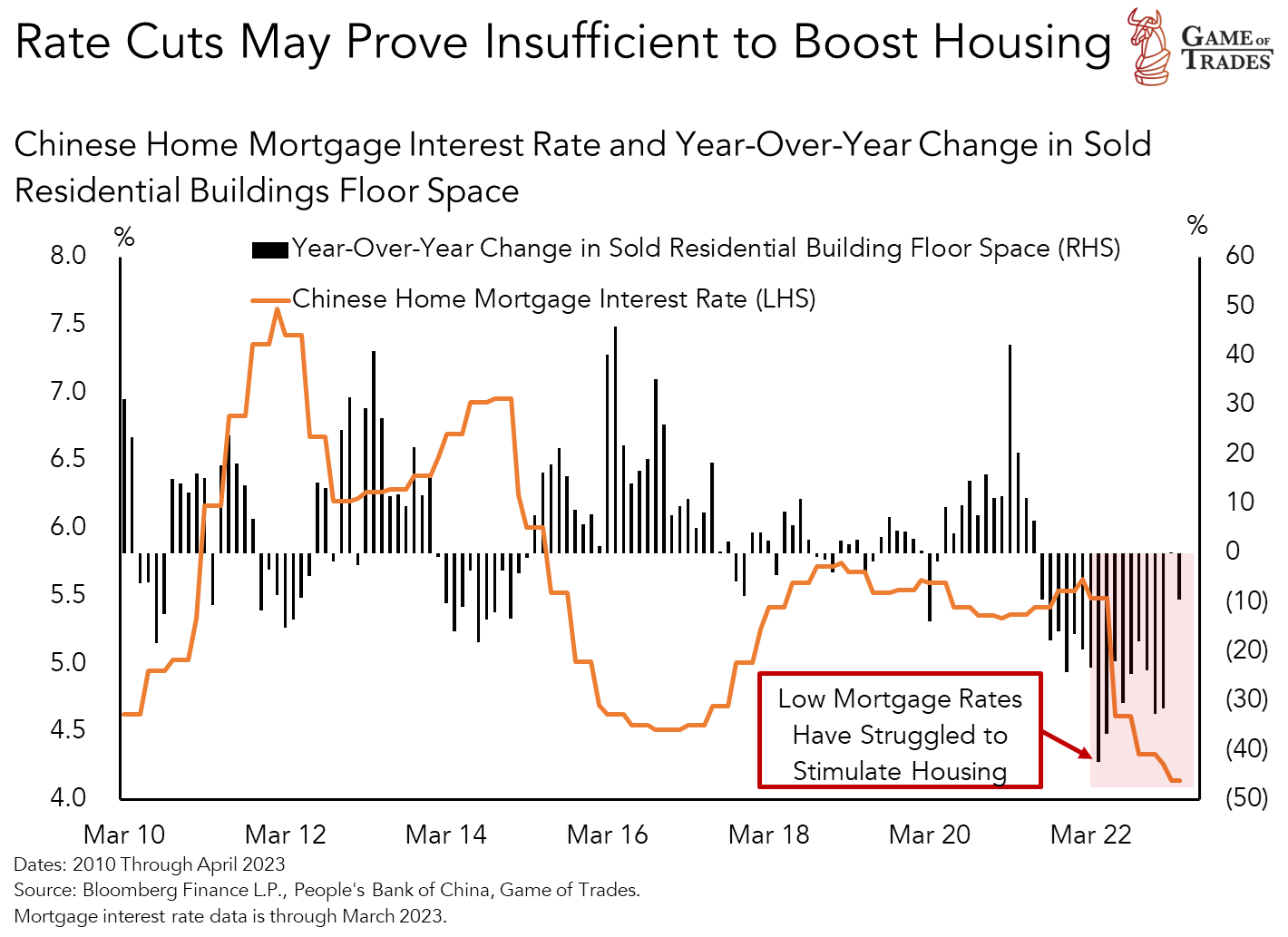

China’s housing market has recently experienced its largest contraction in over a decade, despite the Chinese Central Bank’s efforts to ease monetary policy. This economic weakness is reflected in the decline of China’s large-cap stocks ($FXI), a drop in the 1-year government yield, and falling copper prices.

