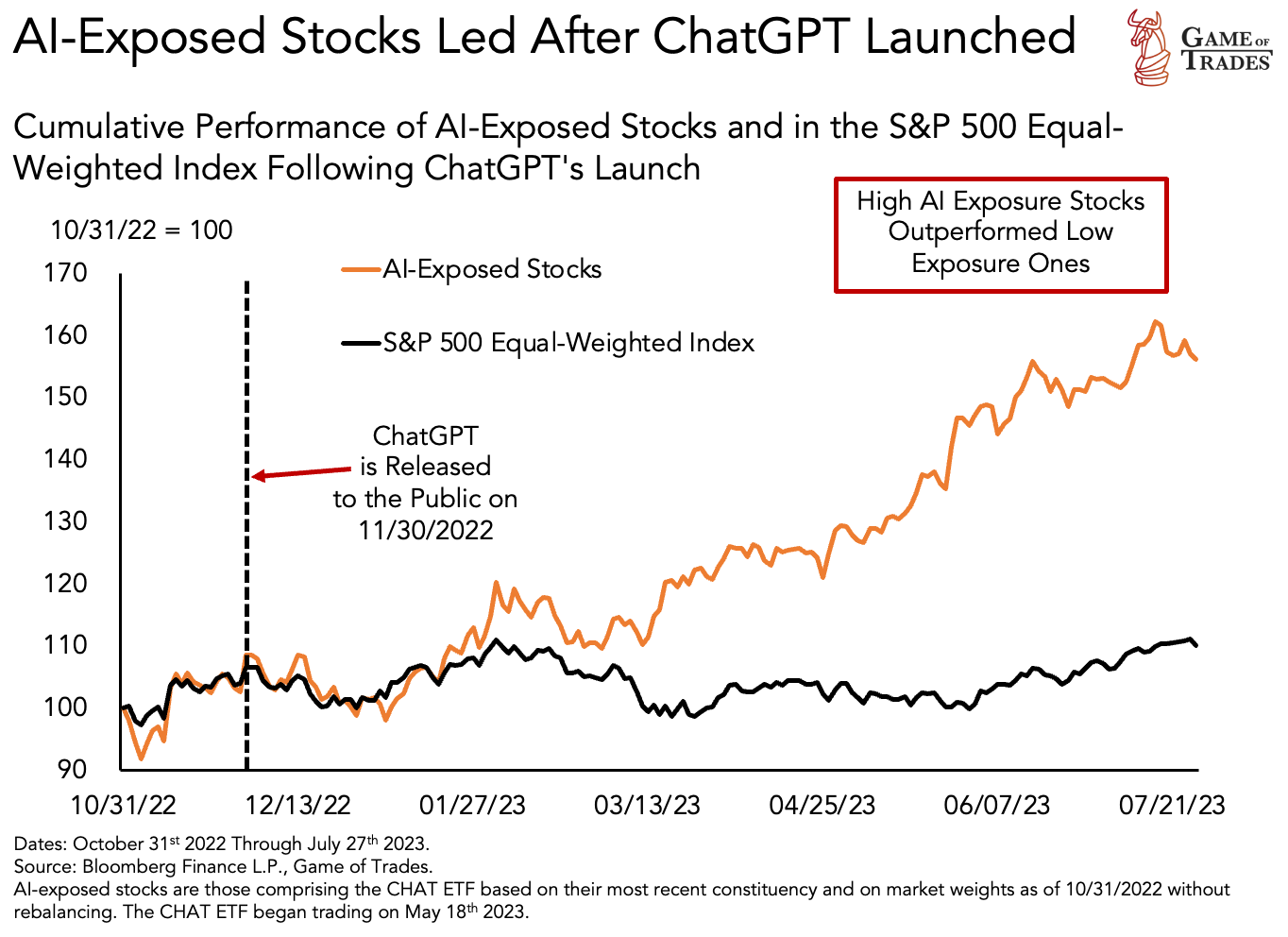

Following the release of Chat GPT by OpenAI in November 2022, the stock market has witnessed an unprecedented boom in AI-related stocks. These stocks have outperformed the broader market significantly, leading many investors to believe that the AI trade has already been factored into the financial markets.

