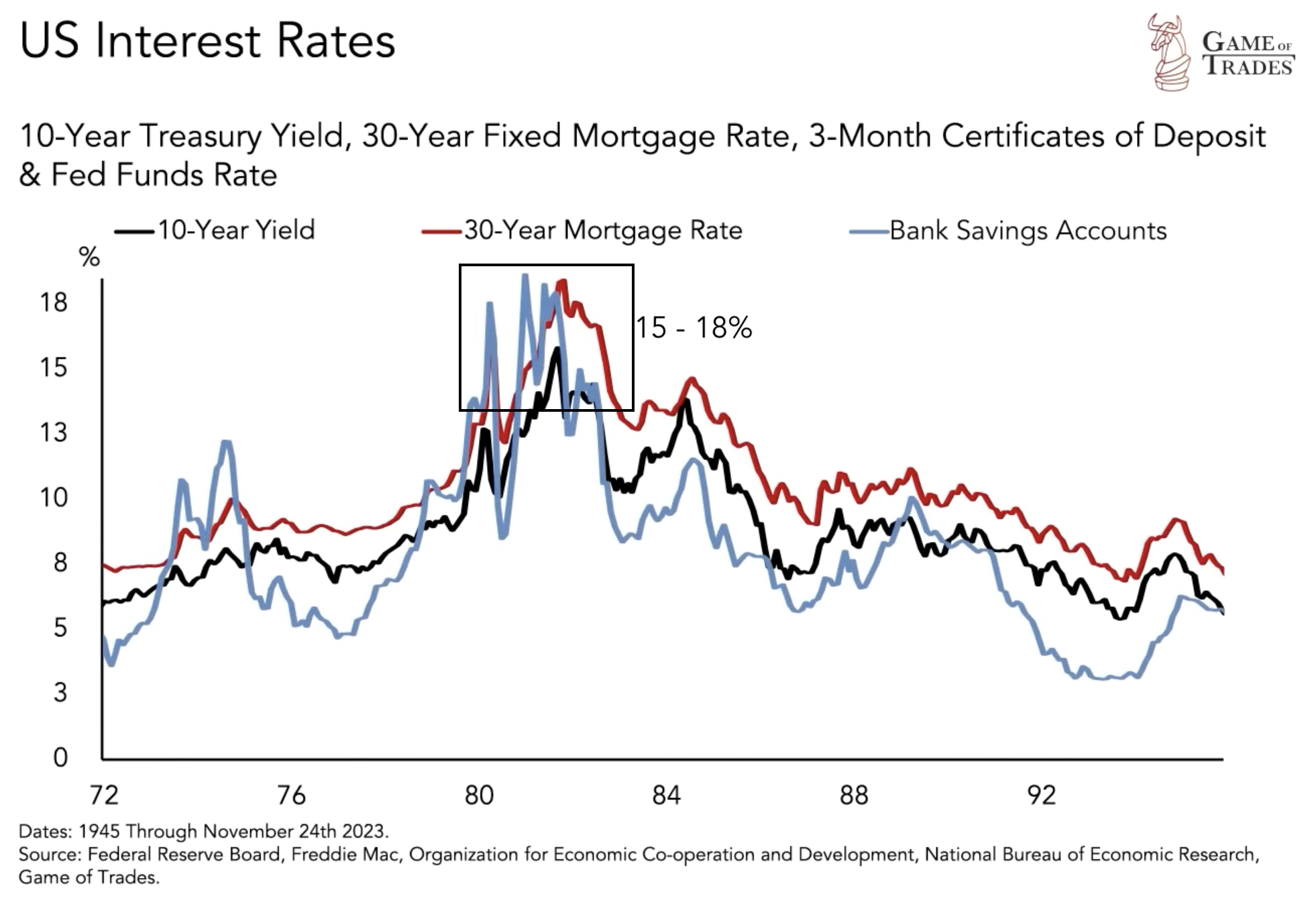

Interest rates have been on a rollercoaster ride over the past 40 years, shaping the economic landscape and influencing investment decisions. In the 1980s, mortgage rates and savings accounts boasted a staggering 15%, but fast forward to the 2010s, and rates had plummeted. However, in the last 1.5 years, we’ve witnessed a noteworthy rise in interest rates.

