Market surges can be exhilarating for investors, but they often come with risks and potential downturns. By examining past instances of significant market rallies, such as those of 1928, 1987, and 1999, we can gain valuable insights into the current market environment and its potential implications.

This article explores the historical context, analyzes the impact of the job market, and provides guidance for investors navigating these uncertain times.

Unveiling Historical Market Surges

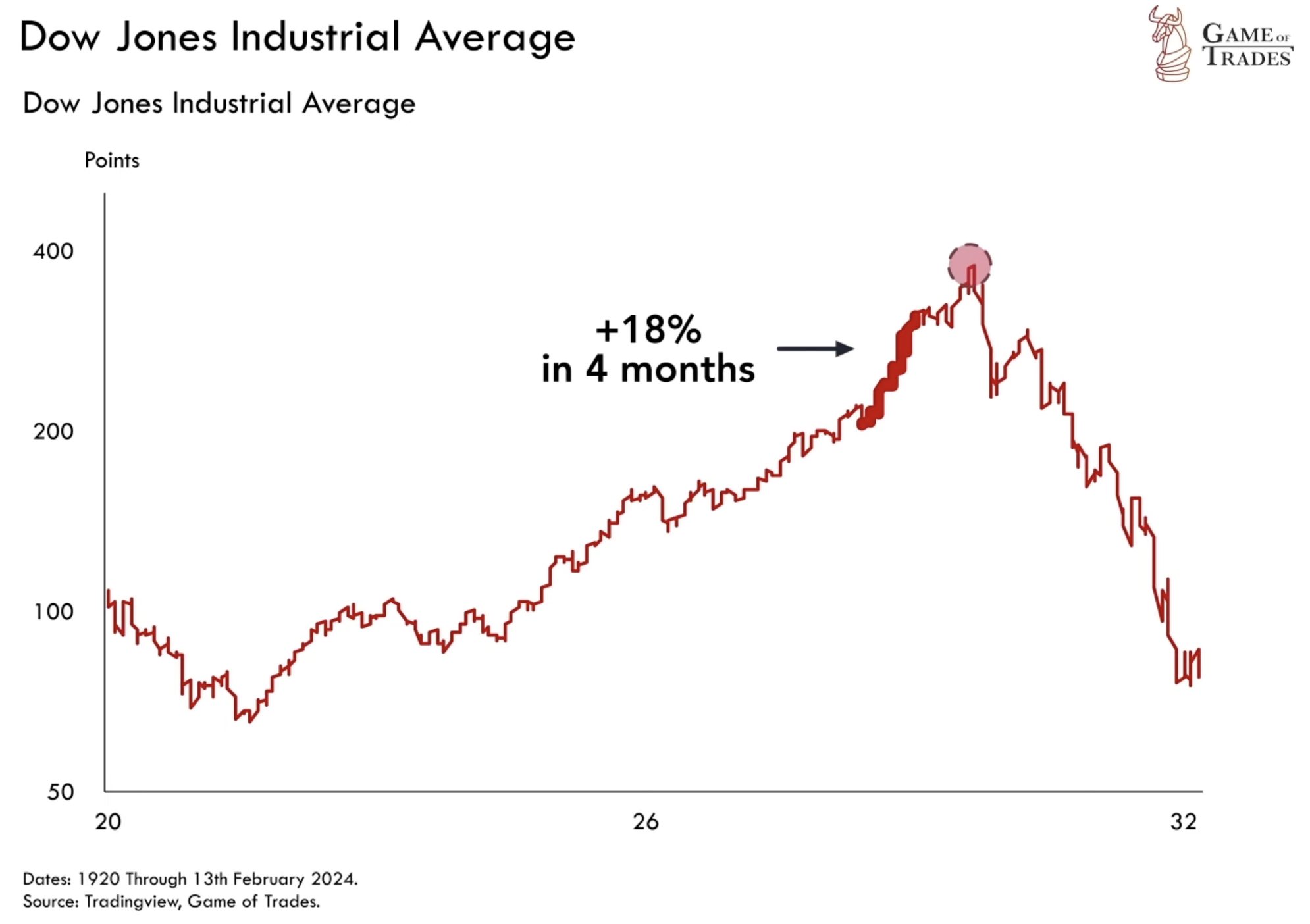

In November 1928, the stock market experienced a remarkable 18% surge within a mere four months, preceding the notorious peak of the Dow Jones in 1929.