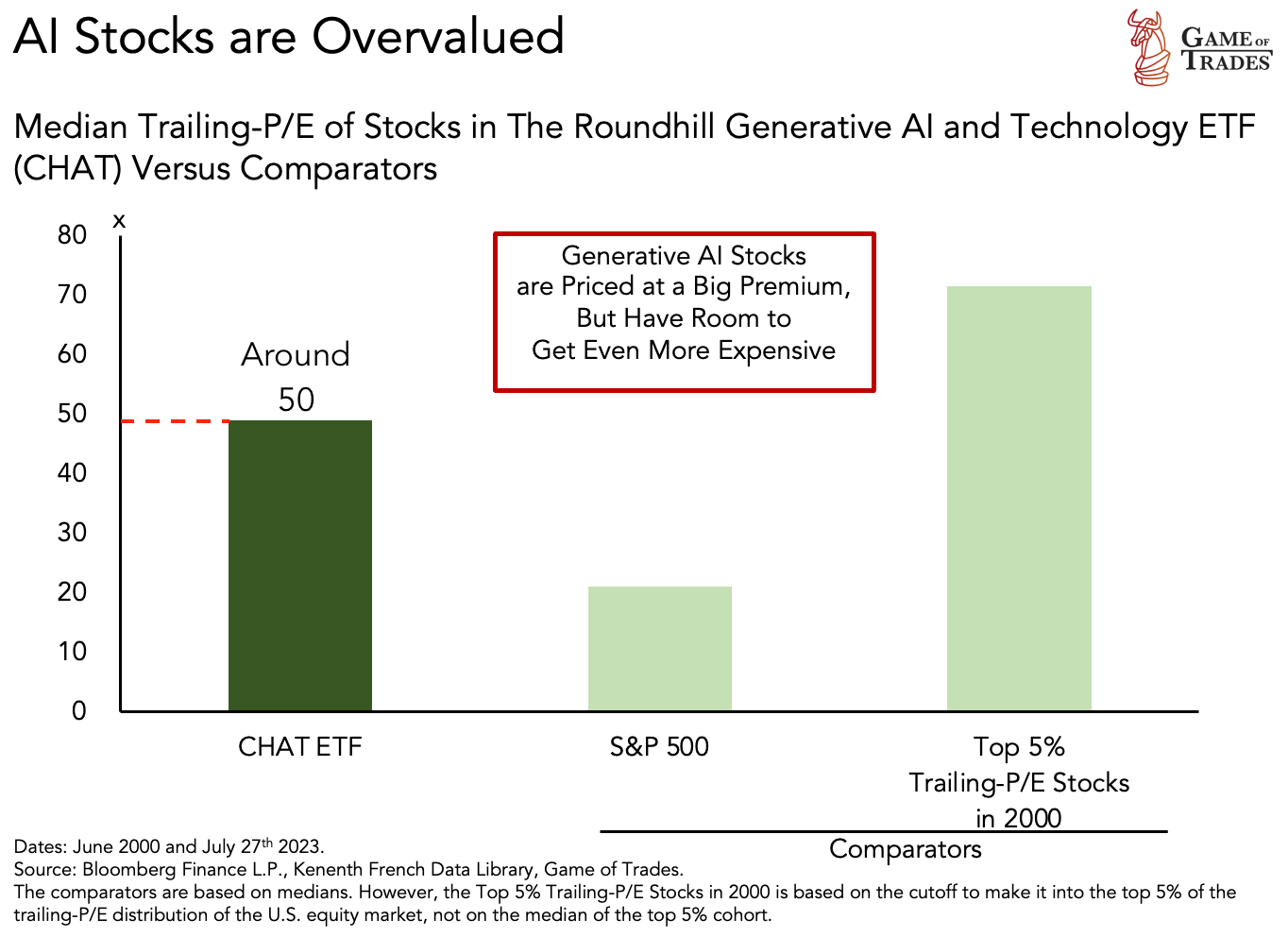

Currently, AI-linked stocks have a trailing Price-to-Earnings (P/E) ratio hovering around 50, a level reminiscent of the Dot Com bubble era. High valuations like this can expose investors to potential revenue shortfalls, which is a palpable risk in today’s AI-influenced market environment.