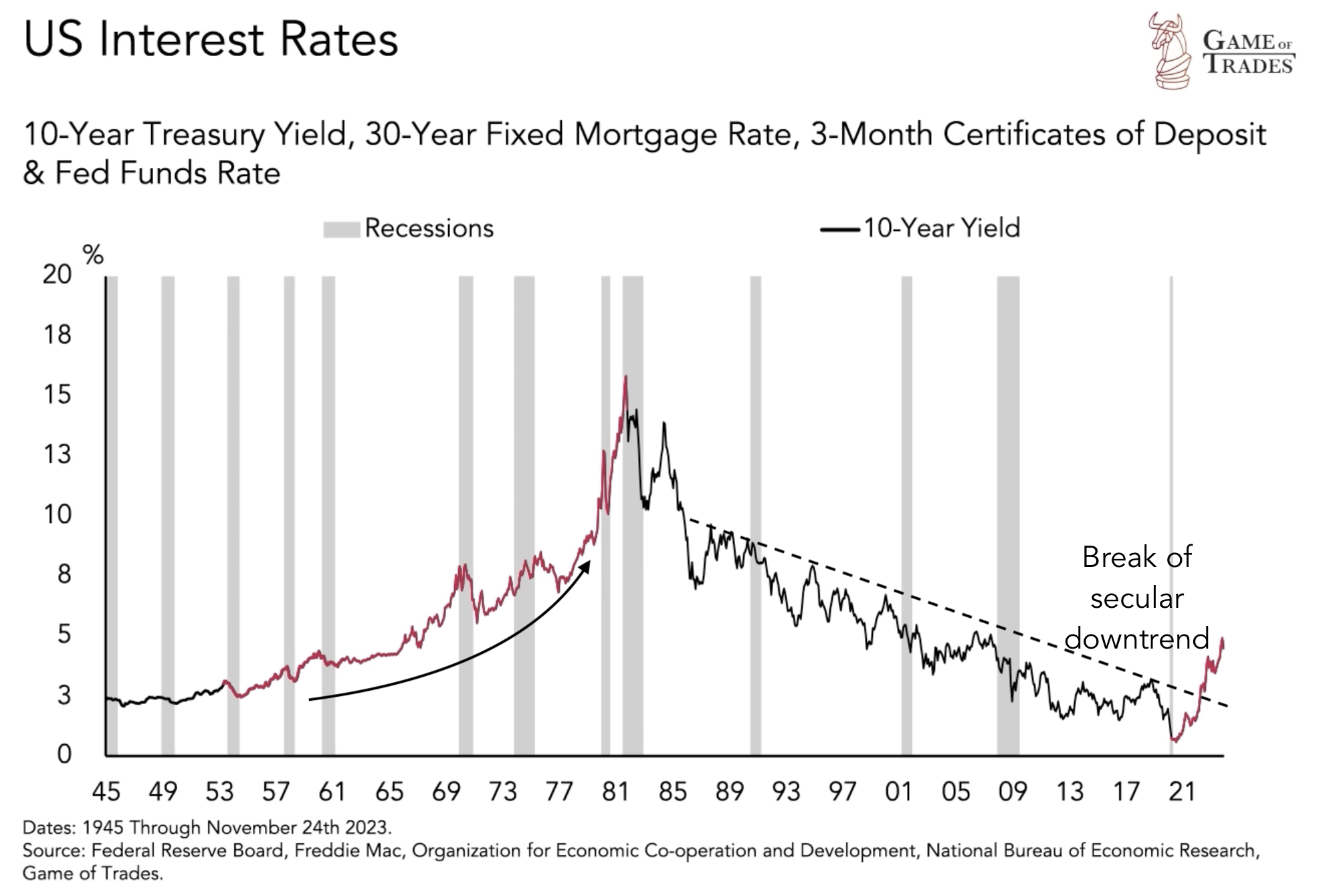

The 10-Year Yield Breakout: Echoes of the Past

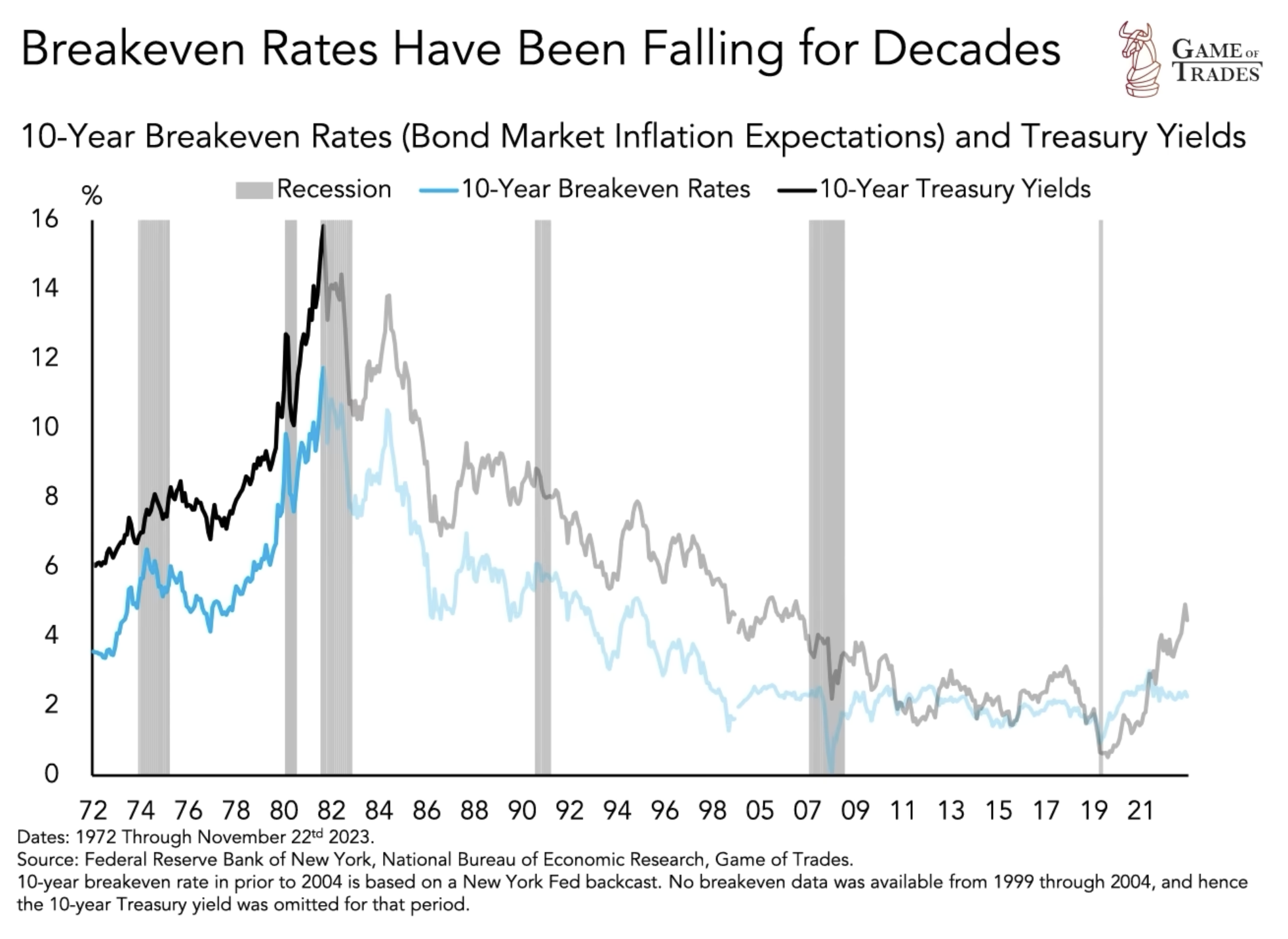

The 10-year yield has broken out of a long downtrend, reaching 5%. This pattern bears resemblance to the onset of a substantial interest rate rise in the 1970s and 1980s, which resulted in four severe downturns. Notably, today’s rate increase has occurred over a compressed timeline, taking only three years to move from 2% to 5%.

