Key Developments

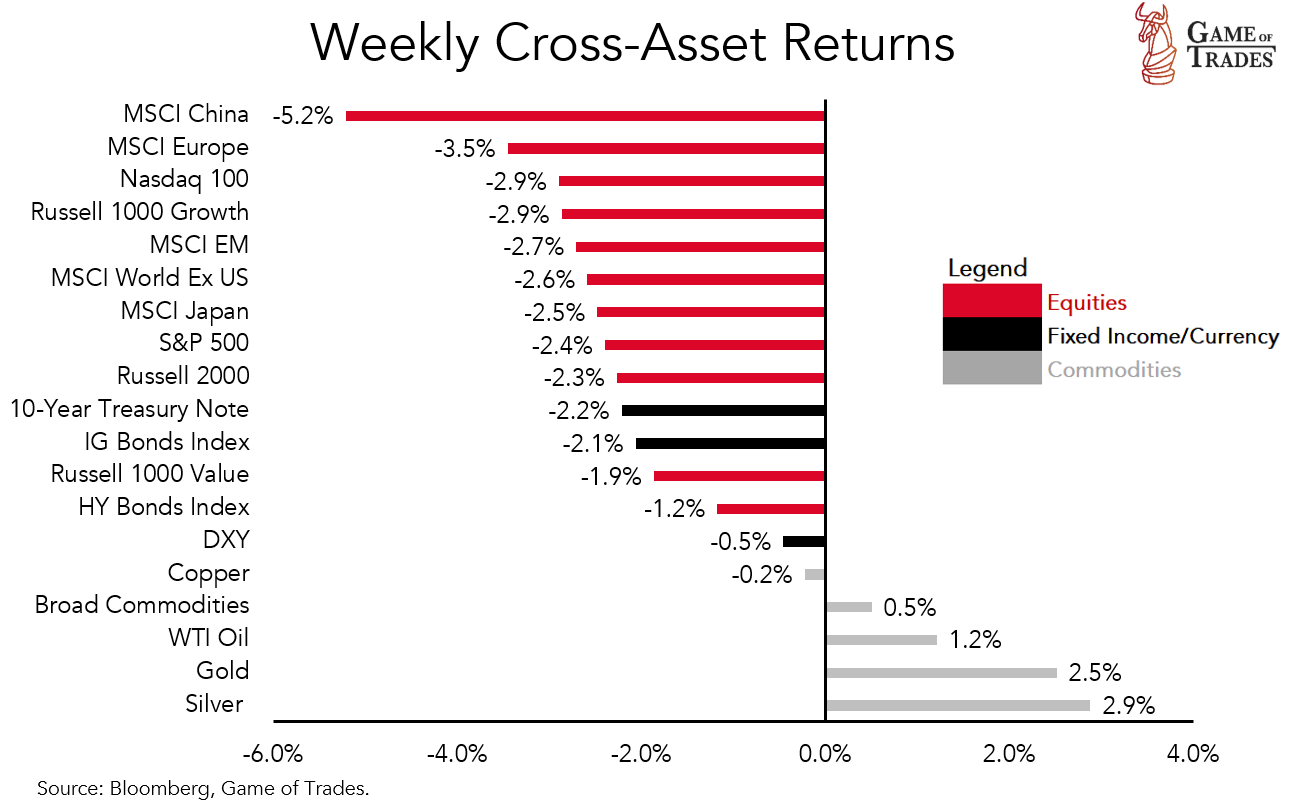

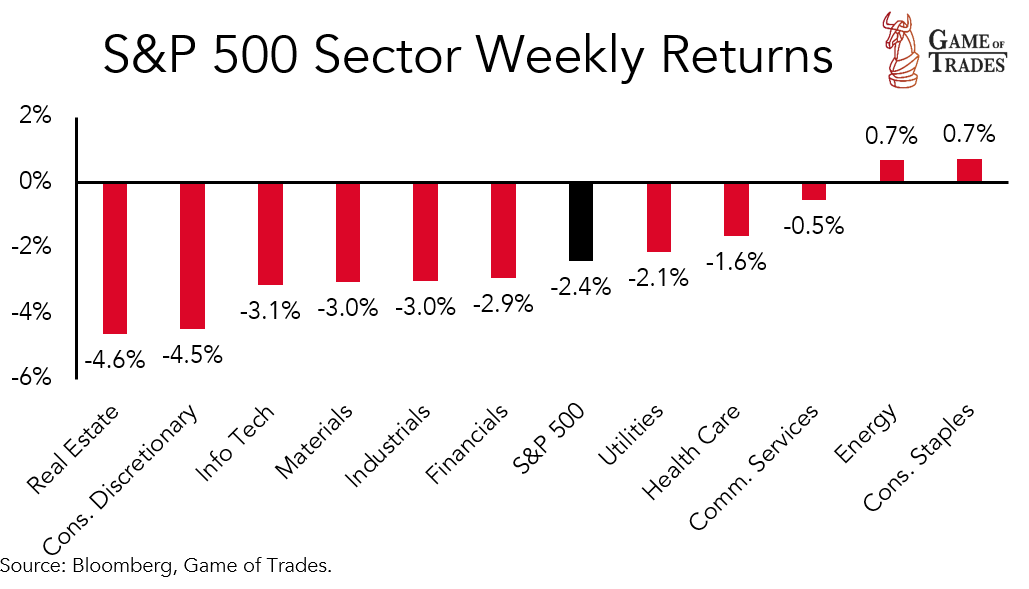

- The S&P 500 declined 2.4% last week, with Consumer Staples (+0.7%) and Energy (+0.7%) the only two sectors positive. Real Estate (-4.6%) lagged.

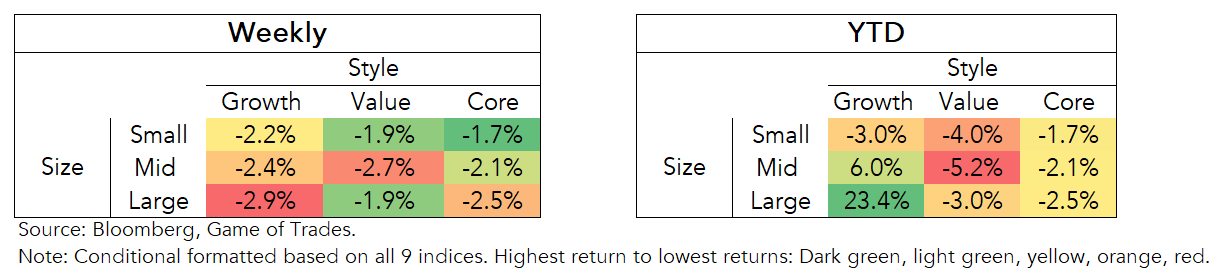

- Higher rates continued to drag on the growth equity style and tech stocks, with the 10-year Treasury yield reaching a high of 4.99% on Friday.

- Commodities were among the best asset class performers, with Silver leading the way up 3% as the US Dollar Index (DXY) fell modestly.

- Mega cap tech will be the focal point for earnings results this week, with MSFT and GOOGL reporting Tuesday, META on Wednesday, and AMZN on Thursday.

