In the ever-changing landscape of the financial markets, investors are constantly seeking reliable indicators to navigate uncertainty and make informed decisions. One such indicator that has caught the attention of market observers is insider selling, particularly during periods of economic concern. Coupled with the rise in news articles highlighting potential recession signals, heightened insider selling has raised market concerns

“Soft Landing” Articles and Insider Selling

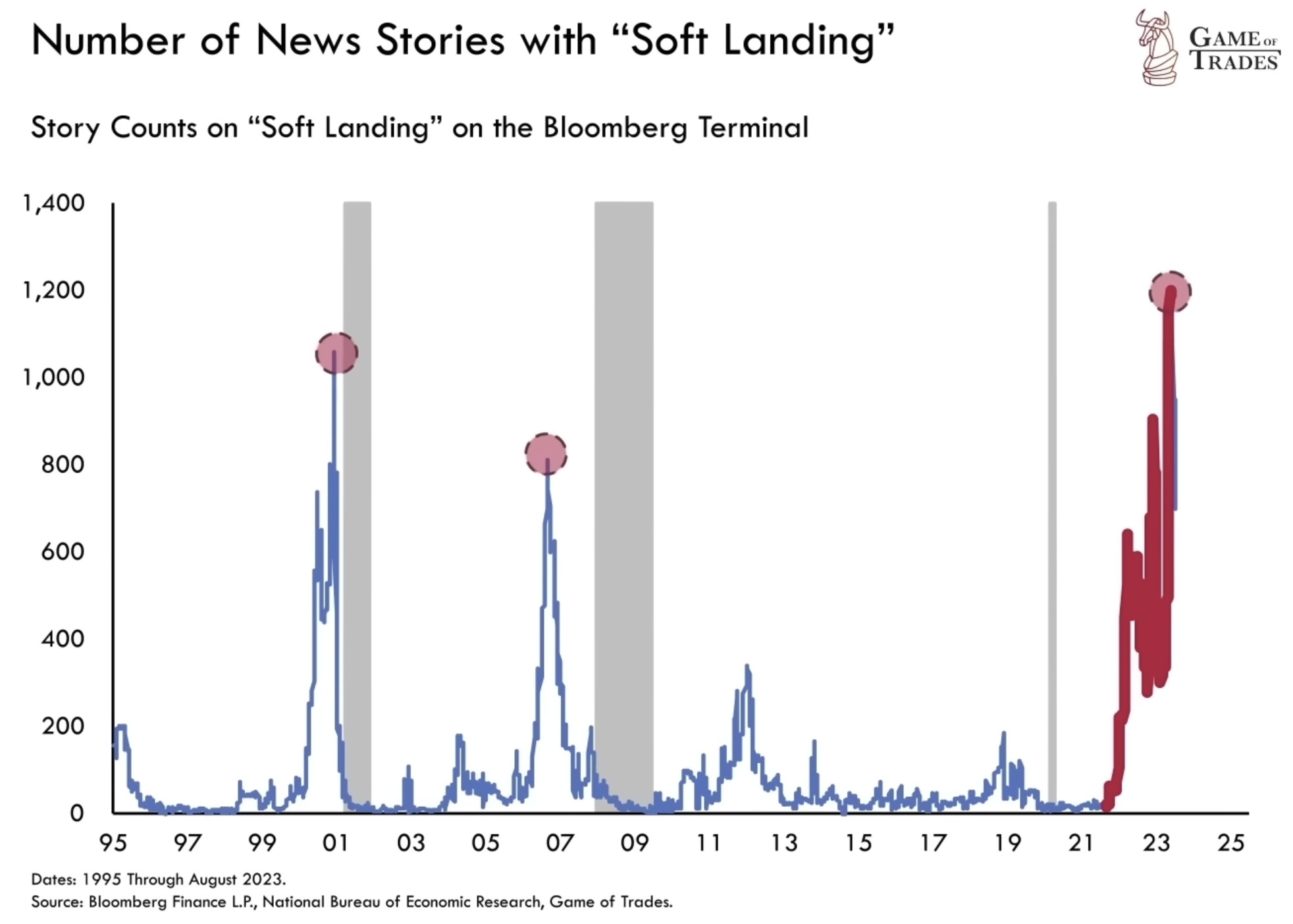

The number of news articles mentioning the term “soft landing” has reached its highest level since 2007 and 2000. These were both instances that ended up preceding severe recessions. This resurgence of the term has sparked concerns about the current state of the economy and the potential for an impending recession. Additionally, corporate insiders, who possess intimate knowledge of their companies, are selling their shares at a rapid pace, as indicated by the ratio of insider buying to selling.

