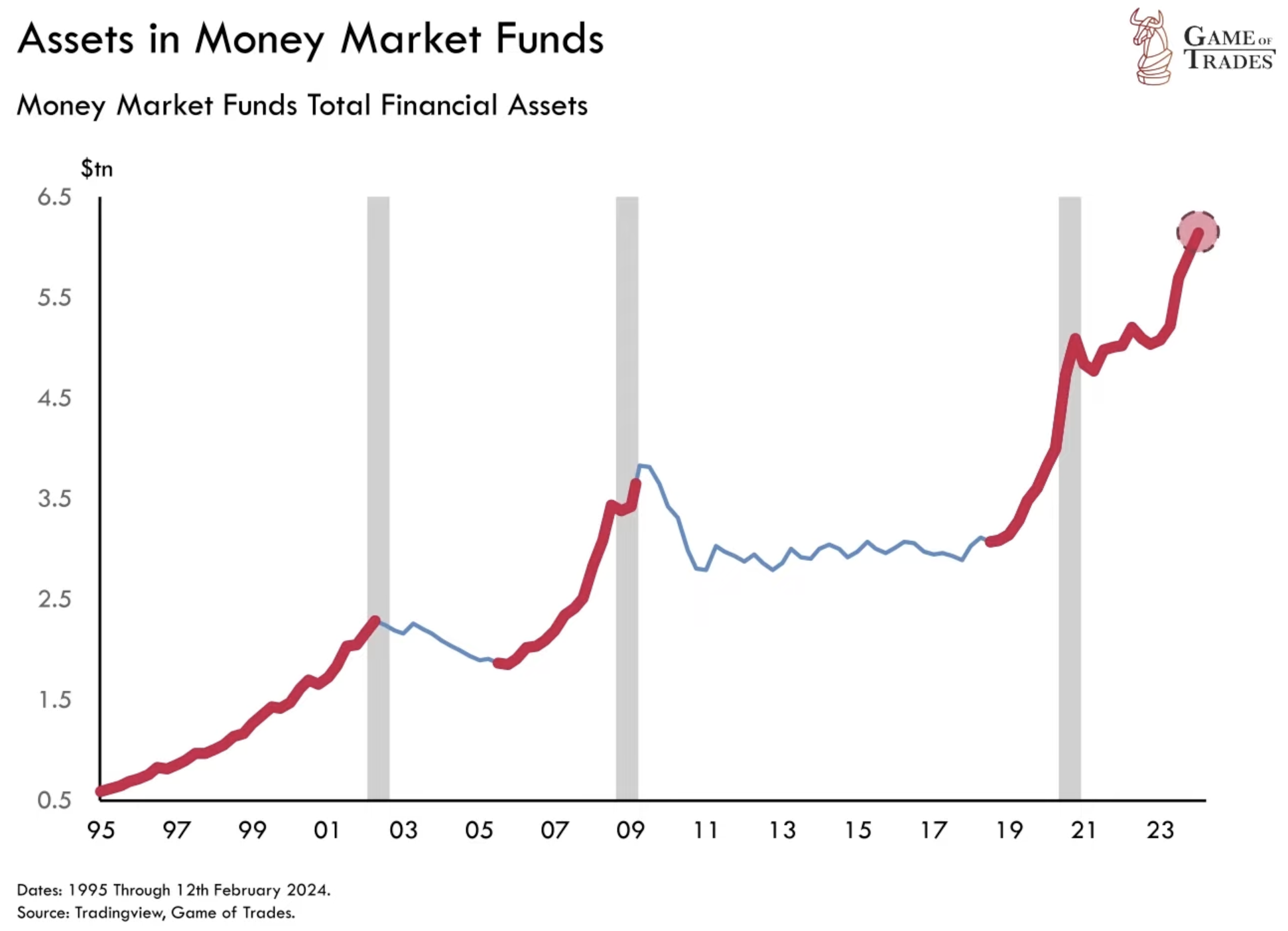

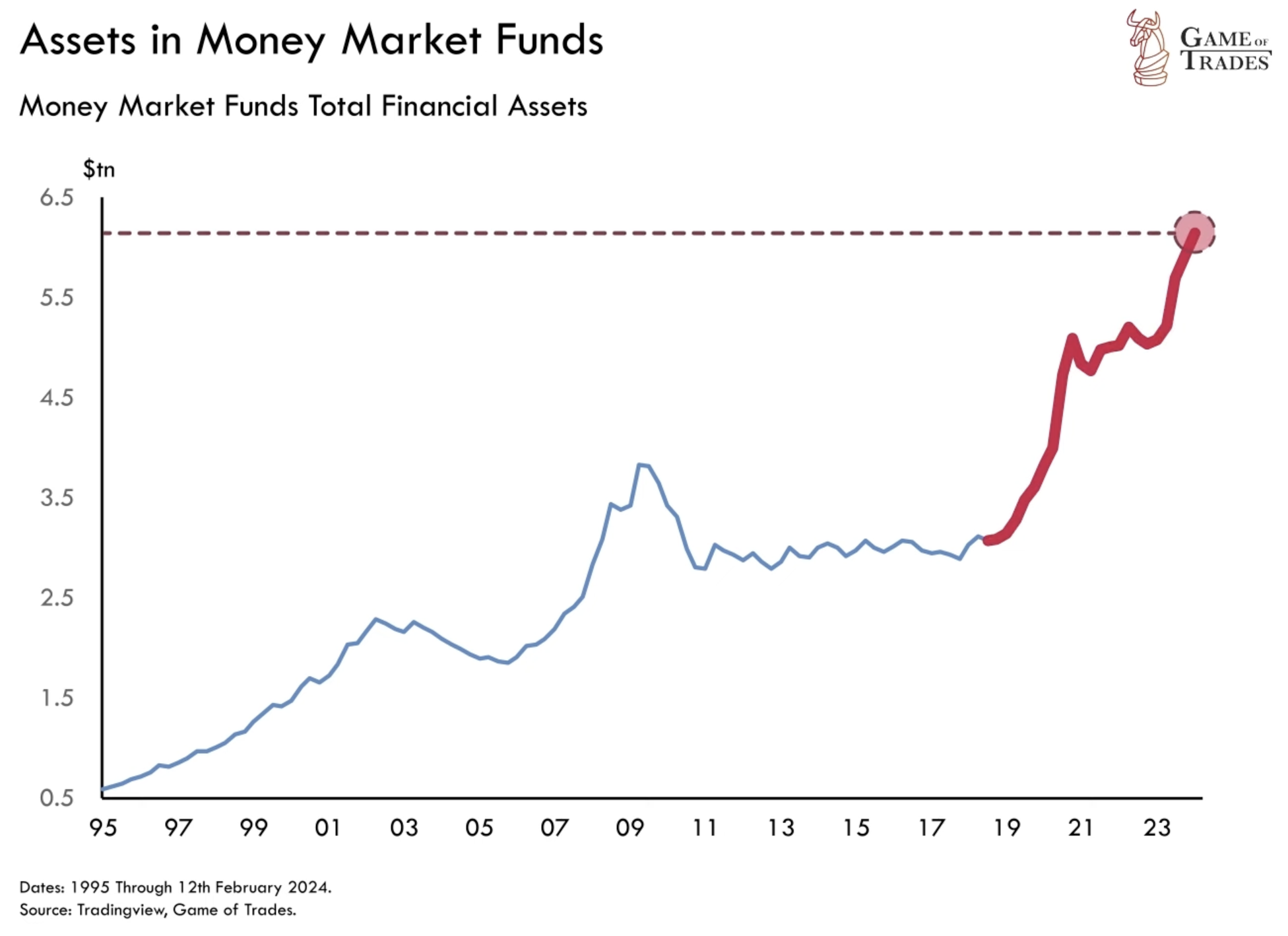

In a remarkable trend, investors find themselves holding a staggering $6 trillion in cash, marking the highest cash holdings in over three decades. The surge in assets within Money Market Funds, which witnessed a $1 trillion increase within just 12 months, raises concerns and prompts a closer examination of the factors driving this shift. This article delves into the attractiveness of cash as an investment option, the historical context surrounding cash yields, the potential impact on the stock market, and the implications for individual investors.