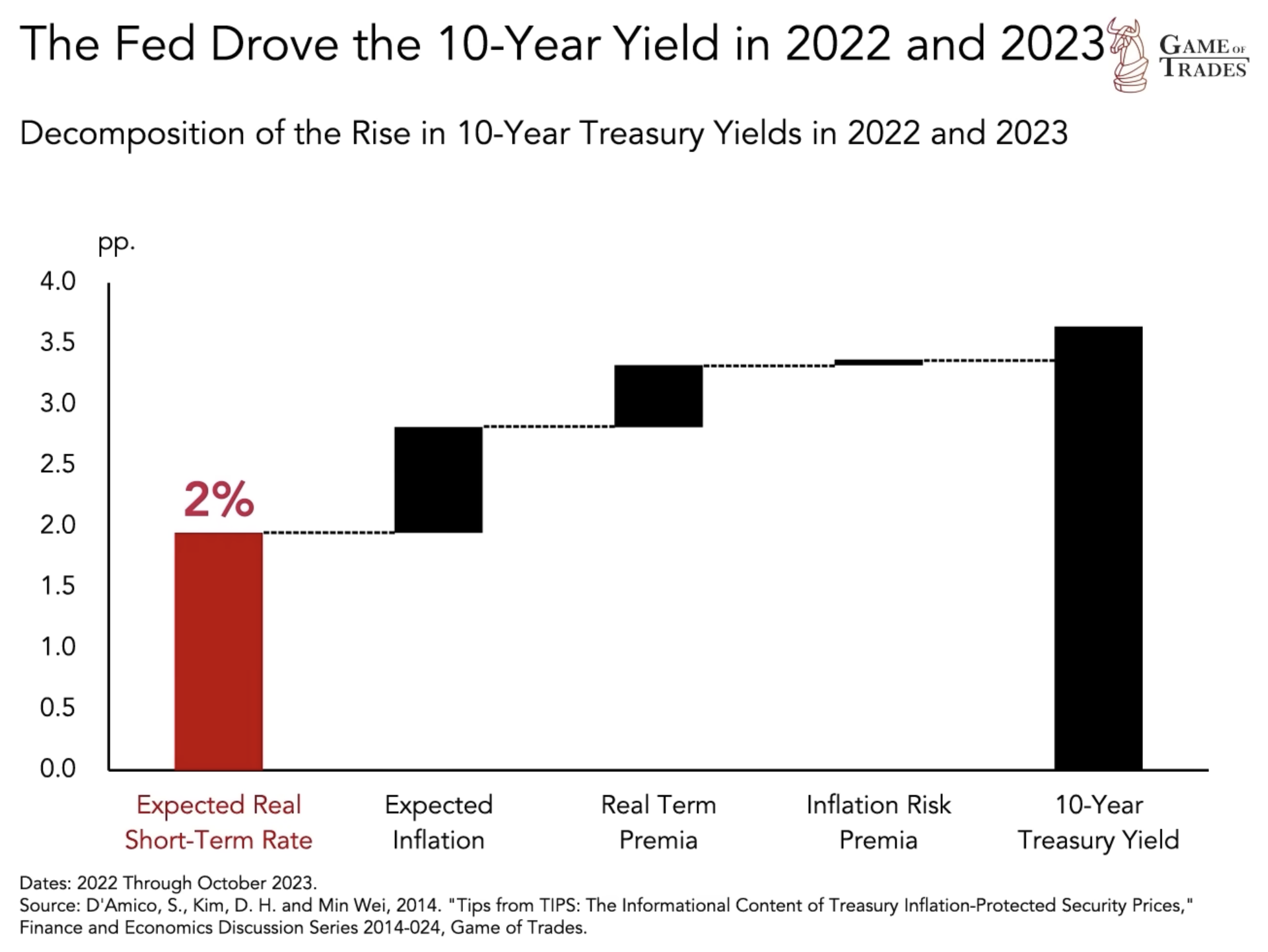

Examining the recent surge in interest rates, the Federal Reserve’s role comes into focus. The Fed funds rate, accounting for 2% of the 3.5% increase in the 10-year rate over the past two years, has been a key driver. Market expectations of future inflation and the term premium also contribute to this shift.

