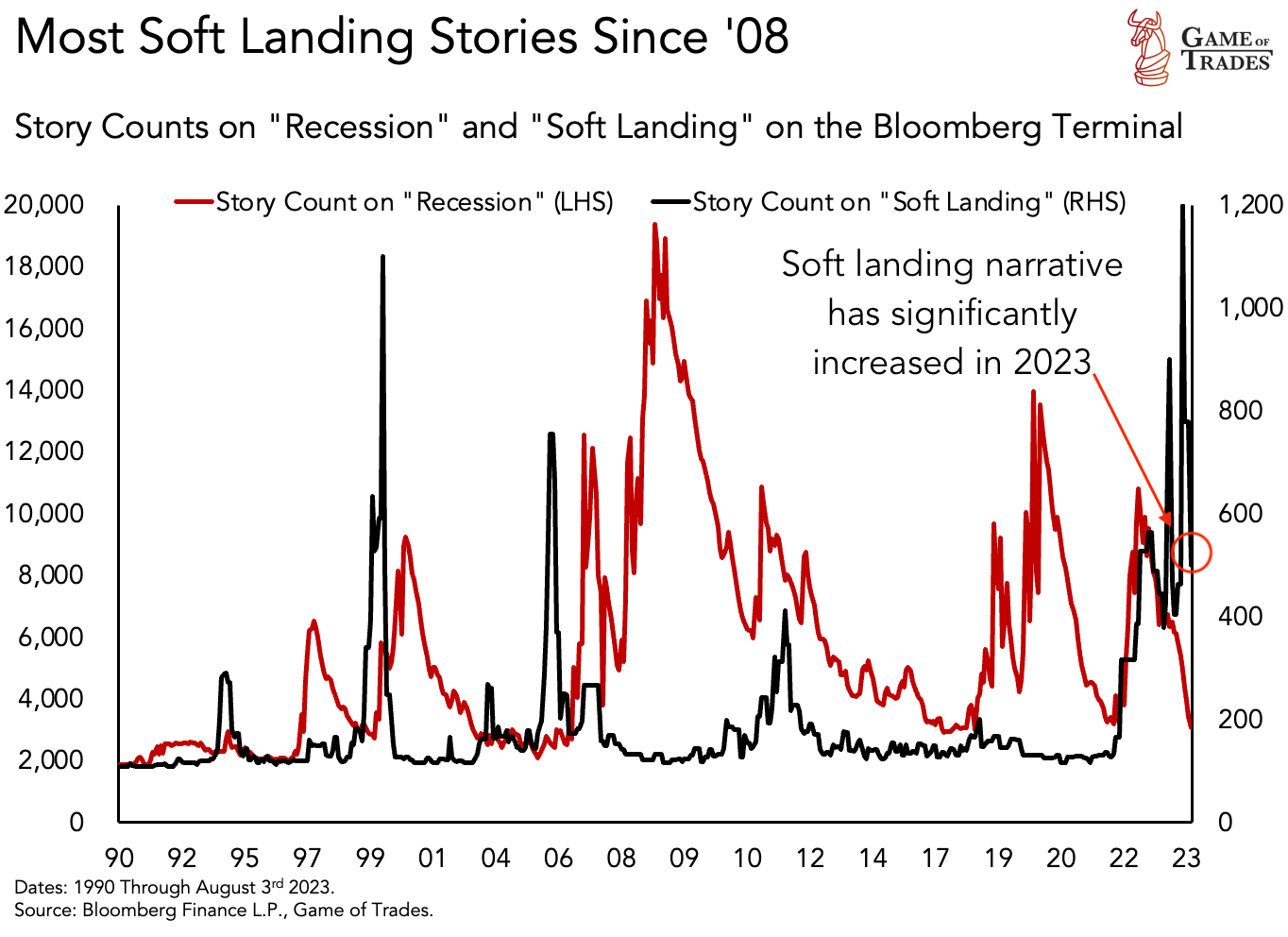

Recent market dynamics have been leaning towards a consensus for the “soft landing” narrative, suggesting economic slowdown without a full-blown recession. This consensus is driven by a strong consumer base and a seemingly resilient labor market. However, a detailed examination reveals emerging consumer weaknesses and points towards the potential pivotal role that the second half of 2023 is likely to play in shaping the unemployment landscape.

