Understanding the dynamics of bull and bear markets is essential for investors looking to navigate the complex world of finance. In this article, we will delve into the historical context of bull markets, explore the conditions necessary for their emergence, and analyze the current market landscape. By examining key factors such as economic recessions, inflation, unemployment rates, and interest rates, we aim to provide insights into the potential for a sustained market rally.

Historical Perspective: Bear and Bull Markets

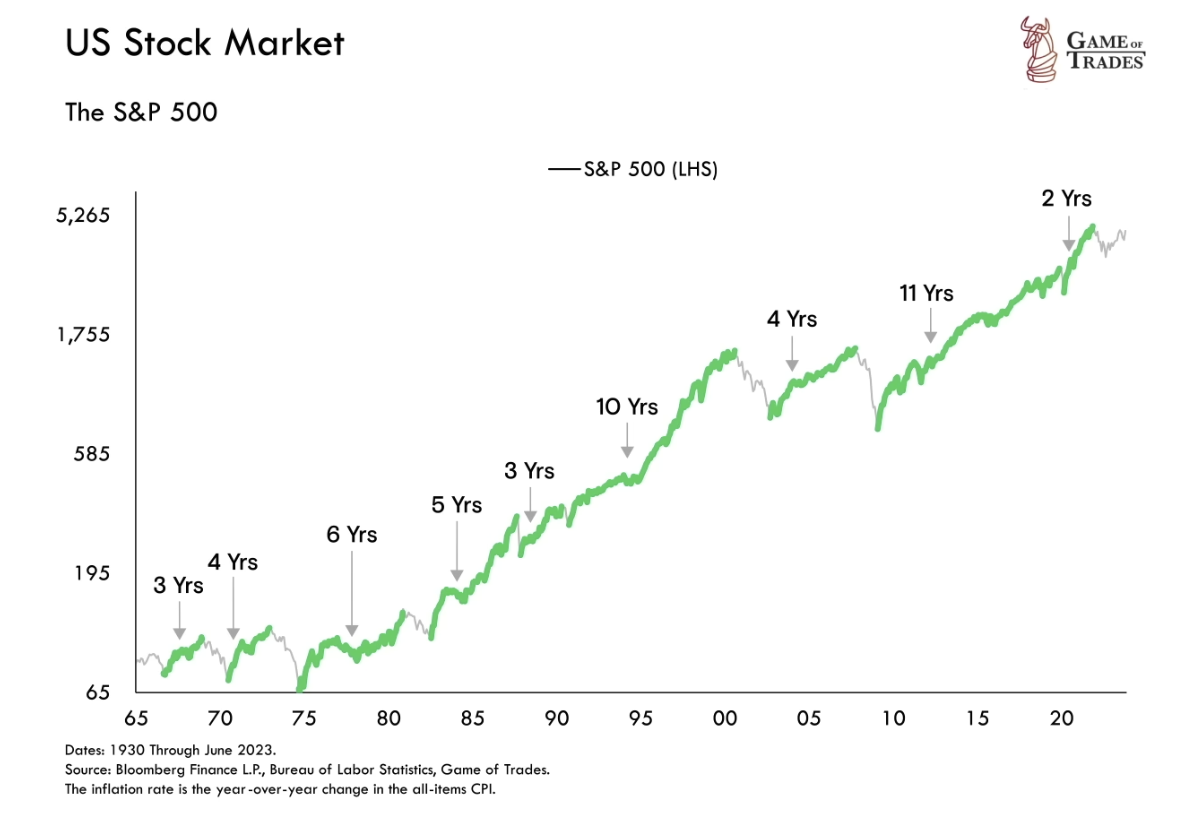

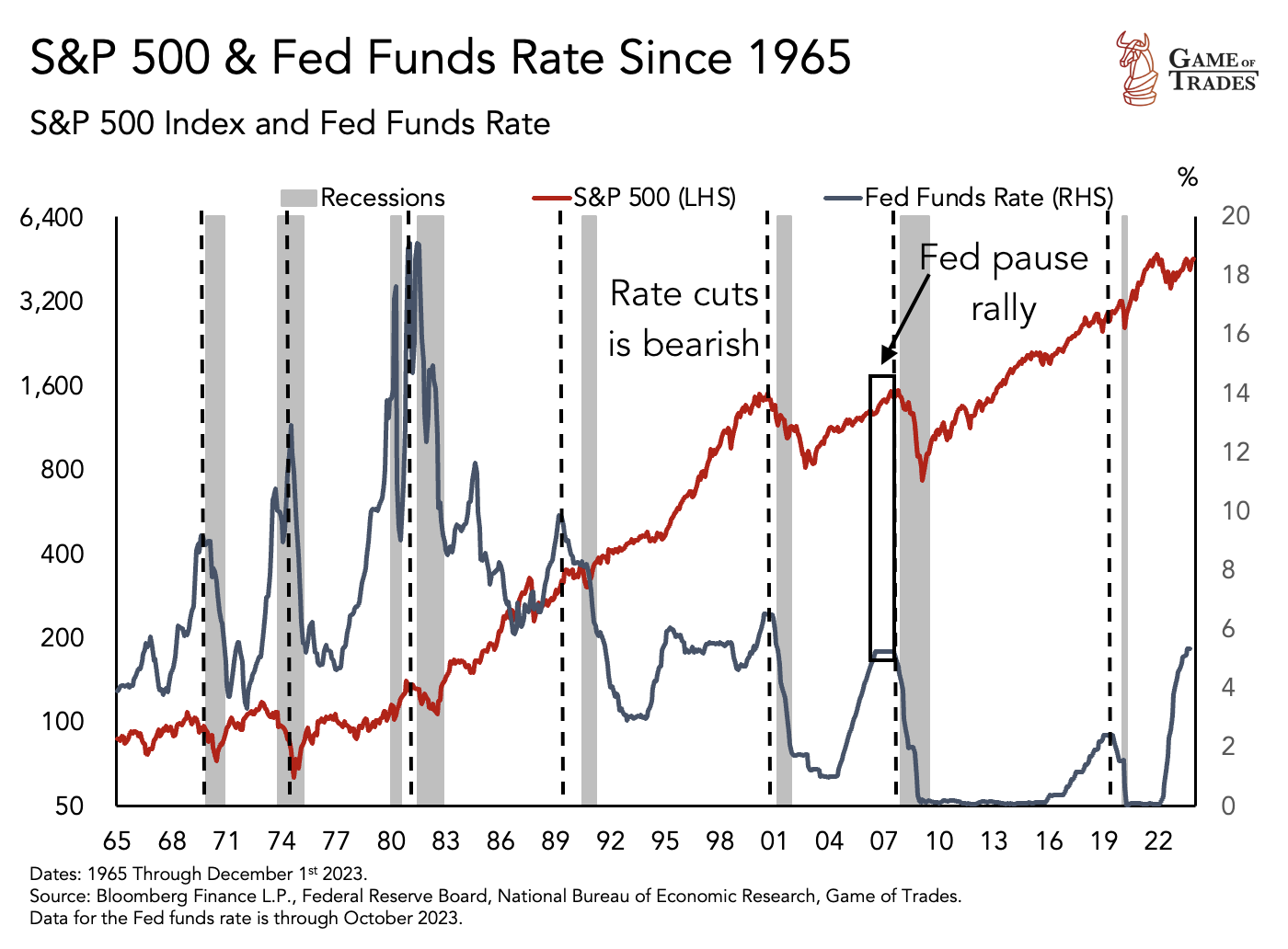

Since the 1960s, there have been ten bear markets, each followed by a bull market that resulted in an average return of 170%. These bull markets typically lasted around five years. Understanding the historical patterns can provide valuable insights into the potential duration and magnitude of a future bull market.

