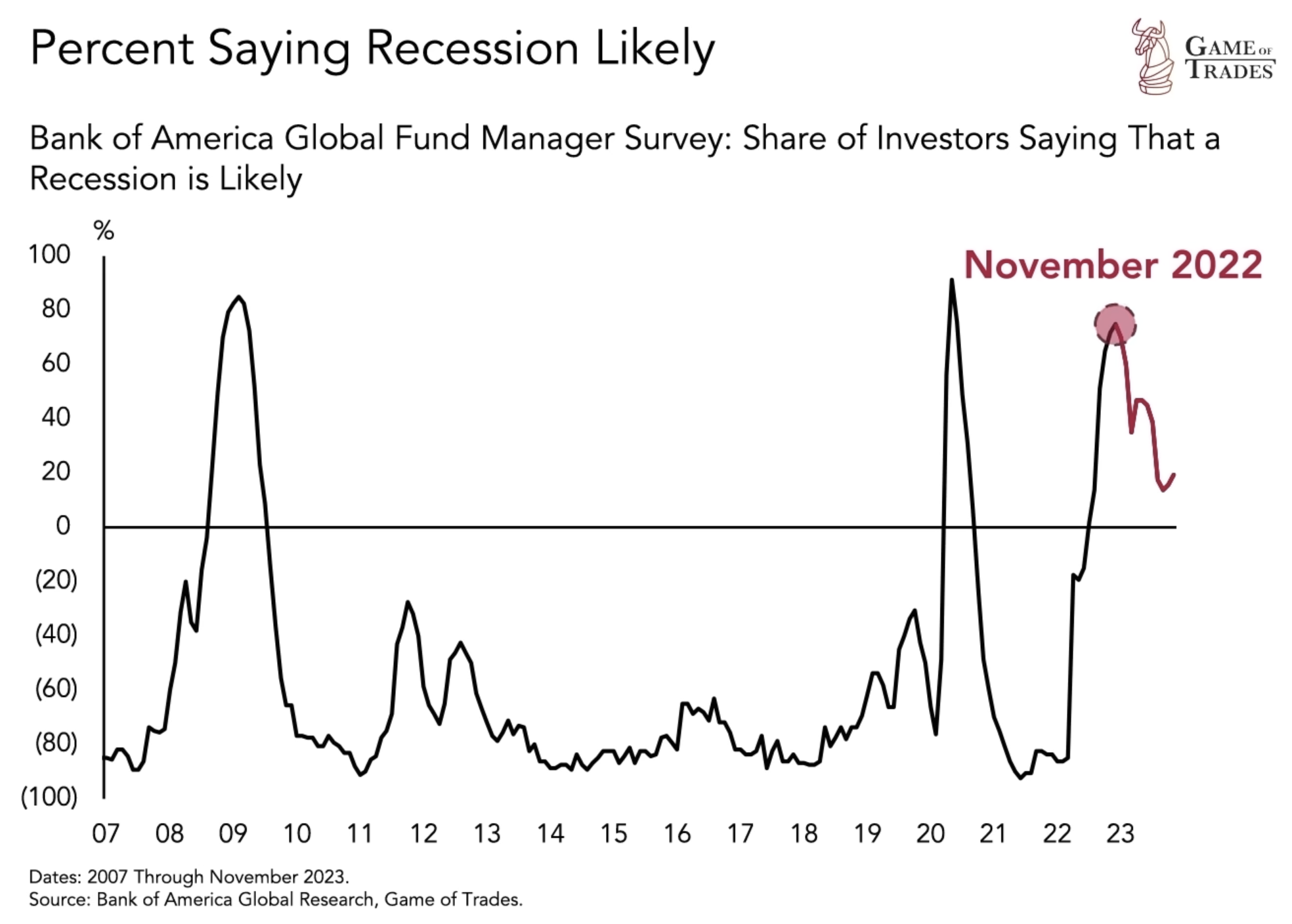

Recessions are inevitable in financial markets, often bringing high unemployment rates and economic contractions. Despite predictions of an impending recession in 2022, the economy has yet to experience one. Understanding the relationship between the housing market, unemployment rates, and lending standards can provide valuable insights into the likelihood of a recession in 2024.

