Summary

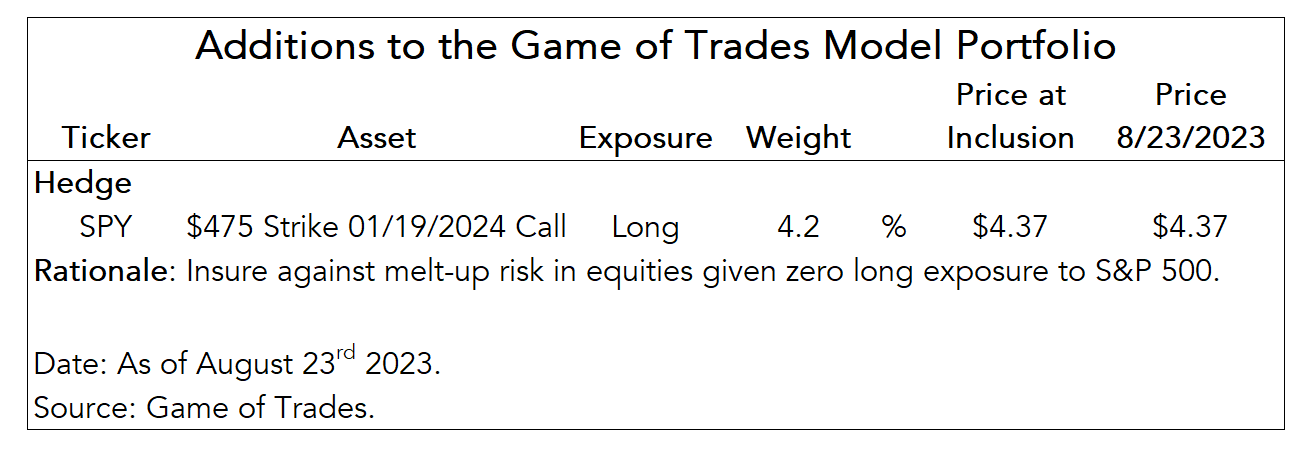

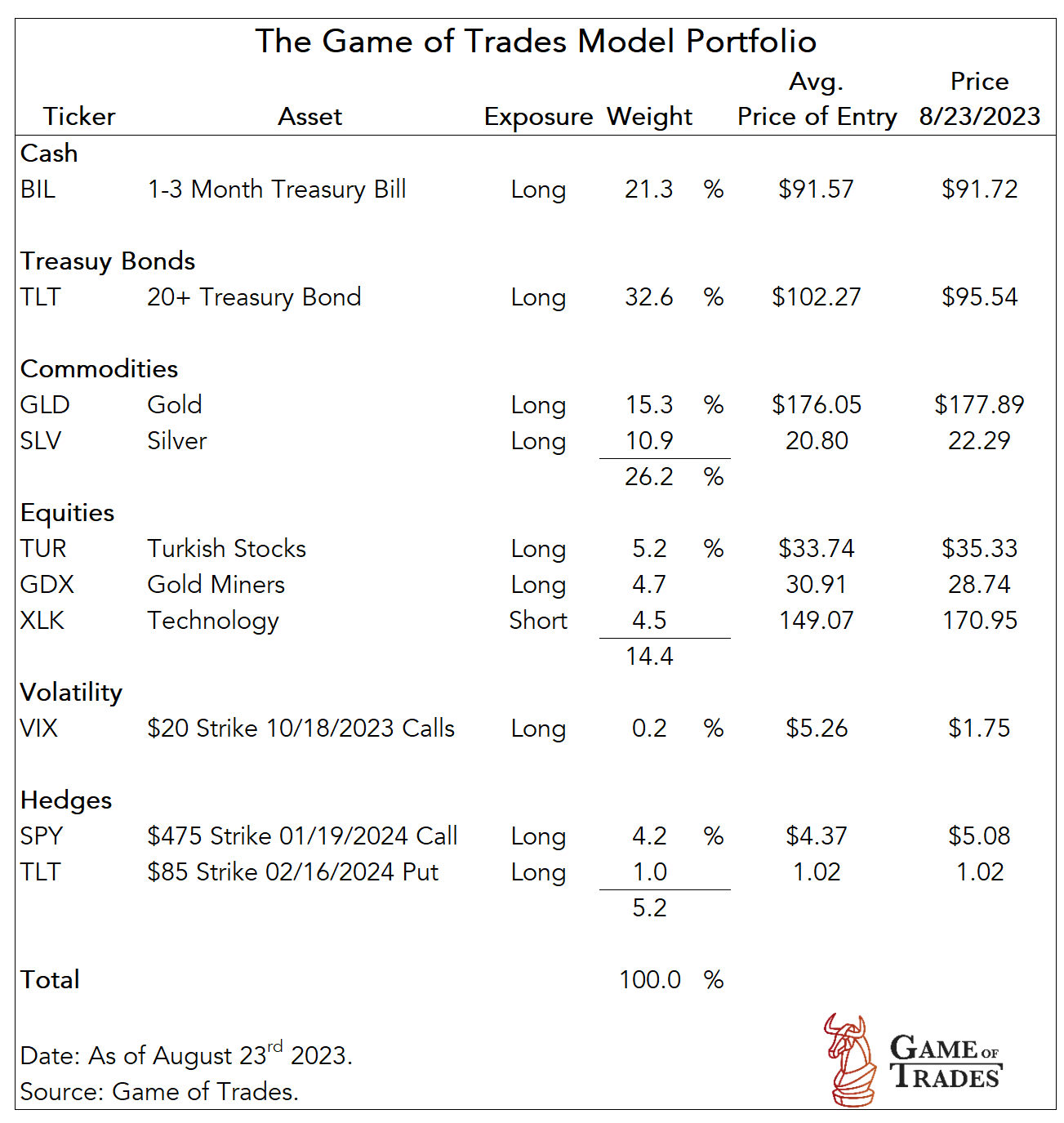

- We’re initiating a long 4.2% position in out-of-the-money (OTM) call on the SPY ETF.

- The objective is to eliminate melt-up risk in equities given that we have no exposure to the S&P 500 in our Model Portfolio.

- While stocks could continue moving lower in the short-term, we’re not looking to time the market in deploying this hedge, as it’s purpose is to insure the portfolio.

- The preferred call option is the $475 Strike with January 19th 2024 expiration.

