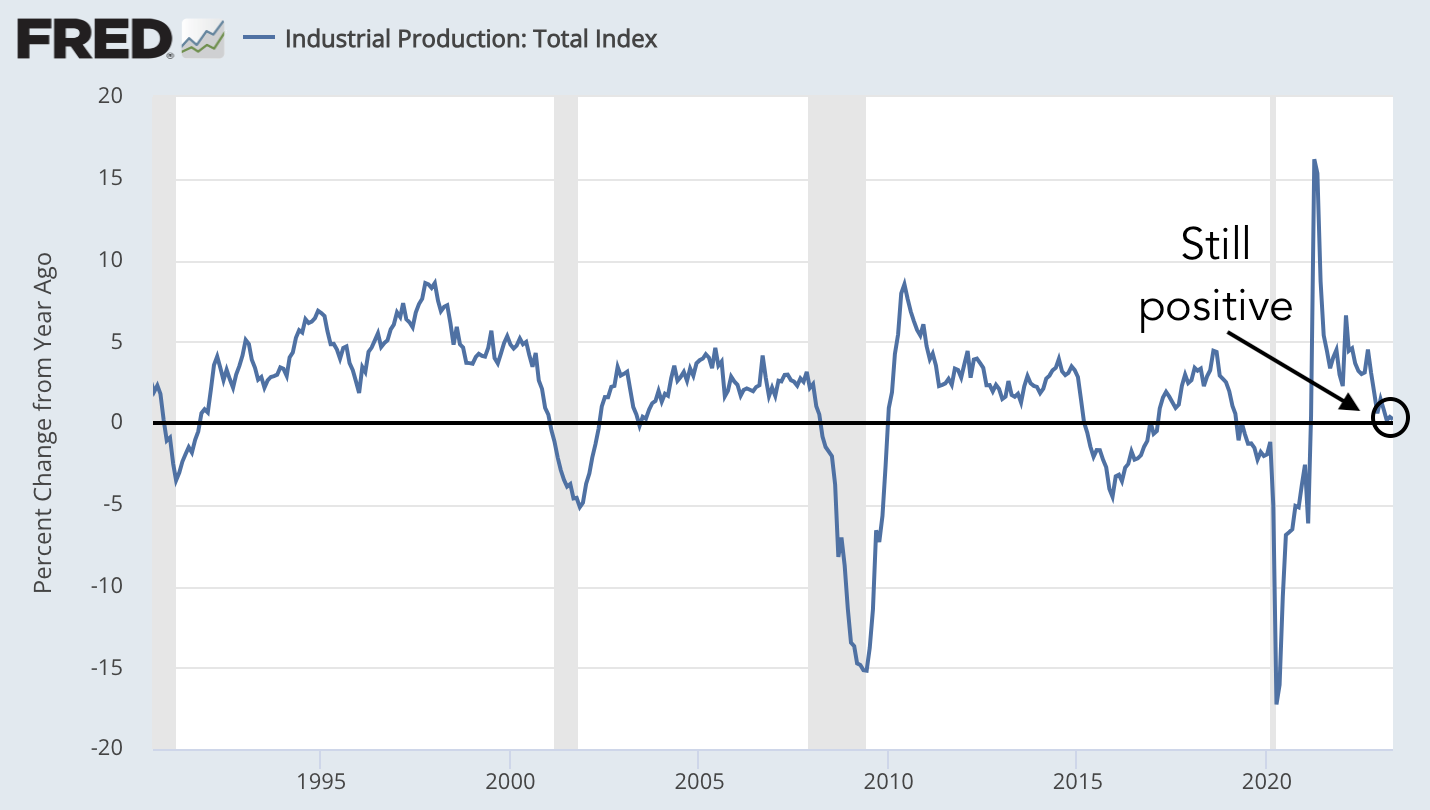

Despite numerous predictions of a recession by the first half of 2023, the US economy has managed to sustain positive economic growth thus far. This defies the conventional understanding of a recession, which typically involves significant contractions in economic production. But what’s been the saving grace for the US economy? And how might the tide turn in the second half of 2023?

The Two Pillars of the US Economy: High Consumer Savings and a Robust Labor Market

The resilience of the US economy throughout 2022 and early 2023 can be attributed to two main factors: elevated post-pandemic consumer savings and a strong labor market. However, these supporting elements are expected to weaken as we move into the latter half of 2023.