Fed Funds Rate: A Key Player in Economic Dynamics

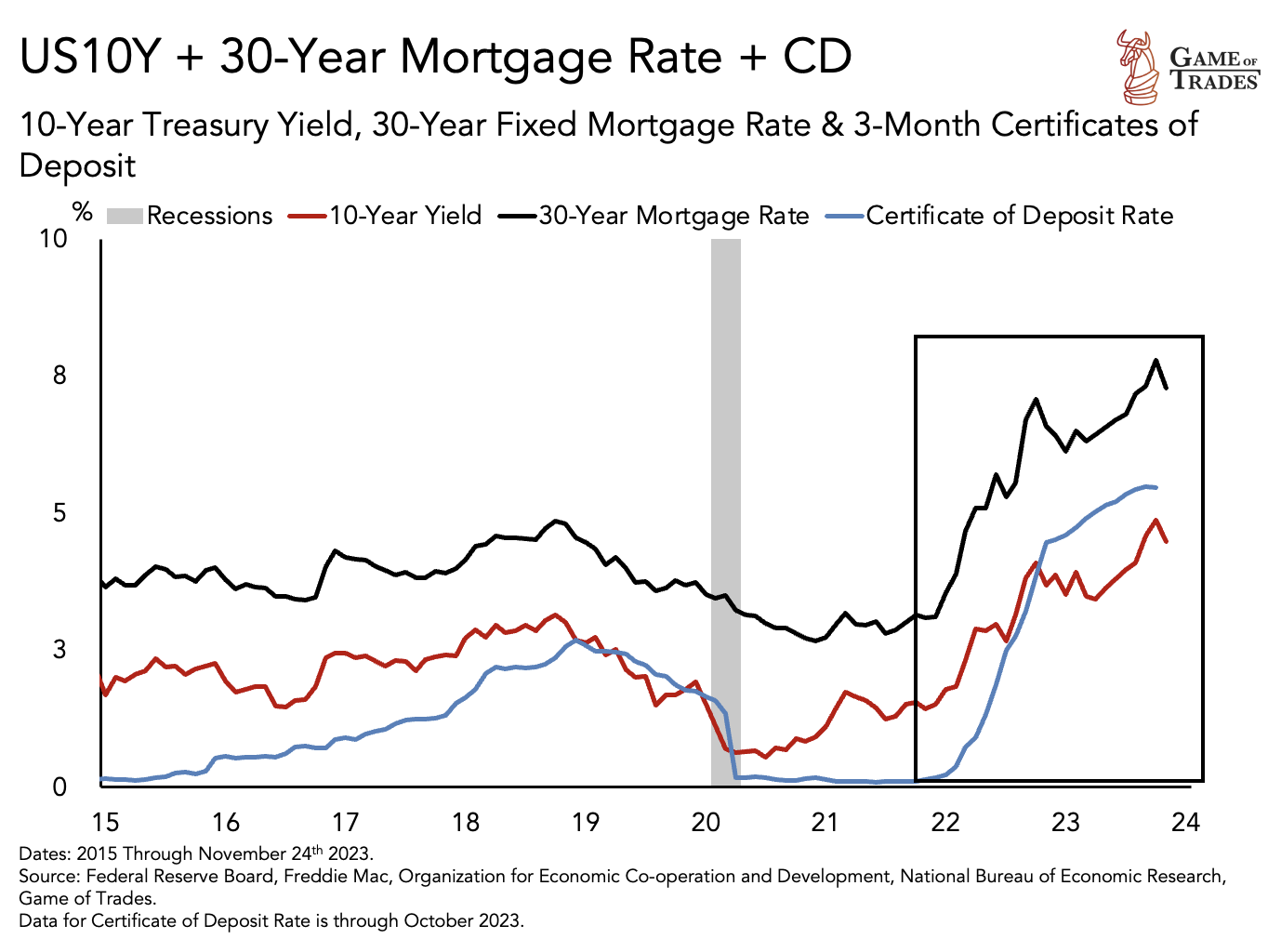

The Fed funds rate, controlled by the Federal Reserve, plays a pivotal role in shaping interest rates across the economy. Since 2022, the rise in rates has had a ripple effect, pushing up mortgage and savings account rates.

