The US national debt has experienced a staggering surge, growing from $31.5 trillion to $32.3 trillion in just the second quarter of 2023. This rapid increase raises concerns about the sustainability of debt expansion and its potential impact on the economy. In this article, we will delve into the implications of the growing US national debt, exploring its historical context, the risks associated with it, and the importance of addressing this issue to ensure long-term economic growth.

The Surge of US National Debt

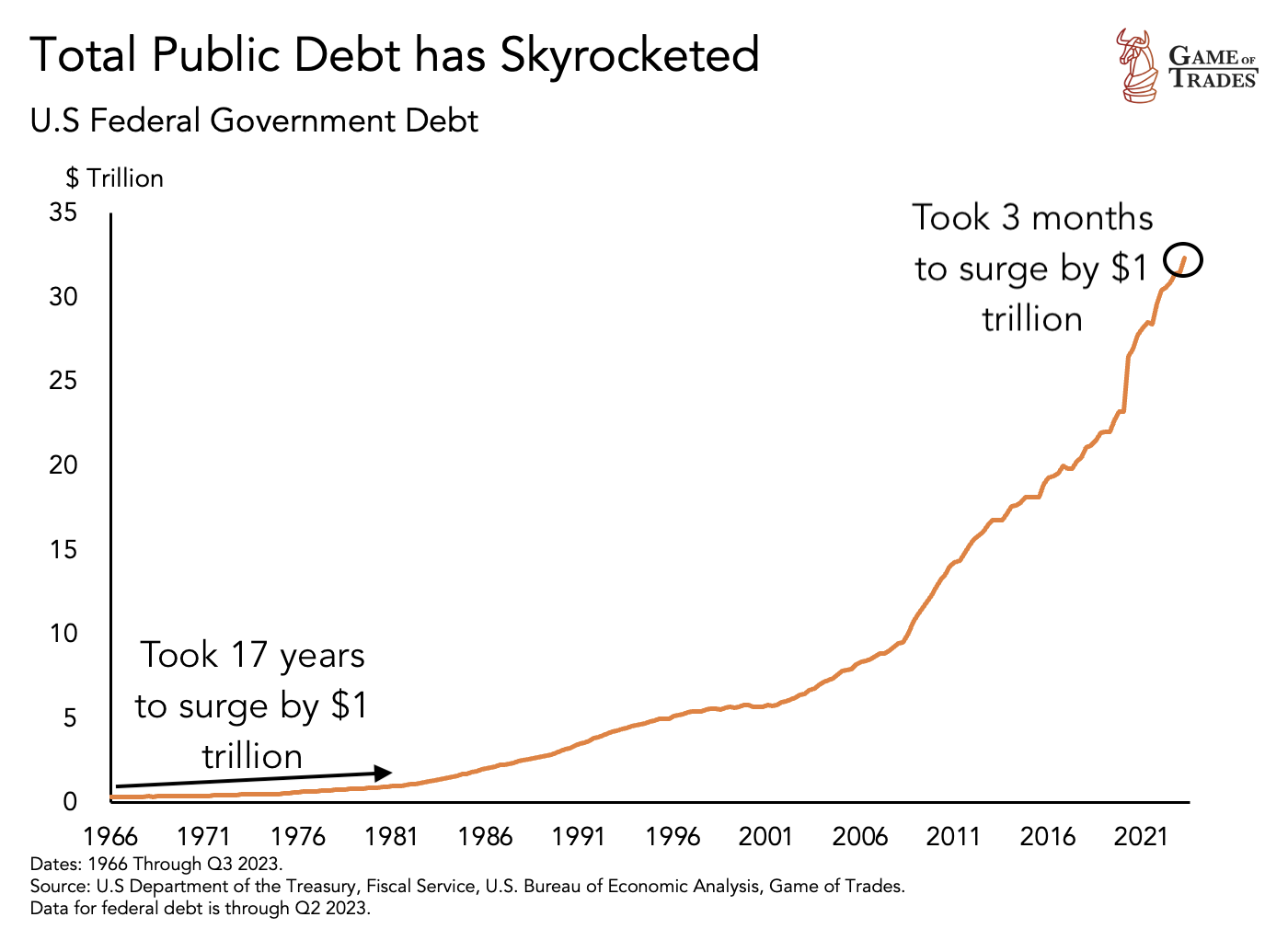

In 1966, it took 17 years for the US debt to increase by $1 trillion, but recent data reveals that in 2023 it took only 3 months to achieve the increase. This significant surge in debt raises questions about the underlying factors driving this expansion and the potential consequences for the economy.

