Financial markets are complex and influenced by various factors, including investor sentiment and fund manager strategies. In recent times, there has been a notable increase in the level of leverage among financial institutions, as well as growing bullishness among average investors. These developments have significant implications for the stock market in the near term.

This article aims to explore the consequences of high leverage and investor sentiment on market dynamics, providing insights for individual investors. By examining historical patterns and current market conditions, we can gain a better understanding of the potential risks and opportunities in the current stock market environment.

Fund Manager Exposure and Leverage

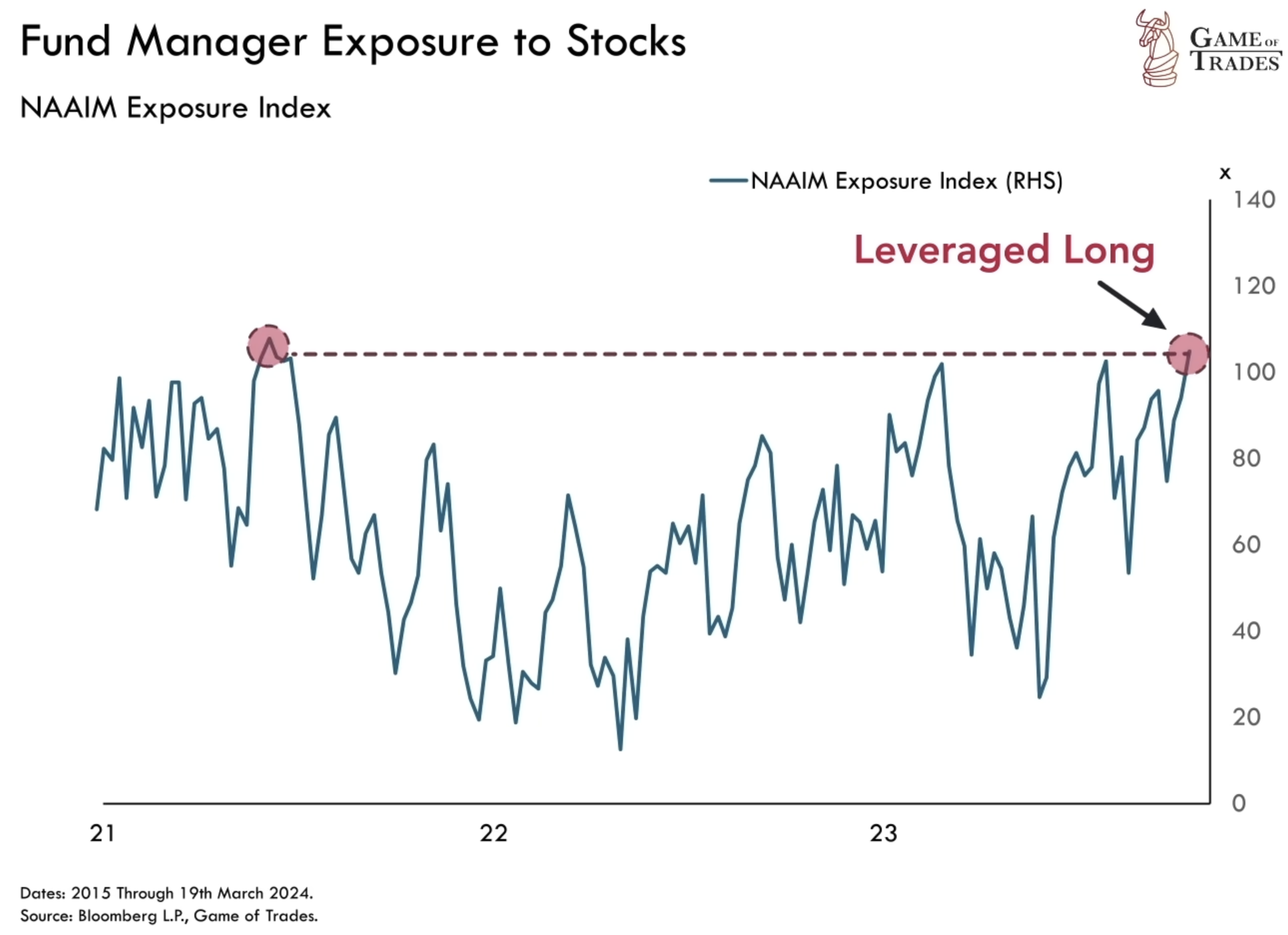

