This week was FOMC week, and the Federal Reserve announced a 0.75 basis point rate hike in line with market expectations. We will be posting a tactical update following the weekly close that will be covering:

- September Fed meeting conclusions and how the financial markets have interpreted what was said.

- Inter-market dynamics and how they are impacting the broad market and specific sectors.

- Internal market dynamics, including market breadth, and how top components are leading or lagging.

- Relative sector performance and where opportunities currently stand.

- Recent key technical developments in the equity markets.

- A quick review of some macro dynamics currently at play.

Here is today’s Youtube video:

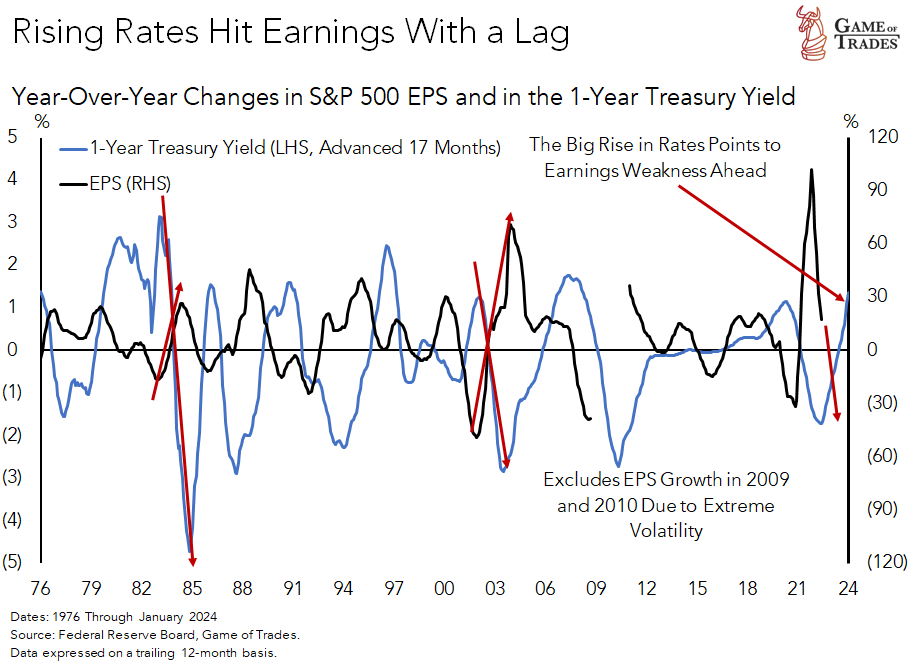

Is the team suggesting the effect on earnings is likely to be 3Y from start of tightening and 1.5Y from end of tightening per the 2004-8 example shown in the video or effect lags 1.5Y from start? Thanks as always

Since mid-September, both US02Y and US10Y have further risen drastically, what were actually the major driving factors, other than the earlier unexpectedly hot core inflation reading, for this short-term move? What the FED said to the press a few days seemed nothing particularly surprising to the upside for yields.

The important figures here are:

2022: Fed Funds Rate is projected to hit 4.4% in 2022 up from 3.5% in June.

2023: Fed Funds Rate is projected to hit 4.6% in 2023 up from 3.8% in June.

2022: GDP growth is set to grow at only 0.2% down from 1.7% in June.

2023: GDP growth is set to grow at only 1.2% down from 1.7% in June.

Inflation projections have been raised across the board.

Inflation is not set to reach its target until 2025.

Great analysis on delayed rate effect on earning. What about strong dollar? S&P companies have 40% earnings from overseas. Strong dollar impact on earning should be immediate. Have you looked into this?

Can you please share the details of your tightening-eps causality? What causality tests did you perform? Did you try negative lags? Do you have phase plots of the lagged variables?

Thank you for posting the youtube video.