-

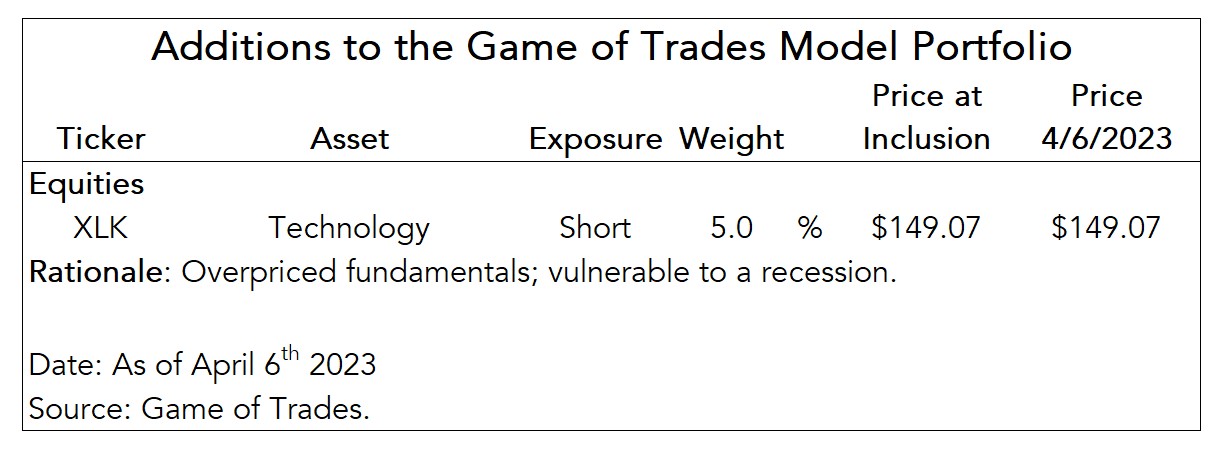

Initiating 5% Short Position on Tech (XLK)

Dipping Our Toes on a Short Tech Trade

We’re initiating a 5% short position on Tech through the XLK ETF. Last week we posted a Macro Note pointing out that Tech is a vulnerable sector in the recession we anticipate later this year.

Tomorrow we’ll post a second Macro Note on Tech where we look at the sector’s fundamentals and valuations.