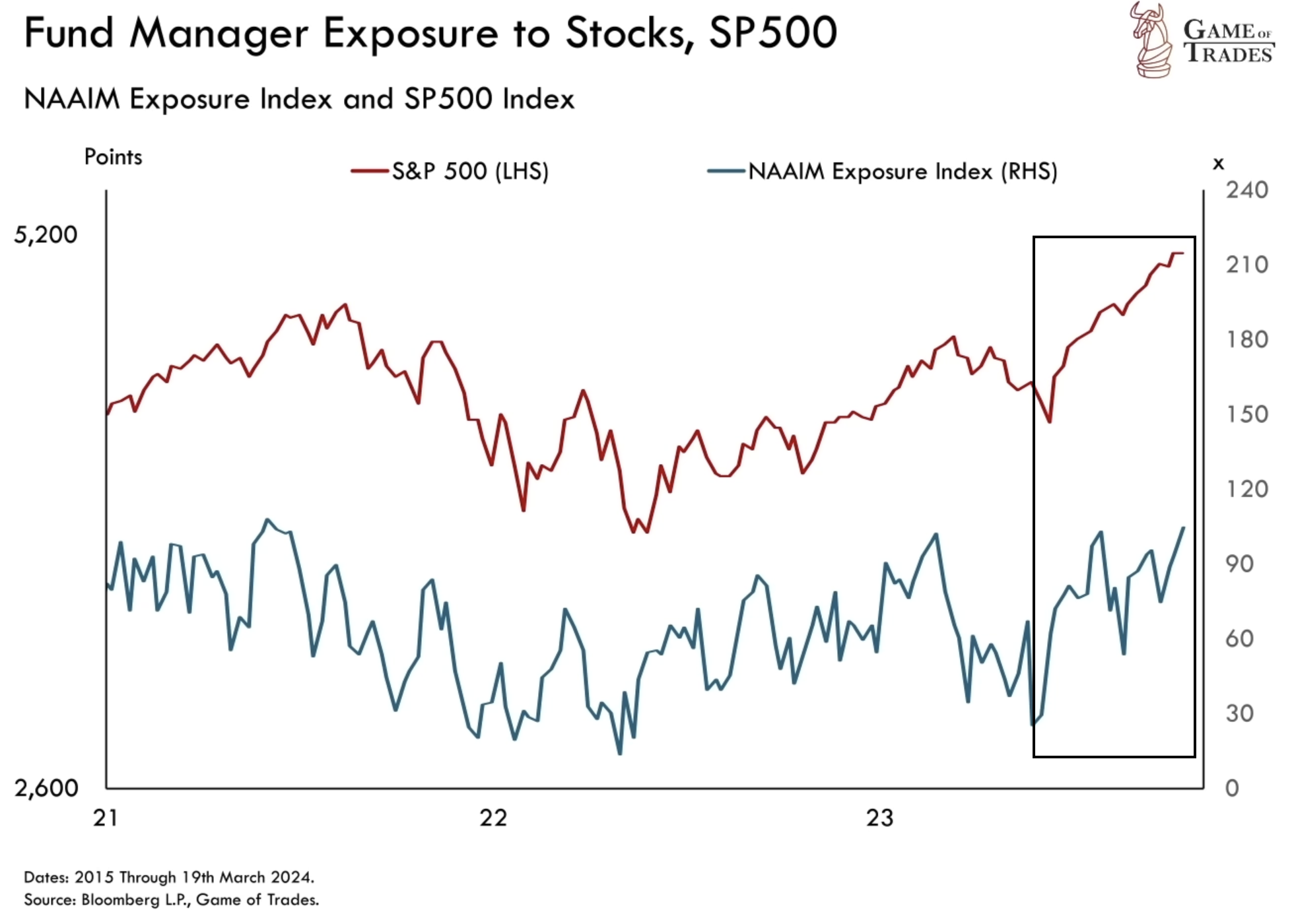

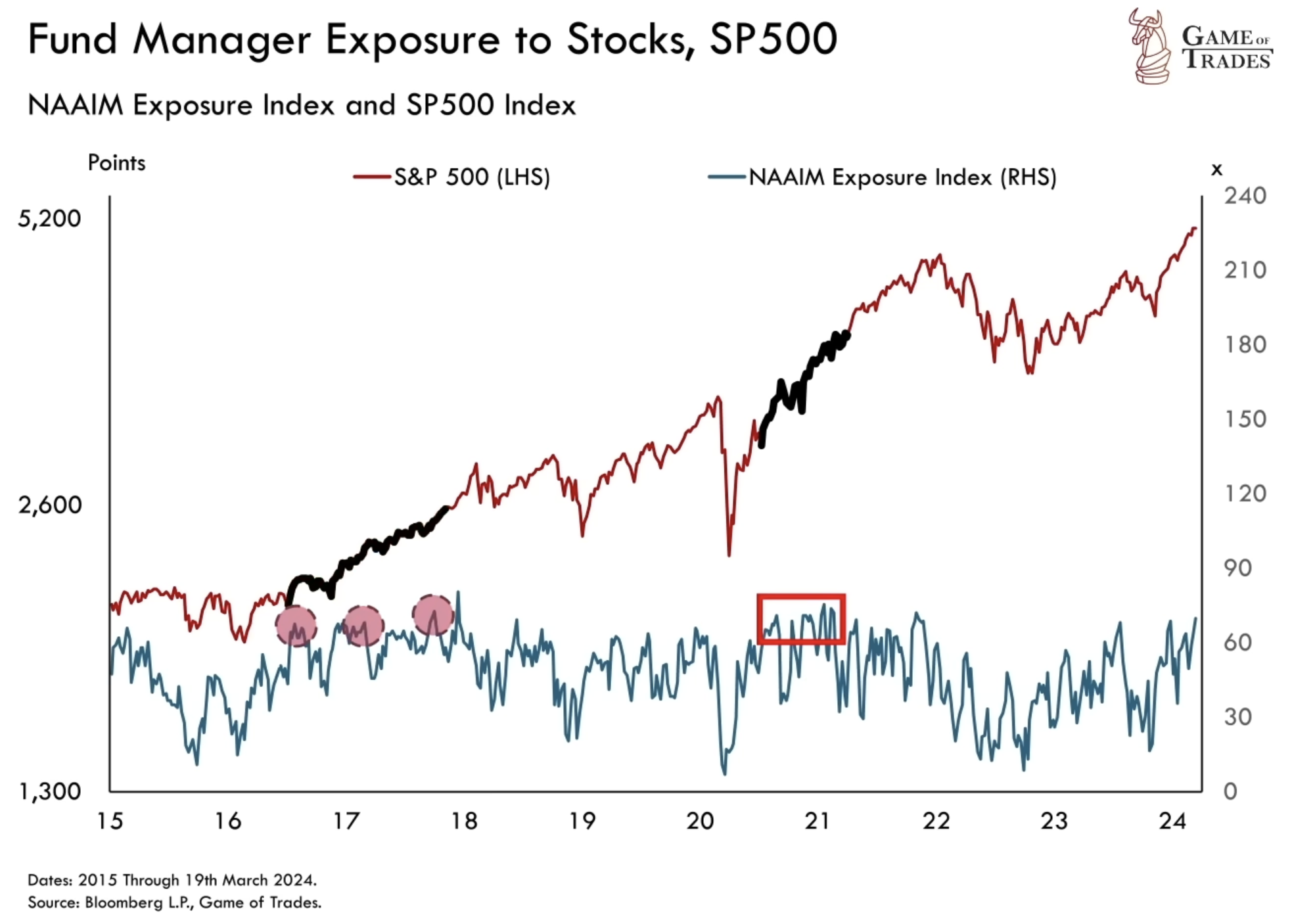

Financial institutions play a crucial role in the stock market, managing portfolios on behalf of clients and investors. One way to gauge their market exposure is by assessing the level of leverage employed. Leverage refers to the use of borrowed funds to amplify investment returns. The higher the leverage, the greater the exposure to market movements. An index reflecting fund managers’ exposure to the stock market, named NAAIM exposure index, reveals that they are currently leveraged long at the highest level since November 2021. Being leveraged long means that fund managers are fully invested in the stock market and possibly even beyond, indicating an elevated risk appetite.