The Role of Recessions in Bull Market Emergence

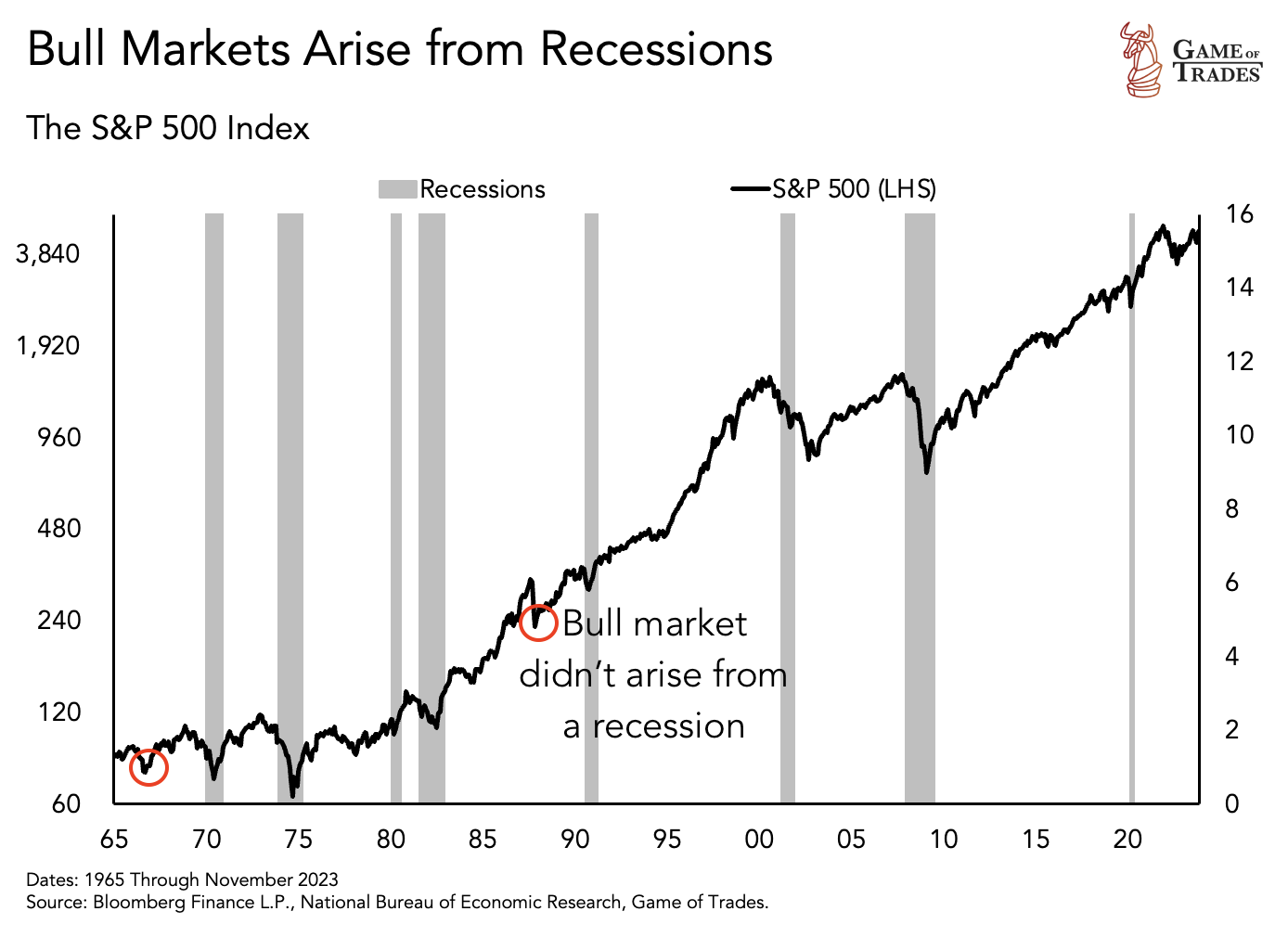

In most cases, bull markets arise from recessions, as economic downturns lead individuals to withhold spending. When optimism returns and pent-up demand is unleashed, it creates a significant economic boom. However, there have been two exceptions, namely the rallies born from the bear markets of 1966 and 1987, which were not recession-born. Analyzing these precedents suggests that markets could continue rising until the end of 2024.