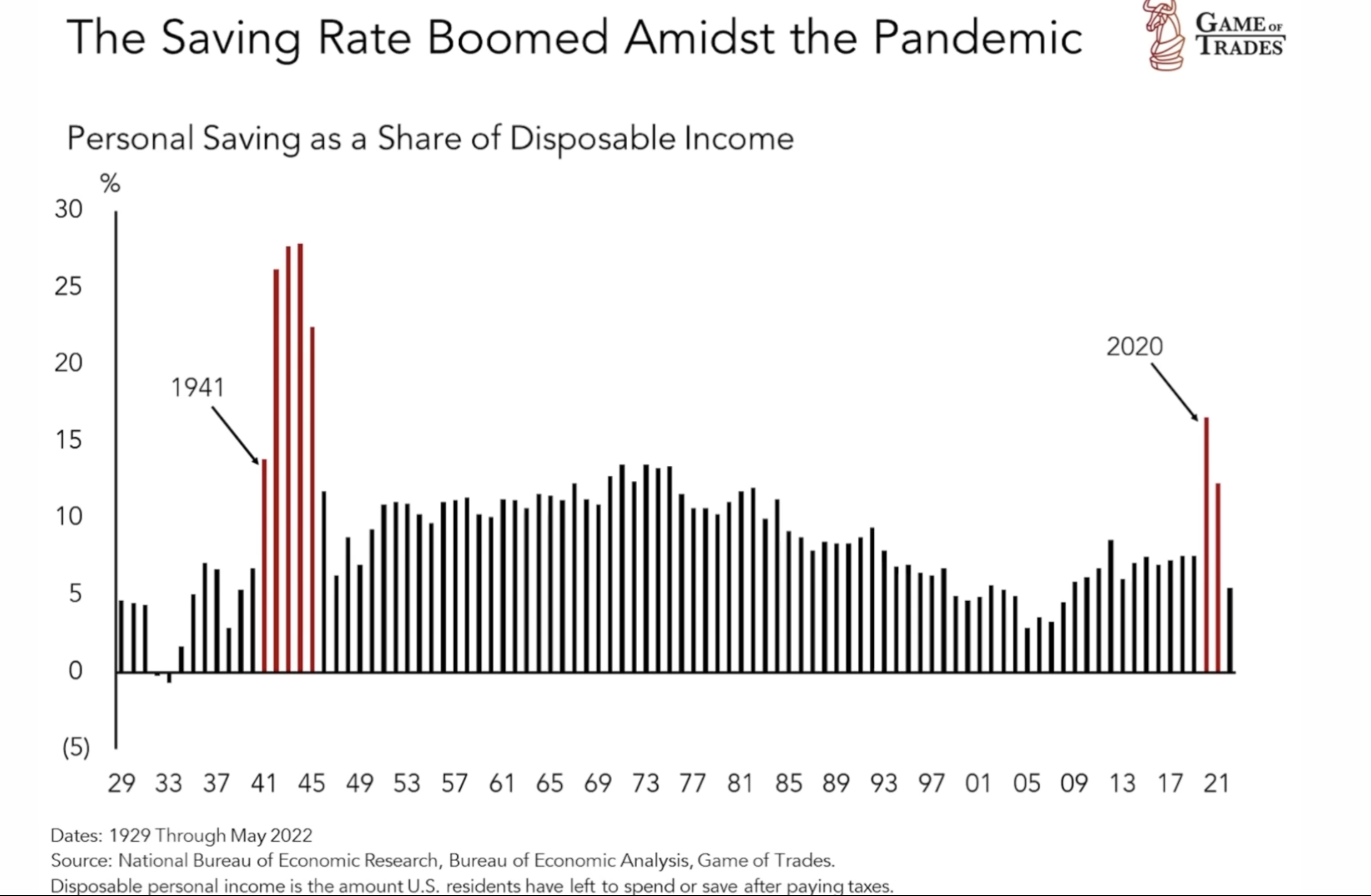

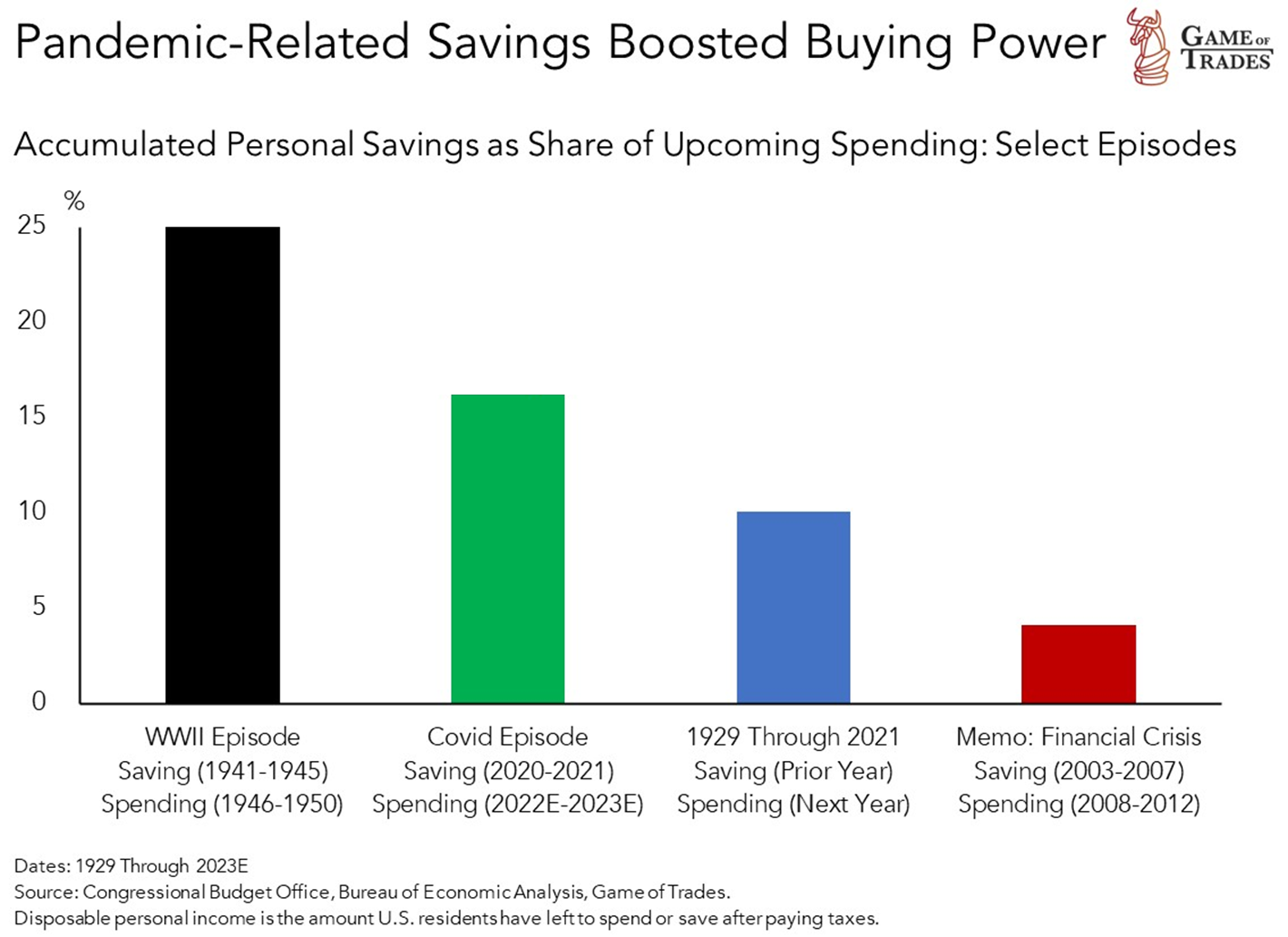

The unprecedented fiscal stimulus issued in response to the COVID-19 pandemic led to the highest savings rate since World War II. These robust savings have acted as a financial buffer for consumers, enabling them to weather the storm of high inflation, tight monetary policy, and economic weakening seen in 2022 and 2023.

In July 2022, we highlighted that consumer savings in 2022 were 50% higher than the average savings rate from 1929 to 2021. Retail interest typically surges towards recessions, as most expect imminent economic deterioration. Interestingly, the term “recession” hit record interest levels in June/July 2022, even though consumers were financially healthier during this period.

