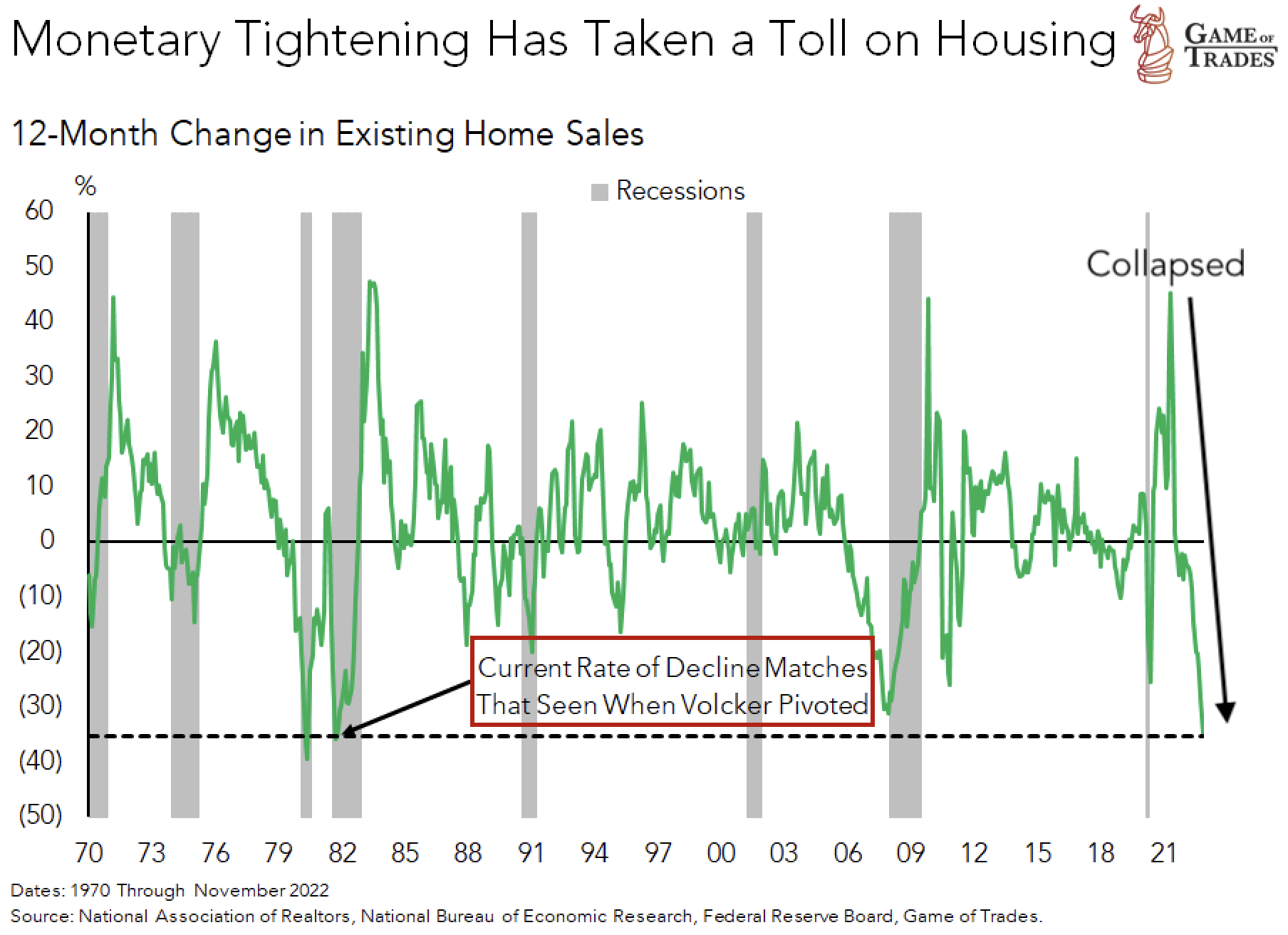

The U.S. housing market has recently undergone a significant shift. Year-over-year existing home sales have plummeted to levels unseen since the 1980s. This downturn is particularly noteworthy as Q1 2023 marked the first decrease in home prices since the Covid-19 pandemic-induced surge in housing demand.