The Attractiveness of Cash: A Shift in Perspective

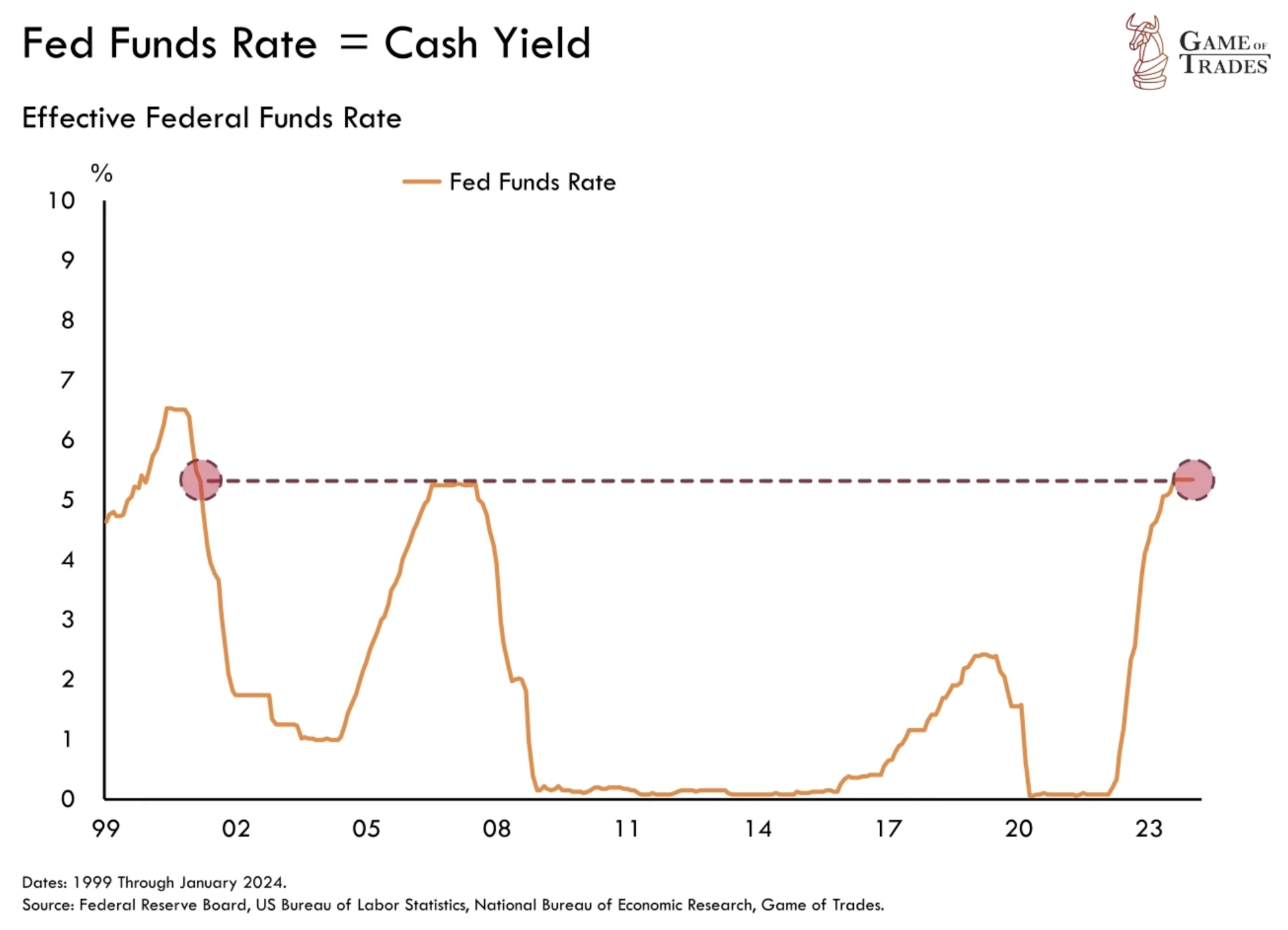

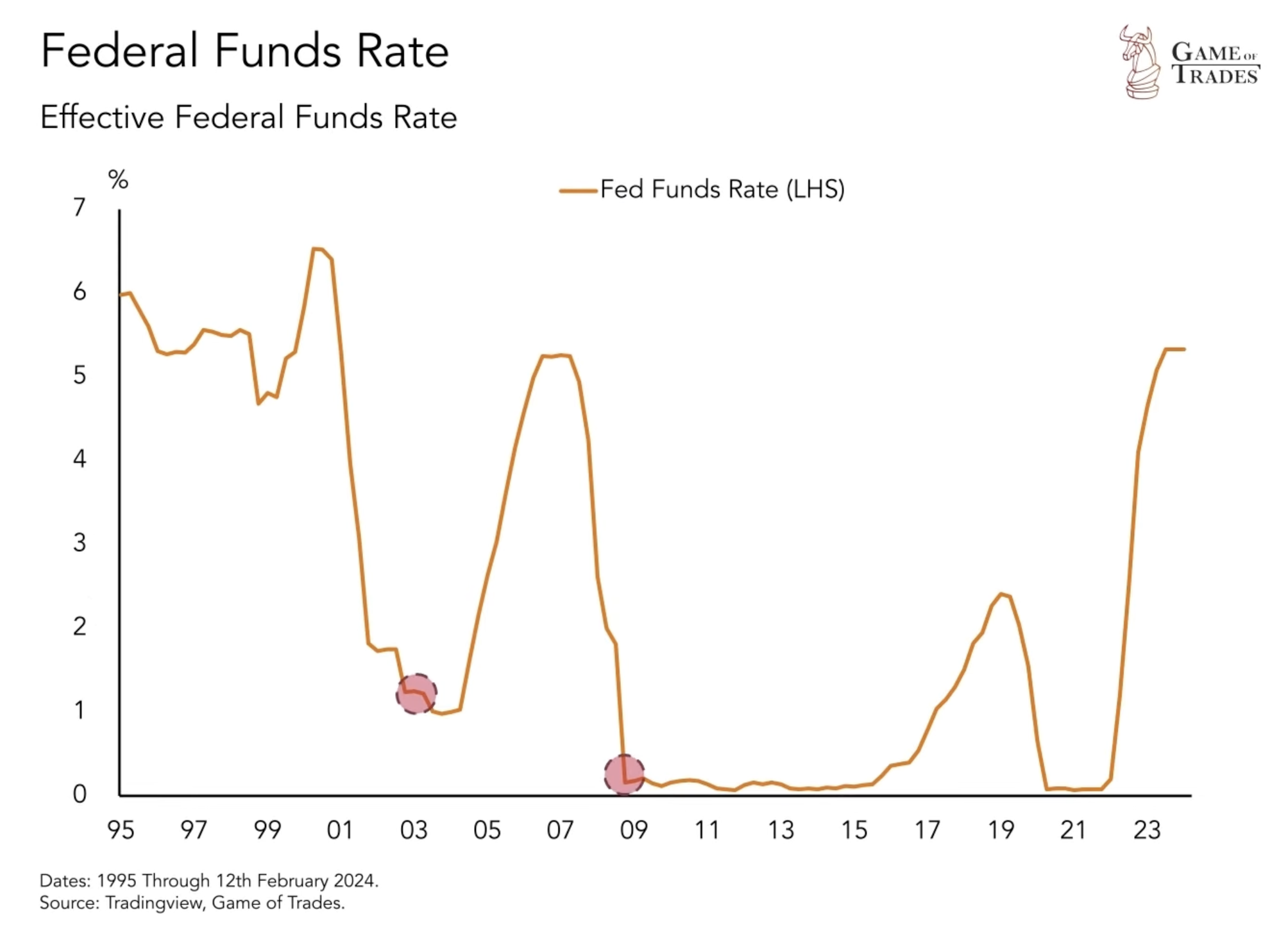

In a surprising turn of events, renowned investor Ray Dalio has expressed a newfound appreciation for cash, endorsing it as a preferred option. This sentiment is not unfounded, given the record-high interest rates on cash that currently prevail, reaching levels not seen in 23 years.