The Link Between Unemployment and Recessions

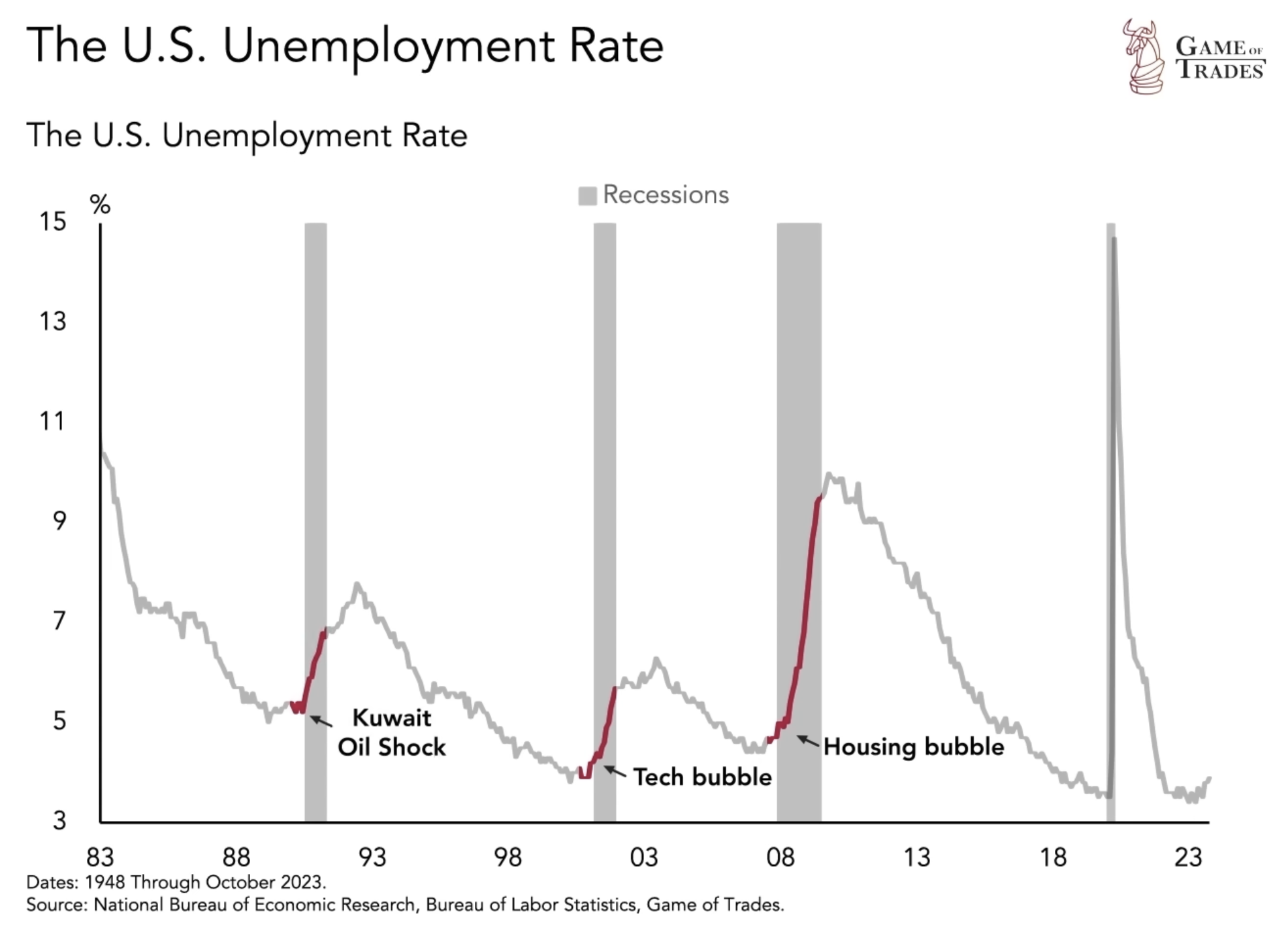

A recession is commonly defined as a period of economic decline characterized by rising unemployment rates. The National Bureau of Economic Research (NBER), an official organization that labels recessions, utilizes unemployment as a key metric. Historical recessions have been triggered by various economic shocks, such as the burst of the housing bubble in 2007 or the tech bubble burst in 2001.