Heightened Insider Transaction Ratio Raises Concerns

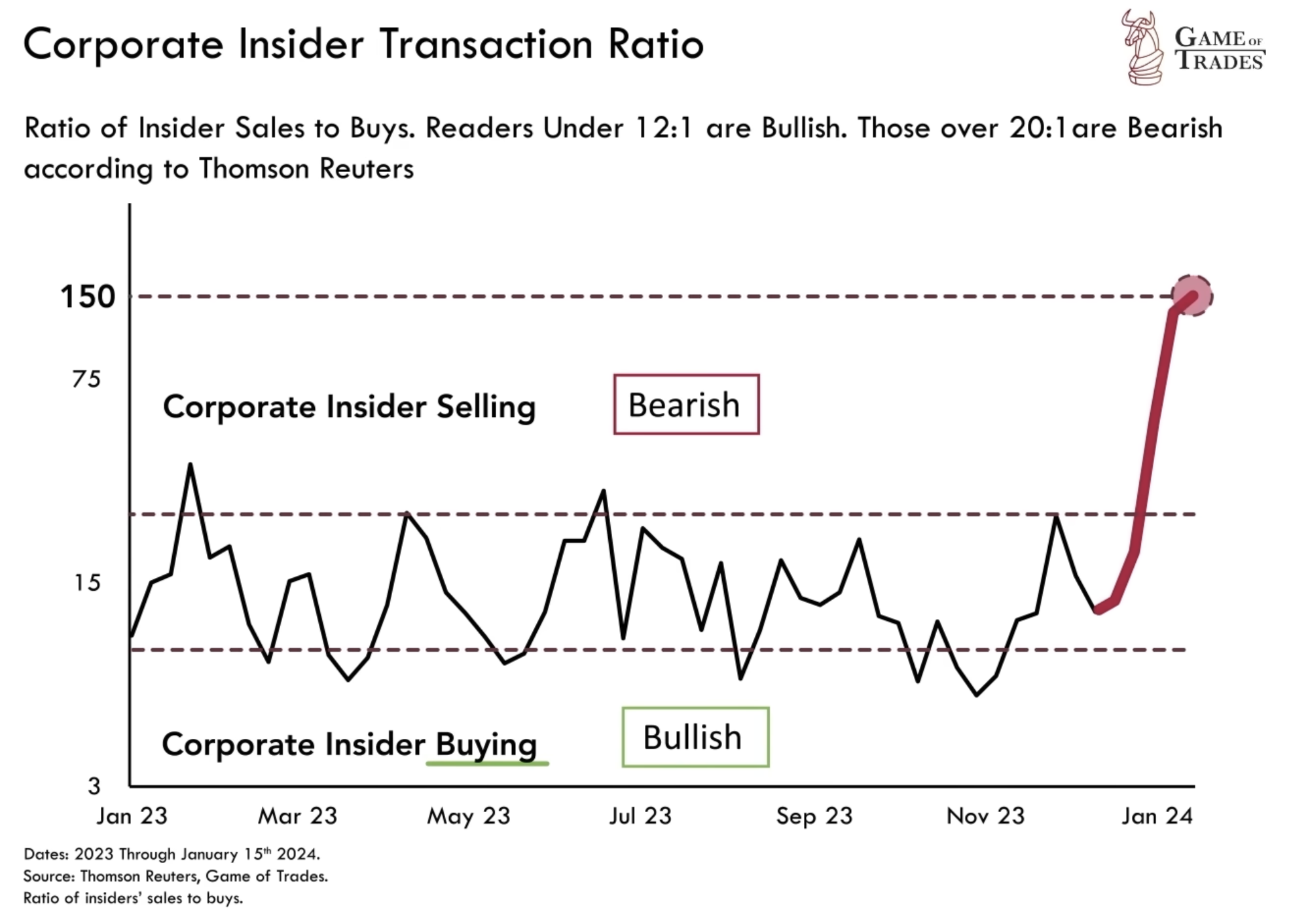

Insider transaction ratios serve as a valuable market indicator, shedding light on the sentiment of corporate insiders. When this ratio exceeds 20, it is considered bearish, indicating heightened insider selling. Conversely, a ratio below 12 is seen as bullish, suggesting increased insider buying. Presently, the insider transaction ratio stands at an alarming 150, signaling a significant increase in insider selling the likes of which haven’t been seen since 2023. Such actions by corporate insiders are often viewed as a significant warning sign for the broader market.

Analyzing the historical performance of insider transactions reveals intriguing patterns. In April and June 2023, corporate insiders were actively selling their shares, while in March, May, August, October, and November 2023, they were buying. In hindsight, the months of January, April, and June proved to be opportune times for selling stocks, while March, May, August, October, and November presented favorable buying opportunities. This historical performance suggests that insider actions may have predictive value for future market movements.

Reason Behind Insider Selling

It is important to note that insider selling does not perfectly predict a proportional market correction. Corporate insiders tend to sell during aggressive market rallies and buy during significant sell-offs. They understand that their business does not undergo drastic changes on a weekly basis and, therefore, make strategic use of extreme market movements. Since October 2023, the market has experienced a remarkable rally, with gains exceeding 20%. This surge has been primarily driven by the Fed’s intentions to cut interest rates in 2024. Given the magnitude of this rally, it is logical for corporate insiders to take advantage of the opportunity to sell and realize profits.

