No new activations this week.

Key Highlights: This week we closed trades on Bitcoin, XLRE, and IWM trades for respectable profits. We also close MCHI for a loss. More details are provided below.

SPY, NFLX and XLY hit their 2nd targets over the past week, while ADBE and AMZN hit target 1.

In some instances, members may choose to let winners run. We recommend lowering your stop losses (on short trades) and raising them on (on long trades) in that circumstance.

Previous Activations

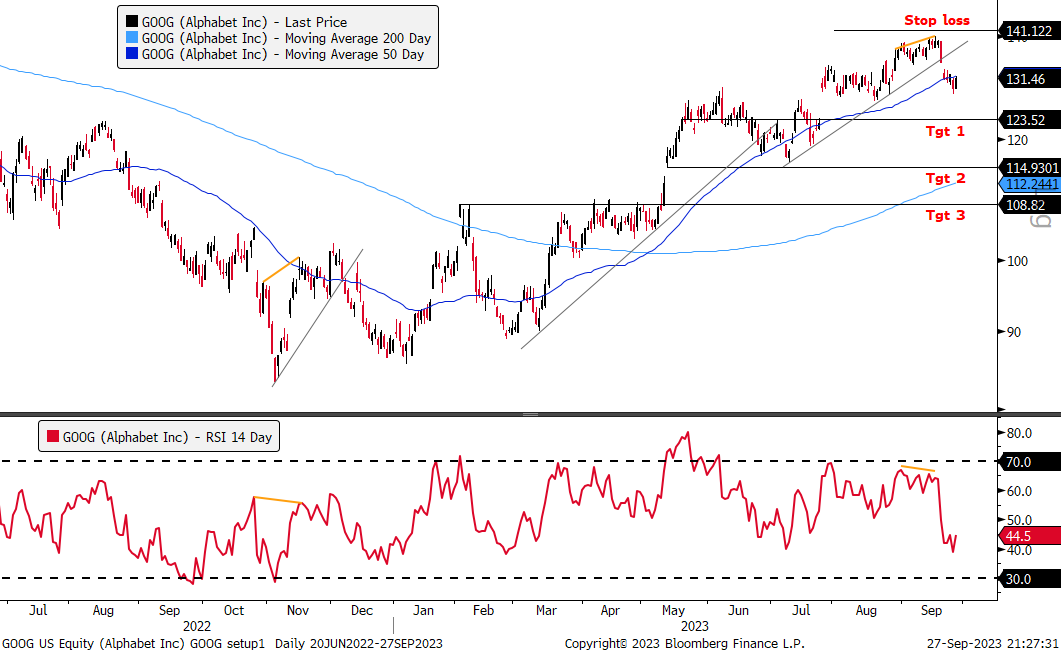

- Short GOOG

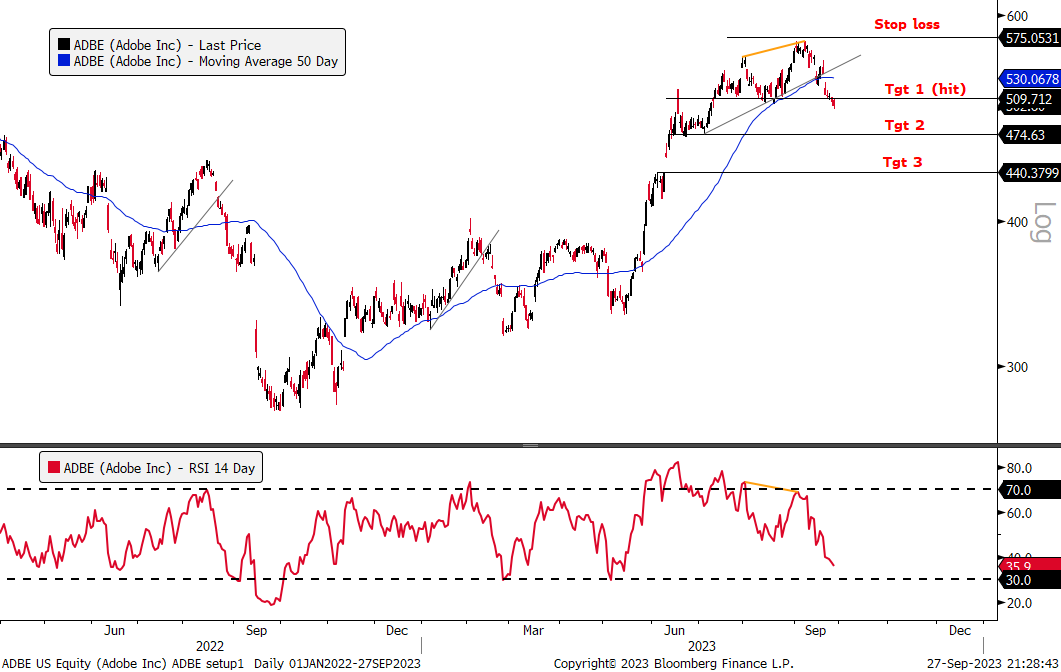

- Short ADBE (Tgt 1 hit)

- Short AMZN (Tgt 1 hit)

- Short ITB (Tgt 1 hit)

- Long Corn Future

- Short XLV (Tgt 1 Hit)