Similarly, in July 1987, a rapid 18% rally occurred over four months, propelling the stock market to new highs. However, this surge was followed by the infamous Black Monday crash, resulting in a 40% drop from the peak.

In April 1999, the Dow Jones surged 18%, reaching record highs. Unfortunately, this surge was a precursor to a severe three-year bear market.

Over the past four months, the Dow Jones has once again surged by more than 18%, indicating a speculative market trend. It is important to note that similar market moves were observed in 2019, 2017, 2012, and 2009, which were followed by more upside. These exceptional rallies often mark bear market bottoms. However, it is crucial to recognize that the current difference is the market being at all-time highs, which adds a unique element of uncertainty.

Assessing the Current Market Strength

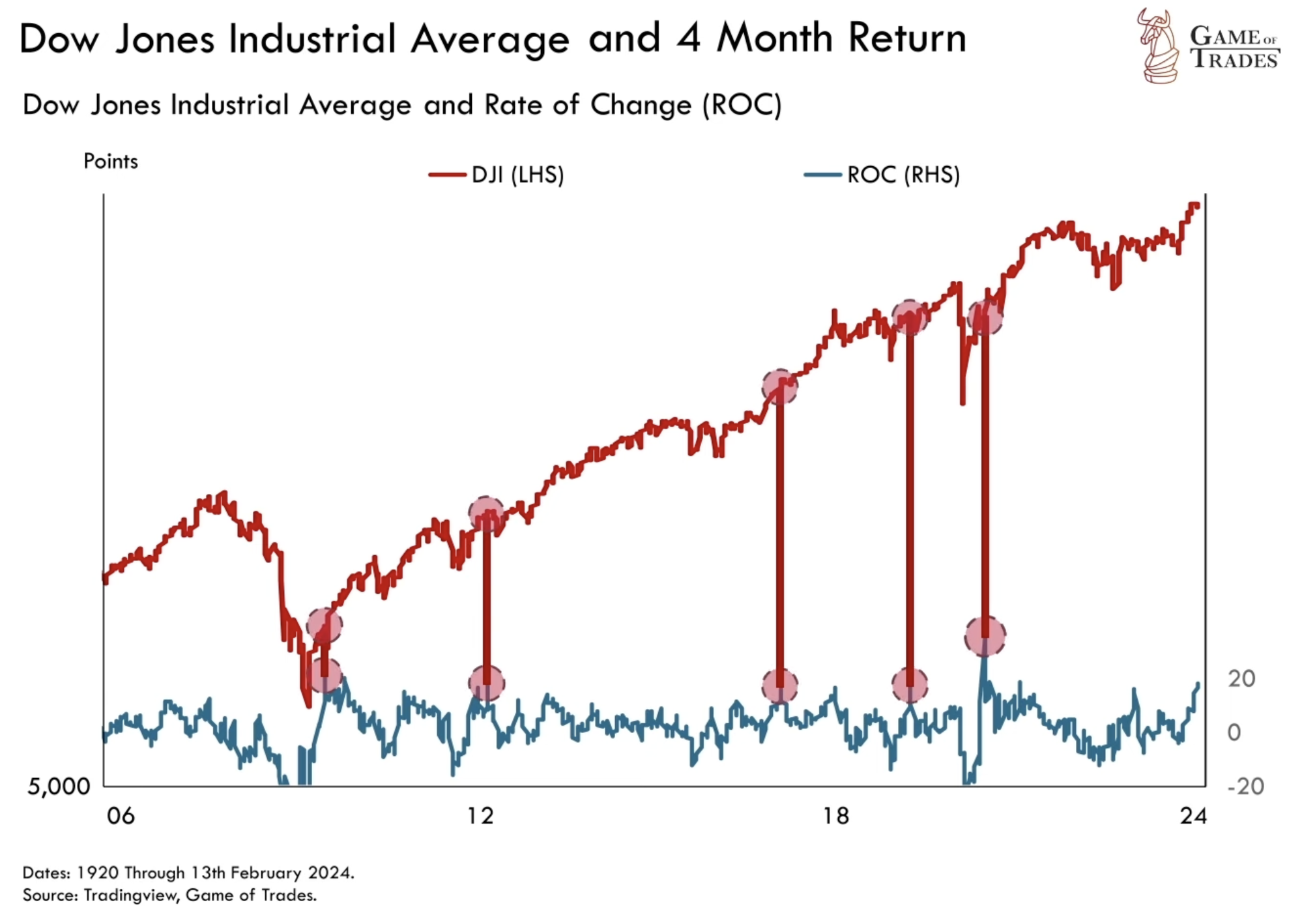

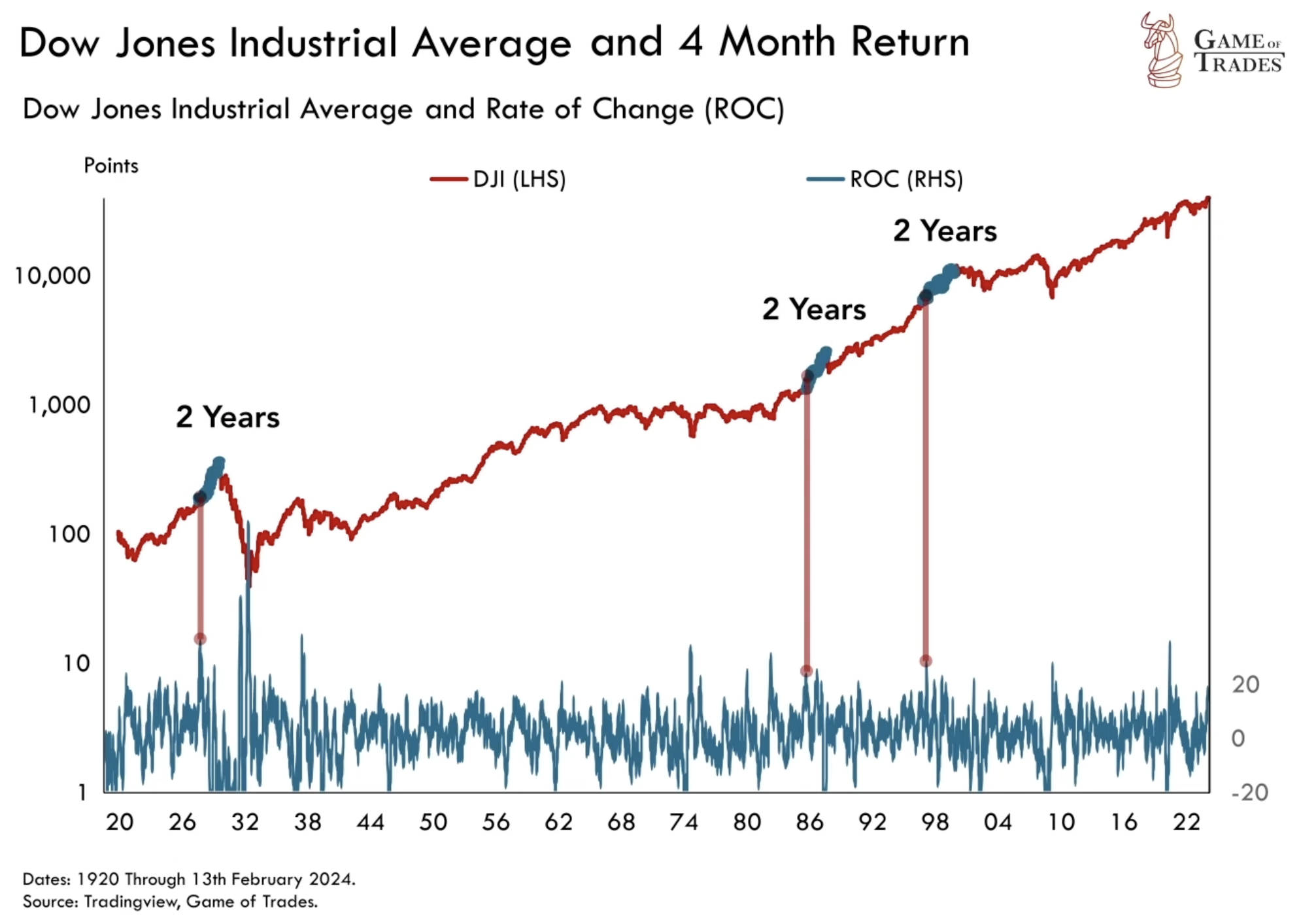

The occurrence of an 18% rally in just four months at all-time highs is a rare phenomenon. Historical analysis reveals that such a pattern was observed only in three periods: 1927-1929, 1986-1987, and 1997-1999.