Long-Term Opportunities in AI

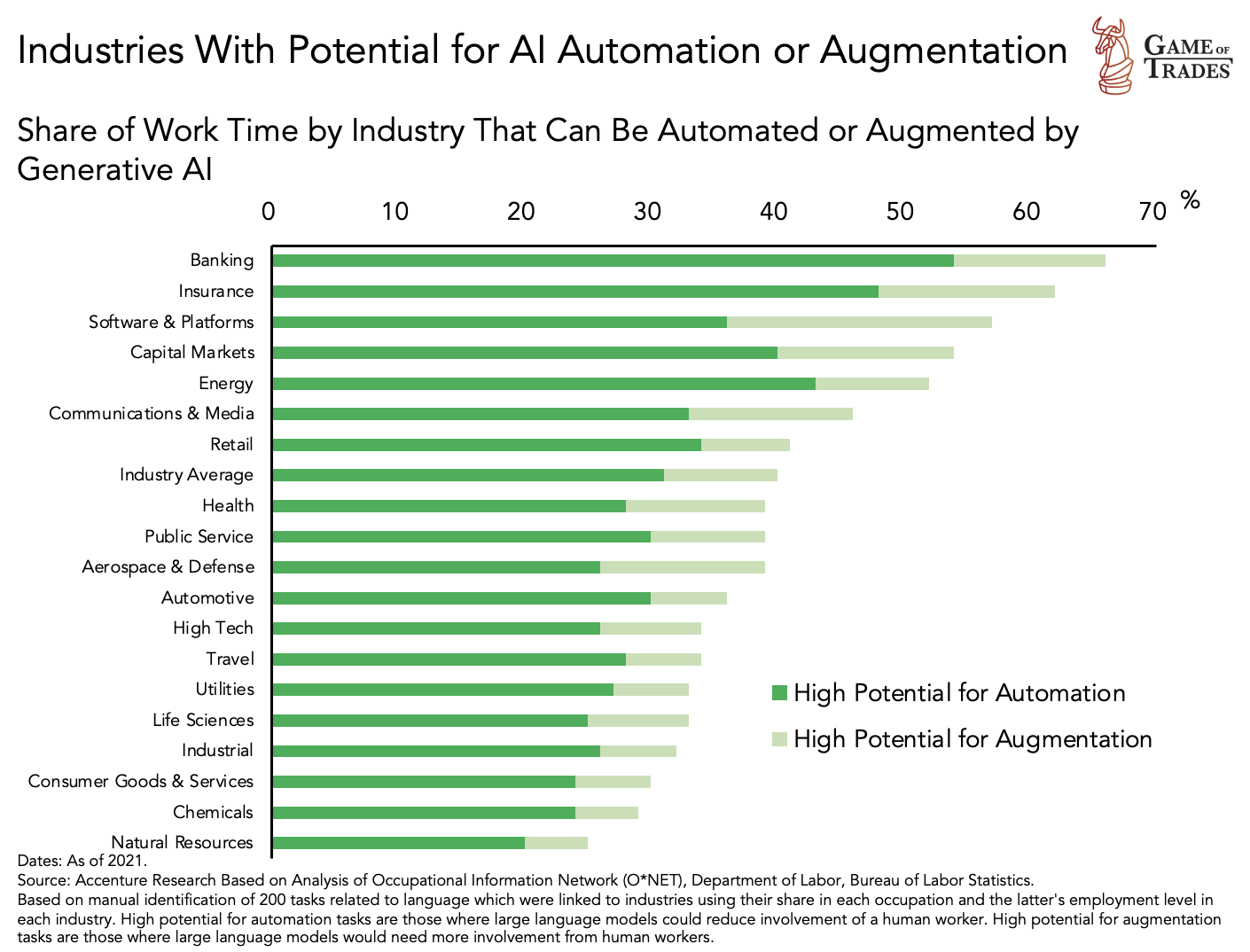

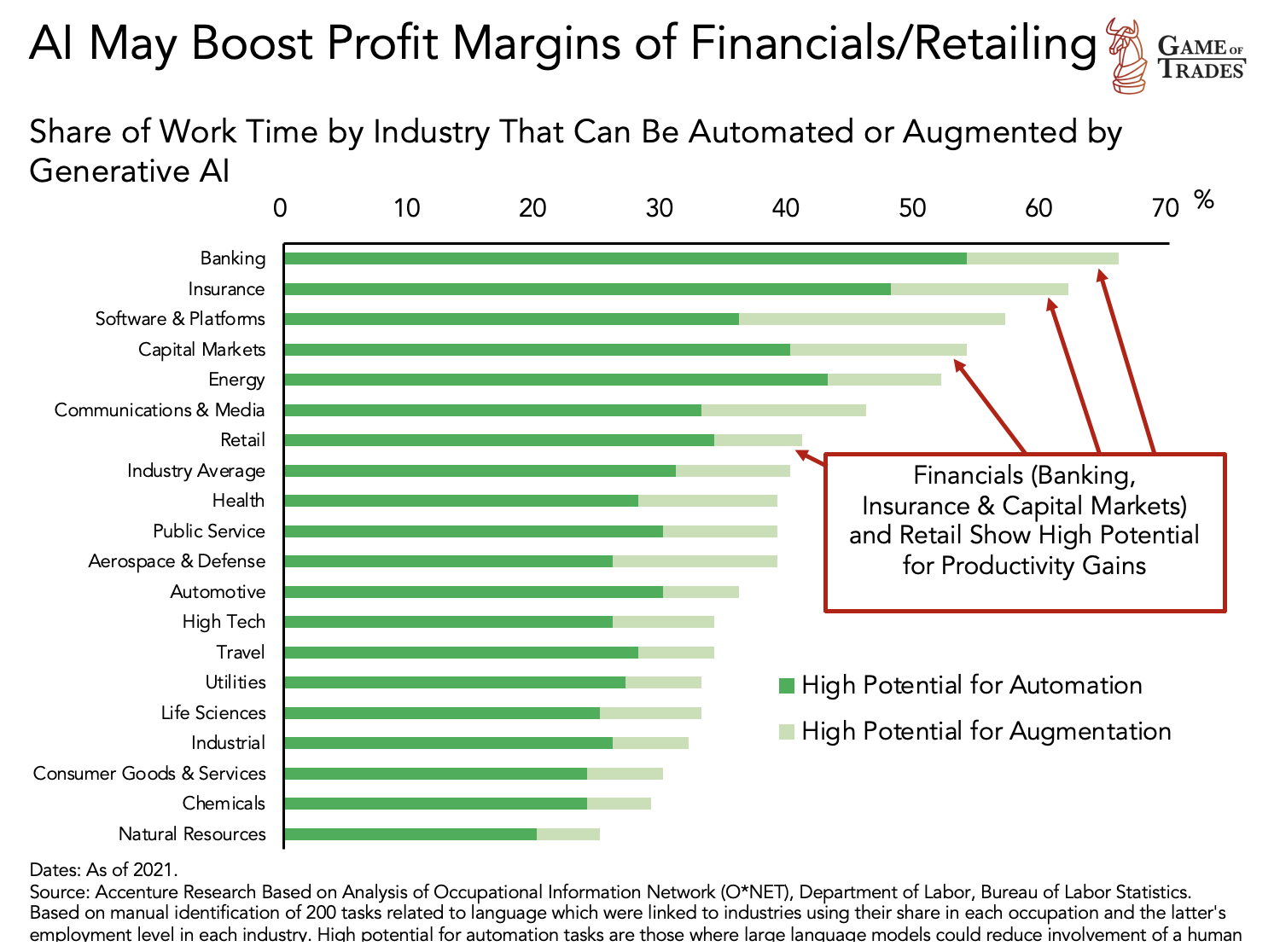

Despite the current hype and high valuations, the exuberance around AI technologies may just be the preamble to a more profound shift impacting both the economy and financial markets. This shift suggests that for patient, long-term investors, there are still numerous opportunities to explore in the AI sector. One such opportunity lies in the potential productivity surge from AI integration. A recent report by Accenture has identified 200 tasks suitable for AI automation or augmentation, implying that AI integration could significantly enhance productivity across various industries.