China’s Stimulus Packages and Economic Struggle

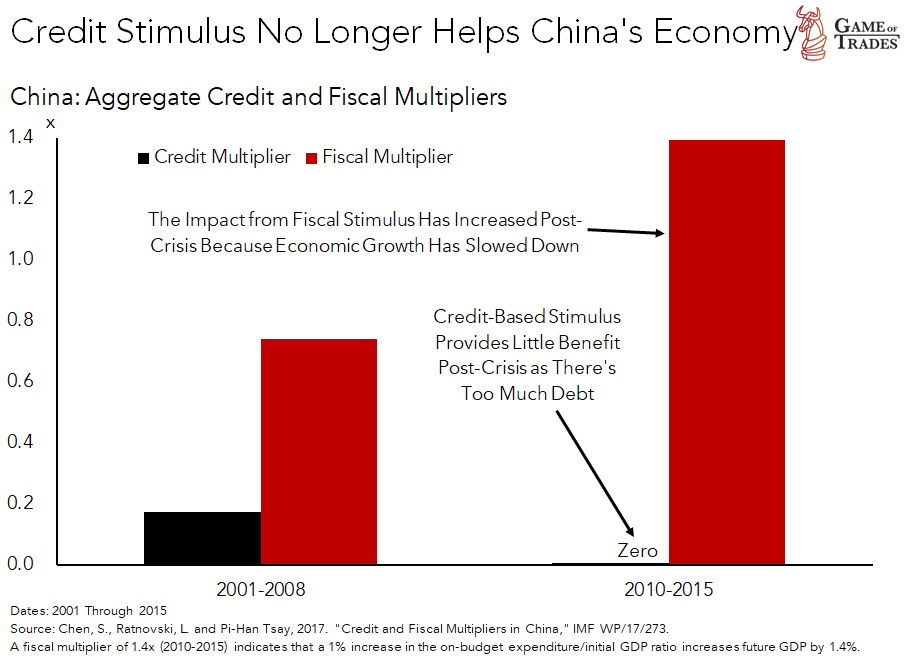

Copper, an industrial metal, is largely consumed by China. Weak copper prices suggest not only a slowdown in China’s economy but also a potential global economic downturn. Despite large stimulus packages, China’s 1-year government bond yield has been on a downtrend since February 2023. An IMF research paper suggests that since 2010, credit stimulus has not boosted China’s economy, while fiscal stimulus remains effective. Without fiscal stimulus, China’s economic struggle may persist.

