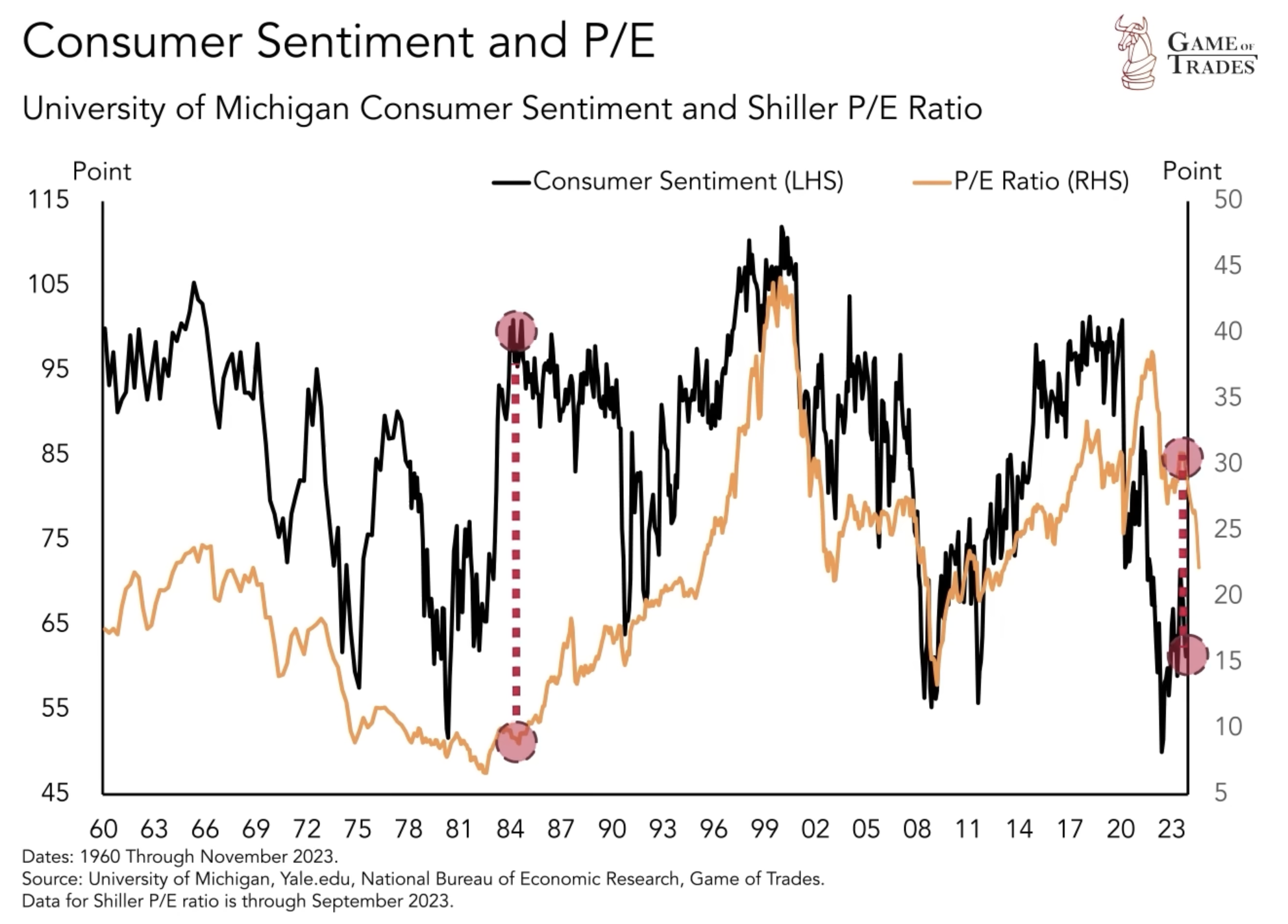

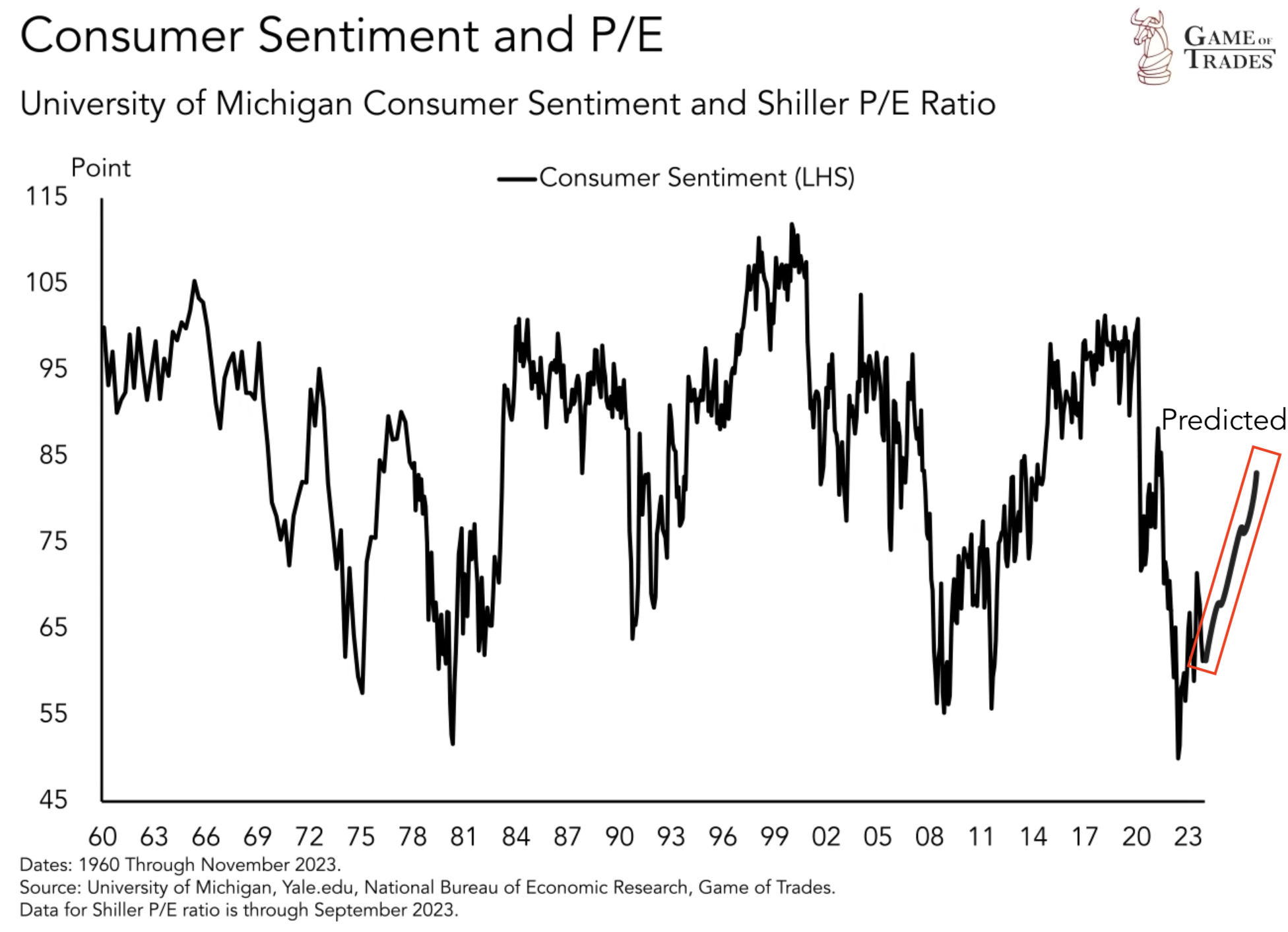

Presently, stock market valuations are soaring to levels seen during prosperous times like the 1960s and the late 1990s. This surge in valuations, coupled with Wall Street’s positive outlook on Corporate America, contrasts sharply with the average person’s concerns about the economy as seen through the low consumer sentiment reading. This discrepancy raises questions about the accuracy of market valuations and whether they truly reflect the underlying economic conditions.

Consumer Sentiment: The Consumer Knows Best?

Drawing parallels to the divergence seen in 1983, when consumer sentiment surged while the stock market lagged, we can see that the consumer’s sentiment about the economy tends to align with reality over time.

In the 1980s, the stock market eventually caught up with the optimistic sentiment of the average person. This historical precedent suggests that Wall Street’s expectations will eventually align with consumer expectations.