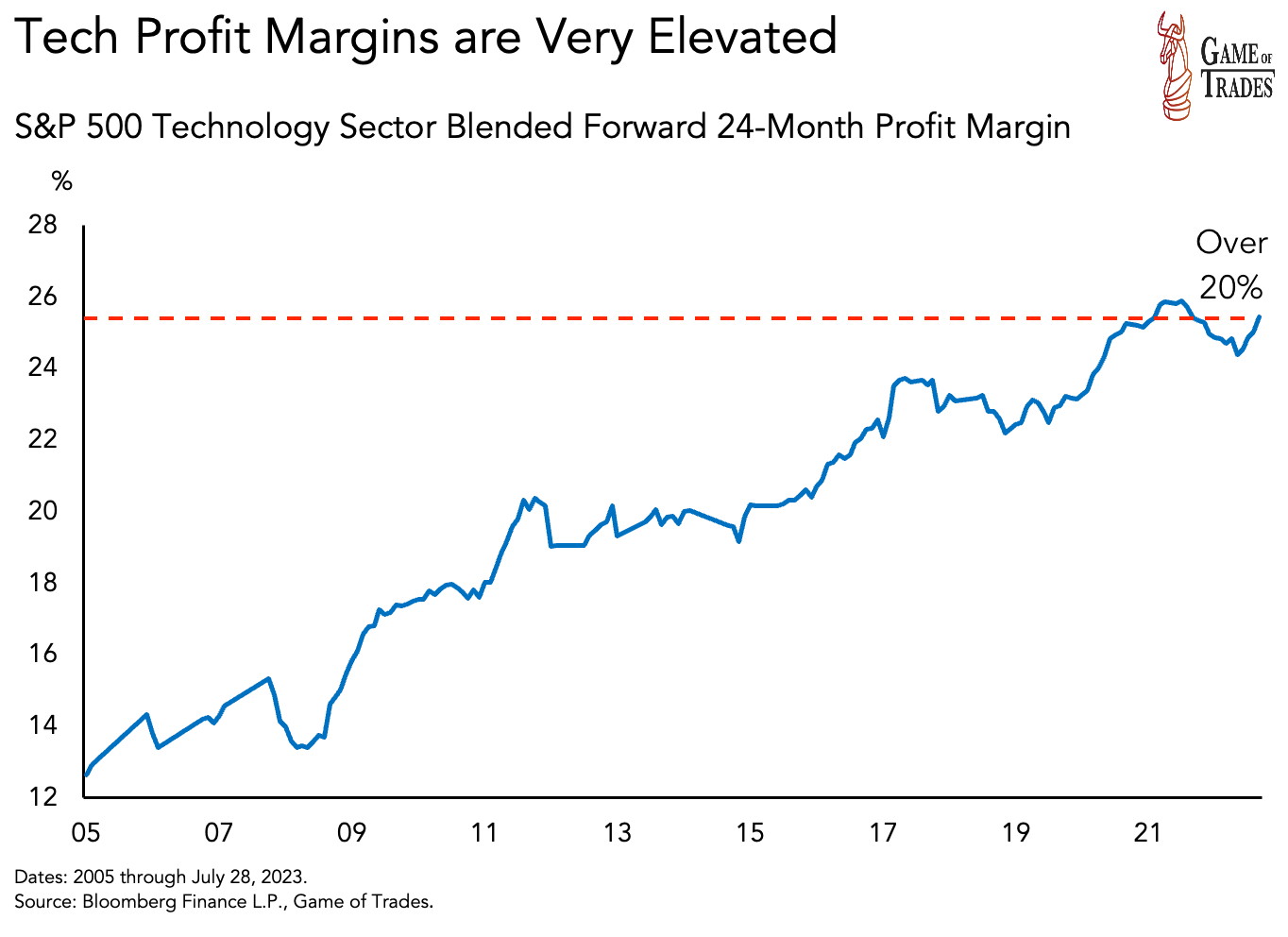

AI and Profit Margins

Since the late 1980s, much of the profit margin expansion has been concentrated within the S&P 500 Tech sector. With profit margins exceeding 20%, it’s makes sense that tech stocks have consistently outperformed other sectors since 2004. However, sectors like healthcare, consumer discretionary, and consumer staples haven’t seen comparable margin expansion over the past 10-20 years. This is where AI could act as a catalyst for change, driving profit margin expansion across these sectors.

AI Transformation in Key Industries

Industries such as banking, insurance, energy, retail, and healthcare form a large portion of the US GDP and the S&P 500. These industries have the potential to be AI automated or augmented by up to 40-50%, leading to significant efficiency gains and cost reductions. Although the odds of a recession are currently high, the potential of AI to drive profit margin expansion post-recession could be a bullish indicator for stocks, particularly in sectors that currently have low profit margins.