The Predictive Power of the Housing Market

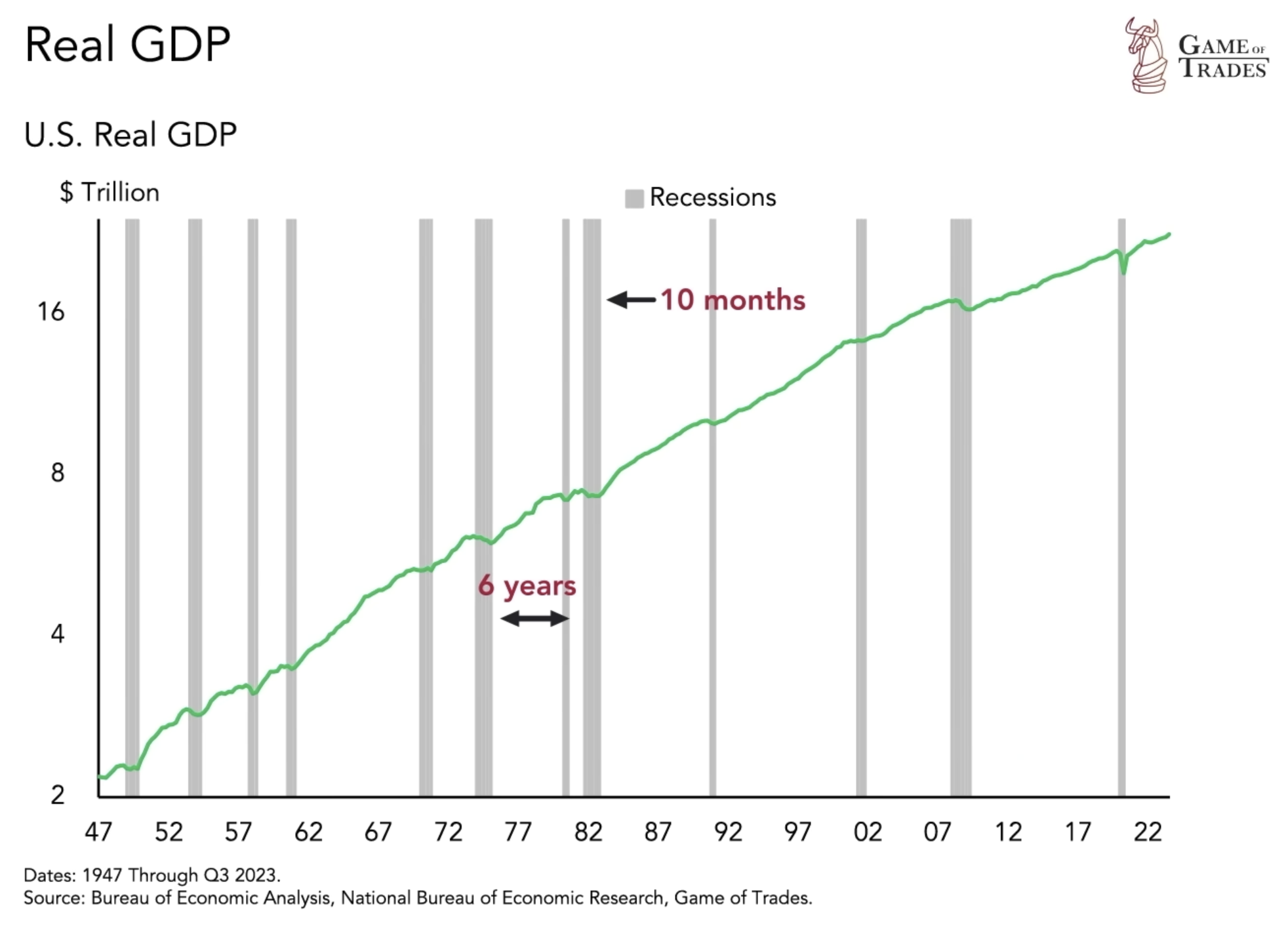

Since 1948, 12 recessions have occurred i.e., one every 6.25 years, and lasted about 10 months on average. In each recession, the housing market weakened leading up to the economic downturn.