China’s P/E Ratios and Global Economic Influence

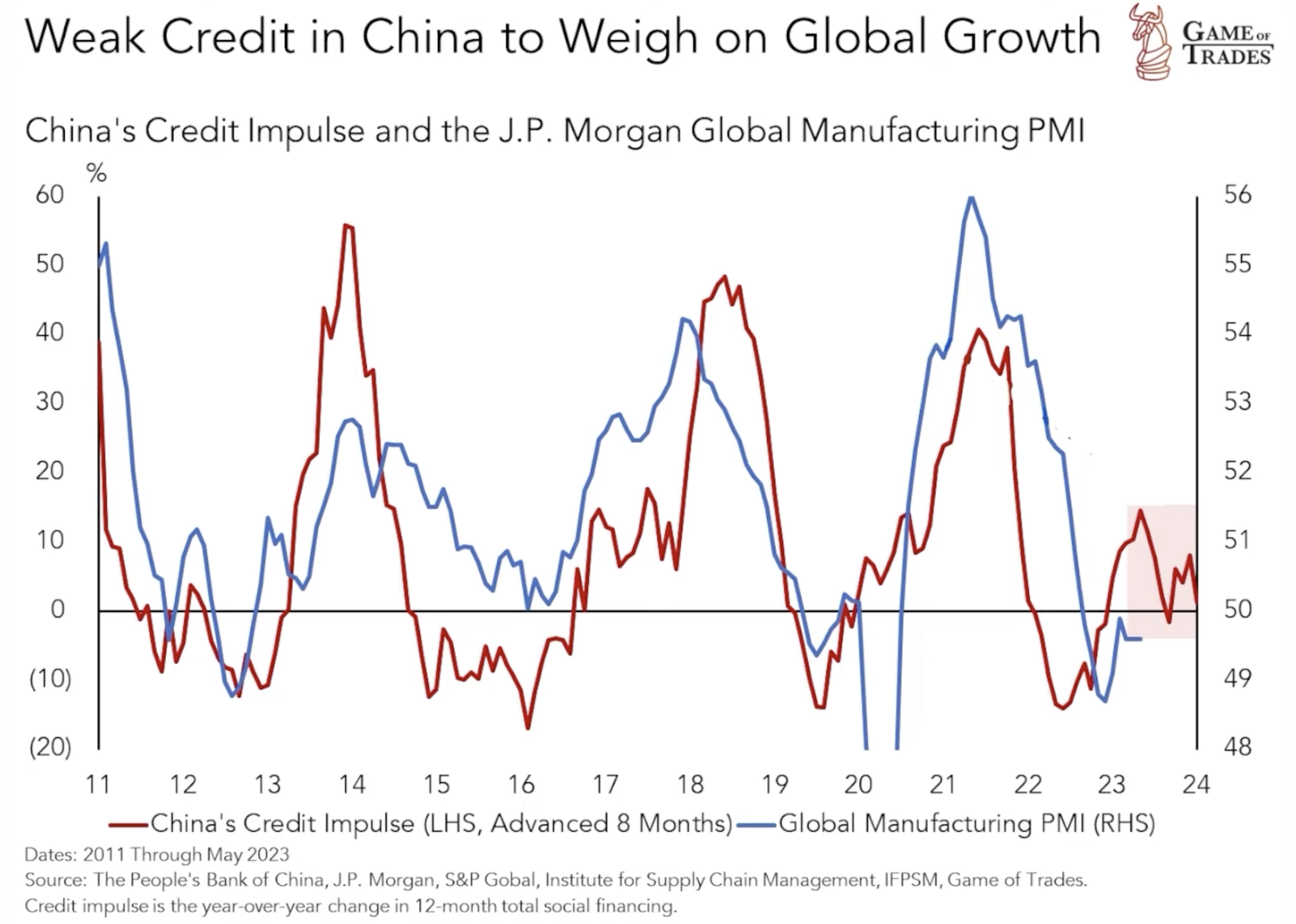

China’s P/E ratios are historically low compared to the U.S., reflecting investor skepticism towards China’s stimulus and recovery efforts. Over the past 15 years, the Chinese economy and monetary policy have significantly influenced global economic activity. The global manufacturing PMI has a positive correlation with China’s credit impulse, with the latter leading by about 8 months.