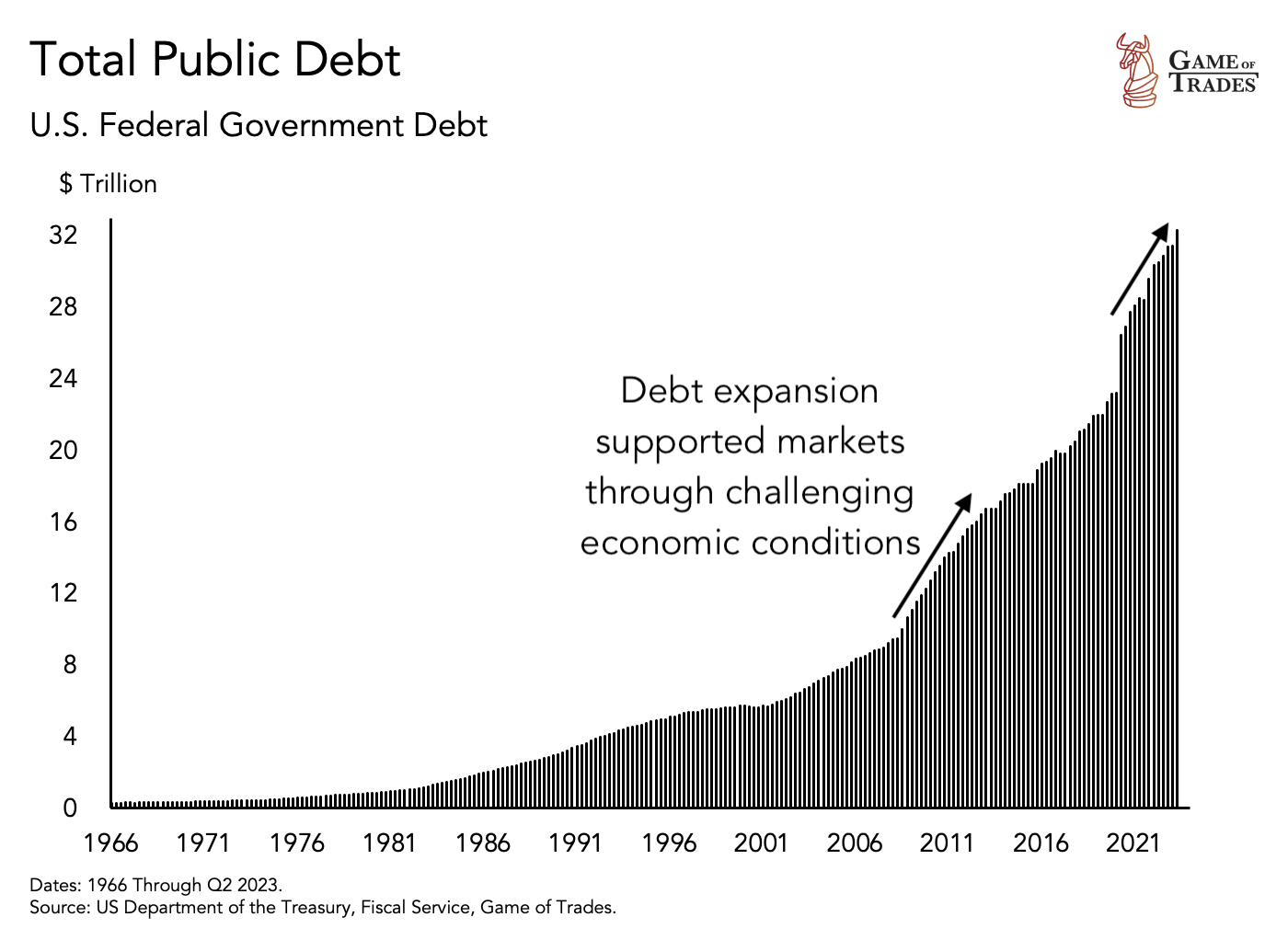

Debt expansion has played a crucial role in supporting financial markets during challenging economic conditions, such as the Financial Crisis and the Pandemic. While this expansion has helped stabilize the markets, some experts argue that it may be a bubble waiting to burst, leading to severe repercussions for the economy.

Moody’s Downgrade and Concerns of a Debt Default

Moody’s recent downgrade of US debt from stable to negative had heightened concerns about the possibility of a debt default. The rating agency warns that a debt default could result in an 8% unemployment rate, underscoring the potential magnitude of the impact on the economy.

