-

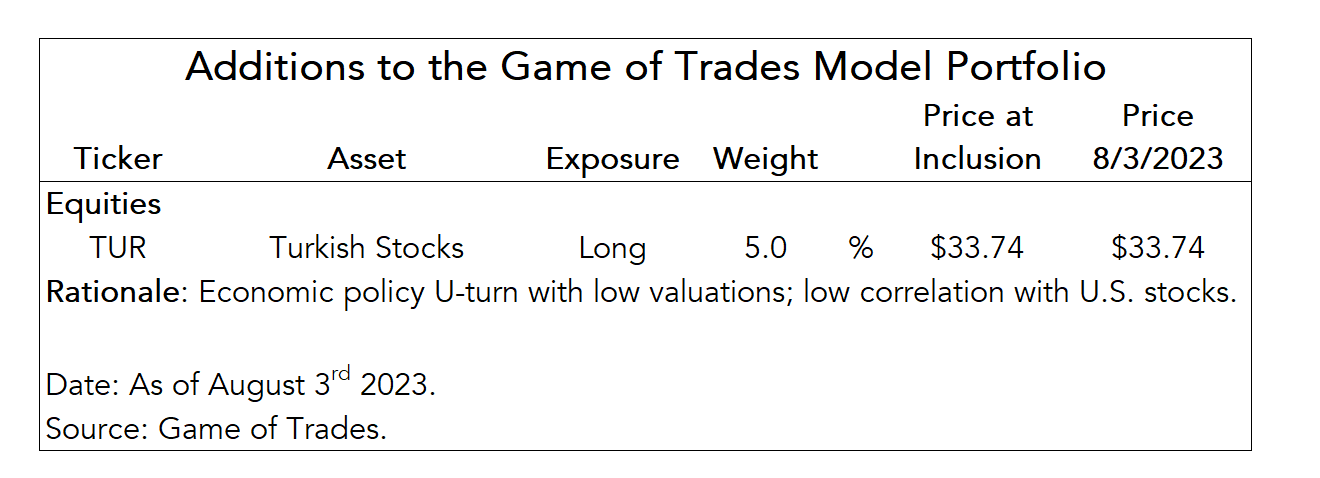

Initiating 5% Long Position on Turkish stocks (TUR)

-

Target is set at $46, with a stop loss at $29.90

Adding Turkish Equities to Our Model Portfolio

We’re initiating a 5% long position on Turkish stocks through the TUR ETF (iShares MSCI Turkey).