- Short Bitcoin (Close) – Target 1 and 2 were hit but recommend closing the trade as price had recent bullish divergence and it has acted resilient on this equity market sell-off. Generated ~9% return on short after breaking below trendline.

- Short Natural Gas

- Long MRK (Tgt 1 hit)

- Short XLRE (Close) – Price has hit and fallen below all three targets, we recommend closing position and booking the gains. After breaking trendline, short trade generated a ~12% return.

- Short CRM (Tgt 1 hit)

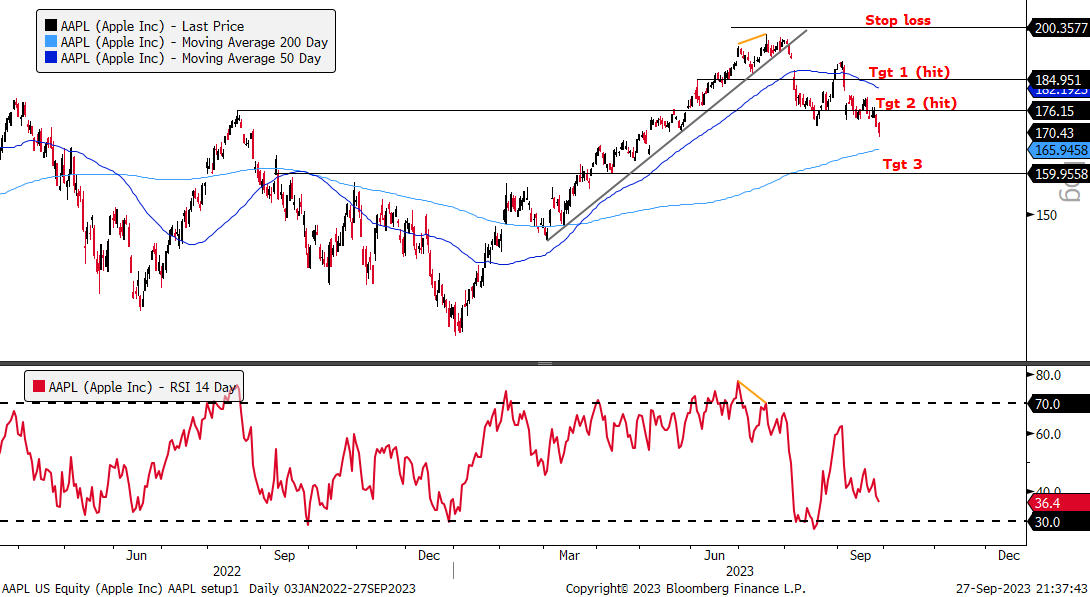

- Short AAPL (Tgt 1 and 2 hit)

- Short IWM (Close) – All three targets have been hit and price is below target 3, we recommend closing the trade. Generated ~8% return on short after breaking trendline.