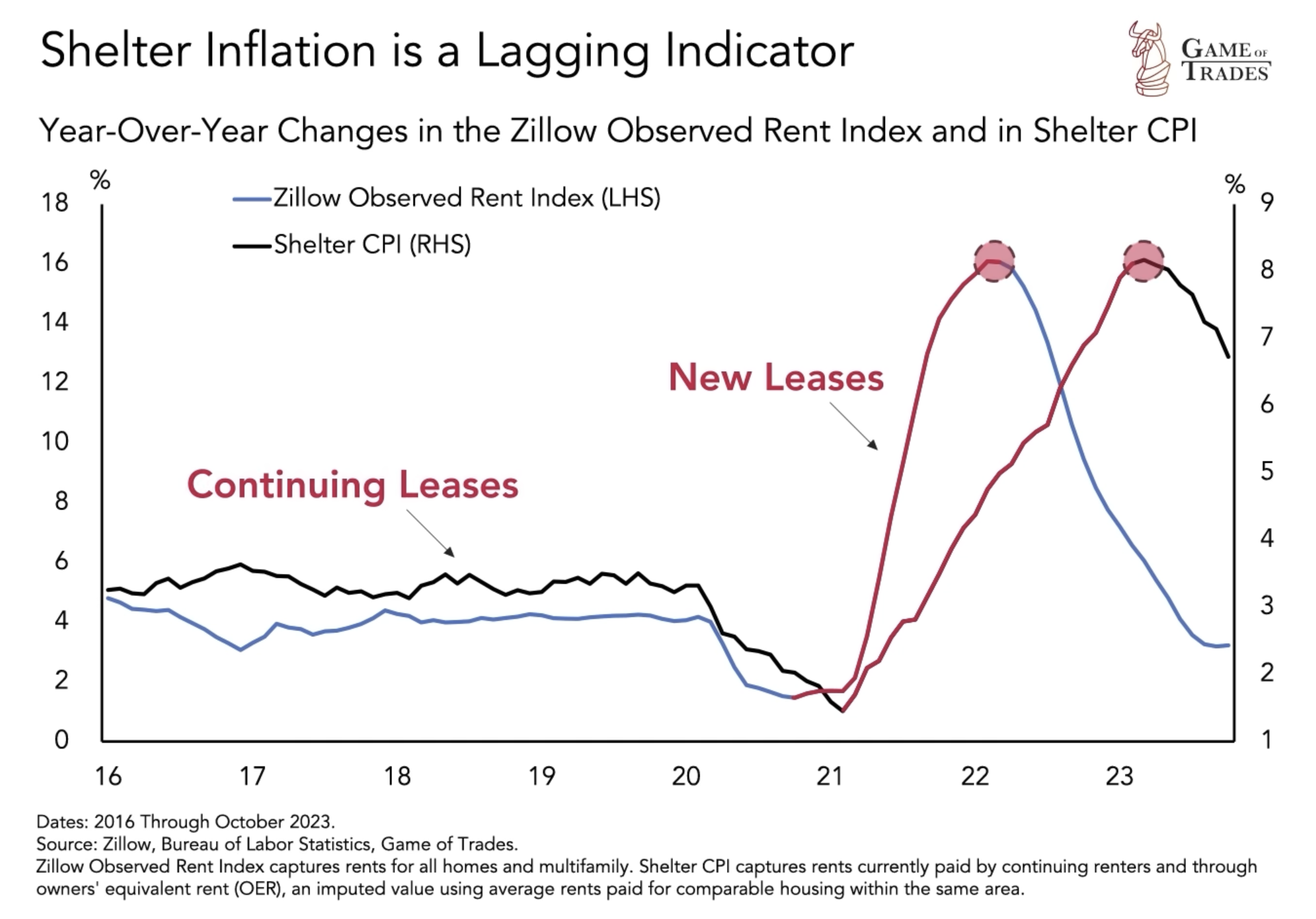

While the Fed’s aggressive rate hikes in 2022 aimed to tackle high inflation, recent trends suggest a decline in inflation. Housing costs, a major inflation driver, have slowed, and the Zillow index, a leading shelter CPI indicator, shows no signs of rising.