Consumer Sentiment and Housing Market Concerns

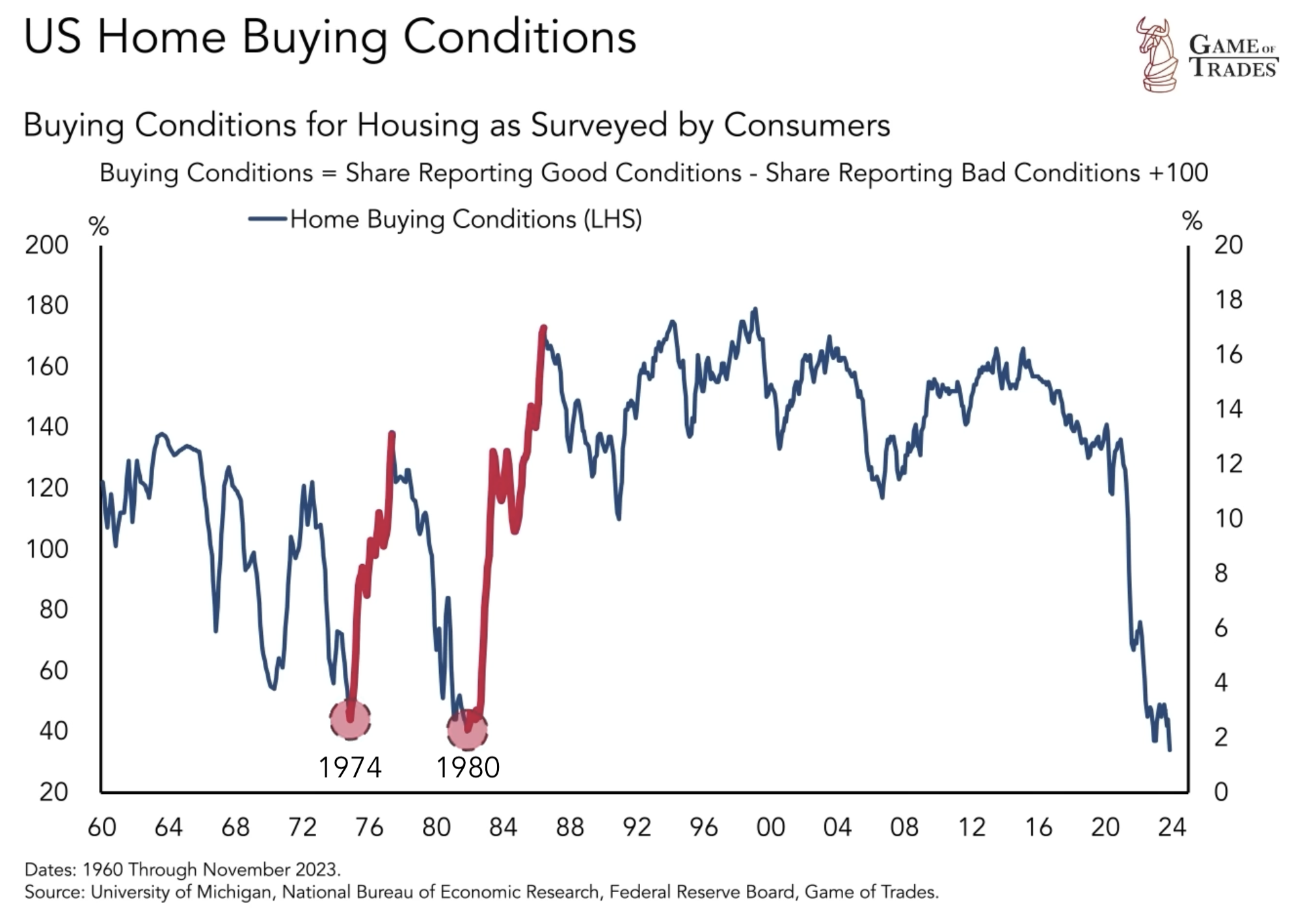

One key driver of the current pessimism is the state of the housing market. Buying conditions for housing are at their lowest levels in the last six decades, primarily due to rising home prices and mortgage rates.

Since real estate represents a significant portion of most people’s wealth, negative sentiment about the housing market can spill over into overall economic sentiment. The current levels of housing market buying conditions are worse than 2007, and are at similar levels to the challenging periods of 1974 and 1980.

