Key Developments

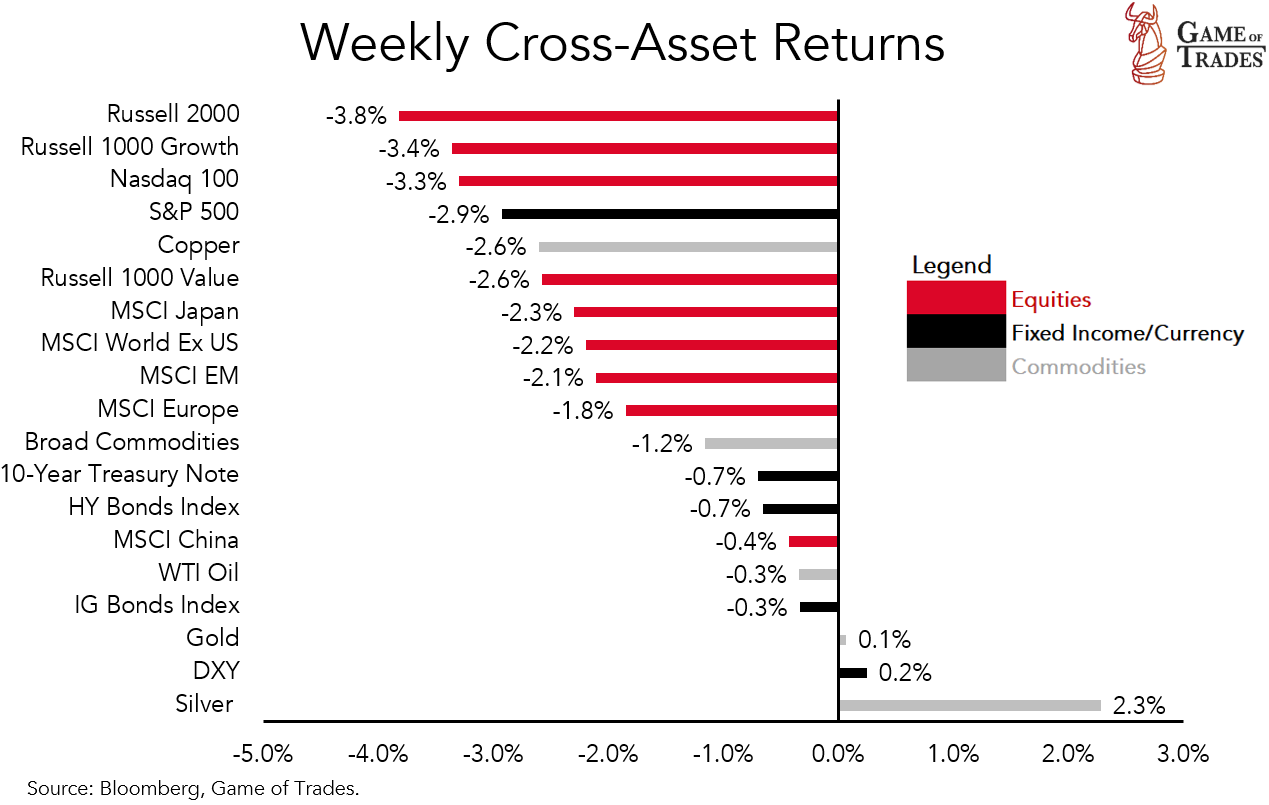

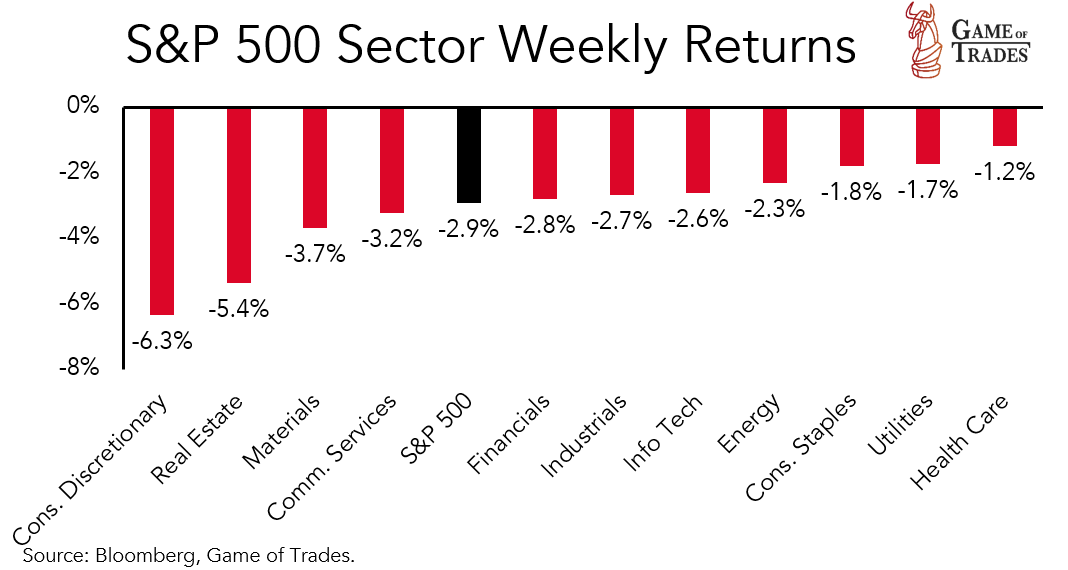

- The S&P 500 declined 2.9% last week, the worst weekly return since March of this year. All 11 sectors were lower. Health Care was the best relative performer, losing 1.2%, while Consumer Discretionary lagged, falling 6.4%.

- The September FOMC was interpreted as hawkish, as the Fed’s median projection for the Fed Funds rate in 2024 rose to 5.1%, up