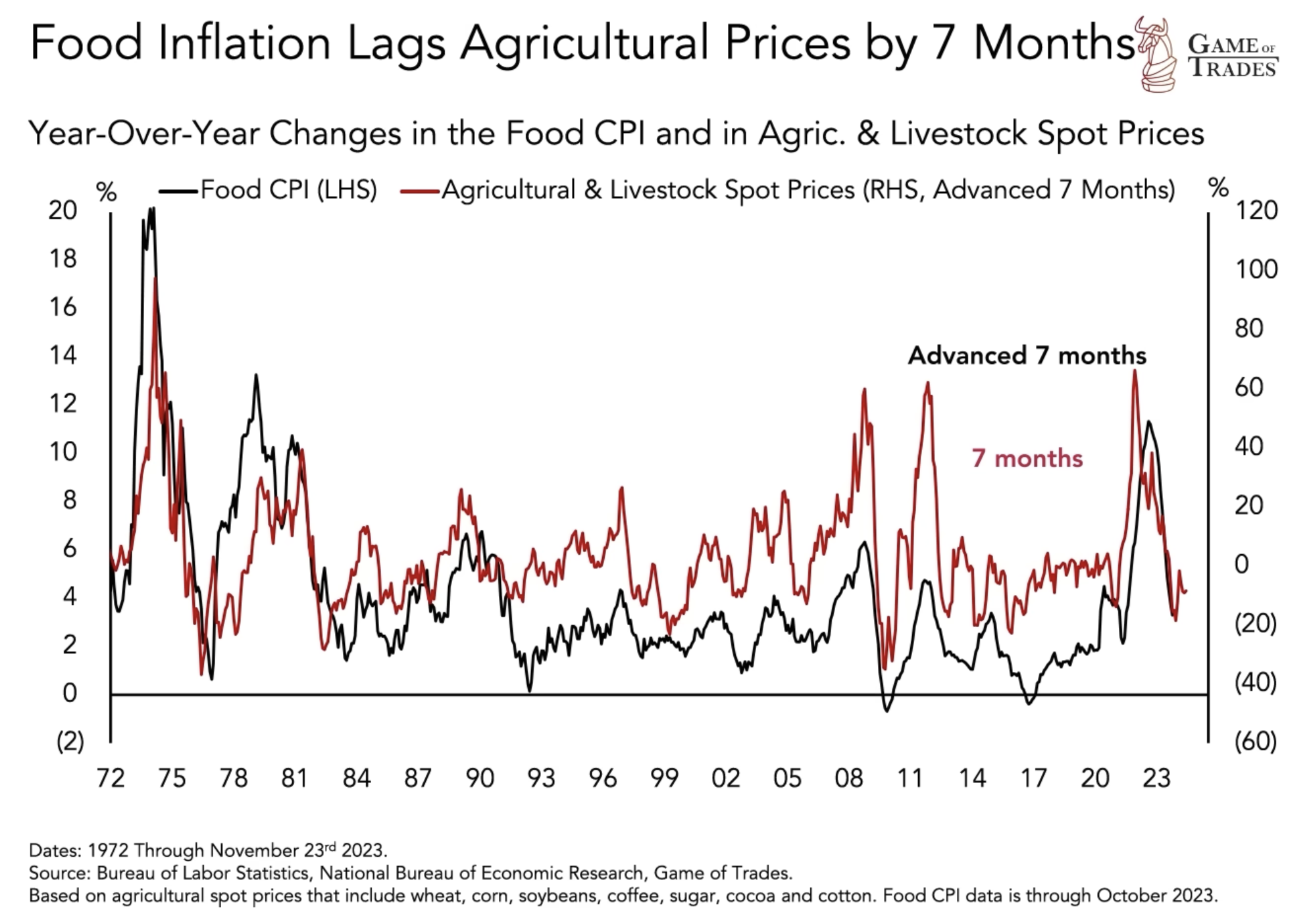

On the other hand, agricultural and livestock prices are rising again, albeit with a slight uptick. Food CPI follows tends to follow this metric with a 7 month lag, indicating that food prices will rise slightly in the coming months but nowhere near the 10% rate of 2022.

