Many of our pending setups have either been activated or moved back to a monitoring status given the significant weakness in markets last week.

We have two new setups this week, while AMZN, GOOG, ADBE and XLE turned active.

New Setups

- Walmart Inc. (WMT)

- Copper Future

Asset Classes

Equities

- Walmart Inc. (WMT): New Setup

- Amazon.com Inc. (AMZN): Pending→Active (Turned active September 20)

- Bank of America Corp (BAC): Pending→Monitoring (Divergence was burned through as both RSI and price made lower low).

- Alphabet Inc. (GOOG): Pending→Active (turned active September 20)

- NIKE Inc. (NKE): Pending→Monitoring (Divergence was burned through as both RSI and price made lower low).

- Adobe Inc. (ADBE): Pending →Active (turned active September 15)

Equity ETFs

- SPDR S&P Biotech ETF (XBI): New Setup→Monitoring (Divergence was burned through as both RSI and price made lower low)

- iShares MSCI Eurozone ETF (EZU): Pending→Monitoring (Divergence was burned through as both RSI and price made lower low)

- SPDR S&P Regional Banking ETF (KRE): Pending→Monitoring (Divergence was burned through as both RSI and price made lower low)

- SPDR Energy ETF (XLE): Pending→Active (turned active September 21)

Commodities

- Copper Future (HG1): New Setup

Equities

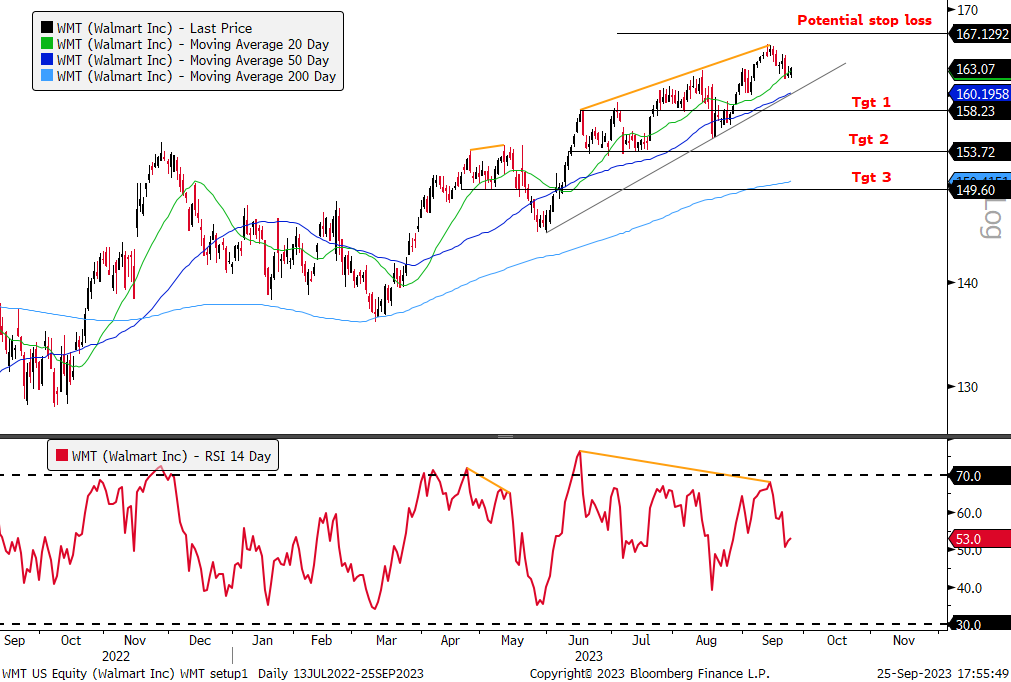

New Setup: Short Walmart Inc. (WMT)

-Bearish divergence setup with price making higher high and RSI lower high in September compared to June levels.

-A move below the 50-DMA and trendline that extended from May would provide the sell signal.

-All targets align with horizontal support levels, while target 3 would see price check back to the 200-DMA.

-A potential stop loss is placed slightly above YTD highs.

Commodities

New Setup: Long Copper Future (HG1)

-Bullish divergence setup with price making lower low and RSI higher low in September compared to middle of August levels.

-A break above the short-term trendline extending from beginning of August would prompt the buy signal.

-Target 1 and 2 aligns with key horizontal resistance levels while target 3 would meet the early 2023 highs.

-Macro Catalyst: With the US Dollar Index up for 10 straight weeks, a reversal lower there could help commodities near term. Continued stimulus measures in China could also help propel copper.

-A potential stop loss is placed slightly below the YTD lows.