Average Investor Sentiment

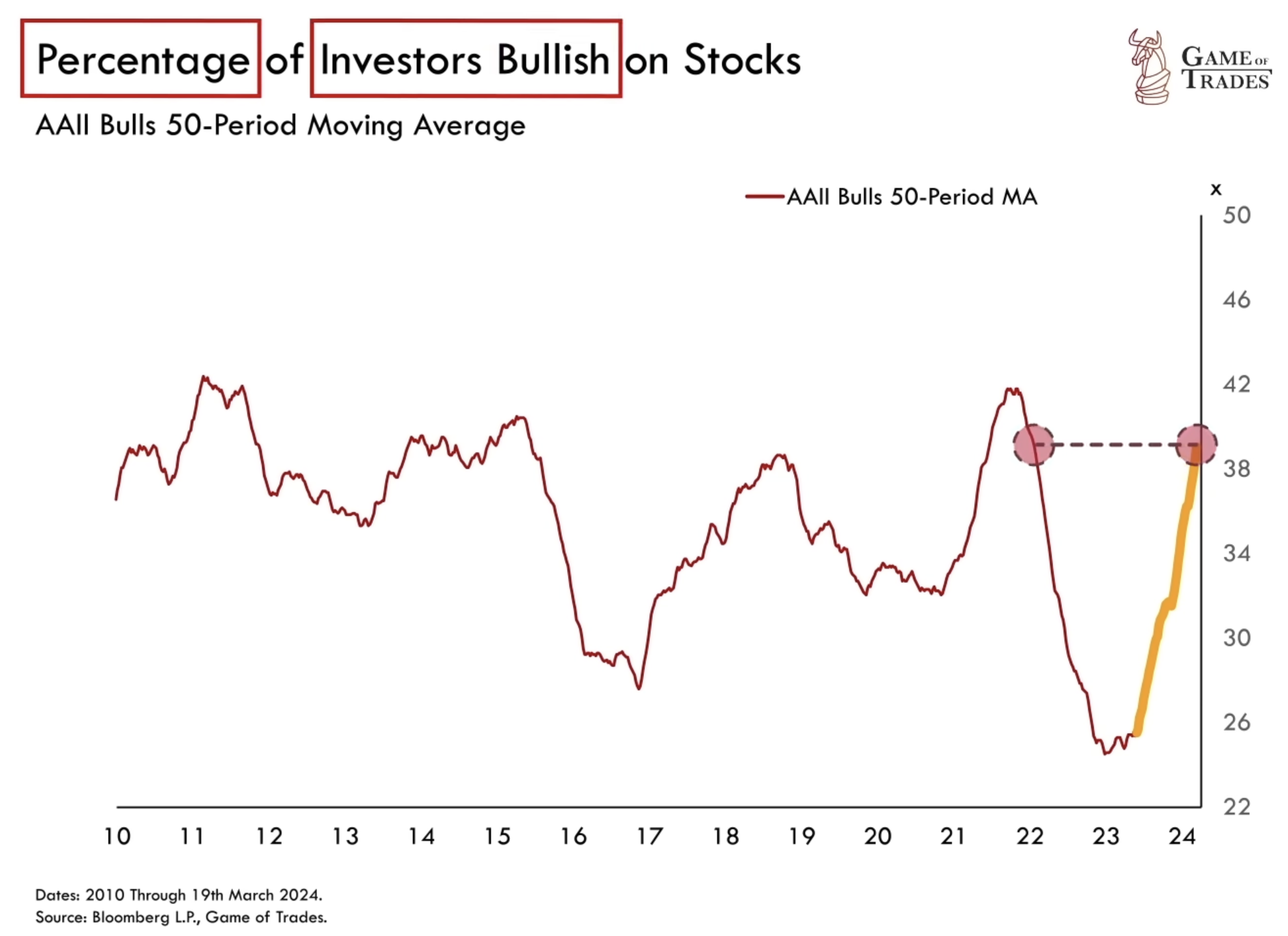

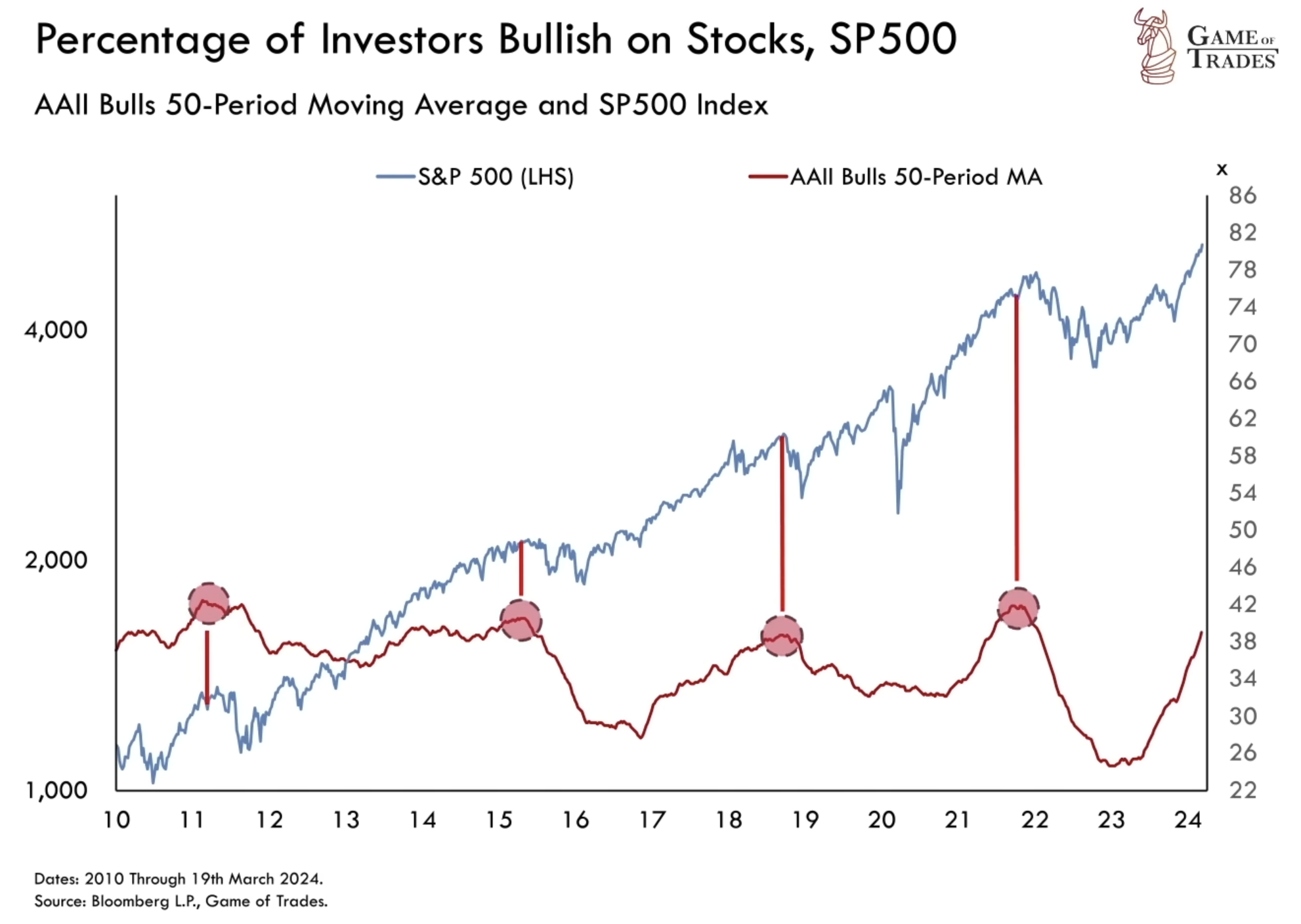

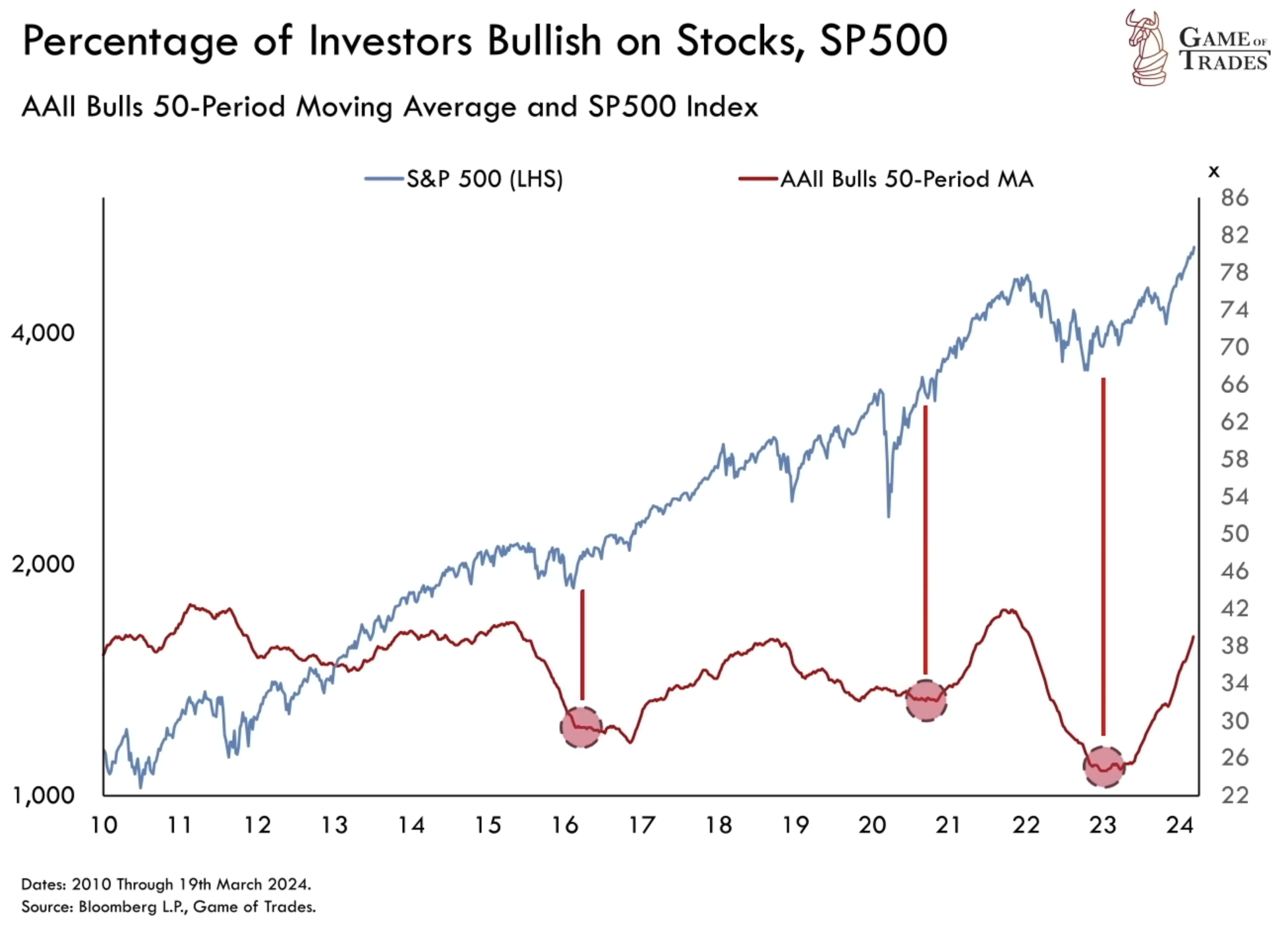

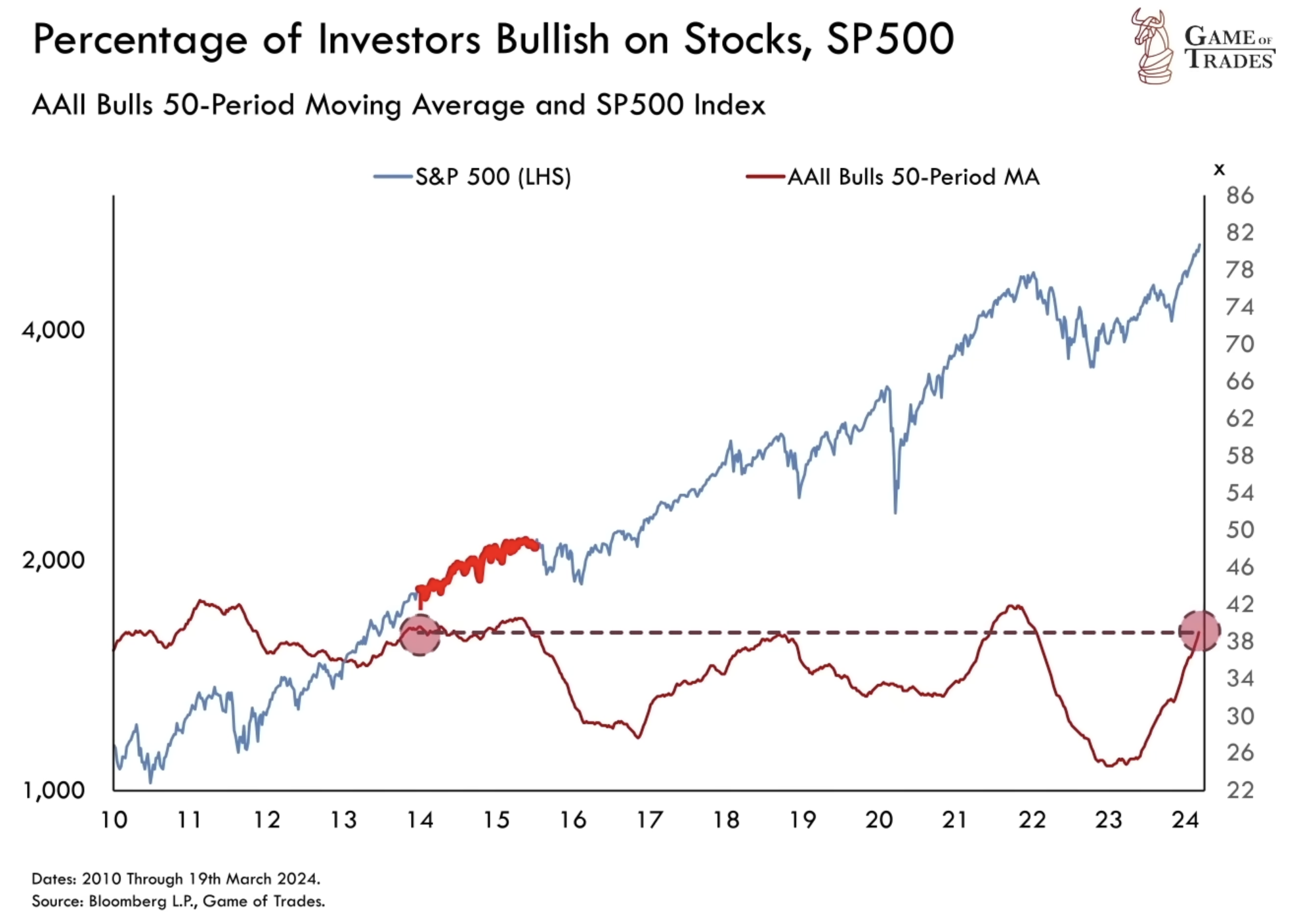

In addition to fund managers, average investors also play a role in shaping market dynamics. Monitoring investor sentiment provides insights into their collective outlook on the stock market. The AAII bulls indicator smoothed by a 50-day average reveals that average investors are currently the most bullish since January 2022. Historically, extreme optimism among investors has often coincided with market peaks, while periods of pessimism have presented buying opportunities. However, it is important to note that timing the market based solely on investor sentiment can be challenging, as sentiment can persist during extended market rallies.

Historical Patterns and Market Peaks

Analyzing historical data allows us to identify patterns between investor sentiment and market peaks. During periods of pronounced optimism, market peaks have frequently occurred. For example, peaks in optimistic sentiment like in 2011, 2015, 2018, and 2021 corresponded with peaks in the stock market.

Conversely, moments of heightened pessimism, such as late 2022, late 2020 and early 2016, proved to be favorable entry points as the market subsequently rallied.

While optimistic sentiment can be a warning sign, it is worth considering that previous instances of similar sentiment levels did not always result in immediate market declines. For instance, in 2014 and March 2021, investors were very optimistic, but the market continued rallying for another 1.5 years. Therefore, it is essential to assess multiple factors when evaluating market conditions.