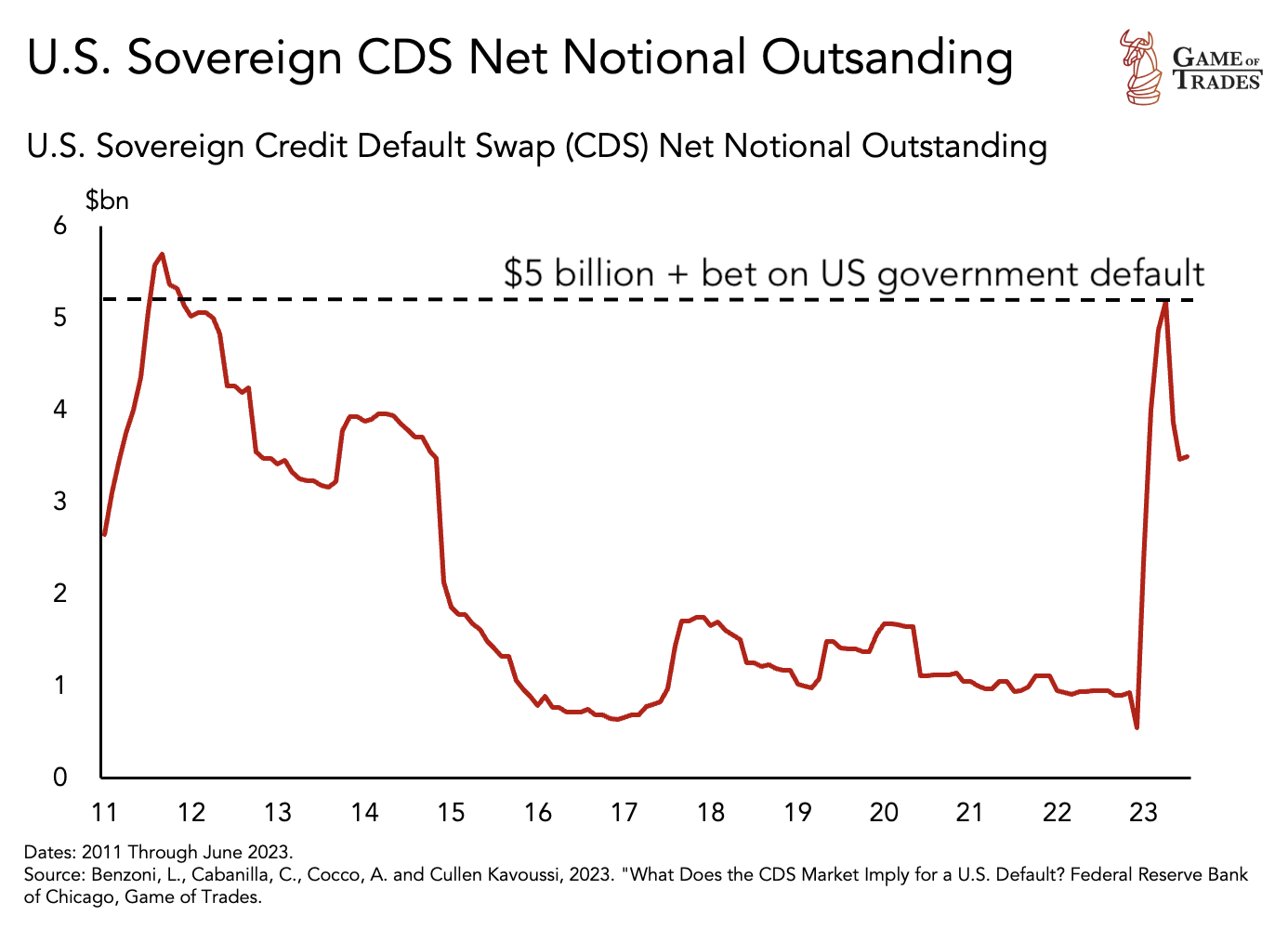

In 2023, traders made a $5 billion bet on a potential US debt default. This echoes a similar occurrence during the 2011 debt ceiling crisis, highlighting the market’s apprehensions regarding the risk of a default and its potential consequences.

Addressing the Debt Ceiling and Political Divisions

To understand the dynamics of debt expansion, it is crucial to examine the history of the debt ceiling. The debt ceiling has been raised 78 times since 1960, often as a routine event. However, in recent years, political divisions have emerged, with Republicans refusing to raise the ceiling without reducing deficit spending, like in 2011, 2013 and 2023. This recurring issue adds complexity to the management of the national debt.