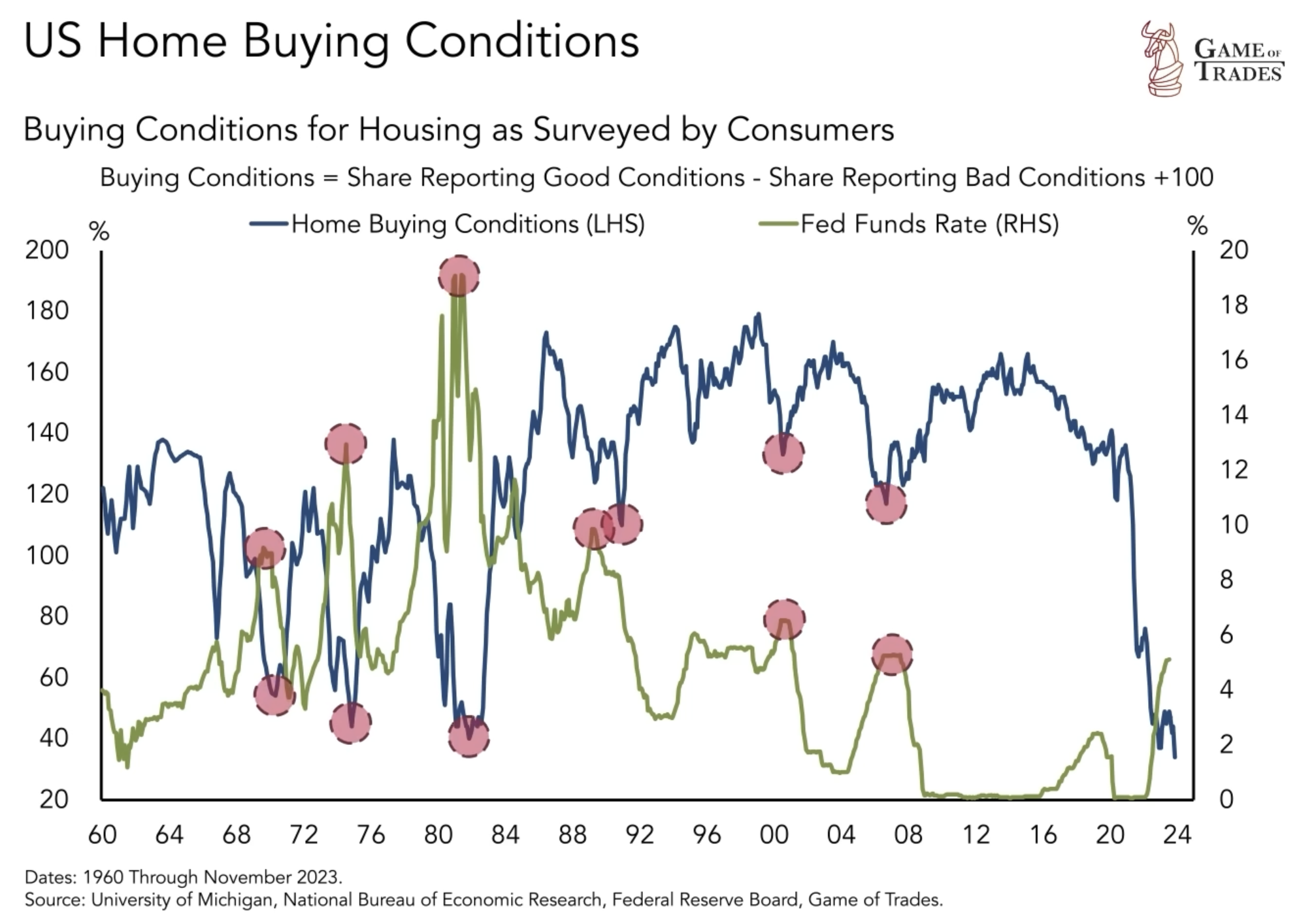

The Role of the Federal Reserve

Historically, the recovery of consumer sentiment has been closely tied to the actions of the Fed. During previous episodes of low sentiment, the Fed employed aggressive interest rate cuts to stimulate the housing market. Lower interest rates directly lead to reduced mortgage rates, making homes more affordable.

Looking ahead, the Fed anticipates interest rate cuts in 2024, which could potentially reignite confidence in the housing market and, subsequently, consumer sentiment.

While a recovery in consumer sentiment without a recession is rare, there is a possibility of a “soft landing” scenario. In this scenario, the Fed’s interest rate cuts boost the housing market, which, in turn, improves consumer sentiment. This outcome would align consumer expectations with current stock market valuations, potentially resulting in continued market growth.

Risks and Uncertainties

However, it is essential to acknowledge that consumer sentiment typically rebounds only after recessions. Rarely does such a resurgence occur without a preceding economic downturn. This happens because recessions reduce home prices leading to higher affordability. Also, the Fed tends to cut interest rates during economic downturns resulting in cheaper mortgage rates and better buying conditions.

