We have four new activations over the past week that have moved from pending to active setups.

New Activations

- Short CRM

- Short AAPL

- Short IWM

- Short SPY

Previous Activations

- Short NFLX

- Long MCHI (Target 1 Hit)

- Long MRNA – Stop loss has been hit, active trade removed.

- Short XLY

- Long TLT – Stop loss has been hit, active trade removed.

- Long Palladium

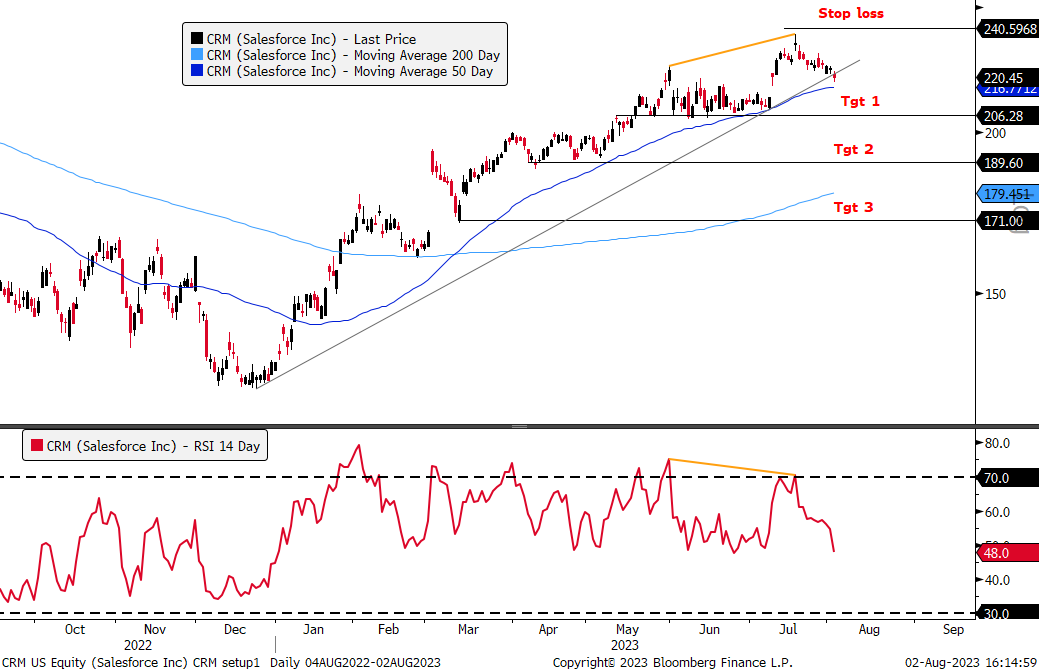

Short CRM (New)

-The trade activated on August 2 with a break below the trendline starting in December of 2022. So far, the breakdown has not been impulsive, but a breakdown nonetheless.

-Follow through in coming days on the short side would see CRM break through the 50-DMA towards target 1, providing opportunity to take profits.

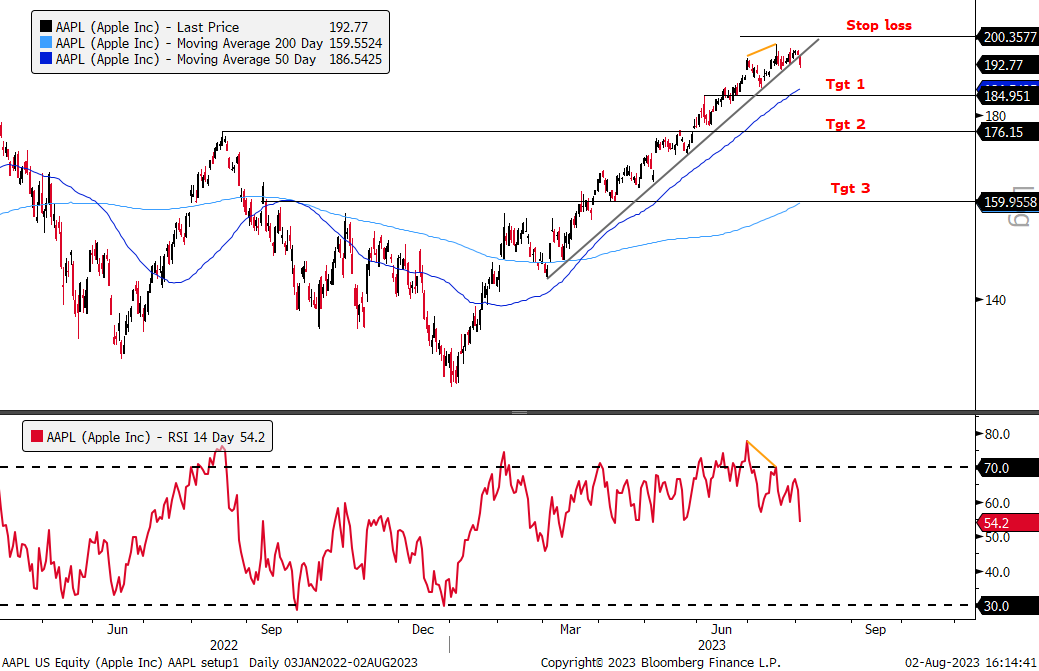

Short AAPL (New)

-The trade was activated on August 2 with the break below the trendline that has held since March.