Fund Managers’ Market Timing and Vulnerability

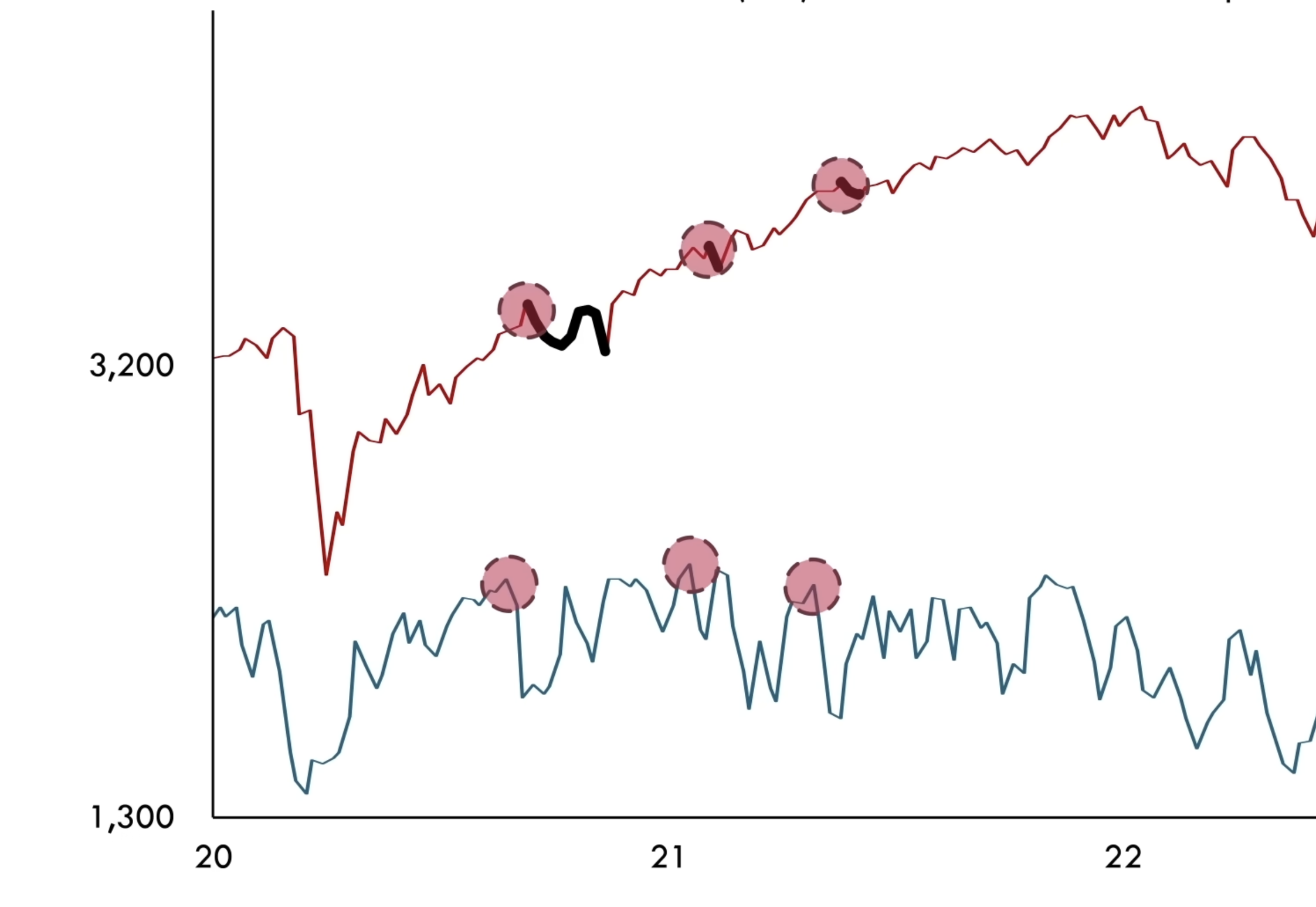

Fund managers’ leverage levels can serve as a near-term warning signal for the stock market. Historical analysis reveals instances where their positioning and leverage coincided with market bottoms or peaks. In October 2023, when fund managers were significantly underexposed to the stock market, it coincided with a market bottom. Conversely, in November 2021, when they were highly leveraged long, it preceded a significant market decline of more than 25%.

However, there are instances when fund managers were leveraged long without coinciding with a market peak, like in 2016, 2017 and 2020. These observations suggest that while fund managers’ leverage can indicate vulnerability, it should not be the sole determinant of market expectations.

In the short-term, however, spikes in leverage often serves as warning signals. Fund managers’ leverage spiked in in Aug 2020, Jan 2021, Mar 2021, and Oct 2021, which ended in market corrections of 10%, 5%, 5%, and 10% respectively

Portfolio Rebalancing and Market Impact

Portfolio rebalancing is a common practice among financial institutions, and their actions can influence market behavior. When most money managers are long on the market, a collective decision to reduce positions could lead to market declines. Conversely, when they are underexposed, a substantial increase in investments could drive the market higher. Therefore, when a significant number of fund managers engage in similar strategies, it increases the vulnerability of the market to shifts in sentiment and investment decisions.

Factors Supporting Market Optimism

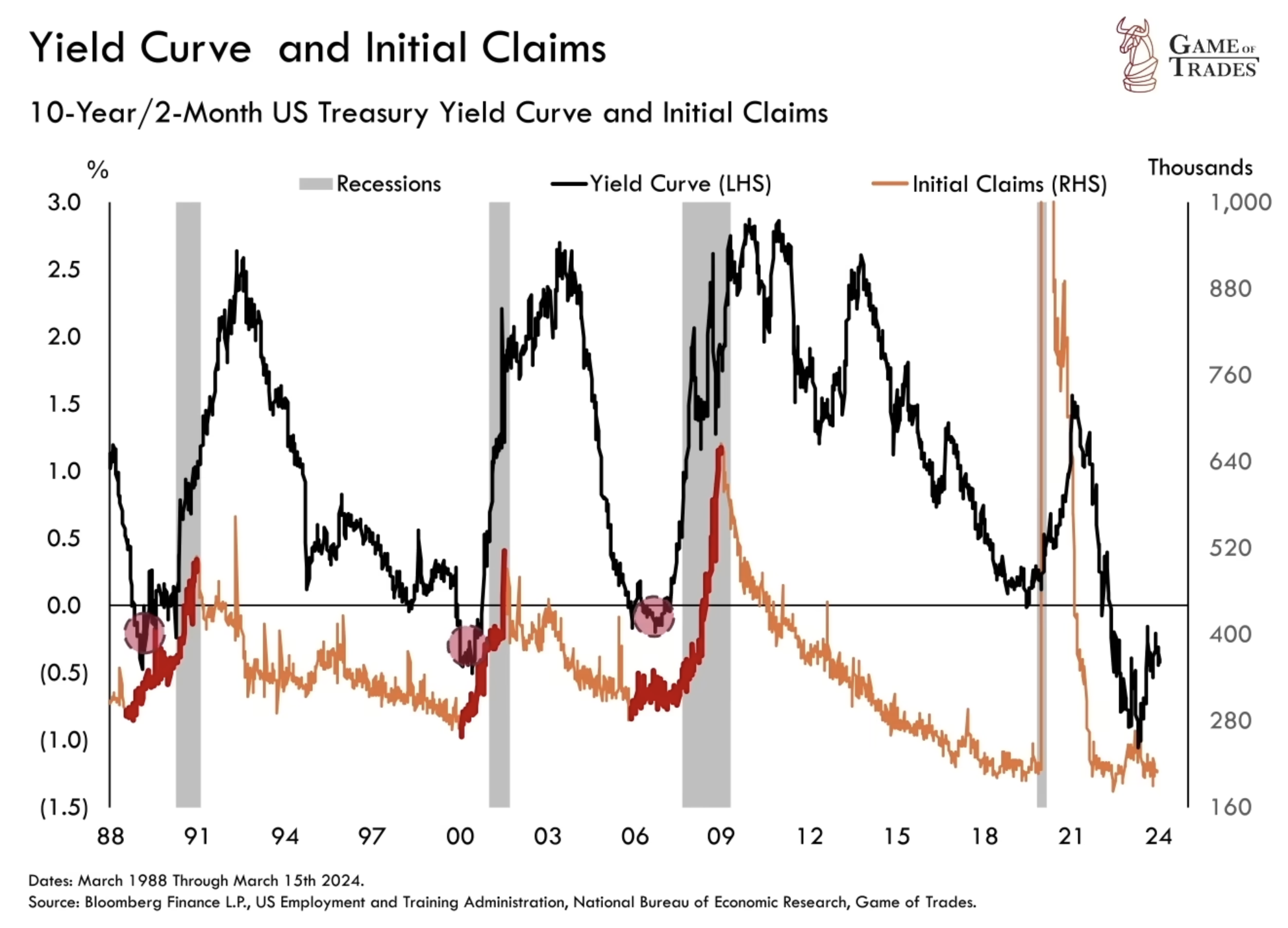

The yield curve has been inverted for the last 1.5 years anticipating an economic downturn. Despite the inversion, the job market remains surprisingly resilient today, unlike past inversions. Economic stimulus measures over the last few years is likely contributing to this unusual strength.