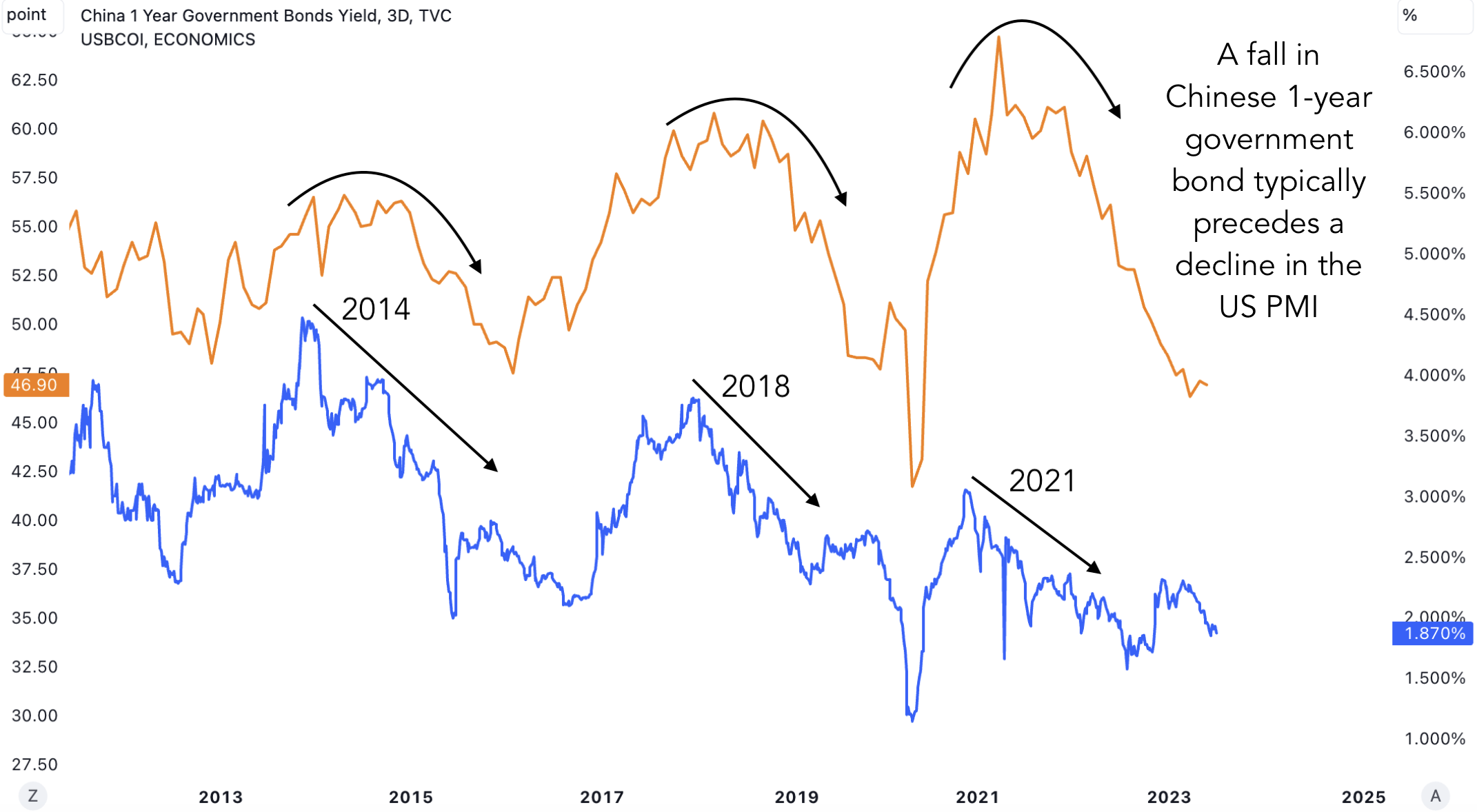

China’s Economic Slowdown and Impact on US Manufacturing

Unlike in 2009, 2016, and 2020, China is currently not showing signs of an economic recovery. A weakening China, evidenced by falling 1-year yield, typically precedes a decline in US manufacturing activity (US PMI), as observed in 2014, 2018, and 2021.

China’s Global Impact

A slowdown in the Chinese economy is a major headwind for the US economy, but it can also significantly impact Europe, with negative spillovers to the US. Germany, one of the biggest exporters to China, is seeing a contraction in exports to China, indicating weak Chinese consumer demand.