The Role of Existing Home Sales in Economic Growth

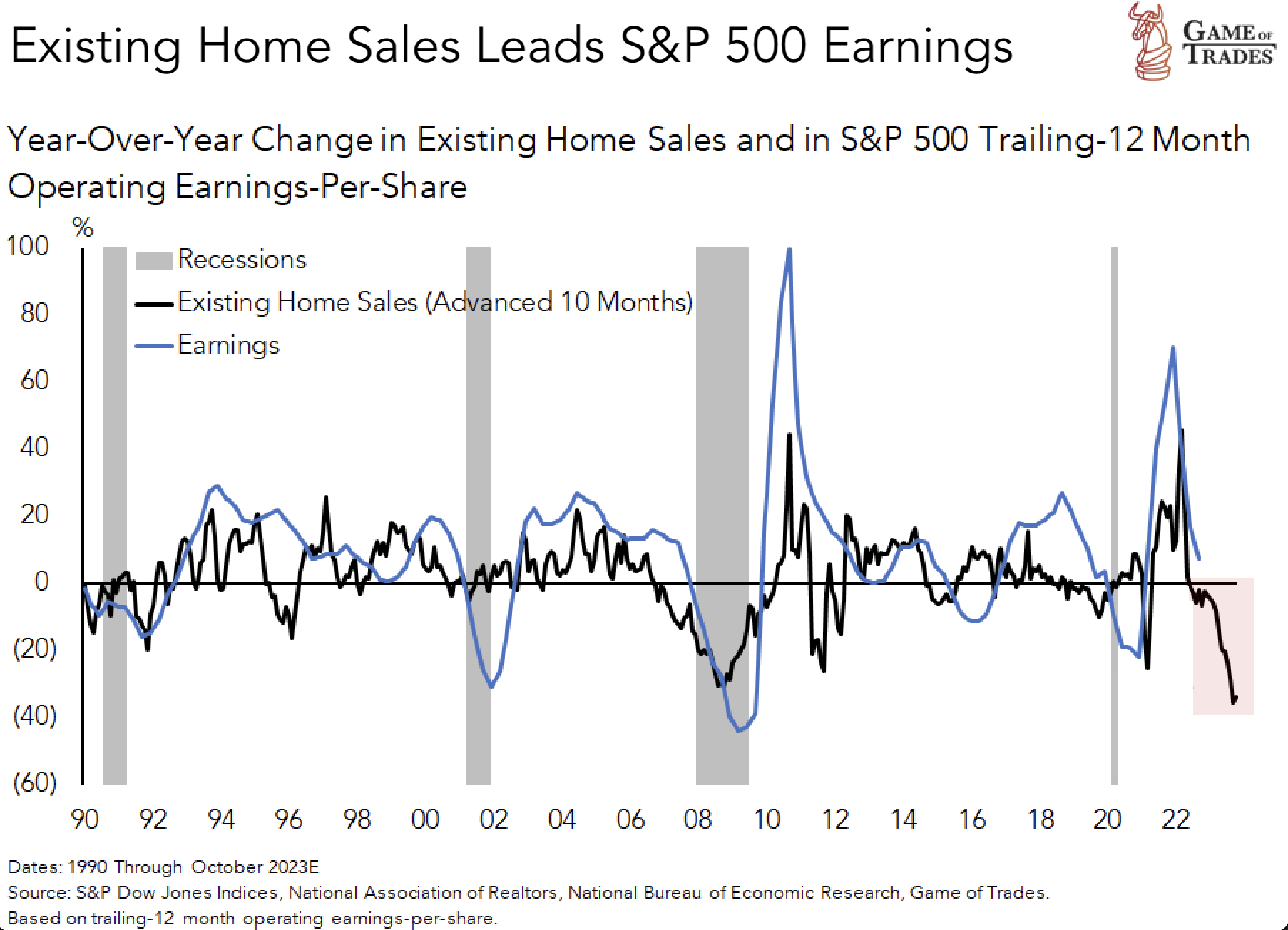

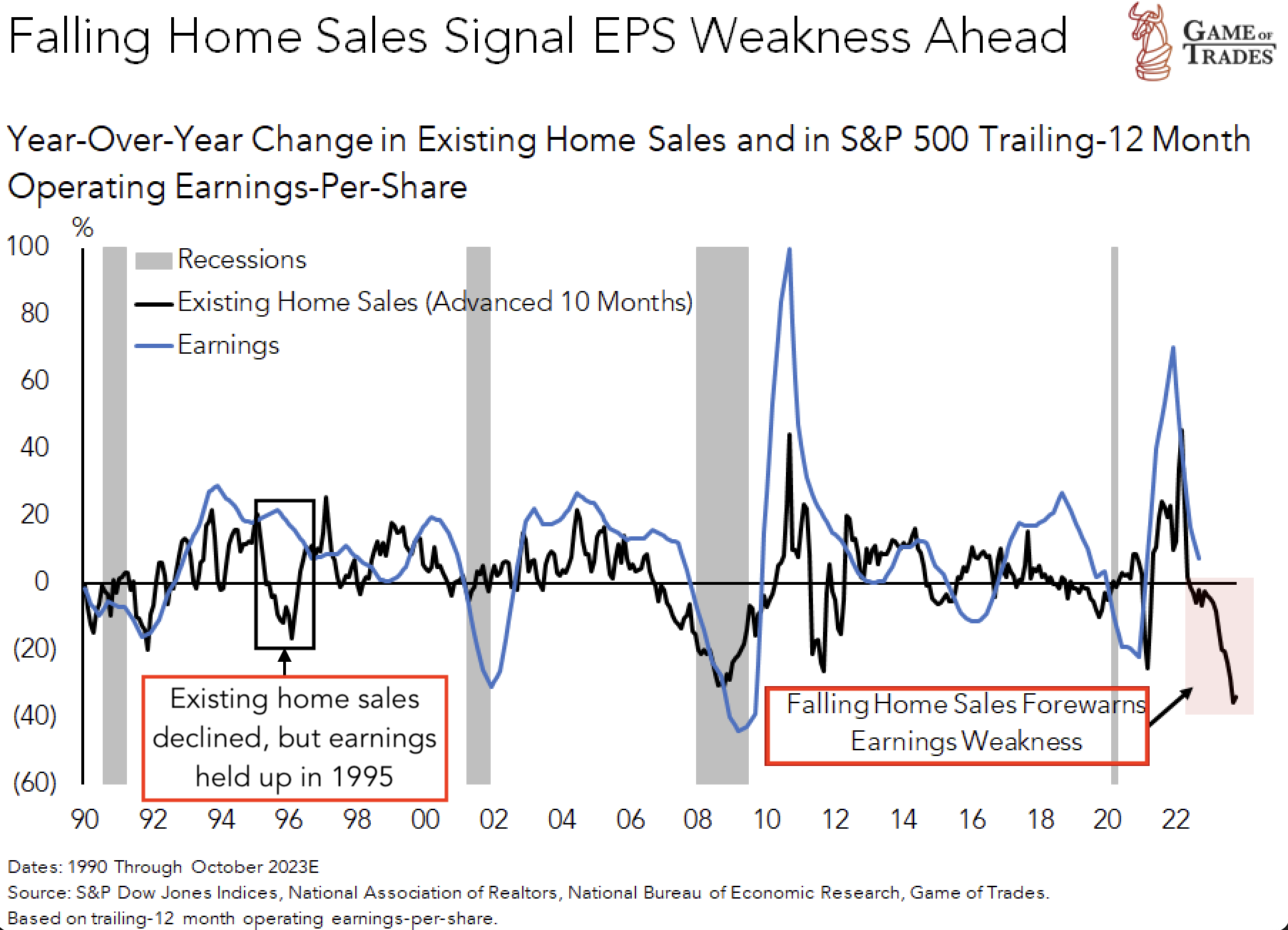

Existing home sales serve as more than just a barometer of the housing market’s health; they are a significant driver of economic growth. These sales can predict S&P 500 earnings by approximately 10 months. The more homes sold, the higher the demand for durable goods like furniture and appliances, which in turn boosts market earnings. Conversely, a drop in home sales triggers the opposite effect, leading to a decrease in demand for these goods.