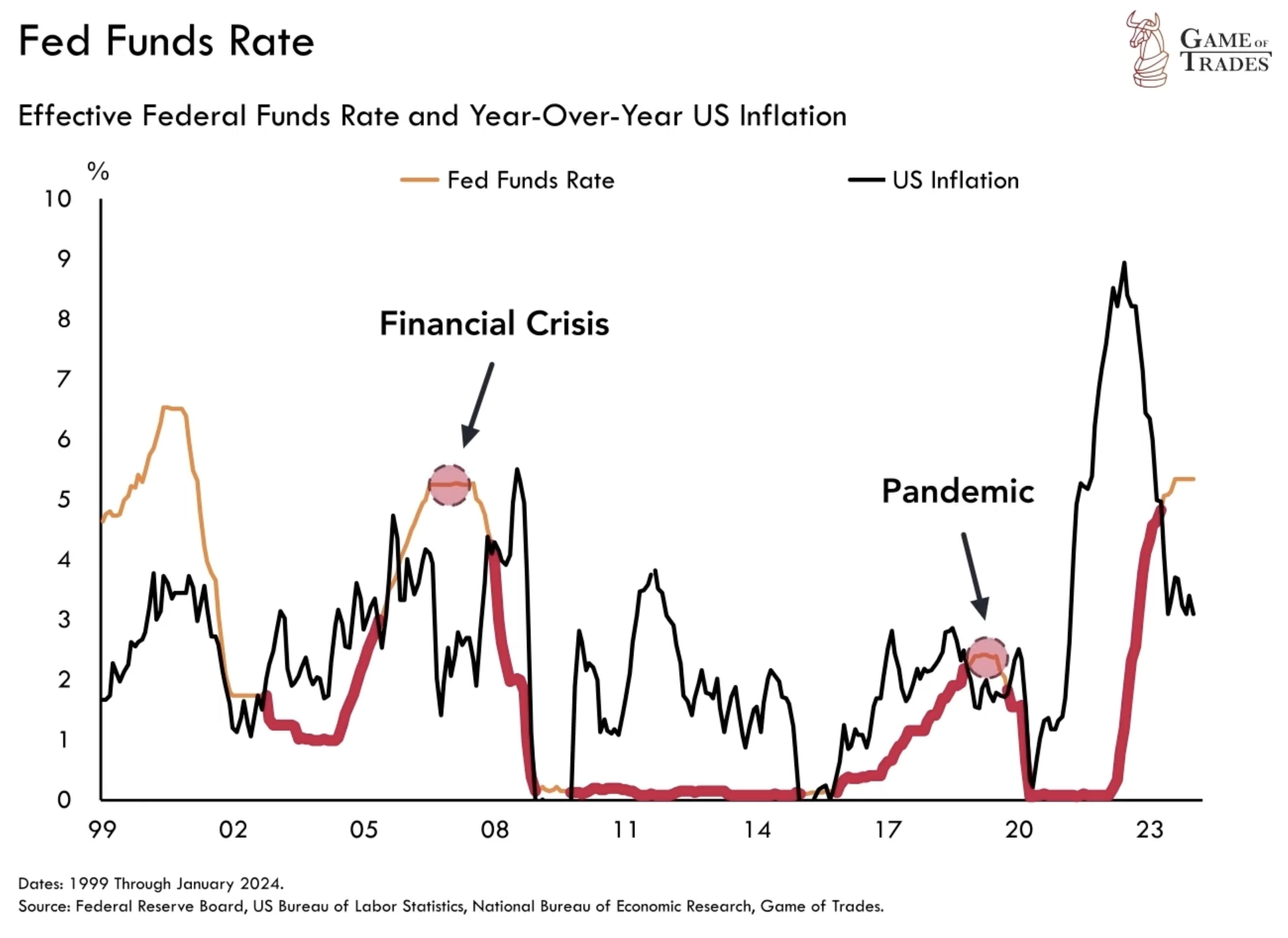

Historically, cash yields have been lower than inflation, except in 2007 and 2019. Today, rates are 2% higher than inflation. As a result, cash yields now offer positive returns, challenging the historical notion that cash yields are typically lower than inflation. Cash has shed its derogatory label as “trash” and emerged as a viable investment alternative.

The Appeal of Cash: Stability and Limited Risk

The allure of cash lies in its stability and limited risk compared to the volatility of the stock market. With guaranteed returns and protection against erosion from inflation, individuals are flocking to Money Market Funds. This desire for stability drives the surge in cash investments. Holding cash provides a sense of security during uncertain times, shielding investors from market fluctuations and offering peace of mind.