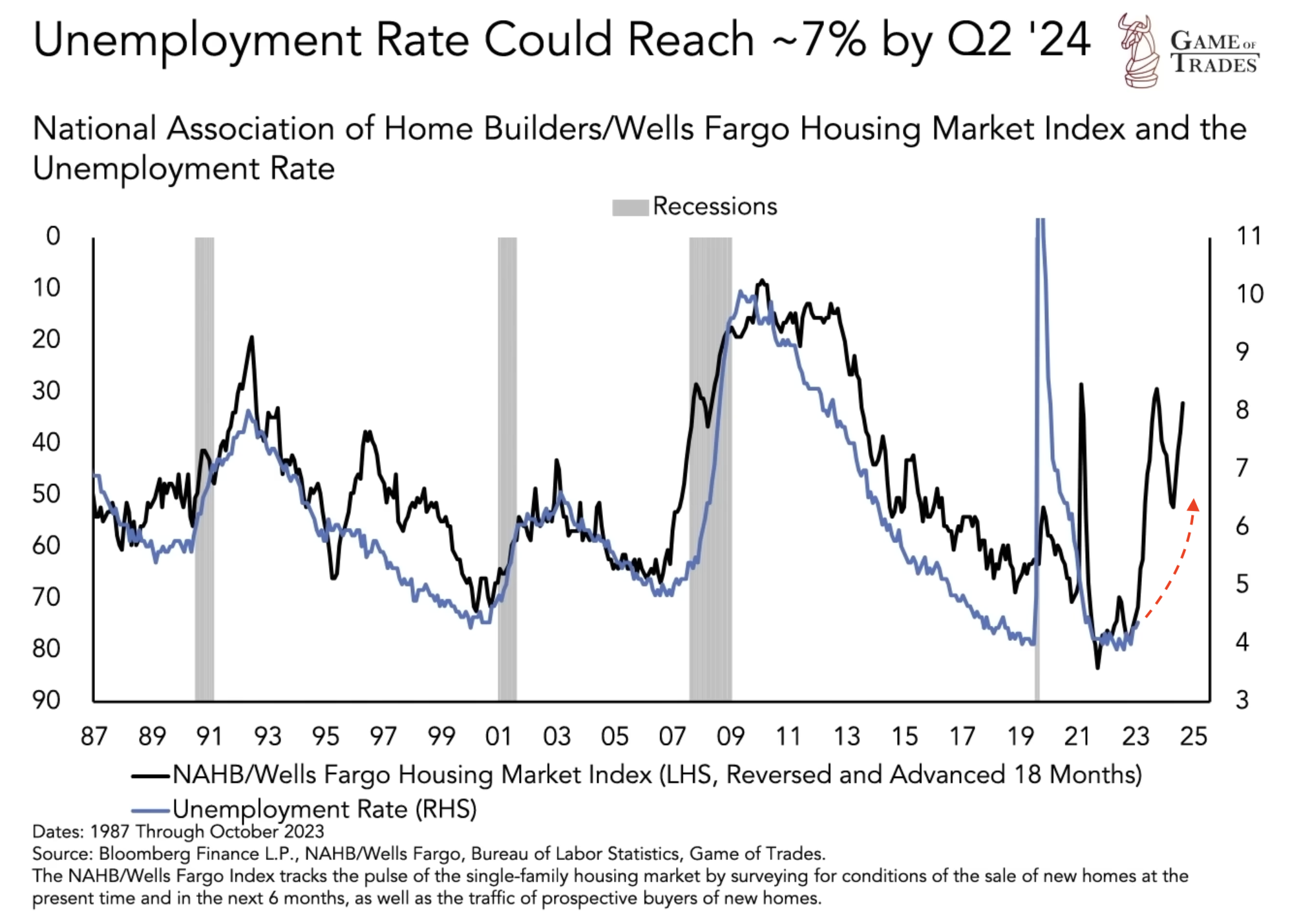

The housing market has proven to be a reliable predictor of future unemployment rates. By observing the housing market index with an 18-month lag, a strong correlation emerges. Currently, this relationship indicates a rising unemployment rate in 2024, favoring the possibility of a recession. However, it is essential to note that the housing market’s predictive power is not foolproof, as evidenced by the exception of 1996 when the housing market recovered despite low unemployment rates.