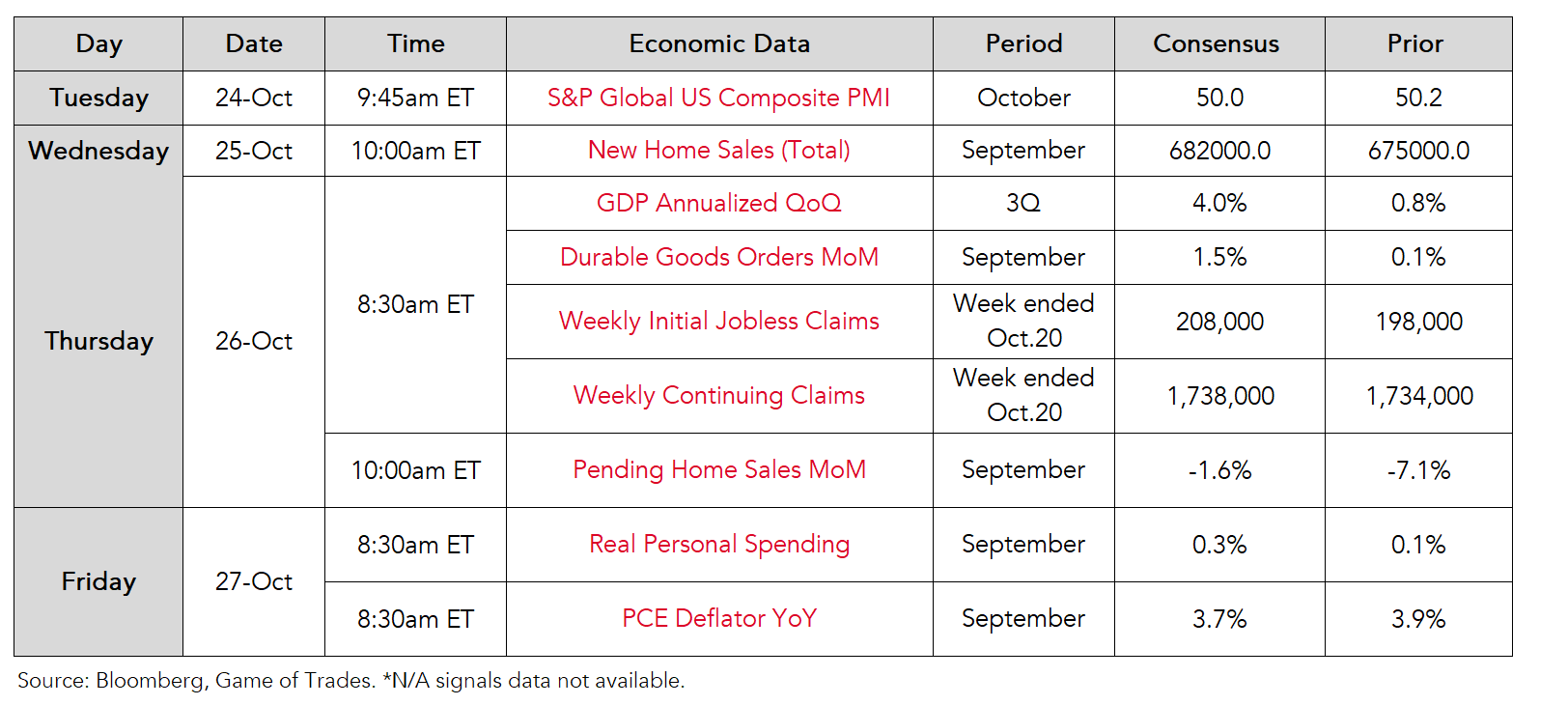

This Week’s Economic Data

Chart of the Week

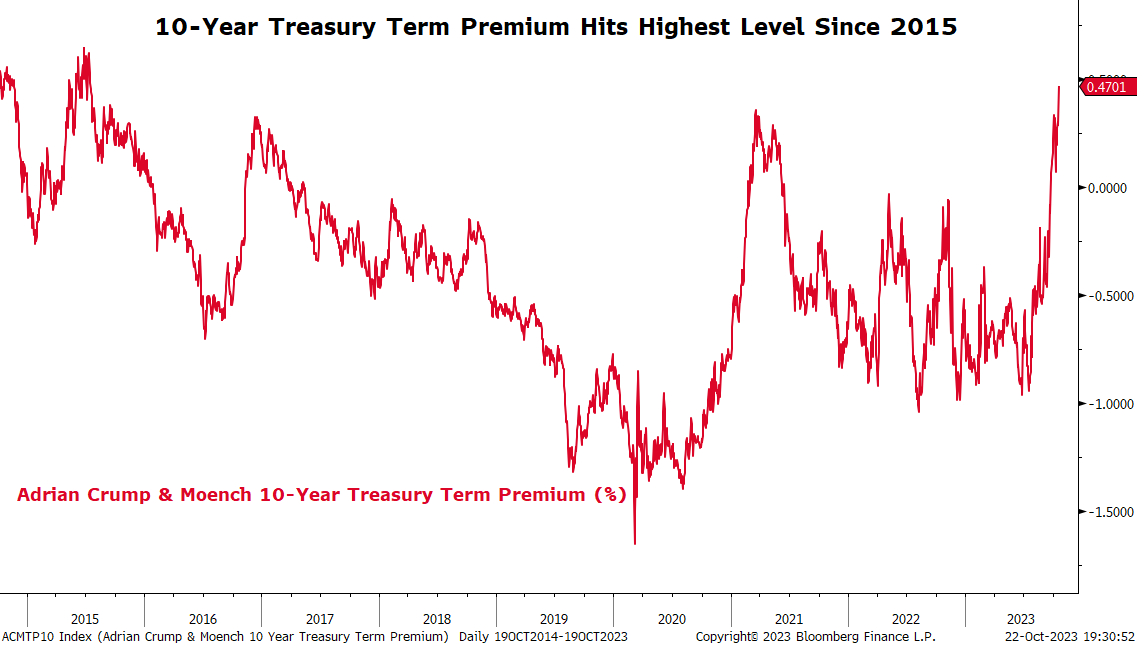

Term Premium Hits Highest Level Since 2015

- The term premium has continued its ascent, rising to 47 basis points last week, the highest since 2015.

- Concerns over US fiscal sustainability amid ballooning deficits fueled by debt is causing bond investors to demand more yield compensation in long-term bonds.