The Role of Inflation and Unemployment

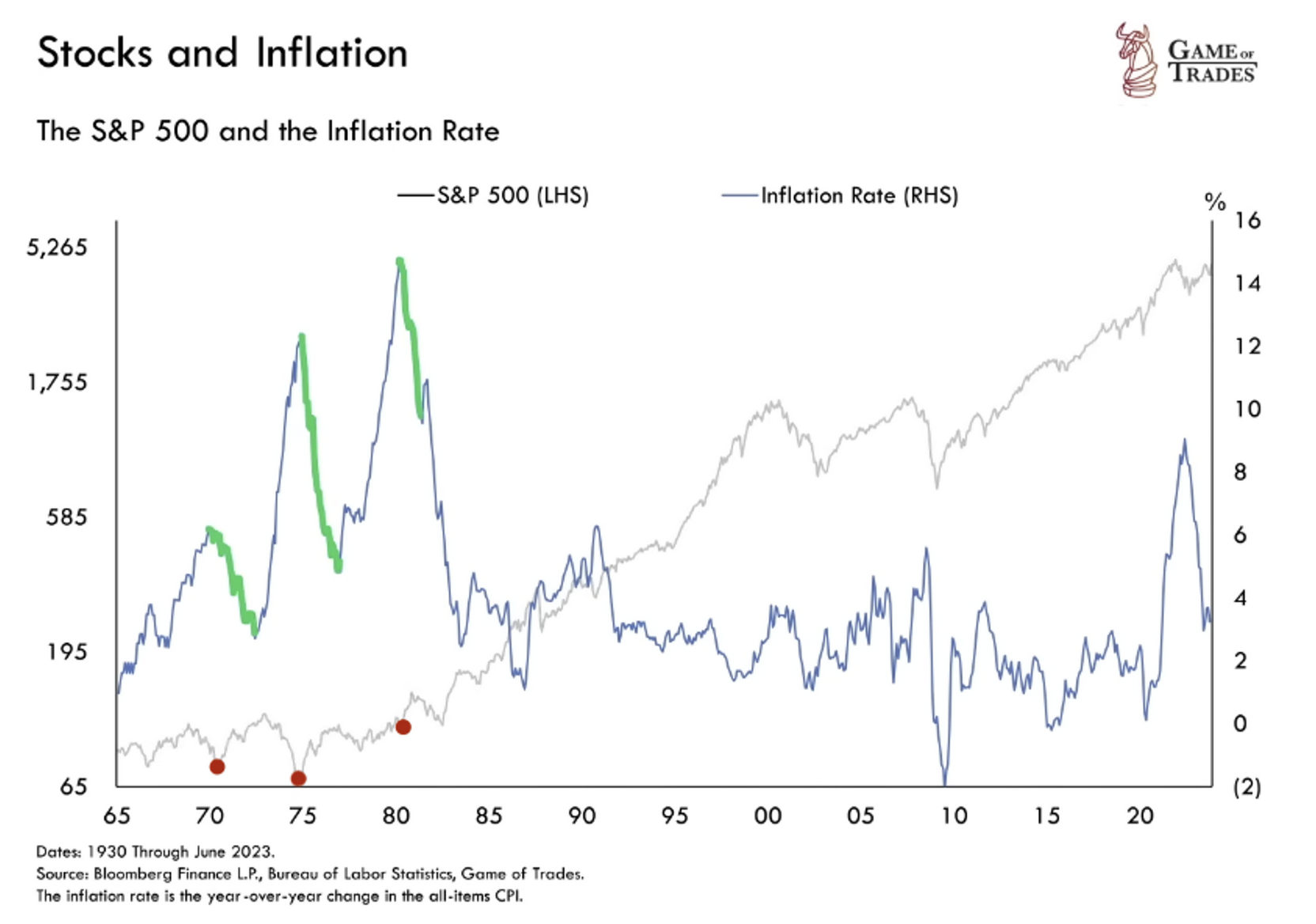

In addition to recessions, inflation and unemployment play crucial roles in assessing bull market potential. Rising inflation tends to drive up the cost of living, leading to a decline in the stock market. However, when inflation peaks, such as in 2022, equities often bottom out and begin recovering. Normalizing inflation after elevated levels is key for a full-fledged bull market. Historical data reveals that three bull markets emerged from major inflation tops in 1970, 1974, and 1981.