from 4.6% previously. This signifies continued restrictive policy into next year until inflation comes sustainably lower.

- Rates moved higher on the back of a hawkish Powell, with the 10-year yield hitting 4.51% by Friday, the highest since 2007.

- The VIX rose above 17, after hitting a more than 3-year low the week prior at 12.8.

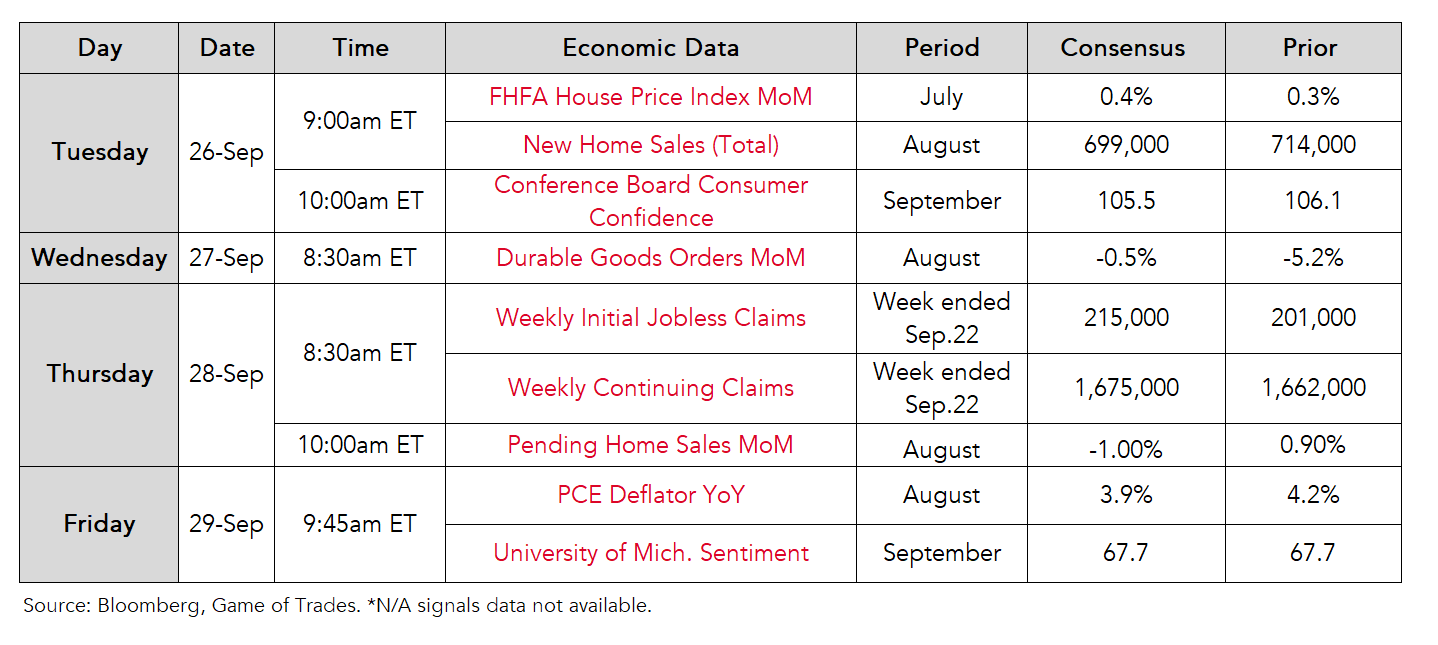

- Housing data throughout the week will be the key data to monitor.