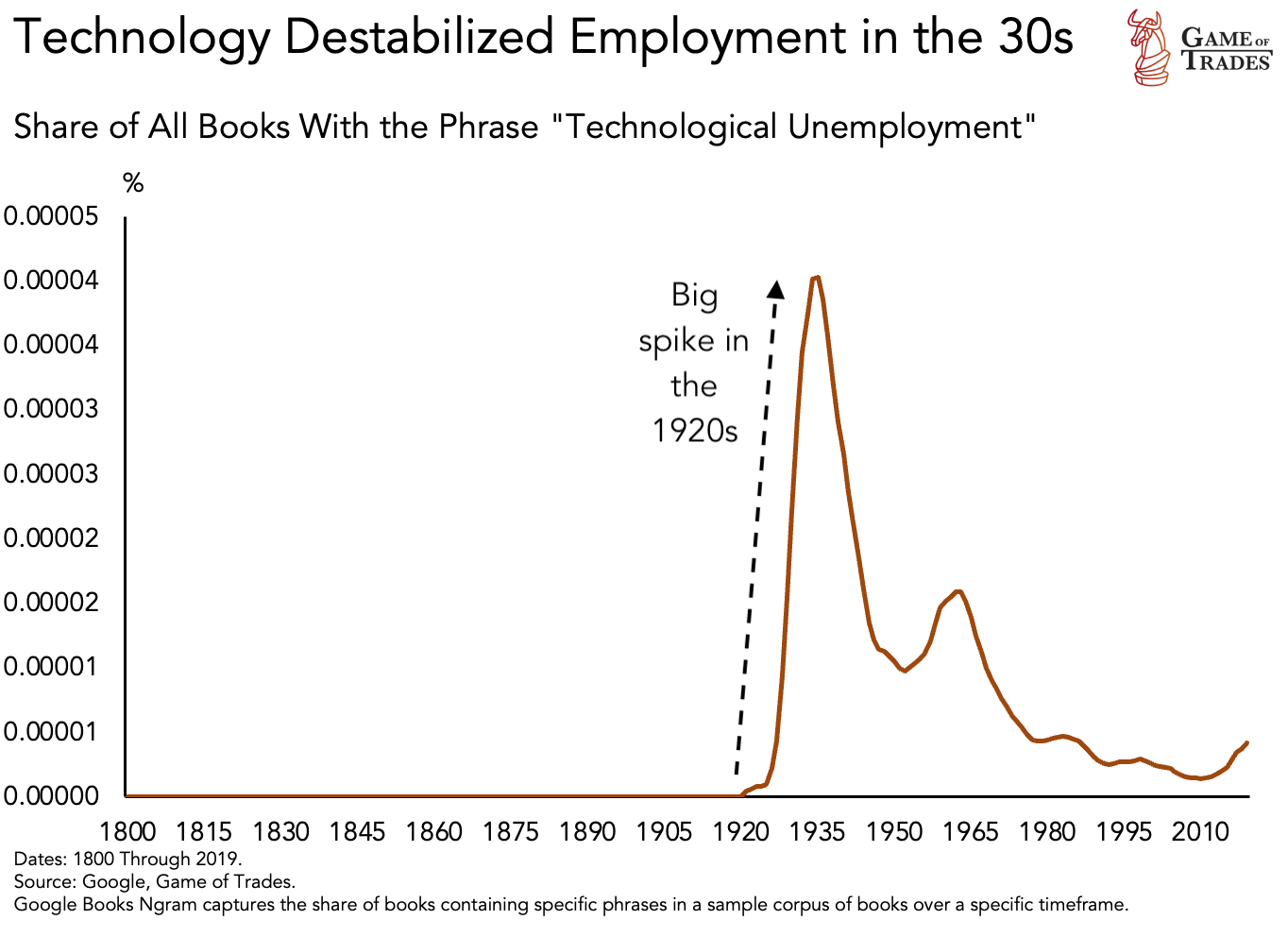

Technology’s Double-Edged Sword: Lessons from the 1920s

Historically, we’ve seen how technology can have transformative effects on various industries. In the 1920s, the advent of tractors, assembly lines, and supermarkets revolutionized the agriculture, manufacturing, and retail sectors respectively. However, history has also taught us that technological advancements can come with long-term risks. A significant workforce replacement with AI could lead to a surge in structural unemployment, a phenomenon that occurs when there is a mismatch between workers’ skills and the skills required by employers.

