We have four new setups this week, while COPX was removed from the pending list given a break below its primary upward trendline.

New Setups

- NVDA

- IWM

- XLI

- KRE

Asset Classes

Equities

- Nvidia Corp (NVDA): New Setup

Equity ETFs

- iShares Russell 2000 ETF (IWM): New Setup

- SPDR S&P 500 Industrials ETF (XLI): Net Setup

- SPDR S&P Regional Banking ETF (KRE): New Setup

- Global X Copper Miners ETF (COPX): Pending>Monitoring (The primary trendline was broken making the potential bullish setup invalid).

- iShares MSCI Brazil ETF (EWZ): Pending

Fixed Income ETFs

- iShares 20+Year Treasury Bond ETF (TLT): Pending

Equities

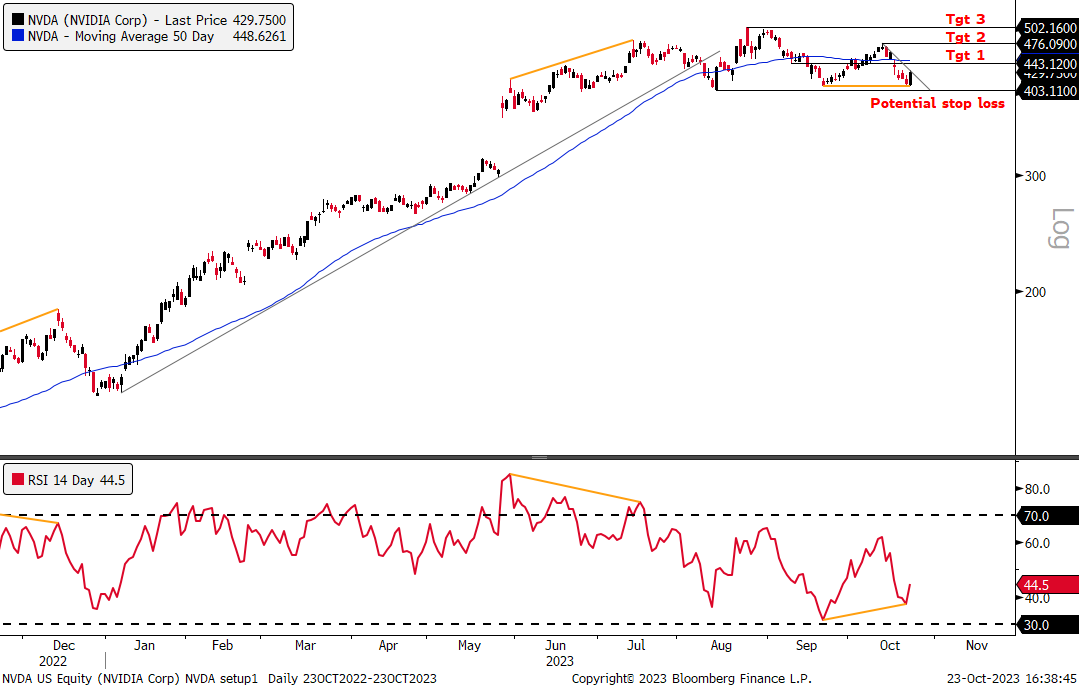

New Setup: Long Nvidia (NVDA)

-Bullish divergence setup with price making lower low and RSI higher low in October compared to end of September. The divergence is not as strong, with price only slightly undercutting the September low level.

-A break above the short-term trendline from mid-October would activate the buy signal.

-Price has been able to find support around the $410 area for the third time in the past three months.

-Target 1 aligns with the 50-DMA, while target 2 would see price hit the October high. Target 3 would see price hit a new all-time high.

-A potential stop loss is placed at the local low in August.

Equity ETFs

New Setup: Long iShares Russell 2000 ETF (IWM)

-Bullish divergence setup as price made lower low and RSI higher low in late-October compared to beginning of October.

-A break above the downtrend line from beginning of September would activate the buy signal.

-Target 1 aligns with horizontal resistance, while target 2 is near the 50-DMA. Target 3 also aligns with a key horizontal resistance level.

-Macro Catalyst: Small caps have bared the brunt of the market correction in the last couple months, down 17% since their local top in July. Any year end rally in markets could benefit small caps given the extent of recent underperformance.

-A potential stop loss is placed at the October 2022 lows.

New Setup: Long SPDR S&P 500 Industrials ETF (XLI)

-Bullish divergence setup with price making lower low and RSI higher low in late-October compared to beginning of October.

-A break above the downtrend line from the end of August would activate the buy signal.

-Target 1 aligns with horizontal resistance, target 2 with the 50-DMA, and target 3 with horizontal resistance

-Macro Catalyst: A reversal lower in the dollar would help industrial stocks given their larger revenue generation abroad.

-A potential stop loss is placed near the May and June lows.

New Setup: Long SPDR S&P Regional Banking ETF (KRE)

-Bullish divergence setup with price making lower low and RSI higher low in late-October compared to beginning of October.

-A break above the downtrend line from August would activate a buy signal.

-Target 1 aligns with the 50-DMA, while target 2 with key horizontal resistance and is also close to the 200-DMA. Target 3 would see price rise to the highs in July.

-Macro Catalyst: If interest rates consolidate or move lower, regional banks could see some relief

-A tight potential stop loss is placed slightly below current levels.

Long: iShares MSCI Brazil ETF (EWZ)

-EWZ has been consolidating since it broke its 2023 uptrend. It recently printed a bullish divergence, potentially suggesting that the consolidation is losing steam and the uptrend is poised to pick back up

-A break above the downwards trendline capturing the two recent peaks would confirm that the price consolidation is done and set the ETF up for more upside, triggering the trade

-Macro Catalyst: a weakening of the dollar reflecting easing concerns around the global economy would propel Brazilian stocks higher given their exposure to China and the commodity cycle.

-A potential stop loss could be placed around the $30.75 mark. Price revisiting this level after a break above the trendline would likely negate any bullish development.

Fixed Income ETFs

Long: iShares 20+ Year Treasury Bond ETF (TLT)

-Price is trending within a tight downwards channel. It has recently hit a deeply oversold reading

-Short-term bullish divergence has formed with the RSI indicating that the downwards momentum is fading

-A break above the price channel could trigger the trade and a potential meaningful reversal of TLT back to key levels of resistance above

-Macro Catalyst: Weakening of U.S. economic data or an acceleration in geopolitical concerns would see investors seek out safe haven assets like Treasuries.

-A stop loss placed under $85 would ensure that the trade is stopped out and limit losses in the event that a breakout above the short-term price channel fails to hold

Was über stopped out today?

Yes, I saw it in the active trades with a remark that it was stopped out

[…] Long NVDA […]