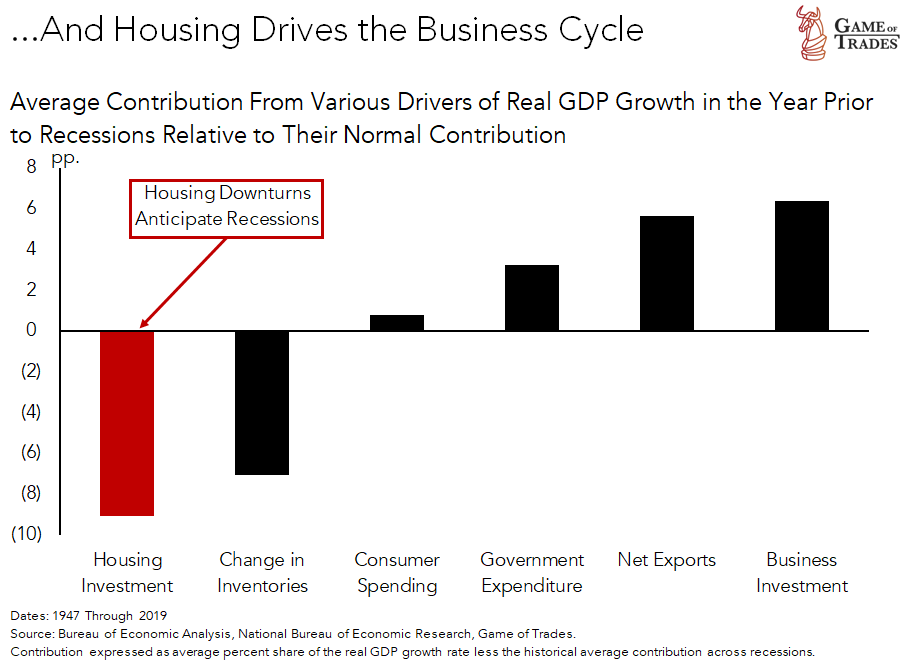

Housing as a Predictor of Real GDP Growth and its Connection to Monetary Policy

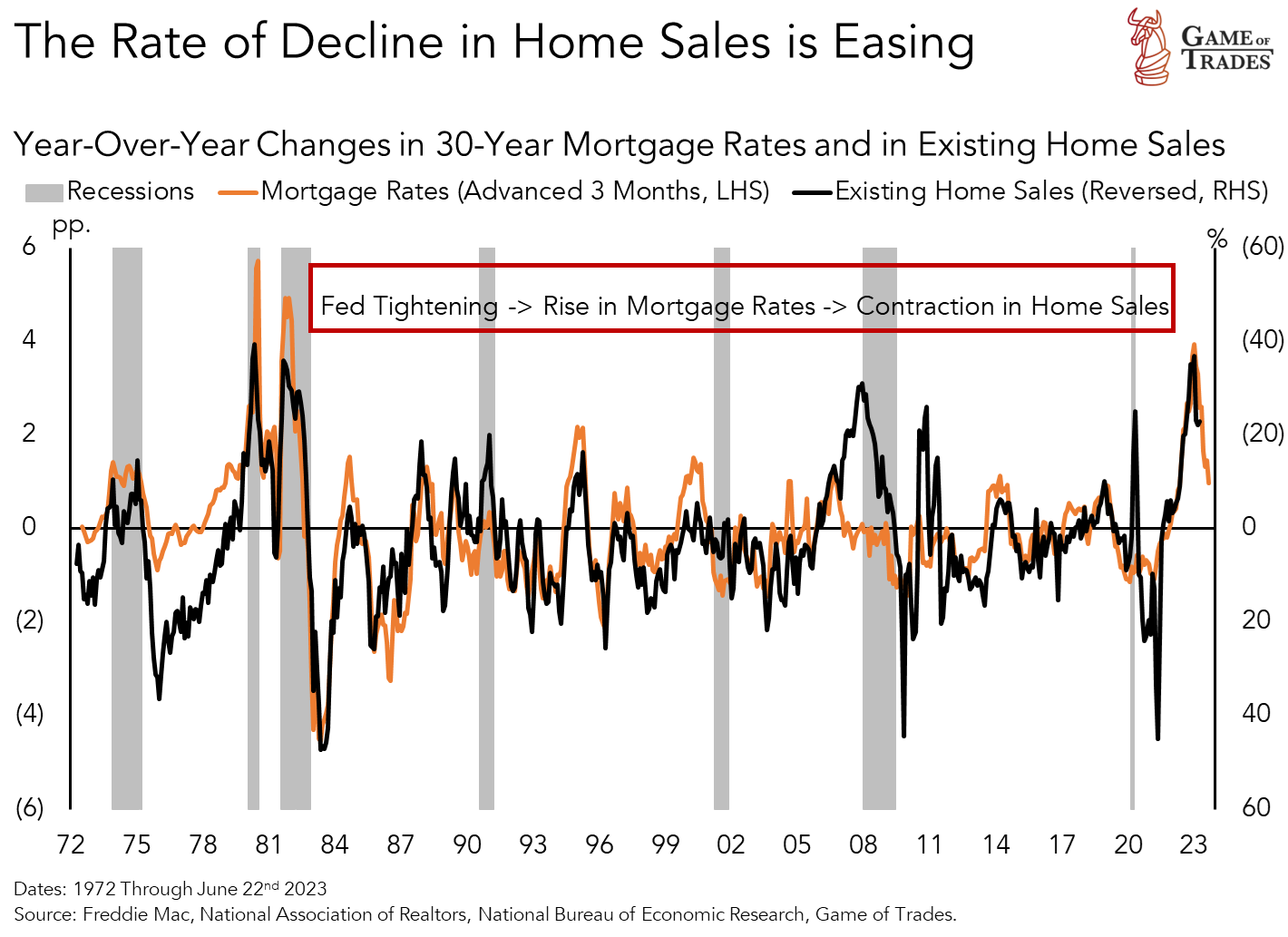

Housing plays a crucial role in predicting real GDP growth. Among GDP components like consumer spending and net exports, housing typically weakens most in the year leading up to a recession. This trend is closely tied to the Federal Reserve’s monetary policy. When the Federal Reserve raises interest rates, one of their primary objectives is to slow down the housing market to cool the economy and curb inflation.

As the Fed increases interest rates, mortgage rates rise, leading to a decline in existing home sales. Market participants expect the Fed funds rate to be between 5.25-5.50% by December 2023, indicating no rate cuts by year-end. While the decline in existing home sales may have peaked, significant mortgage rate reductions are unlikely. Historically, for mortgage rates to drop, the economy must enter a recession, as the Fed only eases monetary policy during times of rapid economic deterioration.