The Echoes of The Great Depression

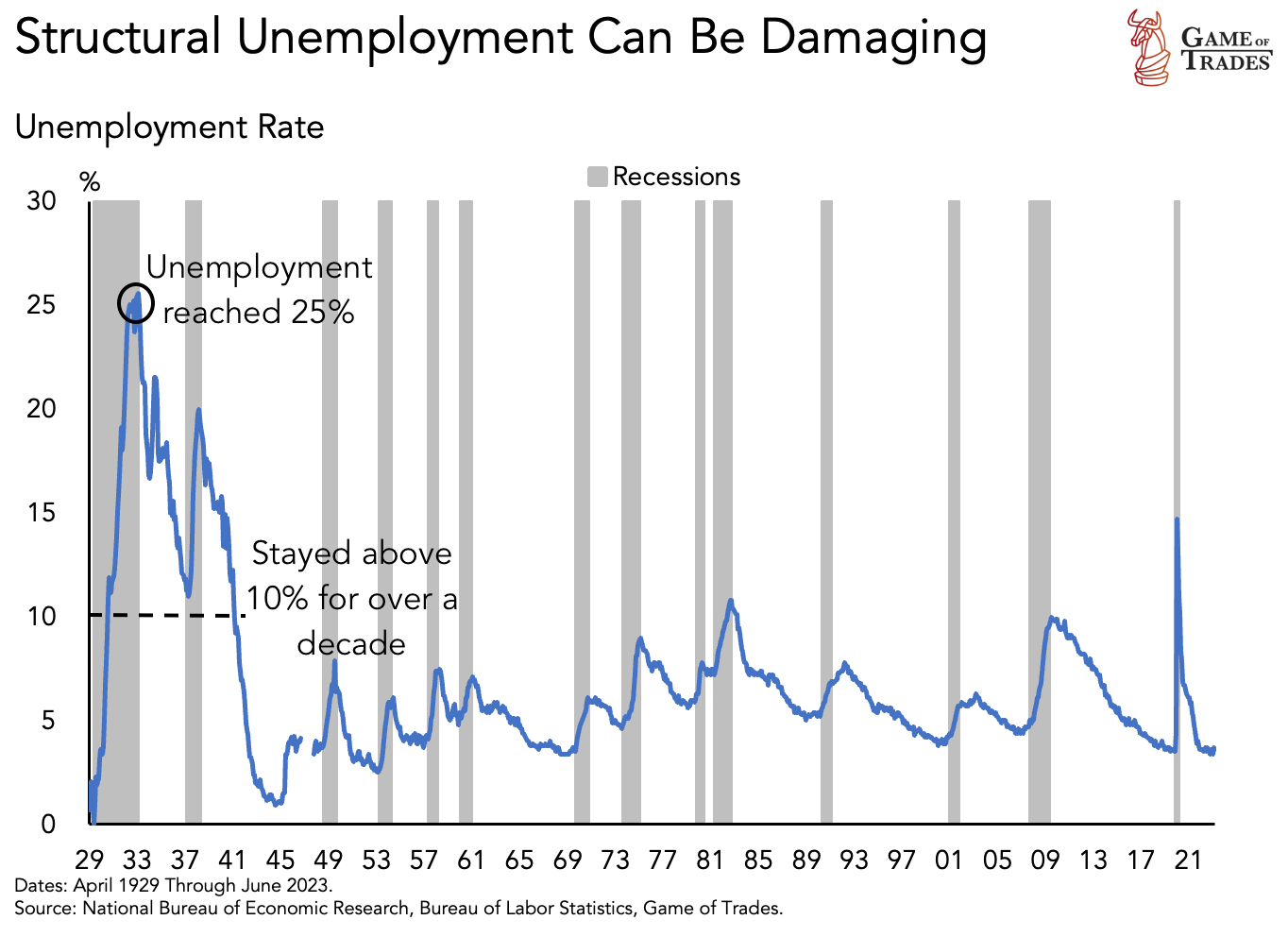

The last significant instance of structural unemployment occurred during the Great Depression, triggered by the very technologies that fueled the optimism of the 1920s. New machinery and assembly lines replaced numerous jobs, leading to a surge in “Technological Unemployment”. At its peak, the Great Depression saw unemployment reach a staggering 25%, with the rate staying above 10% for over a decade. During this period, the Dow Jones Industrial Average plummeted by over 80%.