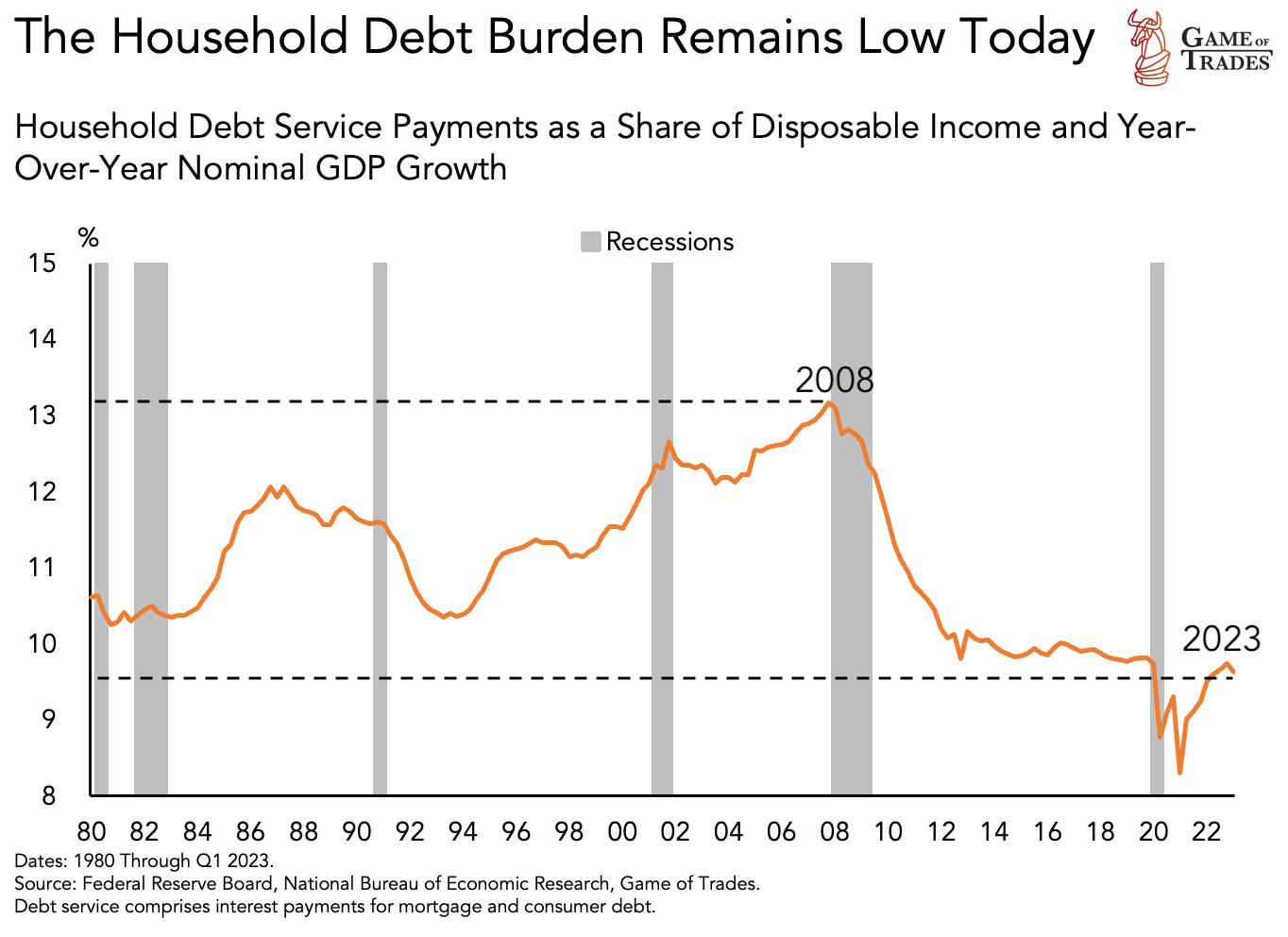

The Household Debt-to-Service Ratio: A Sign of Healthy Disposable Income?

Optimists point out that the current low household debt-to-service ratio – the proportion of income spent on debt interest payments – suggests a healthy level of disposable income relative to household debt. Indeed, when compared to the 2008 financial crisis, current household balance sheets appear healthier, hinting that the potential next recession might not be as severe.