Debt-to-GDP Ratio and its Impact

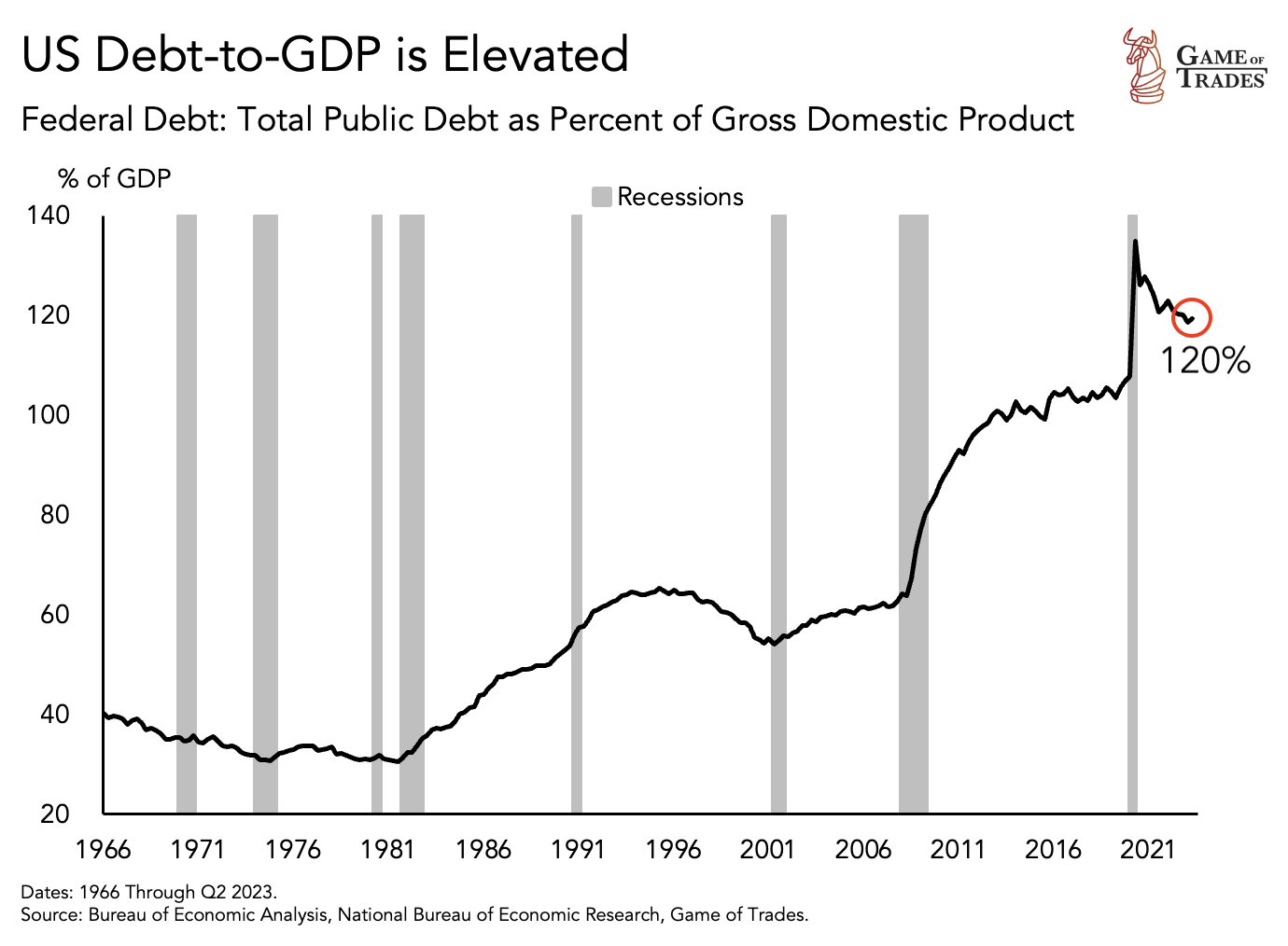

Assessing the impact of debt requires considering its relative size compared to the economy. Currently, the US Debt-to-GDP ratio stands at 120%, surpassing the total size of the US economy.