At first glance, this level of market strength may raise concerns, as it led to significant corrections in all three cases. However, it is important to note that between the initial reading and the market’s peak, there were approximately two years of upside. In 1986-1987, the Dow Jones rallied 40% over 2 years, whereas, in 1997-1999, the market saw an additional 30%. These episodes presented challenges for rational investors due to an expensive yet strong market that sustained its strength for years.

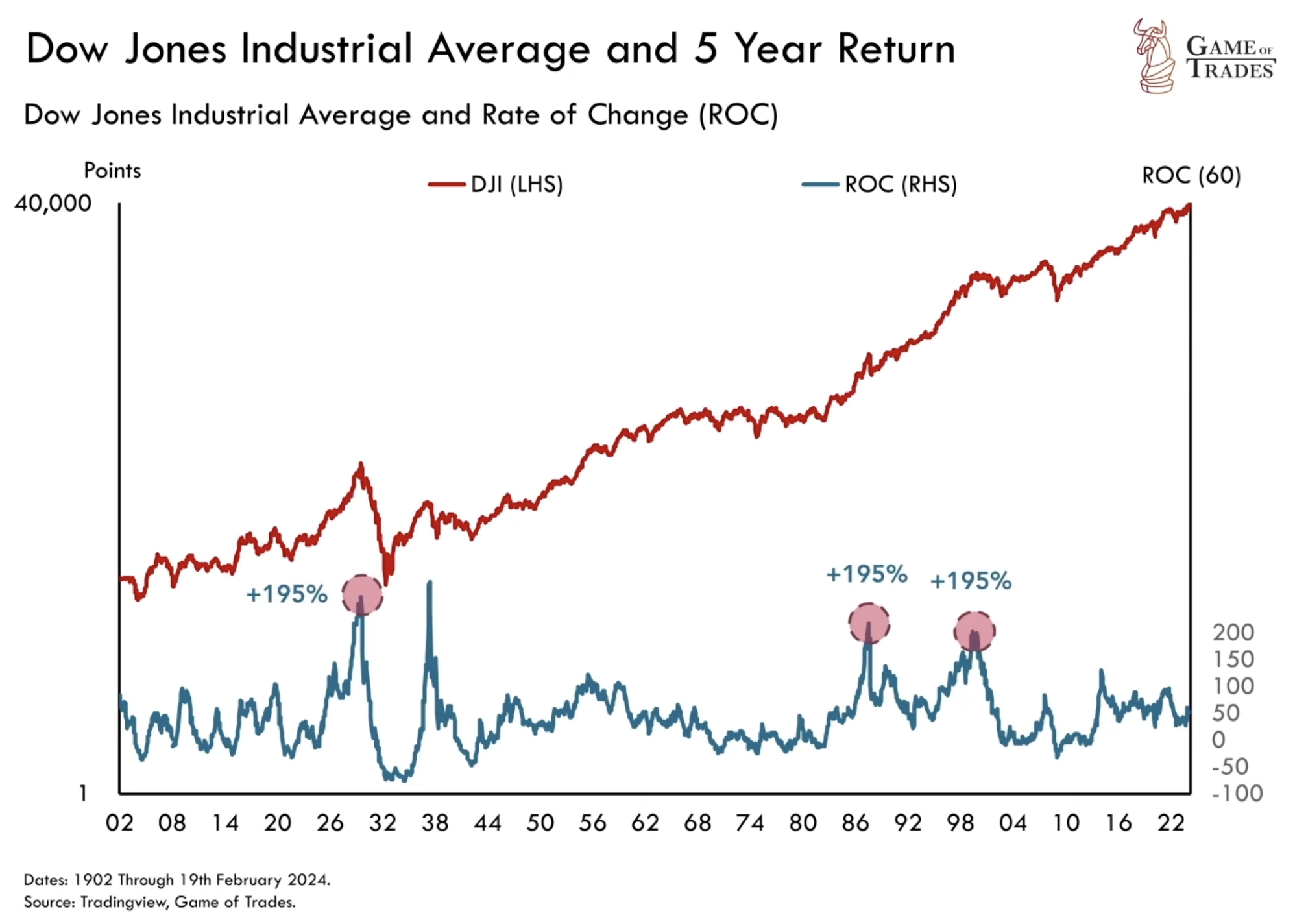

The 5-year return of the Dow Jones Industrial Average shows a 49% gain, which is lower than the returns before 1999, 1987, and 1929. In those cases, the market rose by 195% in the 5 years leading up to the tops. This suggests that the market may have more room to grow before reaching a similar euphoric state.