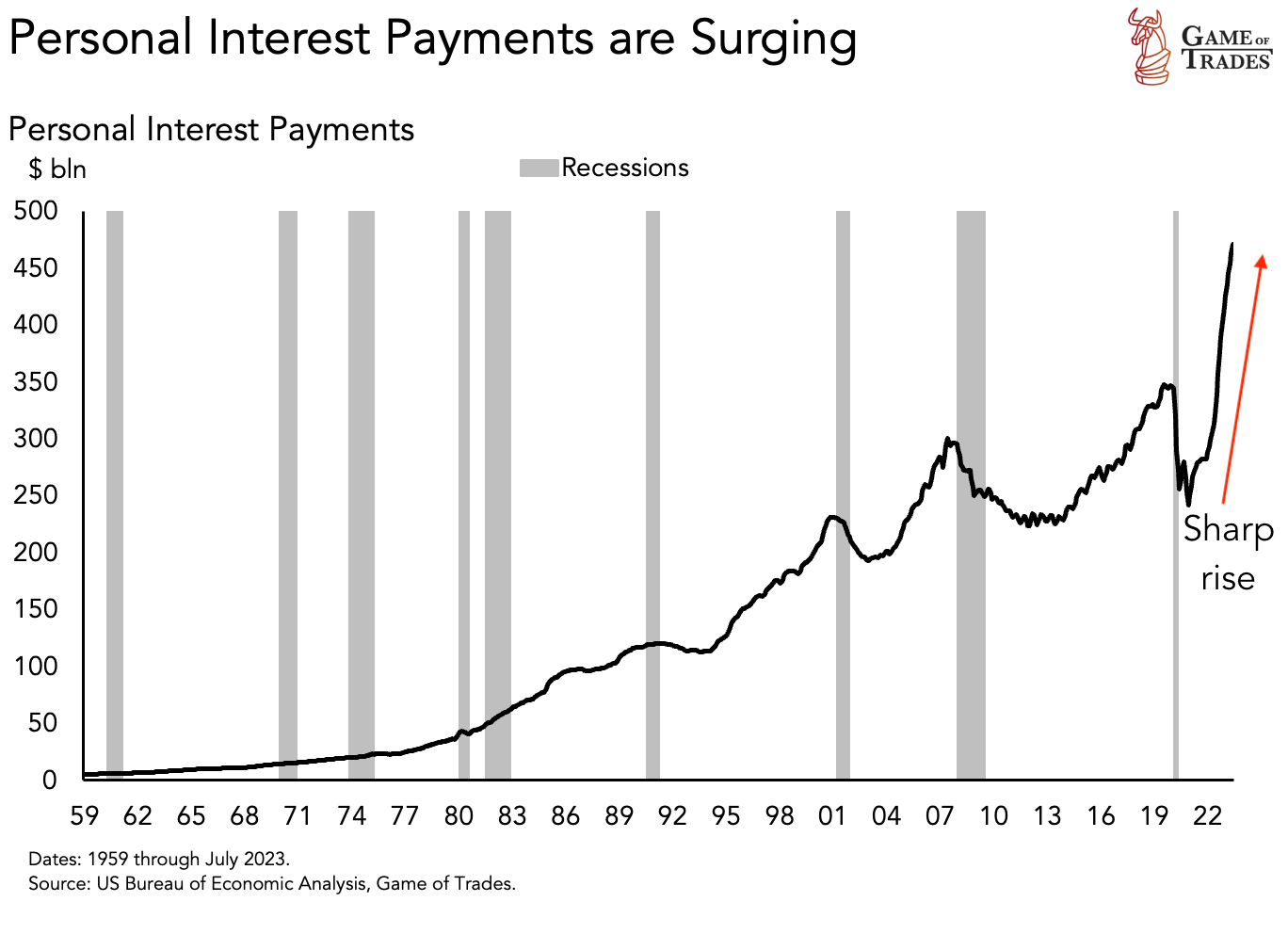

Consumer Pressure in a Tight Monetary Policy Environment

However, amidst these positive indicators, we must remember that consumers are still feeling the pressure in this tight monetary policy environment. Personal interest payments have surged, driven by an increase in credit card debt and interest rates. This spike in interest payments is worrisome, especially when credit card interest rates are at a record high of over 20%.