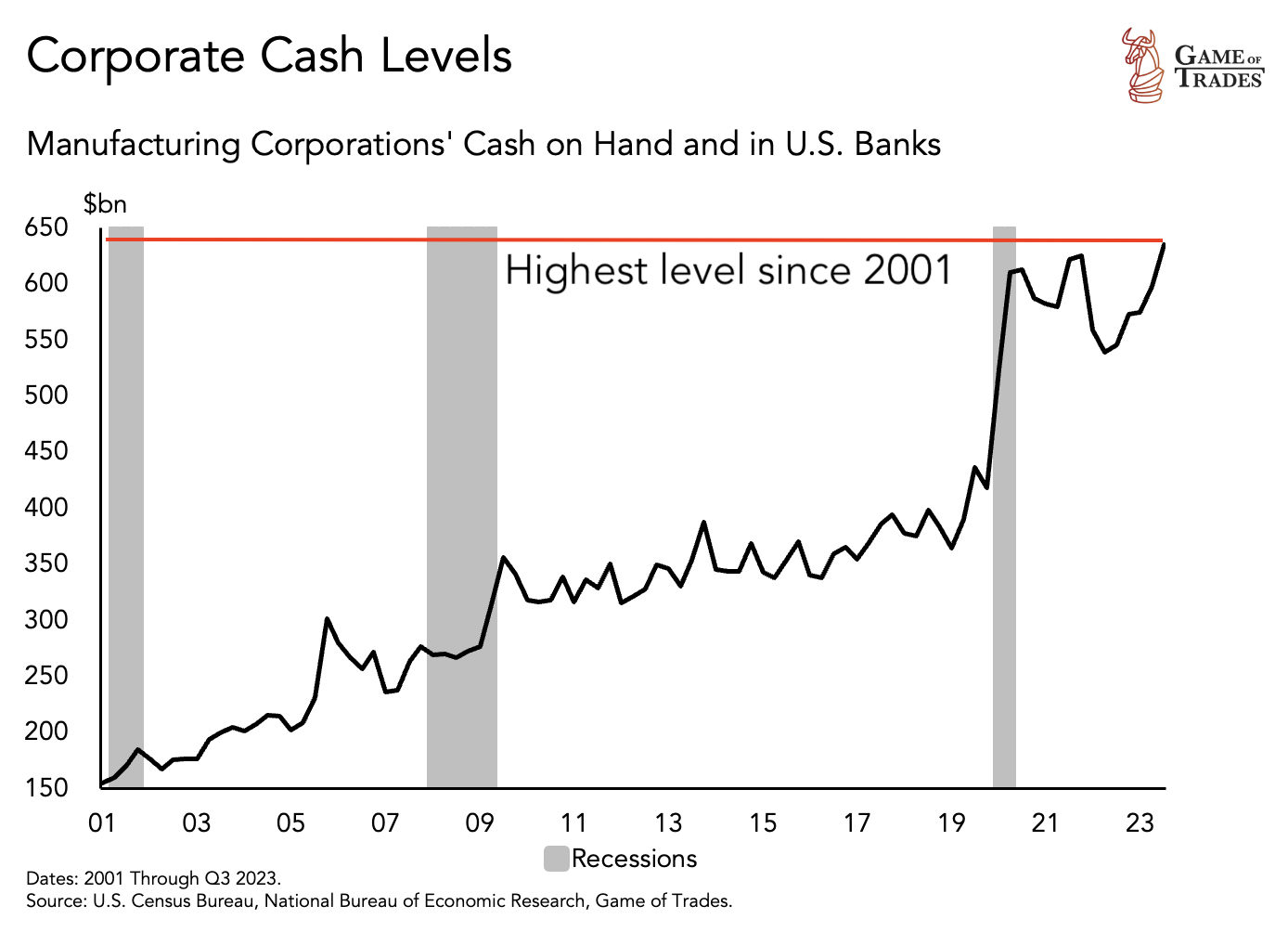

Moreover, there are several additional factors supporting the current market optimism, despite the potential risks associated with high leverage and investor sentiment. Firstly, S&P 500 companies have experienced substantial increases in profit margins. These companies also have a large pile of cash following recent stimulus. Furthermore, the decline in interest rates, coupled with the Federal Reserve’s commitment to further rate cuts in 2024, has fueled the market’s positive sentiment.