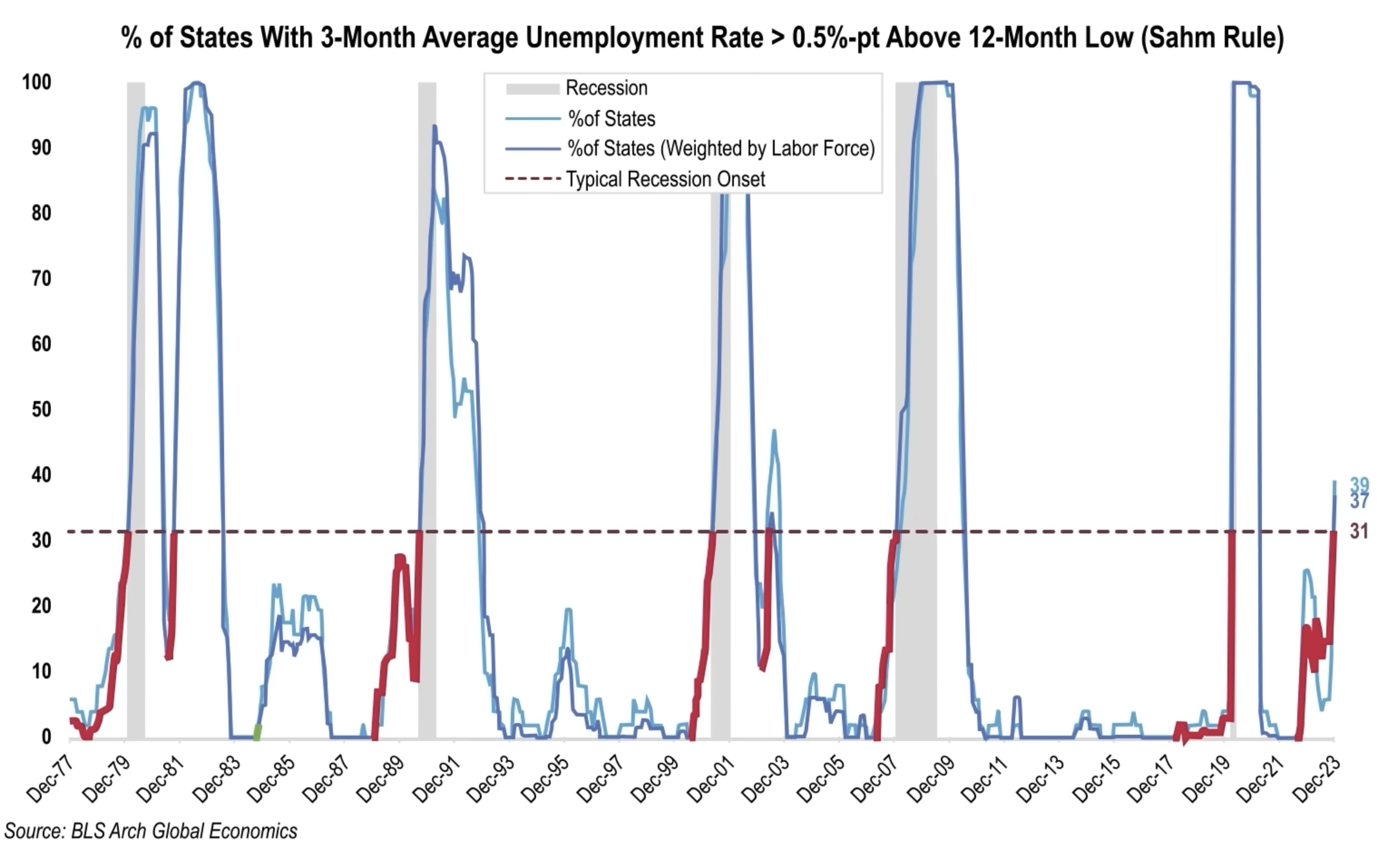

The rising unemployment rates in several US states raise concerns about a possible recession. While there have been instances where rising unemployment rates did not lead to a recession, a threshold of 30% of states experiencing rising unemployment has historically indicated proximity of a downturn.

If a recession occurs, it is likely to have a negative impact on the stock market, given that stocks have historically declined during economic downturns.

Conclusion

The divergence between Wall Street’s optimism and average consumer sentiment raises questions about the accuracy of current market valuations. Historical patterns suggest that consumer sentiment tends to align with the actual state of the economy over time.

While the Fed’s interest rate cuts could potentially boost the housing market and consumer sentiment, the future remains uncertain. Risks of a recession are still present, which could lead to a stock market decline. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Cash is Now More Attractive Than Stocks