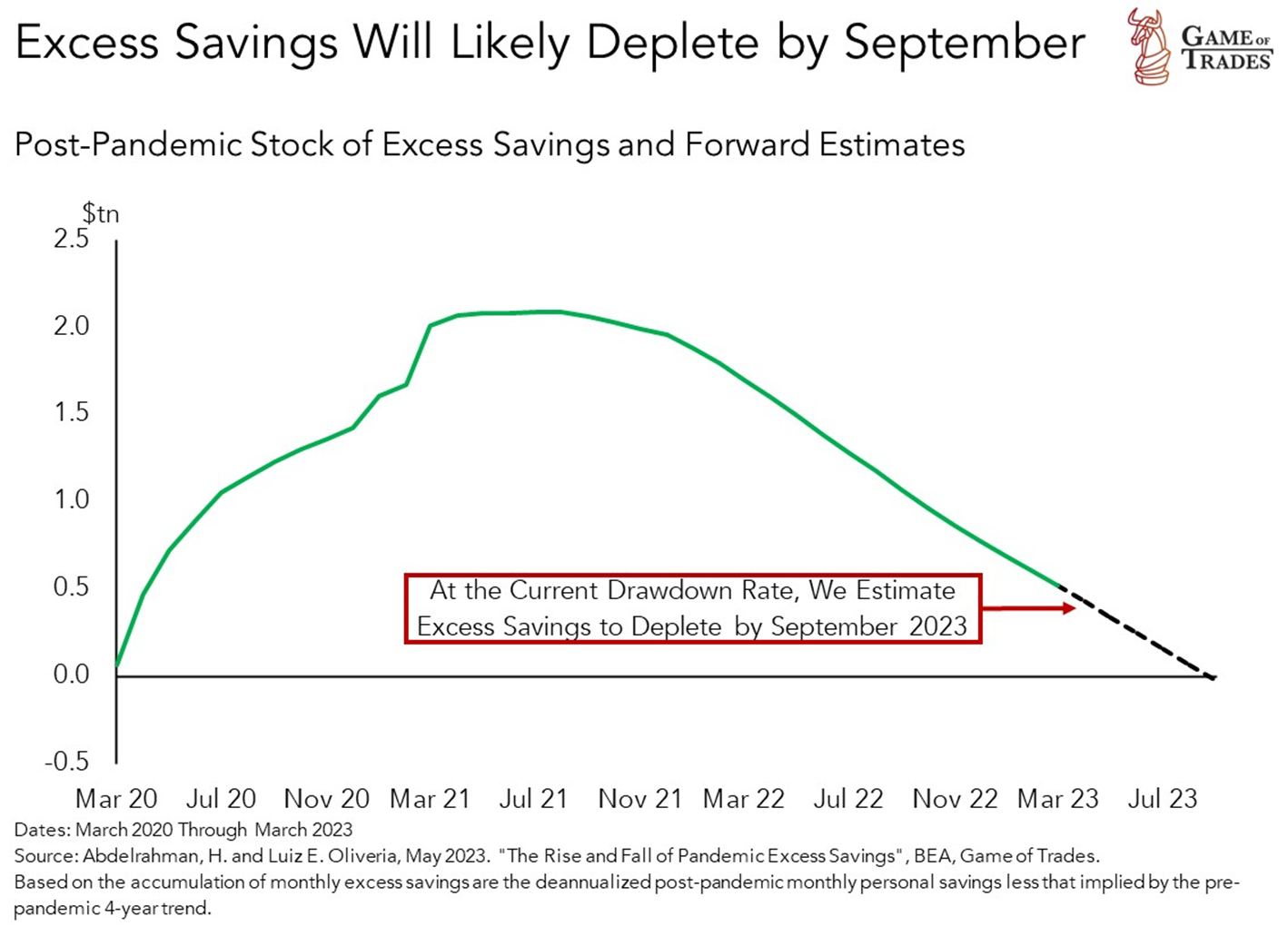

The Diminishing Cushion: Consumer Savings and the Looming Economic Shift

By the end of 2022, the savings rate began to drop to historic lows. A challenging macro environment forced consumers to tap into their savings, causing a steady decline from the post-pandemic peak of over $2tn in July 2021. Current savings stand at a mere $0.5tn and are projected to be fully depleted by September 2023.

The Shaky Second Pillar: Unemployment and Consumer Spending

The second factor bolstering the US economy is the robust labor market, with unemployment rates at historic lows. A strong labor market typically fuels consumer spending, which in turn propels economic growth. However, a rise in unemployment leads to a decline in consumer spending, often triggering a recession.