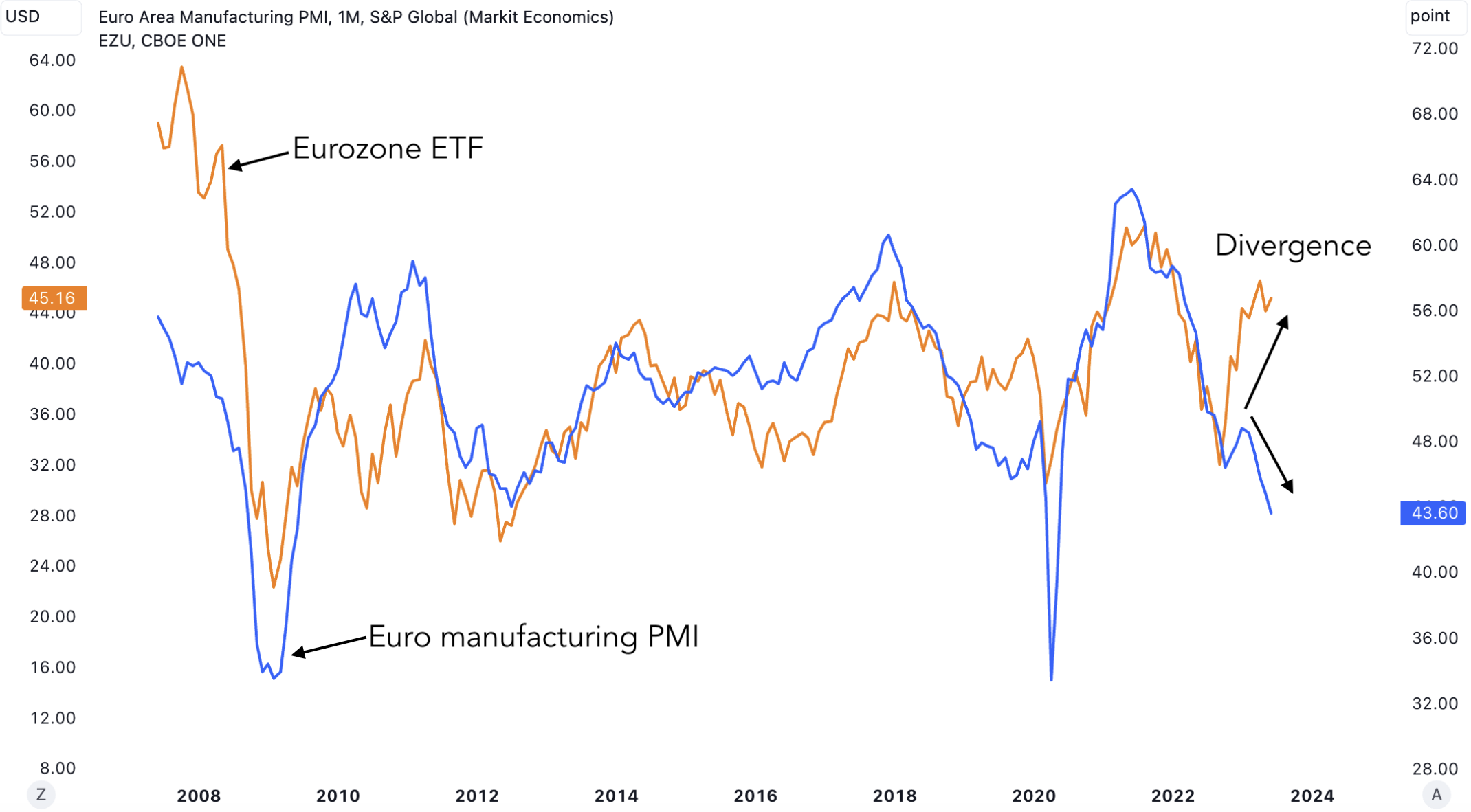

The Euro area manufacturing PMI has hit levels reminiscent of the COVID-19 pandemic and the Financial Crisis, signaling a rapid deterioration in Europe’s manufacturing sector. The Euro manufacturing PMI and European equities ($EZU) usually move in tandem. However, in 2023, European equities have diverged significantly, showing signs of irrationality and skewing the odds in favor of downside.

A strong China is crucial for the global economy and markets to sustainably grow. However, Chinese economic data has been deteriorating rapidly, an ominous sign for US and European markets. This situation calls for a close monitoring of China’s economic indicators and a strategic approach to global investment decisions. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Predicting US Unemployment Trends: Rise Expected by September 2023