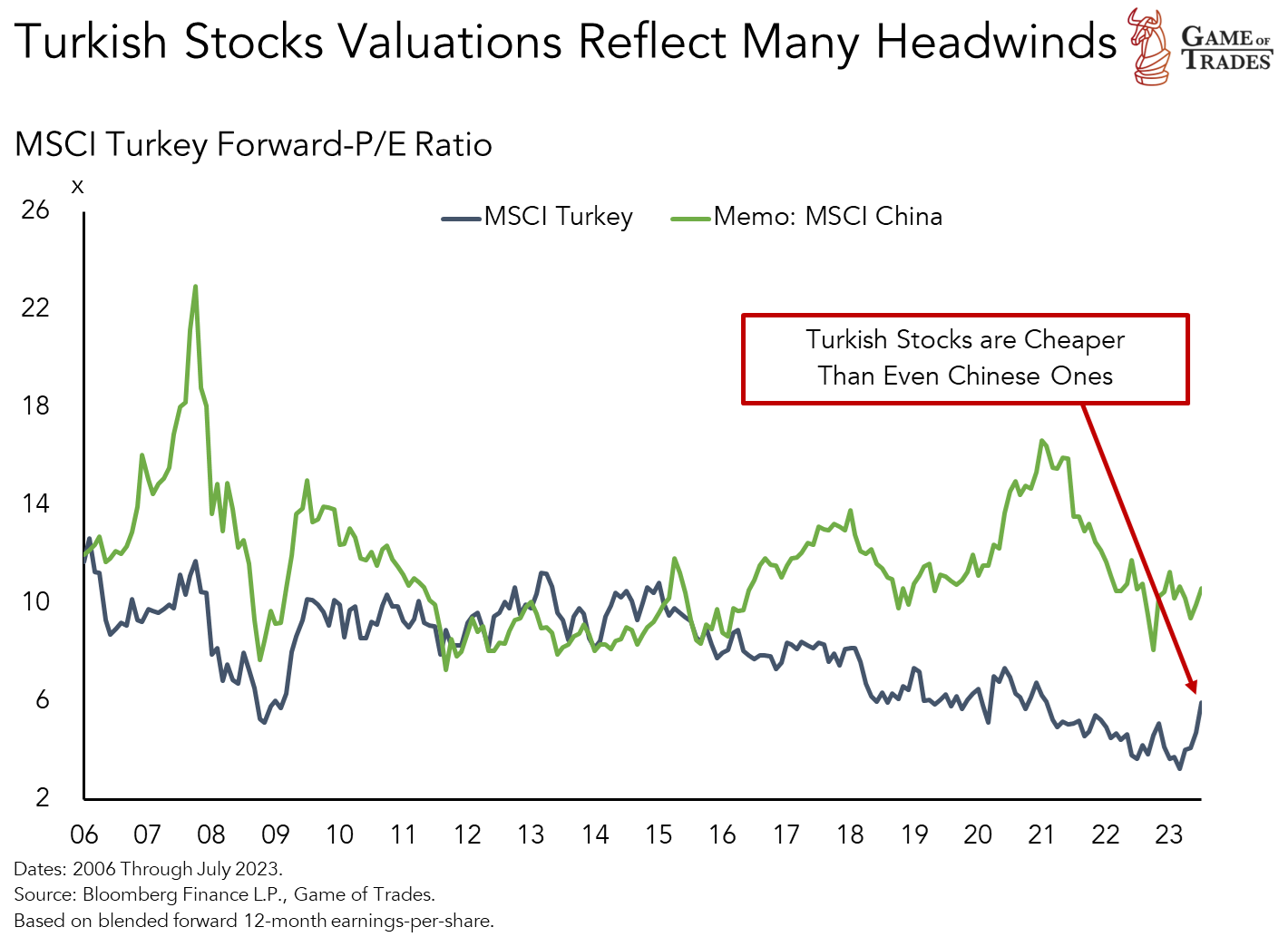

In a note posted yesterday, we laid out our constructive thesis on Turkish equities. We’re betting on a policy U-turn to reverse economic mismanagement in the face of very low valuations.

Given the pessimism priced in TUR, the upside could prove significant. However, if the policy pivot loses credibility in coming weeks, TUR’s recent gains may reverse as foreign investors scram.