This Week’s Economic Data

Chart of the Week

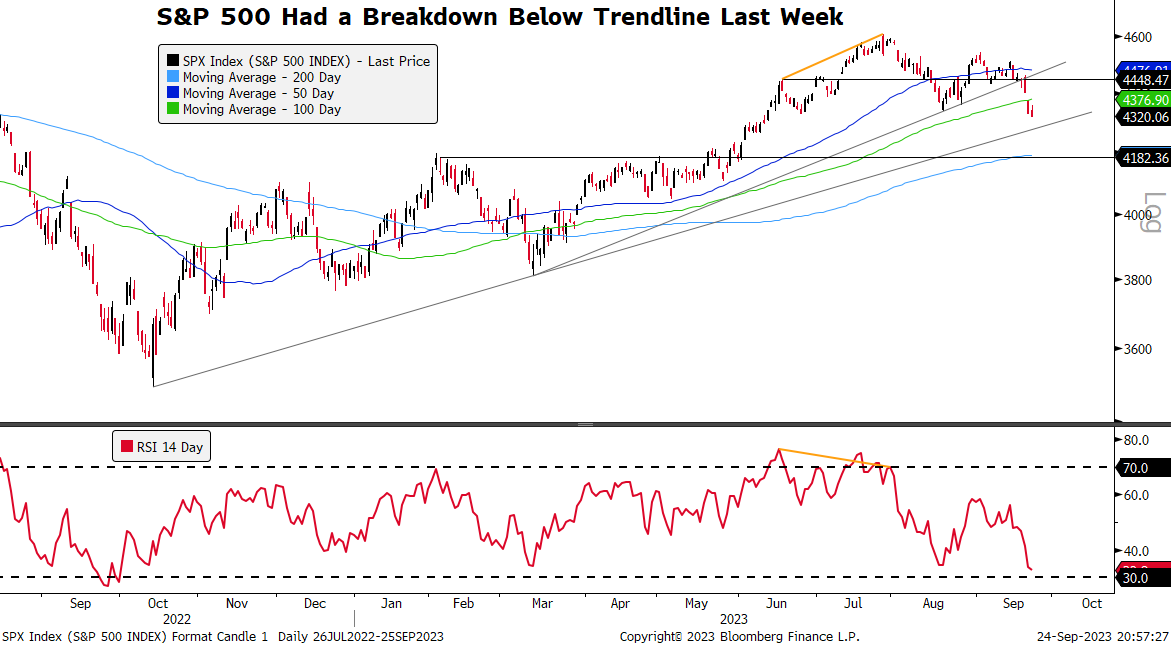

S&P 500 Break Below Key Trendline as Recent Weakness Continues

-The S&P 500 broke below 4,450 horizontal support, trendline support, as well as 100-DMA support, a clear negative technical development.

-The longer-term trendline could be tested next if downside were to continue in the near term.