Navigating Economic Headwinds: Recession and Inflation

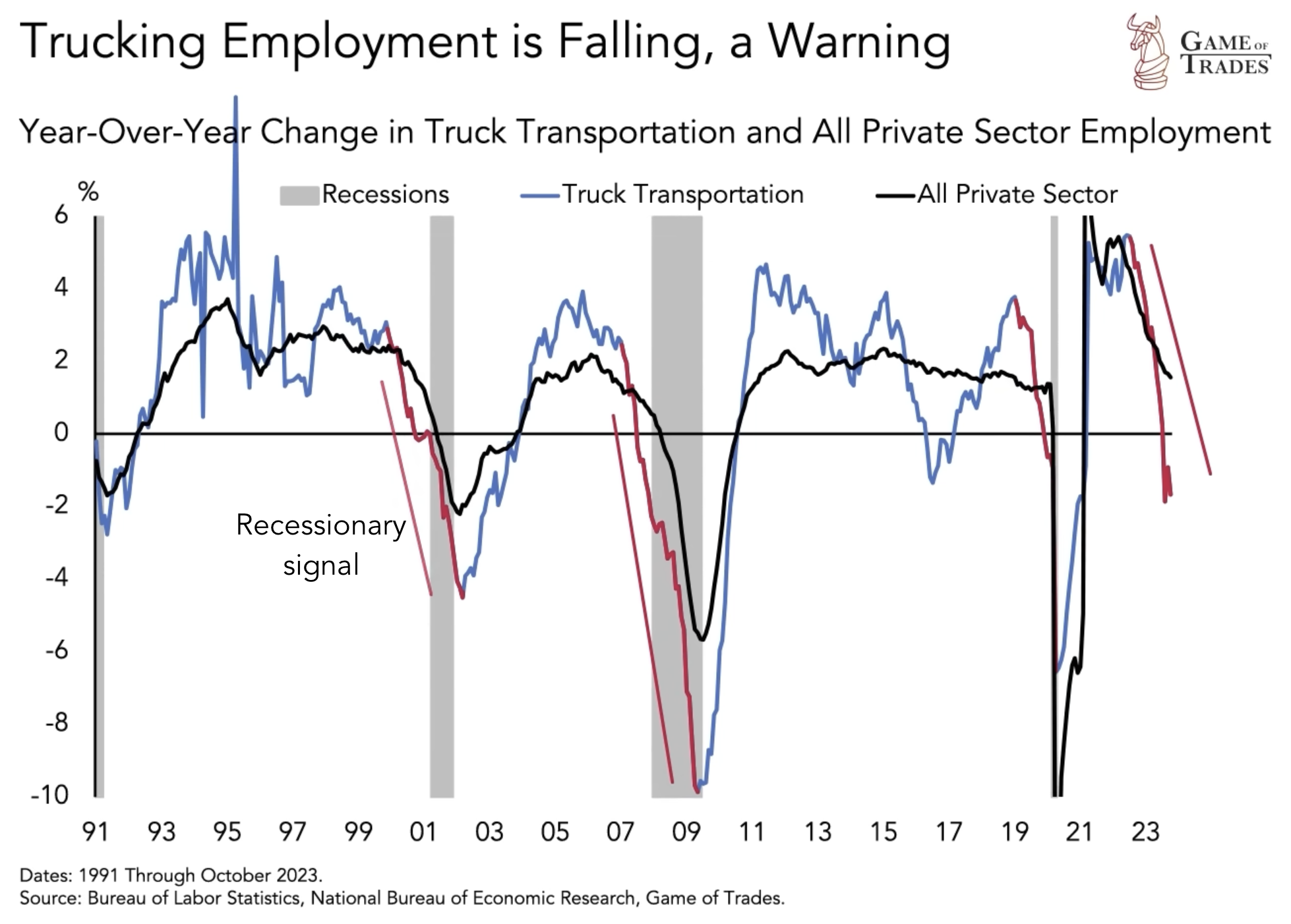

Despite cooling inflation, the risk of a recession looms large. Historical indicators, such as weakening trucking employment, often precede economic downturns. Trucking is closely tied to the transportation of goods, so layoffs signal a slowdown in economic activity.