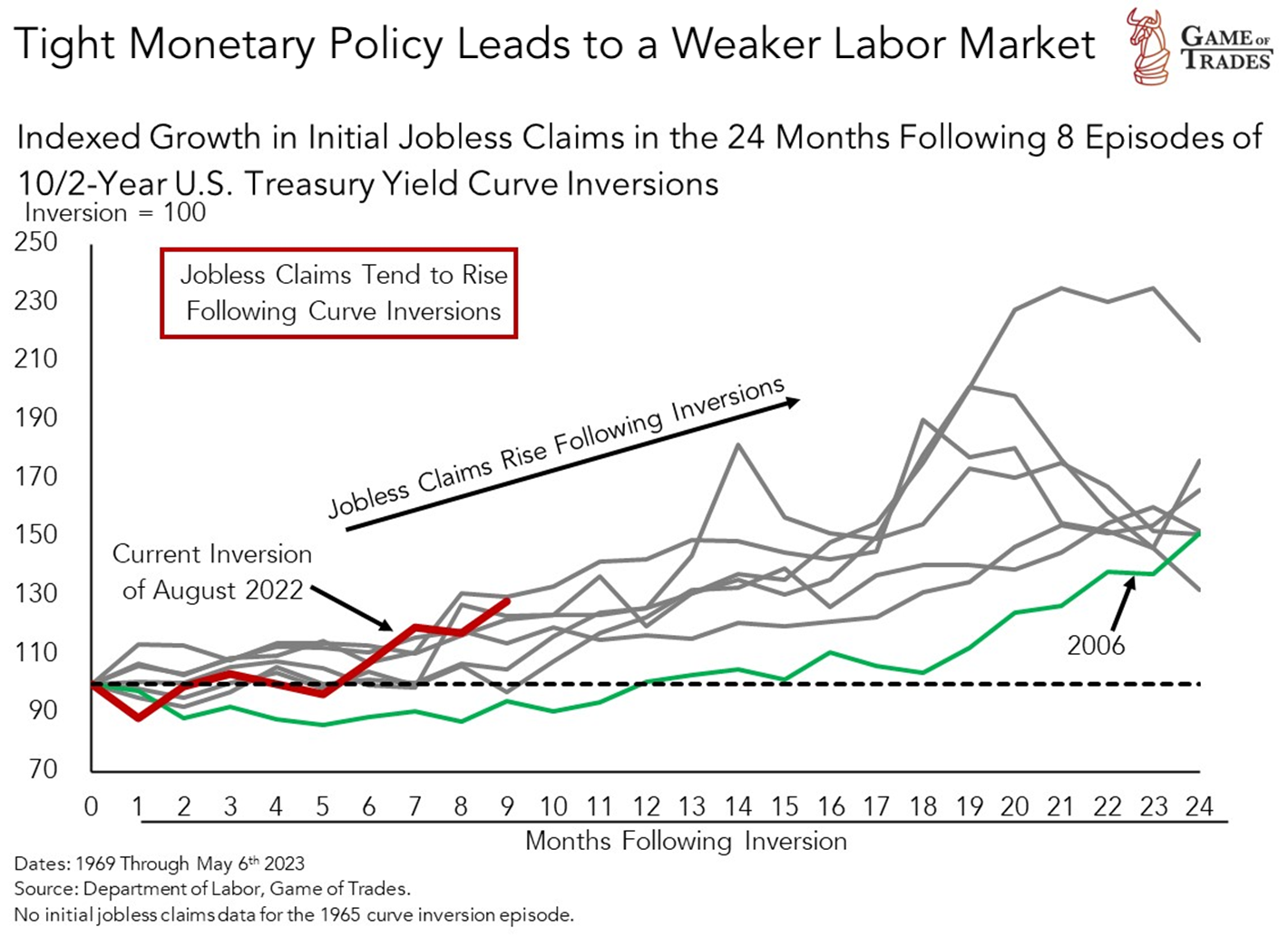

The tight monetary policy has resulted in the deepest yield curve inversion since the 1980s. Based on historical trends from the eight inversions since 1969, jobless claims typically rise for up to 24 months post-inversion. This trend indicates that the labor market is likely to weaken in the coming months, leading to a contraction in consumer spending—a typical recessionary development.

In conclusion, with consumer savings predicted to run out by September 2023, and the impending weakness in the labor market, the US economy may be heading towards a critical turning point. The ability to navigate the future economic landscape will depend on how quickly and effectively individuals and policymakers can adapt to these anticipated changes. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: 2023’s Yield Curve Inversion is Comparable to 1928 and 2006