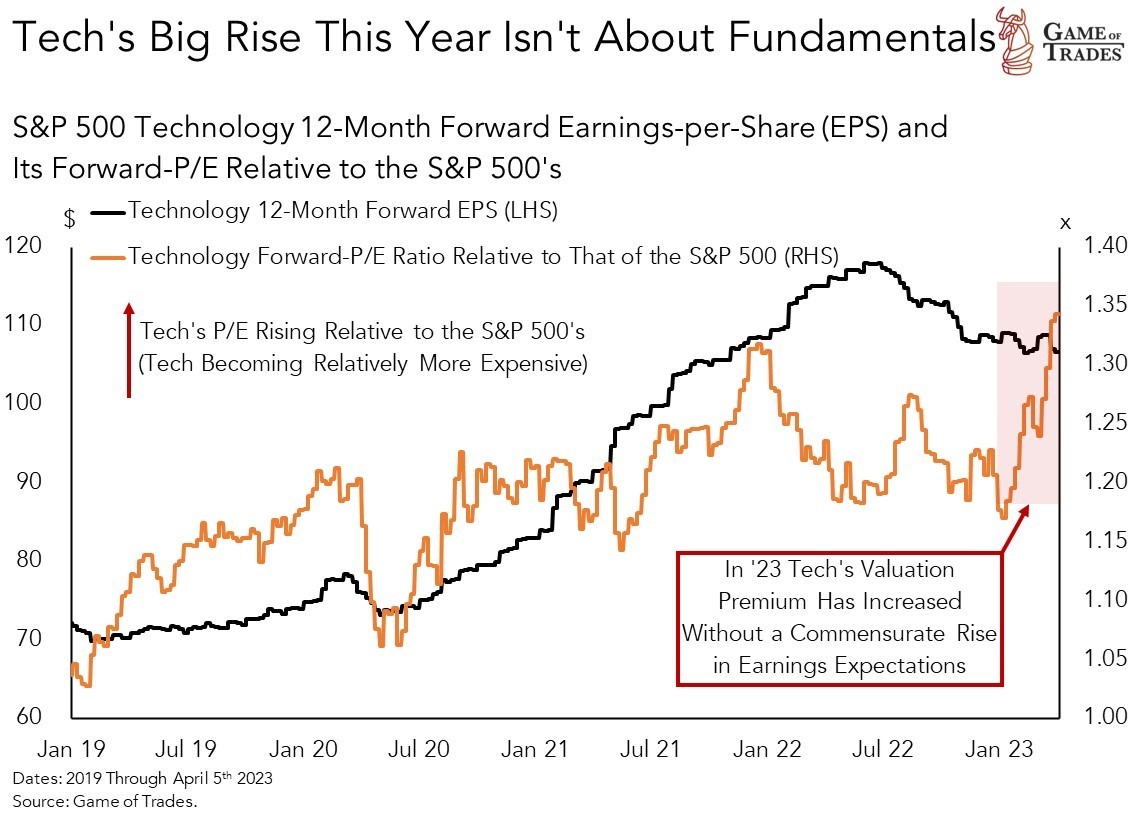

We find Tech’s fundamental fall short of what the market is expecting considering Tech’s lofty 30+% forward-P/E premium.

Tech’s outperformance this year has been solely driven by P/E expansion, while earnings expectations are flat to lower. That means the move isn’t supported by underlying fundamentals.

As highlighted in yesterday’s Tactical Update, Tech’s technicals also signal incoming weakness relative to Treasury bonds. Tech’s returns are the most positively correlated with TLT, a concern.

We believe that Tech’s high correlation with bonds makes it an unreliable hedge in a recession. That’s because investors will ultimately rely on a real haven (TLT), not an overpriced bond proxy.

We’re funding our 5% short on XLK with funds from cash. Our target price for the ETF is $125 in the next 6-12 months.

We’ll be looking opportunistically to add to the position in coming weeks. Stay tuned for Tactical Updates on that topic.