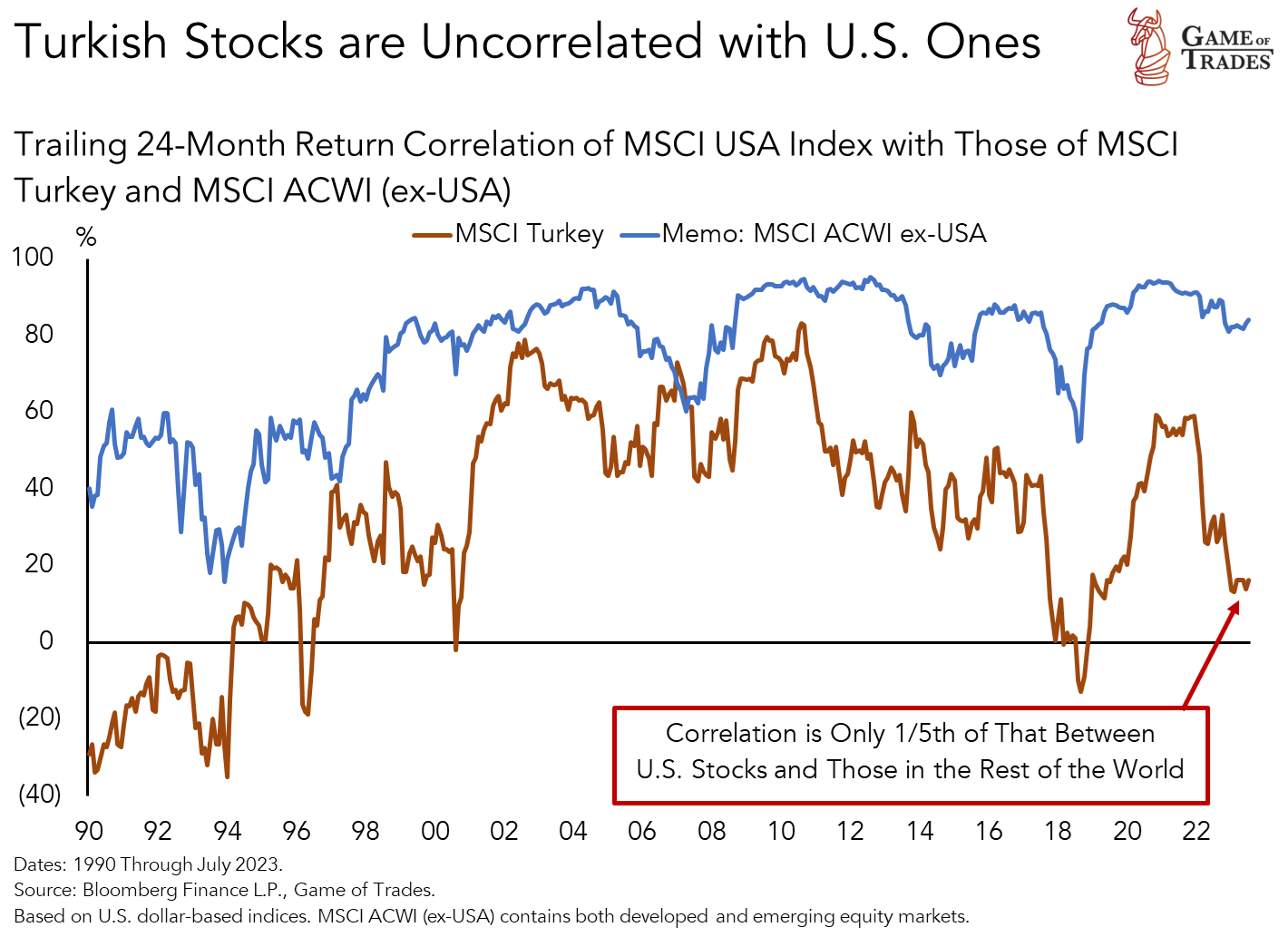

One of the advantages of the TUR long in our portfolio is the low correlations of the ETF’s returns with those of the S&P 500. That adds diversification benefits to our portfolio.

The resiliency of TUR in recent days, amidst weakening in U.S. equities, offers an example of how Turkish equities’ idiosyncratic dynamics can help diversify our exposures in the portfolio.