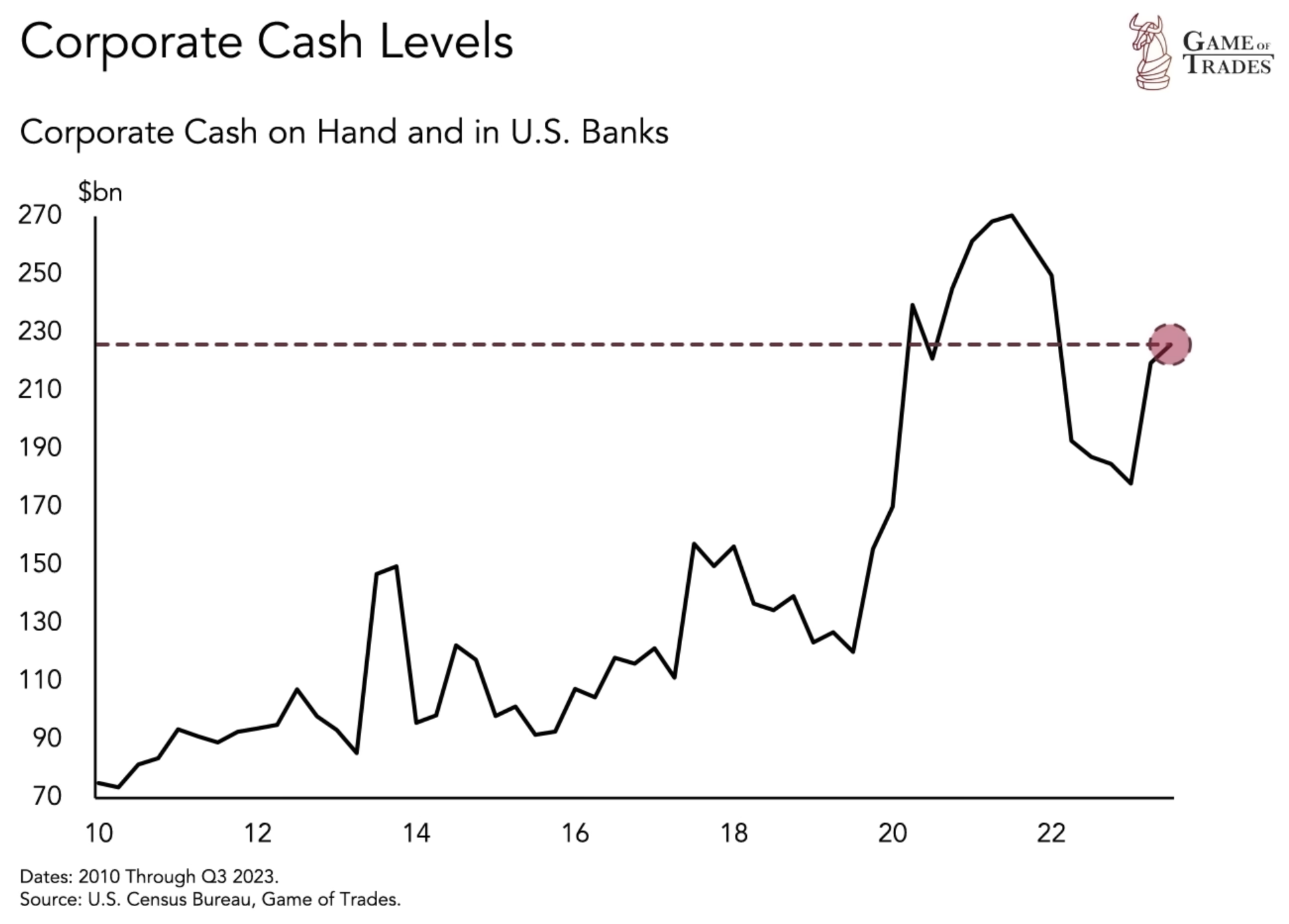

Corporate Cash Reserves as a Buffer

One factor that could potentially mitigate the impact of an upcoming recession is the substantial corporate cash reserves accumulated during the COVID-19 economic stimulus. US corporations currently hold around $200 billion in cash, thanks to the government intervention. These reserves played a crucial role in avoiding a recession during the 2022 oil shock. With cash levels remaining high, corporations have the ability to weather future turbulence, potentially reducing the severity of the next economic downturn.