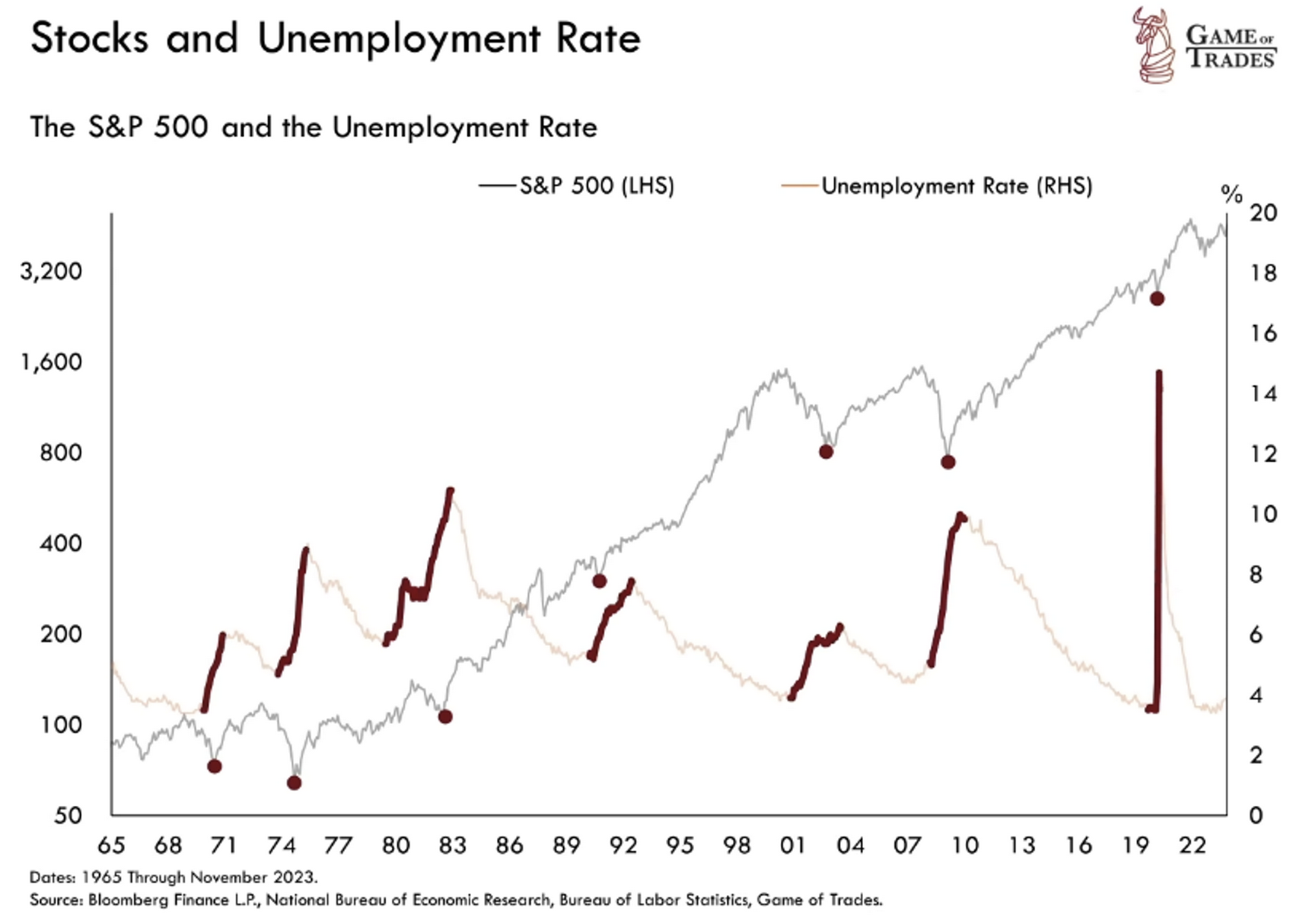

Nonetheless, despite inflation peaking in 2022, the recession component is still missing for a robust bull run. While some argue that the technical recession occurred in 2022, with negative GDP for 2 consecutive quarters, unemployment still remained historically low around 3.7%. Stocks tend to bottom after the unemployment rate has risen, with an exception in 1967 and 1987.

The Role of Interest Rates

The last factor that plays a crucial role in assessing bull market potential is interest rates. New bull markets often emerge when interest rates are low. Currently, the market has been rallying fueled by a Fed pause (like 2006), but the Fed anticipates rate cuts in 2024. Historically, the Fed cutting rates is a bearish sign for equities, which could lead to the actual top of the market.

Conclusion

Assessing the potential for a new bull market requires a comprehensive analysis of various factors, including historical patterns and current market conditions. While bear market bottoms have historically paved the way for remarkable rallies, several key factors must be considered. These include the presence of a recession, inflation levels, unemployment rates, and interest rates. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Debt-to-GDP Ratio – The Drag on US Economic Growth