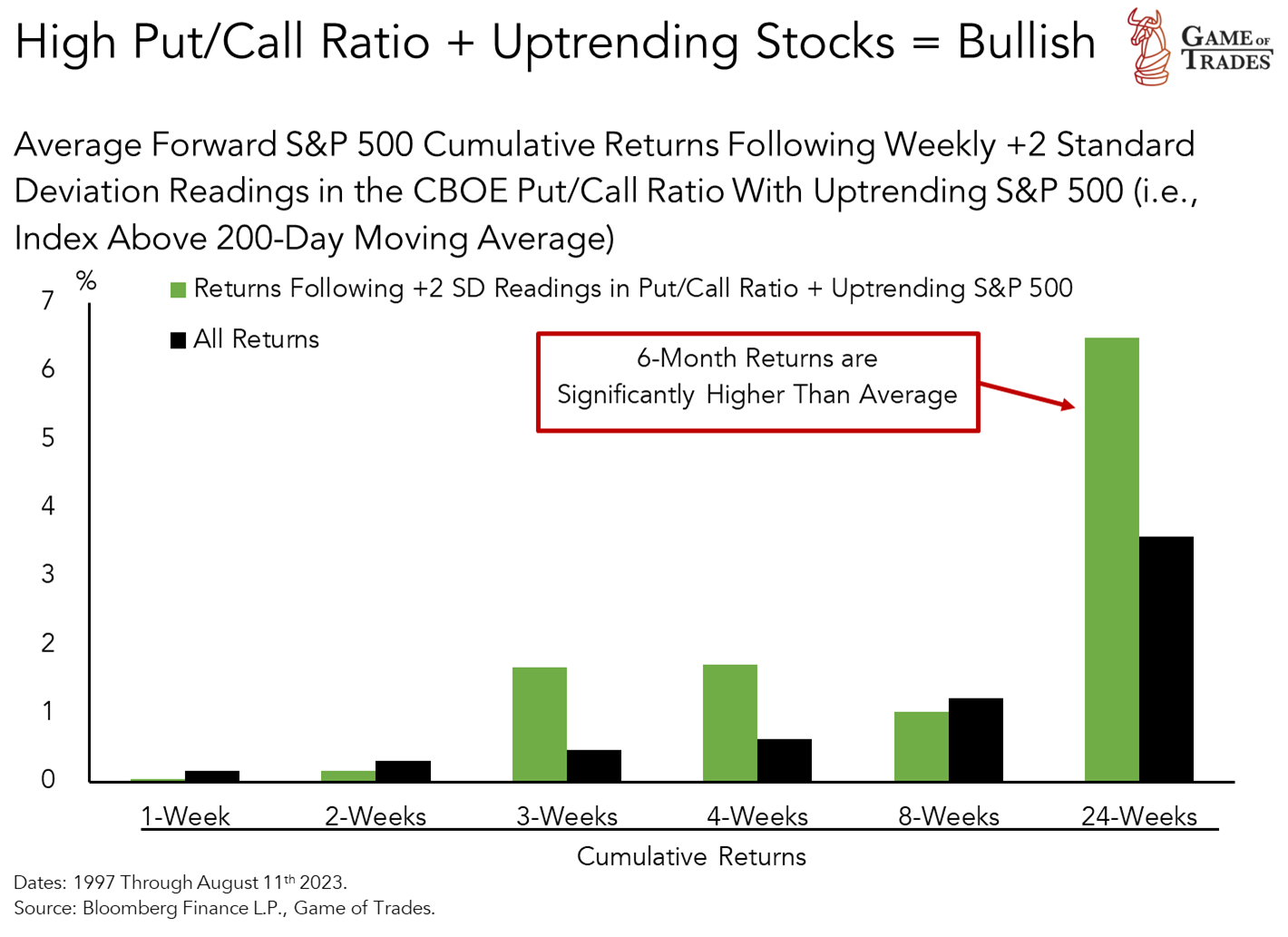

Spike in Put/Call Ratio = Take Melt-up Risk Seriously

In a recent S&P 500 Memo we noted that recent weakness in stocks creates opportunity for investors with little equity exposure to buy cheap insurance against a melt-up reigniting.

The put/call ratio spiked to a +3 std. deviation level last week as market worries ensued. That contrarian indicator has historically led to above-median returns in the months that followed.