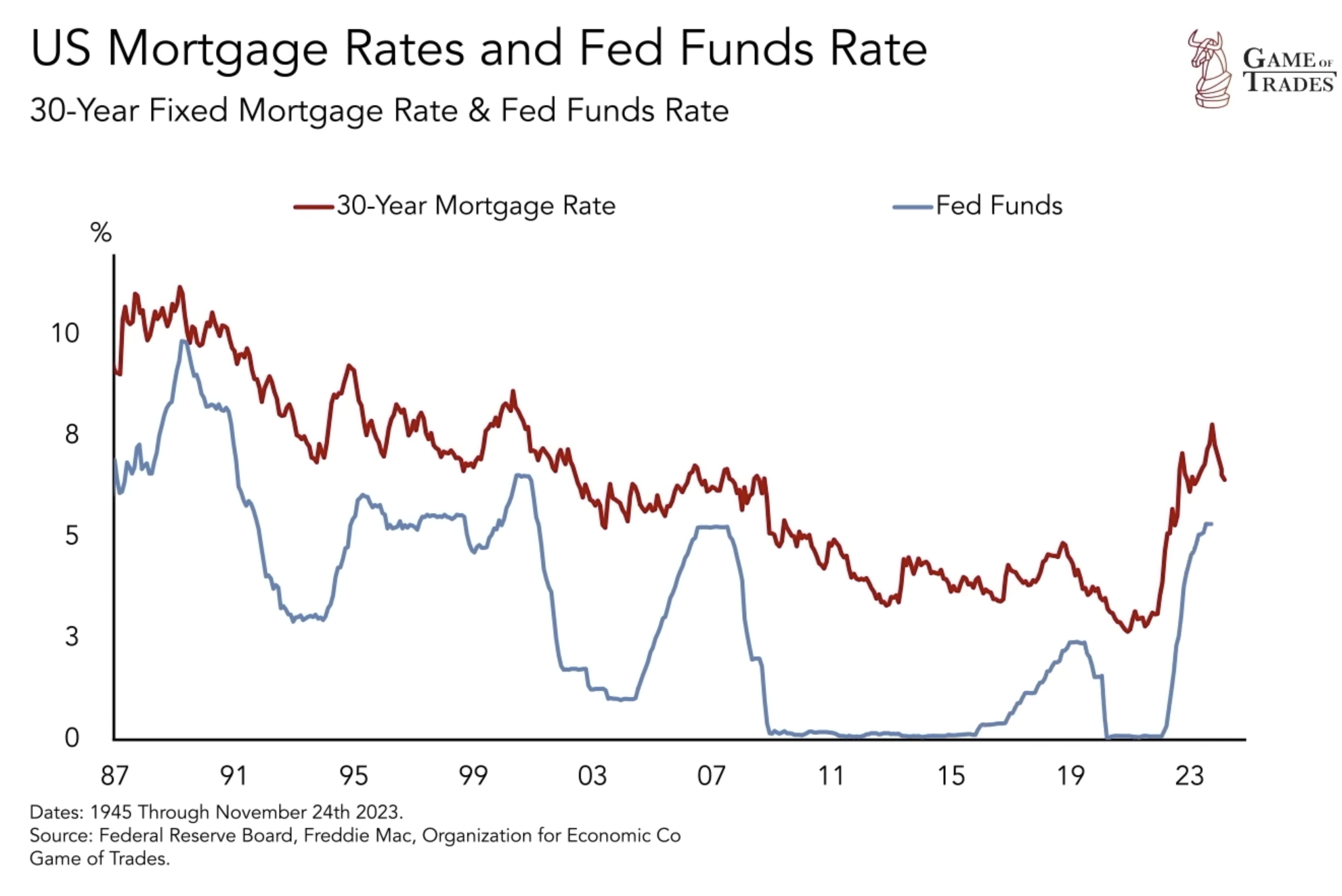

Influence of Mortgage Rates

The recovery of the housing market, a key indicator for the economy, is influenced by mortgage rates. Rising rates, often influenced by the Fed’s interest rate decisions, weaken the housing market, while falling rates can stimulate a rebound.