- Short SPY (Tgt 1 and 2 hit)

- Short NFLX (Tgt 1 and 2 hit)

- Long MCHI (Close) – Closing the trade as the bullish divergence worked briefly back in June, but price action continues to be negative and we don’t see any near term upside here. The trade generated a ~9% loss.

- Short XLY (Tgt 1 and 2 hit)

Our Closed Trades

IWM

MCHI

-The trade turned active on September 20 with a break below the trendline.

-The negative reaction to the September FOMC meeting, where Fed Chair Powell appeared hawkish, sent growth stocks lower and interest rates higher.

-Price is now testing the 50-DMA, which is something to monitor in coming days.

Short AMZN (Tgt 1 Hit)

-The trade turned active on September 20 with a break below the trendline.

-The negative reaction to the September FOMC meeting, where Fed Chair Powell appeared hawkish, sent growth stocks lower and interest rates higher.

-Price has continued lower, and is nearing target 2.

Short ADBE (Tgt 1 Hit)

-The setup turned active on September 15 with a move below the trendline.

-Price is falling slightly below target 1, after the initial rebound above trendline failed.

Short ITB (Tgt 1 Hit)

-The trade activated on September 13 with a move below the trendline.

-Price retested the trendline, but failed, and has now hit target 1.

-The trade activated on September 11 with a move above the downward trendline.

-Price briefly fell almost below the stop loss level, but reversed sharply higher as it nears target 1.

Short XLV (Tgt 1 Hit)

-The trade turned active with a break below the trendline on September 5.

-Price has fallen back below both moving averages and briefly tested its upward trendline intraday.

Short Natural Gas (Tgt 1 hit)

-A break below the trendline on August 23 activated the short trade.

-Natural gas appears to be breaking out with oil now, as it moved above its 200-DMA and towards the stop loss level, something worth watching.

Long MRK (Tgt 1 Hit)

-The trade activated on August 11 with a move above the short-term trendline.

-MRK has broken down below the 50-DMA, and is nearing the upward trendline and stop loss area.

Short CRM (Tgt 1 Hit)

-The trade activated on August 2 with a break below the trendline starting in December of 2022.

-CRM fell below its 50-DMA and hit target 1 again, but has not made new lows versus August yet.

Short AAPL (Tgt 1 and 2 Hit)

-The trade was activated on August 2 with the break below the trendline that has held since March.

-AAPL continues to be a barometer for risk for this market, as has continued lower towards the 200-DMA.

Short SPY (Tgt 1 and 2 Hit)

-The trade was activated on August 2 with the break below the trendline that has held since May.

-SPY broke out of its channel and hit target 2.

Short NFLX (Tgt 1 and 2 hit)

-The break below the upward trendline on July 20 activated the short trade as NFLX had lackluster earnings results.

-Significant move below the price channel on September 13 is a material change in the previous bullish technical structure. That move is continuing as price fell below target 1 and just hit target 2.

Short XLY (Tgt 1 and 2 Hit)

-XLY broke below the trendline which activated the short trade on July 20.

-Price decisively fell below the 100-DMA and hit target 2.

I don’t get why JPM wasn’t triggered. Hope you’re working on rapid alerts for Trigger/Close events

Hi @Aleksey Neverov Thanks for your question. We notified members in the report linked below that JPM’s bullish divergence was no longer valid given that both RSI and price made new lows. I hope that clears it up for you.

https://www.gameoftrades.net/news-feed/weekly-pending-setups-report-new-setups-ezu-kre/

Oh no! Looks like I’ve somehow missed that article and through that setup is still valid. But nevertheless, I’m more about the lack of alerts that some setup is now active, or position should be closed. I’m currently trying to follow the setups by placing strategic alerts for price breach, but sometimes it is too late, some times too early. If you in a report writing that some setup was triggered on 20th September, it’d be wonderful to have a short message from you on 20th September, before market closes: setup X become active!

Love the trader watchlist. All of your enhancements are valuable.