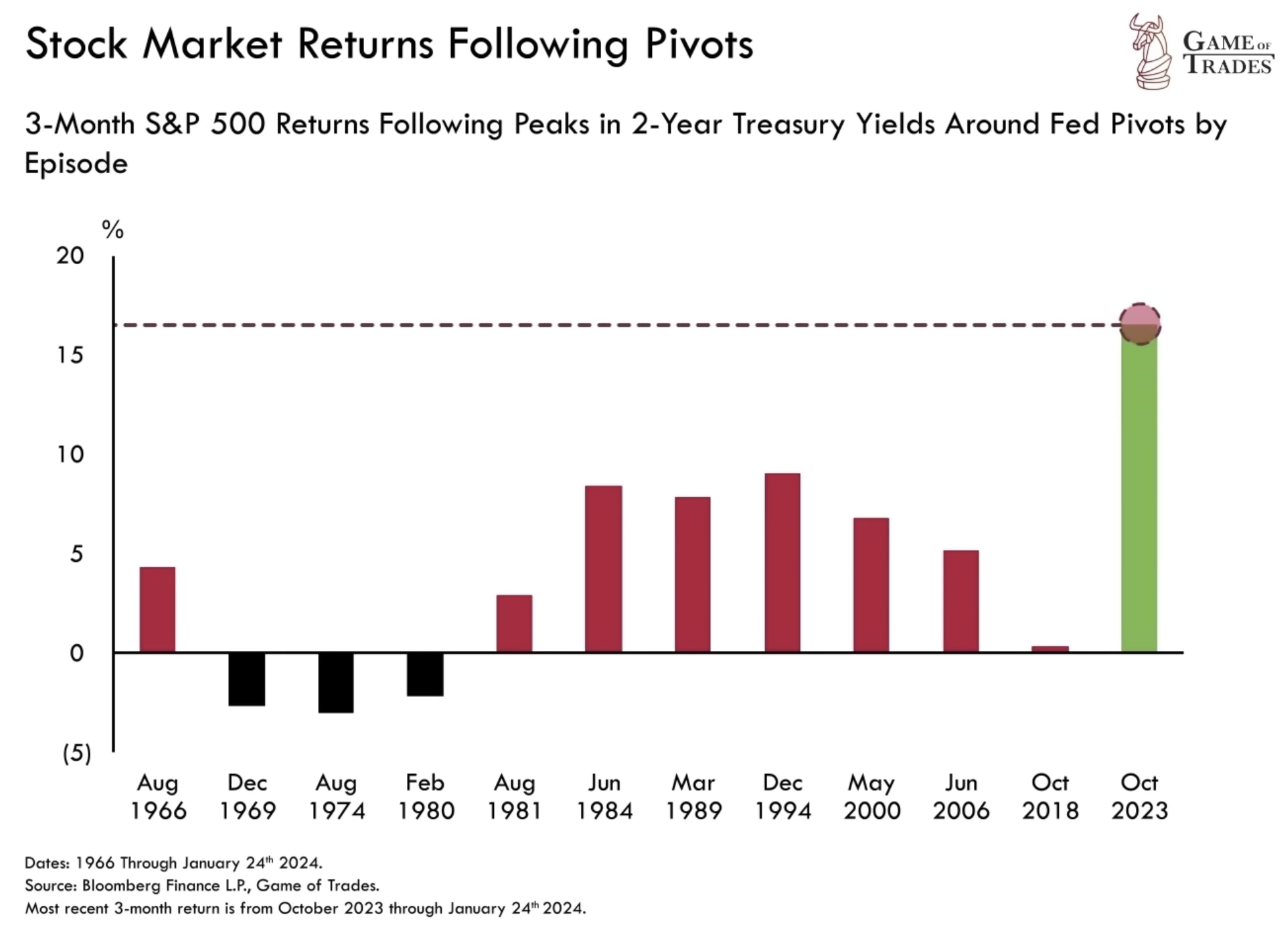

While markets historically rise following Fed pivots, the rally since October 2023 represents the most significant three-month post-pivot rally in history. As corporate insiders have not encountered substantial changes in their businesses, their selling activity during this rally can be attributed to profit-taking.