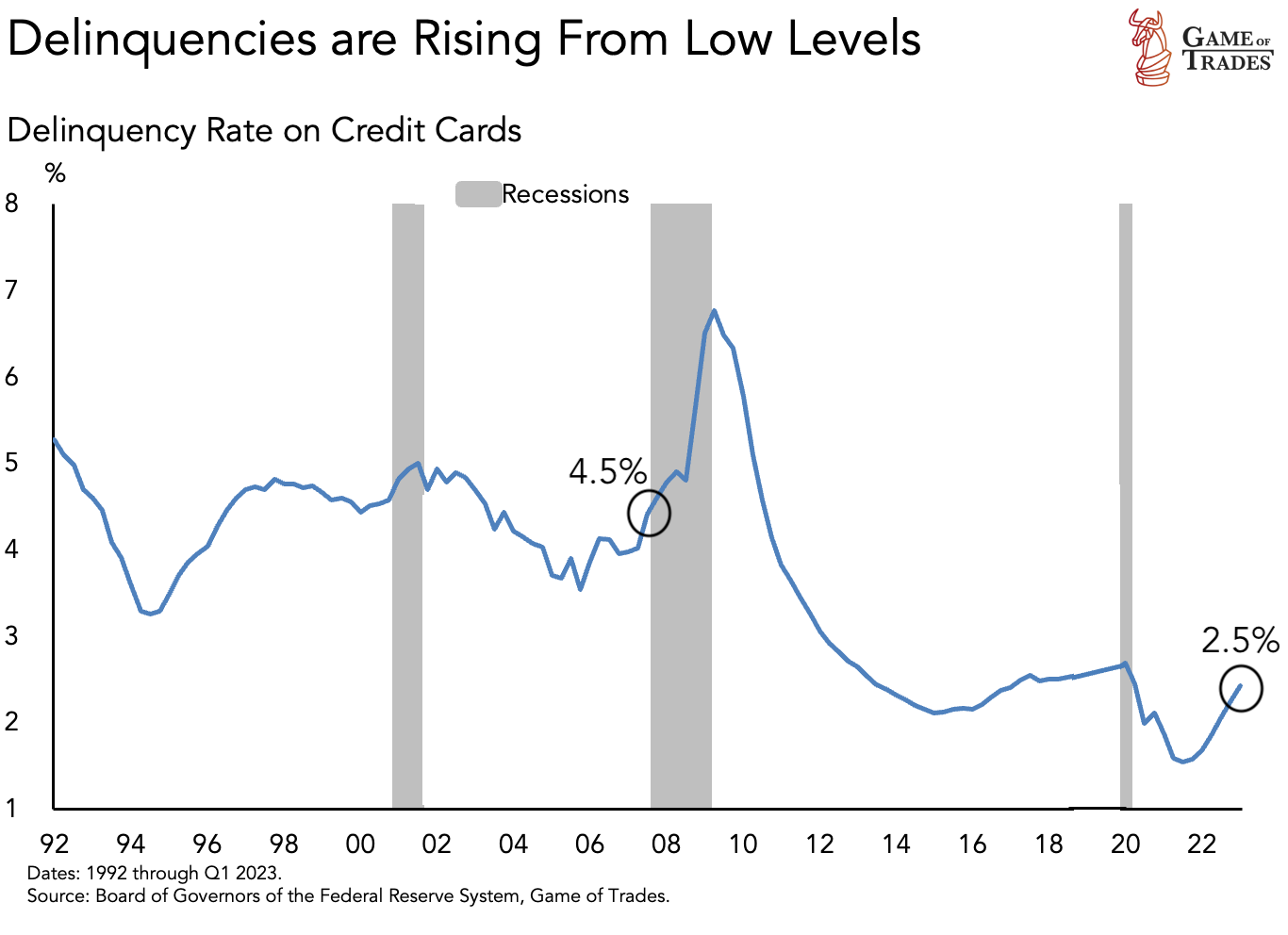

The Ripple Effect: Higher Delinquency Rates on Credit Card Loans

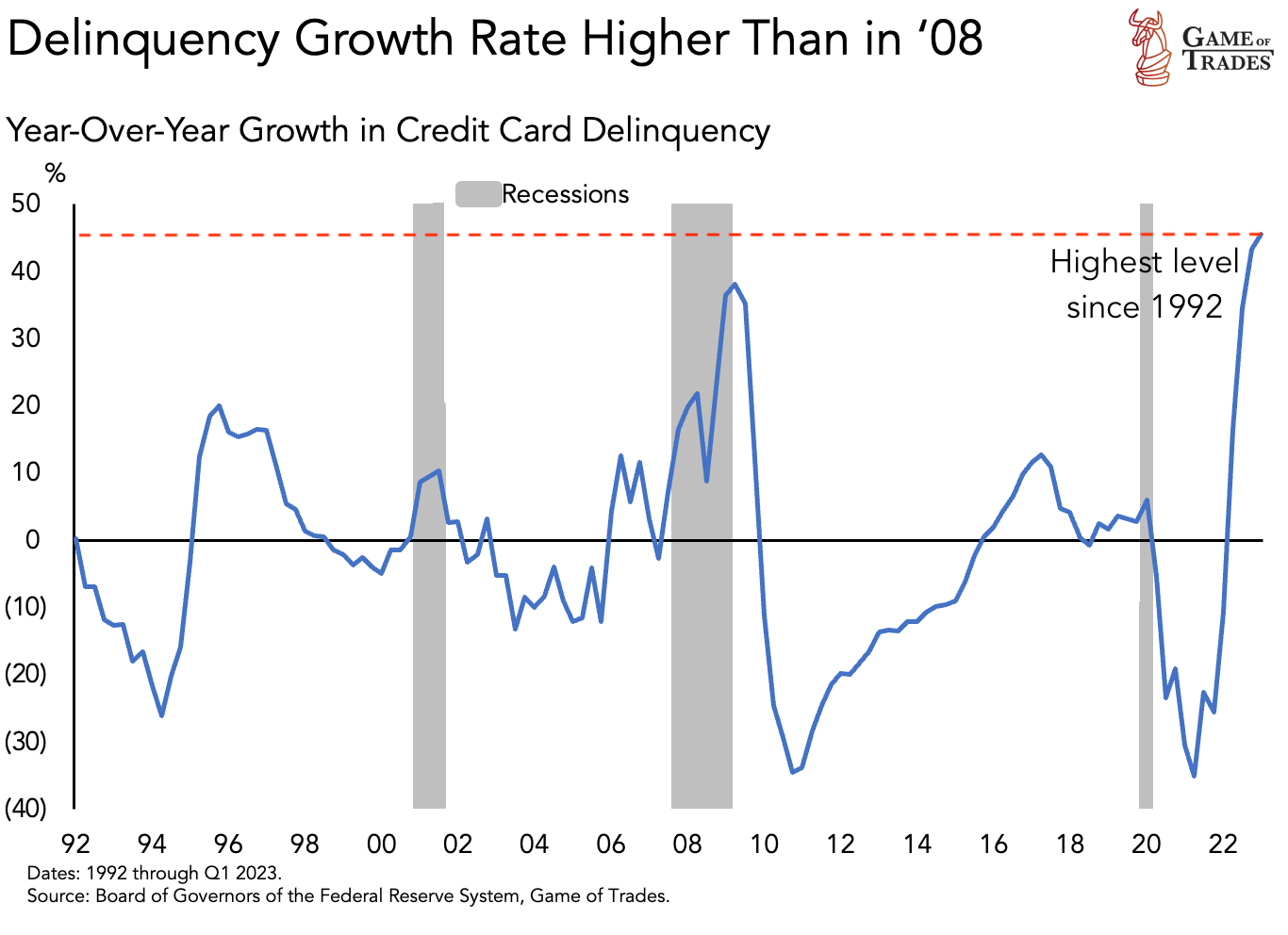

The surge in personal interest payments has a ripple effect, leading to higher delinquency rates on credit card loans. As of now, the low debt-to-service ratio is reflected in today’s relatively low delinquency rate of 2.5%, compared to the pre-financial crisis rate of 4.5%.

However, the current rate of increase in delinquency is the highest since 1992, indicating that the default rate is increasing at an unprecedented speed. If this trend continues, it could become a major warning signal in the coming months.