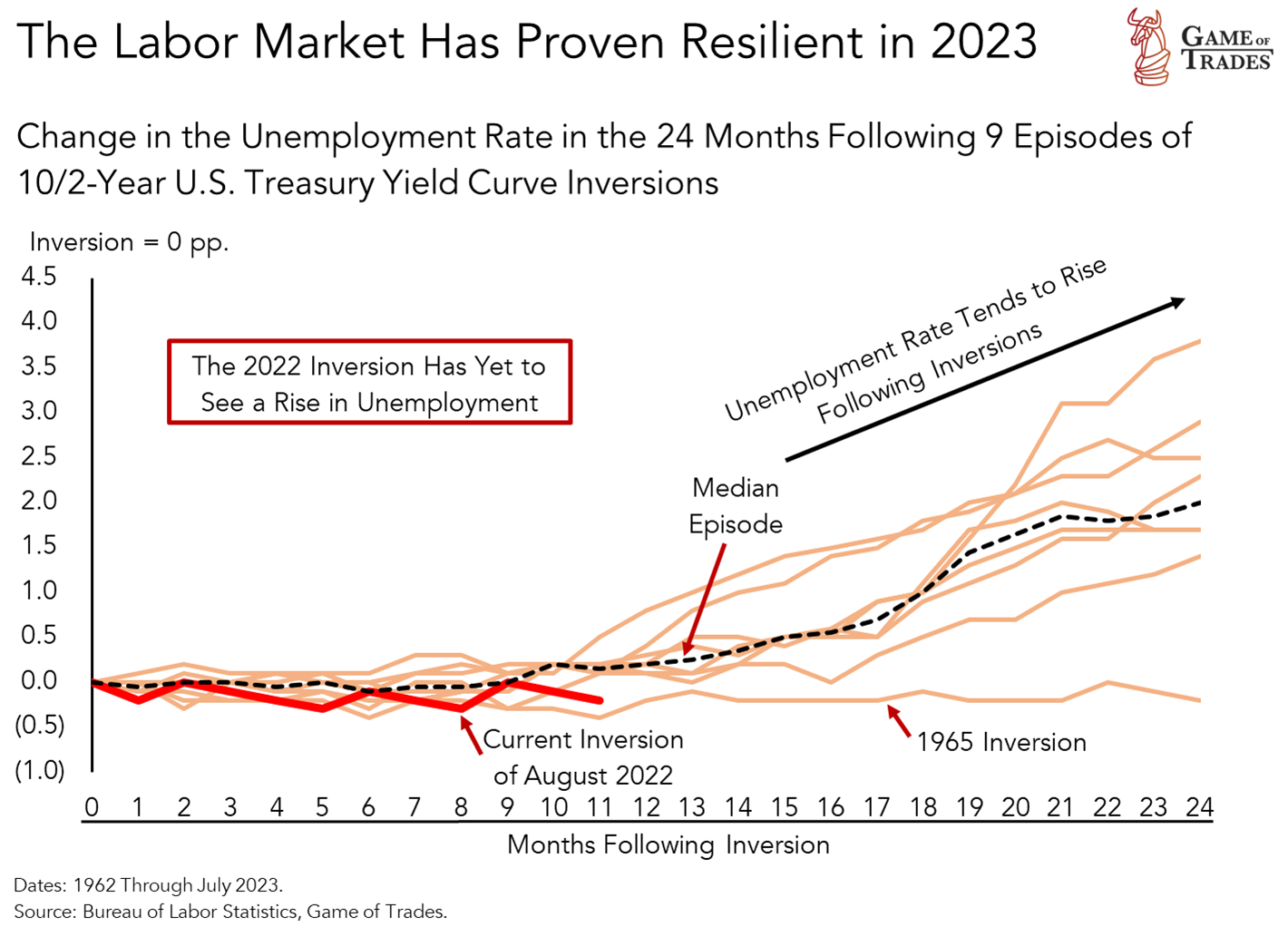

While a recession remains our base case, unemployment has yet to rise to levels consistent with prior yield curve inversions. That’s led us to extend the timeline for recession to the 1st-half of ‘24.

With a tight labor market, the elevated put/call ratio suggests that the uptrend in stocks could continue in coming months. That’s a risk we’re taking seriously given our lack of exposure to stocks.