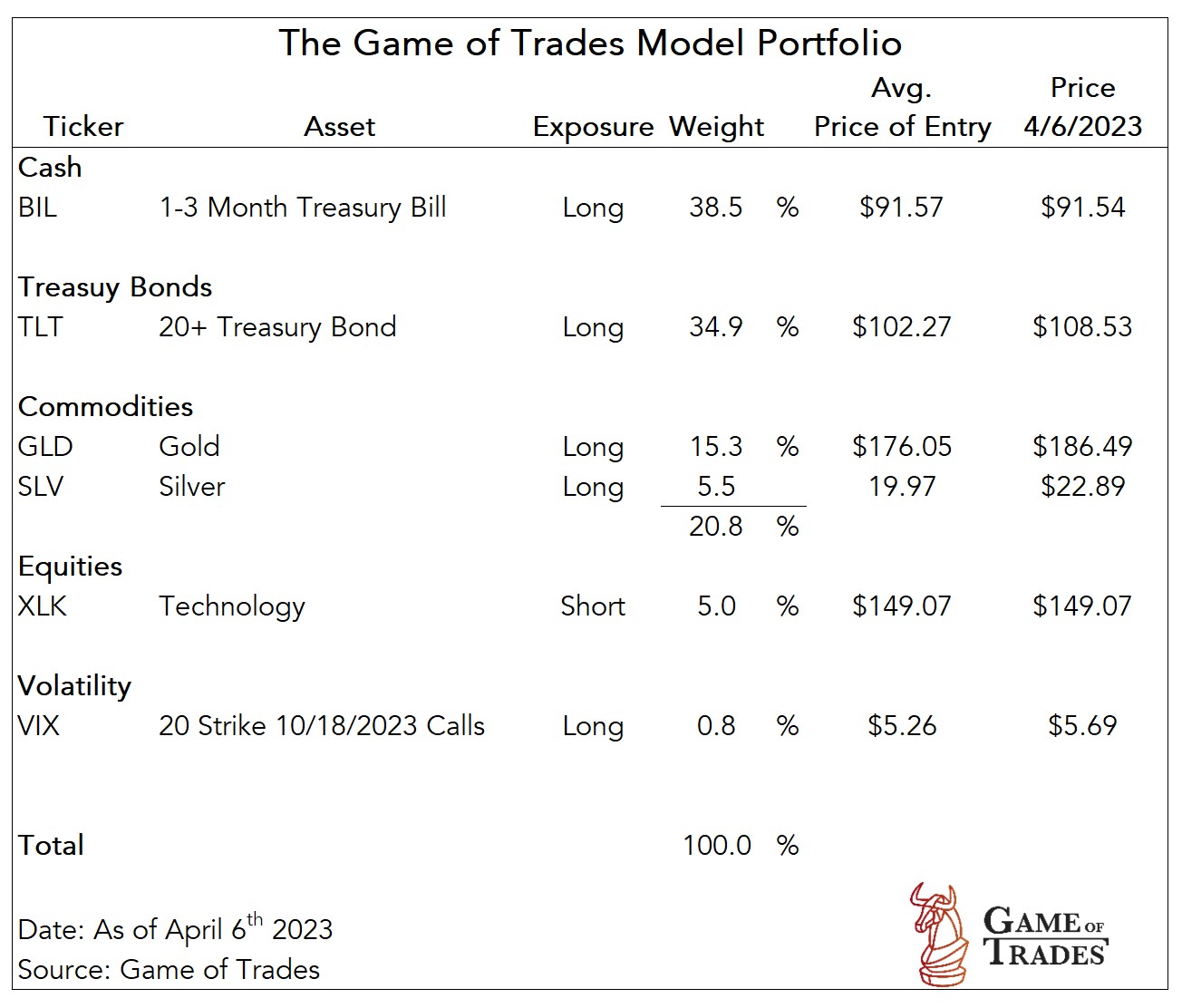

Below is the updated GOT Model Portfolio.

How did you go short on this? Bought puts?

He is suggesting you sell this etf short. He would have stated strike price and time if option. Just remember you have to have a margin account to short sell. Unlimited risk. Just my opinion. But Peter’s position is very small.

@angoya Thank you for the question. The short trade on XLK is expressed by selling short the XLK ETF. This isn’t an options trade. The only options trade in the portfolio today is the long VIX call position.

Hi there, if you were to go in and short this at the current price of $152ish, when would you hope to repurchase the stock? And how does this play into paying interested compounding daily on margin?

I am newer to these types of plays and want to be crystal clear before I even do such a thing in my paper trading account.

Thank you!

I’m confused. This ETF is an inverse ETF?

Hi Nick, thank you for the question. XLK isn’t an inverse ETF. It’s an ETF representing the Technology sector in the S&P 500. Please see the link below for more details from the ETF provider.

https://www.ssga.com/us/en/intermediary/etfs/funds/the-technology-select-sector-spdr-fund-xlk

Why short XLK instead of QQQ or US100 indices? Short using CFD?

@Shawn Wang Hi Shawn. XLK is a more pure-play representation of the Tech sector than QQQ. The QQQ ETF represents the Nasdaq-100, which isn’t entirely made up Tech companies. For example, the QQQ ETF has only 50% allocation to Technology. Communication Services and Consumer Discretionary comprise 30% of the ETF’s allocation.

You can see the details here:

https://www.invesco.com/qqq-etf/en/home.html

The work we’ve done recently is specifically centered around the Tech sector, and hence we believe XLK is a better vehicle to express our work.

I believe XLK excludes Amazon, Google, Tesla and Meta which are in QQQ. For myself, I have shorted QQQ at 320 because I believe the above names share the same risks highlighted in this article. Also for option traders, QQQ has higher liquidity. Just sharing.

New subscriber here. Is there no specific recommendation as to the date and strike price of what must be an XLK put option you are recommending?

@William Dennis Welcome to the service, William. There’s no option trade documented in this Portfolio Update. The trade in our Model Portfolio is a short on the XLK ETF.

If a person wanted to be more aggressive in this investment suggestion, what one company looks to be your choice? Are your plans to increase this position?

Do you have any thoughts on oil being sold in non dollar denominations from Arab nations? How serious should these comments be taken in protecting one’s financial survival?

For those confused: to short the XLK on a platform such as Fidelity Active you simply enter XLK and then click Sell 2x which brings up Sell Short, enter # of shares and hit ‘Place’. On Think or Swim (a much better platform), just type in XLK and hit ‘Sell’. If you don’t already own any XLK, you will automatically open a short position. (BTW, on Fidelity if you DO own XLK, it won’t liquidate those shares; instead it will open a separate short position, known as a “Short Against the Box”. ) If you wish to open Puts, bring up the options page (In TOS, it’s under ‘Trade All products’) enter XLK and the option series comes up. The 5/26 series is a weekly with good volume. Current price is 149.07 on XLK. The 148 PUT has a bid of 2.00 and an Ask of 5.0 (but market is closed so those may be artificial). However, if real, that is an enormous spread and to be avoided since you would implicitly lose $300/contract the moment you enter. The 147 strike is 1.50/4.50. It has a 59% chance of closing out of the money, i.e. worthless. The implied volatility is 19%, so for every $1 XLK drops, the option will gain roughly $0.20. That will increase once it is ‘In the Money’. The June 16 option only prices in units of 5 right now, so the 145 is 4.0/5.15, which is a more realistic, but still wide, spread. Hope this helps. NO Trades being recommended by me.