The Role of the Job Market in Market Dynamics

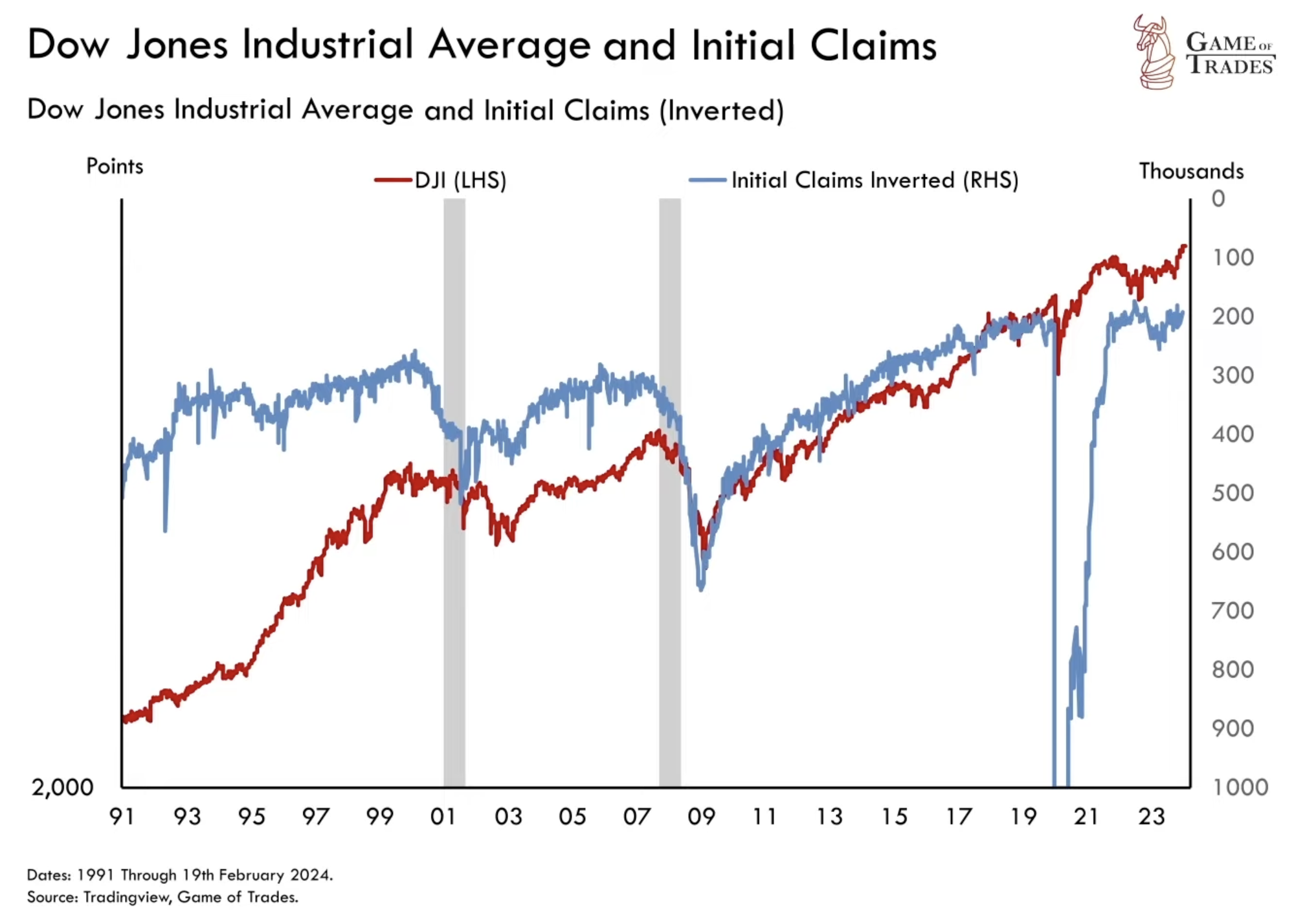

The strength or weakness of the job market has a significant impact on market trends. In past instances, it was observed that when the job market weakened, the market’s strength turned into weakness. Presently, a strong job market is giving investors a sense of confidence that we may not be on the verge of a recession like in 2008 and 2001, where initial jobless claims were rising leading into the downturns. As long as the trend of a robust job market continues, we could see the stock market display bouts of strength, similar to what we have witnessed over the past few months.