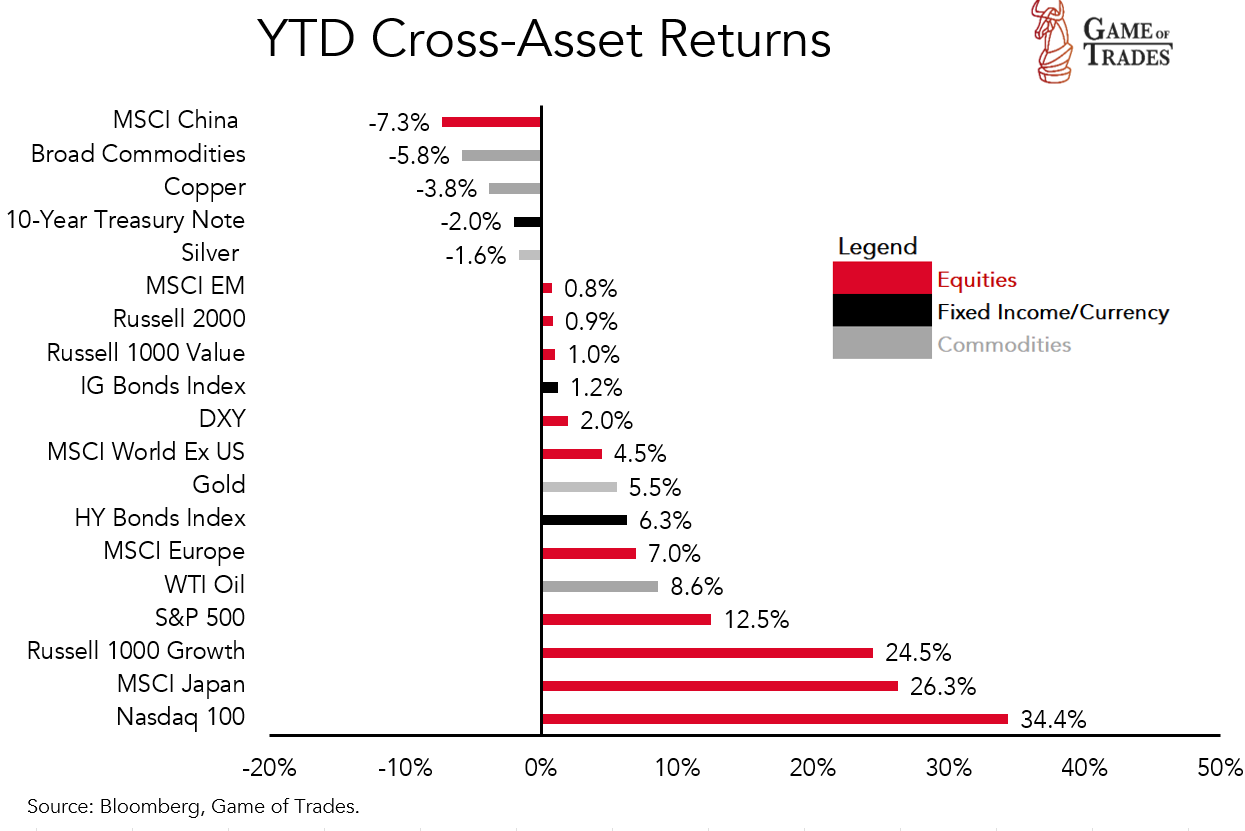

Global Cross-Asset Performance Summary

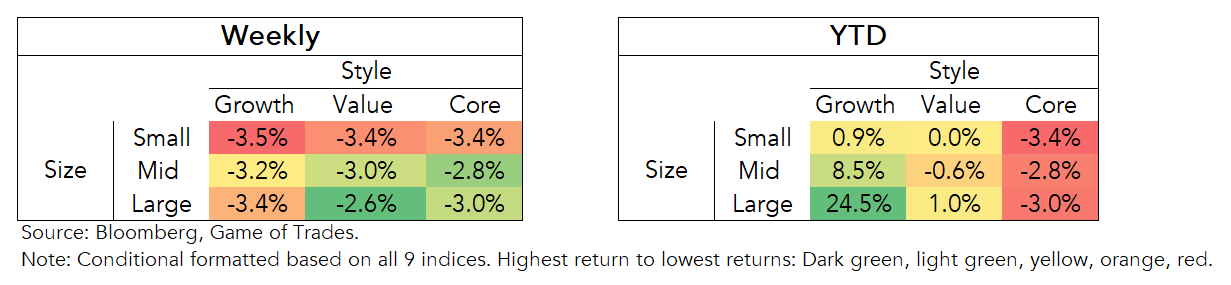

Weekly

Year to Date

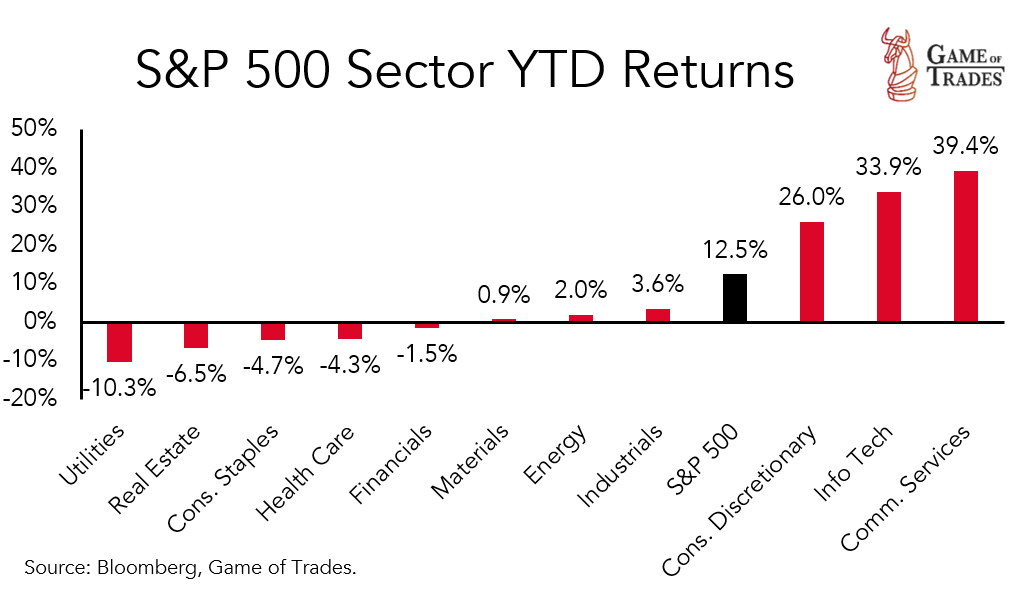

S&P 500 Sector Performance

Weekly

Year to Date

is S&P 500 index not future quote?

Is the German market capitulating and ready for a melt up like TUR is experiencing?