The Labor Market: A Pillar of the “Soft Landing” Narrative

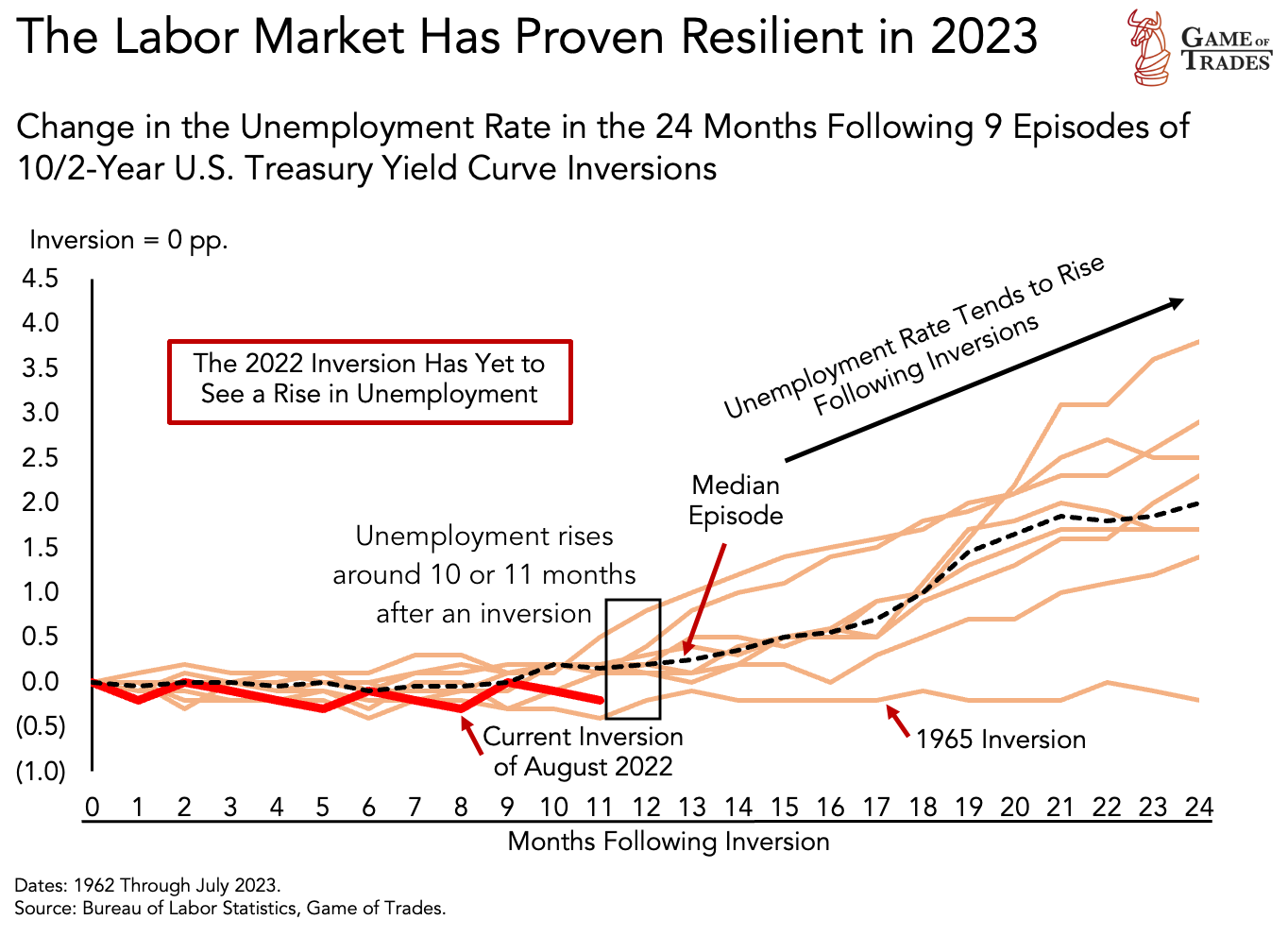

The strength of the labor market is another cornerstone of the “soft landing” narrative. Historically, the unemployment rate tends to rise around 10 or 11 months after a yield curve inversion. Yet, following the inversion in August 2022, unemployment remains low. The only instance when the labor market didn’t deteriorate after the yield curve inversion was in 1965, which resulted in no recession. If the labor market remains resilient, it could hint at a successful recession dodge in our current scenario.