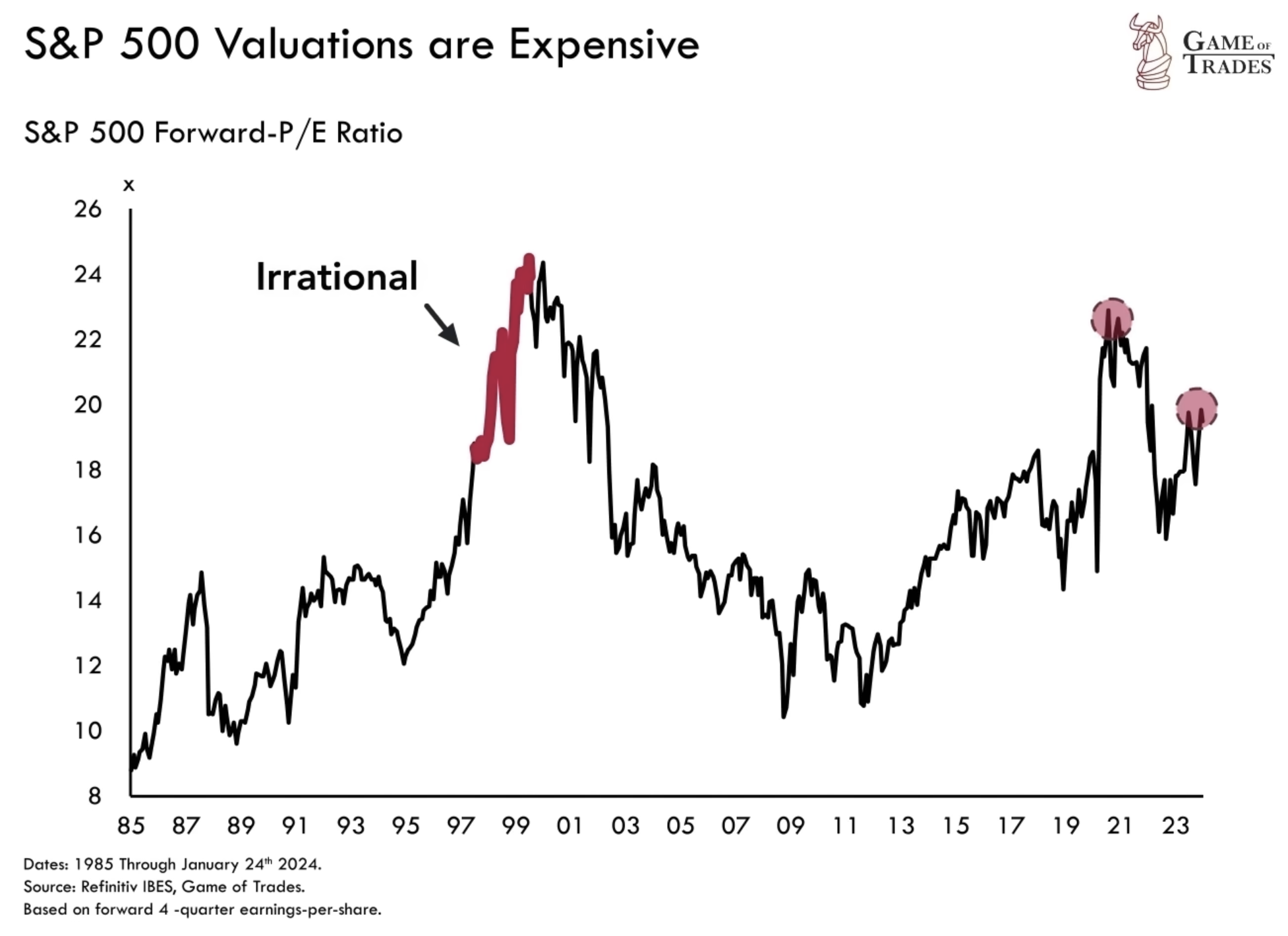

Despite the overall market optimism, with PE ratios reaching historic highs, insiders may not share the same sentiment. They may perceive current valuations as excessively high, suggesting a potential divergence in perspectives. However, it is important to note that market timing based on insider sentiment has its limitations, as witnessed during the irrational market behavior of 2020 and the late 1990s.