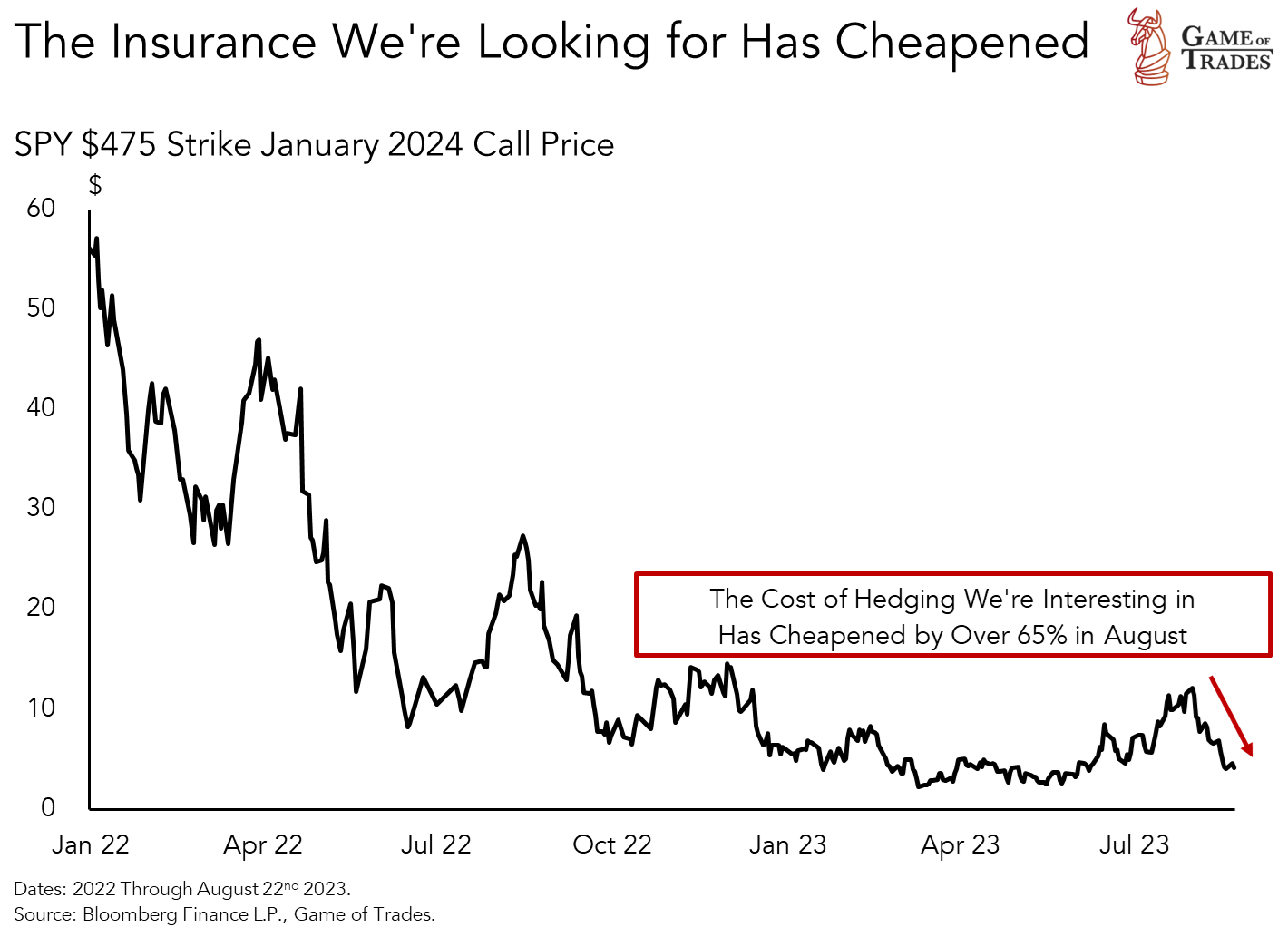

Timing is an important dimension in hedging our lack of stock exposure, as the cost of insurance is time-varying. The cost to hedge upside risks has cheapened as stocks have fallen lately.

Out-of-the-money call options on the SPY ETF have declined substantially in August. For instance, the January 2024 $475 Strike calls are down more than 65% after peaking in end-July.

While the cost of insurance could keep falling if stocks fail to gain traction in coming weeks, we’re not looking to time the market here as the objective is to minimize portfolio downside.

We believe the risks of waiting too long could see the market move higher quickly and negate the benefit of low-cost insurance, exceeding any potential advantage in attempting to time the market.