FWIW: My 1 day indicator on XLK produced the following trades over the last year: Sht 6/9/22 136.3, cover 6/13 131.05; Lng 6/24 133.45; Sht 8/8 145.77; Lng 9/9 137.2; Sht 11/1 126.8, Sht 11/29 129.46, Sht 12/2 135.36; Lng 12/29 124.61; 2/3/23 Sht 141.77; Lng 3/3/23 140.14; Sht 4/5/23 148.23. That’s 8 trades for total of roughly 60.44 points (hypothetical, of course) with 7 ‘wins’ and 1 ‘loss’. Approx 7.55 average per ‘trade’. About 43% ROI. And, as to shorting versus puts, I always prefer to buy/short the actual. In options, the theta will eat you alive. As ever, NO trades being recommended.

The odds of a 25 basis point hike for May went up does that change the thesis or is it already priced in to the pause that is sure to follow?

I cannot short in my IRA but I found a close inverse ETF for XLK.

ProShares UltraShort Technology (REW)

That’s where I went also.

I am in the same boat, but I like your REW better than the TECS I had been considering. Thanks for a good idea.

According to Fidelity TECS has the upper hand as its more liquid, more AUM. TECS has $134.44 mill, REW only has $6.19mill and SSG has $7.51mill

Note: I don’t like this after I looked into it, and I don’t think this was Peter posting, but this is from the previous post to those who want it.

“Hi–For this trade we are not recommending an option position, but rather an outright short of the XLK ETF. If it is your personal preference to use options, then yes, we would recommend longing an out of the money put option on XLK. We would most likely recommend a strike price at least 10% below the current price, so ~$130, and an expiration month further out to take advantage of the potential for tech to underperform over a longer-term horizon. I hope that helps”

Hey GOT,

The non-farm payroll data came out positive than expected. So, what do you think about this short trade?

@nahathouba While there wasn’t a big miss on the labor market report, the revisions to the initial claims do point out to underlying weakness in the labor market. Given the 30+% P/E premium on Tech today, we believe the sector is priced to perfection. There’s an asymmetry where too hot/too cold labor market data is likely to push down on Tech’s high P/E ratios, and therefore makes Tech’s success only viable in the narrow circumstance that the labor market slows down only gradually enough to signal a Fed pivot but no recession. We believe that’s an unlikely scenario.

I like that you give a time frame so I can determine if I want to use options or just stock.

i feel if you are going to recommend a short you should provide a more precise target date (or at least the one you used) , spread, net debit / credit , suggested stop in case it goes the other way as well as a suggested profit target.

Before you buy an ultrashort etf of any kind, zoom out to max on the chart to take look before you plunge. You need the timing of a demigod. I don’t have any guts for that for a stock fund. I dabbled in SCO (2x short oil) a bit ago when Peter was recommending short and got a K-1 for my troubles…

Peter, is the model portfolio based on real funds that you have set aside, or is this just for informational purposes as a guideline for followers?

It makes a big difference on how committed GoT really is to their calls, to which I believe the recession call is much too premature. The flip from a 5200 SPX target which never even came remotely close to 3500 has me concerned about GoT’s conviction levels.

Hi Alexander, thank you for the question. The Model Portfolio is for informational purposes and guidance. It synthetizes our investment strategy by providing our members actionable insights in global markets of where our convictions lie.

I am using Fidelity IRA and IRA ROTH accounts and there is no selling an ETF short or margin allowed.

So can you provide for those of us in this situation an alternative technique or ETF to invest in.

Is there any comment on using REW versus shorting the XLK. It seemed to respond positively during October time frame in 2022. Are the conditions close enough to invoke a similar response going forward that would provide a good alternative to the type of trade you made?

James: I checked my timing charts for my 1 day indicator on REW against my XLK indicator (see post by me above). There is a strong inverse correlation between the two: i.e. if XLK is a short, then REW triggers a Long within 1 or 2 days before or after the XLK signal. I make no comment on whether the actual move percentage wise is strongly correlated, and am not making any trade recommendations. Hope this helps with your thought processes.