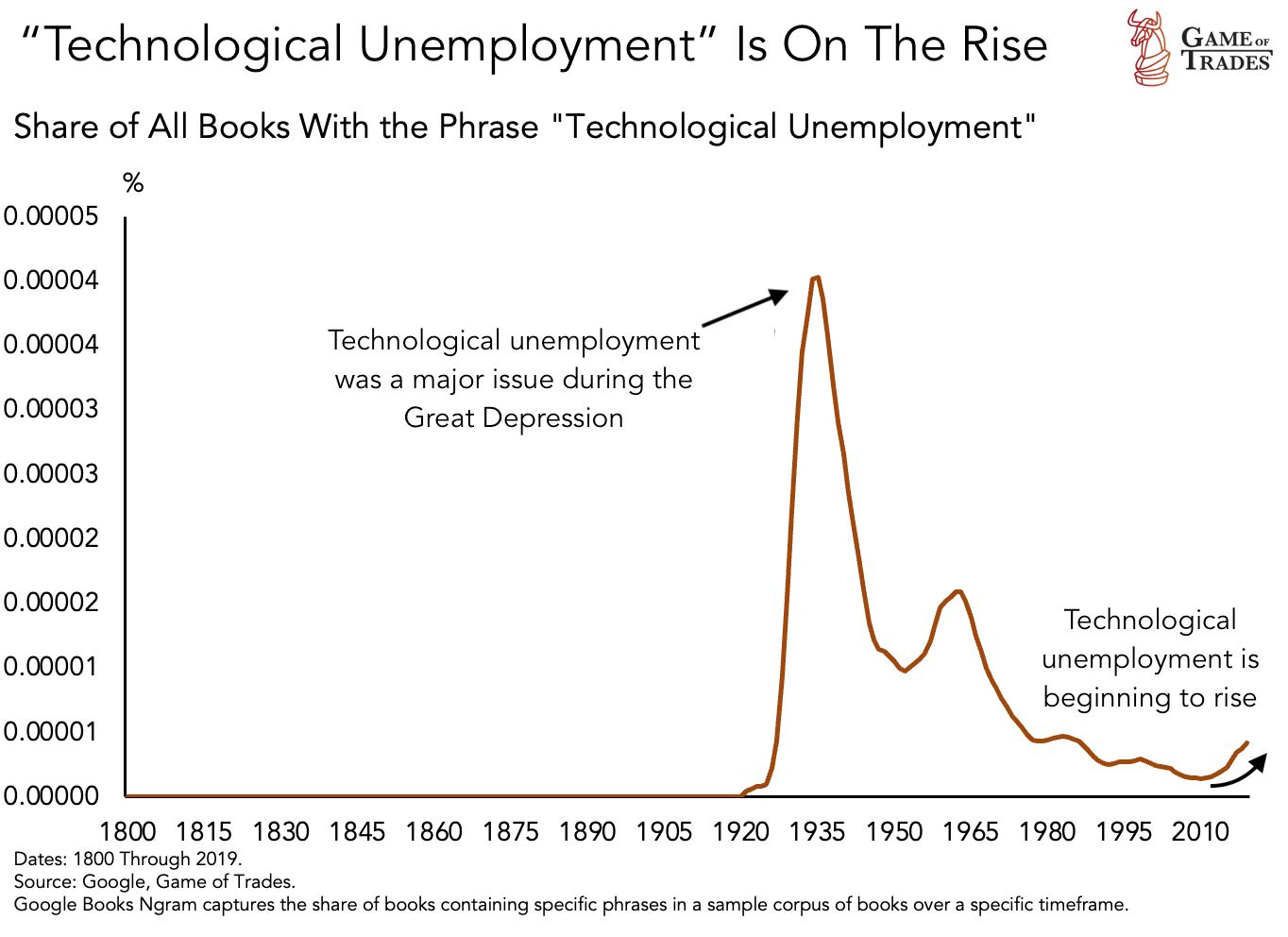

The Future: Technological Unemployment and AI

Since 2010, “Technological Unemployment” has emerged as a pressing concern once again. While AI promises productivity boosts and improved living standards, it also poses a potential threat to the labor market, reminiscent of the Great Depression.

It is crucial to remember that big technological shifts often induce significant economic transformations. The AI narrative has become a mainstream conversation, which could have major implications for long-term growth in the labor market. As we navigate this new frontier, it’s vital for investors to consider how to capitalize on, and guard against, the potential tidal shifts that AI could bring. Click here to get free trial for 7 days! Subscribe to our YouTube channel and Follow us on Twitter for more updates!

Read more: The Rising Tide of Corporate Bankruptcies Amidst High Interest Rates