The Potential Impact on the Stock Market: A $6 Trillion Catalyst

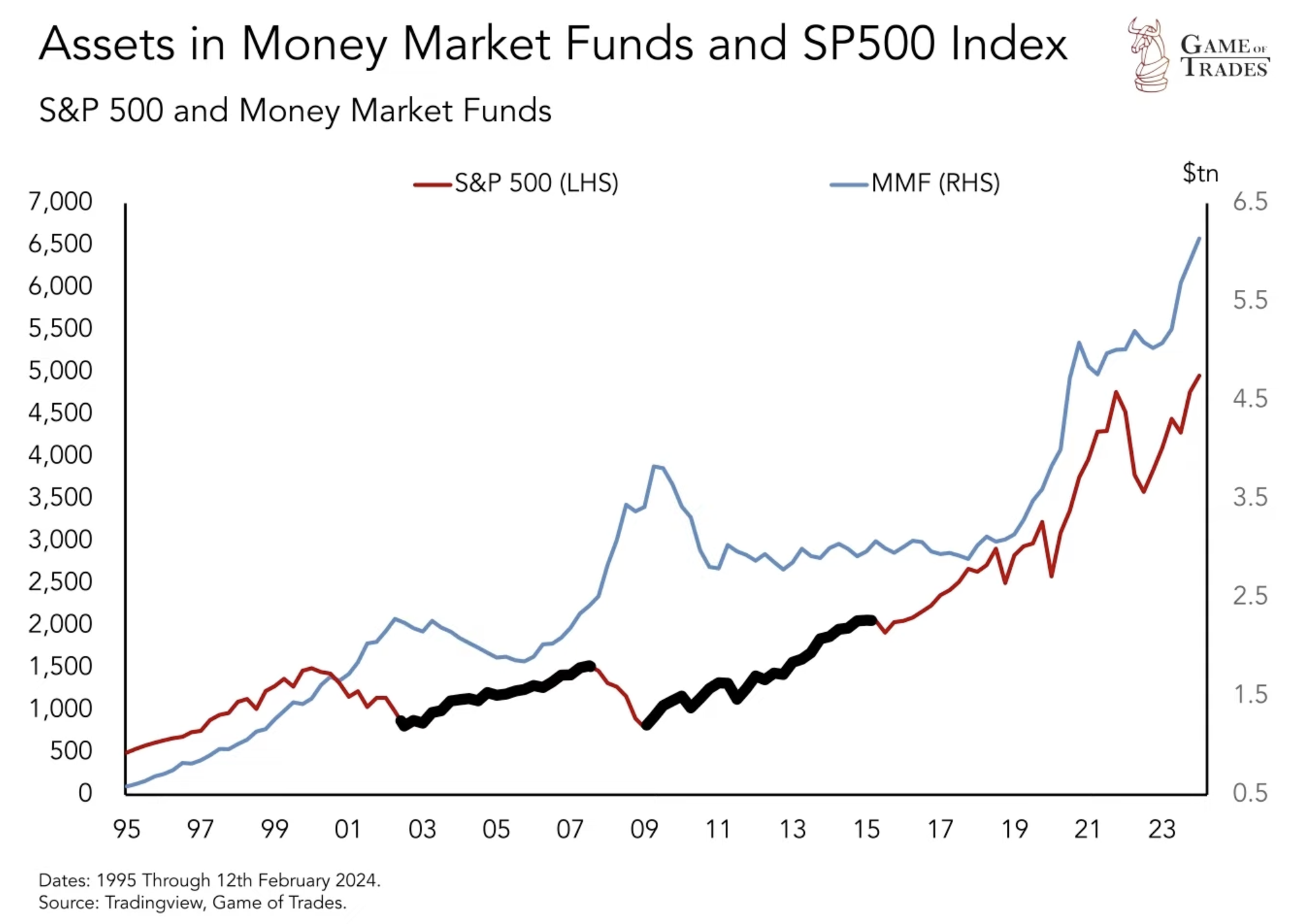

The massive $6 trillion held in Money Market Funds has prompted speculation about its potential impact on the stock market. Historical precedents reveal instances where cash deployment led to significant stock market surges, as witnessed in 2002 and 2009. If a portion of this substantial cash reserve finds its way into the stock market, it has the potential to propel the S&P 500 to new heights.

However, it is crucial to recognize the distinctions between the current conditions and those of 2002 and 2009. During those periods, cash yields were exceptionally low (1.5% and 0% respectively), providing investors with no incentive to hold cash. Conversely, today’s higher cash yields make it an attractive option for risk-averse investors. As a result, the dynamics that historically led to cash deployment may not necessarily apply in the current landscape.