Warning Signs: Declining Leading Indicators

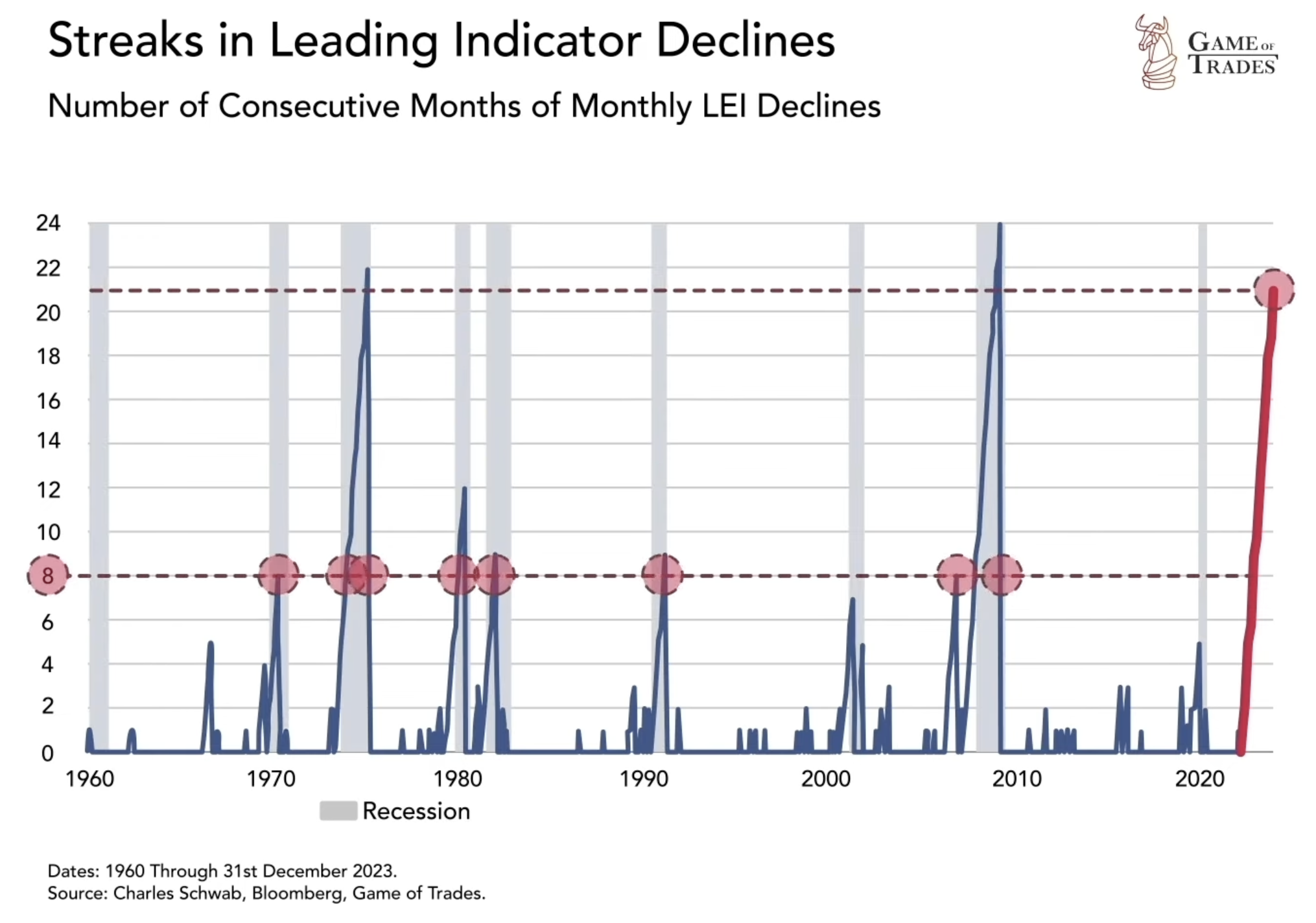

While the job market remains strong, investors should exercise because of the signs shown by leading indicators. The leading indicator index from the Conference Board has declined for twenty consecutive months. Historically, a recession has occurred if this index declined for more than eight consecutive months.