Insiders Worry About a Recession

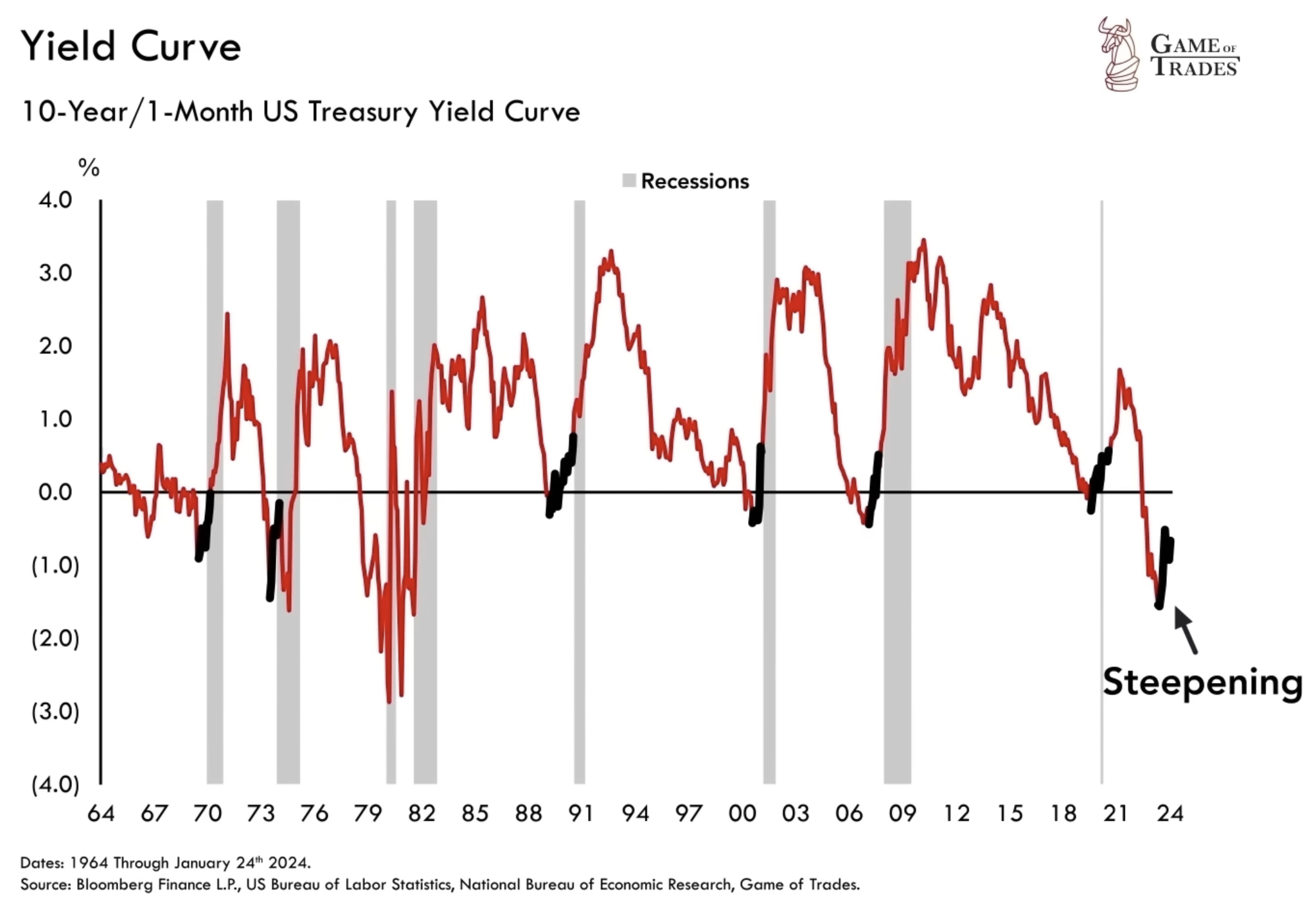

The steepening of the yield curve is another factor that has caught attention, with some attributing insider selling to this phenomenon. Historical data reveals that the yield curve steepening has occurred before every recession. While the exact reasons behind heightened insider selling remain unknown, other concerning signs in the economy, such as rising unemployment in several states, further contribute to recession signal provided by the yield curve steepening.