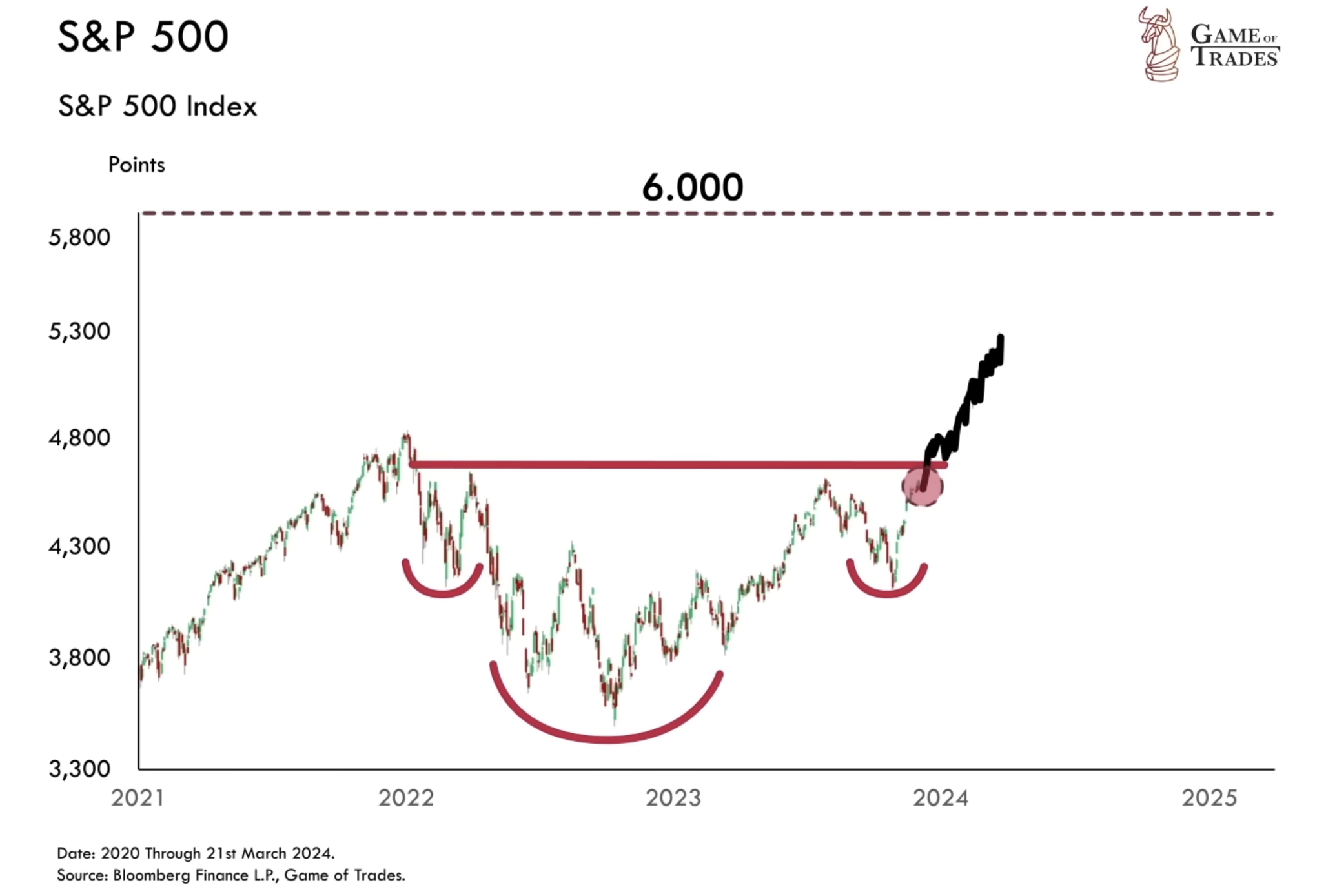

These factors contribute to the ongoing rally in the S&P 500, which has seen strong price momentum since October. The S&P 500 has broken out above its inverse head and shoulder bottoming pattern, and has been on a relentless run inching towards the 6000 point inverse head and shoulder target. However, the rally is technically overextended and institutions are leveraged long, making the market at risk of a violent pullback.

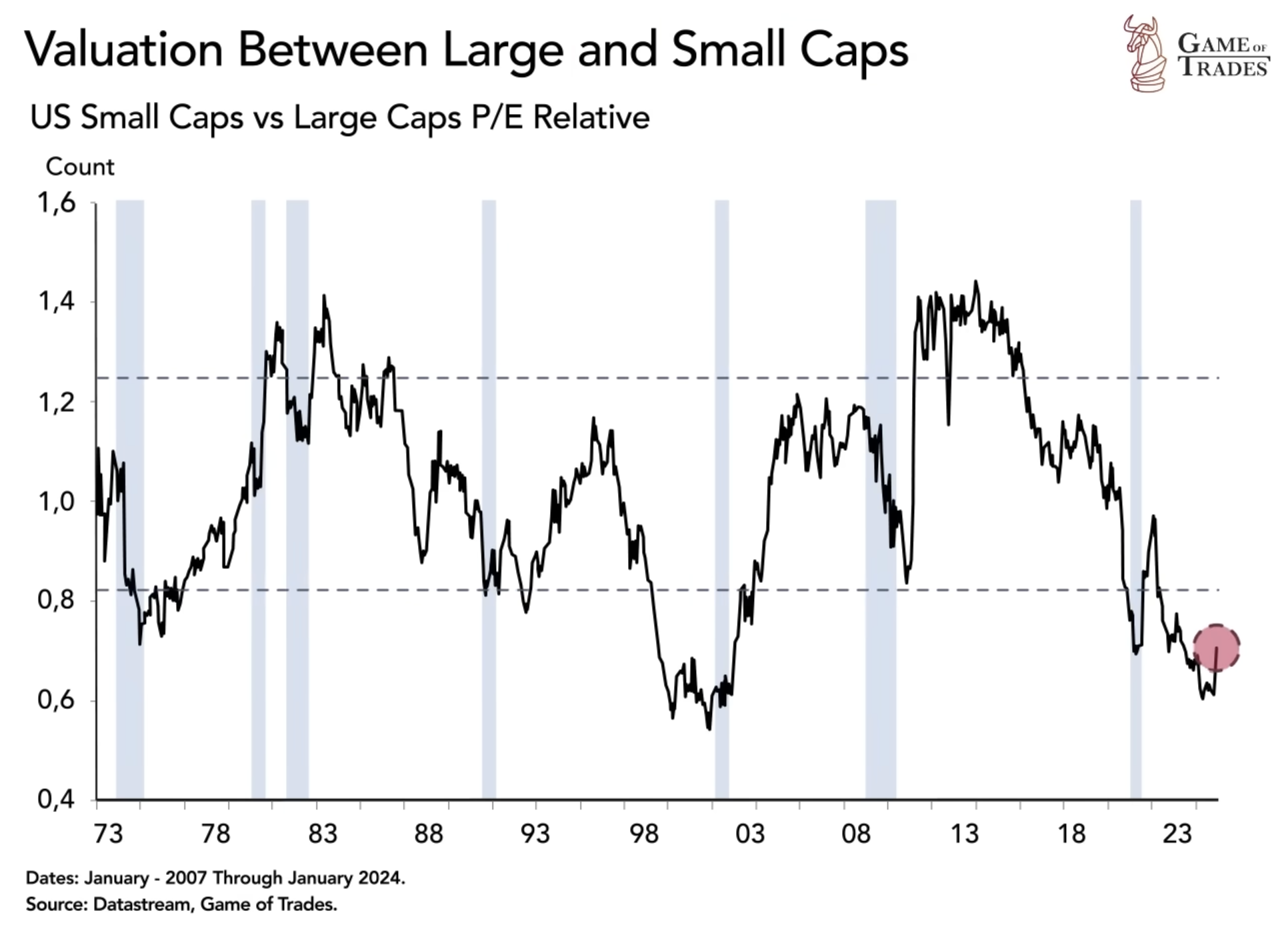

Instead, we’re betting on small caps that offer a much better risk-reward at this point. Find our next big bet at https://gameoftrades.net/?rfsn=7910058.d62f47

Conclusion

While the stock market demonstrates signs of optimism, it is important to exercise caution and consider the implications of high leverage and investor sentiment. Fund managers’ leverage levels and average investor sentiment can provide valuable insights. However, relying solely on these indicators for market timing may not yield consistent results. Understanding historical patterns and the impact of portfolio rebalancing helps assess the vulnerability of the market to shifts in sentiment and investment decisions. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Dot Com Bubble Versus Today