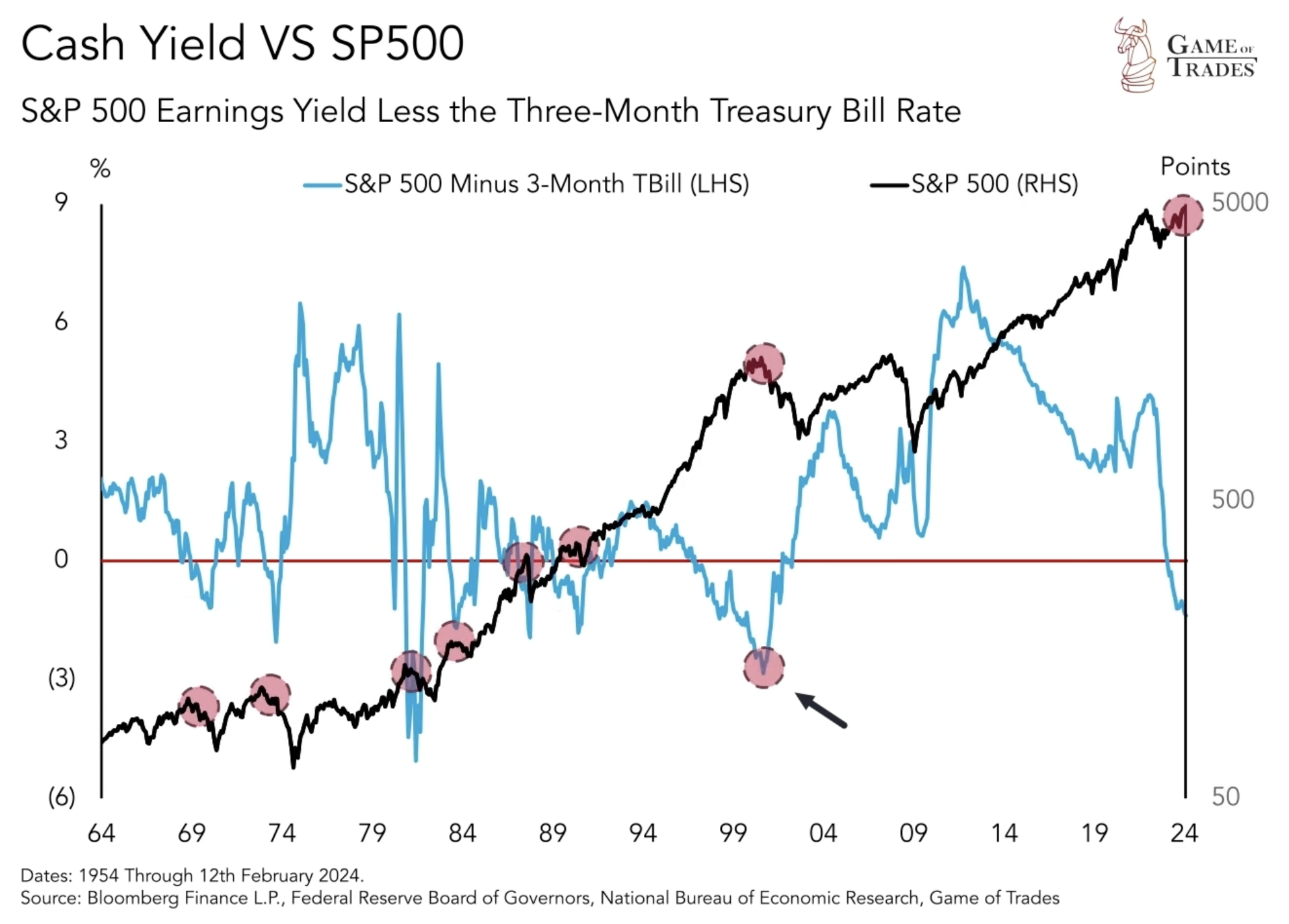

Furthermore, in 2002 and 2009, the yield on stocks was significantly higher (4.5% and 7% respectively), rendering them more appealing to investors. By contrast, the current stock market presents a different scenario, with the earnings yield of the S&P 500 at historically low levels of 3.5%. Consequently, the stock market may not offer the same level of attractiveness as it did in the past, particularly when cash yields exceed stock market returns.

The Safer Investment Option

The surge in cash holdings, with investors currently holding a staggering $6 trillion, reflects a shift towards safer investment options amidst market uncertainty. Cash, once deemed less favorable, has gained newfound appeal due to its attractive yields and stability. While the massive cash reserve may not indicate an impending market crash, it does underscore investors’ desire for a safe investment alternative.

The potential impact on the stock market remains uncertain. Cash deployment has the potential to fuel significant stock market rallies. However, the current landscape, characterized by higher cash yields and lower stock market earnings yields, warrants a cautious approach based on historical precedents.

Conclusion

Investors must carefully evaluate their risk appetite and investment goals. While cash offers stability and guaranteed returns, it may fall short of the long-term average returns provided by stocks. By considering the historical context, current market conditions, and individual risk preferences, investors can make informed decisions to navigate these uncertain times. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Inflation Trends Unmasked