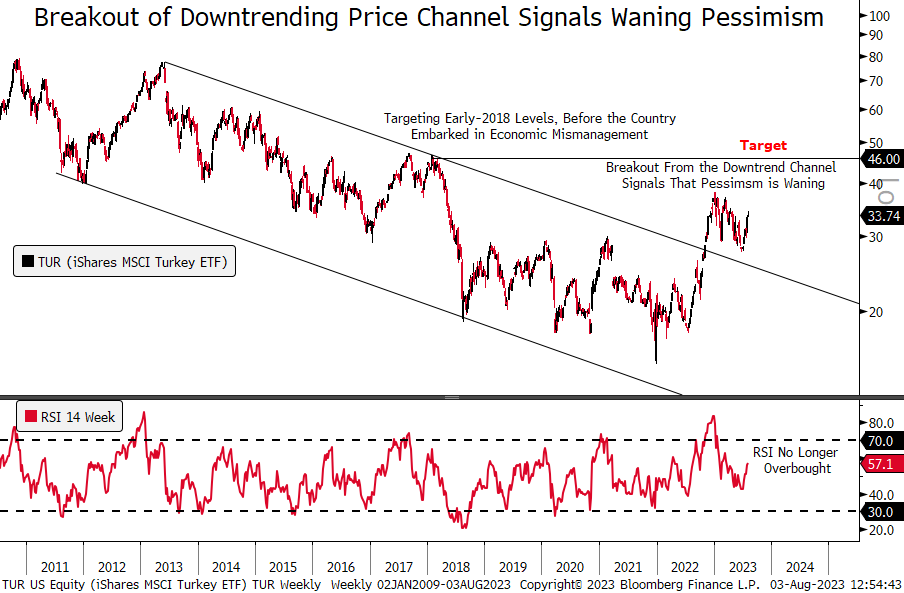

TUR’s breakout from the weekly price channel that had prevailed over the last decade proved that pessimism has been waning. The run exhausted this year as the RSI fell from overbought.

We’re targeting the $46 level, corresponding to levels in early-2018 before investors began pricing Turkey’s economic mismanagement.

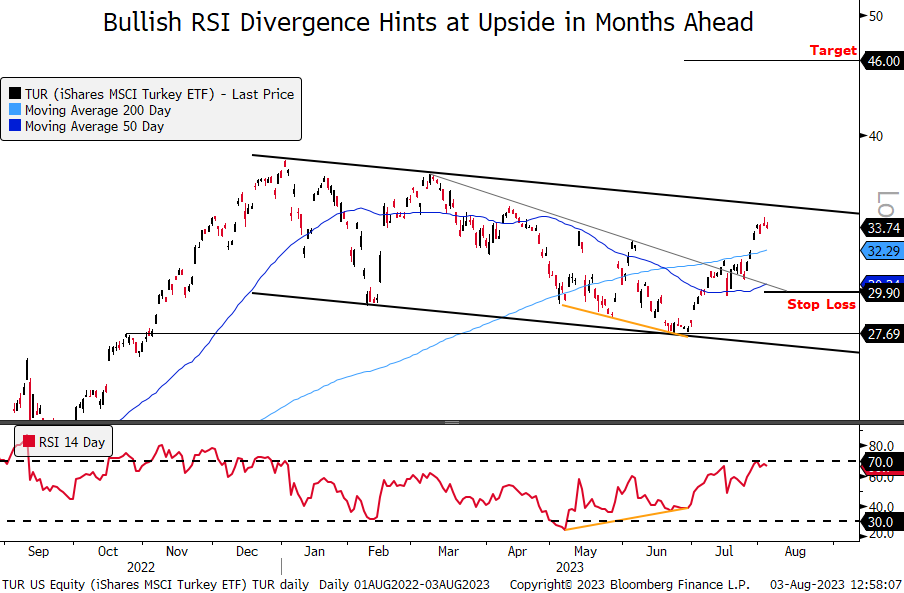

On the daily timeframe, TUR is exhibiting a bullish RSI divergence that developed between May and July. That signals potential for the ETF to see further upside.

A stop loss is set at $29.90, which would entail a breakdown from the 50-day MA and the downward trendline if price were to reverse in quick order.

We initiated the long at market close at today’s closing price, funding the 5% position with our cash allocation (BIL).