Global Cross-Asset Performance Summary

Weekly

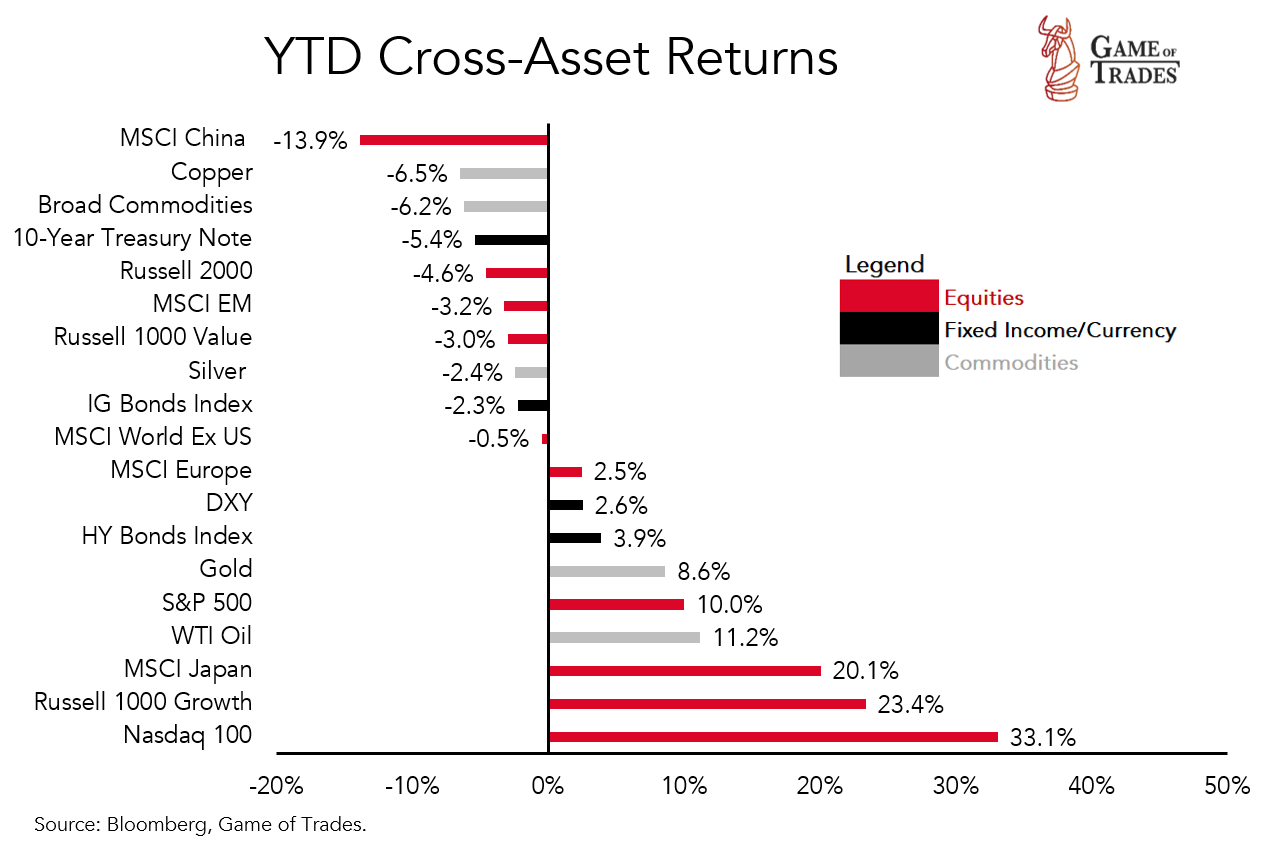

Year to Date

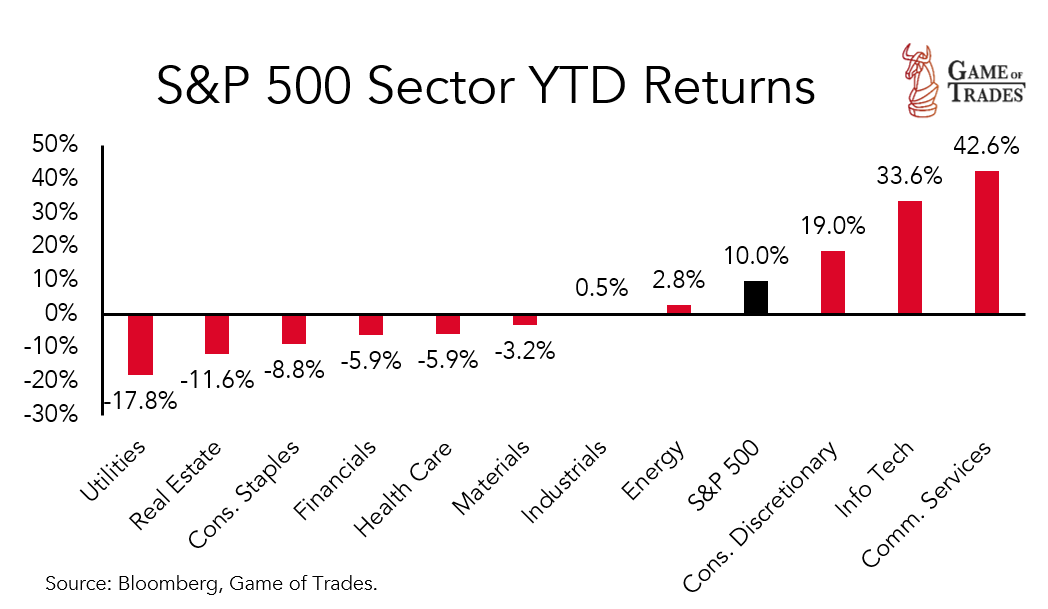

S&P 500 Sector Performance

Weekly

Year to Date

Thanks for the insights!

I think a portfolio review is overdue since weeks. When is that coming?