@James Thank you for the question. Given our investment horizon of 6-12 months, an ETF like REW is not something we would use for the expression of our short idea on Tech. Please take a look at the ETF provider’s disclaimer on the use of REW on their website below.

https://www.proshares.com/our-etfs/leveraged-and-inverse/rew

“Important Considerations

This short ProShares ETF seeks a return that is -2x the return of its underlying benchmark (target) for a single day, as measured from one NAV calculation to the next.

Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return, and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks.

Investors should monitor their holdings as frequently as daily. Investors should consult the prospectus for further details on the calculation of the returns and the risks associated with investing in this product.”

What do you think of simply buying the Direction Daily Technology Bear 3X (TECS) shares instead of the sugested short of XLK?

Hi Peter, thanks much for such an informative post.

My question is if I want to leverage the short position, do you recommend inverse 3x etf (if so which ticker symbol do you recommend) or do you recommend an option play on XLK with expiration around October timeframe (similar to what you have with VIX call)?

Thanks so replying for response.

@tuan nguyen Hi Tuan, please take a look at our response above to James Haswell regarding the use of leveraged ETFs. Given our 6-12 month horizon, leveraged ETFs are not something we use to express our views given the return compounding issue.

Haven’t used many options myself but the REW (ProShares UltraShort Tech ) might work also.

Looking at the XLK/QQQ ratio. QQQ is a significantly better short. Please correct me if you have a reason you chose XLK.

@SVO XLK is a more pure-play representation of the Tech sector than QQQ. The QQQ ETF represents the Nasdaq-100, which isn’t entirely made up Tech companies. For example, the QQQ ETF has only 50% allocation to Technology. Communication Services and Consumer Discretionary comprise 30% of the ETF’s allocation.

You can see the details here:

https://www.invesco.com/qqq-etf/en/home.html

The work we’ve done recently is specifically centered around the Tech sector, and hence we believe XLK is a better vehicle to express our work.

Good Answer.)

What about SARK? (-1x daily ARKK).

For those comparing XLK and REW: in Oct 22 REW had a high of 26.71, dropping to a low last week of 13.57, almost exactly 50%. Whereas XLK hit a low of 112.97 same time and rose to high of 151.15, only about a 35% increase, although the timing correlates exactly. If the hypothesis of a SHORT of XLK is correct, then REW should outperform the XLK short. No trades recommended by me.

Just my 2 cents but technically XLK has formed a higher swing high after a higher swing low from what looks like a Wyckoff distribution pattern …. I get that the macro backdrop isn’t looking rosy for tech … but the present technicals just don’t point to a short position. Given that you are requiring clients to trade on margin, in order to initiate this short position, I really feel this is bordering on irresponsible … especially as you aren’t recommending a stop loss. If this goes the wrong way, people will get hurt.

Thank you for the feedback, Micha. Contrary to your comments, we don’t require our members to do anything with our content. We’re not financial advisors. The objective of the research is for informational purposes so that our members can see where our convictions stand. We don’t make trade recommendations. Our members should use proper risk management and stop losses that are consistent with their risk tolerance, as well as and consult with a financial advisor.

Are you in the entertainment business, or are you just legally required to say this since you are not acting as a CFP or some such? I think it is a legitimate question if you run any of your money in the model portfolio.

@Maxrothira Is the question whether we run real money on the Model Portfolio? The answer is no. The Model Portfolio is for informational purposes to synthetize our research into actionable ideas that could be of service to our members. Risk management is of utmost importance in investing and trading, and therefore we recommend our members to consult with their financial advisor as to the suitability of any investment.

@GOT Would you be able to recommend an inverse ETF that would allow IRA accounts to trade this position?

Hi!

What is your Stop Loss set at?

Thanks

Yes, I asked the same. didn’t get an answer.

Stop losses? how do you mange risk?

Explain how you execute you XLK short position? Puts? How far out?

Hi. New here. When you say your shorting XLK are buy outs to short. If so which do you buy. Thanks

I think I will wait for the confirmation down in tech before going short XLK in my individual and buying REW in my roth IRA.

I am looking for help as I am trying to better view and understand the trade’s actions over time.

Is there a way to see the updates of each trade in a **summarized** way?

On the model portfolio, the P/L is -45.06% for the VIX call trade.

But in one of the posts, I saw that it said he took profits of 39% when trimming the position.

So overall, is this trade down 45% or not?

It’s not easy to review what happens with a trade over time.

The weight is currently 0.4% but based on what happened over time the trade would tell a different story.

Thank you