Hedging Stock Market Upside Risks with Out-of-the-Money (OTM) Calls

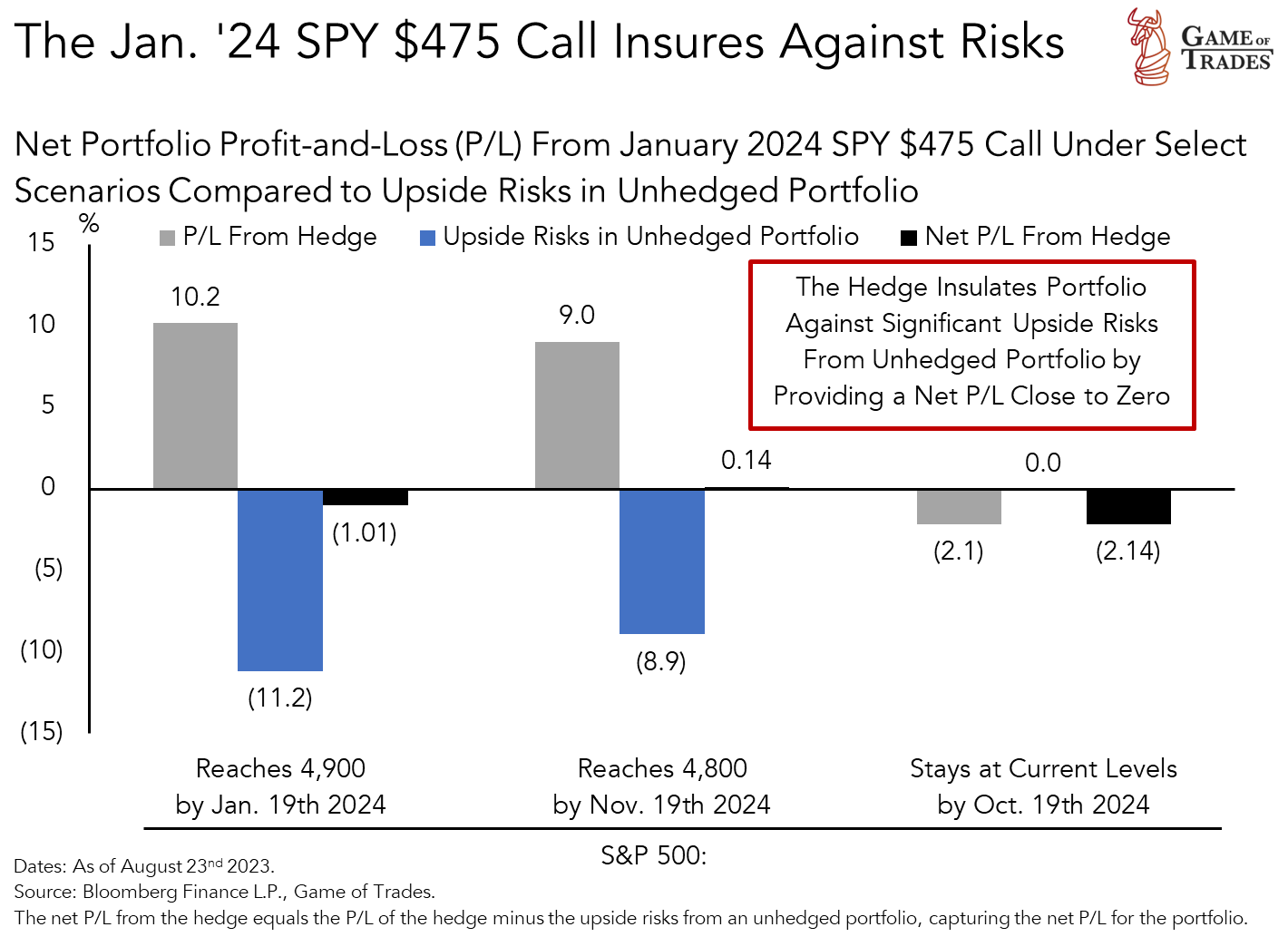

Because we’re insuring against tail risks (i.e., melt-up), we believe that out-of-the-money calls represent the optimal way in limiting downside without sacrificing upside.

We’re looking to take this exposure via the January 19th 2024 SPY $475 calls, considering that our Model Portfolio’s performance is being benchmarked against the S&P 500.

In terms of insurance horizon, we’re targeting the Jan. ’24 expirations to protect for the next 5 months, when our recession thesis will be tested. The cost of the option is 4.2% of the portfolio.

If by expiration of Jan. ’24 the S&P 500 is at 4,900, or up 12% from today’s level, the option would generate a net portfolio loss of 1%. That’d almost fully insulate that 12% opportunity cost.

If the S&P 500 were to hit 4,800 by mid-November, the highs before the Fed began its rate-hiking program, the option would fully insure against that 10% rise.

If the S&P 500 were to stay flat by mid-Oct., the call would generate a net P/L of -2.1%. That’d be the cost of buying time for job market data to validate a recession, while insuring against a melt-up.

Weak technicals in the S&P 500 signal potential for more weakness in equities in the short-term, as highlighted in this week’s S&P 500 Memo. However, we’re not looking to time the market here.

Nvidia’s earnings coming out at the close today, and the Jackson Hole Symposium later this week, could prove catalysts for market direction, but we’re not looking to predict those outcomes.

The objective is to insure the portfolio against the tail risk of stocks resuming their melt-up. Hence, we’re looking to buy insurance when it’s relatively cheap, not when it’s in high demand.