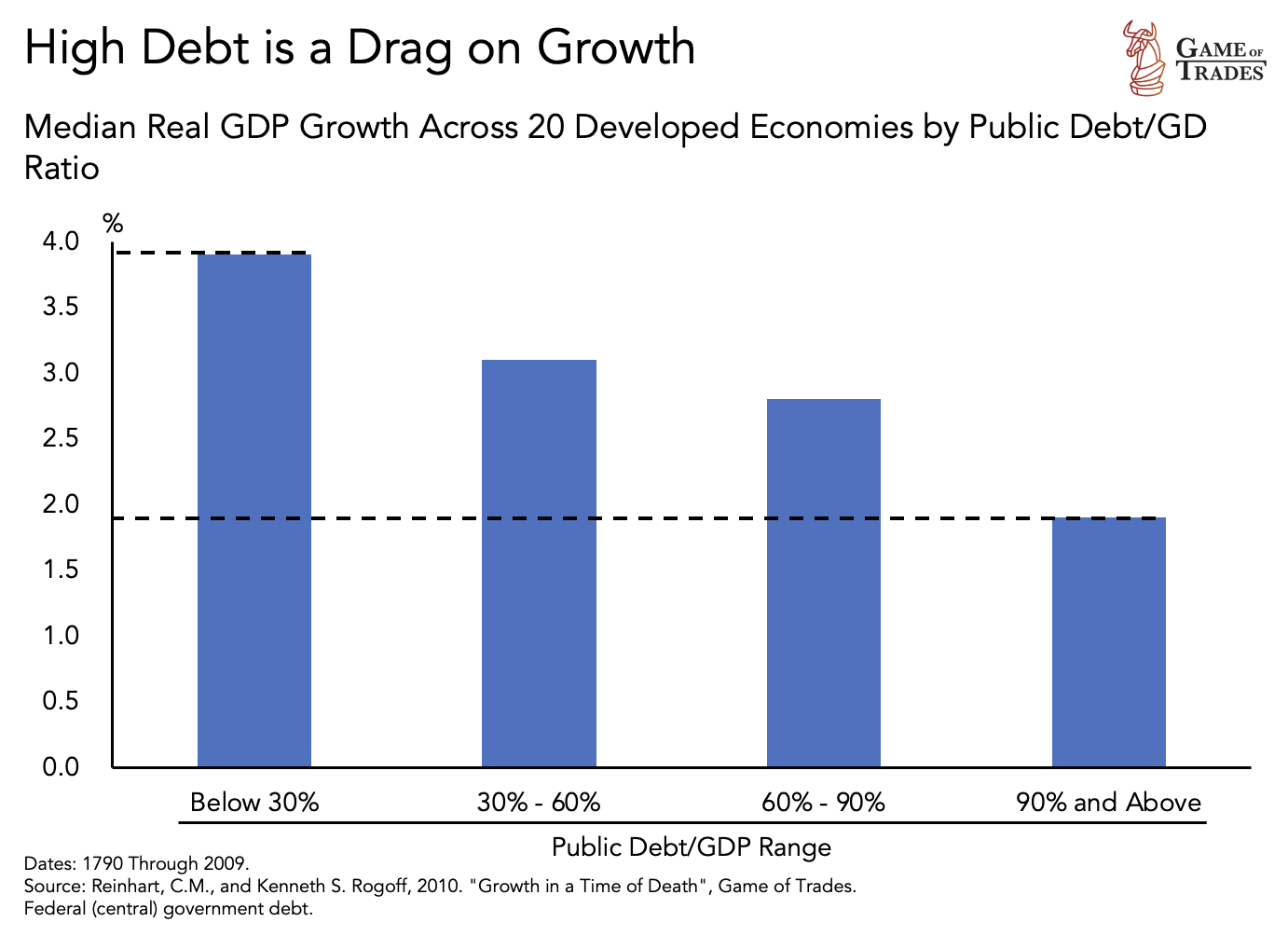

High levels of debt-to-GDP ratio act as a major drag to economic growth. Countries with less than 30% debt-to-GDP ratio tend to experience higher average growth compared to those with over 90%. Therefore, addressing the debt issue becomes imperative to avoid long-term growth problems.

While the US has the power to print money to repay its debt, a significant concern arises if the debt continues to rise rapidly while economic growth stagnates. In such a scenario, government interest payments will grow in relation to revenue, leading to a massive fiscal deficit that poses risks to the economy’s stability.