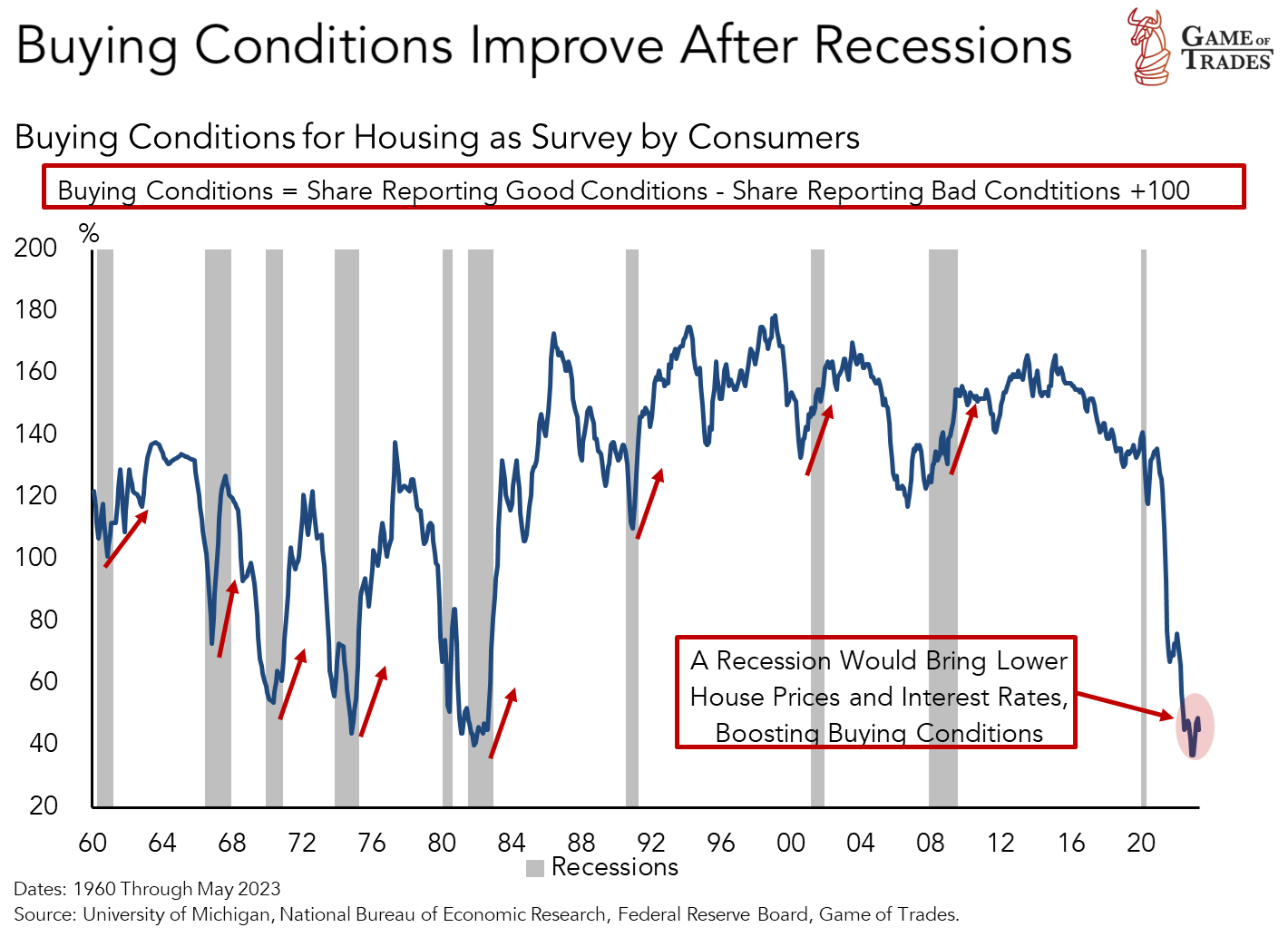

The Current State of Housing Buying Conditions

Some optimists may argue that the worst of housing weakness is behind us, and a resurgence in home buying will stimulate the economy and markets. However, housing buying conditions are near an all-time low, similar to the Volcker-era levels in the 1980s. The “buying conditions for housing” survey tends to improve post-recession, signaling the start of a real housing recovery.

The Correlation Between S&P 500 Earnings and Existing Home Sales

Since 1990, S&P 500 earnings and existing home sales have shown a positive correlation, with the latter being a leading indicator. Currently, existing home sales indicate a sharp earnings contraction. However, it is important to remember that there are occasions when the relationship between earnings and existing home sales diverge. For instance, the Fed’s tight monetary policy in 1995 led to a decline in existing home sales, but didn’t trigger a recession as stock market earnings remained stable.

Today, the housing market suggests a near 28% decline in S&P 500 earnings. While such a steep contraction isn’t our base case, we anticipate earnings to fall short of analysts’ consensus, driving equities lower. This trend underscores the importance of monitoring the housing market as a key indicator of broader economic trends. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: China’s Economic Slowdown: A Global Concern