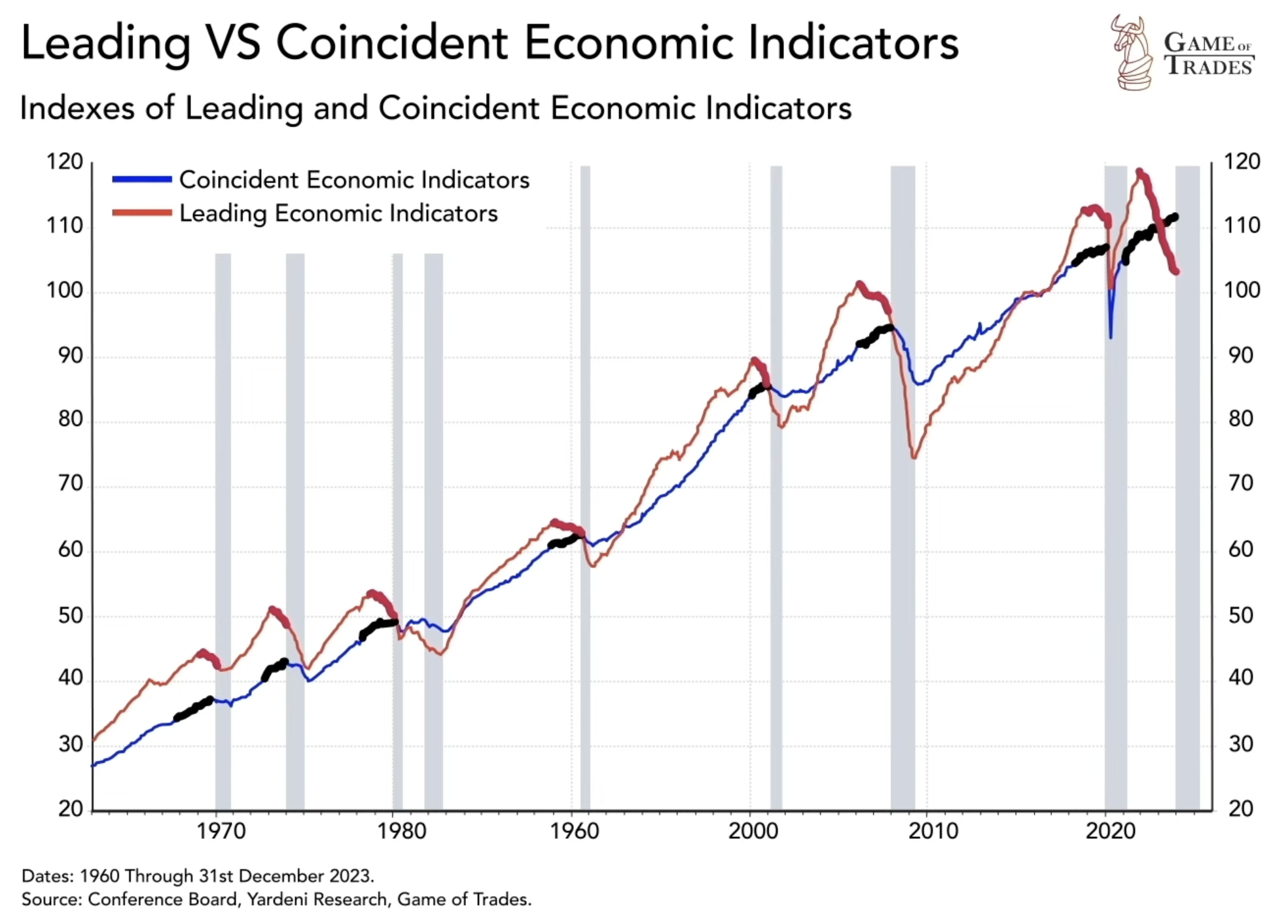

Despite the decline in leading indicators, coincident economic indicators show upward movement. This pattern has been observed throughout history, with such divergences eventually resolving as coincident indicators catch down. It is important to monitor both leading and coincident indicators to gain a comprehensive understanding of the overall economic landscape and its potential impact on the market.

Conclusion

While recent market gains may be encouraging, it is crucial to remain cautious and consider the broader economic indicators. The strength of the job market brings a sense of confidence, but warning signs from declining leading indicators warrant attention. As investors, it is important to maintain a balanced and informed investment approach, considering both the historical context and the current market dynamics. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Stock Market Valuations VS Consumer Sentiment: Who’s Right?