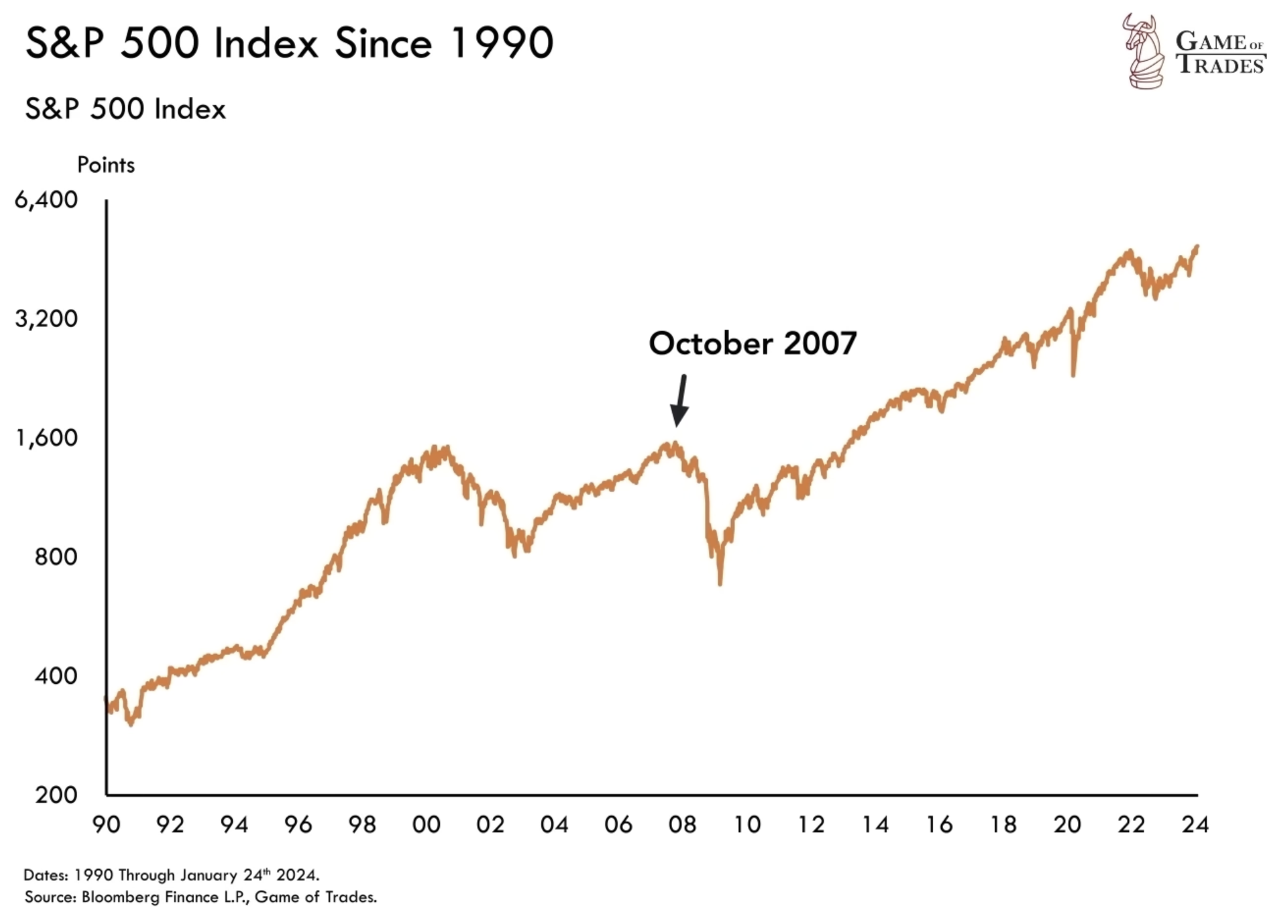

It is crucial to acknowledge that the occurrence of these indicators does not guarantee an immediate recession. Drawing parallels from the past, labor market weakening began in October 2006, a year before the stock market peaked in October 2007. In the short term, this weakening proved beneficial for the market. If historical patterns hold true, the potential for a recession in the second half of 2024 becomes a distinct possibility.

Conclusion

In conclusion, monitoring insider selling and understanding its implications on market movements can provide valuable insights for investors. While it is essential to consider multiple indicators, such as news article sentiment, insider transaction ratios, and economic signals like the yield curve, it is equally important to exercise caution and avoid making hasty investment decisions based solely on one or only a few indicators. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!