Learning from History: The UK’s Devaluation Approach

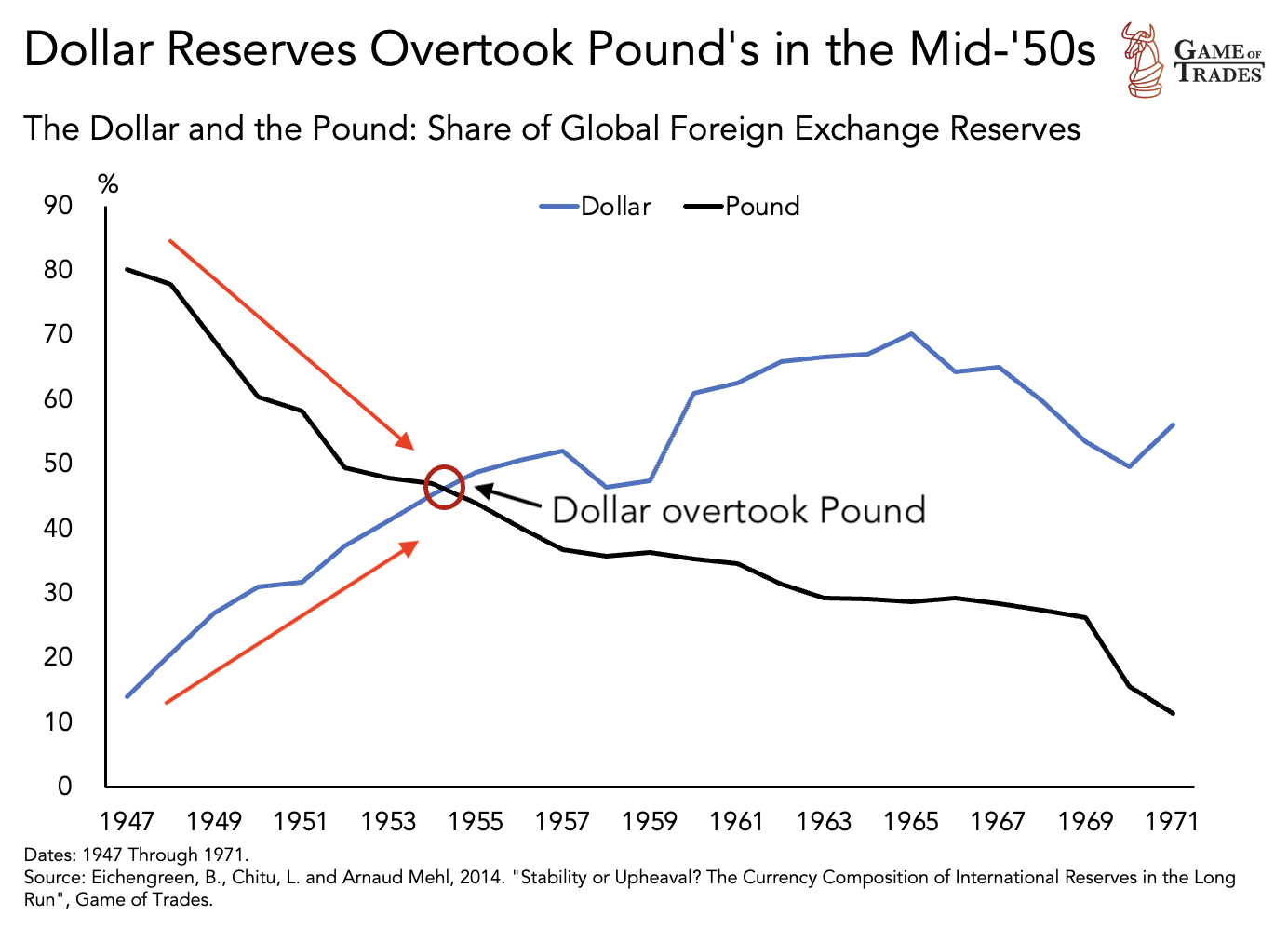

Drawing lessons from history, we examine the UK’s devaluation strategy in the 1940s when faced with high debt relative to its economy. By devaluing its currency, the UK stimulated its economy, boosting demand and increasing exports, but also experienced a loss of investor confidence that ultimately led to the Pound losing its global reserve currency status.

Conclusion

The US national debt has reached unprecedented levels, raising concerns about its long-term sustainability and potential risks to economic growth. Addressing the debt problem is crucial to avoid stagnated growth and the potential consequences of a default. Balancing market prosperity with the need for sustainable growth will be a critical challenge for policymakers and investors moving forward. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: The Growing Challenges of Homeownership in the US