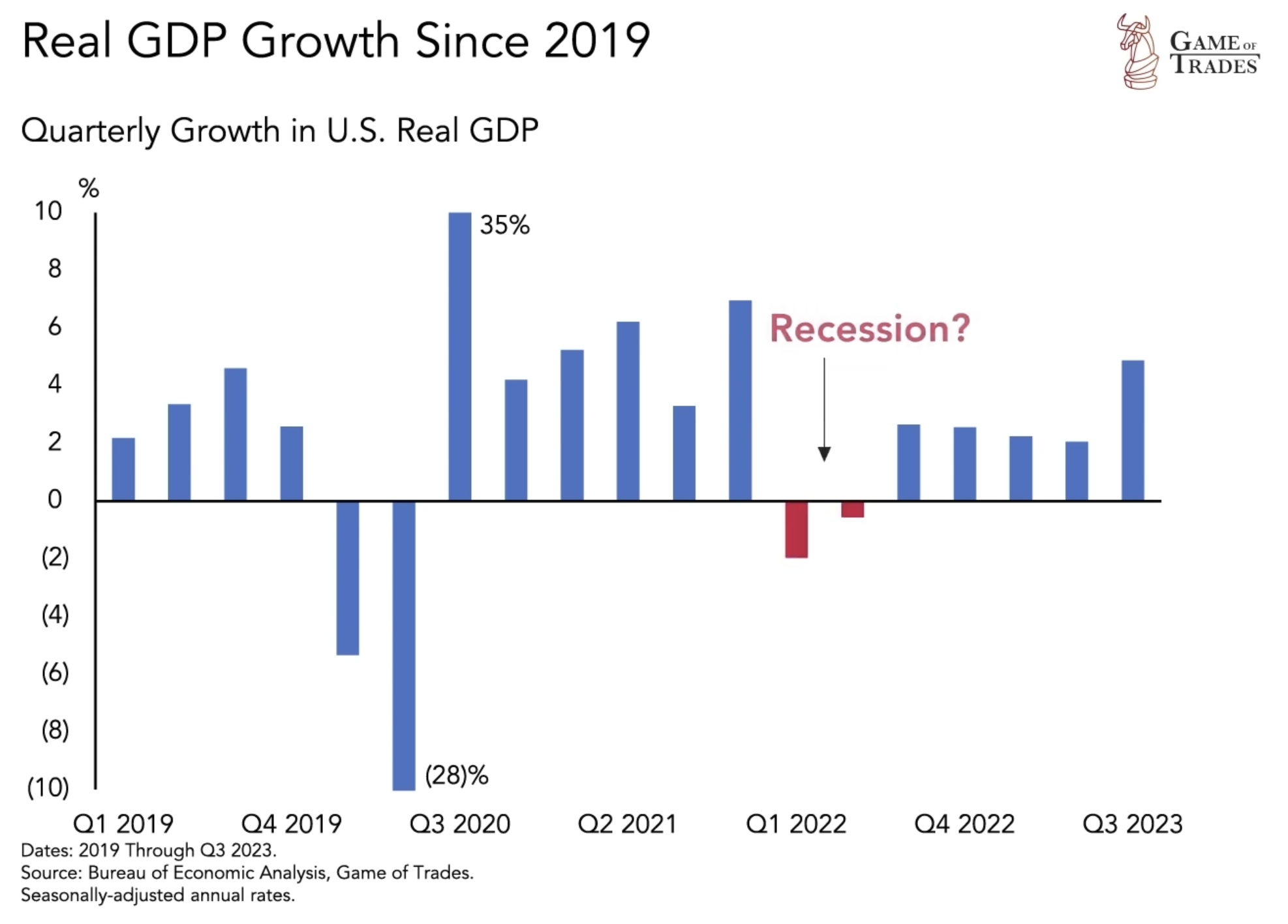

Some argue that there was already a technical recession in 2022 with 2 consecutive quarters of GDP contraction, suggesting that the economy is headed into an expansion. However, if growth continues, inflation could rise due to a tight labor market. As wages increase, companies may raise their prices, leading to a wage-price spiral.

Inflation Expectations and the Fed’s Role

Anchoring inflation expectations is a priority for the Fed. In the 1970s, sustained high inflation led to expected future price increases, boosting short-term demand and inflation. This is a mistake the Fed is trying to avoid today. In the unlikely event the economy avoids recession and inflation continues declining, there may be de-anchoring of expectations and lower rate expectations like today. Such an environment would boost assets like Bitcoin.

Conclusion

As we navigate the complex web of interest rates, inflation, and financial markets, it’s crucial for investors to stay vigilant. The recent surge in interest rates, coupled with the ongoing dynamics of inflation and recession risks, requires a nuanced approach. Whether the economy heads towards expansion or contraction, understanding these market trends is essential for informed decision-making in the ever-evolving financial landscape. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: Is This a New Bull Market or the Final Push Higher After a 13-year Bull Market?