We initiated a long position on a Jan. ’24 SPY $475 call today at a price of $4.37 with an allocation of 4.2%, funded from cash (BIL).

How does GOT look at new home sales that have been reaching new highs recently? While GOT has emphasized existing home sales are more significant in earnings projection, does GOT have an explanation for the better-than-expected performance of new home sales, and any thoughts on its implication on existing home sales?

@Samonita Kayden That’s a great question. In our view existing home sales is more closely tied to earnings than new home sales, given that the former is a much bigger part of the universe of home sales and as a result the multiplier effects on the economy are likely bigger. The big growth in home sales recently, diverging from the weakness in existing home sales, is likely the result of low inventories whereby the marginal transaction is happening in the new home sales universe. That’s likely been a reason why the homebuilders have done well against a backdrop of rising mortgage rates.

How many contracts does that represent? How to define the right amount of contracts for the hedge?

@michael The number of contracts depends on the size of your portfolio and how much exposure to S&P 500 upside you’re looking to hedge against. You can think of our portfolio as having an initial allocation of $10,000 when launched back in September of 2022.

@GOT thanks. In that case, does it mean one option?

Yes. I would recommend tho that you read a bit foundational material about options. 1 Contract give you the option for 100 shares meaning your cost basis is 100 times contract price.

Yes, Michael. That’s correct.

@michael. I would avoid buying options if I didn’t understand how they work. You will want to make sure you understand them first. These are not stocks, its basically insurance. This call option is basically hedging the current portfolio against further upside in the markets (since the portfolio is design for downside, and GOT has since re-evaluated and is thinking a delay in that downside). With that said, should the markets actually fall, this option will be worth less. However, since the options got cheap, it is anticipated that it’s worth the risk.

I entered the position now at 5.02 since I couldnt enter at open. I hope that 60$ premium mames it still good value.

Just quoting from the article “While the cost of insurance could keep falling if stocks fail to gain traction in coming weeks, we’re not looking to time the market here as the objective is to minimize portfolio downside.”

Meaning you minimized your portfolio downside substantially, but the higher contract price decreased your potential upside a tiny bit. Good trade off, I would say 🙂

Like others, I’m trying to figure out quantities. If we take a $100 000 portfolio. And you want 4.2% allocated to the SPY option as per your portfolio it means investing $4200 in the options. To make things simpler let’s say the option is being bought at $4.2 each. So it would mean taking 1000 options for $4200. But since each option’s contract represents 100 SPY that would mean we have options that represent 1000*100*445 (current SPY value), ie $44 500 000. That would be a gigantic leverage so I must be getting something wrong…..

Or is it that to represent $4200 you actually take 10 contracts since each actually cost $4.2*100 (contract size) = $420 ? and if you have 10 contracts that reprensents 10x100x445 which would a more reasonable $445000 in SPY value ?

Correct. However, suggested strike price is 475

Hi Erik–Thanks for your questions. If we take your hypothetical scenario, then yes you are correct in saying $4,200 in premium would need to be bought. Keep in mind however, that buying one call option gives you the right, but not the obligation to buy 100 shares of the underlying. So, again going back to your scenario – If the options price is $4.20 each, you would need only 10 options to satisfy the hedge: 10 * 100 * 4.2 = $4,200 paid in premium. I hope this clear things up for you. Please let us know if not. Thank you

I feel pushing the recession thesis by 6 months is not based on any logic. It’s basically saying that you stand by your original thesis but don’t think it will happen soon enough. Why 6 months and why not 7 or 8 or 11?. Most recession drops come with sudden credit / geo-political events and don’t give 6 months advance notice. I respect your choice of buying a hedge, I am thinking about doubling down on the recession thesis.

Curious, why only an analysis based on SPX reaching 4800 or 4900, not sure how upside risk was estimated here. What happens if the portfolio drops to 4300 with this hedge?

I went with out of the money CHAT March calls thinking a melt up would have to include AI. And a little overweighting TUR with the less correlation to US market’s especially as it looks to break resistance.

[…] S&P 500 hedge (SPY Call) added the most to the portfolio, close to 2 pp., as the market rebounded shortly after […]