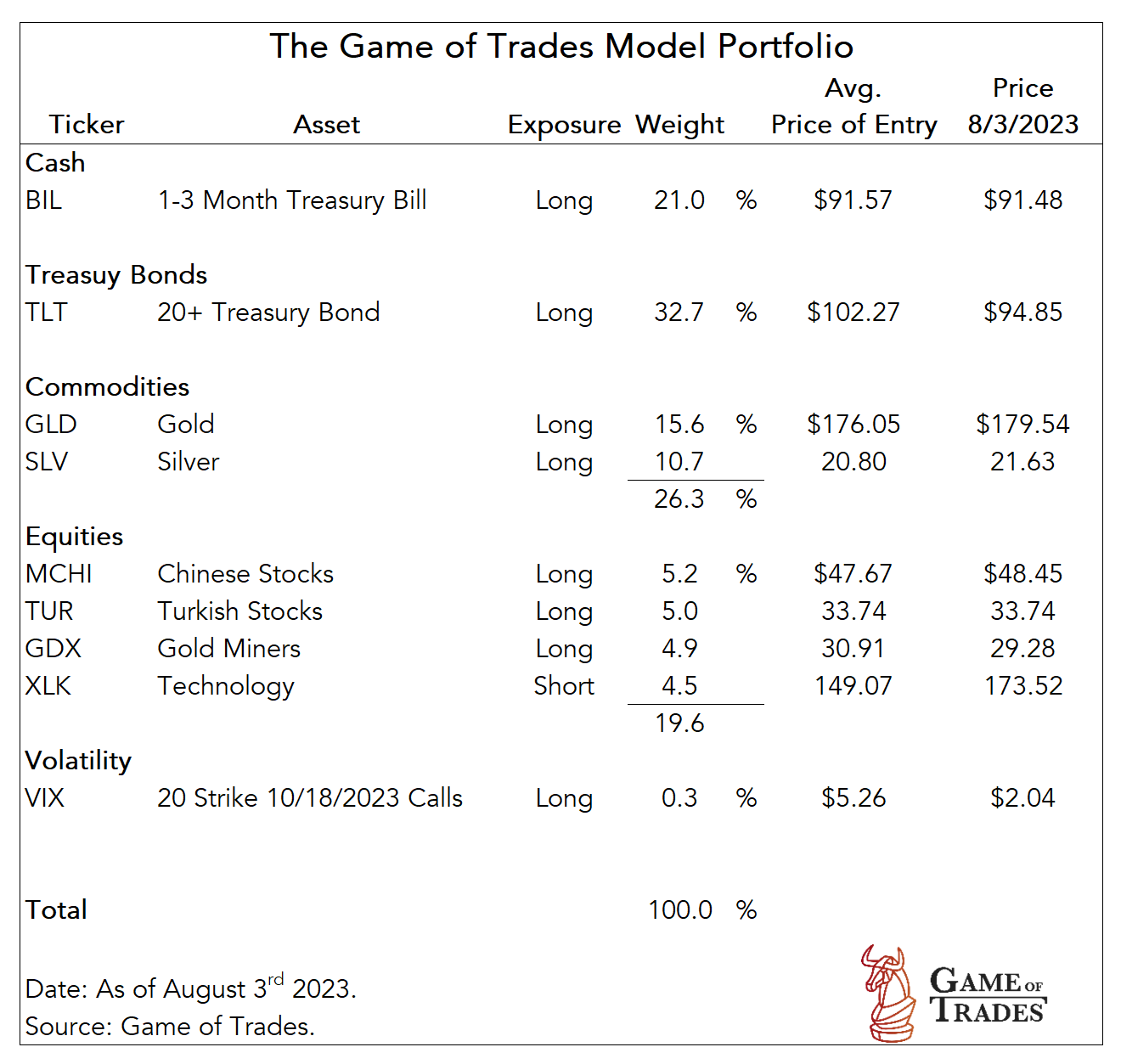

Below is the updated Model Portfolio.

What is the TLT stop loss?

There’s no stop loss because it’s not a risky trade.