-We have a tight stop loss slightly above the highs, especially given AAPL reports earnings after the bell today (August 3) and could see an outsized move in either direction.

Short IWM (New)

-The trade was activated on August 2 with the break below the trendline from the beginning of July.

-Given small caps outperformance the past two months, a continued fall in the broad markets could see much of that outperformance reverse quickly.

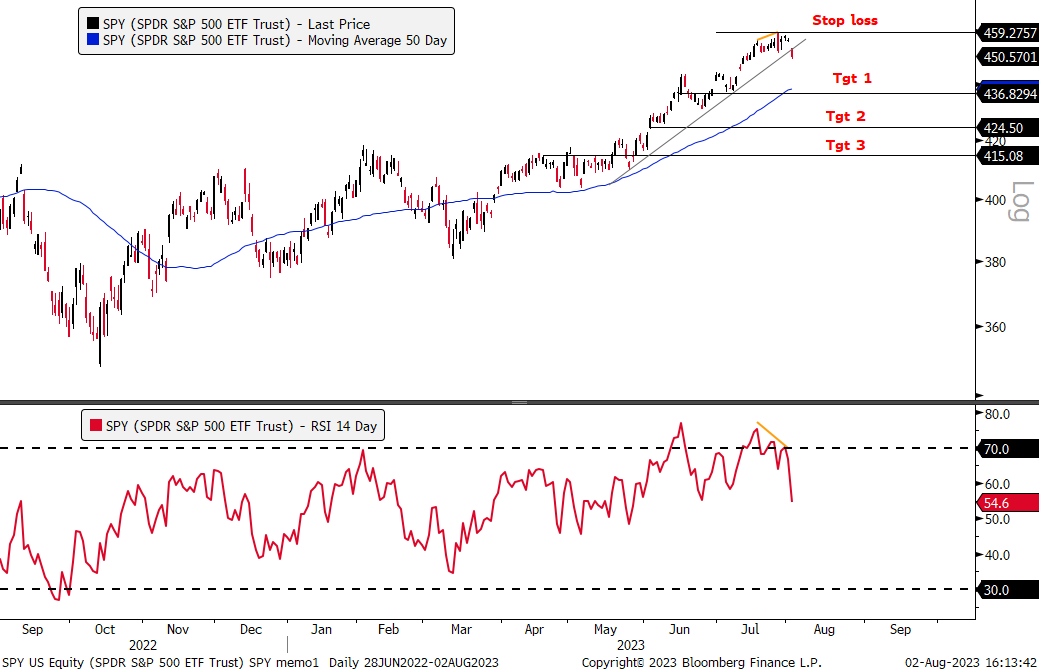

Short SPY (New)

-The trade was activated on August 2 with the break below the trendline that has held since May.

-The downgrade of US debt by Fitch ratings spooked markets. We’d like to see more follow through in coming days as the bulls have been in control in recent months. In fact, this was the first 1%+ down move in the SPX since May 23rd.

-The break below the upward trendline on July 20 activated the short trade as NFLX had lackluster earnings results.

-Price is still in somewhat of a no-mans-land, but within a few percentage points of hitting target 1.

-Traders could look to book partial profits and lower the stop loss level if price hits target 1, given this would be relatively strong support at the bottom of the price channel.

-Recent stimulus measures vowed by the Chinese government helped MCHI breakout above the trendline and activate the long trade on July 26.

-Target 1 was hit, but price has reverted back towards the trendline, allowing for opportunity for attractive re-entry.

-The converging 200 and 100-DMAs and downward trendline should provide very strong support here, but breaking those levels would decrease odds of the trade working.

-XLY broke below the trendline which activated the short trade on July 20.

-Short-term head and shoulders top pattern has formed.

-Disappointing results from the top weighted stock in the sector, TSLA, was the main catalyst for initial XLY downside, while recent downside is coming from higher yields pressuring growth stock valuations.

-XLY is close to reaching the 50-DMA and target 1, which is an opportunity to book some profits.

-Palladium broke above its downward trendline on July 18, activating the trade on the long side.

-Price is holding the downward trendline so far, but a continued move higher in bond yields or the DXY could cause more weakness in the commodity.

Paypal Holdings Inc (PYPL): Pending → Active (turned active July 31) ?

New price target for TLT at 90? I’ve only carried a 5% position on TLT and now that it’s broken down. I think The Fed and the news has sold the “Everything is fine” idea and that’s why we have the bond’s selling off.

What happened to PayPal,

PYPL was listed in the pending report as having turned active 7/31.

I acted on that but I do not see it here. I am pretty sure it hit the stop but am wondering why it is not listed

PYPL hit the stop on 8/3 for a complete loss…. Game of Trades will not update daily, it is not a signal service.

What is the new AAPL daily close stop now that first take profit was hit? 184.95?

How are you trading Palladium?

Are you buying futures or an etf or how?