The Uncertain Future of the Labor Market

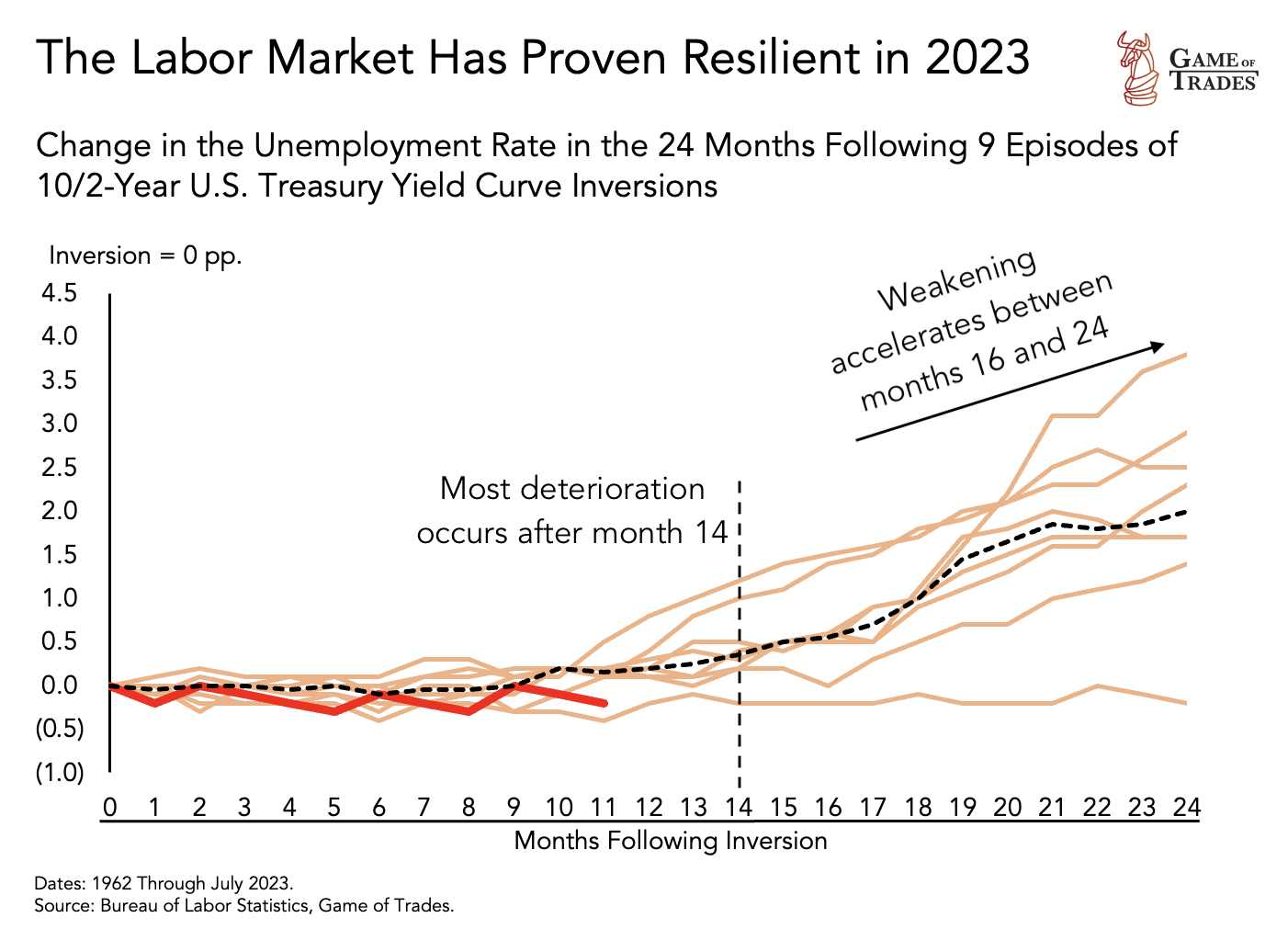

However, it’s premature to declare the labor market entirely out of the woods. The most significant labor market deterioration typically happens after the 14th month of the inversion, with a notable acceleration between the 16th and 24th month. We’re currently in the 12th month following the August 2022 yield curve inversion. If we follow historical trends, we might see unemployment rise above 4% by the end of 2023, approximately 15 months post-inversion.

Conclusion: A Potential Economic Turbulence Ahead

The combination of soaring personal interest payments and the historical behavior of the labor market following an inversion hint at possible economic turbulence ahead. Such an environment typically poses significant challenges for equities. While the “soft landing” narrative is currently prevailing, market participants need to remain vigilant and keep a close eye on consumer behavior and labor market dynamics as potential indicators of what lies ahead. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: The Looming Threat of Skyrocketing Corporate Interest Payments: Decoding the “No Recession” Scenario