@SVO We don’t have a stop loss for TLT. The stop losses we’ve put in place have been for riskier trades like MCHI and TUR. We’ll be reviewing the TLT trade next week through an Investment Radar piece.

TUR RSI at 70, a bit thinly traded, up 2+% today. Added to watch list but will not chase it here

In the portfolio page under TLT there a positive result of 0.2% at a price of 102 when today TLT closed at 94 and the loss should be 7.8%. How often are the portfolio results updated?

After recommending TLT, shorting Tech, staying in cash and missing the AI rally, now we are entering Chinese and Turkey stocks. Really?

@Giuseppe Santoro In the last several weeks we’ve been expanding our research to non-U.S. markets that are less correlated with U.S. stocks. The idea is to increase the diversification of the portfolio to exposures outside of a U.S. recession, which is our core thesis.

I find difficult to follow the logic that to protect Vs a possible mild recession in the US we should invest in Turkey and China. To protect a possible mild US recession you can just increase the bond allocation with Corporate investment grade and then return to stocks. Turkey and China will suffer even more in case of a US recession

I believe this the first time you mentioned a stop loss in the Model Portfolio. Can you please add stop losses for the entire model portfolio in the table so they are easy to find? TLT losses are killing the portfolio.

We also have a stop loss for MCHI, one of our more recent trades. The stop losses we’ve put in place have been for riskier trades like MCHI and TUR. We’ll be reviewing the TLT trade next week through an Investment Radar piece.

Why is XLK showing the original price target of $125 by December? In your last XLK video you raised the price target and added another 6 months…

Is there a mistake in the model portfolio showing $125 instead of the new number?

Even though I think TLT will ouperform in the long run, i have to concur. This seems erratic investing.

Please let us know your thoughts about what you find erratic in the TUR trade. We welcome your feedback.

@Growgeek The $125 target was revised properly in the Watchlist to $140, but the update wasn’t done on the Model Portfolio page. That’s now fixed. We apologize for the confusion.

Confusion is not what were are talking about…. You should leave the old target with a date and the new target with a date…

The old target should be left on the chart and the new target should be added…

Complete transparency please…. Show all past information and new information at the same time for historical data.

Thank you,

Brian

I just looked at the watch list… You did NOT update the xlk target, still showing 125….

Please leave the 125 there and put the new target as well.

Complete transparency please.

@Growgeek Please take a look again. On our end we can see the target is reflecting $140. Please let us know if that’s not the case on your end. Thank you.

I took a look again and your new target is shown but the old target was removed…

You should leave the old or original targets in place with a date, as well as the new target with date, the other signal services do.

You should have complete transparency, don’t you agree?

You should show if a trade hit a stop or moved the wrong direction for the trade to be profitable.

:/

Path beats timing, guys. No one is forcing you to do every investment like the model portfolio. Drawdowns in the price should always be considered as buying opportunities. Do you still believe in the hypothesis? If yes how much money would u bet on it? Turkey is obviously a contrarian bet that is as uncorrelated as possible with US stocks. However, if you feel US stocks have great value right now, feel free to invest there. We also haven’t missed the AI Rallye. The recommendation to sell was just coming to early.

come on, aren’t you making it too easy? “No one is forcing you to do every investment like the model portfolio.” ? That is exactly the reason why people are here and pay money for it. Because you don’t know any better than maybe GoT.

To say, it’s your own fault, that you follow the portfolio would mean in reverse, that if the portfolio had been done it would have nothing to do with the research and portfolio of GoT.

This is not a YouTube or Telegram channel where you simply say his opinion, but here people pay money so that someone who knows better sets up a portfolio that they can follow “blindly”.

And yes the AI really was sold right at the beginning and one has additionally opposed with trades. Is also not so bad, if one learns now from it.

At this point in time, one has to say that an inclusion of more short on XLK/QQQ and long on the VIX would have been smart just because of the seasonality. Instead, times just a new trade with TUR and MCHI … whether that is smart remains to be seen.