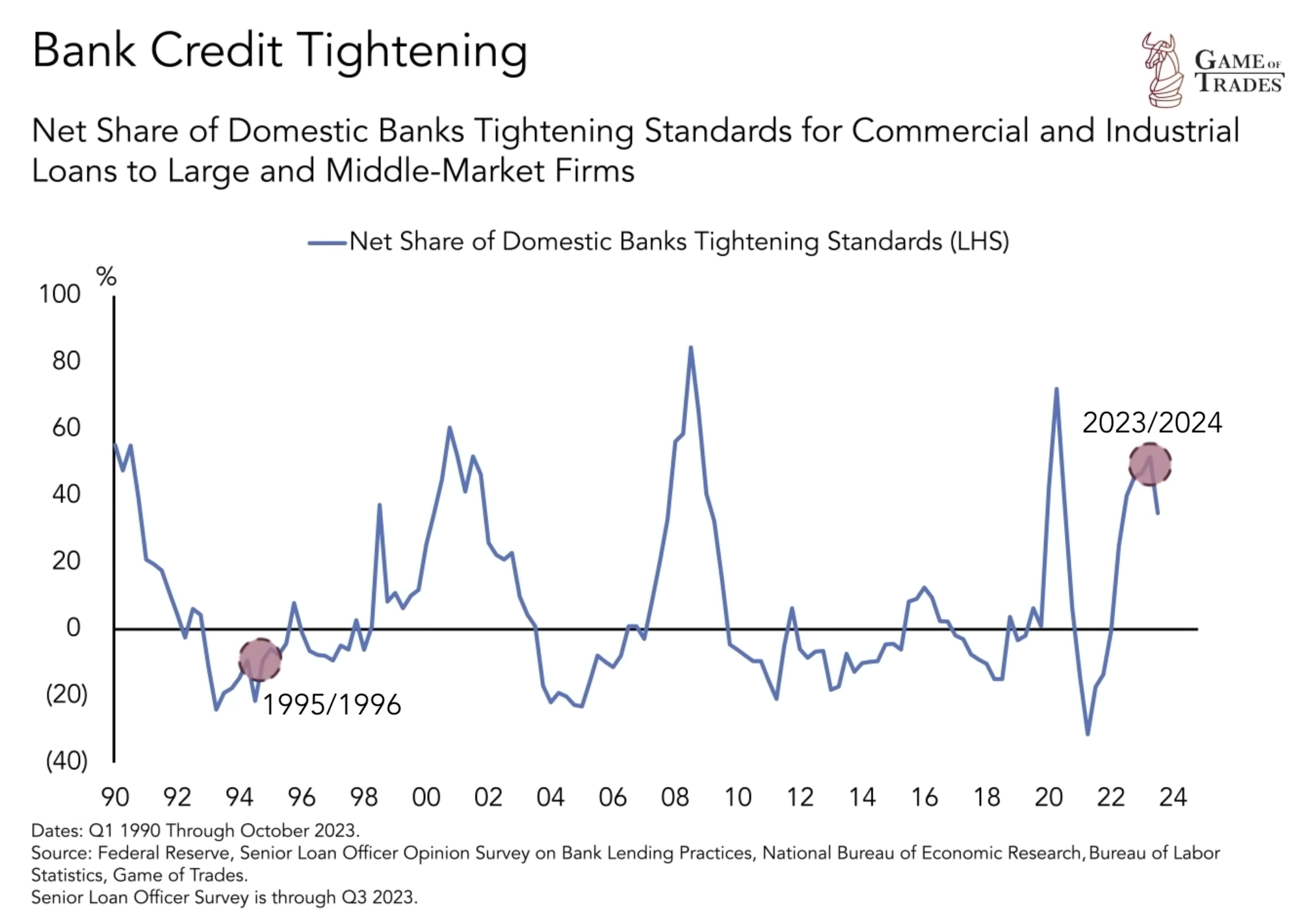

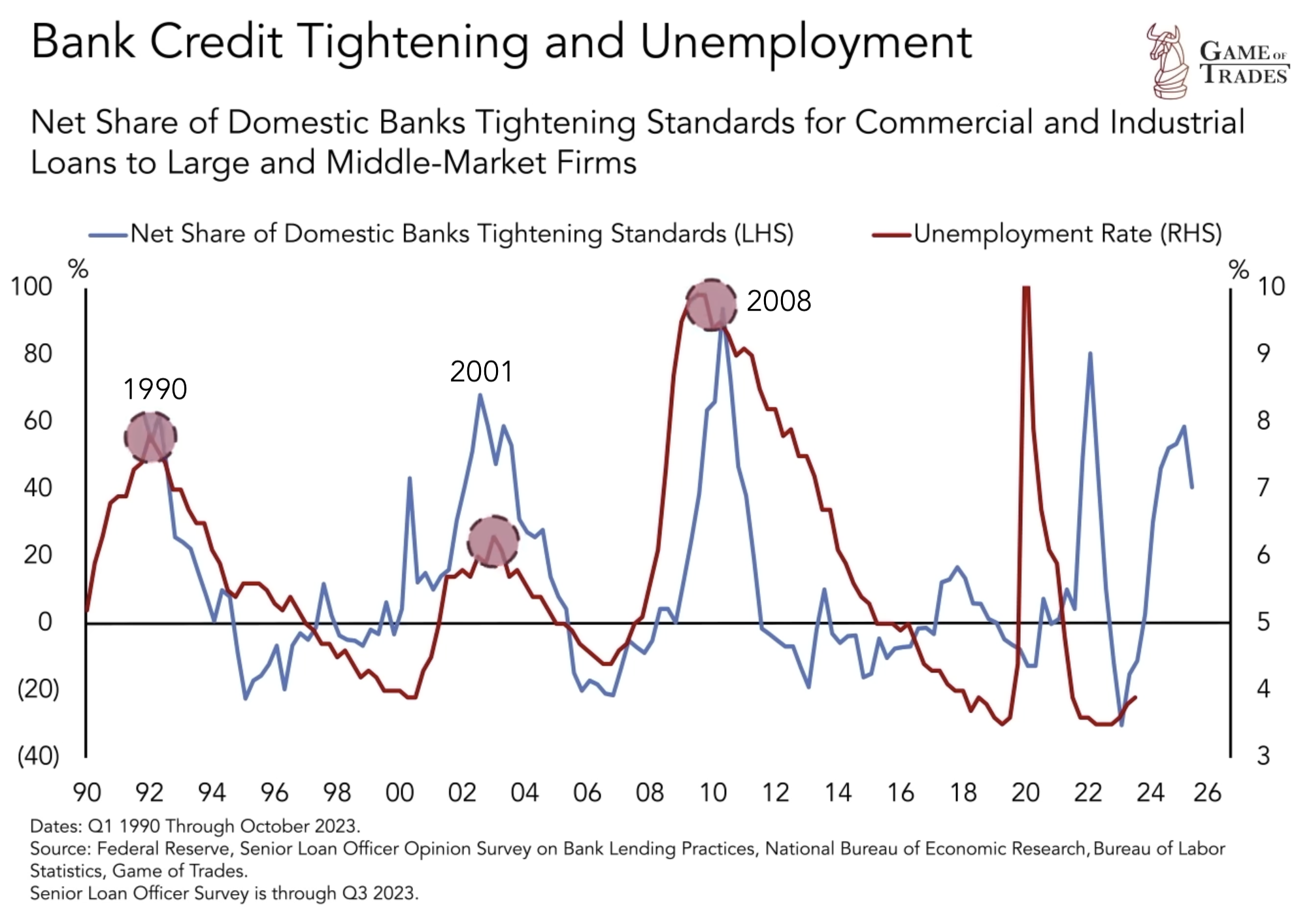

Importance of Lending Standards

A crucial distinction between the present situation and 1996 lies in the lending behavior of banks. Since early 2022, US banks have significantly tightened their lending standards, contrasting the more active lending environment of 1996.

Lending standards have shown a predictive relationship with the unemployment rate, with a lead time of 1.5 years. Historical data reveals that lending standards accurately anticipated the rise and peak of unemployment in 1990, 2001, and 2008. The ongoing trend of tightening lending standards suggests that the employment rate will rise in 2024, potentially peaking towards the end of the year.

Conclusion

While the stock market currently reflects an expectation of a soft landing akin to 1996, the evidence points to a significant possibility of a recession materializing in 2024. Factors such as the housing market, lending standards, and corporate cash reserves provide valuable insights into this potential outcome. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!